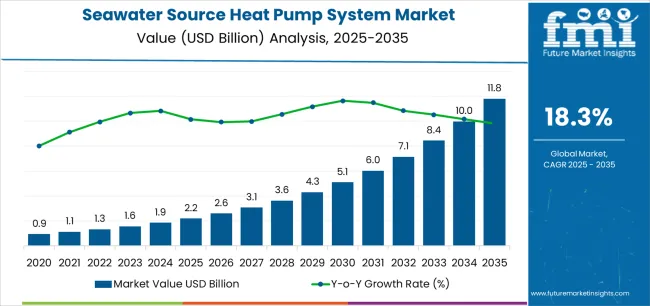

The global seawater source heat pump system market is projected to reach USD 11.9 billion by 2035, recording an absolute increase of USD 9.7 billion over the forecast period. The market is valued at USD 2.2 billion in 2025 and is set to rise at a CAGR of 18.3% during the assessment period. The overall market size is expected to grow by nearly 5.4 times during the same period, supported by increasing demand for sustainable heating and cooling solutions across coastal facilities worldwide, driving demand for efficient renewable energy systems and increasing investments in marine resource utilization projects globally.

Seawater source heat pump systems represent advanced thermal energy equipment that extracts renewable heat from ocean water for building climate control and industrial process applications. These systems operate by circulating seawater through heat exchangers where refrigerant absorbs thermal energy, with compression cycles elevating temperatures to levels suitable for space heating, domestic hot water production, or industrial processing requirements. The technology leverages ocean thermal stability, with seawater temperatures varying only 5-8°C seasonally compared to 30-40°C air temperature swings, enabling consistent performance throughout annual heating and cooling cycles. Coastal facility applications require heat pump systems that resist corrosion from saltwater exposure while maintaining efficiency across operating conditions spanning intake water temperatures from 4°C to 28°C depending on geographic location and seasonal variation.

The market expansion reflects fundamental shifts toward renewable energy utilization and carbon emissions reduction across building operations and industrial processes. Seafood processing facilities adopt seawater heat pumps to capture waste heat from refrigeration systems while providing process heating, achieving 40-60% energy cost reduction compared to conventional boiler and chiller combinations. Aquarium complexes specify seawater thermal systems for maintaining precise water temperatures across exhibition tanks while managing facility HVAC requirements, with integrated designs reducing equipment redundancy and simplifying maintenance protocols. Aquaculture operations deploy heat pumps to optimize water temperatures in production systems, accelerating fish growth rates by 15-25% through precise thermal management that maximizes biological productivity within optimal temperature ranges.

Technology advancement in corrosion-resistant materials and heat exchanger designs enables next-generation systems with extended service life and improved efficiency. Titanium plate heat exchangers provide superior resistance to seawater corrosion while achieving compact configurations that reduce system footprint and refrigerant charge requirements. Advanced coating technologies protect aluminum and copper-nickel alloys in less demanding applications, offering cost-effective alternatives to titanium in brackish water or temperature-controlled seawater installations. Variable speed compressor integration enables precise capacity modulation matching thermal loads, improving part-load efficiency by 20-30% compared to fixed-speed systems cycling on-off to maintain setpoints.

Facility retrofit applications demand seawater heat pump systems that integrate with existing building infrastructure without extensive modifications. Modular equipment designs accommodate installation in confined mechanical rooms typical of older coastal facilities with limited space allocation for equipment upgrades. Dual-source configurations enable operation on seawater during optimal conditions while switching to supplemental heat sources during extreme cold events or seawater system maintenance, maintaining facility operations throughout year-round service. Remote monitoring capabilities provide operational data supporting predictive maintenance programs that minimize downtime and optimize performance across distributed installations.

Government regulations promoting renewable energy adoption and emissions reduction accelerate seawater heat pump deployment across coastal regions. Carbon pricing mechanisms in European markets create economic incentives favoring renewable thermal systems over fossil fuel alternatives, with heat pumps qualifying for green energy certificates and tax incentives. Building energy codes in Nordic countries mandate renewable heating in new construction, driving specification of seawater systems in coastal developments where ocean thermal resources provide optimal efficiency. Climate action programs in island nations prioritize energy independence through indigenous renewable resources, creating policy support for seawater thermal infrastructure development.

Technical challenges constrain adoption in certain geographic and application contexts. Seawater intake infrastructure requires capital investment ranging from USD 100,000 to USD 500,000 depending on distance from shore and water depth, creating barriers in locations without existing seawater supply systems. Marine growth fouling on heat exchangers necessitates regular cleaning and biofouling control measures, adding operational complexity and maintenance costs that may exceed USD 10,000-USD 30,000 annually for commercial installations. Environmental permitting processes addressing thermal discharge and marine organism protection can extend project timelines by 12-24 months, delaying implementation and creating uncertainty in project economics during development phases.

Between 2025 and 2030, the seawater source heat pump system market is projected to expand from USD 2.2 billion to USD 5.1 billion, resulting in a value increase of USD 2.9 billion, which represents 29.4% of the total forecast growth for the decade. This phase of development will be shaped by rising demand for coastal facility renewable heating solutions and marine resource utilization, product innovation in corrosion-resistant heat exchangers and variable capacity compressor systems, as well as expanding integration with district energy networks and industrial process heat recovery applications. Companies are establishing competitive positions through investment in seawater-resistant materials technology, system efficiency optimization, and strategic partnerships with coastal developers and industrial facility operators.

From 2030 to 2035, the market is forecast to grow from USD 5.1 billion to USD 11.9 billion, adding another USD 6.8 billion, which constitutes 70.6% of the overall ten-year expansion. This period is expected to be characterized by the expansion of specialized system configurations, including ultra-high temperature heat pumps for industrial process applications and integrated seawater cooling/heating systems for coastal district energy networks, strategic collaborations between heat pump manufacturers and marine infrastructure developers, and an enhanced focus on efficiency optimization and environmental impact minimization. The growing emphasis on renewable energy transition and carbon neutrality commitments will drive demand for advanced, high-performance seawater source heat pump solutions across diverse coastal facility applications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.2 billion |

| Market Forecast Value (2035) | USD 11.9 billion |

| Forecast CAGR (2025-2035) | 18.3% |

The seawater source heat pump system market grows by enabling coastal facility operators to achieve superior energy efficiency and renewable heating delivery while meeting carbon reduction commitments across building and industrial applications. Facility managers face mounting pressure to transition from fossil fuel heating systems, with seawater heat pump solutions typically providing 40-60% energy cost reduction compared to conventional boiler and chiller combinations, making ocean thermal resource utilization essential for sustainable coastal facility operations. The renewable energy transition movement creates demand for proven thermal systems that can deliver reliable heating and cooling from marine resources while eliminating direct carbon emissions associated with combustion-based climate control.

Government initiatives promoting renewable energy adoption and carbon emissions reduction drive adoption in seafood processing, aquariums, and aquaculture applications, where seawater thermal system performance has a direct impact on facility operating costs and environmental compliance. The global shift toward sustainable building operations accelerates seawater heat pump demand as coastal developers seek indigenous renewable resources that reduce energy import dependencies while supporting climate commitments. High capital costs for seawater intake infrastructure and technical complexity in managing marine growth fouling may constrain adoption rates among smaller facilities and locations without existing seawater supply systems operating with limited capital budgets.

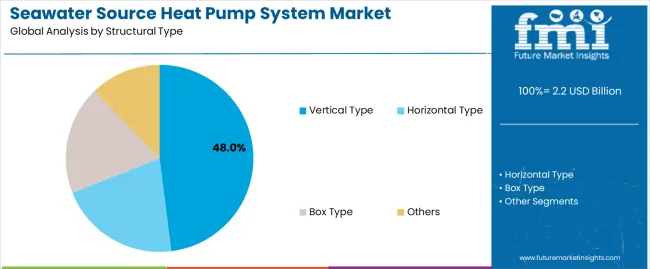

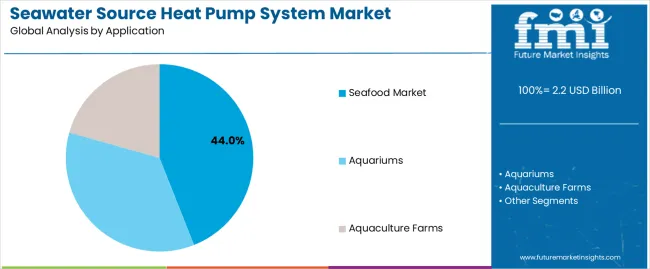

The market is segmented by structural type, application, and region. By structural type, the market is divided into vertical type, horizontal type, box type, and others. Based on application, the market is categorized into seafood market, aquariums, and aquaculture farms. Regionally, the market is divided into Asia Pacific, Europe, North America, Latin America, and Middle East & Africa.

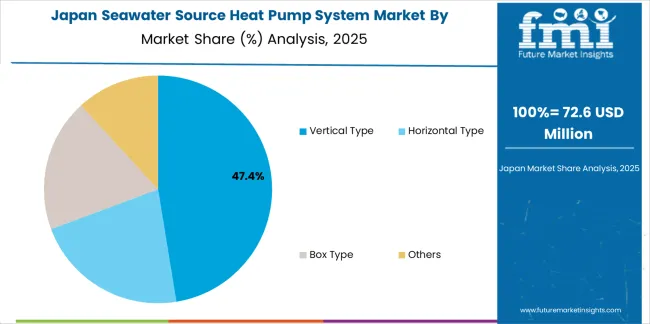

The vertical type segment represents the dominant force in the seawater source heat pump system market, capturing approximately 48.0% of total market share in 2025. This advanced category encompasses space-efficient configurations featuring vertical orientation of compressor, heat exchangers, and auxiliary components, delivering comprehensive heating and cooling capabilities with minimized floor space requirements suitable for confined mechanical rooms typical of coastal facilities. The vertical type segment leads through its exceptional space efficiency enabling installation in existing buildings without major structural modifications, proven reliability across diverse marine environments, and compatibility with both new construction and retrofit applications requiring compact equipment footprints.

The horizontal type segment maintains a substantial 32.0% market share, serving applications requiring distributed component layout through conventional horizontal configurations suitable for outdoor installations and facilities with adequate floor space. The box type accounts for 13.0% market share, while other structural configurations collectively represent 7.0% market share. Key advantages driving the vertical type segment include optimal space utilization achieving 40-50% footprint reduction compared to horizontal configurations in equivalent capacity, simplified piping arrangements reducing installation labor and refrigerant line lengths in multi-story facilities, enhanced serviceability with components arranged vertically for improved maintenance access in confined spaces, and architectural flexibility enabling concealment in building service cores or placement on rooftops where floor space proves unavailable for mechanical equipment in space-constrained coastal developments.

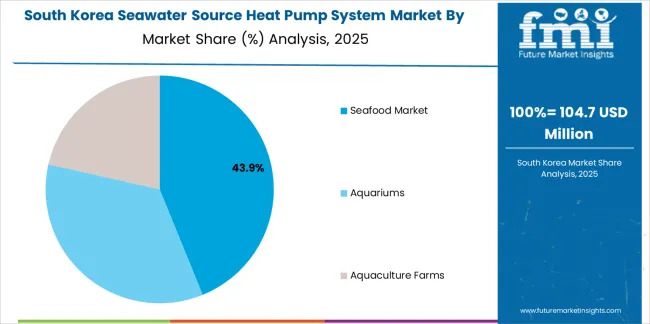

Seafood market applications dominate the seawater source heat pump system market with approximately 44.0% market share in 2025, reflecting the extensive deployment across fish markets, seafood processing facilities, and cold storage operations requiring simultaneous heating, cooling, and refrigeration services optimally matched to seawater heat pump capabilities. The seafood market segment leads through deployment in wholesale fish markets maintaining refrigerated display areas, processing plants requiring process heat and space conditioning, and distribution facilities managing temperature-controlled storage with integrated thermal management.

The aquariums segment represents 31.0% market share through applications in public aquariums, marine research facilities, and exhibition centers requiring precise water temperature control. Aquaculture farms account for 25.0% market share, serving production operations optimizing growth conditions through water temperature management. Key market dynamics supporting application preferences include seafood market facilities requiring year-round refrigeration with waste heat recovery providing concurrent space heating and hot water production, aquarium applications demanding precise temperature stability maintaining exhibition tank conditions within ±0.5°C tolerances critical for marine organism health, aquaculture operations optimizing biological productivity through temperature control accelerating fish growth by 15-25% in heated culture systems, and integrated facility energy management where seawater heat pumps provide multiple thermal services from single equipment installation reducing capital and operating costs compared to separate heating, cooling, and refrigeration systems.

The market is driven by three concrete demand factors tied to renewable energy transition and operational efficiency. First, carbon reduction commitments create increasing requirements for renewable heating systems, with coastal facility operators targeting 60-80% emissions reduction through heat pump electrification compared to fossil fuel boilers, supported by renewable electricity supplies enabling zero-carbon thermal services. Second, energy cost optimization drives technology adoption, with seawater heat pumps achieving coefficient of performance values of 3.5-5.0 compared to 0.85-0.95 for conventional boilers, delivering 70-80% energy cost reduction in heating-dominated applications. Third, seafood industry growth requires thermal management infrastructure, with global aquaculture production expanding 4-6% annually requiring temperature-controlled production systems where seawater heat pumps provide cost-effective thermal optimization.

Market restraints include seawater intake infrastructure capital costs affecting project economics, particularly in locations requiring pipeline construction exceeding 500 meters from shore or water depths necessitating specialized intake structures costing USD 200,000-USD 500,000. Marine growth fouling creates operational challenges requiring heat exchanger cleaning every 3-6 months and biofouling control systems adding USD 15,000-USD 40,000 annual maintenance costs depending on system size and water quality. Environmental permitting complexity poses project development barriers, as regulatory approvals addressing thermal discharge impacts and marine organism protection require 12-24 month review periods with uncertain outcomes that discourage investment in some jurisdictions.

Key trends indicate accelerated adoption in Asia Pacific markets, particularly China where government programs support renewable energy development and coastal facility modernization drives seawater thermal system deployment. Technology advancement trends toward high-temperature heat pumps achieving output temperatures exceeding 80°C for industrial process applications, integrated district energy systems combining seawater cooling and heating for coastal developments, and AI-enabled control systems optimizing performance across variable operating conditions enable next-generation facility energy management. The market faces potential disruption if emerging technologies including offshore floating solar thermal systems or advanced geothermal heat pumps achieve cost-effectiveness sufficient to compete with seawater systems in coastal thermal applications currently driving market growth.

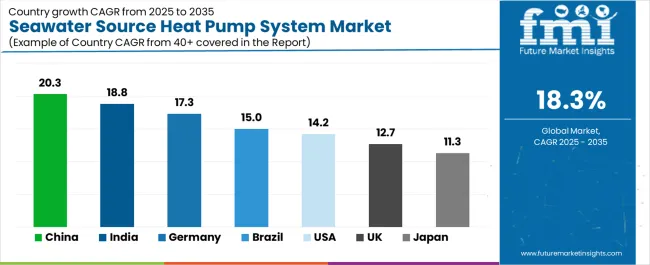

| Country | CAGR (2025-2035) |

|---|---|

| China | 20.3% |

| India | 18.8% |

| Germany | 17.3% |

| Brazil | 15.4% |

| USA | 14.2% |

| UK | 12.7% |

| Japan | 11.3% |

The seawater source heat pump system market is gaining momentum worldwide, with China taking the lead thanks to aggressive coastal development programs and renewable energy mandates. Close behind, India benefits from aquaculture expansion initiatives and coastal industrial development, positioning itself as a strategic growth hub in the Asia Pacific region. Germany shows strong advancement, where established renewable energy infrastructure and coastal facility modernization strengthen its role in European sustainable heating supply chains. The USA demonstrates robust growth through coastal facility upgrade programs and renewable energy adoption, signaling continued investment in marine thermal resource utilization. Meanwhile, Japan stands out for its aquaculture industry focus and advanced heat pump technology with quality emphasis, while UK continues to record consistent progress driven by offshore renewable energy integration and coastal development. Together, China and India anchor the global expansion story, while established markets build stability and technical sophistication into the market growth path.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

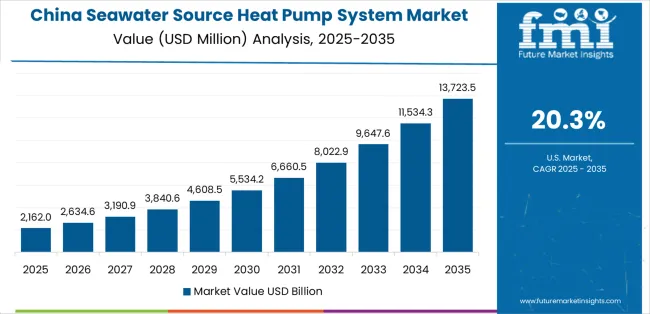

China demonstrates the strongest growth potential in the Seawater Source Heat Pump System Market with a CAGR of 20.3% through 2035. The country leads through comprehensive coastal development programs, aquaculture industry expansion, and renewable energy promotion driving adoption of marine thermal technologies. Growth is concentrated in major coastal regions, including Shandong, Guangdong, Fujian, and Zhejiang, where seafood processing facilities and aquaculture operations are implementing seawater heat pump systems for energy efficiency and operational cost reduction. Distribution channels through heat pump manufacturers, marine equipment suppliers, and direct facility relationships expand deployment across seafood markets, aquaculture farms, and coastal industrial applications. The country's renewable energy development policies provide support for marine resource utilization, while extensive coastline infrastructure creates favorable conditions for seawater thermal system deployment.

Key market factors:

In the Gujarat, Tamil Nadu, Kerala, and West Bengal coastal regions, the adoption of seawater source heat pump systems is accelerating across aquaculture farms, seafood processing facilities, and coastal industrial operations, driven by renewable energy promotion schemes and aquaculture sector development initiatives. The market demonstrates strong growth momentum with a CAGR of 18.8% through 2035, linked to comprehensive coastal development and increasing focus on energy-efficient facility operations. Indian facility operators are implementing seawater thermal systems and renewable heating solutions to reduce energy costs while improving operational sustainability in seafood processing and aquaculture applications. The country's Blue Revolution programs create sustained demand for aquaculture infrastructure, while increasing emphasis on renewable energy drives adoption of seawater heat pump technologies enabling cost-effective thermal management.

Germany's advanced renewable energy sector demonstrates sophisticated implementation of seawater source heat pump systems, with documented case studies showing 50-65% energy cost reduction in coastal facility applications. The country's coastal infrastructure in major port regions, including Hamburg, Bremen, and Schleswig-Holstein, showcases integration of seawater thermal technologies with existing facility energy systems, leveraging expertise in renewable heating and district energy networks. German facility operators emphasize system reliability and long-term performance, creating demand for premium seawater heat pump solutions that support sustainability commitments and operational efficiency objectives. The market maintains strong growth through focus on renewable energy leadership and coastal industrial development, with a CAGR of 17.3% through 2035.

Key development areas:

The Brazilian market leads in aquaculture expansion based on integration with coastal resource development and seafood production growth driving demand for thermal management systems. The country shows solid potential with a CAGR of 15.4% through 2035, driven by aquaculture sector investment and coastal facility modernization across major coastal regions, including Santa Catarina, Bahia, Ceará, and Rio de Janeiro. Brazilian aquaculture operations are adopting seawater heat pump systems for compliance with production optimization requirements in shrimp farming, particularly in applications requiring temperature control for accelerated growth and in processing facilities managing energy costs. Technology deployment channels through marine equipment suppliers, aquaculture service providers, and direct operator relationships expand coverage across diverse coastal applications.

Leading market segments:

The USA market leads in advanced heat pump technology based on integration with coastal facility operations and sophisticated renewable energy programs for emissions reduction. The country shows solid potential with a CAGR of 14.2% through 2035, driven by aquarium facility development and seafood processing modernization across major coastal regions, including Alaska, Pacific Northwest, Northeast, and Gulf Coast. American facility operators are adopting specialized seawater heat pumps for compliance with renewable energy objectives in coastal applications, particularly in aquarium complexes requiring precise temperature control and in processing facilities targeting carbon neutrality. Technology deployment channels through mechanical contractors, heat pump distributors, and direct facility relationships expand coverage across aquarium, seafood processing, and industrial applications.

Leading market segments:

The UK market demonstrates sophisticated implementation focused on coastal renewable energy integration and marine facility development, with documented integration of seawater heat pump systems achieving carbon emissions reduction in aquarium and seafood processing applications. The country maintains steady growth momentum with a CAGR of 12.7% through 2035, driven by marine energy programs and coastal facility sustainability initiatives aligned with net-zero commitments. Major coastal development regions, including Scotland, Southwest England, and Wales, showcase advanced renewable heating implementations where seawater heat pump programs integrate seamlessly with existing facility infrastructure and sustainability protocols.

Key market characteristics:

In Hokkaido, Kyushu, and coastal Honshu regions, aquaculture operators are implementing seawater source heat pump programs to enhance production efficiency and meet sustainability requirements, with documented case studies showing integration in fish farming operations and seafood processing facilities. The market shows solid growth potential with a CAGR of 11.3% through 2035, linked to Japanese aquaculture industry quality standards, facility management sophistication, and emphasis on energy efficiency. Japanese facility operators are adopting specialized seawater heat pump technologies and advanced control integration to maintain optimal production conditions while achieving energy cost reduction through renewable thermal management.

Market development factors:

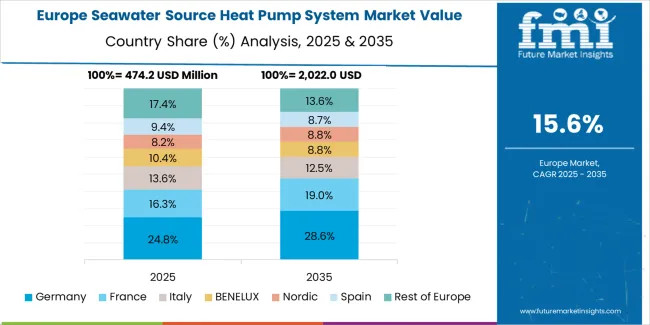

The seawater source heat pump system market in Europe is projected to grow from USD 602.1 million in 2025 to USD 2,987.3 million by 2035, registering a CAGR of 17.2% over the forecast period. Germany is expected to maintain its leadership position with a 28.5% market share in 2025, declining slightly to 27.8% by 2035, supported by its advanced renewable energy infrastructure and major coastal facility development including North Sea and Baltic Sea installations. France follows with a 21.0% share in 2025, projected to reach 21.5% by 2035, driven by comprehensive marine energy programs and coastal aquaculture development initiatives. The United Kingdom holds a 18.5% share in 2025, expected to decrease to 18.0% by 2035 through established aquarium operations and seafood processing facility modernization. Italy commands a 12.0% share, while Spain accounts for 9.5% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 10.5% to 11.2% by 2035, attributed to increasing seawater heat pump adoption in Nordic countries and emerging Eastern European coastal development implementing renewable heating programs.

The Japanese seawater source heat pump system market demonstrates a mature and technology-focused landscape, characterized by sophisticated integration of corrosion-resistant heat exchangers and precision control systems with existing aquaculture facility infrastructure across fish farming operations, seafood processing plants, and marine research facilities. Japan's emphasis on production quality and operational efficiency drives demand for advanced seawater heat pump solutions that support aquaculture productivity objectives and facility sustainability standards in demanding marine applications. The market benefits from strong partnerships between international heat pump suppliers and domestic aquaculture operations including major seafood producers, creating comprehensive technology ecosystems that prioritize system reliability and performance optimization. Coastal aquaculture centers in Hokkaido, Kyushu, and other major production regions showcase advanced facility implementations where seawater heat pump systems achieve precise temperature control while maintaining energy efficiency targets essential for competitive aquaculture operations.

The South Korean seawater source heat pump system market is characterized by growing international technology provider presence, with companies maintaining significant positions through comprehensive installation services and technical integration capabilities for aquaculture and coastal facility applications. The market demonstrates increasing emphasis on facility automation and energy efficiency optimization, as Korean aquaculture operators and seafood processors increasingly demand advanced seawater heat pump systems that integrate with domestic facility management infrastructure and sophisticated control platforms deployed across coastal operations. Regional marine equipment suppliers are gaining market share through strategic partnerships with international heat pump manufacturers, offering specialized services including Korean regulatory compliance support and application-specific installation programs for aquaculture and processing facilities. The competitive landscape shows increasing collaboration between multinational equipment companies and Korean marine facility specialists, creating hybrid service models that combine international heat pump expertise with local facility integration knowledge and aquaculture industry requirements.

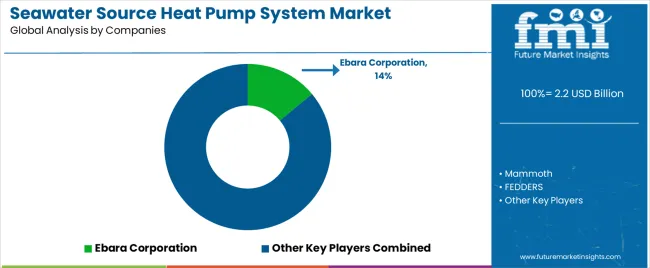

The seawater source heat pump system market features approximately 25-30 meaningful players with moderate fragmentation, where the top three companies control roughly 32-38% of global market share through established marine equipment expertise and comprehensive product portfolios. Competition centers on corrosion resistance, system efficiency, and installation service quality rather than price competition alone. Ebara Corporation leads with approximately 14.0% market share through its comprehensive marine pump and heat exchanger portfolio including seawater-resistant thermal systems for coastal applications.

Market leaders include Ebara Corporation, Mammoth, and FEDDERS, which maintain competitive advantages through decades of marine equipment experience, established corrosion-resistant technology portfolios ensuring long-term reliability, and deep expertise in coastal facility thermal applications, creating trust and reliability advantages with seafood processors and aquaculture operators. These companies leverage engineering capabilities in seawater heat exchanger design and marine system integration alongside ongoing technical support networks to defend market positions while expanding into emerging markets and specialized applications.

Challengers encompass Qingdao KC Blue New Energy and Shandong St.claier, which compete through specialized system configurations and strong regional presence in key coastal markets. Product specialists, including Guangdong AQUA, Dezhou Yatai Group, and Jiangsu HALIDOM, focus on specific structural types or application segments, offering differentiated capabilities in vertical configurations, aquaculture-optimized systems, and cost-effective solutions for emerging markets.

Regional players and emerging heat pump manufacturers create competitive pressure through localized production advantages and competitive pricing strategies, particularly in high-growth markets including China and India, where domestic manufacturers provide advantages in delivery lead times and responsive technical support for coastal facility operators. Market dynamics favor companies that combine reliable corrosion resistance with comprehensive installation services and ongoing maintenance support addressing the complete facility thermal management needs from initial system design through operational optimization and long-term marine equipment service.

Seawater source heat pump systems represent critical renewable energy technologies that enable coastal facility operators to achieve 40-60% energy cost reduction compared to conventional heating systems, delivering superior thermal efficiency and carbon emissions elimination with validated effectiveness in demanding marine applications. With the market projected to grow from USD 2,216.5 million in 2025 to USD 11,914.8 million by 2035 at a 18.3% CAGR, these renewable thermal systems offer compelling advantages for seafood market applications (44.0% market share), aquariums (31.0% share), and aquaculture farms (25.0% share) seeking sustainable heating solutions with proven operational reliability. Scaling market adoption and technology advancement requires coordinated action across heat pump manufacturers, coastal facility operators, marine infrastructure developers, renewable energy advocates, and sustainable technology investment capital.

How Governments Could Spur Local Production and Adoption?

How Industry Bodies Could Support Market Development?

How OEMs and Technology Players Could Strengthen the Ecosystem?

How Suppliers Could Navigate the Shift?

How Investors and Financial Enablers Could Unlock Value?

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 billion |

| Structural Type | Vertical Type, Horizontal Type, Box Type, Others |

| Application | Seafood Market, Aquariums, Aquaculture Farms |

| Regions Covered | Asia Pacific, Europe, North America, Latin America, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, USA, UK, Japan, and 40+ countries |

| Key Companies Profiled | Ebara Corporation, Mammoth, FEDDERS, Qingdao KC Blue New Energy, Shandong St.claier, Guangdong AQUA, Dezhou Yatai Group, Jiangsu HALIDOM, Shandong ZKNKT, Shandong FUERDA |

| Additional Attributes | Dollar sales by structural type and application categories, regional adoption trends across Asia Pacific, Europe, and North America, competitive landscape with heat pump manufacturers and marine equipment suppliers, seawater intake requirements and specifications, integration with facility energy systems and thermal management programs, innovations in corrosion-resistant technologies and efficiency optimization, and development of specialized configurations with enhanced reliability and performance capabilities. |

The global seawater source heat pump system market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the seawater source heat pump system market is projected to reach USD 11.8 billion by 2035.

The seawater source heat pump system market is expected to grow at a 18.3% CAGR between 2025 and 2035.

The key product types in seawater source heat pump system market are vertical type , horizontal type, box type and others.

In terms of application, seafood market segment to command 44.0% share in the seawater source heat pump system market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seawater Cooling Pumps Market

Outsourced Testing Services Market Insights – Trends & Forecast 2025 to 2035

Air Source Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Open Source Service Market Size and Share Forecast Outlook 2025 to 2035

Crowdsourced Security Market Size and Share Forecast Outlook 2025 to 2035

Crowdsourced Testing Market Size and Share Forecast Outlook 2025 to 2035

Open Source Intelligence Market Trends – Growth & Forecast 2025 to 2035

Water Source Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Natural Source Vitamin E Market Analysis - Size, Share, and Forecast 2025 to 2035

AC Power Source Market Size and Share Forecast Outlook 2025 to 2035

Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Service Resource Planning (SRP) SaaS Solutions Market Size and Share Forecast Outlook 2025 to 2035

Hospital Resource Management Market

Enterprise Resource Planning (ERP) Software Market Size and Share Forecast Outlook 2025 to 2035

Tritium Light Source Market Size and Share Forecast Outlook 2025 to 2035

Aquatic Plant-Sourced Retinoids Market Size and Share Forecast Outlook 2025 to 2035

Analyzing Tritium Light Source Market Share & Applications

Remote Plasma Source Market

Demand for R290 Air Source Heat Pump in USA Size and Share Forecast Outlook 2025 to 2035

High-Power Microwave Source Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA