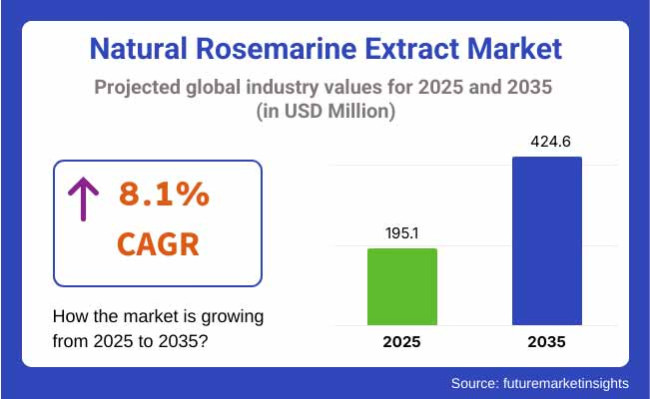

The world natural rosemarine extract market stood at 156 million USA dollars in the year 2022. The report indicates that these products are of enormous demand since the same market will reach USD 195.1 million by the year 2025. It will grow with an expected CAGR of 8.1% during the period 2025 to 2035 and will reach USD 424.6 million by the year 2035.

Rosemarine extract is a substance which is derived from Rosmarinus officinalis and is applied in food & beverage, pharma, and cosmetics based on antioxidant, antimicrobial, and preservative property. Increasing requirements for natural food preservatives and functional plant ingredients are also driving strongly increasing demand for rosemarine extract globally across all geographies.

Pure rosemarine extract as clean label substitute to chemical-based preservative like BHA & BHT in food & beverage. Food companies are applying rosemarine extract to assist to give the product longer shelf-life. Along with long term natural antioxidant protection. Another Application of Extract to Offer Extended Flavor Protection to Bakery Food, Dairy Food and Processed Meat

Pharma industry never remained oblivious to the miracle of rosemarine extract and has developed a range of nutraceutical products and herbal formulations, researched intensively to provide anti-inflammatory and neuroprotective activity. Its antioxidant effect quality, mental health, cardiovascular health, etc. have been researched intensively by scientific research articles published making it a food supplement ingredient in demand.

Rosemarine extract is also in the sight of the personal care and cosmetic industry due to the advantage of being anti-aging, soothing and antibacterial. Natural and plant cosmetics are changing the way of purchasing behavior, and herbal skin care companies are adding it to shampoos, wrinkle creams, and serums.

Since pro-natural preservatives are the dominant regulatory models of today's market, and because customers use and consume transparency-label products at very high rates, North America and Europe are the dominant markets to a large extent.

Asia-Pacific is therefore an emerging one with higher consumption of herbal and functional ingredients in place of traditional drugs and the food sector. Natural and Plant-based Food Preservatives Demand will increase, Advanced Technology Applied in Extraction Process to Create New Opportunity to Rosemary Extract Market.

This part of the report is latest global natural rosemarine extract market overview, its markets analysis on base year (2024) and current year (2025) six-months duration CAGR fluctuation till up to October 2023. This fact has been used to calculate some growth trend fluctuations and revenue values in the forecast period.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.8% |

| H2 (2024 to 2034) | 7.9% |

| H1 (2025 to 2035) | 8.0% |

| H2 (2025 to 2035) | 8.1% |

The market will grow by 8.0% in the first half of the decade under assumption (2025 to 2035) to 8.1% for the second half (H2). H1 2025 was 20 BPS above H1 2024, and 10 BPS are from H2 2025 and reflect strong solid general market growth trends.

Hence, the overall natural rosemarine extract market will grow as there is increased use as clean-label preservatives and plant-based skin-care formula preventatives and nutraceutical applications. The moment the experts re-discover the preservative and health potential of the extract, the companies would challenge themselves with new extracts and new formulation, offering a company for sustainable growth.

The natural rosemarine extract market is highly fragmented, and demand for clean-label food preservatives, natural antioxidants, and herbal cosmetics is increasing. The market contains organised and unorganised players with different geography concentration.

The organized segment consists of lead botanical extract producers, food ingredient producers, and cosmetic ingredient producers that produce high-purity rosemary extracts to the food, cosmetic, and pharmaceutical sectors. The companies include Kemin Industries, Naturex (Givaudan), Sabinsa Corporation, FLAVEX Naturextrakte, and Nexira. The companies are based in North America, Europe, and Asia and focus on organic certification, solvent-free extraction, and food safety conformity.

Organised players are investing in high-end extraction technology such as CO₂ supercritical extraction to accelerate antioxidant activity at the expense of neither clean-label and natural product platforms. They provide applications across natural food protection, functional derma, and herbal medicine and serve mass-scale manufacturers and global distributors.

The unorganised sector comprises small rosemary producers, regional oil producers, and small distributors, mainly in Mediterranean nations, India, and Latin America where rosemary is farmed widely. These manufacturers use traditional steam distillation or solvent extraction and sell raw rosemary oil or raw extracts to regional markets, herbalists, and small cosmetic firms.

Since they are unscalable and disproportional in terms of purity, unorganised producers are unable to compete with worldwide regulation levels. But they supply inexpensive, natural rosemary extract to home industries and small industries for craft food, hand-made cosmetics, and herbal medicine.

The market will grow in the wake of demand for natural food, cosmetic, and pharmaceutical antioxidants from consumers. Organized players will be high-performance extracts with assured performance, whereas unorganized will be value additions through processing technology and certifications for mass market gains.

Growing Demand for Plant-Based Antimicrobial Meat and Seafood Ingredients

Shift: As the consumers started asking for chemical-free meat with clean labels, the industry has shifted away from chemicals such as BHA and BHT. Plant-based rosemarine extract with rosmarinic acid and carnosic acid is a very potent antimicrobial and antioxidant with shelf life and quality retention.

It is a very stringent requirement in Europe and North America due to stringent regulatory pressure along with market demand from customers for chemical impurities-free along with food safe foods. Processed meat firms and meat industry now stand prepared to embrace rosemarine as natural substitute man-made additive.

Strategic Response: Market leader company Corbion launched Veri-Nat™ Rosemary Extract for use on meats as well as on seafoods. It is applied on sausages, deli meat, and smoked fish to lower microbial load and spoilage. This portfolio attained 12% penetration rate in European meat processors.

Naturex partnered in Asia with seafood manufacturers to blend rosemarine extract in cold-smoked tuna and salmon and market clean-label, premium foods. The trend is a reaction to regulatory advancements to drive natural preservatives and attains evident market advantage in premium food segments. These war efforts utilizing rosemarine illustrate its increasing significance to safe, environmentally sound meat preservation.

Path-breaking Introduction into Environmentally Friendly Home Cleansers and Body Care Products

Shift: Active consumers are turning to plant-based, non-toxic cleaning and personal care products in the home. The more caustic, antiquated chemicals like ammonia and bleach are no longer indoor air quality as well as overall well-being. Natural rosemarine extract with antimicrobial, antifungal, and deodorant activity is being added to hand soap, dish soap, and surface sprays. And its pleasant natural scent adds to the product's selling point with function plus sensory benefit.

Strategic Response: Seventh Generation introduced a rosemary-based, multi-surface cleaner under its "Botanical Solutions" line of products for green-minded consumers. The product contributed to sales growth by 9% in North America's green cleaning market. Method introduced rosemarine extract under its "Herbal Clean" line of products and promoted it as a botanical antibacterial for application to a variety of surfaces.

New companies such as Truce Clean also feature rosemarine extract in zero-waste home cleaning sets for consumers who care about sustainability and minimalism. For personal care, Dr. Bronner's incorporated rosemarine in its castile soaps and hair rinses, cementing its botanical, cruelty-free brand identity. This green expansion into the market is an irrefutable move toward safe, plant-based living.

Natural Pet Foods and Pet Grooming Products Applications

Shift: Pet owners are shifting pet nutrition and pet grooming to their health and wellness values. Natural preservatives and functional botanicals are increasingly being requested to be used in pet food and personal care.

Rosemarine extract, as a means of preventing oxidation and imparting antimicrobial properties, is increasingly being used in natural pet foods as a means of obtaining shelf life without the need for added preservatives. Additionally, its relaxing and anti-inflammatory characteristic positions it as an in-demand ingredient in shampoos and skin care in pets.

Strategic Response: Blue Buffalo, a natural pet food company producing premium natural pet food, launched preservative-free dry dog foods stabilized by rosemarine extract, which saw a 14% boost in their organic line of products. The company focuses on its clean-label promise, which is appealing to health-conscious pet owners.

In pet grooming, Earthbath introduced a rosemarine and aloe vera deodorizing and anti-itch pet shampoo that attracted positive consumer feedback for performance and efficacy and all-natural ingredients. Only Natural Pet businesses include rosemarine extract in pet supplements to support joint function and immune system health. This indicates a shift towards increased convergence between human and pet health, and rosemarine extract is a consistent, multi-use animal botanical.

Innovation in Herbal Teas and Functional Drinks

Shift: Increased numbers of functional beverages are produced with natural botanicals for mental clarity, stress resilience, and gut health. Rosemarine extract, the ancient herbal drug without nootropic and adaptogenic effect, is one of the leading-selling ingredients currently being highlighted in healthy drinks. Its refreshing herbal taste, natural energy-enhancing effects, and gut health attractiveness appeal to customers, especially in clean-label tea, detox drinks, and fermented drinks such as kombucha.

Strategic Response: Pukka Herbs introduced "Focus & Clarity," a functional tea containing rosemarine, mint, and ginseng, that resonated with wellness-oriented consumers looking for natural mental assistance. The product was an instant hit among wellness groups in the UK and Germany. In the United States, REBBL introduced rosemarine extract in its "Brain Boost" adaptogenic beverages, propelling sales growth of 8% in the functional beverage segment.

Kombucha brands such as Humm combined rosemarine in detox beverages to add flavor interest and functional interest. This botanical-beverage beverage trend demonstrates consumer interest in overall well-being with demand for multifunctional, clean-label beverages showing therapeutical properties - a marketplace where rosemarine extract is a player.

Ethical Sourcing and Regenerative Agriculture Trend

Shift: Sustainability and Sourcing ethics are some of the strongest drivers of food purchasing decision in the beauty, and wellness industries. Customers are demanding more and more ingredient source, growing practice, and their environmental impact to be revealed to them Rosemarine extract manufacturers.

Strategic Response: Botanica Extracts collaborated with regenerative Spanish and Italian farms to ensure organically cultivated rosemarine traceability. The firm utilized blockchain technology-based tools of transparency and obtained certifications such as ECOCERT and Fair for Life that appealed to EU retailers concerned about sustainable supply chains. Symrise, the world's ingredient leader, utilized vertical farming practices to cultivate rosemarine on 80% less water and no pesticides.

These approaches empower business sustainability efforts and consumer requests for sustainable ingredients. Moreover, niche brands increasingly utilize rosemarine source tales on-pack, including facilitating smallholder farmers and carbon-free logistics. Green storytelling facilitates both brand differentiation and both environmental stewardship and consumer trust.

The following table shows the estimated growth rates of the top five territories. These markets are set to experience high consumption through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 7.8% |

| Germany | 8.3% |

| China | 8.0% |

| Japan | 7.6% |

| India | 8.7% |

Robust Consumer Demand for Clean-Label Ingredients Boosting USA Rosemary Extract MarketNatural ingredients are steadily paving the way in the preservatives market, consequently accelerating growth of the USA rosemary extract market. With synthetic additives accumulating, food makers are gravitating toward rosemary extract, a natural antioxidant, in everything from processed foods and snacks to drinks.

Its antibacteria abilities, on the other hand, are greatly used in meat and poultry sector due to their shelf life. The increasing nutraceutical and dietary supplement market also drives demand since rosemary extract is known for its cognitive, anti-inflammatory effects. Market trends are also evolve due to sustainability initiatives, organic farming and eco-friendly extraction methods.

Germany is among the key markets for the natural rosemary extract owing to well-developed organic as well as functional food division. Because consumers prefer more and more plant-based and non-GMO ingredients, rosemary extract has now gained popularity in natural food preservation and herbal supplements. Moreover, the strict food safety regulations in the European Union support the use of natural additives in place of synthetic counterparts, thus accelerating the growth of the market.

Clean-label beauty and personal care products containing rosemary extract are also in demand, as shoppers look for natural skincare and haircare treatments. Germany’s well-developed retail landscape featuring organic supermarkets and specialty shop channels guarantees widespread availability of products based on rosemary extract.

The rapid urbanization in China and a growing population of middle-class people are increasing the demand for natural and functional ingredients, which is consequently propelling the growth of the rosemary extract market. With growing health consciousness, demand for herbal and plant-based preservatives in the food & beverages has increased. The rosemary extract, due its antioxidant and anti-aging properties, makes it perfect for use in cosmetics and personal-care products, fuelling industry expansion.

Marketplace growth is also sustained by government policies promoting the natural food and cosmetics industry. The expanding e-commerce industry in China has also improved accessibility to high-end rosemary extract products, thereby increasing sales and consumer knowledge.

Japan’s emphasis on longevity and health has made rosemary extract a desirable element of its functional food and nutraceutical industries. With growing interest in natural ingredients with beneficial properties in cognition and inflammation among the aging population, rosemary extract is gradually becoming an ingredient of choice in dietary supplements and herbal teas.

Also, Japan’s growing clean-label movement has seen the use of it being adopted in processed foods and beverages as a natural preservative. Demand is also driven by the expanding market for natural skin care, as rosemary extract is known to have skin-rejuvenating properties. Tyler Campbell is a repeat state champion in cross-country, nationally competitive athlete, and race director.

| Segment | Value Share (2025) |

|---|---|

| Powder(By Form) | 63.5% |

Most of the market is dominated by powdered formulations, which have an extended shelf life, are easy to incorporate in multiple products, and convenient to store and transport. As a result, powdered forms are used in several industries such as food & beverages, pharmaceuticals, and nutraceuticals owing to their excellent retention of nutrients and precision in dosing. In food and beverage segment, the powders are preferred for their capacity to dissolve into drinks, smoothies and functional food products.

Powder formulations offer controlled release, mixability, and process ability in supplements, tablets, and capsules as raw materials in pharmaceutical and nutraceutical companies. In the pet and animal food industries, powdered forms are popular and are used as nutritional additives to improve digestion, immunity, and overall health.

Trend for product usage in powdered formulations is also increasing given the growing awareness plant-based and natural-based products among consumer segment. With key manufacturers adopting advanced processing technologies to enhance the bio-availability and stability of powdered ingredients, the powdered ingredients segment will hold a significant share in the market.

| Segment | Value Share (2025) |

|---|---|

| Food & Beverage (By Application) | 41.2% |

Key Players in the Peptides Market Increasing consumer demand for functional foods made with natural ingredients has been favoring the food and beverage industry, the largest application segment for these products. As health consciousness rises, consumers are looking for food and beverage products infused with nutritional ingredients that will contribute to their well-being.

Household food items such as energy bars, protein shakes, dairy alternatives and health drinks, powdered and liquid ingredients are widely used in all these products. The beverage market, especially functional drinks such as herbal teas, energy drinks, and meal replacements, is witnessing an aggressive uptake of these ingredients, owing to their health benefits.

Moreover, consumers increasingly favor plant-based and organic products, thereby driving demand growth in food industry. With consumers narrowing in on wellness, weight management and immunity-booster diets, the food and beverage applications demand will continue to grow as well, making it a major revenue generator, confirmed the report.

The Natural Rosmarinic Extract Market is highly concentrated with few players such as Naturex (Givaudan), Kemin Industries and Sabinsa Corporation, who have a competitive edge in their brand presence, innovative product development and global reach added to the competition. Some of the key players in the global market are also dominant suppliers of high purity, standardized rosmarinic acid extracts used in food preservation, dietary supplements, and cosmetic applications.

These clinically validated formulations, offered in sustainably sourced packaging, help build their business, attracting health-conscious customers and environmentally knowledgeable consumers alike. Product quality and packaging innovation have become top priority for manufacturers.

The same effect has been achieved in the food, beverage and personal care space by companies creating water-soluble and oil-soluble versions of rosemary extract. In addition, sustainable and resealable packaging is on a rise, gaining popularity with eco-aware shoppers.

For instance:

Market segmented into Powder and Liquid.

Market segmented into Food & Beverage, Pharmaceuticals, Nutraceuticals, Cosmetics & Personal Care, Pet Food, and Animal Food.

Market segmented into North America, Latin America, Europe, East Asia, South Asia, and the Middle East & Africa (MEA).

The global natural rosemarine extract market is projected to grow at a CAGR of 8.1% during the forecast period.

The market is estimated to reach approximately USD 424.6 million by 2035.

The food and beverage segment is expected to witness the fastest growth due to increasing use of rosemarine extract as a natural preservative and antioxidant.

Key growth drivers include rising demand for clean-label ingredients, growing consumer preference for natural antioxidants, and increasing applications in cosmetics and pharmaceuticals.

Leading companies in the market include Kemin Industries, Naturex (Givaudan), FLAVEX Naturextrakte GmbH, Danisco (IFF), and Kalsec Inc.

Table 1: Global Value (US$ Mn) Forecast by Region, 2017 to 2032

Table 2: Global Volume (MT) Forecast by Region, 2017 to 2032

Table 3: Global Value (US$ Mn) Forecast by Form, 2017 to 2032

Table 4: Global Volume (MT) Forecast by Form, 2017 to 2032

Table 5: Global Value (US$ Mn) Forecast by Application, 2017 to 2032

Table 6: Global Volume (MT) Forecast by Application, 2017 to 2032

Table 7: North America Value (US$ Mn) Forecast by Country, 2017 to 2032

Table 8: North America Volume (MT) Forecast by Country, 2017 to 2032

Table 9: North America Value (US$ Mn) Forecast by Form, 2017 to 2032

Table 10: North America Volume (MT) Forecast by Form, 2017 to 2032

Table 11: North America Value (US$ Mn) Forecast by Application, 2017 to 2032

Table 12: North America Volume (MT) Forecast by Application, 2017 to 2032

Table 13: Latin America Value (US$ Mn) Forecast by Country, 2017 to 2032

Table 14: Latin America Volume (MT) Forecast by Country, 2017 to 2032

Table 15: Latin America Value (US$ Mn) Forecast by Form, 2017 to 2032

Table 16: Latin America Volume (MT) Forecast by Form, 2017 to 2032

Table 17: Latin America Value (US$ Mn) Forecast by Application, 2017 to 2032

Table 18: Latin America Volume (MT) Forecast by Application, 2017 to 2032

Table 19: Europe Value (US$ Mn) Forecast by Country, 2017 to 2032

Table 20: Europe Volume (MT) Forecast by Country, 2017 to 2032

Table 21: Europe Value (US$ Mn) Forecast by Form, 2017 to 2032

Table 22: Europe Volume (MT) Forecast by Form, 2017 to 2032

Table 23: Europe Value (US$ Mn) Forecast by Application, 2017 to 2032

Table 24: Europe Volume (MT) Forecast by Application, 2017 to 2032

Table 25: East Asia Value (US$ Mn) Forecast by Country, 2017 to 2032

Table 26: East Asia Volume (MT) Forecast by Country, 2017 to 2032

Table 27: East Asia Value (US$ Mn) Forecast by Form, 2017 to 2032

Table 28: East Asia Volume (MT) Forecast by Form, 2017 to 2032

Table 29: East Asia Value (US$ Mn) Forecast by Application, 2017 to 2032

Table 30: East Asia Volume (MT) Forecast by Application, 2017 to 2032

Table 31: South Asia Value (US$ Mn) Forecast by Country, 2017 to 2032

Table 32: South Asia Volume (MT) Forecast by Country, 2017 to 2032

Table 33: South Asia Value (US$ Mn) Forecast by Form, 2017 to 2032

Table 34: South Asia Volume (MT) Forecast by Form, 2017 to 2032

Table 35: South Asia Value (US$ Mn) Forecast by Application, 2017 to 2032

Table 36: South Asia Volume (MT) Forecast by Application, 2017 to 2032

Table 37: Oceania Value (US$ Mn) Forecast by Country, 2017 to 2032

Table 38: Oceania Volume (MT) Forecast by Country, 2017 to 2032

Table 39: Oceania Value (US$ Mn) Forecast by Form, 2017 to 2032

Table 40: Oceania Volume (MT) Forecast by Form, 2017 to 2032

Table 41: Oceania Value (US$ Mn) Forecast by Application, 2017 to 2032

Table 42: Oceania Volume (MT) Forecast by Application, 2017 to 2032

Table 43: MEA Value (US$ Mn) Forecast by Country, 2017 to 2032

Table 44: MEA Volume (MT) Forecast by Country, 2017 to 2032

Table 45: MEA Value (US$ Mn) Forecast by Form, 2017 to 2032

Table 46: MEA Volume (MT) Forecast by Form, 2017 to 2032

Table 47: MEA Value (US$ Mn) Forecast by Application, 2017 to 2032

Table 48: MEA Volume (MT) Forecast by Application, 2017 to 2032

Figure 1: Global Value (US$ million) by Form, 2022 to 2032

Figure 2: Global Value (US$ million) by Application, 2022 to 2032

Figure 3: Global Value (US$ million) by Region, 2022 to 2032

Figure 4: Global Value (US$ million) Analysis by Region, 2017 to 2032

Figure 5: Global Volume (MT) Analysis by Region, 2017 to 2032

Figure 6: Global Value Share (%) and BPS Analysis by Region, 2022 to 2032

Figure 7: Global Y-o-Y Growth (%) Projections by Region, 2022 to 2032

Figure 8: Global Value (US$ million) Analysis by Form, 2017 to 2032

Figure 9: Global Volume (MT) Analysis by Form, 2017 to 2032

Figure 10: Global Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 11: Global Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 12: Global Value (US$ million) Analysis by Application, 2017 to 2032

Figure 13: Global Volume (MT) Analysis by Application, 2017 to 2032

Figure 14: Global Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 15: Global Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 16: Global Attractiveness by Form, 2022 to 2032

Figure 17: Global Attractiveness by Application, 2022 to 2032

Figure 18: Global Attractiveness by Region, 2022 to 2032

Figure 19: North America Value (US$ million) by Form, 2022 to 2032

Figure 20: North America Value (US$ million) by Application, 2022 to 2032

Figure 21: North America Value (US$ million) by Country, 2022 to 2032

Figure 22: North America Value (US$ million) Analysis by Country, 2017 to 2032

Figure 23: North America Volume (MT) Analysis by Country, 2017 to 2032

Figure 24: North America Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 25: North America Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 26: North America Value (US$ million) Analysis by Form, 2017 to 2032

Figure 27: North America Volume (MT) Analysis by Form, 2017 to 2032

Figure 28: North America Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 29: North America Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 30: North America Value (US$ million) Analysis by Application, 2017 to 2032

Figure 31: North America Volume (MT) Analysis by Application, 2017 to 2032

Figure 32: North America Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 33: North America Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 34: North America Attractiveness by Form, 2022 to 2032

Figure 35: North America Attractiveness by Application, 2022 to 2032

Figure 36: North America Attractiveness by Country, 2022 to 2032

Figure 37: Latin America Value (US$ million) by Form, 2022 to 2032

Figure 38: Latin America Value (US$ million) by Application, 2022 to 2032

Figure 39: Latin America Value (US$ million) by Country, 2022 to 2032

Figure 40: Latin America Value (US$ million) Analysis by Country, 2017 to 2032

Figure 41: Latin America Volume (MT) Analysis by Country, 2017 to 2032

Figure 42: Latin America Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 43: Latin America Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 44: Latin America Value (US$ million) Analysis by Form, 2017 to 2032

Figure 45: Latin America Volume (MT) Analysis by Form, 2017 to 2032

Figure 46: Latin America Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 47: Latin America Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 48: Latin America Value (US$ million) Analysis by Application, 2017 to 2032

Figure 49: Latin America Volume (MT) Analysis by Application, 2017 to 2032

Figure 50: Latin America Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 51: Latin America Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 52: Latin America Attractiveness by Form, 2022 to 2032

Figure 53: Latin America Attractiveness by Application, 2022 to 2032

Figure 54: Latin America Attractiveness by Country, 2022 to 2032

Figure 55: Europe Value (US$ million) by Form, 2022 to 2032

Figure 56: Europe Value (US$ million) by Application, 2022 to 2032

Figure 57: Europe Value (US$ million) by Country, 2022 to 2032

Figure 58: Europe Value (US$ million) Analysis by Country, 2017 to 2032

Figure 59: Europe Volume (MT) Analysis by Country, 2017 to 2032

Figure 60: Europe Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 61: Europe Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 62: Europe Value (US$ million) Analysis by Form, 2017 to 2032

Figure 63: Europe Volume (MT) Analysis by Form, 2017 to 2032

Figure 64: Europe Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 65: Europe Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 66: Europe Value (US$ million) Analysis by Application, 2017 to 2032

Figure 67: Europe Volume (MT) Analysis by Application, 2017 to 2032

Figure 68: Europe Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 69: Europe Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 70: Europe Attractiveness by Form, 2022 to 2032

Figure 71: Europe Attractiveness by Application, 2022 to 2032

Figure 72: Europe Attractiveness by Country, 2022 to 2032

Figure 73: East Asia Value (US$ million) by Form, 2022 to 2032

Figure 74: East Asia Value (US$ million) by Application, 2022 to 2032

Figure 75: East Asia Value (US$ million) by Country, 2022 to 2032

Figure 76: East Asia Value (US$ million) Analysis by Country, 2017 to 2032

Figure 77: East Asia Volume (MT) Analysis by Country, 2017 to 2032

Figure 78: East Asia Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 79: East Asia Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 80: East Asia Value (US$ million) Analysis by Form, 2017 to 2032

Figure 81: East Asia Volume (MT) Analysis by Form, 2017 to 2032

Figure 82: East Asia Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 83: East Asia Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 84: East Asia Value (US$ million) Analysis by Application, 2017 to 2032

Figure 85: East Asia Volume (MT) Analysis by Application, 2017 to 2032

Figure 86: East Asia Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 87: East Asia Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 88: East Asia Attractiveness by Form, 2022 to 2032

Figure 89: East Asia Attractiveness by Application, 2022 to 2032

Figure 90: East Asia Attractiveness by Country, 2022 to 2032

Figure 91: South Asia Value (US$ million) by Form, 2022 to 2032

Figure 92: South Asia Value (US$ million) by Application, 2022 to 2032

Figure 93: South Asia Value (US$ million) by Country, 2022 to 2032

Figure 94: South Asia Value (US$ million) Analysis by Country, 2017 to 2032

Figure 95: South Asia Volume (MT) Analysis by Country, 2017 to 2032

Figure 96: South Asia Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 97: South Asia Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 98: South Asia Value (US$ million) Analysis by Form, 2017 to 2032

Figure 99: South Asia Volume (MT) Analysis by Form, 2017 to 2032

Figure 100: South Asia Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 101: South Asia Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 102: South Asia Value (US$ million) Analysis by Application, 2017 to 2032

Figure 103: South Asia Volume (MT) Analysis by Application, 2017 to 2032

Figure 104: South Asia Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 105: South Asia Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 106: South Asia Attractiveness by Form, 2022 to 2032

Figure 107: South Asia Attractiveness by Application, 2022 to 2032

Figure 108: South Asia Attractiveness by Country, 2022 to 2032

Figure 109: Oceania Value (US$ million) by Form, 2022 to 2032

Figure 110: Oceania Value (US$ million) by Application, 2022 to 2032

Figure 111: Oceania Value (US$ million) by Country, 2022 to 2032

Figure 112: Oceania Value (US$ million) Analysis by Country, 2017 to 2032

Figure 113: Oceania Volume (MT) Analysis by Country, 2017 to 2032

Figure 114: Oceania Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 115: Oceania Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 116: Oceania Value (US$ million) Analysis by Form, 2017 to 2032

Figure 117: Oceania Volume (MT) Analysis by Form, 2017 to 2032

Figure 118: Oceania Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 119: Oceania Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 120: Oceania Value (US$ million) Analysis by Application, 2017 to 2032

Figure 121: Oceania Volume (MT) Analysis by Application, 2017 to 2032

Figure 122: Oceania Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 123: Oceania Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 124: Oceania Attractiveness by Form, 2022 to 2032

Figure 125: Oceania Attractiveness by Application, 2022 to 2032

Figure 126: Oceania Attractiveness by Country, 2022 to 2032

Figure 127: MEA Value (US$ million) by Form, 2022 to 2032

Figure 128: MEA Value (US$ million) by Application, 2022 to 2032

Figure 129: MEA Value (US$ million) by Country, 2022 to 2032

Figure 130: MEA Value (US$ million) Analysis by Country, 2017 to 2032

Figure 131: MEA Volume (MT) Analysis by Country, 2017 to 2032

Figure 132: MEA Value Share (%) and BPS Analysis by Country, 2022 to 2032

Figure 133: MEA Y-o-Y Growth (%) Projections by Country, 2022 to 2032

Figure 134: MEA Value (US$ million) Analysis by Form, 2017 to 2032

Figure 135: MEA Volume (MT) Analysis by Form, 2017 to 2032

Figure 136: MEA Value Share (%) and BPS Analysis by Form, 2022 to 2032

Figure 137: MEA Y-o-Y Growth (%) Projections by Form, 2022 to 2032

Figure 138: MEA Value (US$ million) Analysis by Application, 2017 to 2032

Figure 139: MEA Volume (MT) Analysis by Application, 2017 to 2032

Figure 140: MEA Value Share (%) and BPS Analysis by Application, 2022 to 2032

Figure 141: MEA Y-o-Y Growth (%) Projections by Application, 2022 to 2032

Figure 142: MEA Attractiveness by Form, 2022 to 2032

Figure 143: MEA Attractiveness by Application, 2022 to 2032

Figure 144: MEA Attractiveness by Country, 2022 to 2032

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Food Preservatives Market Size and Share Forecast Outlook 2025 to 2035

Natural Cosmetic Color Market Size and Share Forecast Outlook 2025 to 2035

Natural Polymer Market Size and Share Forecast Outlook 2025 to 2035

Natural Gas Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Natural Mineral Oil Coolant Market Size and Share Forecast Outlook 2025 to 2035

Natural Synthetic Cytokinin (Anti-zeatin Riboside) Market Size and Share Forecast Outlook 2025 to 2035

Natural Food Flavors Market Size and Share Forecast Outlook 2025 to 2035

Natural Silicone Alternative Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Natural Surfactant Market Size and Share Forecast Outlook 2025 to 2035

Natural Bitterness Blockers Market Analysis - Size And Share Forecast Outlook 2025 To 2035

Naturally Fermented Food Market Size and Share Forecast Outlook 2025 to 2035

Natural Refrigerants Market Size and Share Forecast Outlook 2025 to 2035

Natural Ferulic Acid Market Size and Share Forecast Outlook 2025 to 2035

Natural Vitamin E Product Market Size and Share Forecast Outlook 2025 to 2035

Natural Oil Polyols NOP Market Size and Share Forecast Outlook 2025 to 2035

Natural Rubber Market Size and Share Forecast Outlook 2025 to 2035

Natural Language Processing in Finance Market Size and Share Forecast Outlook 2025 to 2035

Naturally Derived Fatty Alcohol Market Size and Share Forecast Outlook 2025 to 2035

Natural Fiber Composites Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA