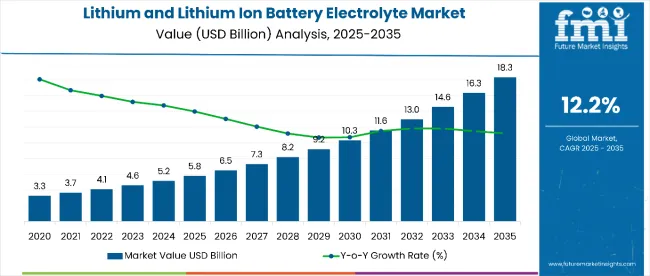

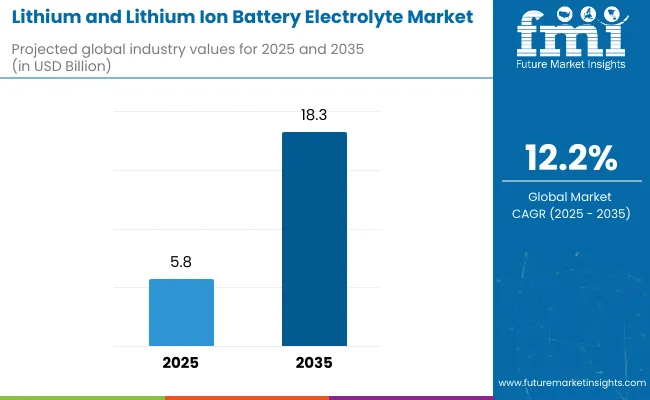

The lithium and lithium ion battery electrolyte market is projected to expand significantly from USD 5.8 billion in 2025 to USD 18.3 billion by 2035, advancing at a robust CAGR of 12.2%. This growth is driven by increasing electric vehicle adoption, rising consumer electronics demand, and expanding energy storage applications. The market demonstrates a strong upward trajectory, supported by technological innovations in electrolyte formulations, stringent regulatory policies promoting clean energy, and growing investments in battery manufacturing capacities worldwide.

By 2030, the market is forecast to reach USD 10.3 billion, reflecting steady growth in the first half of the period. The absolute dollar growth between 2025 and 2035 is projected at about USD 12.6 billion, indicating rapid and sustained expansion. Growth is expected to accelerate as advancements in solid-state electrolytes, high-purity lithium salts, and sustainable sourcing solutions gain broader market penetration in automotive, consumer electronics, and power sectors.

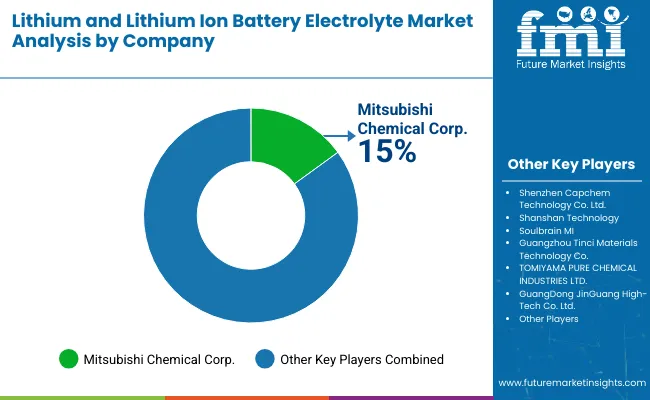

Key companies such as Mitsubishi Chemical Corp., Shenzhen Capchem Technology Co. Ltd., and Shanshan Technology are consolidating their leadership by scaling production capacities, enhancing R&D in next-generation electrolyte technologies, and forming strategic partnerships across the battery value chain. Their innovation pipelines focus on high-performance, safe, and environmentally friendly electrolyte materials, enabling stronger positioning in fast-growing electric vehicle and energy storage markets.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 5.8 billion |

| Market Forecast Value (2035) | USD 18.3 billion |

| Forecast CAGR | 12.2% |

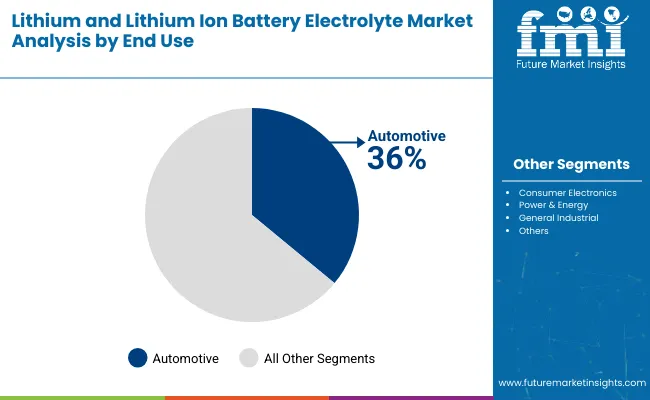

The market accounts for 30% of the automotive battery segment, driven by the essential role of lithium-ion batteries in powering electric vehicles worldwide. It accounts for around 10.8% of the consumer electronics battery market, supported by demand for smartphones, laptops, and wearable devices requiring high-performance electrolytes. The market contributes significantly to the stationary energy storage systems sector, which is rapidly expanding with renewable energy adoption. It also holds a notable share in general industrial battery applications, including power tools and backup systems.

The market is evolving with advancements in solid-state and gel electrolyte technologies that enhance safety, energy density, and battery life. Manufacturers are expanding into high-purity, pharmaceutical-grade, and sustainable electrolyte formulations to meet stringent regulatory standards and consumer expectations. Strategic collaborations between electrolyte suppliers, battery manufacturers, and automakers, along with rising investments in battery recycling and sustainable sourcing, are reshaping the supply chain and distribution landscape. These trends are challenging traditional battery chemistries and accelerating the shift toward next-generation energy storage solutions.

The lithium and lithium ion battery electrolyte market is growing rapidly due to multiple converging factors. Primarily, the global shift toward clean and sustainable energy solutions is accelerating demand for electric vehicles (EVs), which rely heavily on lithium-ion batteries for power. Governments worldwide are enforcing stricter emission regulations and offering incentives to boost EV adoption, driving battery manufacturers to enhance performance, safety, and energy density, thereby necessitating advanced electrolytes.

Technological innovation also plays a significant role, as the development of solid-state and gel electrolytes enables safer, longer-lasting batteries with faster charging capabilities. These advancements address key challenges such as thermal instability and leakage in traditional liquid electrolytes, increasing consumer confidence and widening application scope.

Additionally, growing consumer electronics markets including smartphones, laptops, and wearable devices require high-performance batteries with reliable electrolytes to extend usage time and efficiency. The expanding stationary energy storage sector, vital for renewable energy integration, further fuels electrolyte demand.

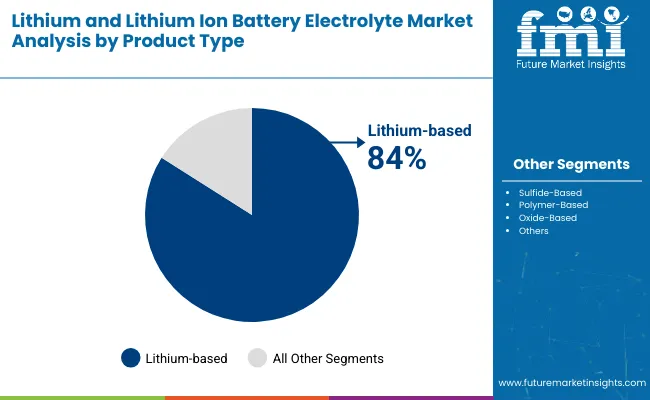

The market is segmented by form, product type, end use, and region. By form, the market is divided into liquid, solid, and gel. Based on product type, the market is categorized into lithium-based, sulfide-based, polymer-based, oxide-based, and others (such as hybrid and composite electrolytes). In terms of end use, the market is classified into automotive, consumer electronics, power & energy, and general industrial. Regionally, the market is divided into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

The lithium-based electrolyte segment is the most lucrative and dominant sector within the lithium and lithium ion battery electrolyte market, commanding 84% of the market share in 2025. This segment's prominence stems from lithium’s inherent properties such as high energy density, lightweight nature, and excellent electrochemical stability, making it the preferred choice for electric vehicles (EVs), consumer electronics, and energy storage systems. Lithium-based electrolytes enable batteries to deliver superior performance with longer cycle life and faster charging capabilities, critical requirements in rapidly evolving automotive and electronics industries.

The surge in global electric vehicle adoption, driven by stringent emission regulations and sustainability initiatives, is a key growth engine fueling lithium-based electrolyte demand. Additionally, ongoing research into enhancing safety and reducing costs of lithium electrolytes further strengthens this segment’s market position. Although emerging segments like sulfide, polymer, and oxide-based electrolytes offer promising innovation, they currently hold smaller shares due to developmental and commercialization challenges. The expansive application horizon and ongoing technological advancements assure that lithium-based electrolytes will maintain their lucrative and commanding position from 2025 to 2035.

The automotive segment is the most lucrative and dominant end-use category in the lithium and lithium ion battery electrolyte market, accounting for 36% of the market share in 2025. This segment's strong growth is driven largely by the accelerating global adoption of electric vehicles (EVs), fueled by stringent emission regulations, government incentives, and increasing consumer preference for clean mobility solutions. Lithium-ion batteries are integral to EV performance, relying heavily on advanced electrolytes that offer higher energy density, improved safety, and extended battery lifespan.

The rise of electric buses, commercial vehicles, and passenger EVs worldwide, especially in markets like China, India, Europe, and North America, further propels demand for automotive-grade electrolytes. In addition, automakers are investing substantially in battery technologies to enhance vehicle range and reduce charging times, directly benefiting the electrolyte market. While consumer electronics and power & energy sectors are significant, the automotive segment's scale, regulatory backing, and continuous innovation make it the most lucrative and impactful market driver for lithium-ion battery electrolytes from 2025 to 2035.

From 2025 to 2035, escalating adoption of electric vehicles (EVs) and rapid advancements in consumer electronics are driving significant growth in the lithium and lithium ion battery electrolyte market. Increasing focus on clean energy, sustainability, and efficient energy storage systems has positioned manufacturers investing in innovative electrolyte technologies, such as solid-state and gel electrolytes, as key players in meeting evolving performance and safety requirements.

Growing Electric Vehicle Adoption Drives Market Expansion

Rising global environmental regulations and government incentives to reduce carbon emissions act as primary catalysts propelling the lithium ion battery electrolyte market. By 2025, battery manufacturers are expected to enhance electrolyte formulations to improve energy density, charging speeds, and thermal stability, supporting the mainstream adoption of EVs and augmenting demand for high-purity lithium-based electrolytes.

Technological Innovations Enhance Market Opportunities

Recent innovations in electrolyte chemistry including solid-state electrolytes, lithium salts with higher ionic conductivity, and safer non-volatile formulations are broadening applications across automotive, consumer electronics, and stationary energy storage systems. Manufacturers embracing sustainable sourcing, advanced manufacturing processes, and eco-friendly chemistries gain competitive advantage, catering to increasingly stringent regulatory standards and environmentally conscious consumers, thereby reinforcing sustained market growth.

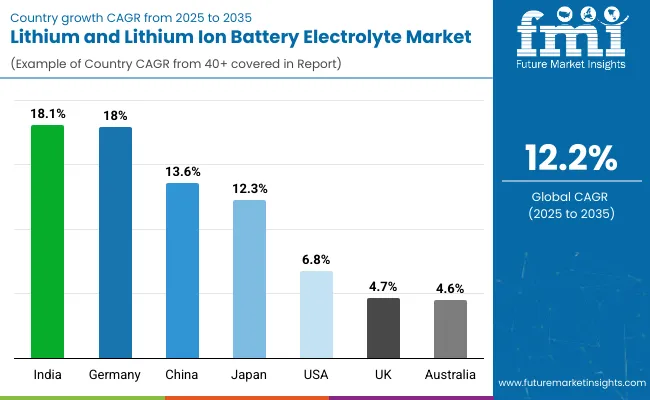

| Country | CAGR (%) |

|---|---|

| India | 18.1 |

| Germany | 18.0 |

| China | 13.6 |

| Japan | 12.3 |

| United States | 6.8 |

| United Kingdom | 4.7 |

| Australia | 4.6 |

In the lithium and lithium-ion battery electrolyte market, India is projected to lead with the highest CAGR of 18.1%, driven by strong government support and expanding EV adoption. Germany follows closely at 18.0%, fueled by its automotive sector and strict EU regulations. China’s growth rate stands at 13.6%, supported by its vast EV market and integrated supply chains. Japan grows at 12.3%, focusing on advanced electrolyte technologies. The USA expands moderately at 6.8%, backed by incentives and domestic production. The UK and Australia have lower CAGRs of 4.7% and 4.6%, respectively, with growth tied to innovation and resource availability.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Demand for lithium and lithium ion battery electrolyte in India is projected to grow at a robust CAGR of 18.1%, reflecting rapid output expansion driven by strong government support including national EV policies and clean energy initiatives. Investments in domestic electrolyte manufacturing facilities are increasing, supported by partnerships with global technology leaders. Rising demand from the automotive and consumer electronics sectors fuels capacity growth. Manufacturers focus on enhancing product quality and sustainability, addressing raw material supply challenges while fostering innovation. The push toward localized production reduces import dependency and strengthens India’s position as a key electrolyte supplier in Asia. Growing R&D efforts also aim to advance solid-state electrolyte technologies, further diversifying India's market offerings.

Revenue from lithium and lithium ion battery electrolyte in China is expected to grow at a CAGR of 13.6%, maintaining its position as the global leader in production capacity expansion. This growth is driven by the world’s largest electric vehicle market and aggressive clean energy policies. Comprehensive supply chain integration and economies of scale enable cost-effective manufacturing and rapid innovation cycles. Leading domestic companies and multinational players invest heavily in R&D to produce high-performance electrolytes, driving China’s dominant market share. The government’s commitment to renewable energy adoption fosters stationary energy storage growth, expanding electrolyte demand further. Solid-state electrolyte pilot programs signify China’s technological advancement in next-gen battery chemistry.

Demand for lithium-ion battery electrolyte in Germany is poised for growth at a CAGR of 18.0%, underscored by structural adoption of advanced battery technologies and expanding production capacities. As Europe’s automotive hub, Germany leads the shift toward cleaner and high-energy-density batteries, necessitating superior electrolyte materials. Investments in sustainable manufacturing and recycling align with stringent EU regulations. German electrolyte producers prioritize product safety, quality certifications, and green formulations. The country’s robust R&D ecosystem partners with automotive manufacturers to innovate solid and polymer electrolytes, positioning Germany as a critical supplier in the European battery supply chain.

Revenue from lithium and lithium ion battery electrolyte in Japan continues to emphasize technology-driven electrolyte market growth with a forecast CAGR of 12.3%, focusing on breakthroughs in solid-state and polymer electrolyte development. Its battery industry prioritizes safety, performance, and longevity, fostering demand for sophisticated electrolyte solutions. Expansion of production capacity is accompanied by rigorous quality controls and sustainability policies. Japanese companies lead in integrating electrolytes into next-generation batteries used in automotive and electronics sectors. Strategic collaborations aim to accelerate commercialization of advanced electrolytes, maintaining Japan’s reputation for precision manufacturing and innovation.

Sales of lithium and lithium ion battery electrolyte in the USA are forecasted to grow at a CAGR of 6.8%, showcasing steady scaling of production capacity motivated by growing electric vehicle sales and energy storage projects. Federal and state incentives support clean transportation and renewable integration, directly benefiting electrolyte manufacturers. Emphasis on advanced electrolyte formulations addressing safety and thermal stability is prominent. The market also benefits from a strong innovation ecosystem and partnerships between startups and established players. Increasing investments in domestic battery supply chains aim to reduce reliance on imports, supporting long-term market resiliency.

Demand for lithium and lithium-ion battery electrolyte in the UK is expected to grow at a CAGR of 4.7%, driven by innovation and gradual capacity expansion. Government initiatives promoting green energy and clean transportation incentivize electrolyte development. The UK hosts several startups pioneering solid and gel electrolyte technologies, accelerating commercialization. Renewable energy storage projects further support market demand. Focus on environmental compliance and sustainability drives innovation in eco-friendly electrolyte formulations, positioning the UK as a growing hub for advanced electrolyte materials.

Revenue from lithium and lithium-ion battery electrolyte growth is closely linked to its rich lithium mineral resources, underpinning raw material security. The market is projected to grow at a CAGR of 4.6%, supported by investments in local processing and manufacturing of lithium salts and electrolytes to expand capacity. The country focuses on environmentally responsible mining and sustainable supply chains. Domestic EV adoption and renewable energy initiatives supplement market demand. Collaborations between mining companies and electrolyte producers enhance industry integration and promote advanced electrolyte technologies.

The market is characterized by several well-established global and regional players, whose strategies focus on innovation, capacity expansion, and strategic partnerships. Leading companies such as Mitsubishi Chemical Corp., Shenzhen Capchem Technology Co. Ltd., Shanshan Technology, LG Chem, and Panasonic Corporation dominate the market due to their extensive product portfolios, advanced R&D capabilities, and strong manufacturing infrastructure.

Market leaders continuously invest in developing next-generation electrolyte technologies, including solid-state and gel electrolytes, to address safety, energy density, and charging speed challenges. Strategic collaborations with automotive OEMs, battery manufacturers, and research institutions allow these players to accelerate product innovation and commercialize cutting-edge electrolyte solutions tailored for electric vehicles, consumer electronics, and energy storage systems.

Capacity expansions, especially in Asia-Pacific regions like China, India, and Japan, bolster the supply chain’s robustness to meet surging demand. Additionally, companies are focusing on sustainable and environmentally friendly electrolyte production processes to comply with stringent regulations and cater to eco-conscious consumers.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 5.8 Billion |

| Form | Liquid, Solid, Gel |

| Product Type | Lithium-Based, Sulfide -Based, Polymer-Based, Oxide-Based, and Others ( such as hybrid and composite electrolytes) |

| End Use | Automotive, Consumer Electronics, Power & Energy, General Industrial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa, and 40+ countries |

| Key Companies Profiled | Mitsubishi Chemical Corp., Shenzhen Capchem Technology Co Ltd, Shanshan Technology, Soulbrain MI, Guangzhou Tinci Materials Technology Co., TOMIYAMA PURE CHEMICAL INDUSTRIES, LTD., GuangDong JinGuang High-Tech Co., Ltd, Panax Etec Co Ltd, UBE Industries, Zhangjiagang Guotai-Huarong New Chemical Materials Co., Ltd., and NEI Corporation |

| Additional Attributes | Market segmentation by product type and end use, rising demand from EV adoption and energy storage, innovations in solid-state and gel electrolytes, strategic partnerships, regulatory focus on recycling, and improved energy density and charging |

Based on product type, the industry is segmented into lithium-based, sulfide-based, polymer-based, oxide-based, and others.

Based on form, the industry is divided into liquid, solid, and gel.

Based on end-use, the industry is segregated into automotive, consumer electronics, power and energy, and general industrial.

The sector has been analyzed with the following regions covered: North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East and Africa.

The global lithium and lithium ion battery electrolyte market is estimated to be valued at USD 5.8 billion in 2025.

The market size for lithium and lithium ion battery electrolyte is projected to reach USD 18.3 billion by 2035.

The lithium and lithium ion battery electrolyte market is expected to grow at a 12.2% CAGR between 2025 and 2035.

The lithium-based segment is projected to lead in the lithium and lithium ion battery electrolyte market with 84% market share in 2025.

In terms of end use, the automotive segment is projected to command 36% share in the lithium and lithium ion battery electrolyte market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for Lithium & Lithium-ion Battery Electrolyte in EU Size and Share Forecast Outlook 2025 to 2035

Lithium Compound Market Forecast Outlook 2025 to 2035

Lithium Mining Market Size and Share Forecast Outlook 2025 to 2035

Lithium Hydroxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium-sulfur Solid-state Batteries Market Size and Share Forecast Outlook 2025 to 2035

Lithium Cobalt Oxide Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iodide Market

Lithium Bromide Market

Lithium Battery Thermal Runaway Sensor Modules Market Size and Share Forecast Outlook 2025 to 2035

Lithium Battery Shear Wrenches Market Size and Share Forecast Outlook 2025 to 2035

Lithium Silicon Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Residential Solar Energy Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium-Ion Battery Market Size and Share Forecast Outlook 2025 to 2035

Lithium Ion Battery Separator Market Growth & Trends 2025 to 2035

Lithium Ion Battery Dispersant Market Growth – Trends & Forecast 2024-2034

Lithium Ion Battery Material Market Growth – Trends & Forecast 2024-2034

Lithium ion Stationary Battery Storage Market Size and Share Forecast Outlook 2025 to 2035

Lithium Extraction From Brine Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA