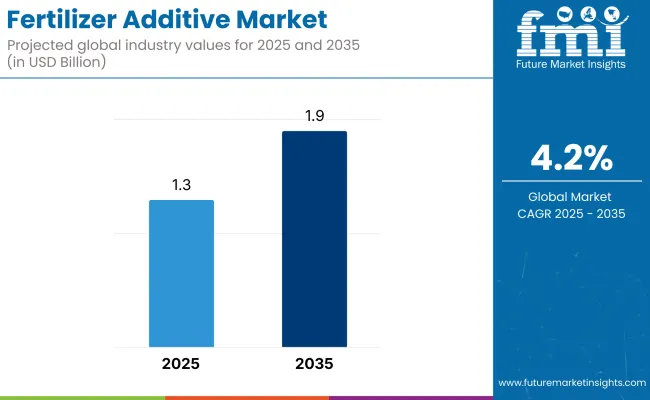

The fertilizer additive market is estimated to be USD 1.3 billion, and is expected to expand to around USD 1.9 billion by 2035, at a CAGR of about 4.2%. The primary reason behind the growth of the industry primarily lies in the need for improved crop yields as well as in sustainable agriculture practices.

Fertilizer additives are vital in improving nutrient absorption, lowering volatilization, and enhancing soil quality. With the increasing global demand for food, farmers are increasingly being challenged to increase productivity while reducing the environmental footprint of using conventional fertilizers-rendering these additives a key component in contemporary agricultural practice.

Some of the major industry drivers include increasing nitrogen loss and nutrient leaching concerns, which not only lower fertilizer efficiency but also lead to damage in the surrounding environment. Additives such as urease inhibitors, nitrification inhibitors, and anti-caking agents are reducing wastage and delivering maximum nutrition to crops.

Regulatory agencies and governments are also encouraging the use of improved-efficiency fertilizers (EEF), which contain advanced additives. These measures are designed to reduce greenhouse gas emissions and maintain soil integrity, especially in areas with intensive agriculture and climate-driven agricultural stress.

The greater expense of additive-enhanced fertilizers over their traditional counterparts has the potential to discourage small farmers, particularly those in emerging economies. In some areas, even limited awareness or access to the solutions also slows down wider use throughout the value chain of agriculture.

Moreover, inconsistent practice and different soil types can influence the efficacy of some additives. This necessitates improved farmer education, precision agriculture equipment, and localized R&D to adapt additive application to individual crop and soil conditions for optimal performance.

In spite of these constraints, robust opportunities are on the horizon. Technical improvements in formulation technology and biotechnology are producing stronger, more environmentally friendly additives. Greater use of organic and bio-based additives is enabling sustainability targets while meeting growing demand for organic and regenerative agriculture methods.

Asia Pacific, Latin American, and some African industries are expected to drive future growth. Population increase, urbanization, and growth of food demand in these nations are fueling agricultural intensification, necessitating greater input optimization through additives.

Some of the most compelling trends that regulate the industry include the application of data analytics, satellite imaging, and intelligent application systems that enable precise delivery and timing of the nutrients. With the rise of precision agriculture, the application of additives to maximize fertilizer ROI becomes more and more necessary.

Market Metrics

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 1.3 billion |

| Industry Value (2035F) | USD 1.9 billion |

| CAGR (2025 to 2035) | 4.2% |

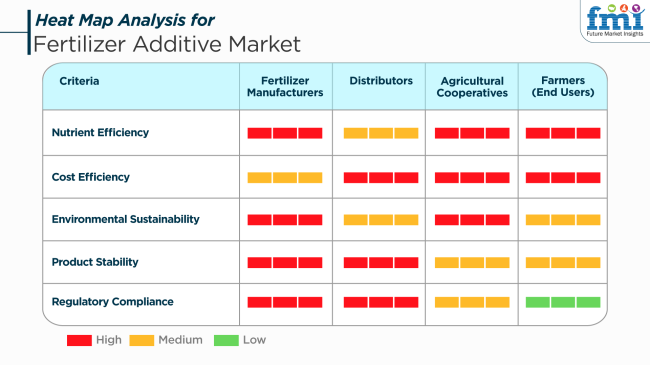

Fertilizer Producers are focusing on nutrient efficiency and environmental stewardship, committing to research and development for the manufacture of additives that optimize fertilizer performance while reducing environmental footprint. Developments encompass the production of anti-caking agents and slow-release coatings that enhance product stability and nutrient release.

The industry is led by the Asia-Pacific region with more than 60.5% of global industry share in 2024 due to growth in the agriculture industry in countries such as China and India. Growth in the adoption of smart irrigation systems and precision agriculture solutions is also contributing to the rising demand for personalized fertilizer additives.

Overall, the fertilizer additives industry is developing to suit the varied needs of stakeholders, while emphasizing the growth of agricultural productivity, environmental sustainability, and addressing economic concerns.

From 2020 to 2024, industry kept growing at a steady rate due to rising demand for enhanced agricultural performance and the necessity to enhance fertilizer efficiency. There was greater application of additives like anti-caking agents, dust suppressants, and stabilizers, with an objective to enhance the physical characteristic of fertilizers and provide proper distribution of nutrients.

Pressure and environmental concerns also led to creating additives that save nutrients and impact the environment least. For the future in 2025 to 2035, the industry will be most likely to change with progress in sustainable agriculture practices as well as precision agriculture technology. More use of intelligent additives based on specific soil and crop requirements will gain momentum, improving use efficiency of nutrients and yields.

In addition, the focus on greenhouse gas mitigation and eco-friendly agriculture is expected to drive the expansion of biodegradable and eco-friendly additives. Growth economies are expected to contribute significantly to industry growth, fueled by the need for food production improvement and the improvement of agricultural processes.

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Physical improvement of fertilizers, caking and dust reduction | Smart additives for precision agriculture, biodegradable and green formulations |

| Formulation development for basic additives | Hybrid of nanotechnology and responsive additives customized for specific crops |

| Growing demand for more efficient fertilizers, environmental legislation | Sustainable agriculture programs, adoption of precision farming |

| Monopolization of mature industrie s in Europe and North America | Strong growth in Asia-Pacific and Latin America |

| Traditional chemical additives | Biodegradable and environmentally friendly additives |

| First steps towards green practices | Strong emphasis on sustainable production and circular economy principles |

The fertilizer additives market is highly responsive to raw material price volatility. Volatility of prices in the most significant of inputs like minerals and chemicals can have a meaningful impact on costs of production. A sudden hike in price can eat into margins, and it becomes harder for companies to maintain pricing models at competitive levels.

Strict environmental regulation is a major threat to the fertilizer additive industry. Compliance with evolving local requirements requires continuous vigilance and adaptation. Willful failure to adhere to these standards incurs legal penalties and damage to reputation, affecting industry position and customer trust.

Supply chain interruptions, like transportation issues or geopolitical tensions, can delay the delivery of raw materials and finished goods. These disruptions can cause production stoppages and frustrated customer demand, negatively impacting sales and long-term business relationships.

The industry is threatened by growing consumer demand for sustainable and organic farm produce. Conventional chemical additives could become unpopular, and the need to invest in research and development of environmental-friendly substitutes to accommodate changing industry trends and regulatory standards.

Innovation and technological development are imperative in the fertilizer additive industry. Those that do not invest in product development can become obsolete. Staying competitive involves constant research on increased efficacy, reduced environmental impacts, and addressing the unique needs of different farming practices.

Industry competition is stiff, with numerous competitors vying for industry share. Competition could lead to price wars, which decrease profitability. Companies must differentiate themselves through innovation, customer service, and quality to gain a competitive edge and to remain sustainable in the long term.

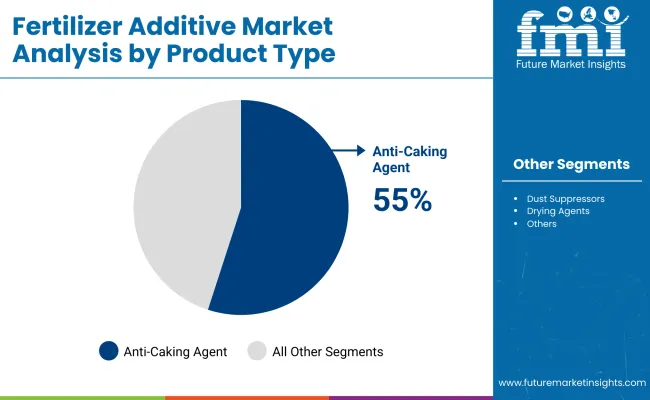

In terms of product type, anti-caking agents are expected to take the lead in 2025 with a commanding share of about 55%, followed by dust suppressors with nearly 15% of the total share of the industry.

Anti-caking agents are most commonly used, particularly during their manufacture, packaging, and dispatch of powders and granules of fertilizers like urea, ammonium nitrate, and NPK blends. These agents work mainly to avoid the formation of lumps due to moisture absorption and compaction during storage, thus providing these fertilizers with anti-caking properties.

The demand is moreover sustained by increased bulk blending and automated fertilizer application technology within agriculture. Major manufacturers such as ArrMaz (a subsidiary of Arkema), Clariant, and Forbon Technology provide specialized anti-caking solutions adapted to specific climatic and material conditions to help manufacturers keep product consistency and minimize material losses.

With almost 15% of the overall industry share by volume, dust suppressors are reportedly under increasing scrutiny because of environmental legislation and health concerns of workers. Dust suppressors are generally applied in fertilizer production, packaging, and application to avoid airborne particles.

An increasing phase of the agriculture industry toward sustainable principles, with concurrent stringent dust emission standards in Europe and North America, has been a powerful encouragement for the usage of dust control technology. Coming up next are the Hexion Inc. and Solvay formularies for new-generation suppressants aimed at improving air quality and reducing material losses while creating a safe working environment, particularly in large-scale fertilizer works.

Fertilizer additives, especially anti-caking and dust control agents, are gaining popularity because manufacturers are keen to increase operational efficiency, meet regulatory compliances, and go beyond regular supply of fertilizer in different agroclimatic areas.

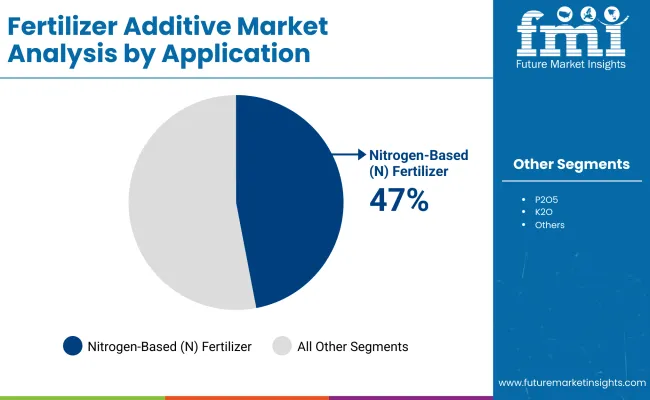

In 2025, the industry, segmented into applications, will predominantly be led by nitrogen-based (N) fertilizers, which are projected to contribute about 47% of the entire industry, along with Phosphorus-based (P₂O₅) fertilizers capturing around 25%. The added demand for these segments would be because of the need to maximize fertilizer efficiency, minimize nutrient losses, and improve handling and application performance.

Nitrogen fertilizers, including urea, ammonium nitrate, and ammonium sulfate, constitute the base for the use of fertilizers in the world as they hold the key to vegetative growth and yield improvement. Most nitrogenous fertilizers are liable to caking, dust generation, and losses due to volatilization or leaching.

Hence, almost entirely these fertilizers are subject to anti-caking, coating, and even stabilizing agents in their preparation. K+S Joegler and Agri-Chemicals, with Haifa Group and ArrMaz, are herein with companies that grant tailored additives to increase the shelf life, reduce clumping, and lessen nitrogen losses for those companies using their products, especially in humid conditions or long-term storage.

Phosphorus fertilizers like monoammonium phosphate (MAP) and diammonium phosphate (DAP), 25% of the total share, are indispensable in root development and flowering of any crop. Caking and dust, inherent in these fertilizers, tend to occur under humid conditions or by mechanical stresses during transport. This complication is resolved through surface treatments and anti-dust coatings to afford the products uniformity and a lesser degree of pollution to the environment. Clariant, Forbon Technology, Chemipol, and other similar businesses provide specialized additives that enhance flowability, safety during handling, and particulate emissions reduction associated with phosphorus fertilizers.

Globally, as sustainable agriculture evolves, additive integration across N and P₂O₅ fertilizers will become increasingly imperative for nutrient efficiency maximization while preserving product integrity across complex distribution channels.

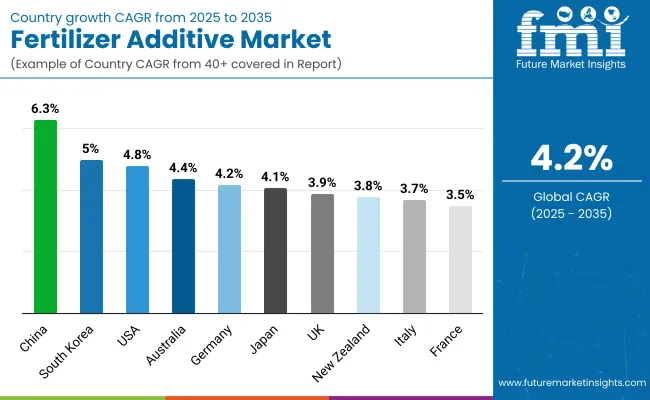

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.8% |

| UK | 3.9% |

| France | 3.5% |

| Germany | 4.2% |

| Italy | 3.7% |

| South Korea | 5% |

| Japan | 4.1% |

| China | 6.3% |

| Australia | 4.4% |

| New Zealand | 3.8% |

The USA industry is expected to register a constant CAGR of 4.8% from 2025 to 2035 because of the widespread application of advanced agriculture technology and precision farming practices. The ongoing need for increased productivity of soil, in addition to an incentive towards farm sustainability practices, is favoring increased use of additives like anti-caking agents, dust suppressants, and granulation aids. Priorities of environmental protection regulations are also favoring the use of green additive solutions.

Key industry players in the United States are Nutrien Ltd., The Mosaic Company, and Koch Agronomic Services. These players are aggressively investing in R&D to craft formulations that help maximize the performance of nutrients as well as have a lower effect on the environment. Additionally, the acceleration of organic and specialty fertilizers is opening up fresh opportunities for innovation in additives, especially in bio-based and polymer-based additives.

The UKindustry is projected to grow at a CAGR of 3.9% during 2025 to 2035, driven by a strategic shift towards sustainable agriculture and harmonization of regulation with environmental norms. Increasing demand for high-performance fertilizers is driving increased use of additives that improve application efficiency and minimize nutrient loss.

Key industry participants in the UK are Yara UK Ltd., EuroChem Group, and Origin Enterprises plc. Industry players are looking to produce additives that are compatible with liquid fertilizers and controlled-release products. Precision agriculture is also gaining increasing traction, which is fueling demand for regional soil profile and crop pattern-specific specialty additives.

France is expected to record a CAGR of 3.5% in the industry through 2035, driven by agricultural modernization and the necessity of adhering to strict environmental regulations. The industry is slowly shifting towards ammonia volatilization and reduction of nitrate leaching additives, supported by regulatory driving forces surrounding nutrient management.

Industry leaders like Timac Agro, Borealis L.A.T., and Groupe Roullier from France are focusing on sustainable product innovation. Increased farmer knowledge about the advantages of additive-enriched fertilizers, together with government favor towards eco-friendly inputs, is propelling industry expansion, especially within the granulation and stabilizers segments.

Germany's industry is projected to grow at a CAGR of 4.2% during 2025 to 2035. Its highly mechanized agricultural industry and rising use of controlled nutrient delivery systems are driving demand for functional additives. The nation's focus on the EU Green Deal targets is also encouraging the use of additives to manage lowered rates of nutrient runoff and greenhouse gas emissions.

Major players in the industry are BASF SE, HELM AG, and K+S Aktiengesellschaft. These companies are channeling investments into additives that increase the bioavailability of nutrients and meet sustainability standards. Merging with smart farming solutions is driving the possibility of smart additive solutions with data-driven fertilization.

Italy is expected to reach a CAGR of 3.7% in the industry during 2025 to 2035. Productive agricultural land, particularly in the north of the country, is showing a trend toward increased nutrient efficiency through the use of additives. Demand is growing for fertilizers with anti-caking and corrosion-inhibiting attributes, consistent with the requirement for extended product shelf-life and enhanced application precision.

They comprise major Italian firms like Valagro, Italpollina, and Haifa Group, which already produce additive-enriched fertilizers for organic and conventional agriculture. The European Union's programs also support the use of industry forces to encourage sustainable input use and reduce carbon footprints in agriculture.

South Korea will be one of the fastest-growing industries for the industry, with a CAGR of 5% from 2025 to 2035. This is driven by robust government encouragement of smart farming and increasing food security issues. Focus on hydroponics and urban agriculture has resulted in fertilizer formulation innovation wherein additives have a central role in ensuring ideal nutrient balance.

Major South Korean firms like LG Chem, Namhae Chemical Corporation, and Kukbo Science Co., Ltd. are investing in pre-eminent additive technologies like polymer coating and stabilizers in specific. Automated and artificial intelligence-driven delivery systems integration for nutrients is increasing the demand for tailor-made additive solutions.

Japan's industry will expand at a CAGR of 4.1% during the forecast period thanks to increased emphasis on land maximization and intensive methods of farming in the geographically confined agriculture space. An aging population of farmers is likewise escalating dependence on precision hardware as well as value-added solutions, including additives, that ease use and increase the efficiency of nutrients.

Leading players include Mitsubishi Chemical Corporation, Sumitomo Chemical, and Ube Industries Ltd., which are developing water-soluble and slow-release fertilizer additive technologies. The industry is slowly shifting towards bio-based and green formulation in a move to meet regional environmental regulations as well as the needs of their clients.

China is set to dominate the target nations' industry with a strong CAGR of 6.3% during 2025 to 2035. Ongoing growth of intensive farming activities and unified efforts to adopt modern ways of farming are key drivers of growth. Governmental efforts towards soil enrichment and avoidance of chemical imbalance are driving additive demand.

Chinese industry major companies like Sinofert Holdings, Stanley Agricultural Group, and Hubei Xinyangfeng Fertilizer are expanding their capacity and investing in R&D of additives. The growing use of nutrient-use efficiency technology and precision agriculture is also propelling growth, especially in the urease and nitrification inhibitor segments.

Australia is anticipated to achieve a CAGR of 4.4% in the industry during the forecast period due to soil condition issues and emphasis on crop productivity in dry areas. Leaching-resistant additives and moisture-retention additives are becoming popular, especially in horticulture and broad acre agriculture.

Major industry players are Incitec Pivot Limited, Summit Fertilizers, and Nufarm Limited. Development of controlled-release technology and partnerships with agritech companies are driving additive formulation growth. Environmental sustainability in government and minimizing the loss of inputs are supporting consistent growth in regional industries.

New Zealand, too, will be growing at a CAGR of 3.8% in the industry during 2025 to 2035. The dominance of pasture farming in the country and its vulnerability to environmental stress are forcing a slow transition towards additive-based fertilizer products, facilitating nitrogen stabilization and soil health enhancement.

Major industry producers like Ravensdown, Ballance Agri-Nutrients, and Fertco Ltd. are focusing on slow-release and bio-based additives in a bid to meet national sustainability targets. Policy efforts minimizing waterway pollution and maximizing nutrient stewardship are driving the shift towards high-value fertilizer products.

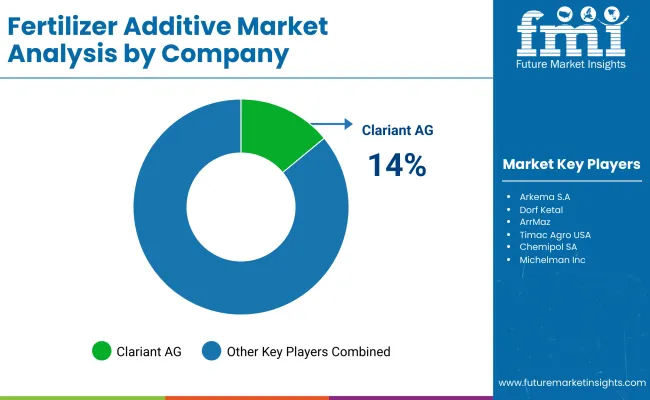

The industry comprises mostly of multinational chemical companies, specialized agrochemical firms and niche players. The leading companies in this segment are Clariant AG, Arkema S.A, and Dorf Ketal, among several others, for their advanced chemical formulation with anti-caking agents, corrosion inhibitors, and stabilizers for different types of fertilizers. Their R&D outlays, along with their effective distribution channels, place them at an advantage in the global competitive industries.

These include firms like ArrMaz and Timac Agro USA that have created niches for themselves in the industry by coating and improving fertilizers to retain more of their nutrients. These companies leverage their proprietary technologies to lessen losses because of leaching as well as volatilization before bringing great improvements to agricultural productivity. Their competitive advantage lies in customized solutions tailored to specific soil conditions and regional fertilizer applications.

Such are Hubei Forbon Technology and Fertibon Products Pvt Ltd, which, like other Asia-centered economic innovators, view cost-efficient additives to fulfill the needs of indigenous fertilizer producers wishing for a cost-effective performance additive. The priority of such companies is local generation, optimizing supply chains and establishing strategic alliances with fertilizer manufacturers for them to gain new industries.

Sustainability and precision agriculture are shaping the industry, with players investing in biodegradable coatings, controlled-release additives, and compatibility with organic fertilizers. Innovations in the field of nanoparticle and microbe-based additives are on the rise, as this would help companies differentiate offerings by catering to the growing interests in environment-friendly agricultural inputs.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Clariant AG | 14-18% |

| Arkema S.A | 12-16% |

| Dorf Ketal | 10-14% |

| ArrMaz | 8-12% |

| Timac Agro USA | 6-10% |

| Others (combined) | 40-50% |

| Company Name | Key Offering and Activities |

| Clariant AG | Develops advanced fertilizer coatings and stabilizers to enhance nutrient efficiency and shelf life. |

| Arkema S.A | Supplies corrosion inhibitors and anti-caking agents to improve fertilizer handling and storage. |

| Dorf Ketal | Specializes in customized fertilizer additives for optimized performance and reduced nutrient loss. |

| ArrMaz | Produces specialty surfactants and coatings that enhance nutrient uptake and minimize leaching. |

| Timac Agro USA | Provides biological and chemical fertilizer enhancers focused on precision agriculture and sustainability. |

Key Company Insights

Clariant AG (14-18%)

A global leader in fertilizer additives, offering proprietary coatings and stabilizers that improve nutrient efficiency and long-term storage.

Arkema S.A (12-16%)

Innovates in anti-caking agents and chemical enhancers, focusing on minimizing fertilizer degradation during transport and storage.

Dorf Ketal (10-14%)

Provides tailored additive solutions that help manufacturers enhance fertilizer effectiveness while ensuring environmental compliance.

ArrMaz (8-12%)

Develops specialty coatings that improve fertilizer flowability and reduce nutrient runoff, addressing key challenges in sustainable agriculture.

Timac Agro USA (6-10%)

Focuses on integrating biological enhancers with traditional additives, optimizing nutrient availability in various soil conditions.

Other Key Players

By product type, the industry is segmented into anti-caking agents, dust suppressors, drying agents, granulation agents, and others.

By application, the industry is categorized based on key applications: N (Nitrogen), P2O5, K2O, and others.

By region, the industry spans across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is estimated to be worth USD 1.3 billion in 2025.

The sales are projected to reach USD 1.9 billion by 2035.

South Korea is expected to grow at a CAGR of 5%.

Anti-caking agents dominate the industry due to their essential role in maintaining fertilizer flowability and effectiveness during storage and transportation.

Prominent companies include Clariant AG, Arkema S.A, Dorf Ketal, ArrMaz, Timac Agro USA, Michelman, Inc., Hubei Forbon Technology Co Ltd, Fertibon Products Pvt Ltd, Chemipol SA, and Neelam Aqua & Speciality Chem (P) Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nitrogen Fertilizer Additives Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Packaging Market Forecast and Outlook 2025 to 2035

Fertilizer Tester Market Size and Share Forecast Outlook 2025 to 2035

Additives for Metalworking Fluids Market Size and Share Forecast Outlook 2025 to 2035

Additive Manufacturing With Metal Powders Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Value Added Coatings Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Fertilizer Applicators Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Market Size and Share Forecast Outlook 2025 to 2035

Fertilizer Bags Market Growth - Demand & Forecast 2025 to 2035

Additive Manufacturing and Material Market Trends - Growth & Forecast 2025 to 2035

Fertilizer Injection Pumps Market

Additives for Floor Coatings Market

Biofertilizers Market Size and Share Forecast Outlook 2025 to 2035

NPK Fertilizers Market Analysis - Size, Share, and Forecast 2025 to 2035

Ink Additives Market Growth – Trends & Forecast 2025 to 2035

Wet Fertilizer Spreaders Market

Feed Additive Nosiheptide Premix Market Size and Share Forecast Outlook 2025 to 2035

Nano Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Seed Additives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Fuel Additives Market Segmentation based on Type, Application, and Region: Forecast for 2025 and 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA