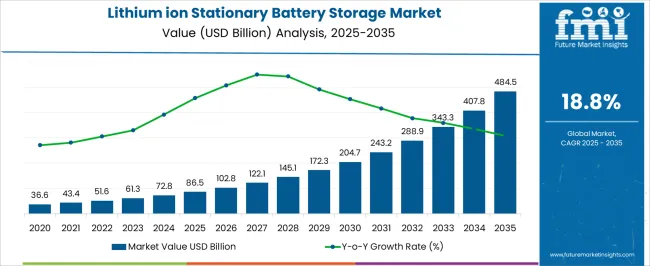

The lithium ion stationary battery storage market is estimated to be valued at USD 86.5 billion in 2025 and is projected to reach USD 484.5 billion by 2035, registering a compound annual growth rate (CAGR) of 18.8% over the forecast period. A growth contribution index (GCI) analysis reveals that the market experiences strong acceleration, with significant contributions from both volume and price growth. Between 2025 and 2030, the market grows from USD 86.5 billion to USD 204.7 billion, contributing USD 118.2 billion in growth, with a CAGR of 19.4%. This early-stage growth is largely driven by the increasing demand for energy storage solutions, particularly in the context of renewable energy integration, grid stabilization, and electric vehicles.

The focus on reducing reliance on fossil fuels and enhancing energy security plays a crucial role in accelerating adoption. From 2030 to 2035, the market continues to grow from USD 204.7 billion to USD 484.5 billion, adding USD 279.8 billion in growth, with a slightly lower CAGR of 18.2%. Despite the deceleration, the late-phase growth is driven by continued technological advancements, cost reductions, and increased deployment of lithium ion batteries in large-scale energy storage projects. The GCI analysis reveals that the largest contribution to the market expansion comes from the increasing demand for stationary battery storage solutions as the world transitions toward more sustainable energy systems, ensuring long-term, continued growth.

| Metric | Value |

|---|---|

| Lithium ion Stationary Battery Storage Market Estimated Value in (2025 E) | USD 86.5 billion |

| Lithium ion Stationary Battery Storage Market Forecast Value in (2035 F) | USD 484.5 billion |

| Forecast CAGR (2025 to 2035) | 18.8% |

Utilities, industrial players, and grid operators are increasingly deploying stationary storage solutions to support grid stability, improve energy efficiency, and reduce dependence on fossil fuel-based peaking plants.

Industry developments shared through press releases and investor updates have highlighted growing investments in storage infrastructure, driven by government-backed energy transition programs and regulatory mandates for emissions reduction. Future growth potential is being shaped by advancements in battery chemistry, increased focus on supply chain localization, and the need for more flexible and scalable energy storage systems.

Key energy publications and industry journals have identified the role of stationary battery systems in enabling time-shifting of renewable generation and providing ancillary services such as frequency regulation and peak shaving.

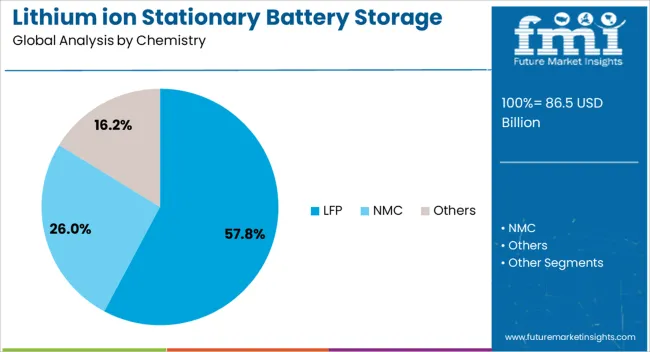

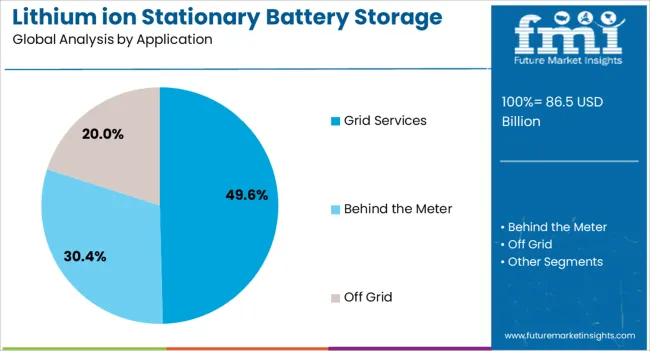

The lithium ion stationary battery storage market is segmented by chemistry, application, and geographic regions. By chemistry, the lithium ion stationary battery storage market is divided into LFP, NMC, and Others. In terms of application, the lithium-ion stationary battery storage market is classified into Grid Services, Behind the Meter, and Off-Grid. Regionally, the lithium ion stationary battery storage industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The LFP chemistry segment is projected to contribute 57.8% of the market revenue share in 2025, making it the leading chemistry type. This dominance is being supported by the superior thermal stability, safety, and long cycle life offered by lithium iron phosphate compared to other lithium-ion chemistries. Industry updates and technical documentation have emphasized that LFP batteries do not rely on costly or geopolitically sensitive materials such as cobalt and nickel, which has made them a preferred choice in stationary applications.

Their lower degradation rate and higher tolerance for frequent charge-discharge cycles have made them particularly suited for grid-tied systems. Press announcements from battery manufacturers have also indicated rapid expansion of LFP-focused production lines, reflecting rising demand from utility and commercial sectors.

The segment's growth is further reinforced by its compatibility with renewable energy sources and the increasing prioritization of fire safety in large-scale battery installations. These attributes have positioned LFP as the most adopted chemistry in stationary storage solutions.

The grid services application segment is expected to hold 49.6% of the market revenue share in 2025, establishing it as the largest application segment. This leadership position has been driven by the growing deployment of energy storage systems to support grid balancing, voltage regulation, frequency control, and reserve capacity. Government policy announcements and utility investment plans have pointed toward a sharp increase in grid-connected battery installations to stabilize fluctuating renewable energy inputs.

Statements from power utilities and independent system operators have also recognized the role of battery-based grid services in enhancing reliability and reducing operational costs associated with traditional peaking plants. In recent years, industry news has covered the acceleration of battery projects that provide fast response ancillary services, which are in high demand due to renewable intermittency.

These systems are also being used to defer infrastructure upgrades, creating economic value beyond energy arbitrage.

Energy storage, particularly using lithium-ion technology, plays a crucial role in enhancing grid stability, balancing supply and demand, and integrating renewable energy sources into the power grid. As the adoption of renewable energy such as solar and wind power increases, energy storage solutions are essential for storing excess energy generated during peak production times and supplying it when demand is high or production drops. The continuous development of lithium-ion batteries, offering higher energy densities and longer lifespans, further drives the growth of this sector, positioning energy storage as a key element in the future of sustainable energy management.

Despite the significant potential, challenges are hindering the broader adoption of energy storage systems. One of the major obstacles is the high initial cost of implementing battery-based storage solutions. Although the technology offers significant long-term benefits, the upfront investment required for installation and infrastructure can deter many businesses and utilities. Additionally, concerns about the environmental impact of lithium mining and battery disposal remain a challenge, especially as demand for batteries increases. There are also technical issues related to the performance and longevity of the batteries, which may degrade over time, impacting efficiency. The lack of standardization and varying regulations across different regions adds complexity to the development and deployment of energy storage systems. Overcoming these challenges will be essential to fully unlocking the potential of energy storage in the coming years.

The growing need for reliable backup power, particularly in regions with unstable power grids, is a significant driver. As power outages become more frequent, especially in areas prone to natural disasters, the demand for efficient energy storage solutions has increased. Another key driver is the rise of renewable energy sources, which require storage to manage intermittent power production. Batteries are ideal for this, as they provide a compact, efficient, and scalable solution. Government policies and incentives supporting the transition to cleaner energy solutions are accelerating the adoption of energy storage technologies. As industries increasingly look for ways to reduce their carbon footprints, energy storage offers a viable way to manage renewable energy efficiently, further driving market growth. The continuous advancement of battery technologies, improving both cost and performance, also contributes to the increasing adoption of energy storage systems.

The energy storage sector offers numerous opportunities for growth, particularly as the global demand for clean and reliable energy continues to rise. One of the primary opportunities is the integration of energy storage systems into the grid, where they can help stabilize power supply and improve grid reliability. By storing excess energy during low-demand periods and discharging it during peak demand, energy storage can reduce strain on the grid and prevent outages. Another opportunity lies in the growing market for off-grid energy solutions, particularly in remote and developing regions where access to reliable electricity is limited. As renewable energy projects expand, there is also an increasing need for efficient energy storage to store excess energy generated by solar and wind farms. Furthermore, advancements in battery technology are continually improving the performance and affordability of energy storage systems, which will open new doors for deployment across residential, commercial, and industrial sectors.

The energy storage sector is evolving with several key trends that will shape its future. One significant trend is the increasing adoption of advanced lithium-ion batteries with higher energy densities, longer lifespans, and faster charging capabilities. As technology advances, batteries are becoming more cost-effective, making energy storage more accessible to a wider range of applications. Another trend is the growing integration of energy storage with smart grid systems, where storage solutions not only provide backup power but also enhance grid management and efficiency. The rise of decentralized energy systems, including residential energy storage, is also gaining traction, as more consumers seek control over their energy usage and costs. There is a focus on developing recycling solutions for lithium-ion batteries to address environmental concerns. These trends suggest that energy storage will continue to play a crucial role in the future energy landscape, particularly in the transition to renewable energy sources and more resilient power systems.

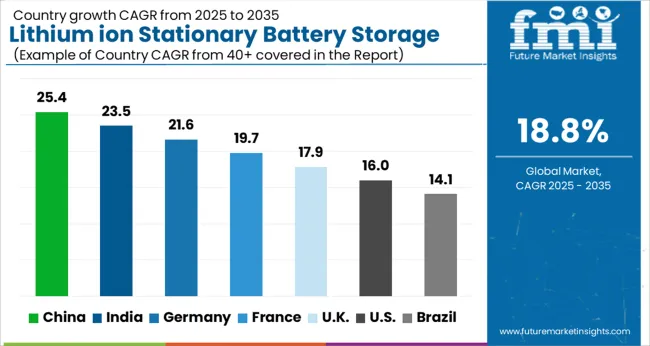

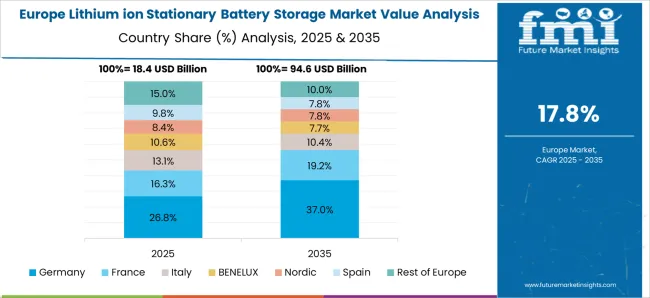

The global lithium ion stationary battery storage market is projected to grow at a CAGR of 18.8% from 2025 to 2035. China leads at 25.4%, followed by India at 23.5%, and France at 19.7%, while the United Kingdom records 17.9% and the United States posts 16.0%. Investments in renewable energy, grid modernization, and energy storage infrastructure are increasing in China and India. In contrast, more mature markets like the United States and the United Kingdom are experiencing more moderate growth due to their established infrastructure and regulatory constraints. The analysis includes over 40+ countries, with the leading markets detailed below.

China is experiencing significant growth in lithium ion stationary battery storage, projected at a CAGR of 25.4% through 2035. As the world’s largest producer and consumer of renewable energy, China is focusing on large-scale energy storage systems to accommodate its increasing wind and solar capacity. The rise in electric vehicle adoption also supports the growth of storage solutions. China’s government continues to invest in grid modernization and energy storage infrastructure, aiming to enhance energy security and efficiency. The country’s vast manufacturing base for lithium ion batteries further strengthens its position as a leader in the global energy storage market.

The lithium ion stationary battery storage market in India is set to grow at a CAGR of 23.5% through 2035. India is increasingly focusing on addressing energy access challenges in rural areas while expanding renewable energy capacity. As the country ramps up its solar energy infrastructure, the need for reliable, efficient energy storage becomes critical. The rise in electric vehicles and a push for green mobility solutions further contribute to market expansion. Additionally, government initiatives that promote the adoption of energy storage systems for industrial applications and rural electrification will continue to accelerate the adoption of lithium-ion battery storage solutions in India.

Growth Analysis of Lithium Ion Stationary Battery Storage in France

The lithium ion stationary battery storage market in France is growing at a CAGR of 19.7% through 2035. France’s increasing reliance on renewable energy, particularly solar and wind, is driving the adoption of storage solutions. The country’s regulatory frameworks support the expansion of smart grid systems, enhancing energy efficiency and grid reliability. As electric vehicle infrastructure continues to expand, the demand for energy storage to support these vehicles also rises. France’s focus on improving energy autonomy, particularly in remote areas, is further promoting the adoption of lithium-ion storage systems to balance supply and demand effectively.

The UK is projected to see growth at a CAGR of 17.9% through 2035 in its lithium ion stationary battery storage market. The country’s increasing focus on renewable energy integration and grid efficiency is driving the adoption of energy storage systems. As the UK expands its offshore wind energy projects and solar infrastructure, the need for energy storage solutions to support these systems grows. The UK is also investing heavily in decentralized energy networks, promoting the use of lithium-ion batteries for local storage solutions in residential and commercial sectors. The push for green mobility and electric vehicles further supports the market expansion.

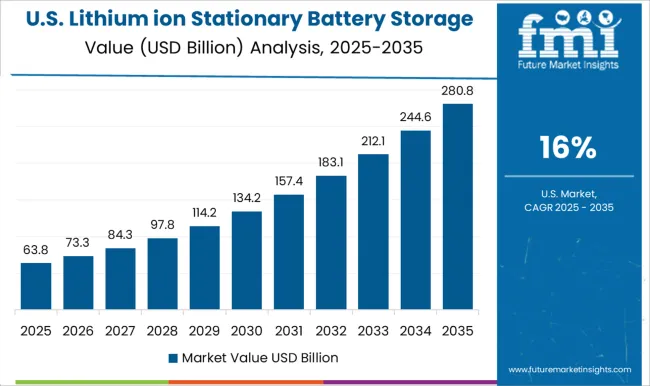

The USA market for lithium ion stationary battery storage is expected to grow at a CAGR of 16.0% through 2035. The USA is increasingly investing in energy storage technologies as part of its efforts to integrate renewable energy sources into the grid. As solar and wind energy continue to gain momentum, the need for reliable storage solutions to ensure grid stability grows. The rise of electric vehicles in the USA and the growing focus on energy independence further accelerate the adoption of lithium-ion battery storage. Additionally, federal and state-level incentives for clean energy solutions contribute to the market’s expansion.

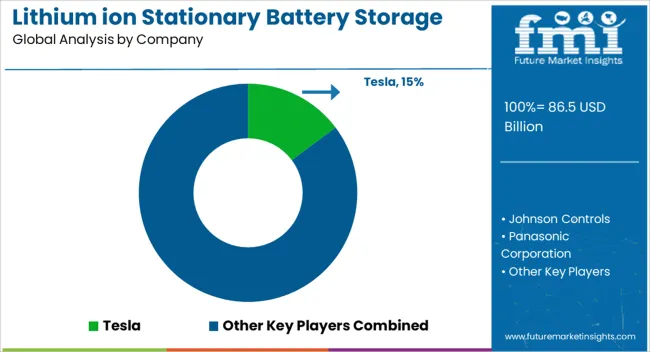

The lithium ion stationary battery storage market is driven by major players offering efficient energy storage solutions for applications in renewable energy integration, grid balancing, and backup power systems. Tesla is a leading player, known for its high-performance energy storage solutions, including the Powerwall and Powerpack, which are designed to optimize energy use in residential, commercial, and industrial settings. Johnson Controls provides advanced battery storage systems that offer reliable performance and long service life, supporting various energy storage applications. Panasonic Corporation is a key player, supplying lithium-ion battery technology for both electric vehicles and stationary storage systems, contributing to grid stability and renewable energy integration. Leclanché SA offers high-capacity storage solutions for industrial and commercial sectors, providing efficient energy storage systems that help optimize energy usage during peak demand periods.

LG Chem provides lithium-ion battery technology known for its high energy density and reliability, making it suitable for use in large-scale energy storage applications. Exide Technologies is a key player that offers lead-acid and lithium-ion batteries for stationary applications, catering to both residential and industrial segments. Toshiba Corporation and GS Yuasa International Ltd focus on providing lithium-ion batteries for large-scale storage projects, offering robust solutions for energy storage in commercial and utility-scale systems. Siemens Energy provides advanced energy storage systems that optimize the use of stored energy, catering to industries and grid infrastructure applications. BYD Company Ltd. and SK Innovation Co. Ltd offer lithium-ion battery storage solutions focused on grid integration and large-scale energy storage, with an emphasis on long-term performance and efficiency. VARTA AG focuses on providing lithium-ion battery solutions for stationary energy storage, known for their compact size, efficiency, and long cycle life, suitable for both commercial and residential.

| Item | Value |

|---|---|

| Quantitative Units | USD 86.5 Billion |

| Chemistry | LFP, NMC, and Others |

| Application | Grid Services, Behind the Meter, and Off Grid |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tesla, Johnson Controls, Panasonic Corporation, Leclanché SA, Hitachi Energy Ltd., LG Chem, Exide Technologies, Toshiba Corporation, GS Yuasa International Ltd, Siemens Energy, BYD Company Ltd., SK Innovation Co Ltd, and VARTA AG |

| Additional Attributes | Dollar sales by product type (residential storage, commercial storage, industrial storage, grid storage) and end-use segments (renewable energy integration, backup power, grid balancing, off-grid applications). Demand dynamics are influenced by the increasing adoption of renewable energy sources, the rising need for energy storage systems to manage intermittent energy supply, and the growing focus on energy independence. Regional trends show strong growth in North America, Europe, and Asia-Pacific, driven by increasing energy storage demand in response to renewable energy adoption. Innovation trends focus on enhancing battery efficiency, reducing costs, and improving charge/discharge cycles. Environmental considerations include improving battery recyclability, reducing raw material consumption, and optimizing manufacturing processes. |

The global lithium ion stationary battery storage market is estimated to be valued at USD 86.5 billion in 2025.

The market size for the lithium ion stationary battery storage market is projected to reach USD 484.5 billion by 2035.

The lithium ion stationary battery storage market is expected to grow at a 18.8% CAGR between 2025 and 2035.

The key product types in lithium ion stationary battery storage market are lfp, nmc and others.

In terms of application, grid services segment to command 49.6% share in the lithium ion stationary battery storage market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Stationary Lithium-Ion Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium Mining Market Size and Share Forecast Outlook 2025 to 2035

Lithium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium-sulfur Solid-state Batteries Market Size and Share Forecast Outlook 2025 to 2035

Lithium Cobalt Oxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Lithium Compound Market Growth – Trends & Forecast 2024-2034

Lithium Iodide Market

Lithium Bromide Market

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Lithium Silicon Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Battery Separator Market Growth & Trends 2025 to 2035

Lithium Ion Battery Dispersant Market Growth – Trends & Forecast 2024-2034

Lithium Ion Battery Material Market Growth – Trends & Forecast 2024-2034

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Lithium and Lithium Ion Battery Electrolyte Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA