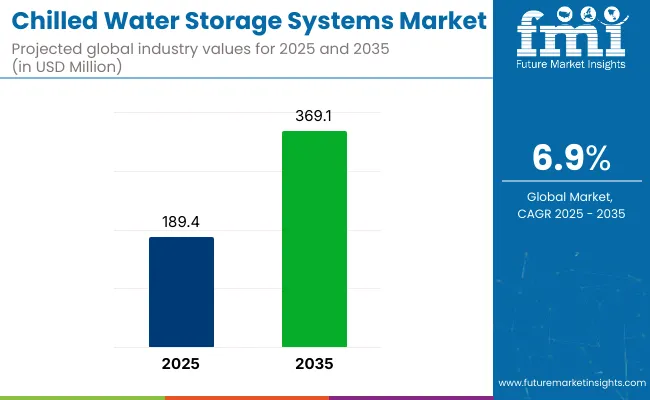

The global chilled water storage system market is valued at USD 189.4 million in 2025 and is poised to reach USD 369.1 million by 2035, reflecting a CAGR of 6.9%. Factors driving this growth include the increasing demand for energy-efficient cooling solutions, rising urbanization, and the need for peak load management in HVAC systems. Technological advancements in thermal energy storage, such as improved stratified tank designs and nano-insulated materials, are also supporting market expansion.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 189.4 million |

| Market Value (2035) | USD 369.1 million |

| CAGR (2025 to 2035) | 6.9% |

Government incentives for energy efficiency and load shifting are accelerating chilled water storage system adoption. Integration of smart controls enhances cooling efficiency and grid flexibility. Commercial buildings and district cooling applications are expected to dominate. Rising demand for sustainable HVAC solutions, especially in smart city projects, is further boosting market growth across both developed and emerging economies.

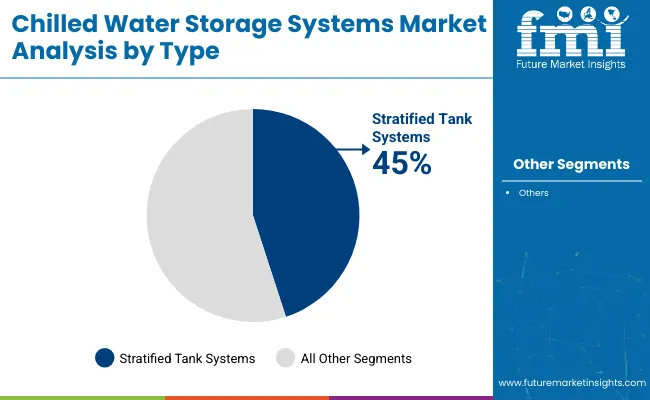

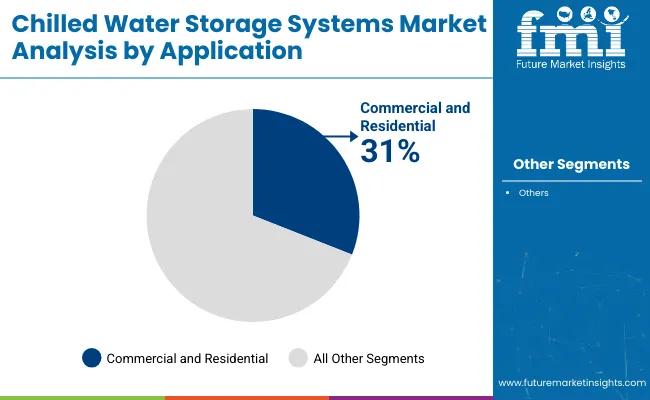

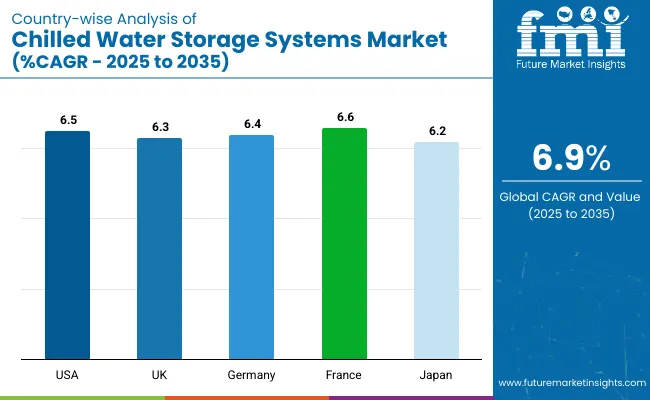

The USA and France will also exhibit robust growth, with projected CAGRs of 6.5% and 6.6%, respectively. Based on type, stratified tank chilled water storage systems are projected to be the largest segment, commanding over 45% share of the total market in 2025, while by application, the commercial and residential lead with 31% in 2025.

Looking ahead, the market is expected to benefit from innovations in nano-insulation, AI-driven load optimization, and integration with renewable energy. Emerging technologies such as phase change materials (PCMs) and modular thermal storage systems are enabling compact, high-capacity solutions suited for urban installations. Manufacturers are investing in research and development to launch innovative products.

The global chilled water storage system market is segmented by type, application, and region. By type, the market is divided into stratified tank chilled water storage systems, multiple tank chilled water storage systems, and diaphragm tank chilled water storage systems.

In terms of application, the market is categorized into food processing & storage, industrial, commercial and residential applications, healthcare & pharmaceuticals, petrochemical processing, petroleum & natural gas refining, and power generation and automotive. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

Among the system types, stratified tank chilled water storage systems are expected to lead the market, accounting for more than 45% of total revenue share in 2025.

In terms of application, chilled water storage systems for commercial and residential use are anticipated to be the top revenue-generating segment, commanding a 31% share in 2025.

The global chilled water storage system market is experiencing robust growth, fueled by the rising need for energy-efficient and sustainable cooling solutions across urban infrastructure. Rapid urbanization, increasing HVAC demand in commercial buildings, and advancements in thermal storage technologies such as stratified tanks and nano-insulated materials are accelerating adoption. Supportive government regulations and integration with renewable energy systems further boost market momentum.

Recent Trends in the Market

Key Challenges

The global chilled water storage system market is experiencing steady expansion, fueled by the growing demand for energy-efficient HVAC technologies, rising urban cooling needs, and the integration of smart building systems. Leading countries such as the UK, USA, France, Germany, and Japan are advancing production and distribution, driven by thermal innovation and infrastructure development.

The USA chilled water storage system market is expected to grow at a CAGR of 6.5% from 2025 to 2035, driven by rising energy efficiency mandates and expanding infrastructure investments.

The UK chilled water storage system market is projected to expand at a CAGR of 6.3% during the forecast period, supported by green building mandates and net-zero targets.

Germany’s chilled water storage system market is expected to grow at a CAGR of 6.4% between 2025 and 2035, fueled by strict EU climate regulations and industrial modernization.

The French chilled water storage system market is anticipated to witness a CAGR of 6.6% from 2025 to 2035, with strong policy alignment around energy efficiency and smart building initiatives.

Japan’s chilled water storage system market is forecast to grow at a CAGR of 6.2% during 2025-2035, driven by the need for disaster-resilient cooling and rising urban cooling demand. Chilled water systems are being favored for their ability to maintain operations during power disruptions and support energy grid stability.

The chilled water storage system market is moderately consolidated, with leading firms such as Carrier, Trane, Johnson Controls, Daikin, and Thermo King holding significant shares, while numerous smaller, niche players compete at regional levels. These top companies are competing intensively on pricing, technological innovation, strategic partnerships, and geographic expansion.

Johnson Controls and Daikin continue to differentiate through smart HVAC management systems, green refrigerants, and strategic local manufacturing. Thermo King and Baltimore Aircoil have strengthened their niche in transport refrigeration and hybrid cooling solutions. Calmac, Viking Cold, Evapco, and STULZ focus on modular and specialized applications, catering to district cooling, process industries, and data center micro-cooling.

Recent Chilled Water Storage System Industry News

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 189.4 million |

| Projected Market Size (2035) | USD 369.1 million |

| CAGR (2025 to 2035) | 6.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD millions/Volume in units |

| By Type Analyzed | Stratified Tank Systems, Multiple Tank Systems, and Diaphragm Tank Systems |

| By Application Analyzed | Food Processing & Storage, Industrial, Commercial & Residential, Healthcare & Pharmaceuticals, Petrochemical Processing, Petroleum & Natural Gas Refining, Power Generation and Automotive |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Carrier Global Corporation, Trane Technologies, Johnson Controls, Daikin Industries, Ltd., Thermo King Corporation, Baltimore Aircoil Company, Calmac (A Trane Company), Viking Cold Solutions, Evapco, Inc., STULZ GmbH |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise adoption trends, technology benchmarkin |

In terms of Type, the industry is divided into Stratified Tank Chilled Water Storage Systems, Multiple Tank Chilled Water Storage Systems, Diaphragm Tank Chilled Water Storage Systems

In terms of Application, the industry is divided into Chilled Water Storage System for Food Processing & Storage, Chilled Water Storage System for Industrial, Commercial and Residential Applications, Chilled Water Storage System for Healthcare & Pharmaceuticals, Chilled Water Storage System for Petrochemical Processing, Chilled Water Storage System for Petroleum & Natural Gas Refining, Chilled Water Storage System for Power Generation and Automotive

The report covers key regions, including North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East and Africa (MEA).

The market is valued at USD 189.4 million in 2025.

The market is projected to grow to USD 369.1 million by 2035.

The market is expected to grow at a CAGR of 6.9% during 2025 to 2035.

By type, the stratified tank systems lead the market with over 45% share in 2025.

Key players include Carrier, Trane, Johnson Controls, Daikin, and Thermo King.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chilled Beams Market Size and Share Forecast Outlook 2025 to 2035

Chilled Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Chilled Processed Food Market Analysis by Ready Meal, Processed Meat, Processed Fish or Seafood Through 2035

Chilled Soup Market Analysis by Packaging Type and Distribution Channels Through 2035

Analysis and Growth Projections for Chilled Meal Kits Market

Market Share Breakdown of Chilled Food Packaging Manufacturers

Chilled Beam System Market Analysis - Size and Demand Forecast Outlook 2025 to 2035

Waterless Bathing Solution Market Size and Share Forecast Outlook 2025 to 2035

Waterborne UV Curable Resin Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Chemical Market Size and Share Forecast Outlook 2025 to 2035

Water Adventure Tourism Market Forecast and Outlook 2025 to 2035

Water Packaging Market Forecast and Outlook 2025 to 2035

Water Soluble Bag Market Size and Share Forecast Outlook 2025 to 2035

Water Leak Sensors Market Size and Share Forecast Outlook 2025 to 2035

Water-soluble Packaging Market Size and Share Forecast Outlook 2025 to 2035

Water and Wastewater Treatment Equipment Market Size and Share Forecast Outlook 2025 to 2035

Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Water Activity Meter Market Size and Share Forecast Outlook 2025 to 2035

Water Leakage Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA