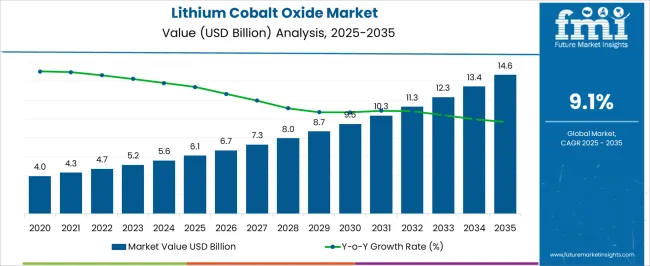

The lithium cobalt oxide (LCO) market is expected to grow from USD 6.1 billion in 2025 to USD 14.6 billion by 2035, registering a 9.1% CAGR and creating an absolute dollar opportunity of USD 8.5 billion. Growth is driven by rising demand for lithium-ion batteries in consumer electronics, electric vehicles, and energy storage systems. Improvements in energy density, battery lifespan, and safety, along with increasing deployment of renewable energy solutions, support expansion across global markets. Acceleration and deceleration patterns provide insight into changes in market momentum over the forecast period.

From 2025 to 2028, growth accelerates moderately, led by North America, Europe, and East Asia, where the rising production of consumer electronics and electric vehicles contributes to incremental revenue. Between 2029 and 2032, the market experiences faster acceleration as Asia Pacific, particularly China, India, and Southeast Asia, scales battery manufacturing and energy storage deployment. From 2033 to 2035, growth moderates in early-adopting regions as markets reach higher penetration, with incremental gains coming from replacements, upgrades, and high-performance LCO applications. Overall, the USD 8.5 billion opportunity reflects early steady uptake, mid-period rapid expansion, and late-stage moderation, illustrating the trajectory of the global lithium cobalt oxide market between 2025 and 2035.

| Metric | Value |

|---|---|

| Lithium Cobalt Oxide Market Estimated Value in (2025 E) | USD 6.1 billion |

| Lithium Cobalt Oxide Market Forecast Value in (2035 F) | USD 14.6 billion |

| Forecast CAGR (2025 to 2035) | 9.1% |

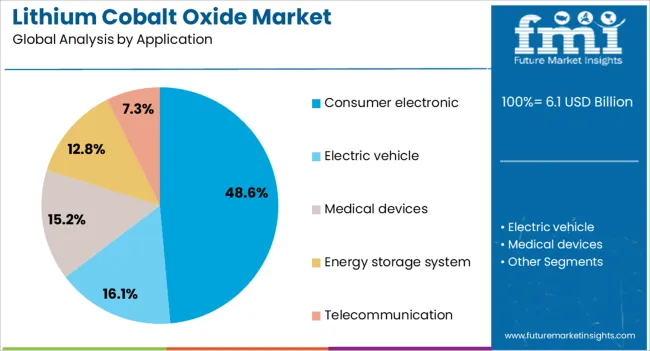

The lithium cobalt oxide (LCO) market is primarily driven by the consumer electronics sector, which accounts for around 48% of the market share, as LCO is widely used in rechargeable lithium-ion batteries for smartphones, laptops, tablets, and wearable devices. The electric vehicle (EV) segment contributes about 25%, where LCO-based batteries are applied in hybrid and plug-in hybrid vehicles for high energy density and compact form factors.

The energy storage systems segment represents close to 15%, integrating LCO batteries in small-scale residential and commercial backup applications. Industrial tools and equipment account for roughly 8%, utilizing LCO for portable power tools and machinery. The remaining 4% comes from aerospace, medical devices, and specialty electronics requiring lightweight, high-performance battery solutions. The market is evolving with innovations in battery chemistry, energy density, and sustainability. Manufacturers are improving cathode formulations to enhance cycle life, thermal stability, and safety. High-capacity, compact LCO cells are increasingly used in consumer electronics to meet growing performance demands. Recycling and cobalt recovery initiatives are expanding to address ethical sourcing and reduce environmental impact. Hybrid and multi-chemistry batteries combining LCO with NMC or LFP are gaining attention to balance performance, cost, and stability.

Strategic partnerships between battery manufacturers, electronics OEMs, and research institutions are accelerating development. Rising demand for portable devices, electric mobility, and renewable energy storage continues to drive the global LCO market.

The lithium cobalt oxide market is experiencing sustained growth due to rising demand for high energy density battery materials, especially in consumer electronics and emerging electric mobility applications. Known for its stable performance and long lifecycle, lithium cobalt oxide is widely preferred in lithium ion battery manufacturing.

Continuous advancements in portable electronic devices, smartphones, and medical equipment are fueling the need for compact high capacity battery solutions. Additionally, research efforts directed toward enhancing charge efficiency and thermal stability are further strengthening product adoption.

Environmental regulations and raw material sourcing strategies are also influencing the supply dynamics of cobalt based compounds. As global energy storage demand escalates, the lithium cobalt oxide market is expected to expand steadily, with strong emphasis on optimizing material purity and balancing performance with cost efficiency.

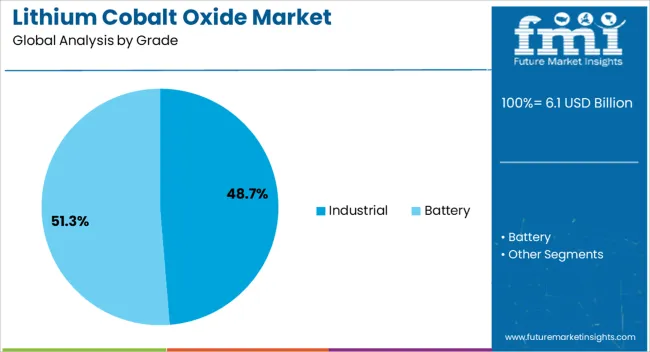

The lithium cobalt oxide market is segmented by grade, application, and geographic regions. By grade, lithium cobalt oxide market is divided into Industrial and Battery. In terms of application, lithium cobalt oxide market is classified into Consumer electronic, Electric vehicle, Medical devices, Energy storage system, and Telecommunication. Regionally, the lithium cobalt oxide industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The industrial grade segment is projected to hold 48.70% of the total market share by 2025, positioning it as the dominant grade. This leadership is driven by its use in large scale battery manufacturing where performance reliability, thermal resilience, and material consistency are essential.

Industrial grade lithium cobalt oxide is favored in applications that demand uniform particle morphology and high purity levels to ensure safety and longevity. Battery manufacturers targeting automotive components, medical devices, and aerospace systems rely heavily on this grade for performance intensive applications.

Additionally, regulatory standards and product qualification processes for these industries favor the controlled specifications offered by industrial grade materials. As demand rises for robust and scalable battery components, this segment continues to lead due to its strong alignment with high performance energy storage systems.

The consumer electronic segment is anticipated to account for 48.60% of the total revenue share by 2025 under the application category, establishing it as the largest application area. This dominance is supported by the proliferation of smartphones, laptops, cameras, and wearable devices that require compact long lasting batteries.

Lithium cobalt oxide is widely adopted in this space due to its high energy density and stable discharge profile, which are critical for uninterrupted device performance. The miniaturization of electronic gadgets and increasing emphasis on battery longevity have further elevated the use of this material.

Additionally, consumer preferences for fast charging and lightweight devices have encouraged manufacturers to adopt lithium cobalt oxide based batteries to meet these expectations. This segment remains pivotal to market growth as technological innovation and digital lifestyle trends continue to drive demand for advanced power solutions.

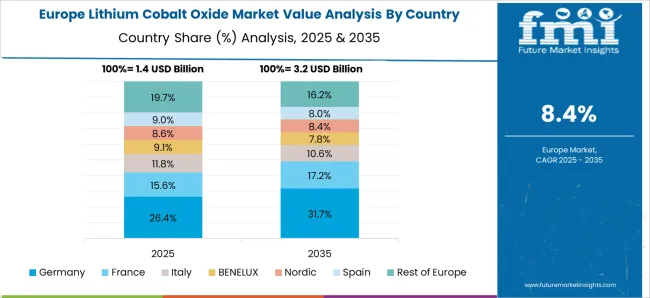

The lithium cobalt oxide market is expanding due to rising demand for lithium-ion batteries in consumer electronics, electric vehicles (EVs), and energy storage systems. Asia Pacific leads with approximately USD 14 billion in 2024, driven by China (USD 8 billion), South Korea (USD 3 billion), and Japan (USD 3 billion). Europe accounts for USD 6 billion, led by Germany (USD 2.5 billion), France (USD 1.5 billion), and UK (USD 2 billion). North America holds USD 5 billion, primarily the USA, while the rest of the world represents USD 1 billion. Key applications include EV batteries (40%), smartphones and laptops (30%), grid storage (20%), and other electronics (10%).

Growth is driven by increasing adoption of lithium-ion batteries with high energy density. EV batteries account for 40% of market deployment, consumer electronics 30%, grid storage 20%, and other electronics 10%. Asia Pacific leads with USD 14 billion, Europe USD 6 billion, and North America USD 5 billion. LCO batteries provide 150–200 Wh/kg energy density, suitable for high-performance portable devices. Rising EV sales, exceeding 12 million units in 2024 globally, and increased deployment of smartphones and laptops, totaling over 3.5 billion devices annually, are key contributors. Battery manufacturers favor LCO for stable voltage output and high charge/discharge efficiency in compact formats.

Key trends include coated LCO cathodes, blended lithium chemistries, and battery recycling integration. Surface-coated LCO cathodes, adopted in 20% of EV and consumer battery cells, improve cycle life by 15–20%. Hybrid cathode formulations combining nickel, manganese, and cobalt enhance thermal stability and energy density, representing 25% of new production. Advanced recycling methods recover up to 90% of cobalt from end-of-life batteries, supporting circular supply chains. Adoption of fast-charging LCO cells is increasing in portable electronics, enabling charging in 30–45 minutes. Asia Pacific and Europe lead in R&D and commercial deployment of high-performance LCO cells to meet rising energy storage demand.

Opportunities exist in electric vehicles, consumer electronics, grid energy storage, and other high-energy applications. EV batteries account for 40% of adoption, consumer electronics 30%, grid storage 20%, and other devices 10%. Asia Pacific is projected to reach USD 18 billion by 2027, Europe USD 7 billion, and North America USD 6 billion. Increasing EV penetration in China, USA, and Europe drives demand for high-performance LCO cells. Expansion in smartphones, laptops, and wearable electronics creates additional high-value opportunities. Recycling and cobalt recovery programs can add USD 500–700 million in potential savings annually, improving supply security for manufacturers.

High cobalt cost, resource scarcity, and safety concerns restrict adoption. LCO cells require cobalt, which costs USD 55,000–60,000 per metric ton. Limited cobalt availability, primarily from the Democratic Republic of Congo, constrains production. Thermal instability of LCO cells at high charge/discharge rates can cause overheating, requiring safety systems that add USD 50–150 per battery pack. Integration into large EV battery packs is technically challenging, increasing assembly time by 15–20%. Regulatory and environmental compliance for cobalt mining and battery disposal adds USD 5–10 million annually for large-scale manufacturers. Price sensitivity in consumer electronics and small EV segments limits adoption despite performance advantages.

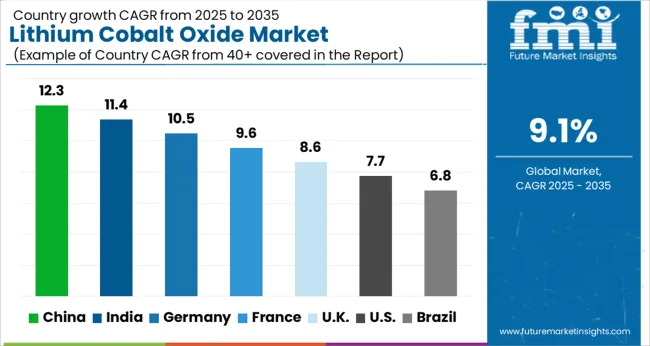

| Country | CAGR |

|---|---|

| China | 12.3% |

| India | 11.4% |

| Germany | 10.5% |

| France | 9.6% |

| UK | 8.6% |

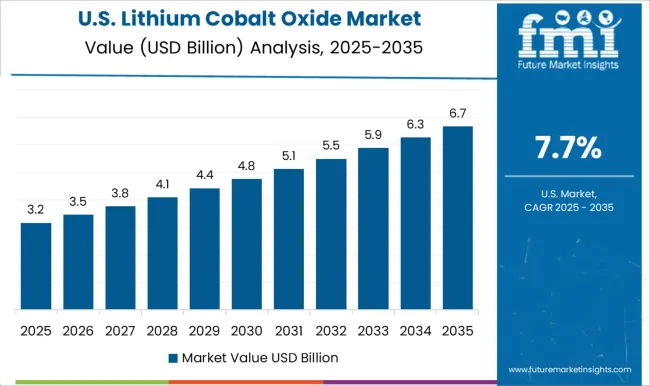

| USA | 7.7% |

| Brazil | 6.8% |

The lithium cobalt oxide market is projected to grow at a global CAGR of 9.1% through 2035, driven by rising demand for lithium-ion batteries, electric vehicles, and portable electronics. China leads at 12.3%, a 1.35× multiple over the global benchmark, supported by BRICS-driven expansion in battery manufacturing, EV production, and energy storage solutions. India follows at 11.4%, a 1.25× multiple of the global rate, reflecting growth in renewable energy storage, EV adoption, and consumer electronics applications. Germany records 10.5%, a 1.15× multiple of the benchmark, shaped by OECD-backed innovation in high-performance battery materials, energy storage systems, and automotive applications. The United Kingdom posts 8.6%, 0.95× the global rate, with demand concentrated in EV batteries, energy storage projects, and industrial electronics. The United States stands at 7.7%, 0.85× the benchmark, with steady uptake in portable electronics, renewable energy storage, and electric mobility solutions. BRICS economies drive most of the market volume, OECD countries emphasize technological advancement and efficiency, while ASEAN nations contribute through expanding energy storage and EV markets.

The lithium cobalt oxide market in China is projected to grow at a CAGR of 12.3%, driven by rising demand for lithium-ion batteries in electric vehicles, consumer electronics, and energy storage systems. Domestic suppliers such as CATL, BYD, and GEM provide high-purity LCO materials optimized for high energy density and thermal stability. Technological developments emphasize battery longevity, improved charge-discharge efficiency, and enhanced safety. Growth is supported by government incentives for EV adoption and the expansion of energy storage infrastructure.

The lithium cobalt oxide market in India is expected to grow at a CAGR of 11.4%, supported by increasing electric vehicle adoption, expanding electronics manufacturing, and growing energy storage initiatives. Key suppliers such as Exide Industries and Amara Raja provide high-quality LCO materials for lithium-ion batteries with improved cycle life and thermal management. Technological improvements focus on energy density optimization, battery safety, and consistent performance. Adoption is concentrated in EV batteries, consumer electronics, and grid-scale energy storage.

Germany’s lithium cobalt oxide market is projected to grow at a CAGR of 10.5%, influenced by demand for electric vehicles, industrial energy storage, and high-performance batteries in consumer electronics. Suppliers such as BASF and Umicore provide LCO materials with high energy density, improved thermal stability, and low degradation rates. Technological focus includes battery longevity, energy efficiency, and integration into EV and stationary storage systems. Adoption is concentrated in automotive and industrial battery applications.

The lithium cobalt oxide market in the United Kingdom is expected to grow at a CAGR of 8.6%, driven by adoption in electric vehicles, consumer electronics, and energy storage projects. Suppliers focus on high-purity LCO materials with improved energy density, thermal management, and battery safety. Technological developments emphasize longer cycle life, higher efficiency, and reliable performance in demanding applications. Adoption is concentrated in EV batteries, portable electronics, and industrial energy storage.

The lithium cobalt oxide market in the United States is projected to grow at a CAGR of 7.7%, supported by EV adoption, portable electronics, and energy storage systems. Key suppliers such as Livent and FMC provide LCO materials with high purity, enhanced energy density, and thermal stability. Technological improvements focus on improving cycle life, safety, and performance consistency. Adoption is concentrated in electric vehicles, consumer electronics, and industrial storage applications.

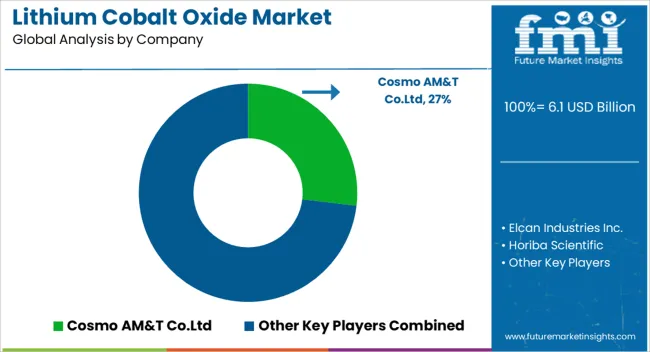

Competition in the lithium cobalt oxide market is being shaped by material purity, electrochemical performance, and scalability for lithium-ion batteries used in electric vehicles, energy storage systems, and consumer electronics. Market positions are being reinforced through advanced synthesis technologies, high-quality raw material sourcing, and global supply networks that ensure consistent particle size, crystallinity, and electrochemical stability. Cosmo AM&T Co. Ltd. and Elcan Industries Inc. are being represented with high-purity lithium cobalt oxide engineered for high energy density and long cycle life. Horiba Scientific and Huayou New Energy Technology Co. Ltd. are being promoted with materials structured for battery research, performance testing, and industrial-scale production. Merck and Nichia Corporation are being applied with advanced cathode formulations optimized for stable voltage, thermal stability, and uniform performance in high-capacity cells. NIPPON CHEMICAL INDUSTRIAL CO., LTD. and Otto Chemie Pvt. Ltd. are being showcased with products designed for consistent particle morphology and low impurity levels, supporting high-efficiency battery applications. Stanford Advanced Materials, Targray, and Tokyo Chemical Industry are being advanced with lithium cobalt oxide powders engineered for laboratory, prototype, and commercial-scale production, ensuring reproducibility and quality. Strategies in the market are being centered on enhancing energy density, improving thermal stability, and scaling production to meet growing demand in electric vehicles and grid storage. Research and development are being allocated to optimize particle structure, reduce manufacturing defects, and improve electrochemical performance. Product brochures are being structured with specifications covering chemical composition, particle size, tap density, purity, and thermal stability. Features such as high capacity, long cycle life, consistent quality, and compatibility with advanced battery systems are being emphasized to guide procurement and manufacturing planning. Each brochure is being arranged to present technical performance, safety compliance, and handling instructions. Information is being provided in a clear, evaluation-ready format to assist battery manufacturers, research labs, and procurement teams in selecting lithium cobalt oxide that meets energy, stability, and operational requirements.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.1 Billion |

| Grade | Industrial and Battery |

| Application | Consumer electronic, Electric vehicle, Medical devices, Energy storage system, and Telecommunication |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cosmo AM&T Co.Ltd, Elcan Industries Inc., Horiba Scientific, Huayou New Energy technology Co Ltd, Merck, Nichia corporation, NIPPON CHEMICAL INDUSTRIAL CO.,LTD., Otto Chemie Pvt. Ltd., Stanford Advanced Materials, Targray, and Tokyo Chemical Industry |

| Additional Attributes | Dollar sales by material type and end use, demand dynamics across batteries for consumer electronics, EVs, and energy storage, regional trends in lithium-ion adoption, innovation in energy density, stability, and safety, environmental impact of mining and recycling, and emerging use cases in high-performance batteries and hybrid systems. |

The global lithium cobalt oxide market is estimated to be valued at USD 6.1 billion in 2025.

The market size for the lithium cobalt oxide market is projected to reach USD 14.6 billion by 2035.

The lithium cobalt oxide market is expected to grow at a 9.1% CAGR between 2025 and 2035.

The key product types in lithium cobalt oxide market are industrial and battery.

In terms of application, consumer electronic segment to command 48.6% share in the lithium cobalt oxide market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithium Battery Thermal Runaway Sensor Modules Market Size and Share Forecast Outlook 2025 to 2035

Lithium Compound Market Forecast Outlook 2025 to 2035

Lithium Silicon Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Mining Market Size and Share Forecast Outlook 2025 to 2035

Lithium & Lithium-ion Battery Electrolyte Market Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Lithium-sulfur Solid-state Batteries Market Size and Share Forecast Outlook 2025 to 2035

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium and Lithium Ion Battery Electrolyte Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Battery Separator Market Growth & Trends 2025 to 2035

Lithium Ion Battery Dispersant Market Growth – Trends & Forecast 2024-2034

Lithium Ion Battery Material Market Growth – Trends & Forecast 2024-2034

Lithium Iodide Market

Lithium Bromide Market

Lithium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA