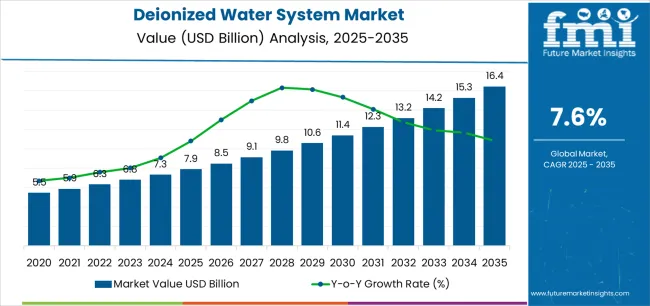

The global deionized water system market is valued at USD 7.9 billion in 2025. It is slated to reach USD 16.3 billion by 2035, recording an absolute increase of USD 8.4 billion over the forecast period. This translates into a total growth of 106.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 7.6% between 2025 and 2035. The overall market size is expected to grow by nearly 2.1X during the same period, supported by increasing demand for ultrapure water in semiconductor manufacturing, growing pharmaceutical and biotechnology industries requiring stringent water quality standards, and rising emphasis on sustainable water treatment solutions across diverse industrial, commercial, and laboratory applications.

Between 2025 and 2030, the deionized water system market is projected to expand from USD 7.9 billion to USD 11.3 billion, resulting in a value increase of USD 3.4 billion, which represents 40.5% of the total forecast growth for the decade. This phase of development will be shaped by increasing semiconductor manufacturing capacity expansions driven by government initiatives, rising pharmaceutical quality standards and regulatory requirements, and growing demand for high-purity water in electronics and biotechnology applications. Industrial manufacturers and laboratory facilities are expanding their deionized water system capabilities to address the growing demand for ultrapure water solutions that ensure product excellence, process reliability, and regulatory compliance.

System design coordination becomes exceptionally complex when deionized water facilities must integrate multiple purification technologies including reverse osmosis, ion exchange, electrodeionization, and ultraviolet sterilization while maintaining continuous operation capabilities. Equipment sizing challenges emerge when peak demand calculations conflict with energy efficiency targets, particularly when facilities must accommodate sudden increases in water consumption during manufacturing campaigns. Engineering teams discover that theoretical system capacities frequently clash with actual regeneration cycle requirements, creating unexpected bottlenecks during high-demand periods.

Regulatory compliance documentation expands when pharmaceutical and food processing applications demand extensive validation protocols demonstrating consistent water quality performance throughout system lifecycle. Documentation requirements intensify when FDA and EPA regulations require detailed records of chemical usage, waste discharge parameters, and equipment sanitization procedures. Environmental permitting becomes complicated when concentrated brine discharge requires specialized treatment or disposal arrangements that exceed standard industrial wastewater capabilities.

Supply chain vulnerabilities emerge when specialized ion exchange resins and membrane components face extended procurement lead times from limited supplier networks while system reliability depends on maintaining adequate spare parts inventory. Vendor coordination becomes challenging when equipment manufacturers require periodic recertification and software updates while facilities operate continuous production schedules that resist planned downtime activities. These operational complexities create ongoing challenges between maintaining water quality standards and meeting competitive manufacturing demands within this essential industrial infrastructure market.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 7.9 billion |

| Forecast Value in (2035F) | USD 16.3 billion |

| Forecast CAGR (2025 to 2035) | 7.6% |

From 2030 to 2035, the market is forecast to grow from USD 11.3 billion to USD 16.3 billion, adding another USD 5.0 billion, which constitutes 59.5% of the overall ten-year expansion. This period is expected to be characterized by the expansion of advanced semiconductor fabrication facilities and next-generation chip manufacturing, the development of zero-liquid discharge systems and circular water management strategies, and the growth of specialized applications for biopharmaceutical production and precision laboratory research. The growing adoption of sustainable water treatment technologies and smart monitoring systems will drive demand for deionized water systems with enhanced efficiency, reduced environmental impact, and real-time quality control features.

Between 2020 and 2025, the deionized water system market experienced steady growth, driven by increasing semiconductor industry investments and growing recognition of deionized water systems as essential infrastructure for ensuring product quality and process reliability in diverse industrial and commercial applications. The market developed as manufacturing engineers and quality managers recognized the potential for deionized water technology to enhance process consistency, reduce contamination risks, and support stringent purity requirements while meeting regulatory standards. Technological advancement in ion exchange resins and membrane filtration began emphasizing the critical importance of maintaining water quality specifications and operational efficiency in challenging application environments.

Market expansion is being supported by the increasing global demand for semiconductor manufacturing capacity driven by digital transformation trends and government industrial policies, alongside the corresponding need for ultrapure water systems that can deliver consistent water quality, enable advanced manufacturing processes, and maintain operational efficiency across various pharmaceutical, electronics, power generation, and laboratory applications. Modern semiconductor manufacturers and pharmaceutical facilities are increasingly focused on implementing deionized water solutions that can achieve stringent purity specifications, enhance process reliability, and provide consistent performance in demanding production environments.

The growing emphasis on sustainability and zero-liquid discharge principles is driving demand for deionized water systems that can support water recycling initiatives, minimize waste generation, and ensure comprehensive environmental performance. Industrial manufacturers' preference for water treatment systems that combine operational excellence with sustainability credentials and energy efficiency is creating opportunities for innovative deionized water implementations. The rising influence of pharmaceutical quality standards and advanced electronics manufacturing is also contributing to increased adoption of deionized water systems that can provide superior water purity characteristics without compromising functionality or regulatory compliance.

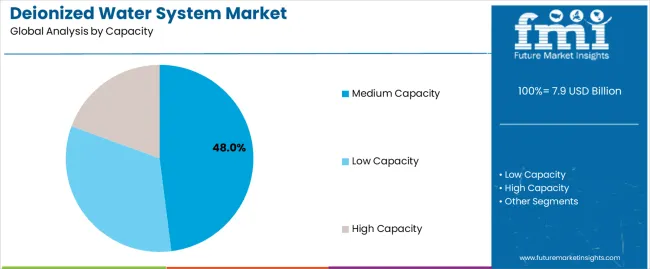

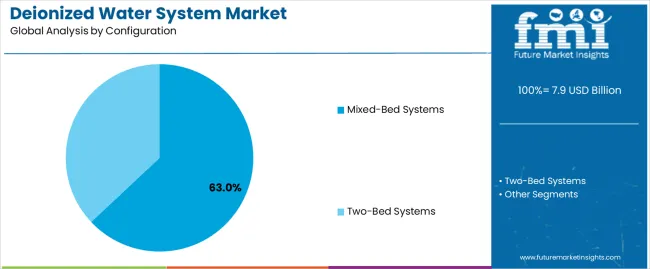

The market is segmented by capacity, configuration, buyer type, end-use industry, and region. By capacity, the market is divided into low capacity, medium capacity, and high capacity. Based on configuration, the market is categorized into mixed-bed systems and two-bed systems. By buyer type, the market is segmented into industrial and commercial. Based on end-use industry, the market includes pharmaceutical, electronics & semiconductor, power generation, laboratory research, bio-medical, metal & mechanical plating, aerospace & engineering, printing & publishing, and others. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

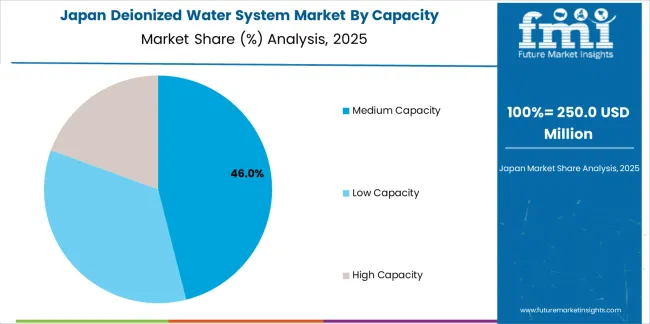

The medium capacity segment is projected to maintain its leading position in the deionized water system market in 2025 with a 48.0% market share, reaffirming its role as the preferred capacity category for industrial manufacturing facilities and commercial applications requiring balanced water production volumes. Manufacturing facilities and processing plants increasingly utilize medium capacity systems for their optimal balance between production output, operational flexibility, and investment requirements. Medium capacity technology's proven effectiveness and application versatility directly address the industry requirements for scalable water purification solutions and cost-effective operations across diverse manufacturing platforms and facility sizes.

This capacity segment forms the foundation of modern industrial water treatment infrastructure, as it represents the system configuration with the greatest contribution to operational efficiency and established performance record across multiple industries and facility types. Industrial sector investments in water quality infrastructure continue to strengthen adoption among manufacturers and facility operators. With regulatory pressures requiring improved water quality standards and enhanced process control, medium capacity systems align with both operational objectives and investment constraints, making them the central component of comprehensive industrial water treatment strategies.

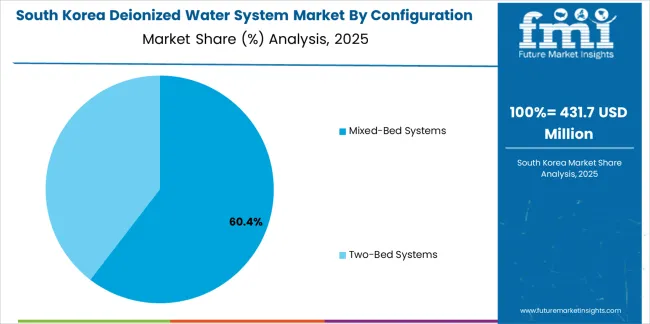

The mixed-bed systems configuration segment is projected to represent the largest share of deionized water system demand in 2025 with a 63.0% market share, underscoring its critical role as the primary technology for achieving ultrapure water quality across pharmaceutical manufacturing, semiconductor fabrication, and precision laboratory applications. Industrial manufacturers prefer mixed-bed systems for water purification due to their exceptional deionization capabilities, superior water quality output, and ability to achieve resistivity specifications while supporting stringent purity requirements and regulatory compliance. Positioned as essential technology for critical manufacturing processes, mixed-bed systems offer both performance advantages and operational reliability.

The segment is supported by continuous innovation in ion exchange technology and the growing availability of advanced resin formulations that enable superior water quality with enhanced regeneration efficiency and reduced operational costs. Additionally, manufacturers are investing in comprehensive mixed-bed system integration programs to support increasingly stringent water quality specifications and production process requirements for advanced manufacturing applications. As semiconductor manufacturing accelerates and pharmaceutical quality standards increase, the mixed-bed systems configuration will continue to dominate the market while supporting advanced water purification and process optimization strategies.

The deionized water system market is advancing steadily due to increasing demand for semiconductor manufacturing capacity driven by government industrial policies and growing adoption of advanced electronics requiring ultrapure water providing enhanced process reliability and product quality benefits across diverse pharmaceutical, electronics, power generation, and laboratory applications. However, the market faces challenges, including high initial capital investment and installation costs, competition from alternative water purification technologies including reverse osmosis and electrodeionization, and operational constraints related to resin regeneration requirements and wastewater management. Innovation in sustainable regeneration technologies and smart monitoring systems continues to influence product development and market expansion patterns.

The growing investment in semiconductor manufacturing capacity is driving demand for advanced deionized water systems that address critical process requirements including ultrapure water for wafer cleaning, chemical dilution, and equipment cooling applications. Semiconductor fabrication facilities require sophisticated water purification systems that deliver consistent resistivity specifications, minimize particle contamination, and maintain operational reliability for continuous production operations. Government initiatives including the CHIPS Act are creating substantial opportunities for deionized water system providers serving next-generation semiconductor facilities with stringent water quality specifications and high production volumes.

Modern deionized water system manufacturers are incorporating zero-liquid discharge principles and circular water management technologies to enhance environmental performance, reduce water consumption, and support comprehensive sustainability objectives through optimized regeneration processes and wastewater recovery systems. Leading companies are developing advanced regeneration technologies, implementing water recycling strategies, and advancing system designs that minimize chemical consumption and waste generation. These technologies improve ecological credentials while enabling new operational benefits, including reduced operating costs, enhanced resource efficiency, and improved environmental compliance. Advanced sustainability integration also allows facilities to support comprehensive environmental objectives and corporate responsibility initiatives beyond traditional water treatment performance.

The advancement of digital technologies and industrial automation is driving adoption of smart deionized water systems with integrated sensors, real-time quality monitoring, and predictive maintenance capabilities that optimize operational performance and minimize downtime. These advanced systems incorporate continuous resistivity monitoring, automated regeneration control, and data analytics platforms that enable proactive maintenance scheduling and performance optimization. Manufacturers are investing in IoT connectivity and cloud-based monitoring platforms that provide remote diagnostics, performance trending, and automated alerts for comprehensive system management and operational efficiency.

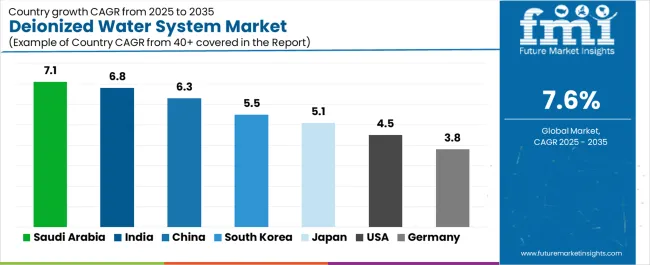

| Country | CAGR (2025-2035) |

|---|---|

| Saudi Arabia | 7.1% |

| India | 6.8% |

| China | 6.3% |

| South Korea | 5.5% |

| Japan | 5.1% |

| USA | 4.5% |

| Germany | 3.8% |

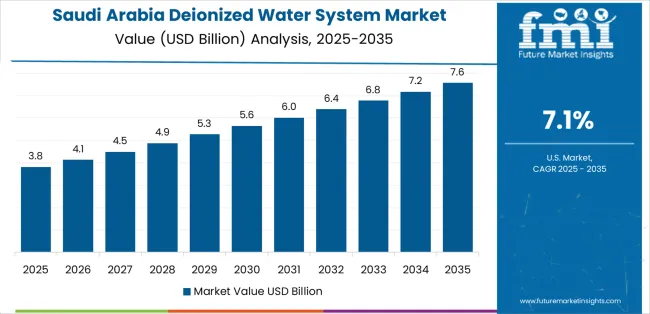

The deionized water system market is experiencing solid growth globally, with Saudi Arabia leading at a 7.1% CAGR through 2035, driven by industrial diversification under Vision 2030, desalination-linked water infrastructure development, and expanding chemical and energy processing sectors. India follows at 6.8%, supported by expanding pharmaceutical hubs and biotechnology parks, new electronics manufacturing clusters, and strong water infrastructure development initiatives. China shows growth at 6.3%, emphasizing largest semiconductor production capacity, policy-driven manufacturing upgrades, and high adoption of ultrapure water systems in electronics applications.

South Korea demonstrates 5.5% growth, supported by memory chip fabrication facilities, battery production hubs, and high-tech industrial manufacturing bases. Japan exhibits 5.1% growth, emphasizing advanced semiconductor fabs, aerospace manufacturing, and medical precision industries requiring ultrapure water. The United States records 4.5%, focusing on CHIPS Act-driven semiconductor fab construction, pharmaceutical FDA compliance standards, and power sector infrastructure upgrades. Germany shows 3.8% growth, supported by chemical and pharmaceutical industry integration, sustainability mandates, but slower unit growth compared to Asia.

The report covers an in-depth analysis of 40+ countries top-performing countries are highlighted below.

<

Revenue from deionized water systems in Saudi Arabia is projected to exhibit exceptional growth with a CAGR of 7.1% through 2035, driven by comprehensive industrial diversification programs under Vision 2030 and rapidly expanding chemical, petrochemical, and energy processing sectors supported by government infrastructure investment and economic transformation initiatives. The country's massive industrial development projects and increasing investment in advanced manufacturing technologies are creating substantial demand for deionized water solutions. Major chemical processors and energy companies are establishing comprehensive water treatment capabilities to serve both domestic industrial requirements and export-oriented manufacturing operations.

Revenue from deionized water systems in India is expanding at a CAGR of 6.8%, supported by rapidly expanding pharmaceutical manufacturing capacity, growing biotechnology parks, and increasing electronics manufacturing clusters driven by government Make in India and production-linked incentive programs. The country's comprehensive pharmaceutical sector growth and technological advancement are driving sophisticated deionized water system capabilities throughout diverse industrial regions. Leading pharmaceutical manufacturers and electronics companies are establishing extensive production and quality control facilities requiring high-purity water systems.

Revenue from deionized water systems in China is expanding at a CAGR of 6.3%, supported by the country's position as the world's largest semiconductor producer, expanding electronics manufacturing capacity, and increasing demand for ultrapure water systems in advanced chip fabrication and display manufacturing applications. The nation's comprehensive manufacturing infrastructure and policy-driven technological advancement are driving sophisticated deionized water capabilities throughout technology sectors. Leading semiconductor manufacturers and electronics companies are investing extensively in advanced water purification technologies and quality control systems.

Revenue from deionized water systems in South Korea is expanding at a CAGR of 5.5%, driven by the country's leadership in memory chip fabrication, expanding electric vehicle battery production capacity, and sophisticated high-tech industrial manufacturing base requiring ultrapure water systems. The nation's advanced technology infrastructure and emphasis on manufacturing excellence are driving comprehensive deionized water capabilities throughout electronics and automotive sectors. Leading semiconductor manufacturers and battery producers are investing in state-of-the-art water purification facilities.

Revenue from deionized water systems in Japan is expanding at a CAGR of 5.1%, supported by the country's leadership in advanced semiconductor fabrication, precision aerospace manufacturing, and sophisticated medical device production requiring ultrapure water with stringent quality specifications. Japan's technological sophistication and quality excellence are driving demand for high-specification deionized water systems. Leading electronics manufacturers and precision engineering companies are investing in specialized water purification capabilities for critical manufacturing processes.

Revenue from deionized water systems in the United States is expanding at a CAGR of 4.5%, driven by major semiconductor fabrication facility construction under CHIPS Act funding, established pharmaceutical manufacturing infrastructure, and ongoing power generation facility modernization programs. The nation's comprehensive industrial base and regulatory framework are driving demand for advanced deionized water solutions. Semiconductor manufacturers and pharmaceutical companies are investing in production capacity expansion requiring sophisticated water treatment systems.

Revenue from deionized water systems in Germany is expanding at a CAGR of 3.8%, supported by the country's integrated chemical and pharmaceutical industries, precision engineering capabilities, and comprehensive sustainability mandates driving water efficiency improvements. Germany's industrial excellence and environmental consciousness are supporting investment in advanced water treatment technologies. Leading chemical manufacturers and pharmaceutical companies are establishing comprehensive water management programs incorporating deionized water systems with sustainability features.

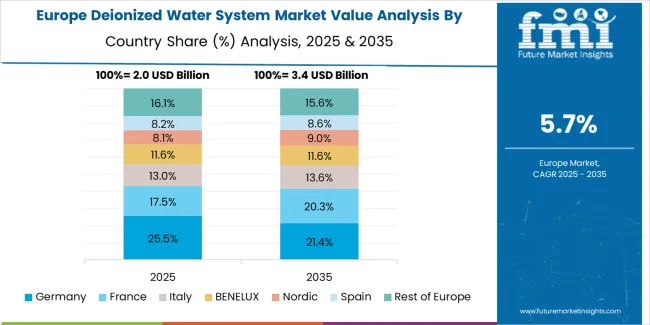

The deionized water system market in Europe is projected to grow from USD 2.2 billion in 2025 to USD 4.4 billion by 2035, registering a CAGR of 7.2% over the forecast period. Germany is expected to maintain leadership with a 24.0% market share in 2025, marginally declining to 23.8% by 2035, supported by strong chemical and pharmaceutical industries and stringent EU water quality directives.

The United Kingdom follows with 17.0% in 2025, edging to 17.1% by 2035, driven by semiconductor fabrication expansions and healthcare sector demand for high-purity water. France holds 15.5% in 2025, rising to 15.7% by 2035 through its pharmaceutical clusters and biotechnology innovation centers. Italy maintains 12.0% share in both 2025 and 2035, supported by metal plating, power generation, and biomedical device production.

Spain accounts for 9.0% in 2025, climbing to 9.2% by 2035 aided by food and beverage processing and specialty chemical manufacturing. The Netherlands holds 5.5% in 2025, reaching 5.6% by 2035 due to its advanced semiconductor facilities and high-tech manufacturing base. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 17.0% in 2025, slightly declining to 16.8% by 2035, reflecting rising adoption across Nordic biotechnology clusters and Central/Eastern European industrial corridors.

The Deionized Water System Market is expanding as industries require high-purity water for manufacturing, laboratory, and process applications. Deionized (DI) water is critical in electronics fabrication, pharmaceuticals, power generation, food and beverage processing, and healthcare environments where mineral ions and dissolved solids must be minimized to prevent contamination, scaling, or product variability. Growth is supported by tighter quality standards, the rise of clean-in-place (CIP) processes, and increasing investment in ultrapure water systems for semiconductor and biotech production.

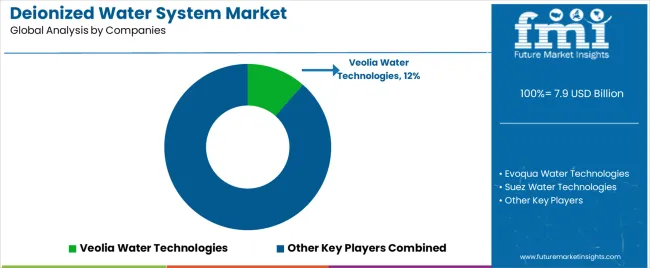

Veolia Water Technologies, Evoqua Water Technologies, and Suez Water Technologies & Solutions remain leading providers of turnkey DI and ultrapure water treatment systems, offering ion exchange, electrodeionization (EDI), reverse osmosis, and polishing technologies tailored to industrial-scale applications. Pall Corporation and Merck Millipore focus strongly on laboratory, pharmaceutical, and biotech-grade water systems with strict microbial and endotoxin control.

DuPont Water Solutions and Kurita Water Industries Ltd. supply key membrane, resin, and chemical conditioning components that support both central plant and point-of-use DI systems. Ovivo Inc. and Mar Cor Purification serve medical device, dialysis, and diagnostic lab markets where sterilizable and validated water purification systems are required. Pure Water Group specializes in high-purity EDI-based systems used in power plants, microelectronics, and specialty chemical processing. As production environments move toward higher purity and continuous monitoring, DI systems are increasingly integrated with digital controls and real-time quality analytics.

Deionized water systems represent a critical water treatment infrastructure segment within industrial and commercial applications, projected to grow from USD 7.9 billion in 2025 to USD 16.3 billion by 2035 at a 7.6% CAGR. These high-purity water production systems—primarily ion exchange and mixed-bed configurations for multiple applications—serve as essential infrastructure in pharmaceutical manufacturing, semiconductor fabrication, power generation, laboratory research, and precision manufacturing applications where consistent water quality, process reliability, and regulatory compliance are essential. Market expansion is driven by increasing semiconductor manufacturing investments, growing pharmaceutical quality standards, expanding biotechnology production capacity, and rising demand for sustainable water treatment solutions across diverse industrial and commercial sectors.

How Industrial Regulators Could Strengthen Quality Standards and Environmental Performance?

How Industry Associations Could Advance Technology Standards and Market Development?

How Deionized Water System Manufacturers Could Drive Innovation and Market Leadership?

How End-User Industries Could Optimize System Performance and Sustainability?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7.9 billion |

| Capacity | Low Capacity, Medium Capacity, High Capacity |

| Configuration | Mixed-Bed Systems, Two-Bed Systems |

| Buyer Type | Industrial, Commercial |

| End-use Industry | Pharmaceutical, Electronics & Semiconductor, Power Generation, Laboratory Research, Bio-Medical, Metal & Mechanical Plating, Aerospace & Engineering, Printing & Publishing, Others |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, South Korea, United States, Germany, Japan, Saudi Arabia, and 40+ countries |

| Key Companies Profiled | Veolia Water Technologies, Evoqua Water Technologies, Suez Water Technologies & Solutions, Pall Corporation, Merck Millipore, DuPont Water Solutions, Kurita Water Industries Ltd., Ovivo Inc., Mar Cor Purification, and Pure Water Group |

| Additional Attributes | Dollar sales by capacity, configuration, buyer type, and end-use industry segments, regional demand trends, competitive landscape, technological advancements in water purification, sustainability development, zero-liquid discharge innovation, and system performance optimization |

The global deionized water system market is estimated to be valued at USD 7.9 billion in 2025.

The market size for the deionized water system market is projected to reach USD 16.4 billion by 2035.

The deionized water system market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in deionized water system market are medium capacity, low capacity and high capacity.

In terms of configuration, mixed-bed systems segment to command 63.0% share in the deionized water system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Water Softening Systems Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Water Leak Detection System for Server Rooms and Data Centers Market Size and Share Forecast Outlook 2025 to 2035

Seawater Source Heat Pump System Market Size and Share Forecast Outlook 2025 to 2035

Chilled Water Storage System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sterile Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Ballast Water Treatment System Market

Produced Water Treatment System Market Size and Share Forecast Outlook 2025 to 2035

Steam And Water Analysis System Market

Industrial Water Cooling System Market Growth – Trends & Forecast 2025-2035

Demand for Water Treatment System in Japan Size and Share Forecast Outlook 2025 to 2035

Demand for Water Treatment System in USA Size and Share Forecast Outlook 2025 to 2035

Pressurized Water Reactor System Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Wet Cleaning Ozone Water System Market Size and Share Forecast Outlook 2025 to 2035

Sponge City Rainwater Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Demand for Sterile Water Treatment System in UK Size and Share Forecast Outlook 2025 to 2035

Bioelectrochemical Systems For Wastewater Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Vapor Permeability Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Water and Waste Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA