The Natural Refrigerants Market is estimated to be valued at USD 1.7 billion in 2025 and is projected to reach USD 3.1 billion by 2035, registering a compound annual growth rate (CAGR) of 6.1% over the forecast period. During the early adoption phase from 2020 to 2024, the market expanded from USD 1.3 billion to USD 1.6 billion, driven by regulatory mandates to reduce greenhouse gas emissions and increasing awareness of eco-friendly alternatives.

The scaling phase from 2025 to 2030 witnesses the market growing from USD 1.7 billion to USD 2.3 billion, fueled by increased adoption in refrigeration, air conditioning, and heat pump systems. Key breakpoints during this period include technology advancements, expansion of production capacities, and strategic partnerships between refrigerant manufacturers and equipment producers. By 2030–2035, the market moves into consolidation, reaching USD 3.1 billion. Growth stabilizes as major players dominate, product portfolios diversify, and global regulatory frameworks mature, solidifying natural refrigerants as the preferred solution in sustainable cooling applications.

| Metric | Value |

|---|---|

| Natural Refrigerants Market Estimated Value in (2025 E) | USD 1.7 billion |

| Natural Refrigerants Market Forecast Value in (2035 F) | USD 3.1 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

The natural refrigerants market is witnessing substantial growth as global climate goals and regulatory frameworks intensify pressure on industries to transition away from high-GWP synthetic refrigerants. Natural refrigerants such as hydrocarbons, ammonia, and carbon dioxide are being increasingly adopted due to their low environmental impact, high thermodynamic efficiency, and regulatory compliance with international standards such as the Kigali Amendment and F-Gas Regulation.

Key market players are investing in R&D and infrastructure to improve the safety, scalability, and performance of these refrigerants across diverse climate conditions. A shift toward decentralized cooling systems, coupled with the growing demand for energy-efficient solutions in refrigeration and air conditioning, is fostering long-term market growth.

Moreover, the cost competitiveness of natural refrigerants, especially in large commercial systems, is expected to further support their adoption As the industry moves toward carbon neutrality and sustainability targets, the demand for naturally occurring refrigerants is set to rise across refrigeration, HVAC, and transport cooling sectors.

The natural refrigerants market is segmented by type, application, end user, and geographic regions. By type, natural refrigerants market is divided into Hydrocarbon, Ammonia, Carbon dioxide, and Others. In terms of application, natural refrigerants market is classified into Air conditioners, Cold storage, Freezers, Food processing, and Others (heat pumps, data centers).

Based on end user, natural refrigerants market is segmented into Commercial, Industrial, and Residential. Regionally, the natural refrigerants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Hydrocarbons are projected to account for 32.8% of the total revenue share in the natural refrigerants market in 2025, positioning this type as a leading choice among available options. The segment’s growth is being driven by the strong thermodynamic performance, low global warming potential, and excellent compatibility with existing refrigeration technologies. Hydrocarbons such as propane and isobutane have been widely incorporated in residential and commercial refrigeration systems due to their energy efficiency and low environmental impact.

Advances in system design and safety protocols have enabled broader use of hydrocarbons in air conditioning and heat pump applications. Additionally, hydrocarbons support cost-effective retrofitting of older systems, allowing businesses to align with new environmental regulations without major overhauls.

Enhanced flammability management and leak detection solutions have made hydrocarbon-based systems viable in urban and enclosed environments. The scalability, efficiency, and regulatory acceptance of hydrocarbons are expected to continue reinforcing their demand in sustainable cooling solutions.

The air conditioners segment is expected to represent 46.2% of the total revenue share in the natural refrigerants market in 2025, making it the dominant application area. Growth in this segment is being supported by increasing urbanization, rising temperatures due to climate change, and growing adoption of green building standards. The use of natural refrigerants in air conditioning systems is gaining momentum as both regulatory and consumer pressure mount to eliminate high-GWP refrigerants.

Technological improvements in system components, such as compressors and heat exchangers, have enabled the effective use of natural refrigerants in both residential and commercial air conditioning applications. Energy efficiency standards and incentives introduced by governments are further driving adoption in this segment.

Manufacturers are actively investing in product development and training to ensure safety and performance when using these refrigerants. The ability to deliver sustainable cooling solutions with reduced lifecycle emissions positions air conditioning as the key growth area within the natural refrigerants ecosystem.

The commercial sector is anticipated to hold 53.7% of the total revenue share in the natural refrigerants market in 2025, underscoring its leadership among end users. The segment’s dominance is being shaped by the need for efficient, compliant, and environmentally responsible refrigeration systems in supermarkets, convenience stores, cold chains, and hospitality industries. Regulatory pressure to eliminate high-GWP refrigerants and reduce carbon emissions has led to a surge in the adoption of natural refrigerants in commercial settings.

System scalability, energy efficiency, and cost savings have made these refrigerants attractive for high-usage applications. Investment in infrastructure upgrades, particularly in food retail and warehousing, has further driven the transition toward ammonia, carbon dioxide, and hydrocarbons.

Commercial operators are leveraging natural refrigerants not only to meet regulatory mandates but also to enhance brand image and sustainability reporting. As cooling demand grows across developing economies and smart retail expands, commercial end users are expected to remain the largest consumers of natural refrigerant-based systems.

The natural refrigerants market is growing rapidly due to increasing environmental concerns, stricter regulations on synthetic refrigerants, and rising adoption in HVAC, refrigeration, and industrial cooling systems. Natural refrigerants, such as ammonia (NH₃), carbon dioxide (CO₂), and hydrocarbons (propane, isobutane), offer low global warming potential (GWP) and zero ozone depletion potential (ODP). Technological innovations in system design, safety enhancements, and energy efficiency are enabling broader adoption. North America and Europe lead regulatory-driven deployment, while Asia-Pacific is expanding due to urbanization, commercial refrigeration, and industrial growth.

Stringent global regulations, including the Kigali Amendment, EU F-Gas Regulation, and USA SNAP program, are phasing down high-GWP synthetic refrigerants. Natural refrigerants, with negligible or zero GWP, are increasingly mandated in commercial and industrial applications. Compliance requires retrofitting or replacing existing systems, providing opportunities for early movers. However, safety standards for flammable (hydrocarbons) or toxic (ammonia) refrigerants demand specialized system design and installation training. Manufacturers developing compliant, high-performance systems with safety certifications gain a competitive edge. Until uniform global enforcement occurs, regulatory-driven adoption remains the primary market driver.

Natural refrigerants like CO₂ and ammonia offer high thermodynamic efficiency, particularly in large-scale industrial and commercial cooling applications. Advanced system designs, including transcritical CO₂ cycles and hybrid ammonia systems, improve energy consumption and reduce operational costs. Energy efficiency benefits are critical in regions with high electricity costs and sustainability mandates. Integration of smart controls and variable-speed compressors further enhances performance. Companies investing in R&D for optimized cycle design, heat exchanger improvements, and system reliability differentiate themselves in the market. Until widespread adoption of energy-efficient solutions occurs, system optimization remains a decisive factor in natural refrigerant selection.

Natural refrigerants present unique safety considerations. Ammonia is toxic, hydrocarbons are flammable, and CO₂ can cause asphyxiation in confined spaces. Proper training, leak detection systems, ventilation, and adherence to safety standards are essential for installation and maintenance. These factors can increase upfront costs and require skilled labor, limiting adoption in smaller facilities or developing regions. Manufacturers offering pre-engineered, safe, and easy-to-operate systems help mitigate risks. Until safety concerns are fully addressed with standardized protocols and technologies, market growth will continue to depend on balancing performance, cost, and user confidence.

Demand for natural refrigerants is expanding beyond traditional refrigeration and air conditioning into cold-chain logistics, industrial freezers, heat pumps, and transport refrigeration. E-commerce, pharmaceuticals, and food processing industries are driving adoption due to sustainability and efficiency requirements. Regional growth in Asia-Pacific is fueled by industrialization, rising refrigeration demand, and the adoption of green building practices. Companies developing modular, scalable systems for diverse applications and climates gain a competitive advantage. Until infrastructure, safety standards, and technician training are widely available, market expansion will be shaped by innovative solutions tailored to emerging and niche applications.

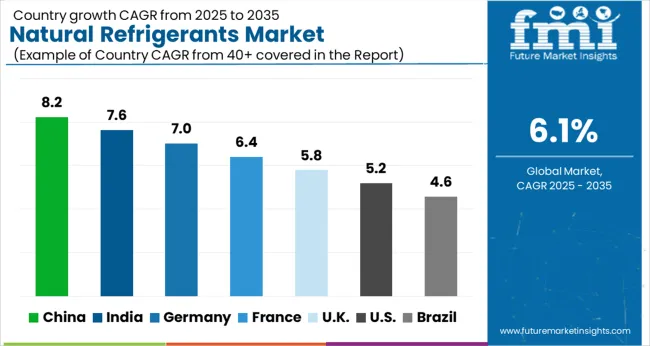

| Country | CAGR |

|---|---|

| China | 8.2% |

| India | 7.6% |

| Germany | 7.0% |

| France | 6.4% |

| UK | 5.8% |

| USA | 5.2% |

| Brazil | 4.6% |

The global Natural Refrigerants Market is projected to grow at a CAGR of 6.1% through 2035, supported by increasing demand across refrigeration, air conditioning, and industrial cooling applications. Among BRICS nations, China has been recorded with 8.2% growth, driven by large-scale production and deployment in commercial and industrial refrigeration systems, while India has been observed at 7.6%, supported by rising utilization in air conditioning and cooling applications. In the OECD region, Germany has been measured at 7.0%, where production and adoption for industrial and commercial cooling solutions have been steadily maintained. The United Kingdom has been noted at 5.8%, reflecting consistent use in refrigeration and HVAC applications, while the USA has been recorded at 5.2%, with production and utilization across industrial, commercial, and residential cooling systems being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

The natural refrigerants market in China is growing at a CAGR of 8.2%, driven by increasing adoption of eco-friendly refrigeration technologies in commercial, industrial, and residential sectors. Rising environmental regulations and government initiatives targeting reduced greenhouse gas emissions are encouraging companies to replace synthetic refrigerants with natural alternatives like ammonia, CO₂, and hydrocarbons. The growing food and beverage, cold chain logistics, and HVAC industries in China contribute significantly to the demand for natural refrigerants. Technological advancements in refrigeration systems, energy-efficient compressors, and low-global-warming-potential solutions further accelerate market growth. Manufacturers are investing in research to enhance system performance while minimizing environmental impact. Adoption in supermarkets, cold storage facilities, and industrial refrigeration is supporting consistent demand. With increasing awareness of climate change and sustainability, China is emerging as a key market for natural refrigerants.

The natural refrigerants market in India is expanding at a CAGR of 7.6%, fueled by growing demand from commercial, industrial, and residential refrigeration sectors. Rising awareness about environmental impact and regulatory frameworks to reduce high-global-warming-potential refrigerants drive adoption of natural alternatives such as CO₂, ammonia, and hydrocarbons. India’s cold chain, food processing, and HVAC industries are key consumers of these refrigerants. Technological innovations in energy-efficient systems and compressors enhance performance and lower operational costs. Government initiatives promoting sustainable refrigeration and green building standards further support market growth. Adoption in supermarkets, warehouses, and industrial facilities is accelerating as businesses seek to comply with environmental standards. With increasing focus on reducing carbon emissions, India’s market for natural refrigerants is poised for steady expansion over the forecast period.

The natural refrigerants market in Germany is growing at a CAGR of 7.0%, driven by stringent environmental regulations and the need for sustainable cooling solutions. Germany’s commercial, industrial, and residential refrigeration sectors are increasingly transitioning from synthetic refrigerants to natural alternatives such as ammonia, CO₂, and hydrocarbons. The food and beverage industry, cold storage facilities, and HVAC systems are major consumers. Technological advancements in refrigeration equipment, compressors, and eco-friendly solutions enhance energy efficiency and reduce operational costs. Government incentives and policies promoting low-global-warming-potential refrigerants are accelerating adoption. Germany’s focus on sustainability, climate goals, and energy-efficient infrastructure further supports market expansion. With growing awareness of environmental impact and technological innovation, Germany maintains a strong position in the global natural refrigerants market.

The natural refrigerants market in the United Kingdom is expanding at a CAGR of 5.8%, driven by industrial, commercial, and residential demand for sustainable cooling solutions. Adoption of natural alternatives like ammonia, CO₂, and hydrocarbons is increasing due to regulatory pressure to reduce synthetic refrigerants with high global warming potential. The UK’s food and beverage, cold chain, and HVAC sectors are major consumers of these refrigerants. Technological innovations in energy-efficient refrigeration systems and low-emission solutions support operational efficiency. Government initiatives and green building regulations accelerate adoption. Supermarkets, warehouses, and industrial facilities are integrating natural refrigerants to comply with environmental standards. Rising awareness about climate change and sustainable practices is fueling steady market growth. The UK is expected to witness consistent demand for natural refrigerants over the forecast period.

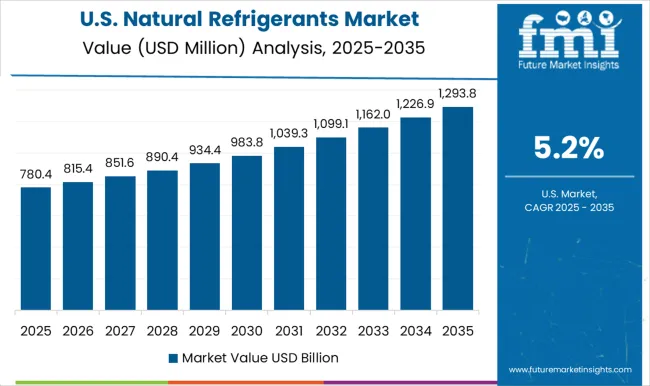

The natural refrigerants market in the United States is growing at a CAGR of 5.2%, fueled by demand from commercial, industrial, and residential refrigeration sectors. Environmental regulations and the push to reduce synthetic refrigerants with high global warming potential drive adoption of natural alternatives such as CO₂, ammonia, and hydrocarbons. The food processing, cold storage, and HVAC industries are major end-users. Technological advancements in energy-efficient refrigeration systems, compressors, and low-emission solutions enhance operational performance and sustainability. Government incentives, regulatory compliance, and green building standards further support market growth. Rising environmental awareness among consumers and industries accelerates the transition to natural refrigerants. With continuous innovation and growing emphasis on eco-friendly solutions, the United States market for natural refrigerants is poised for steady expansion over the forecast period.

The natural refrigerants market is gaining significant momentum due to the growing emphasis on environmentally friendly cooling solutions and stricter regulations on synthetic refrigerants with high global warming potential (GWP). Natural refrigerants, including ammonia (NH₃), carbon dioxide (CO₂), hydrocarbons, and water-based solutions, offer energy-efficient and low-GWP alternatives for commercial, industrial, and residential applications. The market is driven by increasing adoption in refrigeration, air conditioning, heat pumps, and cold storage sectors globally.

Key players shaping the market include A-Gas International, a global supplier specializing in natural refrigerants and sustainable cooling solutions. Linde plc and Air Liquide provide industrial gases, including natural refrigerants, with strong global distribution networks and technological expertise. Danfoss offers advanced components and systems for natural refrigerants, supporting safe and efficient operations.

Other prominent manufacturers include AGC, a leading chemical producer, and Tazzetti S.p.A., known for ammonia-based refrigeration solutions. Asian market players such as Puyang Zhongwei Fine Chemical and Shandong Yuean Chemical Industry are expanding production capacities to meet growing regional demand. HyChill Australia and Engas Australasia focus on sustainable refrigeration solutions for commercial and industrial applications in the Oceania region.

The market is expected to grow rapidly as governments and industries continue transitioning to low-GWP alternatives, driven by environmental policies and energy efficiency goals. Innovations in safety, system design, and refrigerant recovery technologies further enhance the adoption of natural refrigerants, positioning them as a critical component of sustainable cooling strategies worldwide.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.7 Billion |

| Type | Hydrocarbon, Ammonia, Carbon dioxide, and Others (chlorofluorocarbon and hydrochlorofluorocarbon) |

| Application | Air conditioners, Cold storage, Freezers, Food processing, and Others (heat pumps, data centers) |

| End User | Commercial, Industrial, and Residential |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | A-Gas International, Linde plc, Danfoss, Air Liquide, AGC, Tazzetti S.p.A., Puyang Zhongwei Fine Chemical, Shandong Yuean Chemical Industry, HyChill Australia, and engas Australasia |

| Additional Attributes | Dollar sales vary by refrigerant type, including ammonia (NH₃), carbon dioxide (CO₂), hydrocarbons (propane, isobutane), and water (H₂O); by application, such as air conditioning, refrigeration, heat pumps, and industrial cooling; by end-use industry, spanning commercial, residential, industrial, and automotive; by region, led by Asia-Pacific, Europe, and North America. Growth is driven by environmental regulations, demand for low-GWP solutions, and sustainability initiatives. |

The global natural refrigerants market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the natural refrigerants market is projected to reach USD 3.1 billion by 2035.

The natural refrigerants market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in natural refrigerants market are hydrocarbon, ammonia, carbon dioxide and others (chlorofluorocarbon and hydrochlorofluorocarbon).

In terms of application, air conditioners segment to command 46.2% share in the natural refrigerants market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Natural Fiber Composites Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Colors Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA