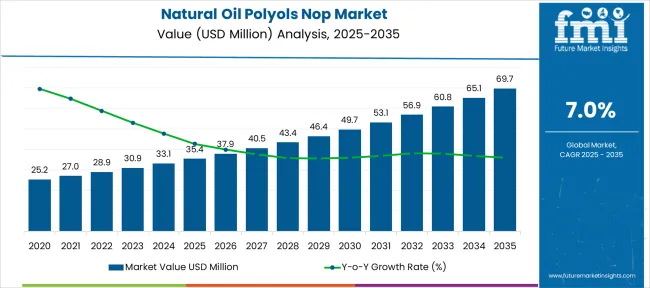

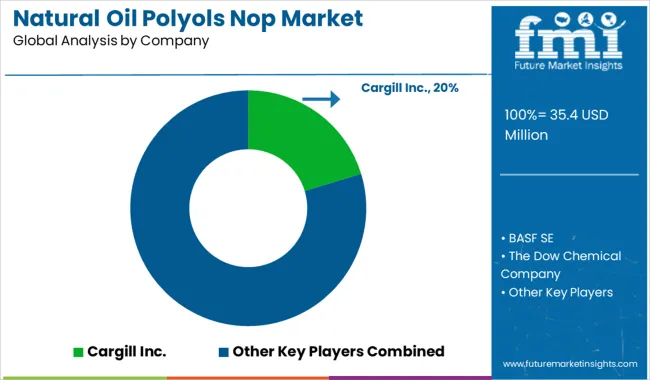

The Natural Oil Polyols NOP Market is estimated to be valued at USD 35.4 million in 2025 and is projected to reach USD 69.7 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Natural Oil Polyols Market Estimated Value in (2025 E) | USD 35.4 million |

| Natural Oil Polyols Market Forecast Value in (2035 F) | USD 69.7 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

Increasing environmental concerns and regulatory pressures have accelerated the adoption of bio-based materials, driving demand for products that reduce carbon footprints.

Advances in agricultural practices and extraction technologies have improved the availability and quality of natural oils used in polyol production. Furthermore, manufacturers are focusing on optimizing product performance to meet the diverse requirements of applications such as coatings, adhesives, and foams.

Growing consumer preference for green products in the construction, automotive, and packaging sectors is further boosting market growth. The trend towards circular economy and renewable resources is expected to support long-term expansion of the Natural Oil Polyols market. Soy oil-based polyols lead segment growth due to their favorable balance of cost, performance, and availability.

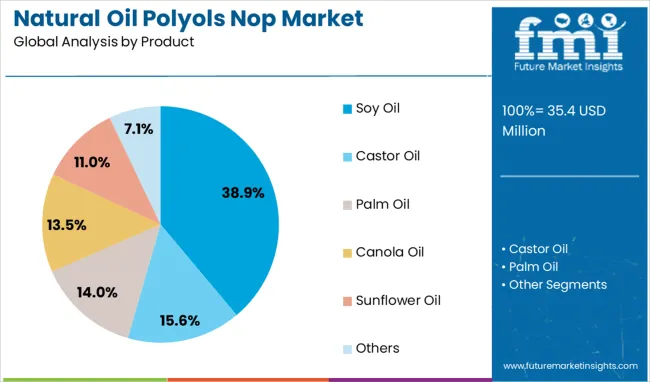

The natural oil polyols market is segmented by product and geographic regions. The product of the natural oil polyols market is divided into Soy Oil, Castor Oil, Palm Oil, Canola Oil, Sunflower Oil, and Others. Regionally, the natural oil polyols industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soy oil segment is expected to account for 38.9% of the Natural Oil Polyols market revenue in 2025, establishing itself as the leading product type. This segment’s growth is driven by the widespread availability of soybeans and the versatility of soy oil in producing polyols with desirable chemical and physical properties.

Soy oil polyols are favored for their compatibility with various polymer systems and their ability to enhance flexibility and durability. The renewable nature and lower environmental impact of soy oil compared to petroleum-based alternatives have made it a preferred choice among manufacturers.

Additionally, advances in processing technologies have improved the efficiency and consistency of soy oil polyols, making them suitable for a broad range of industrial applications. As sustainability continues to influence material selection, the soy oil segment is expected to maintain its market leadership.

The natural oil polyols market is driven by rising demand in polyurethane foams, coatings, and automotive components, supported by construction growth and performance benefits. Competitive strategies focus on R&D, partnerships, and regional expansion to capture emerging opportunities globally.

The natural oil polyols (NOP) market is expanding significantly due to their increasing use in polyurethane applications such as flexible and rigid foams. These foams are essential in insulation, automotive seating, and furniture manufacturing. NOP-based foams offer comparable performance to petrochemical alternatives while reducing dependence on traditional raw materials. The automotive and construction sectors are major demand generators, seeking enhanced energy efficiency and lightweight materials. Manufacturers are investing in bio-based raw materials derived from soybean, castor, and palm oils to meet evolving requirements. As green building certifications and energy-efficient construction practices gain prominence, demand for NOP-based rigid foams is expected to see consistent growth across both developed and emerging economies.

Natural oil polyols are increasingly used in coatings, adhesives, sealants, and elastomers (CASE) due to their functional flexibility and chemical compatibility. These materials provide improved adhesion, chemical resistance, and durability in industrial coatings and flooring systems. Their bio-origin makes them attractive for manufacturers aiming to diversify product portfolios with more environmentally aligned formulations. Growing construction activities and infrastructure projects have created opportunities for polyurethane-based coatings and sealants incorporating NOP. Additionally, rising demand in the packaging and transportation sectors, where performance under stress and environmental compliance are critical, is boosting the integration of NOP in specialty formulations.

Automotive manufacturers are adopting natural oil polyols to develop lightweight, energy-efficient components while maintaining durability and performance. NOP-based polyurethanes are widely used in car seating, headrests, and interior panels. This shift supports the industry’s goal of improving fuel efficiency by reducing vehicle weight through the use of advanced materials. Enhanced cushioning properties and thermal stability of NOP-based foams make them suitable for comfort-driven applications. The market is witnessing collaborations between chemical suppliers and automotive OEMs to scale up production of bio-based foam components, which cater to evolving design preferences and regulatory trends demanding the use of low-VOC, eco-compliant materials.

The natural oil polyols market is marked by strong competition among global and regional players investing in capacity expansion and R&D. Key companies are focusing on partnerships with polyurethane manufacturers to secure long-term supply agreements. Pricing strategies are influenced by fluctuations in vegetable oil availability, pushing manufacturers to explore multiple feedstocks for cost stability. Strategic acquisitions and joint ventures are becoming common as firms look to strengthen their presence in high-growth regions like the Asia-Pacific. Marketing efforts highlighting performance parity with petroleum-based polyols and benefits in reducing environmental impact are supporting increased adoption, particularly in industrial and construction applications.

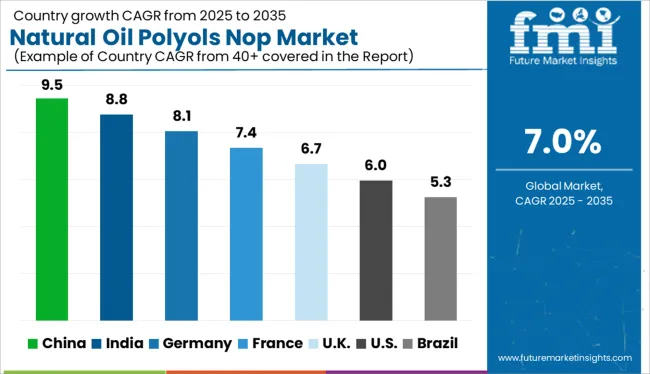

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

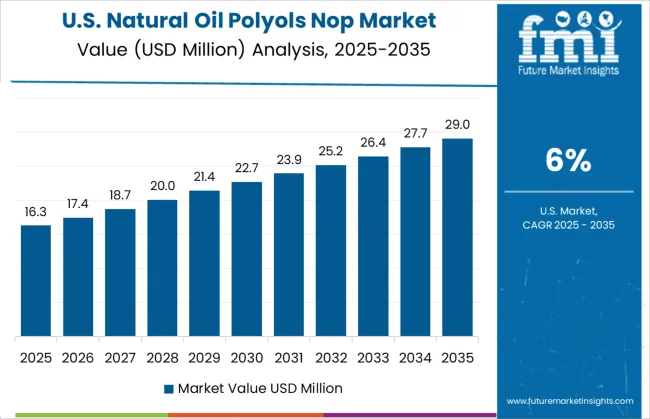

| USA | 6.0% |

| Brazil | 5.3% |

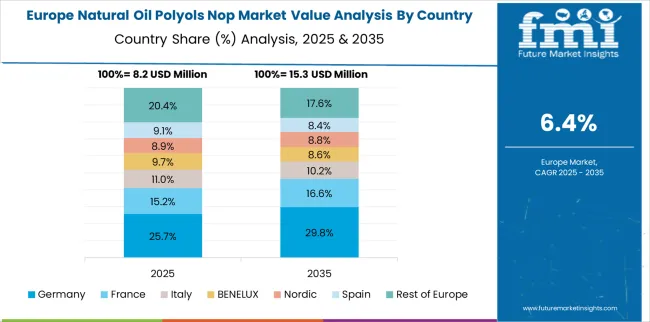

The natural oil polyols market, projected to grow at a global CAGR of 7.0% from 2025 to 2035, demonstrates strong regional variations. China leads with a 9.5% CAGR, supported by large-scale polyurethane production and government incentives for bio-based materials. India follows with an 8.8% CAGR, reflecting significant demand from automotive and construction sectors coupled with rising investments in renewable raw material sourcing. Germany records an 8.1% CAGR due to stringent regulations favoring sustainable chemical inputs and a strong presence of polyurethane manufacturers. France and the United Kingdom are seeing growth rates of 7.4% and 6.7%, respectively, driven by increased adoption of NOP-based foams in insulation and furniture applications. The USA lags slightly at 6.0% CAGR due to mature markets but continues to experience steady demand from industrial coatings and CASE applications. While developed economies show consistent adoption driven by regulatory compliance, high-growth potential is evident in Asia-Pacific countries led by China and India. The report provides a comprehensive analysis of over 40 countries, with the top five highlighted for reference.

The CAGR for the natural oil polyols market in the United Kingdom is estimated to have increased from approximately 4.9% during 2020 to 2024 to 6.7% in the 2025 to 2035 period, driven by growing use of bio-based polyols in construction insulation and flexible foam for furniture. Rising emphasis on energy-efficient buildings and strong government incentives for green materials have contributed significantly to this growth.

Automotive OEMs in the UK are actively integrating bio-based foams for interior applications to reduce carbon footprint and comply with EU low-emission standards. Additionally, partnerships between chemical manufacturers and downstream polyurethane processors have strengthened local supply chains, reducing dependency on imported petrochemical polyols.

China’s natural oil polyols market demonstrated remarkable momentum, with its CAGR rising from about 6.8% during 2020 to 2024 to 9.5% between 2025 and 2035, supported by industrial policies promoting bio-based chemical production. Expansion of the domestic polyurethane sector for furniture, automotive, and appliance applications significantly drove adoption. Large-scale infrastructure development programs incorporating energy-efficient insulation panels accelerated demand for NOP-based rigid foams. Chinese chemical producers, backed by government funding, increased local production capacity of soybean and castor-based polyols, reducing raw material costs and boosting competitiveness against synthetic alternatives.

India recorded substantial progress, with CAGR climbing from 6.2% during 2020 to 2024 to 8.8% in the 2025 to 2035 period, driven by growing polyurethane demand in automotive seating and mattress production. The expansion of affordable housing schemes and infrastructure projects increased adoption of energy-efficient insulation, positioning NOP-based rigid foams as a preferred material. Domestic polyol manufacturers invested in capacity expansions and technology collaborations with global players to ensure high-quality output. Rising consumer awareness about eco-compliant furniture and home décor further propelled market growth in Tier 1 and Tier 2 cities.

The natural oil polyols market in France experienced notable expansion, with the CAGR increasing from 5.1% during 2020 to 2024 to 7.4% for the 2025 to 2035 period, driven by strong regulatory emphasis on reducing carbon-intensive raw materials in industrial applications. The construction sector’s rapid shift toward bio-based insulation materials played a major role, supported by the French government’s stringent building efficiency standards under the RE2025 framework. Automotive manufacturers in France also integrated NOP-based polyurethane foams into vehicle interiors to meet EU emission targets and address consumer demand for eco-friendly components. Partnerships between global chemical giants and French PU converters enhanced local sourcing capabilities, reducing dependency on imported petroleum-based polyols.

The USA market for natural oil polyols posted a steady rise, with CAGR moving from 4.4% in 2020 to 2024 to 6.0% for 2025 to 2035, backed by strong adoption across green construction projects and furniture manufacturing. The implementation of federal tax credits for energy-efficient buildings and voluntary green certification programs (LEED) stimulated higher consumption of rigid insulation foams derived from NOP. The automotive sector also leveraged these materials to achieve weight reduction and improved thermal comfort in EV interiors. American chemical companies expanded their R&D efforts toward low-VOC, high-performance NOP formulations, positioning themselves as key suppliers in domestic and export markets.

The natural oil polyols market is supported by major global players focused on advancing bio-based solutions for polyurethane applications. Cargill Inc., BASF SE, and The Dow Chemical Company remain industry leaders with strong portfolios in flexible and rigid foam applications for construction and automotive sectors. Huntsman Corporation and Covestro (Bayer MaterialScience) are investing in low-VOC polyols tailored for green building materials and sustainable industrial coatings.

Emerging participants like Jayant Agro Organics Ltd and BioBased Technologies LLC specialize in developing polyols derived from renewable feedstocks such as soybean, castor, and palm oils. Companies such as Elevance Renewable Sciences Inc, Stepan Company, and Emery Oleochemicals are focusing on performance-driven NOPs for CASE (coatings, adhesives, sealants, elastomers) segments, addressing demand in industrial manufacturing and automotive markets.

Lubrizol, Mitsui Chemicals Inc., and Vertellus Specialties have expanded production capacities to meet global requirements while enhancing formulation flexibility. Strategic acquisitions and collaborations are prominent across these players, ensuring long-term raw material security and technology innovation.

Bio Amber Inc. and Urethane Soy Systems emphasize niche applications in eco-friendly foams for furniture, bedding, and insulation sectors. The competitive strategies include investment in feedstock diversification, regional manufacturing hubs, and partnerships with polyurethane producers, creating a robust supply chain to cater to the growing demand for renewable and high-performance polyols worldwide.

In February 2025, Cargill announced its intention to exercise its option to acquire the remaining 50% of SJC Bioenergia, gaining full ownership of the sugar–ethanol–bioenergy firm based in Goiás, Brazil.

| Item | Value |

|---|---|

| Quantitative Units | USD 35.4 Million |

| Product | Soy Oil, Castor Oil, Palm Oil, Canola Oil, Sunflower Oil, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill Inc., BASF SE, The Dow Chemical Company, Huntsman Corporation, Jayant Agro Organics Ltd, BioBased Technologies LLC, Elevance Renewable Sciences Inc, Stepan Company, IFS Chemicals Group, Emery Oleochemicals, Covestro (Bayer MaterialScience), Mitsui Chemicals Inc., Lubrizol, Vertellus Specialties, Bio Amber Inc., and Urethane Soy Systems |

| Additional Attributes | Dollar sales, share by application (foams, CASE, coatings), competitive landscape, raw material pricing trends, demand drivers across automotive and construction, regional growth hotspots, and key R&D or regulatory developments. |

The global natural oil polyols nop market is estimated to be valued at USD 35.4 million in 2025.

The market size for the natural oil polyols nop market is projected to reach USD 69.7 million by 2035.

The natural oil polyols nop market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in natural oil polyols nop market are soy oil, castor oil, palm oil, canola oil, sunflower oil and others.

In terms of , segment to command 0.0% share in the natural oil polyols nop market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Refrigerant Chiller Market Size and Share Forecast Outlook 2025 to 2035

Natural Antioxidant Market Size and Share Forecast Outlook 2025 to 2035

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA