The valuation of the Natural Bitterness Blockers Market is anticipated to stand at USD 1,780.2 Million 2025, reaching nearly USD 3,273.3 Million 2035. This trajectory reflects an absolute addition of USD 149.0 Million over the decade, marking a 6.3% CAGR. Effectively, the market size is projected to expand by almost two times, highlighting its position as one of the promising enablers of clean-label and taste-enhanced product formulations.

Natural Bitterness Blockers Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 1,780.2 Million |

| Market Forecast Value in (2035F) | USD 3,273.3 Million |

| Forecast CAGR (2025 to 2035) | 6.3% |

During the first half of the forecast period (2025-2030), the market is set to progress from USD 1,780.2 Million USD 241.0 million, representing a net growth of around USD 633 million. This stage is expected to be shaped by consistent adoption across food and beverage categories, functional supplements, and pharmaceutical oral dosage forms. The growth contribution from this phase will account for more than 40% of the decade’s total expansion, establishing a foundation for accelerated adoption beyond 2030.

From 2030 to 2035, growth momentum is expected to gain strength, as the market expands from USD 241.0 Million to USD 3,273.3 Million, adding approximately USD 860 million. This second phase is forecast to deliver a greater share of incremental gains close to 60% of decade growth driven by regulatory focus on sugar reduction, rising demand for protein-enriched products, and the penetration of functional foods across emerging regions. Market leadership is projected to remain concentrated in North America and Europe, although South Asia & Pacific is likely to emerge as a significant growth engine, underpinned by evolving dietary trends and expanding nutraceutical portfolios.

From 2020 to 2024, the Natural Bitterness Blockers Market expanded steadily, supported by growing reformulation initiatives across food, beverage, and pharmaceutical categories. By 2025, market value is projected at USD 1,780.2 Million, with leaders controlling more than half of total revenues. Early momentum has been built on protein-based formulations, where off-note masking is critical.

The competitive landscape is expected to evolve as players transition from ingredient supply toward integrated taste-modulation ecosystems. Beyond basic bitterness blocking, emphasis is shifting to multi-functional systems that combine sweetness enhancers, salt reducers, and botanical-derived solutions. By 2030, recurring revenues are projected to be supported by AI-enabled sensory modeling, clean-label demand, and co-creation partnerships with global F&B majors. Competitive advantage is forecast to move beyond raw ingredient innovation toward ecosystem strength, scalability, and application-specific customization, ensuring that global leaders sustain their dominance while regional specialists capture niche opportunities.

Growth in the Natural Bitterness Blockers Market is being accelerated by increasing demand for clean-label and health-oriented products. The shift toward sugar and sodium reduction is driving manufacturers to enhance taste profiles without relying on artificial additives. This trend is being reinforced by rising consumer expectations for natural ingredients across food, beverages, pharmaceuticals, and nutraceuticals.

The expansion of protein-enriched foods, plant-based diets, and botanical supplements is intensifying the need for effective taste-masking solutions, as bitterness challenges are more pronounced in these formulations. In addition, regulatory actions aimed at healthier consumption patterns are prompting wider adoption of bitterness blockers to maintain palatability in reformulated products.

Technological advances in flavor modulation and sensory science are expected to improve product performance, enabling precise applications across diverse matrices. Strong investment by leading players in R&D, alongside growing penetration in emerging regions, is anticipated to fuel steady growth. Consequently, the market is positioned for robust and sustained expansion through 2035.

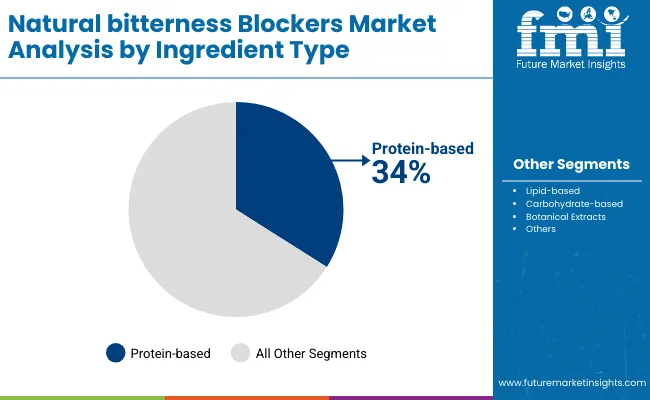

The Natural Bitterness Blockers Market has been segmented across multiple dimensions to highlight the structural drivers shaping long-term demand. Segmentation has been defined by ingredient type, application, and form, ensuring that both supply-side innovation and demand-side adoption are captured comprehensively. By ingredient type, the market has been divided into protein-based, lipid-based, carbohydrate-based, and botanical extracts, reflecting the diversity of natural solutions utilized to improve palatability.

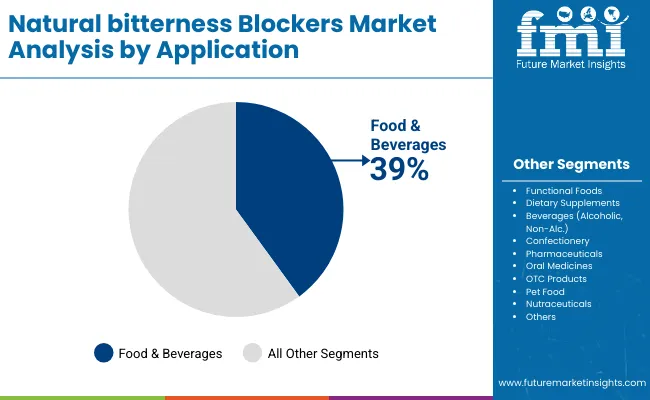

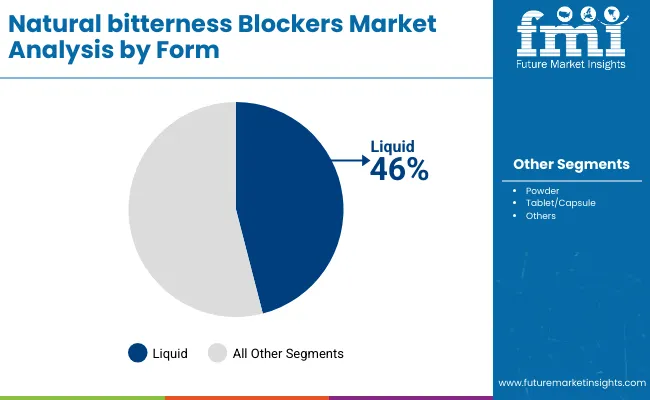

Application-wise, the scope spans food and beverages, pharmaceuticals, nutraceuticals, pet food, and confectionery, with further detail on functional foods, dietary supplements, oral medicines, and OTC products. Form segmentation encompasses liquids, powders, and tablet/capsule formats, showcasing delivery preferences across industries. Through this segmentation, market performance is better understood in terms of adoption rates, growth potential, and future scalability across both developed and emerging regions.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Protein-based | 34% |

| Lipid-based | 26% |

| Carbohydrate-based | 22% |

| Botanical Extracts | 18% |

The protein-based ingredient type segment is projected to account for 34% of the global market revenue in 2025, establishing it as the dominant category among functional ingredient solutions. This leadership will be driven by strong demand in protein-enriched foods, dietary supplements, and sports nutrition. Consumer inclination toward plant-based proteins and the rising emphasis on wellness-focused diets are expected to reinforce growth.

Lipid-based ingredients will continue gaining traction due to their multifunctional role in improving texture and absorption, while carbohydrate-based segments will sustain steady demand in energy products. Botanical extracts are anticipated to expand their market appeal as natural health boosters. Continuous innovation in sourcing, formulation, and delivery formats will help protein-based ingredients consolidate their long-term position.

| Range Segment | Market Value Share, 2025 |

|---|---|

| Food & Beverages | 39% |

| Pharmaceuticals | 23% |

| Pet Food | 7% |

| Nutraceuticals | 8% |

The food and beverages segment is projected to account for 39% of global market revenue in 2025, establishing it as the leading application area for functional ingredients. This dominance will be supported by rising consumer demand for fortified foods, health-focused beverages, and protein-enriched dairy alternatives. Functional foods and dietary supplements will expand their relevance, reflecting the growing popularity of preventive healthcare and nutrition-backed lifestyles.

Pharmaceuticals are expected to remain highly significant, especially with oral medicines and OTC products increasingly fortified with advanced formulations. Pet food and nutraceuticals will also grow steadily as specialized health benefits gain traction. With product diversification, improved solubility, and taste innovation, food and beverages will maintain a central role in ingredient consumption.

| Laser triangulation technology | Market Value Share, 2025 |

|---|---|

| Liquid | 46% |

| Powder | 38% |

| Tablet/Capsule | 16% |

The liquid form segment is projected to account for 46% of global market revenue in 2025, establishing it as the leading formulation category across applications. Its dominance will be reinforced by advantages such as faster absorption, higher bioavailability, and increasing preference for ready-to-drink products. The segment is expected to expand further with rising demand for functional beverages, pharmaceutical syrups, and liquid nutraceuticals. Powdered forms will remain critical in supplements, meal replacements, and sports nutrition due to stability and ease of transport. Tablets and capsules will continue to play a significant role in dosage precision and patient convenience, supported by innovations in encapsulation. Collectively, these formats will sustain balanced market penetration, with liquids maintaining clear leadership.

The Natural Bitterness Blockers Market is being shaped by regulatory reforms, evolving consumer palates, and advances in sensory science. Opportunities are emerging as product portfolios are reformulated for health-conscious consumers, yet dynamics remain influenced by technological, cost, and compliance considerations across industries.

Regulatory Momentum Toward Sugar and Sodium Reduction

Global regulatory frameworks are exerting a pivotal influence on the adoption of natural bitterness blockers. Stricter front-of-pack labeling, nutrient thresholds, and reformulation targets are being implemented across key markets, particularly in North America and Europe. This shift is driving companies to prioritize solutions that preserve sensory quality while meeting health mandates. Governments are linking taste modulation with public health agendas, making compliance not only a legal necessity but also a brand positioning tool. The ability to mask bitterness in protein-rich, mineral-fortified, and plant-based formulations is being viewed as essential to maintaining product appeal. As regulation intensifies, bitterness blockers are projected to evolve from optional enhancers into strategic necessities, shaping investment patterns and long-term category growth.

Integration of AI-Enabled Sensory Modelling

The market is witnessing an emerging trend in which artificial intelligence and machine learning are being integrated into flavor and bitterness-blocking design. Predictive models are being deployed to simulate human taste receptor interactions, reducing reliance on trial-and-error formulation. This technological shift is enabling faster development cycles, customized solutions for specific matrices, and cost efficiencies in R&D.

AI-driven sensory modelling is also allowing suppliers to demonstrate efficacy with quantitative data, which strengthens trust with regulatory authorities and formulators. The trend is expected to expand as digital platforms converge with sensory labs, providing competitive advantage to firms that invest early. By 2030, AI-enabled approaches are anticipated to become embedded within standard formulation workflows, creating differentiation through precision and scalability.

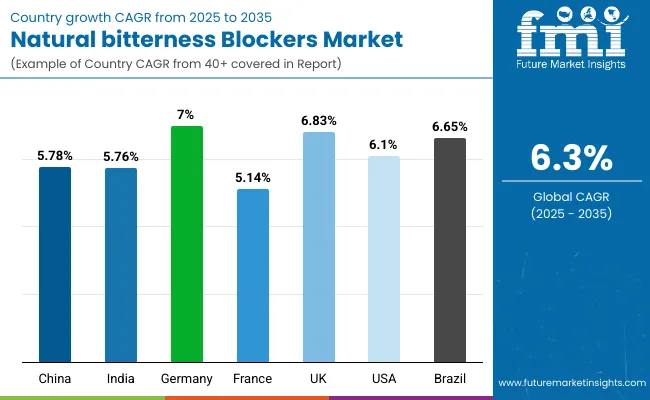

| Countries | CAGR |

|---|---|

| China | 5.78% |

| India | 5.76% |

| Germany | 7.00% |

| France | 5.14% |

| UK | 6.83% |

| USA | 6.1% |

| Brazil | 6.65% |

The Natural Bitterness Blockers Market demonstrates varying growth dynamics across major economies, shaped by regulatory intensity, dietary transitions, and innovation in functional formulations. Germany is expected to lead globally with a CAGR of 7.0%, supported by stringent food quality compliance, advanced flavor research capabilities, and strong pharmaceutical adoption. The UK (6.83%) and Brazil (6.65%) follow closely, benefiting from evolving consumer preferences for fortified products and expanded use in nutraceuticals.

In China (5.78%) and India (5.76%), growth is projected to be driven by rising penetration of functional foods and supplements, alongside increasing awareness of taste-masking solutions in protein-heavy and herbal formulations. These markets are expected to see acceleration as local manufacturers scale up clean-label portfolios.

The USA (6.1%) is forecast to record moderate expansion, reflecting a mature food and beverage base where adoption is influenced more by reformulation requirements linked to regulatory standards on sugar and sodium reduction. France (5.14%) is anticipated to grow at a slower pace relative to peers, with adoption concentrated in premium functional categories rather than mass-market applications.

Collectively, these countries highlight both mature and emerging demand clusters, reinforcing that adoption will be highly dependent on health policy shifts, consumer palatability demands, and technological advances in formulation science.

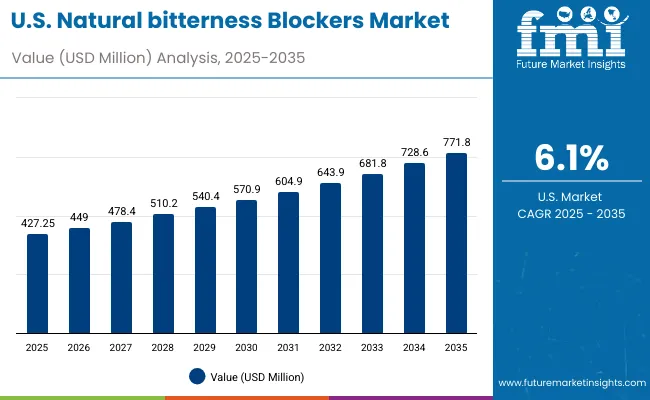

| Year | USA Natural Bitterness Blockers Market (USD Million) |

|---|---|

| 2025 | 427.25 |

| 2026 | 449.0 |

| 2027 | 478.4 |

| 2028 | 510.2 |

| 2029 | 540.4 |

| 2030 | 570.9 |

| 2031 | 604.9 |

| 2032 | 643.9 |

| 2033 | 681.8 |

| 2034 | 728.6 |

| 2035 | 771.8 |

The Natural Bitterness Blockers Market in the United States is projected to expand from USD 427.2 million in 2025 to USD 771.8 million by 2035, reflecting a CAGR of 6.1% over the period. Year-on-year growth is anticipated to remain stable, fluctuating between 5.1% and 6.9%, indicating resilient demand despite market maturity.

Adoption is being accelerated by reformulation mandates tied to sugar and sodium reduction, with food and beverage producers integrating bitterness blockers into mainstream product lines. Pharmaceuticals are expected to contribute strongly, as oral medicines and OTC formulations increasingly require taste-masking solutions to improve adherence. In parallel, functional foods and dietary supplements are expanding as delivery formats diversify, with proteins and botanical blends creating higher reliance on effective modulators.

By the end of the decade, incremental growth of nearly USD 343 million (2025-2030) is forecast, followed by an additional USD 201 million (2030-2035), underscoring the market’s long-term sustainability. The adoption of advanced sensory science and formulation technologies is expected to provide competitive differentiation, while regulatory shifts are projected to further entrench bitterness blockers as standard formulation inputs.

The Natural Bitterness Blockers Market in the United Kingdom is projected to grow at a CAGR of 6.83% between 2025 and 2035, positioning it among the fastest-expanding markets in Europe. Demand is expected to be driven by reformulation across beverages, confectionery, and functional foods, spurred by stringent nutritional labeling regulations and sugar-reduction mandates.

Pharmaceutical adoption is anticipated to rise steadily, with oral medicines and OTC products requiring palatability enhancement to meet compliance standards. Food & beverage manufacturers are expected to embrace natural solutions to differentiate in competitive retail environments where clean-label preferences dominate consumer choices.

The Natural Bitterness Blockers Market in India is forecast to expand at a CAGR of 5.76% from 2025 to 2035, supported by evolving dietary patterns and a fast-growing nutraceuticals sector. Rapid urbanization and the expansion of the health-conscious middle class are expected to accelerate demand.

Functional foods and dietary supplements are projected to be leading adopters, as protein-enriched and herbal formulations face bitterness challenges that require masking. The pharmaceutical industry is also anticipated to adopt natural solutions to improve adherence in pediatric and geriatric medication segments.

The Natural Bitterness Blockers Market in China is expected to grow at a CAGR of 5.78% over 2025-2035, reflecting steady adoption across food, beverages, and health-related applications. Expanding consumer preference for fortified foods and clean-label products is anticipated to underpin long-term growth.

Dietary supplements and functional beverages are forecast to emerge as core drivers, with bitterness blockers integrated to improve acceptance of botanical-heavy formulations. Investments in local manufacturing capabilities are expected to reduce cost barriers, making natural solutions more accessible to mainstream brands.

| Countries | 2025 |

|---|---|

| UK | 20.41% |

| Germany | 21.34% |

| Italy | 11.28% |

| France | 14.44% |

| Spain | 11.41% |

| BNELUX | 6.21% |

| Nordic | 5.78% |

| Rest of Europe | 9% |

| Countries | 2035 |

|---|---|

| UK | 20.15% |

| Germany | 21.03% |

| Italy | 10.52% |

| France | 14.71% |

| Spain | 11.11% |

| BNELUX | 5.24% |

| Nordic | 5.88% |

| Rest of Europe | 11% |

The Natural Bitterness Blockers Market in Germany is projected to achieve the highest CAGR globally at 7.0% between 2025 and 2035, making it a key growth hub in Europe. The strong influence of regulatory standards and innovation in food technology is expected to drive momentum.

Pharmaceutical adoption is projected to remain strong due to Germany’s advanced healthcare sector, while functional foods and dietary supplements are anticipated to expand their reliance on bitterness masking. Demand from beverages and confectionery is expected to be reinforced by consumer insistence on natural and clean-label solutions.

Key Outlook Points

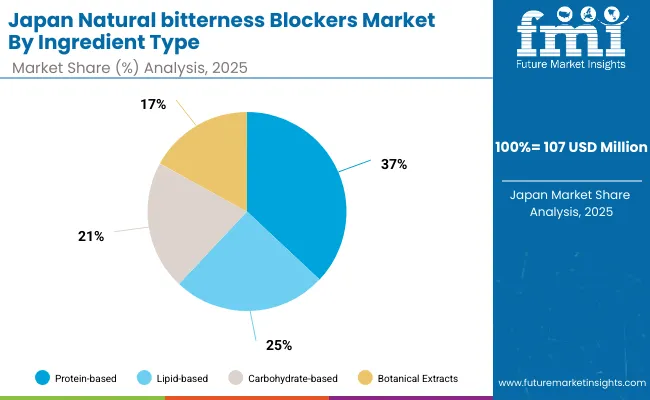

| Component Segment | Market Value Share, 2025 |

|---|---|

| Protein-based | 37% |

| Lipid-based | 25% |

| Carbohydrate-based | 21% |

| Botanical Extracts | 17% |

The Natural Bitterness Blockers Market in Japan is projected at USD 107 million in 2025, expected to nearly double by 2035 underpinned by a balanced CAGR of around 6.6%. Protein-based blockers dominate at 37%, reflecting Japan’s reliance on protein-enriched and amino acid-based formulations where bitterness is a significant challenge. Lipid-based and carbohydrate-based solutions together hold nearly 46%, providing versatility across food and beverage reformulations. Botanical extracts, at 17%, are steadily expanding as consumer preference for herbal and traditional remedies grows, aligning with Japan’s strong nutraceuticals culture.

A decisive transition toward clean-label health products is shaping adoption, while pharmaceutical applications are expected to expand as taste-masking becomes critical for pediatric and geriatric oral formulations. Integration of advanced formulation science with AI-driven sensory modeling is likely to elevate efficacy standards. By 2030, wider use in functional beverages and OTC nutraceuticals is anticipated to anchor market acceleration.

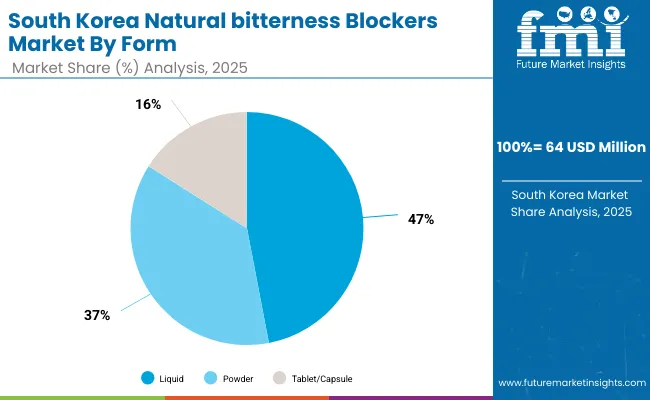

| Range Segment | Market Value Share, 2025 |

|---|---|

| Liquid | 47% |

| Powder | 37% |

| Tablet/Capsule | 16% |

The Natural Bitterness Blockers Market in South Korea is valued at USD ~64 million in 2025, with an expected CAGR of around 6.6% through 2035. Liquids dominate with a 47% share, reflecting the country’s strong beverage innovation pipeline and high penetration of fortified drinks. Powders, holding 37%, are widely utilized in dry formulations, dietary supplements, and instant functional mixes. Tablets and capsules contribute 16%, primarily in the nutraceutical and pharmaceutical categories where controlled dosage and palatability are critical.

Market acceleration is anticipated as South Korea advances its functional beverage culture, supported by government-led health initiatives and consumer focus on wellness. Pharma adoption is projected to strengthen, particularly in pediatric and geriatric oral segments. Integration of natural bitterness blockers with plant-based and botanical-rich matrices is expected to be a decisive growth catalyst, as Korean consumers increasingly demand clean-label, taste-friendly alternatives.

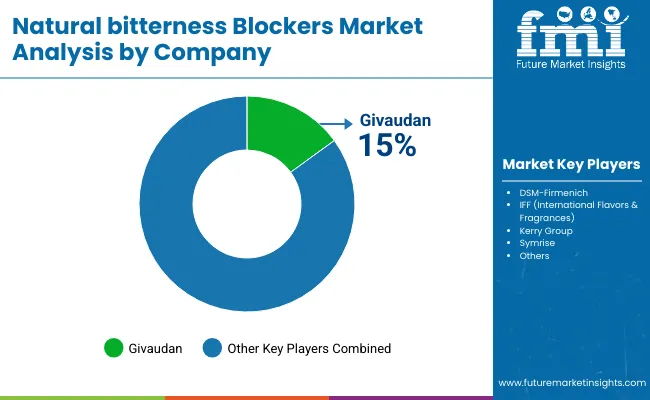

The Natural Bitterness Blockers Market is moderately consolidated, with a small group of multinational leaders, regional innovators, and niche players competing across applications spanning food, beverages, nutraceuticals, and pharmaceuticals. Global leaders such as Givaudan, DSM-Firmenich, IFF (International Flavors & Fragrances), Kerry Group, and Symrise hold significant market share, supported by advanced formulation capabilities, application labs, and strong partnerships with multinational consumer goods companies. Their strategies are increasingly focused on clean-label formulation, sensory science innovations, and regulatory-compliant solutions tailored to health-driven product reformulation.

Mid-sized innovators are expected to strengthen their role by offering specialized bitterness-blocking systems for functional foods, herbal nutraceuticals, and OTC pharmaceuticals. These firms are enhancing competitiveness by emphasizing speed-to-market, regional customization, and integration with flavor-modulation platforms.

Specialist providers are likely to address cost-sensitive emerging markets, particularly in South Asia & Pacific and Latin America, where adoption is at earlier stages. Their differentiation is projected to come from affordability, formulation flexibility, and alignment with traditional herbal product categories.

Competitive advantage is anticipated to shift toward integrated ecosystems where bitterness blockers are combined with sweetness enhancers, salt modulators, and AI-driven sensory modeling. Subscription-based partnerships, co-creation with food majors, and expansion in functional health categories are expected to define the next decade of competition.

Key Developments in Natural Bitterness Blockers Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,780.2 Million 2025; projected to reach USD 3,273.3 Million 2035 |

| Ingredient Type | Protein-based, Lipid-based, Carbohydrate-based, Botanical Extracts |

| Application | Food & Beverages, Functional Foods, Dietary Supplements, Beverages (Alcoholic & Non-Alcoholic), Confectionery, Pharmaceuticals (Oral Medicines, OTC Products), Pet Food, Nutraceuticals |

| Form | Liquid, Powder, Tablet/Capsule |

| Source | Plant-based, Microbial-derived, Synthetic |

| Sales Channel | Direct B2B Sales, Distributors, Online Retailers, Specialty Stores |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, France, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Givaudan, DSM-Firmenich, IFF (International Flavors & Fragrances), Kerry Group, Symrise |

The global Natural Bitterness Blockers Market is estimated to be valued at USD 1,780.2 Million 2025.

The market size for the Natural Bitterness Blockers Market is projected to reach USD 3,273.3 Million 2035.

The Natural Bitterness Blockers Market is expected to grow at a CAGR of 6.3% between 2025 and 2035.

The key product types in the Natural Bitterness Blockers Market are protein-based, lipid-based, carbohydrate-based, and botanical extracts.

In terms of application, the food & beverages segment is projected to command 39% share in the Natural Bitterness Blockers Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Disaster Detection IoT Market Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Natural Fiber Composites Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA