The lithium compound market is witnessing robust growth, propelled by the accelerating adoption of electric vehicles, energy storage systems, and portable electronic devices. Lithium’s unique electrochemical properties make it indispensable in high-energy-density battery applications, driving consistent demand across industries.

The market benefits from large-scale investments in lithium mining, refining, and recycling to secure supply amid increasing consumption. Beyond batteries, lithium compounds are gaining relevance in ceramics, glass, lubricants, and pharmaceuticals, enhancing market diversification.

Price volatility remains a challenge; however, ongoing capacity expansion and technological advancements in extraction methods are expected to stabilize supply chains. With global electrification trends and renewable integration strengthening, the lithium compound market is positioned for long-term growth supported by energy transition initiatives worldwide..

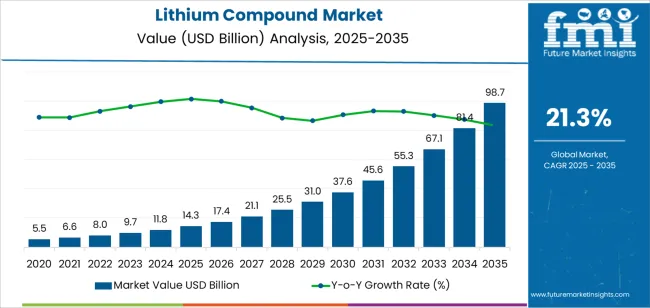

| Metric | Value |

|---|---|

| Lithium Compound Market Estimated Value in (2025 E) | USD 14.3 billion |

| Lithium Compound Market Forecast Value in (2035 F) | USD 98.7 billion |

| Forecast CAGR (2025 to 2035) | 21.3% |

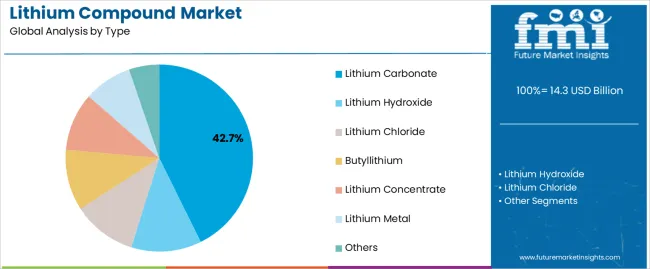

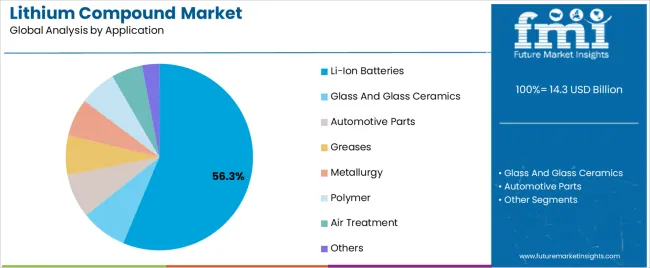

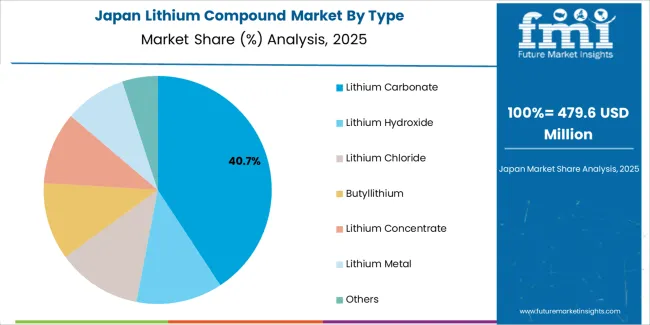

The market is segmented by Type and Application and region. By Type, the market is divided into Lithium Carbonate, Lithium Hydroxide, Lithium Chloride, Butyllithium, Lithium Concentrate, Lithium Metal, and Others. In terms of Application, the market is classified into Li-Ion Batteries, Glass And Glass Ceramics, Automotive Parts, Greases, Metallurgy, Polymer, Air Treatment, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The lithium carbonate segment dominates the type category with approximately 42.7% share, driven by its extensive use as a precursor in cathode materials for lithium-ion batteries. Its versatility across multiple applications, including ceramics and pharmaceuticals, has strengthened its demand profile.

Lithium carbonate is preferred for its cost efficiency and established processing infrastructure, making it a key material for large-scale battery manufacturing. Expansion of electric vehicle production and grid-scale energy storage has intensified consumption, prompting upstream investments in refining capacity.

With sustained growth in battery cell manufacturing and increasing focus on supply security, the lithium carbonate segment is expected to retain its leadership position in the near term..

The Li-ion batteries segment leads the application category, accounting for approximately 56.3% share of the lithium compound market. The segment’s growth is driven by the global shift toward electrification and renewable energy storage solutions.

Lithium compounds form critical components in cathode and electrolyte formulations, offering high energy density, long cycle life, and low self-discharge rates. Expanding EV adoption, coupled with renewable grid integration, has intensified battery demand.

Continuous technological advancements aimed at improving battery efficiency and reducing cost per kilowatt-hour further support market expansion. As energy sustainability initiatives progress and electrification accelerates across sectors, the Li-ion batteries segment is expected to maintain its dominant position in the foreseeable future..

For the 2025 to 2035 period, lithium chloride is expected to progress at a CAGR of 21.0%. Some of the key drivers for the increasing use of lithium chloride are:

| Attributes | Details |

|---|---|

| Top Type | Lithium Chloride |

| CAGR (2025 to 2035) | 21.0% |

Li-ion batteries are predicted to progress at a CAGR of 20.9% over the forecast period. Some of the key drivers for its progress include:

| Attributes | Details |

|---|---|

| Top Application | Li-ion Batteries |

| CAGR (2025 to 2035) | 20.9% |

Impressive quantities of automobile production in the Asia Pacific, including electric vehicles, are signaling a positive outlook for the market in the region. The region’s burgeoning chemical research industry also aids in the market’s development.

The overall pharmaceutical use of the compound is also increasing, with the admittance rates to hospitals reaching substantial quantities in the regions.

| Countries | CAGR |

|---|---|

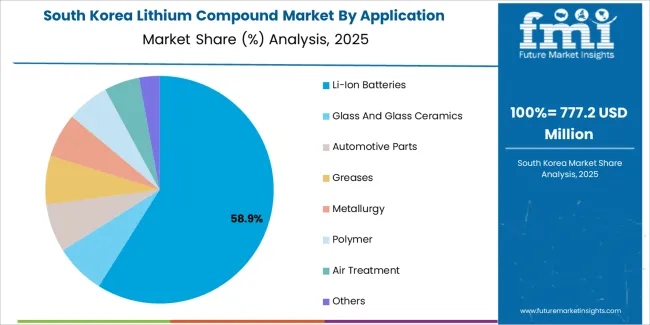

| South Korea | 23.4% |

| Japan | 22.9% |

| China | 21.9% |

| United Kingdom | 22.6% |

| United States | 21.7% |

The market is set to register a CAGR of 23.4% in South Korea for the forecast period. The key drivers for growth are:

The CAGR for lithium compound in China is tipped to be 21.9% over the forecast period. Some of the key factors driving the growth are:

The market is expected to register a CAGR of 22.9% in Japan. Some of the key trends include:

The market is expected to progress at a CAGR of 22.6% in the United Kingdom. Key factors driving the growth are:

The market is anticipated to register a CAGR of 21.7% in the United States over the forecast period. Some prominent factors driving growth are:

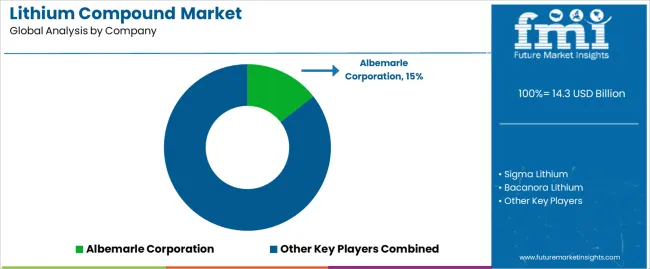

Giants with reputable names in lithium compound manufacturing have made their presence known in the market. Though there is still scope to do business for small-scale players and new entrants, the big-name players control a substantial portion of the market share.

Industry players are on the lookout for new avenues of growth in the form of developing new applications for the product, especially in industrial use. Newer compounds are also being tested for their viability in replacing older compounds.

Recent Developments in the Lithium Compound Market

The global lithium compound market is estimated to be valued at USD 14.3 billion in 2025.

The market size for the lithium compound market is projected to reach USD 98.7 billion by 2035.

The lithium compound market is expected to grow at a 21.3% CAGR between 2025 and 2035.

The key product types in lithium compound market are lithium carbonate, lithium hydroxide, lithium chloride, butyllithium, lithium concentrate, lithium metal and others.

In terms of application, li-ion batteries segment to command 56.3% share in the lithium compound market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithium Silicon Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Mining Market Size and Share Forecast Outlook 2025 to 2035

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Lithium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium-sulfur Solid-state Batteries Market Size and Share Forecast Outlook 2025 to 2035

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

Lithium Cobalt Oxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium and Lithium Ion Battery Electrolyte Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Battery Separator Market Growth & Trends 2025 to 2035

Lithium Ion Battery Dispersant Market Growth – Trends & Forecast 2024-2034

Lithium Ion Battery Material Market Growth – Trends & Forecast 2024-2034

Lithium Iodide Market

Lithium Bromide Market

Demand for Lithium & Lithium-ion Battery Electrolyte in EU Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA