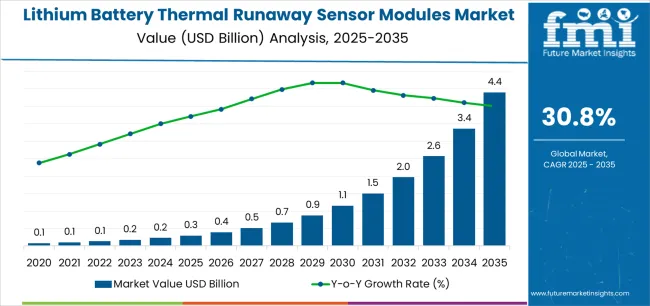

The global lithium battery thermal runaway sensor modules market is projected to reach USD 4.5 billion by 2035, recording an absolute increase of USD 4.2 billion over the forecast period. The market is valued at USD 0.3 billion in 2025 and is set to rise at a CAGR of 30.8% during the assessment period. The overall market size is expected to grow by nearly 14.1 times during the same period, supported by increasing demand for battery safety systems across electric vehicles and energy storage applications worldwide, driving demand for efficient thermal monitoring solutions and increasing investments in battery management technology projects globally.

Lithium battery thermal runaway sensor modules represent specialized safety devices that detect early warning signs of battery failure before catastrophic events occur. These systems monitor critical parameters including internal cell temperature, pressure buildup, and off-gassing chemistry to identify thermal runaway initiation at stages where intervention remains possible. The detection technology operates within milliseconds to trigger protective responses including battery disconnection, cooling system activation, or emergency ventilation protocols. Electric vehicle applications require sensor modules that function reliably across temperature extremes from -40°C to +85°C ambient conditions while maintaining detection accuracy throughout battery pack service life spanning 8-10 years or 150,000-200,000 vehicle kilometers.

The market expansion reflects fundamental shifts in battery safety requirements driven by high-profile thermal runaway incidents and resulting regulatory responses. Energy storage system installations at utility scale and commercial facilities face stringent fire safety codes requiring multi-layer protection including thermal runaway detection as mandatory safety equipment. Insurance underwriters increasingly specify advanced monitoring systems as coverage prerequisites for large-scale battery installations, creating market pull independent of regulatory mandates. Electric vehicle manufacturers adopt thermal runaway sensors to mitigate liability exposure and protect brand reputation, with detection systems representing cost-effective insurance against potential recall expenses and litigation costs associated with battery fire events.

Technology advancement in sensing mechanisms enables next-generation modules with improved sensitivity and reduced false alarm rates. Pressure sensor technologies detect internal cell swelling occurring hours before thermal runaway propagation, providing extended warning periods for emergency response protocols. Gas concentration sensors identify volatile organic compounds released during electrolyte decomposition, offering chemical fingerprinting capabilities that distinguish genuine thermal events from benign temperature excursions. Multi-parameter sensor fusion combining temperature, pressure, and gas detection delivers redundant safety architecture meeting automotive functional safety standards including ISO 26262 requirements for safety-critical systems.

Battery system architectures demand sensor modules that integrate seamlessly with existing battery management systems without compromising pack energy density or adding excessive cost. Distributed sensor networks deployed at cell, module, and pack levels provide spatial resolution enabling precise fault localization within large battery arrays containing hundreds of individual cells. Wireless sensor communication protocols eliminate wiring harness complexity in retrofitted installations while enabling flexible sensor placement optimized for thermal monitoring effectiveness. Edge computing capabilities within sensor modules enable local data processing and intelligent alarm algorithms that reduce false positive rates plaguing first-generation detection systems.

Government regulations promoting battery safety and fire prevention accelerate sensor module adoption across transportation and stationary storage applications. United Nations transportation regulations for lithium battery shipment require thermal monitoring during air and sea transport of large battery consignments. National fire protection codes in developed markets mandate thermal runaway detection systems in energy storage installations exceeding specified capacity thresholds. Electric vehicle safety standards under development in multiple jurisdictions propose thermal runaway detection as standard safety equipment, creating anticipated regulatory drivers that influence current product development priorities across the automotive supply chain.

Technical challenges constrain adoption in cost-sensitive market segments. Achieving detection sensitivity sufficient for early warning while maintaining low false alarm rates requires sophisticated signal processing algorithms and high-quality sensing elements that increase module cost. Sensor calibration drift over battery pack lifetime creates reliability concerns, as detection threshold degradation could compromise safety effectiveness or generate nuisance alarms disrupting system operation. Integration complexity with diverse battery management system architectures across manufacturers poses standardization challenges that limit sensor module interoperability and increase validation costs for multi-platform deployment.

Between 2025 and 2030, the lithium battery thermal runaway sensor modules market is projected to expand from USD 0.3 billion to USD 1.5 billion, resulting in a value increase of USD 1.1 billion, which represents 27.6% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for electric vehicle battery safety systems and utility-scale energy storage protection, product innovation in multi-parameter sensing technologies and wireless communication protocols, as well as expanding integration with battery management systems and cloud-based monitoring platforms. Companies are establishing competitive positions through investment in sensor fusion algorithms, automotive qualification programs, and strategic partnerships with battery manufacturers and electric vehicle producers.

From 2030 to 2035, the market is forecast to grow from USD 1.5 billion to USD 4.5 billion, adding another USD 3.0 billion, which constitutes 72.4% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized sensor architectures, including AI-enabled predictive analytics for pre-failure detection and integrated safety systems combining thermal runaway detection with active suppression mechanisms, strategic collaborations between sensor manufacturers and battery cell producers, and an enhanced focus on cost reduction and miniaturization enabling mass-market adoption. The growing emphasis on battery second-life applications and circular economy principles will drive demand for advanced, high-reliability sensor solutions across diverse battery system applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 0.3 billion |

| Market Forecast Value (2035) | USD 4.5 billion |

| Forecast CAGR (2025-2035) | 30.8% |

The lithium battery thermal runaway sensor modules market grows by enabling battery system operators to achieve superior safety performance and early fault detection while meeting regulatory requirements for fire prevention. Battery manufacturers face mounting pressure to prevent thermal runaway incidents with potentially catastrophic consequences, with sensor module solutions typically providing 30-60 minutes advance warning compared to traditional battery management system monitoring alone, making specialized detection technologies essential for liability management and regulatory compliance. The battery safety movement creates demand for sensor systems that can identify thermal runaway initiation across diverse battery chemistries while maintaining reliability in demanding automotive and industrial operating environments.

Government initiatives promoting electric vehicle safety and energy storage fire prevention drive adoption in transportation, utility-scale storage, and commercial building applications, where sensor performance has a direct impact on occupant safety and property protection. The global shift toward electrified transportation accelerates sensor demand as automotive manufacturers seek validated safety systems that enable battery pack designs optimized for energy density without compromising thermal management capabilities. High sensor module costs relative to battery pack value and technical complexity in achieving consistent detection across varied operating conditions may constrain adoption rates among cost-sensitive applications and smaller battery system integrators operating with limited safety validation resources.

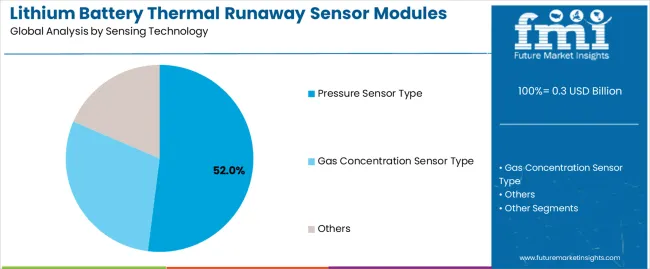

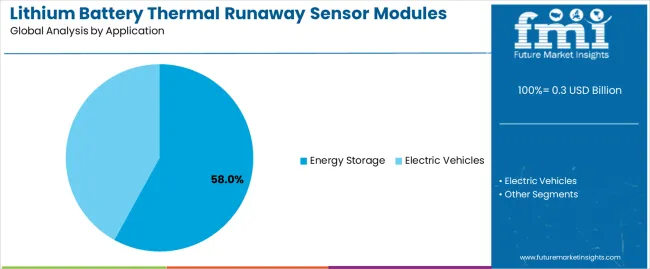

The market is segmented by sensing technology, application, and region. By sensing technology, the market is divided into pressure sensor type, gas concentration sensor type, and others. Based on application, the market is categorized into energy storage and electric vehicles. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

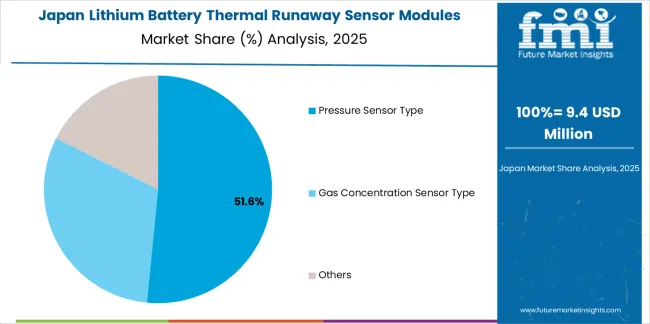

The pressure sensor type segment represents the dominant force in the lithium battery thermal runaway sensor modules market, capturing approximately 52.0% of total market share in 2025. This advanced category encompasses sensing technologies that detect internal cell pressure increases resulting from gas generation during thermal decomposition reactions, delivering early warning capabilities with 30-60 minute lead times before temperature excursion events. The pressure sensor type segment leads through its exceptional sensitivity to initial thermal runaway stages, proven reliability in automotive qualification testing, and compatibility with existing battery pack mechanical designs without requiring intrusive cell modifications.

The gas concentration sensor type segment maintains a substantial 35.0% market share, serving applications requiring chemical detection of volatile organic compounds released during electrolyte decomposition reactions. Other sensing technologies collectively account for 13.0% market share, featuring temperature gradient monitoring, acoustic emission detection, and electrochemical impedance spectroscopy methods. Key advantages driving the pressure sensor type segment include early detection capability identifying thermal events 30-60 minutes before temperature rise becomes detectable, minimal installation complexity integrating with battery module enclosures without individual cell instrumentation, robust performance across automotive temperature and vibration qualification requirements, and established supply chain infrastructure supporting high-volume production at automotive cost targets enabling mass-market electric vehicle deployment.

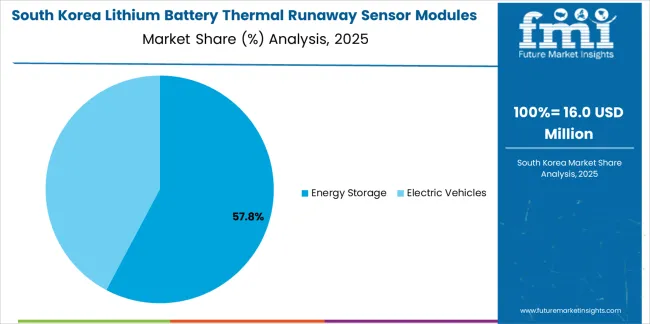

Energy storage applications dominate the lithium battery thermal runaway sensor modules market with approximately 58.0% market share in 2025, reflecting the critical safety requirements for stationary battery installations in utility-scale facilities, commercial buildings, and residential systems where fire prevention represents paramount concern. The energy storage segment leads through deployment in grid-scale battery installations requiring comprehensive fire safety systems, commercial and industrial facilities with building occupancy considerations, and residential energy storage systems installed in living spaces demanding highest safety assurance levels.

The electric vehicles segment represents 42.0% market share through applications in battery electric vehicles, plug-in hybrid electric vehicles, and electric commercial vehicles including buses and trucks. This segment benefits from automotive safety standards evolution and increasing battery pack energy density creating elevated thermal runaway risks. Key market dynamics supporting application preferences include energy storage systems requiring absolute prevention of thermal propagation due to large battery capacities and stationary installation constraints, electric vehicles balancing safety requirements with cost and weight constraints in mobile applications, growing energy storage deployment driven by renewable energy integration creating base load demand, and automotive electrification acceleration increasing electric vehicle production volumes supporting sensor module scale economies that enable cost reduction trajectories toward mass-market price points.

The market is driven by three concrete demand factors tied to safety requirements and regulatory evolution. First, high-profile thermal runaway incidents create increasing requirements for validated safety systems, with insurance underwriters requiring thermal detection as coverage prerequisite for battery installations exceeding 100 kWh capacity, affecting utility-scale projects representing 40-50% of stationary storage deployments. Second, electric vehicle safety regulations under development in multiple jurisdictions propose thermal runaway detection as standard equipment, with anticipated mandates in European Union and China markets covering 60% of global electric vehicle production creating regulatory pull for sensor adoption. Third, battery energy density increases drive risk mitigation requirements, with next-generation battery cells targeting 300+ Wh/kg energy density creating 25-35% higher thermal runaway risk compared to current 250 Wh/kg cells, necessitating enhanced monitoring capabilities.

Market restraints include sensor module cost representing 1-2% of total battery system value affecting adoption in price-sensitive applications, particularly in residential energy storage and entry-level electric vehicles where cost pressures limit safety system budgets. False alarm rate challenges pose operational concerns, as nuisance alerts disrupting energy storage dispatch schedules or triggering unnecessary vehicle service visits create adoption barriers among system operators prioritizing availability over redundant safety. Standardization gaps across battery chemistries and form factors create validation complexity, since sensor detection thresholds optimized for nickel-manganese-cobalt cells may generate false negatives in lithium-iron-phosphate applications with different thermal runaway signatures.

Key trends indicate accelerated adoption in Asia Pacific markets, particularly China where government programs support battery safety technology development through research funding and electric vehicle safety standard advancement. Technology advancement trends toward AI-enabled predictive analytics processing sensor data to identify pre-failure conditions days before thermal events, wireless mesh sensor networks reducing installation complexity in retrofit applications, and integrated safety systems combining detection with active suppression using fire suppressant injection enable next-generation battery protection. The market faces potential disruption if solid-state battery technologies achieve commercialization timelines projected for 2030-2035, potentially reducing thermal runaway risks and diminishing sensor module value proposition in applications where solid-state chemistries offer inherent safety advantages.

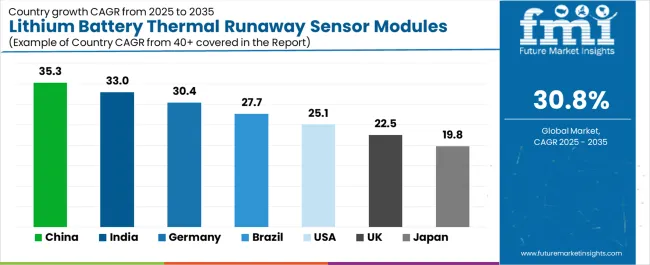

| Country | CAGR (2025-2035) |

|---|---|

| China | 35.3% |

| India | 33.0% |

| Germany | 30.4% |

| Brazil | 27.7% |

| USA | 25.1% |

| UK | 22.5% |

| Japan | 19.8% |

The lithium battery thermal runaway sensor modules market is gaining momentum worldwide, with China taking the lead thanks to aggressive electric vehicle production expansion and energy storage deployment programs. Close behind, India benefits from electric mobility initiatives and renewable energy storage growth, positioning itself as a strategic growth hub in the Asia Pacific region. Germany shows strong advancement, where established automotive industry and energy transition programs strengthen its role in European battery safety technology supply chains.

The USA demonstrates robust growth through electric vehicle adoption and utility-scale storage installations, signaling continued investment in battery safety infrastructure. Meanwhile, Japan stands out for its automotive technology leadership and precision sensor manufacturing with quality emphasis, while UK continues to record consistent progress driven by renewable energy storage deployment and electric vehicle market development. Together, China and India anchor the global expansion story, while established markets build stability and technical sophistication into the market growth path.

The report covers an in-depth analysis of 40+ countries; with top-performing countries highlighted below.

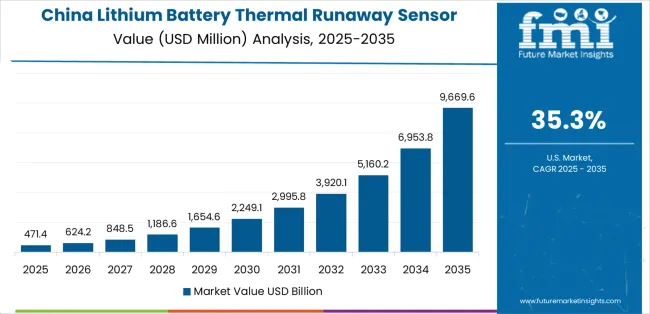

China demonstrates the strongest growth potential in the Lithium Battery Thermal Runaway Sensor Modules Market with a CAGR of 35.3% through 2035. The country leads through comprehensive electric vehicle production expansion, utility-scale energy storage deployment, and battery safety regulation development driving adoption of advanced thermal monitoring technologies. Growth is concentrated in major industrial regions, including Guangdong, Jiangsu, Zhejiang, and Shandong, where battery manufacturers and electric vehicle producers are implementing safety system integration programs for domestic consumption and export markets.

Distribution channels through automotive tier suppliers, battery system integrators, and direct manufacturer relationships expand deployment across electric vehicle battery packs, energy storage installations, and battery manufacturing quality control applications. The country's New Energy Vehicle mandate provides policy support for electric vehicle production growth, while energy storage deployment targets supporting renewable energy integration create demand for thermal safety systems.

Key market factors:

In the Maharashtra, Gujarat, Karnataka, and Tamil Nadu industrial regions, the adoption of lithium battery thermal runaway sensor module systems is accelerating across electric vehicle manufacturing, renewable energy storage projects, and battery assembly operations, driven by electric mobility promotion schemes and grid modernization initiatives. The market demonstrates strong growth momentum with a CAGR of 33.0% through 2035, linked to comprehensive electric vehicle adoption programs and increasing focus on battery safety standards. Indian battery system integrators are implementing thermal monitoring solutions and safety validation protocols to improve reliability while meeting emerging safety standards for domestic market and export applications. The country's National Electric Mobility Mission creates demand for battery safety technologies, while increasing emphasis on grid-scale storage supporting renewable energy targets drives adoption of thermal runaway detection in stationary installations.

Advanced automotive sector in Germany demonstrates sophisticated implementation of lithium battery thermal runaway sensor module systems, with documented case studies showing integration in premium electric vehicle platforms and utility-scale energy storage installations. The country's automotive engineering infrastructure in major production regions, including Bavaria, Baden-Württemberg, Lower Saxony, and North Rhine-Westphalia, showcases integration of thermal monitoring technologies with existing battery management systems, leveraging expertise in automotive electronics and functional safety. German automotive manufacturers emphasize safety validation and performance assurance, creating demand for sensor module sources that support automotive qualification standards and long-term reliability requirements. The market maintains strong growth through focus on technical excellence and export market leadership, with a CAGR of 30.4% through 2035.

Key development areas:

The Brazilian market leads in electric mobility adoption based on integration with renewable energy infrastructure and urban transportation electrification programs driving demand for battery safety systems. The country shows solid potential with a CAGR of 27.7% through 2035, driven by electric bus deployment and renewable energy storage growth across major metropolitan regions, including São Paulo, Rio de Janeiro, Brasília, and Curitiba. Brazilian transit authorities and energy utilities are adopting thermal monitoring systems for compliance with fire safety requirements in electric vehicle fleets, particularly in applications requiring passenger safety assurance and in stationary installations with building integration considerations. Technology deployment channels through automotive suppliers, energy system integrators, and direct utility relationships expand coverage across diverse battery application segments.

Leading market segments:

The USA market leads in advanced battery safety technology based on integration with electric vehicle production and utility-scale energy storage deployment requiring validated thermal monitoring solutions. The country shows solid potential with a CAGR of 25.1% through 2035, driven by electric vehicle adoption acceleration and grid-scale battery installations across major markets, including California, Texas, the Northeast corridor, and the Southeast automotive manufacturing region.

American battery system integrators are adopting specialized sensor modules for compliance with fire safety codes in stationary storage applications, particularly in utility-scale installations requiring regulatory approval and in commercial facilities with building code compliance requirements. Technology deployment channels through automotive tier suppliers, energy storage system integrators, and direct utility procurement relationships expand coverage across transportation and stationary applications.

Leading market segments:

The UK market demonstrates sophisticated implementation focused on renewable energy storage applications and electric vehicle deployment, with documented integration of thermal monitoring systems achieving safety compliance in stationary and mobile battery installations. The country maintains steady growth momentum with a CAGR of 22.5% through 2035, driven by offshore wind energy storage requirements and electric vehicle market expansion aligned with carbon neutrality commitments. Major energy storage development regions, including Scotland, England's industrial corridors, and Wales, showcase advanced battery system implementations where thermal monitoring programs integrate seamlessly with existing safety infrastructure and emergency response protocols.

Key market characteristics:

In Tokyo, Aichi, Osaka, and Hiroshima industrial regions, automotive manufacturers are implementing lithium battery thermal runaway sensor module programs to enhance electric vehicle safety and meet regulatory requirements, with documented case studies showing integration in premium electric vehicle platforms and hybrid vehicle applications. The market shows solid growth potential with a CAGR of 19.8% through 2035, linked to Japanese automotive industry quality standards, precision manufacturing capabilities, and emphasis on safety system reliability. Japanese automotive companies are adopting specialized sensor technologies and advanced integration methods to maintain safety leadership while achieving cost targets through production scale and supply chain optimization.

Market development factors:

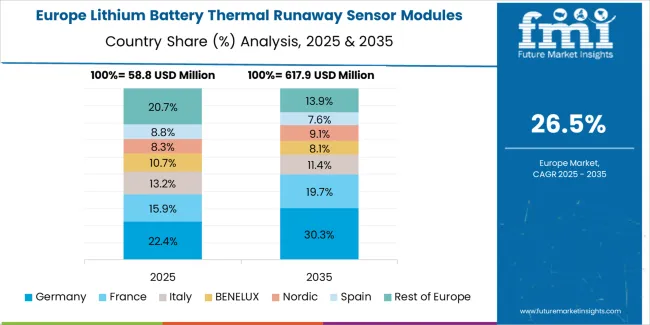

The lithium battery thermal runaway sensor modules market in Europe is projected to grow from USD 92.8 million in 2025 to USD 1,127.5 million by 2035, registering a CAGR of 27.9% over the forecast period. Germany is expected to maintain its leadership position with a 33.5% market share in 2025, declining slightly to 32.8% by 2035, supported by its advanced automotive industry and major electric vehicle production centers including Bavaria and Baden-Württemberg manufacturing clusters. France follows with a 21.0% share in 2025, projected to reach 21.5% by 2035, driven by comprehensive electric vehicle deployment programs and renewable energy storage initiatives.

The United Kingdom holds a 16.5% share in 2025, expected to decrease to 16.0% by 2035 through established energy storage installations and electric vehicle market development. Italy commands a 11.5% share, while Spain accounts for 8.0% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 9.5% to 10.2% by 2035, attributed to increasing sensor adoption in Nordic countries and emerging Eastern European electric vehicle production implementing comprehensive battery safety programs.

The Japanese lithium battery thermal runaway sensor modules market demonstrates a mature and quality-focused landscape, characterized by sophisticated integration of pressure sensing and gas detection systems with existing automotive battery management infrastructure across electric vehicle production, hybrid vehicle applications, and advanced battery research programs. Japan's emphasis on safety validation and reliability testing drives demand for premium sensor solutions that support automotive qualification standards and long-term durability requirements in demanding vehicle operating conditions.

The market benefits from strong partnerships between international sensor suppliers and domestic automotive manufacturers including major vehicle producers, creating comprehensive technology ecosystems that prioritize functional safety compliance and quality assurance. Automotive manufacturing centers in Aichi, Hiroshima, Fukuoka, and other major production regions showcase advanced electric vehicle implementations where thermal monitoring systems achieve safety validation while maintaining cost competitiveness essential for mass-market vehicle deployment.

The South Korean lithium battery thermal runaway sensor modules market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive technical integration and automotive qualification support capabilities for electric vehicle and energy storage applications. The market demonstrates increasing emphasis on battery safety innovation and thermal management optimization, as Korean battery manufacturers and automotive companies increasingly demand advanced sensor networks that integrate with domestic battery cell production and sophisticated battery management systems deployed across electric vehicle platforms.

Regional sensor suppliers are gaining market share through strategic partnerships with international technology providers, offering specialized services including Korean automotive standard compliance support and application-specific integration programs for electric vehicle battery systems. The competitive landscape shows increasing collaboration between multinational sensor companies and Korean battery technology specialists, creating hybrid development models that combine international sensing expertise with local battery integration knowledge and automotive supply chain relationships.

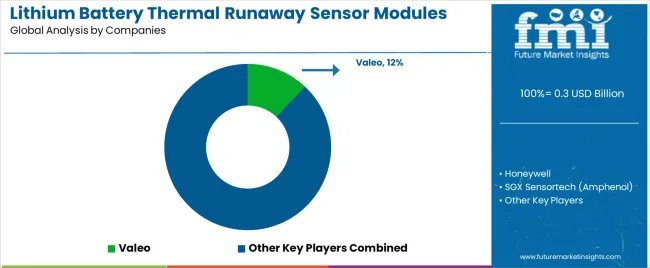

The lithium battery thermal runaway sensor modules market features approximately 20-25 meaningful players with moderate fragmentation, where the top three companies control roughly 28-33% of global market share through established automotive qualification credentials and comprehensive product portfolios. Competition centers on detection sensitivity, false alarm rate minimization, and automotive qualification heritage rather than price competition alone. Valeo leads with approximately 12.0% market share through its comprehensive automotive sensor portfolio including thermal runaway detection systems integrated with battery management platforms.

Market leaders include Valeo, Honeywell, and SGX Sensortech (Amphenol), which maintain competitive advantages through decades of automotive sensor experience, established safety validation infrastructure supporting tier-one supplier qualification, and deep expertise in multi-parameter sensing technologies, creating trust and reliability advantages with automotive manufacturers and battery system integrators. These companies leverage research capabilities in sensor fusion algorithms and automotive functional safety alongside ongoing technical support relationships to defend market positions while expanding into energy storage applications and next-generation electric vehicle platforms.

Challengers encompass Metis Engineering and MSR-Electronic GmbH, which compete through specialized detection technologies and strong positions in industrial safety markets. Product specialists, including Li-ion Tamer (Nexceris), Cubic Sensor And Instrument, and Zhengzhou Weisheng Electronic Technology, focus on specific sensing mechanisms or regional market segments, offering differentiated capabilities in off-gas detection, pressure monitoring, and cost-optimized solutions for emerging markets.

Regional players and emerging sensor technology startups create competitive pressure through innovative detection approaches and rapid adaptation to evolving battery chemistries, particularly in high-growth markets including China and India, where domestic manufacturers provide advantages in local supply chain integration and responsive technical support. Market dynamics favor companies that combine reliable detection performance with comprehensive safety validation documentation that addresses automotive functional safety standards and energy storage fire protection code requirements throughout the complete product lifecycle.

Lithium battery thermal runaway sensor modules represent critical safety systems that enable battery operators to achieve 30-60 minutes advance warning compared to traditional monitoring approaches, delivering superior fault detection and fire prevention capabilities with validated reliability in demanding automotive and industrial applications. With the market projected to grow from USD 315.9 million in 2025 to USD 4,469.4 million by 2035 at a 30.8% CAGR, these safety technologies offer compelling advantages for energy storage applications (58.0% market share), electric vehicles (42.0% share), and battery system operators seeking validated thermal runaway protection with demonstrated effectiveness. Scaling market adoption and technology advancement requires coordinated action across sensor manufacturers, battery producers, automotive suppliers, safety regulators, and battery technology investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 0.3 billion |

| Sensing Technology | Pressure Sensor Type, Gas Concentration Sensor Type, Others |

| Application | Energy Storage, Electric Vehicles |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Valeo, Honeywell, SGX Sensortech (Amphenol), Metis Engineering, MSR-Electronic GmbH, Li-ion Tamer (Nexceris), Cubic Sensor And Instrument, Zhengzhou Weisheng Electronic Technology, Yangzhou Ruikong Automotive Electronics, Jintianhong Technology |

| Additional Attributes | Dollar sales by sensing technology and application categories, regional adoption trends across Asia Pacific, North America, and Europe, competitive landscape with sensor manufacturers and battery system integrators, automotive qualification requirements and specifications, integration with battery management systems and safety protocols, innovations in detection technologies and predictive analytics, and development of specialized sensors with enhanced sensitivity and reliability capabilities. |

The global lithium battery thermal runaway sensor modules market is estimated to be valued at USD 0.3 billion in 2025.

The market size for the lithium battery thermal runaway sensor modules market is projected to reach USD 4.4 billion by 2035.

The lithium battery thermal runaway sensor modules market is expected to grow at a 30.8% CAGR between 2025 and 2035.

The key product types in lithium battery thermal runaway sensor modules market are pressure sensor type, gas concentration sensor type and others.

In terms of application, energy storage segment to command 58.0% share in the lithium battery thermal runaway sensor modules market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithium Compound Market Forecast Outlook 2025 to 2035

Lithium Mining Market Size and Share Forecast Outlook 2025 to 2035

Lithium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium-sulfur Solid-state Batteries Market Size and Share Forecast Outlook 2025 to 2035

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

Lithium Cobalt Oxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iodide Market

Lithium Bromide Market

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Battery Separator Market Growth & Trends 2025 to 2035

Lithium Ion Battery Dispersant Market Growth – Trends & Forecast 2024-2034

Lithium Ion Battery Material Market Growth – Trends & Forecast 2024-2034

Lithium Silicon Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium and Lithium Ion Battery Electrolyte Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA