The demand for lithium and lithium-ion battery electrolyte in the EU is projected to expand from USD 1.3 billion in 2025 to USD 4.2 billion by 2035, recording a compound annual growth rate (CAGR) of 12.2% between 2025 and 2030. The starting phase shows the strategic role electrolytes play in enabling Europe’s transition toward clean mobility and energy storage. Sales of electrolytes are being reinforced by the rapid adoption of electric vehicles, the broader integration of renewables into national grids, and the establishment of multiple gigafactories across Germany, France, and the Nordic countries between 2025 and 2030.

Demand for advanced electrolytes is also supported by the growing complexity of next-generation battery chemistries. Automakers and energy companies are moving beyond conventional solutions, requiring formulations that provide higher thermal stability, fast-charging compatibility, and longer cycle life. Procurement of lithium salts such as LiPF₆ and specialized solvent blends is forecast to grow sharply, reflecting Europe’s ambition to secure local, high-quality supply chains between 2025 to 2030. Adoption of electrolytes suitable for solid-state and advanced lithium-ion chemistries is anticipated to rise, as regional R&D initiatives accelerate pilot production for commercial-scale deployment between 2025 and 2030.

During the first half of the forecast period, sales of electrolytes will rise strongly, supported by electric vehicle adoption targets set under EU Green Deal mandates. Demand for liquid electrolytes tailored for EV batteries, energy storage systems, and portable electronics will intensify, with manufacturers focusing on safety additives that enhance flame retardancy and performance consistency between 2025 to 2030. Renovation of energy infrastructure, particularly the deployment of smart grids, will add momentum to procurement activities, ensuring steady consumption of electrolyte materials across diverse applications between 2025 and 2030. In the latter phase, expansion is expected to accelerate further. Sales of lithium and lithium-ion battery electrolytes are projected to climb toward USD 4.2 billion by 2035, reflecting an absolute increase of nearly USD 2.9 billion between 2025 and 2030. This stage will be defined by the rise of premium electrolyte grades designed for next-generation cells, including high-voltage lithium-ion and solid-state batteries. Adoption of circular economy practices will reinforce demand, as recycling and reuse of electrolytes gain importance under EU regulatory frameworks. Procurement strategies will prioritize localized production capacity, minimizing exposure to external supply chain disruptions between 2025 and 2030. By 2035, demand for lithium and lithium-ion battery electrolyte in the EU will reflect the convergence of electric mobility, renewable energy integration, and domestic industrial policy.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1.3 billion |

| Forecast Value in (2035F) | USD 4.2 billion |

| Forecast CAGR (2025 to 2035) | 12.2% |

Industry expansion is being supported by the rapid increase in electric vehicle battery production across European gigafactories and the corresponding demand for high-performance, safe, and reliable electrolyte solutions with proven functionality in demanding automotive and energy storage applications. Modern battery manufacturers rely on lithium & lithium-ion battery electrolyte as essential active materials for lithium-ion cell production, ionic conduction, and electrochemical energy storage, driving demand for products that match or exceed performance requirements, including high ionic conductivity, wide electrochemical stability window, and superior safety characteristics. Even minor performance requirements, such as low-temperature operation, fast charging capability, or extended calendar life, can drive comprehensive adoption of advanced lithium & lithium-ion battery electrolyte to maintain optimal battery performance and support stringent automotive qualification standards.

The growing awareness of battery safety requirements and increasing recognition of electrolyte formulation's critical role in preventing thermal runaway are driving demand for lithium & lithium-ion battery electrolyte from certified suppliers with appropriate quality credentials and technical expertise. Regulatory authorities are increasingly establishing clear guidelines for battery safety standards, transportation regulations, and environmental compliance to maintain product safety and ensure environmental protection. Scientific research studies and electrochemical analyses are providing evidence supporting advanced electrolytes' performance advantages and safety benefits, requiring specialized formulation methods and standardized manufacturing protocols for optimal salt concentration, appropriate additive selection, and quality validation, including electrochemical characterization and safety testing.

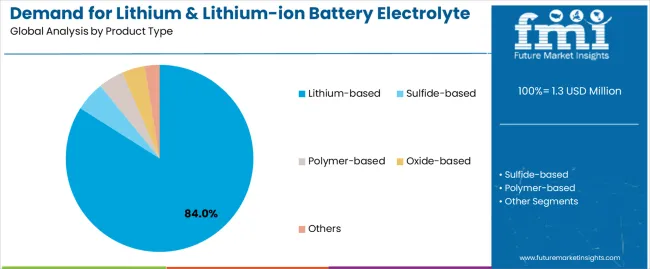

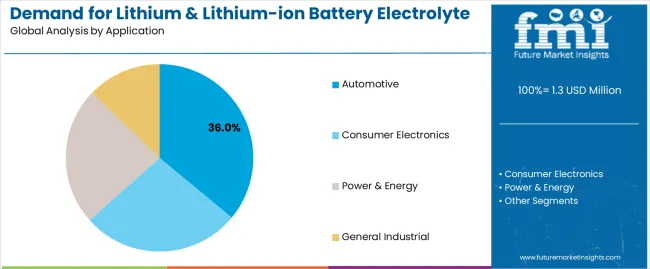

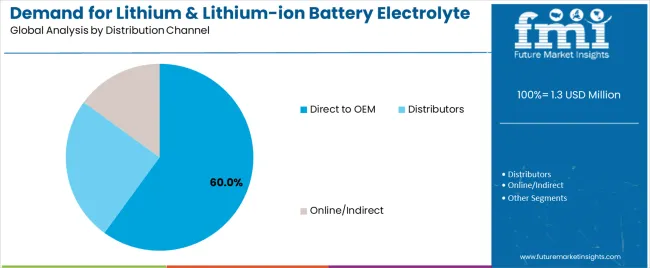

Sales are segmented by product type (chemistry), application (end use), distribution channel, nature (form), and country. By product type, demand is divided into lithium-based, sulfide-based, polymer-based, oxide-based, and others. Based on the application, sales are categorized into automotive, consumer electronics, power and energy, and general industrial. In terms of distribution channel, demand is segmented into direct to OEM, distributors, and online/indirect. By nature, sales are classified into liquid, solid, and gel. Regionally, demand is focused on Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe.

The lithium-based segment is projected to account for 84% of EU lithium & lithium-ion battery electrolyte sales in 2025, establishing itself as the dominant chemistry category across European markets. This commanding position is fundamentally supported by lithium-based electrolytes' proven performance in commercial lithium-ion batteries, comprehensive electrochemical property profile featuring high ionic conductivity, and superior compatibility with established cathode and anode materials. The lithium-based format delivers exceptional reliability, providing manufacturers with validated electrolyte solutions that facilitate cell assembly, battery production, and automotive qualification properties essential for commercial lithium-ion battery manufacturing.

This segment benefits from mature formulation technology, well-established supply chains, and extensive availability from multiple certified electrolyte suppliers who maintain rigorous quality standards and safety specifications. Lithium-based electrolytes offer versatility across various battery formats, including cylindrical cells, prismatic cells, and pouch cells, supported by proven manufacturing technologies that address traditional challenges in safety enhancement and performance optimization.

The lithium-based segment is expected to decline to 78.0% share by 2035, demonstrating gradual positioning adjustment as alternative electrolyte chemistries, including sulfide-based solid electrolytes and polymer electrolytes, gain incremental market share in emerging applications, though lithium-based maintains dominant positioning throughout the forecast period.

Automotive format is positioned to represent 36% of total lithium & lithium-ion battery electrolyte demand across European markets in 2025, increasing to 38.0% by 2035, reflecting the segment's dominance as the primary usage format within the industry ecosystem. This substantial share directly demonstrates that automotive represents the largest single application, with electric vehicle battery manufacturers utilizing lithium & lithium-ion battery electrolyte for traction battery production, plug-in hybrid battery assemblies, and automotive energy storage systems requiring high performance, safety, and reliability.

Modern automotive battery manufacturers increasingly demand advanced electrolytes for next-generation electric vehicle batteries requiring fast charging capability, driving demand for materials optimized for high ionic conductivity with appropriate thermal stability, superior safety characteristics that prevent thermal runaway, and electrochemical stability that ensures long cycle life. The segment benefits from continuous electrolyte innovation focused on improved low-temperature performance supporting cold-climate operation, fast charging compatibility enabling reduced charging times, and safety additive development preventing thermal runaway propagation during abuse conditions.

The segment's expanding share reflects accelerating electric vehicle production and increasing battery energy density requirements, with automotive maintaining dominant positioning as electrification trends intensify throughout the forecast period.

Direct to OEM channels are strategically estimated to control 60% of total European lithium & lithium-ion battery electrolyte sales in 2025, increasing to 65.0% by 2035, reflecting the critical importance of direct relationships between electrolyte suppliers and battery manufacturers for driving technical collaboration, formulation customization, and quality assurance. European battery manufacturers consistently demonstrate strong preference for direct supplier relationships, delivering consistent product specifications, technical support, and supply security supporting gigafactory operations and automotive qualification requirements.

The segment provides essential supply chain support through application engineering, formulation development, and quality management programs that address specific electrochemical requirements and safety specifications. Major European battery manufacturers systematically establish direct supply agreements with electrolyte producers, often conducting extensive material qualification testing, safety validation, and long-term contracts that ensure supply security and enable collaborative product development for emerging battery designs.

The segment's expanding share reflects increasing importance of technical collaboration and customized electrolyte formulations as battery designs become more sophisticated, with direct OEM channels strengthening dominant positioning as performance requirements drive closer supplier-manufacturer relationships throughout the forecast period.

EU lithium & lithium-ion battery electrolyte sales are advancing rapidly due to accelerating electric vehicle gigafactory expansion, growing energy storage system deployment, and increasing demand for high-performance battery materials. The industry faces challenges, including lithium salt price volatility creating cost uncertainty, solid-state battery commercialization delays affecting technology transition timing, and supply chain localization requirements demanding European production capacity. Continued innovation in electrolyte formulation, safety enhancement, and eco-friendly materials remains central to industry development.

The rapidly accelerating construction and ramp-up of European battery gigafactories is fundamentally transforming lithium & lithium-ion battery electrolyte demand from imported battery supply toward localized European battery production requiring substantial electrolyte volumes. Advanced electrolyte formulations featuring optimized additive packages, enhanced safety characteristics, and high-performance specifications enable efficient electric vehicle battery production supporting automotive manufacturer electrification strategies and European battery value chain development. These automotive innovations prove particularly transformative for fast-charging battery designs, including high-nickel cathode batteries requiring stable high-voltage electrolytes, silicon anode batteries demanding specialized electrolyte additives, and long-life battery systems requiring calendar life enhancement through advanced formulations.

Modern lithium & lithium-ion battery electrolyte producers systematically incorporate advanced safety additives, including overcharge protection additives, flame retardant compounds, and solid electrolyte interphase forming agents that deliver superior safety performance, reduced thermal runaway propagation, and enhanced abuse tolerance supporting automotive safety requirements. Strategic integration of safety innovations optimized for electric vehicle applications enables manufacturers to position advanced electrolyte formulations as critical safety solutions where thermal runaway prevention directly determines vehicle safety, regulatory compliance, and commercial success. These safety improvements prove essential for automotive battery applications, as crash safety requirements demand thermal runaway resistance, and for energy storage systems where fire risk mitigation determines site permitting and insurance costs.

European battery manufacturers increasingly prioritize responsible electrolyte supply chains featuring European production capacity, reduced carbon footprint, and circular economy principles that align with European Green Deal objectives and automotive manufacturer commitments. This trend enables electrolyte suppliers to differentiate products through local production facilities, renewable energy-powered manufacturing, and solvent recycling programs that resonate with eco-conscious automotive brands seeking responsible battery value chains. This positioning proves particularly important for electric vehicle applications, where lifecycle environmental impact influences consumer purchasing decisions, and for energy storage systems, where environmental credentials support project development and regulatory approval.

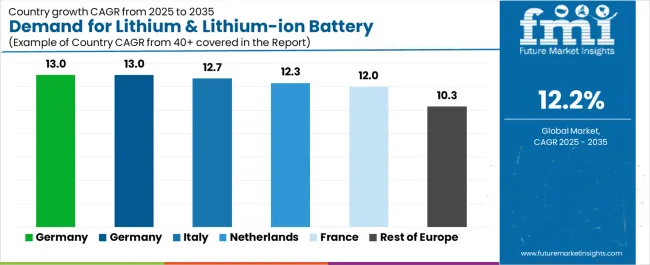

| Country | CAGR % |

|---|---|

| Germany | 13.0% |

| Spain | 13.0% |

| Italy | 12.7% |

| Netherlands | 12.3% |

| France | 12.0% |

| Rest of Europe | 10.3% |

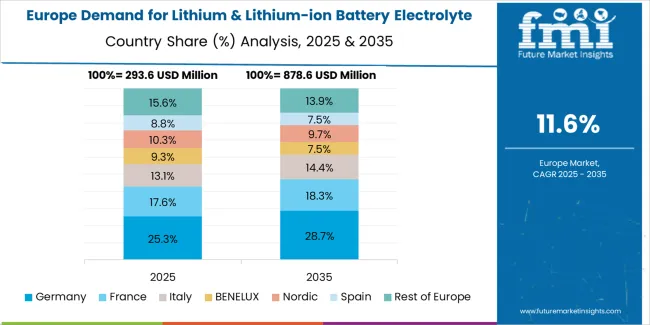

EU lithium & lithium-ion battery electrolyte sales demonstrate robust growth across major European economies, with Germany and Spain leading expansion at 13.0% CAGR through 2035, driven by extensive gigafactory construction and automotive electrification acceleration. Germany maintains leadership through established automotive manufacturing and battery value chain investment. France benefits from growing automotive battery production and energy storage system deployment. Italy leverages expanding automotive component supply chain and gigafactory development. Spain shows strong growth supported by battery manufacturing expansion and renewable energy storage installations. Netherlands emphasizes battery technology innovation and high-tech manufacturing. Sales show strong regional development reflecting EU-wide electric vehicle adoption and battery production localization trends.

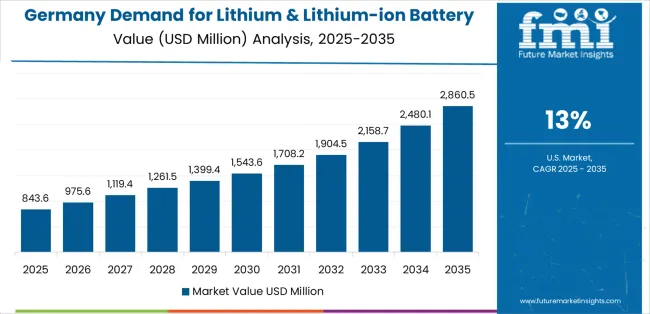

Revenue from lithium & lithium-ion battery electrolyte in Germany is projected to exhibit strong growth with a CAGR of 13.0% through 2035, driven by exceptionally well-developed automotive manufacturing ecosystem, comprehensive gigafactory investment programs, and strong technical expertise in battery technology throughout the country. Germany's sophisticated automotive industry and internationally recognized leadership in electric vehicle development are creating substantial demand for diverse electrolyte formulations across all battery applications.

Major automotive battery manufacturers, including Volkswagen Group's PowerCo, Mercedes-Benz battery production, and BMW battery cell manufacturing, systematically ramp up European gigafactory operations, often dedicating substantial electrolyte supply contracts and technical collaboration programs supporting battery production scaling. German demand benefits from extensive automotive OEM electrification commitments including Volkswagen's electric vehicle strategy, BMW's Neue Klasse platform, and Mercedes-Benz's EQ lineup naturally supporting lithium & lithium-ion battery electrolyte adoption across traction battery production and energy storage applications.

Revenue from lithium & lithium-ion battery electrolyte in France is expanding at a CAGR of 12.0%, substantially supported by growing automotive battery manufacturing emphasizing Stellantis and Renault Group electrification programs, established chemical industry capabilities, and increasing energy storage system deployment across French markets. France's strong automotive and chemical industries and engineering capabilities are systematically driving demand for lithium & lithium-ion battery electrolyte across diverse battery applications.

Major automotive manufacturers and battery producers strategically expand lithium & lithium-ion battery electrolyte utilization through ACC (Automotive Cells Company) gigafactory development, Verkor battery manufacturing, and Stellantis battery production requiring advanced electrolyte formulations. French sales particularly benefit from established chemical industry presence including Arkema and Solvay capabilities supporting electrolyte production and formulation development, driving technical innovation within the lithium & lithium-ion battery electrolyte category. Technical collaboration between battery manufacturers and chemical companies significantly enhances adoption rates across traditional and emerging applications.

Revenue from lithium & lithium-ion battery electrolyte in Italy is growing at a robust CAGR of 12.7%, fundamentally driven by expanding automotive battery component supply chain, growing energy storage system installations, and increasing battery manufacturing investments across Italian industry. Italy's substantial automotive component manufacturing tradition is systematically incorporating battery technology as manufacturers recognize electrification opportunities while supporting European battery value chain development.

Major automotive component suppliers and battery manufacturers strategically invest in lithium & lithium-ion battery electrolyte utilization through Stellantis battery production facilities, Italvolt gigafactory development, and energy storage system deployments requiring electrolyte supply. Italian sales particularly benefit from strong automotive tier-one supplier presence, creating natural opportunities for battery component manufacturing supporting increasing electric vehicle production, combined with expanding renewable energy installations driving energy storage battery requirements.

Demand for lithium & lithium-ion battery electrolyte in Spain is projected to grow at a CAGR of 13.0%, substantially supported by battery gigafactory investments, increasing automotive electrification participation, and growing renewable energy storage system deployments. Spanish automotive industry's transformation toward electric vehicle production and substantial renewable energy capacity positioning lithium & lithium-ion battery electrolyte as valuable materials supporting battery manufacturing growth and energy storage expansion.

Major battery manufacturers and automotive producers systematically expand lithium & lithium-ion battery electrolyte requirements through Volkswagen Group's PowerCo gigafactory in Sagunto, SEAT electrification programs, and substantial grid-scale energy storage installations supporting Spain's extensive solar and wind energy capacity. Spain's renewable energy leadership particularly drives lithium & lithium-ion battery electrolyte demand through energy storage battery systems requiring long calendar life electrolyte formulations supporting utility-scale storage projects.

Demand for lithium and lithium-ion battery electrolyte in the Netherlands is expanding at a CAGR of 12.3%, driven by advancements in battery technology, leadership in environmentally responsible manufacturing, and comprehensive technical capabilities supporting advanced battery development. Dutch manufacturers and research institutions are particularly sophisticated in battery technology and electrolyte development, requiring high-quality formulations.

Netherlands sales benefit significantly from battery technology research and development activities, including innovations in battery chemistry and solid-state battery research, creating demand for advanced electrolyte formulations that support emerging battery technologies. The country’s leadership in environmentally conscious manufacturing goes hand-in-hand with cutting-edge technological progress, as researchers combine their environmental expertise with the development of next-generation battery materials. The Netherlands also serves as a key hub for European battery technology, with successful Dutch innovations often being adopted across broader European manufacturing applications.

EU lithium & lithium-ion battery electrolyte sales are projected to grow from USD 1,331.1 million in 2025 to USD 4,207.3 million by 2035, registering a CAGR of 12.2% over the forecast period. The Germany region is expected to demonstrate the strongest growth trajectory with a 13.0% CAGR, supported by extensive gigafactory development, automotive electrification leadership, and battery value chain investment. Spain and Italy follow with 13.0% and 12.7% CAGR each, attributed to expanding automotive battery production and growing energy storage deployment, respectively.

France, while maintaining substantial share at 17.0% in 2025, is expected to grow at a 12.0% CAGR, reflecting established battery manufacturing and automotive electrification. Netherlands and Rest of Europe also demonstrate 12.3% and 10.3% CAGR, respectively, supported by evolving battery technology development and expanding regional gigafactory investments.

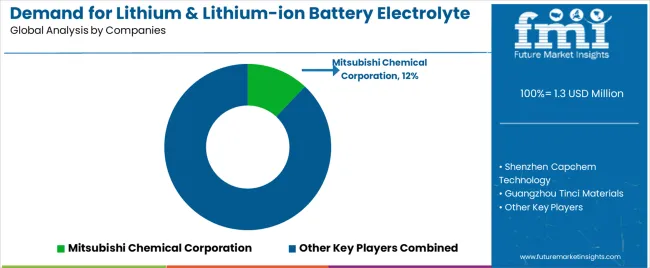

EU lithium & lithium-ion battery electrolyte sales are defined by competition among major Japanese and South Korean chemical companies, Chinese battery material suppliers, and emerging European producers. Companies are investing in European production capacity expansion, formulation technology development, safety performance enhancement, and technical support services to deliver high-performance, safety-certified, and locally supplied electrolyte solutions. Strategic partnerships with gigafactory operators, automotive qualification programs, and technical marketing emphasizing safety and performance are central to strengthening competitive position.

Major participants include Mitsubishi Chemical Corporation with an estimated 12.0% share, leveraging its comprehensive electrolyte portfolio, established automotive OEM relationships, and European technical support programs, supporting consistent supply to battery manufacturers across Europe. Mitsubishi Chemical benefits from integrated electrolyte production capabilities, advanced formulation expertise, and the ability to provide complete electrolyte solutions, including lithium salt procurement, solvent blending, and additive optimization, supporting customer battery performance optimization and automotive qualification.

Shenzhen Capchem Technology holds approximately 9.0% share, emphasizing localized European supply strategies, gigafactory partnerships, and competitive pricing supporting market penetration across automotive and energy storage applications. Capchem's success in establishing European production capacity and securing gigafactory supply agreements creates strong competitive positioning in volume-driven automotive applications, supported by Chinese manufacturing scale and European localization investment.

Guangzhou Tinci Materials accounts for roughly 7.0% share through its position as EV-grade electrolyte supplier, providing high-performance formulations featuring advanced additive packages optimized for automotive applications. The company benefits from extensive automotive battery electrolyte experience, technical collaboration capabilities with battery manufacturers, and partnerships with European gigafactories supporting electric vehicle battery production.

Other companies and regional suppliers collectively hold 72.0% share, reflecting the fragmented nature of European lithium & lithium-ion battery electrolyte sales, where numerous Japanese chemical companies, South Korean battery material suppliers, European chemical producers, and emerging specialty electrolyte manufacturers serve specific market segments, regional customers, and niche applications. This fragmentation provides opportunities for differentiation through specialized formulations (fast-charging electrolytes, solid-state electrolytes), European production capacity, application-specific solutions, and premium positioning resonating with battery manufacturers seeking reliable electrolyte partners with technical expertise and local supply security.

| Item | Value |

|---|---|

| Quantitative Units | USD billion |

| Product Type (Chemistry) | Lithium-based, Sulfide-based, Polymer-based, Oxide-based, Others |

| Application (End Use) | Automotive, Consumer Electronics, Power & Energy, General Industrial |

| Distribution Channel | Direct to OEM, Distributors, Online/Indirect |

| Nature (Form) | Liquid, Solid, Gel |

| Forecast Period | 2025-2035 |

| Base Year | 2025 |

| Historical Data | 2020-2024 |

| Countries Covered | Germany, France, Italy, Spain, the Netherlands, and the Rest of Europe |

| Key Companies Profiled | Mitsubishi Chemical Corporation, Shenzhen Capchem Technology, Guangzhou Tinci Materials, Regional producers |

| Report Pages | 180+ Pages |

| Data Tables | 50+ Tables and Figures |

| Additional Attributes | Dollar sales by product type (chemistry), application (end use), distribution channel, and nature (form); regional demand trends across major European markets; competitive landscape analysis with established chemical companies and specialized electrolyte suppliers; customer preferences for various electrolyte formulations and performance characteristics; integration with electric vehicle gigafactory development and solid-state battery technologies; innovations in safety additives and eco-friendly materials; adoption across automotive, consumer electronics, and energy storage applications; regulatory framework analysis for battery safety standards and transportation regulations; supply chain strategies; and penetration analysis for battery manufacturers and automotive OEMs across European markets. |

The global demand for lithium & lithium-ion battery electrolyte in eu is estimated to be valued at USD 1.3 billion in 2025.

The market size for the demand for lithium & lithium-ion battery electrolyte in eu is projected to reach USD 4.2 billion by 2035.

The demand for lithium & lithium-ion battery electrolyte in eu is expected to grow at a 12.2% CAGR between 2025 and 2035.

The key product types in demand for lithium & lithium-ion battery electrolyte in eu are lithium-based , sulfide-based, polymer-based, oxide-based and others.

In terms of application, automotive segment to command 36.0% share in the demand for lithium & lithium-ion battery electrolyte in eu in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Lithium and Lithium Ion Battery Electrolyte Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

EU Battery Passport Solutions Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lithium Battery Thermal Runaway Sensor Modules Market Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Battery Electrolytes Market Analysis & Forecast by Type, End-Use, and Region through 2035

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Battery Separator Market Growth & Trends 2025 to 2035

Lithium Ion Battery Dispersant Market Growth – Trends & Forecast 2024-2034

Lithium Ion Battery Material Market Growth – Trends & Forecast 2024-2034

Lithium Silicon Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Battery Management System Market Growth – Trends & Forecast 2023-2033

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Silicon Anode Lithium Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Automotive Portable Lithium Iron Phosphate Battery Market Size and Share Forecast Outlook 2025 to 2035

Preheating Tunnel Furnace for Lithium Battery Market Size and Share Forecast Outlook 2025 to 2035

Europe Radiotherapy Patient Positioning Market Size and Share Forecast Outlook 2025 to 2035

Lithium Compound Market Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA