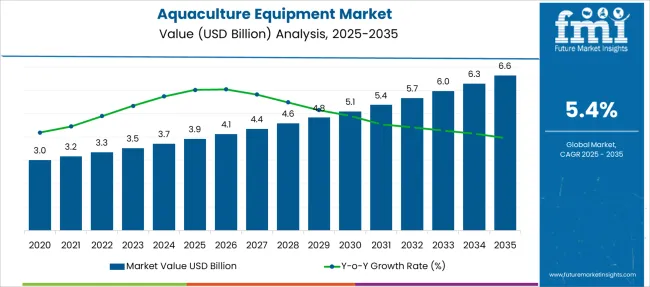

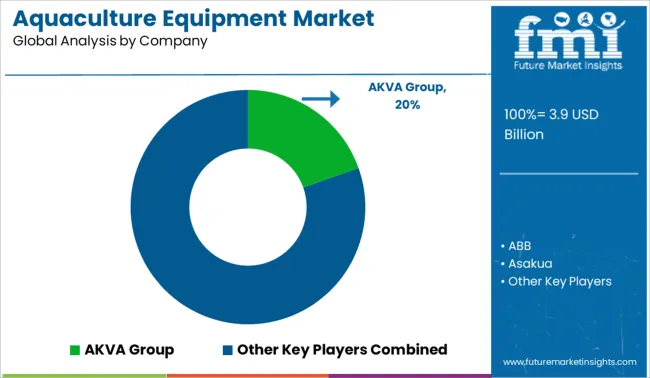

The Aquaculture Equipment Market is estimated to be valued at USD 3.9 billion in 2025 and is projected to reach USD 6.6 billion by 2035, registering a compound annual growth rate (CAGR) of 5.4% over the forecast period.

| Metric | Value |

|---|---|

| Aquaculture Equipment Market Estimated Value in (2025 E) | USD 3.9 billion |

| Aquaculture Equipment Market Forecast Value in (2035 F) | USD 6.6 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

The aquaculture equipment market is growing steadily as the demand for sustainable seafood and aquaculture products increases worldwide. Sea-based aquaculture has expanded rapidly due to the rising need for efficient food production and the depletion of wild fish stocks.

Technological advances in aquaculture equipment have enabled better control of environmental conditions and feeding, which has improved yield and reduced waste. The market is also supported by growing investments in commercial aquaculture farms, where scalable and reliable equipment is essential for large-scale operations.

Enhanced regulations on fish health and environmental sustainability have encouraged the adoption of advanced systems. Moving forward, innovations in feeding systems, monitoring technologies, and automation are expected to drive market growth, helping farms optimize productivity and resource management.

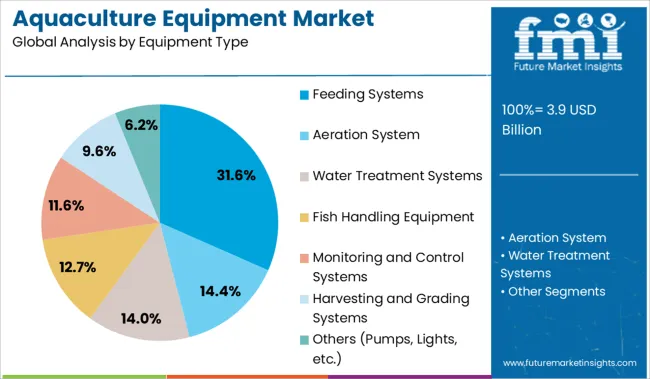

The market is segmented by Equipment Type, Application, End Use, and Distribution Channel and region. By Equipment Type, the market is divided into Feeding Systems, Aeration System, Water Treatment Systems, Fish Handling Equipment, Monitoring and Control Systems, Harvesting and Grading Systems, and Others (Pumps, Lights, etc.).

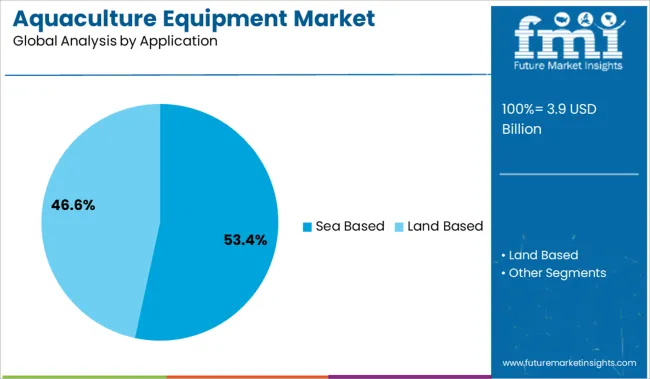

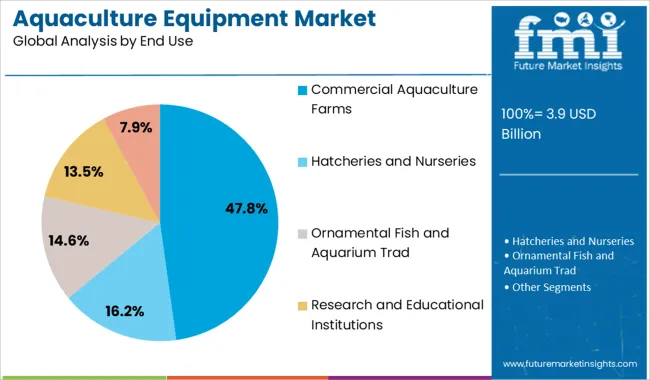

In terms of Application, the market is classified into Sea Based and Land Based. Based on End Use, the market is segmented into Commercial Aquaculture Farms, Hatcheries and Nurseries, Ornamental Fish and Aquarium Trad, Research and Educational Institutions, and Others (Recreational Fishing, Fisheries and Aquaculture Departments, etc.).

By Distribution Channel, the market is divided into Direct and Indirect. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Feeding Systems segment is projected to hold 31.6% of the aquaculture equipment market revenue in 2025. Growth has been driven by the essential role these systems play in providing controlled and efficient feed delivery to aquatic species. Feeding systems reduce feed wastage and ensure consistent nutrition which leads to healthier and faster-growing stock.

Their ability to be automated and remotely controlled has made them particularly attractive for commercial farms aiming to reduce labor costs and improve operational efficiency.

The segment’s expansion has also been supported by advances in feed formulation and feeding technology that enable tailored nutrition for different species and growth stages.

The Sea Based application segment is expected to account for 53.4% of the market revenue in 2025. This segment’s growth is attributed to the increasing shift towards open-water aquaculture which offers access to vast natural environments. Sea-based operations benefit from better water circulation and natural food sources which can enhance growth rates and reduce disease incidence.

Additionally, coastal and offshore farms have gained favor due to lower land use constraints and regulatory support in several regions.

However, these operations require robust and durable equipment that can withstand harsh marine conditions. The demand for sea-based aquaculture equipment has grown in tandem with the expansion of global seafood consumption and sustainable farming practices.

Commercial Aquaculture Farms are projected to represent 47.8% of the aquaculture equipment market revenue in 2025. The dominance of this segment is driven by the scaling of aquaculture activities to meet global seafood demand. Commercial farms require advanced equipment that supports intensive farming techniques, high production volumes, and compliance with health and environmental standards.

These farms invest in automation and precision equipment to enhance feed efficiency, water quality management, and disease control.

The segment’s growth is also fueled by increasing investments from both private and public sectors aimed at expanding aquaculture capacity. As aquaculture continues to evolve towards more industrialized processes, commercial farms will remain the primary users of specialized aquaculture equipment.

The aquaculture equipment market has gained relevance as producers adopt technology to boost productivity and control aquatic environments. Real-time monitoring devices, automated feeders, and oxygenation tools are being deployed across both inland and marine setups. Demand for these systems reflects the need for controlled farming, yield optimization, and compliance with evolving standards. However, cost sensitivity, disease risks, and inconsistent supply chains pose key challenges for operators looking to scale. Market participation now hinges on the ability to provide durable, integrated, and retrofit-friendly equipment packages tailored to diverse aquaculture systems

Sensor-based monitoring tools have been widely implemented to provide granular control over aquaculture environments. Devices measuring dissolved oxygen, temperature, ammonia, and pH are now integrated with real-time alerts and automated triggers, allowing better decision-making. These systems reduce feed waste, optimize aeration, and lower mortality through early detection of unfavourable conditions. Combined with analytics platforms and remote interfaces, farms can now automate water exchange, feeding schedules, and stress detection. The move toward digital oversight has shifted operations from reactive to predictive models. Companies delivering interoperable monitoring systems with minimal calibration and strong post-installation support are being favoured by commercial fish farms and hatcheries alike.

Automated feeders and filtration systems are being adopted to improve feed conversion ratios and water quality. Feeding units are programmed using biomass estimations, behavioral data, and ambient conditions, ensuring precise feed distribution. Concurrently, modular filtration setups, including mechanical, biological, and UV systems, are supporting high-density recirculating aquaculture systems. These installations not only conserve water but also help meet discharge norms and disease prevention targets. Operators are increasingly sourcing bundled systems that reduce manual labor, offer operational visibility, and support future upgrades. Manufacturers offering plug-and-play filtration and feeding modules designed for ease of integration and maintenance are gaining preference in both intensive and semi-intensive farming environments.

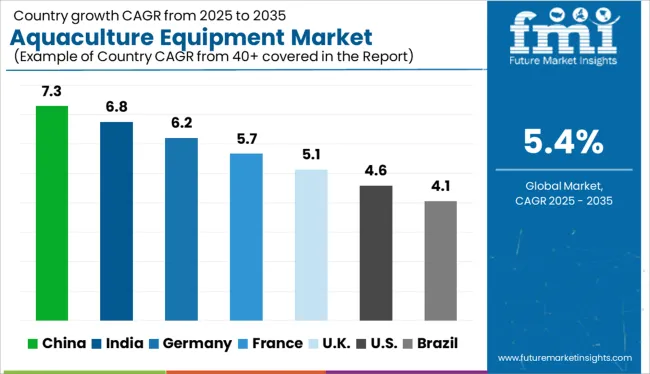

| Country | CAGR |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| France | 5.7% |

| UK | 5.1% |

| USA | 4.6% |

| Brazil | 4.1% |

Global aquaculture equipment market is growing at a CAGR of 5.4% between 2025 and 2035, with national disparities driven by marine zoning reforms, feed-water optimization, and industrial-scale protein demand. China leads at 7.3%, nearly two percentage points above the global rate, supported by high-density recirculating aquaculture systems (RAS), automation of inland fish farms, and scaled output from Shandong and Fujian provinces. India follows at 6.8%, propelled by government-backed PMMSY investments, increased shrimp hatchery upgrades, and pond aeration equipment subsidies in Andhra Pradesh and Tamil Nadu. Germany posts 6.2%, ahead of the global average, where demand centers on smart filtration units and digital monitoring tools for cold-water fish operations. France, at 5.7%, is modernizing shellfish and trout farming sites, supported by regional funding for low-emission feeding systems. The United Kingdom lags at 5.1%, where regulatory hurdles and spatial limits for offshore aquaculture temper growth. The report covers detailed analysis of 40+ countries and the top five countries have been shared as a reference.

Demand for aquaculture equipment in India is expanding at a 7.3% CAGR through 2035, supported by its position as the world’s largest aquaculture producer. The country continues to scale inland and coastal aquaculture with automated feeding systems, dissolved oxygen injectors, and digital water quality monitoring. While large enterprises in provinces like Guangdong, Shandong, and Fujian are leading innovation in equipment deployment, smallholder integration is rising due to cost-effective domestic manufacturing. Advanced cage culture in offshore zones and vertical farming systems for species like tilapia and carp are growing steadily. China’s trajectory remains scale-led with a focus on high-density production and output efficiency across freshwater and brackish water operations.

Sales of aquaculture equipment in India are growing at a 6.8% CAGR through 2035, with expansion driven by semi-intensive fish and shrimp farming systems. States like Andhra Pradesh, Odisha, and Tamil Nadu are witnessing rapid growth in equipment adoption, especially automatic feeders, paddlewheel aerators, and filtration units. Export-oriented shrimp farming has accelerated the need for mechanized post-larval nursery management and disease control systems. Government support through PMMSY and state-level aquaculture schemes helps micro-entrepreneurs upgrade traditional ponds into intensive setups. Compared to Japan’s high-tech orientation, India’s market is volume-focused, supported by localized fabrication and assembly services. OEM partnerships are emerging to reduce dependency on imported components for key filtration and energy-efficient devices.

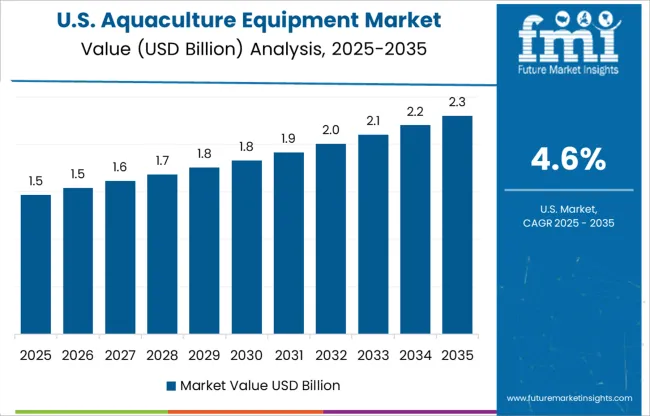

The USA Aquaculture equipment market is expanding at a 6.5% CAGR, driven by regulatory shifts favoring land-based systems and biosecure operations. Salmon and trout farming dominate high-end equipment use, especially in Washington, Maine, and California. Recirculating Aquaculture Systems (RAS) are the core of most installations, requiring high-precision UV sterilizers, advanced water filtration, and automated waste removal units. USA aquaculture equipment demand emphasizes quality, compliance, and resource efficiency rather than output volume. Compared to China or India, where scale drives penetration, USA growth remains premium-led. OEMs like Pentair and Veolia are expanding their commercial offerings for small-scale RAS farms focused on local, sustainable seafood supply.

Demand for aquaculture equipment is advancing at a 6.0% CAGR, underpinned by its preference for compact, high-efficiency systems in a space-constrained environment. Deployment centers around automated cage systems, AI-based water quality sensors, and integrated feed distribution units. High-value marine species like yellowtail, sea bream, and eel are produced using tightly managed systems primarily in Kyushu and Shikoku. Domestic manufacturers like Nitto Seiko and Yamato scale niche solutions tailored for marine conditions and low ecological impact. Japan’s equipment ecosystem emphasizes digital precision and minimal manual intervention, in stark contrast to India’s semi-manual setups. Import dependence remains low due to mature OEM infrastructure, and expansion is driven by post-Fukushima resilience strategies.

The aquaculture equipment market in the United Kingdom is growing at a 5.1% CAGR, with growth concentrated in Scotland’s salmon aquaculture sector and England’s inland trout operations. Regulatory reforms post-Grenfell and post-Brexit have tightened compliance, driving investment into eco-friendly pens, water-quality sensors, and net cleaning robotics. The UK’s equipment ecosystem focuses on low-volume, high-compliance production suited to cold-water species. Emphasis is placed on fish health and environmental footprint, supported by regulations from SEPA and the Marine Management Organisation. Compared to China’s volume-led growth, the UK demonstrates deliberate, policy-mandated expansion. Equipment suppliers focus on automation and remote monitoring to minimize manual labor and disease exposure in harsh maritime conditions.

The market is led by established firms such as Xylem, Pentair Aquatic Eco-Systems, Steinsvik, Baader Group, and Aquaculture Systems Technologies (AST), each offering differentiated systems catering to recirculating aquaculture systems (RAS), open-net pens, and inland tanks. Xylem provides integrated water treatment and flow control systems optimized for marine hatcheries and freshwater farms. Pentair focuses on filtration, aeration, and feeding systems under its Aquatic Eco-Systems division. Steinsvik delivers automated feeding and camera-guided biomass monitoring tools. Baader dominates post-harvest operations, including chilling, bleeding, and grading systems, bolstered by the acquisition of Skaginn 3X. AST offers modular tank-based RAS for land-based fish farming. Rising players like Faivre ETS, Pioneer Group, and Sino-Aqua Corporation are scaling up in Asia and Latin America with affordable aeration, oxygenation, and tank management tools. Strategic collaborations with aquafeed producers and hatchery integrators are driving end-to-end farm automation.

In June 2025, AKVA Group partnered with SurplusHub to launch a resale channel for surplus aquaculture equipment, supporting circular economy initiatives and expanding its secondary market presence within the global aquaculture sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.9 Billion |

| Equipment Type | Feeding Systems, Aeration System, Water Treatment Systems, Fish Handling Equipment, Monitoring and Control Systems, Harvesting and Grading Systems, and Others (Pumps, Lights, etc.) |

| Application | Sea Based and Land Based |

| End Use | Commercial Aquaculture Farms, Hatcheries and Nurseries, Ornamental Fish and Aquarium Trad, Research and Educational Institutions, and Others (Recreational Fishing, Fisheries and Aquaculture Departments, etc.) |

| Distribution Channel | Direct and Indirect |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | AKVA Group, ABB, Asakua, Blue Ridge Aquaculture, Inc., CPI Equipment, eWater Aquaculture Equipment Technology Limited, Frea Aquaculture Solutions, Grundfos Holding A/S, Innovasea, INVE Aquaculture, LINN Gerätebau, Merck & Co. Inc., PentairAES, Pioneer Group, and Xylem |

| Additional Attributes | Dollar sales by equipment type and aquatic species, expansion of automated feeding and water quality monitoring systems, adoption of recirculating aquaculture system (RAS) infrastructure, demand surge in offshore cage farming technologies, integration of IoT sensors and real-time oxygenation tools, investments in disease control units and aeration turbines across Asia-Pacific |

The global aquaculture equipment market is estimated to be valued at USD 3.9 billion in 2025.

The market size for the aquaculture equipment market is projected to reach USD 6.6 billion by 2035.

The aquaculture equipment market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in aquaculture equipment market are feeding systems, aeration system, water treatment systems, fish handling equipment, monitoring and control systems, harvesting and grading systems and others (pumps, lights, etc.).

In terms of application, sea based segment to command 53.4% share in the aquaculture equipment market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Aquaculture Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Aquaculture Vaccines Market Analysis - Size, Share, and Forecast Outlook for 2025 to 2035

Aquaculture Market – Growth, Demand & Sustainable Practices

Global Aquaculture Immunostimulants Market Analysis – Size, Share & Forecast 2024-2034

Chile Aquaculture Vaccines Market Insights – Size, Demand & Forecast 2025-2035

China Aquaculture Vaccines Market Outlook – Growth & Forecast 2025-2035

Norway Aquaculture Vaccines Market Insights – Size, Demand & Growth 2025-2035

Vietnam Aquaculture Vaccines Market Trends – Growth & Demand 2025-2035

Precision Aquaculture Market Size and Share Forecast Outlook 2025 to 2035

Bacterial Diagnostics in Aquaculture Market Insights - Growth & Forecast 2025 to 2035

Australia and New Zealand Aquaculture Vaccines Market Report – Key Trends & Forecast 2025-2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Farm Equipment Market Forecast and Outlook 2025 to 2035

Golf Equipment Market Size and Share Forecast Outlook 2025 to 2035

Port Equipment Market Size and Share Forecast Outlook 2025 to 2035

Pouch Equipment Market Growth – Demand, Trends & Outlook 2025 to 2035

Garage Equipment Market Forecast and Outlook 2025 to 2035

Mining Equipment Industry Analysis in Latin America Size and Share Forecast Outlook 2025 to 2035

Subsea Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA