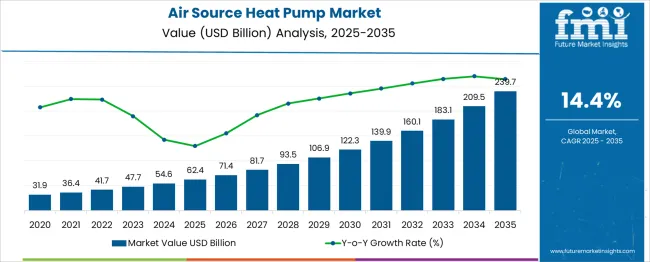

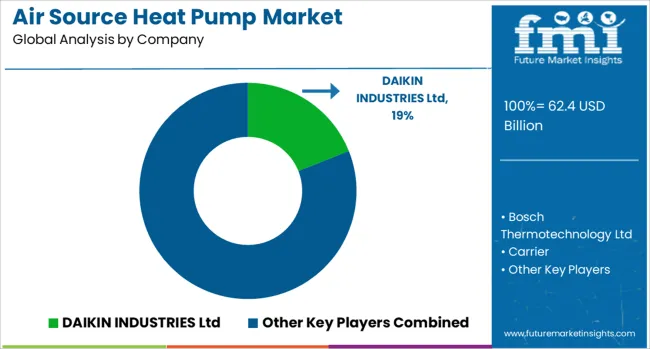

The Air Source Heat Pump Market is estimated to be valued at USD 62.4 billion in 2025 and is projected to reach USD 239.7 billion by 2035, registering a compound annual growth rate (CAGR) of 14.4% over the forecast period. Inflection point mapping helps identify the phases where adoption accelerates significantly due to external or internal catalysts. From 2025 to 2027, the market grows moderately from USD 62.4 billion to USD 71.4 billion, indicating a phase of early adoption stabilization, driven by initial policy incentives and growing consumer awareness. The first major inflection point occurs around 2028–2029, as the market jumps from USD 81.7 billion to USD 93.5 billion and then to USD 106.9 billion. This acceleration coincides with increased decarbonization mandates, electrification of heating systems, and cost reductions in ASHP technology. A second sharper inflection is observed around 2030–2032, with the market expanding from USD 122.3 billion to USD 160.1 billion, fueled by stringent building emission standards across North America and Europe, alongside large-scale retrofitting programs. Beyond 2032, the market enters a mass adoption phase, culminating at USD 239.7 billion by 2035. At this stage, ASHPs move from a sustainable alternative to a mainstream necessity, marking a transformative shift in the global HVAC landscape.

| Metric | Value |

|---|---|

| Air Source Heat Pump Market Estimated Value in (2025 E) | USD 62.4 billion |

| Air Source Heat Pump Market Forecast Value in (2035 F) | USD 239.7 billion |

| Forecast CAGR (2025 to 2035) | 14.4% |

The air source heat pump market is witnessing accelerated adoption due to rising environmental concerns, stringent emission regulations, and the shift toward energy-efficient HVAC technologies. Decarbonization policies across North America, Europe, and Asia-Pacific are incentivizing low-carbon heating solutions, thereby promoting heat pump installations over traditional fossil-fuel-based systems.

Advancements in inverter technology, integration with smart home ecosystems, and improved performance in colder climates are further driving market expansion. Governments and utilities are supporting adoption through subsidies, rebate programs, and regulatory mandates, making air source heat pumps more accessible to both residential and commercial users.

As green building codes and retrofitting initiatives become more aggressive, the market is poised for long-term growth, with manufacturers investing in modular, high-performance, and low-noise system designs to meet evolving customer demands.

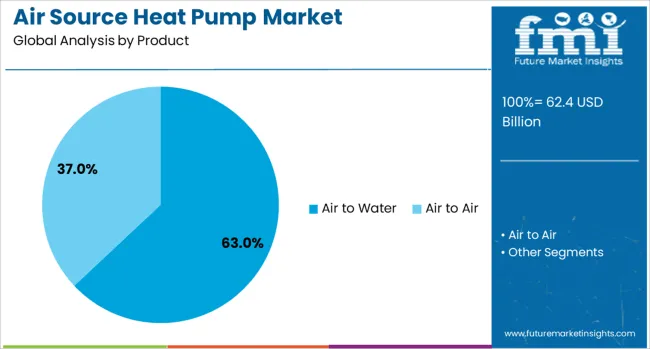

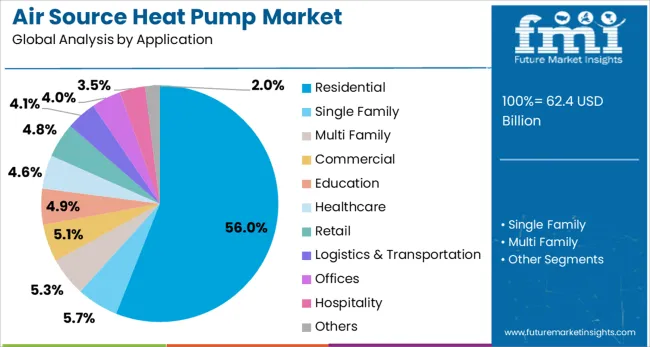

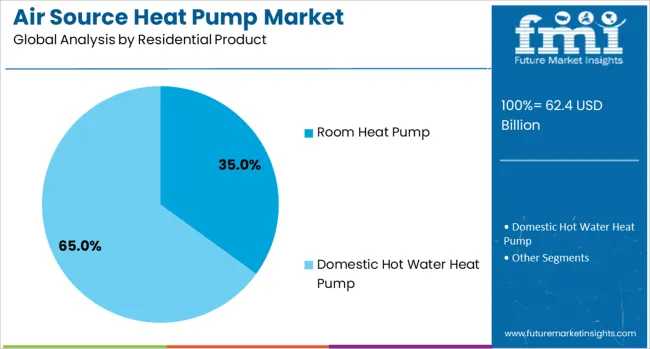

The air source heat pump market is segmented by product, application residential product, and geographic regions. By product of the air source heat pump market is divided into Air to Water Air to Air. In terms of application of the air source heat pump market is classified into Residential, Single Family, Multi Family, Commercial, Education, Healthcare, Retail, Logistics & Transportation, Offices, Hospitality Others. Based on residential product of the air source heat pump market is segmented into Room Heat Pump Domestic Hot Water Heat Pump. Regionally, the air source heat pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The air to water segment is projected to lead the product category with a 63% revenue share in 2025. Its dominance is being reinforced by its dual capability for space heating and domestic hot water supply, aligning well with energy conservation goals in residential and light commercial settings.

The segment is benefiting from its compatibility with underfloor heating systems and low-temperature radiators, which are increasingly installed in new energy-efficient buildings. High energy efficiency ratings and lower operating costs over the lifecycle make air to water systems favorable under government-backed retrofit and zero-emission home schemes.

Additionally, advancements in refrigerant cycles and noise reduction technology have enhanced consumer acceptance, especially in densely populated areas where performance, environmental footprint, and noise compliance are key considerations.

Residential applications are expected to account for 56.00% of total market share in 2025, establishing them as the primary driver of demand. The segment is being supported by rising electricity costs, aging boiler infrastructure, and increased consumer awareness of energy-efficient alternatives.

Policy incentives such as tax credits, carbon levies, and installation grants are accelerating replacement cycles for traditional heating systems. The shift toward decarbonized housing infrastructure, coupled with a surge in residential building construction and renovation activities, is increasing the installation rate of heat pumps.

Moreover, modern consumer preferences for low-maintenance, automated climate control systems are aligning with the operational benefits of air source heat pumps, especially in single-family and multi-family dwellings.

Room heat pumps are anticipated to hold 35.00% share within the residential product segment by 2025. Their growth is being propelled by demand for compact, cost-effective heating solutions that can be deployed without extensive retrofitting.

The segment benefits from increasing urbanization and a growing number of rental properties where centralized systems are impractical. Room heat pumps offer flexible installation, targeted zone heating, and compatibility with existing electrical infrastructure, making them ideal for apartments and smaller living spaces.

Their plug-and-play nature, combined with remote control features and energy monitoring capabilities, supports rising demand from tech-savvy consumers. Furthermore, advancements in aesthetics, noise insulation, and seasonal energy efficiency are strengthening their appeal as an upgrade from conventional space heaters.

The air source heat pump market is expanding as building owners look for efficient heating and cooling systems that align with energy efficiency goals. These units offer a dual function providing warmth in colder months and cooling in warmer periods by extracting and transferring heat from the air. Regulatory backing, financial incentives, and electric infrastructure upgrades are supporting market growth. Enhanced product designs with digital interfaces and hybrid system compatibility broaden adoption across varied climates and building types, while technical barriers still pose limitations.

Government mandates to reduce building-related emissions are pushing the adoption of air source heat pumps as replacements for gas or oil-based heating systems. Many national and regional authorities are offering grants, rebates, and installation subsidies to ease the initial purchase cost, which remains a major consideration for most buyers. These incentives make the transition to heat pumps more viable for residential homeowners and commercial property operators. In regions such as Northern and Western Europe, policy measures have significantly lifted adoption rates by simplifying permit processes and offering recurring installation support. Electric utilities are also restructuring pricing to reward energy-efficient installations, further aligning grid strategies with the deployment of heat pump technologies. Regulations are being updated to prioritize clean heating options in both new construction and retrofits. As governments increase pressure on fossil fuel use and align infrastructure development with electricity-based systems, air source heat pumps are positioned as a key solution.

Despite their potential, air source heat pumps face significant technical and operational challenges in cold climates. These systems struggle with reduced performance during freezing temperatures, requiring backup systems or hybrid formats to ensure sufficient heating. This limitation impacts customer confidence in colder regions, where the systems may be perceived as unreliable or insufficient. Beyond climate-based issues, the limited availability of skilled professionals trained in heat pump installation, sizing, and maintenance is an additional barrier. Installations require technical understanding to configure the system properly for each building type and climate zone, and errors can lead to inefficiencies or mechanical failures. The labor shortage is further complicated by the rapid pace of adoption, which outpaces the development of a knowledgeable workforce. This imbalance can result in long wait times, suboptimal installations, and higher consumer dissatisfaction rates. Without expanded workforce training and cold-weather adaptations, these limitations could curb long-term growth in key regions.

Manufacturers are responding to performance and usability challenges by introducing hybrid systems and advanced controls that make heat pumps more adaptive and user-friendly. Hybrid models can switch between the heat pump and an auxiliary system such as a gas or oil boiler, depending on outdoor temperature and energy pricing, offering more flexibility for users in cold or fluctuating climates. These systems reduce operating costs while maintaining comfort. Smart control features enable homeowners to manage temperature, monitor system performance, and respond to weather changes remotely through apps or connected devices. This convenience attracts tech-savvy consumers and supports greater engagement with energy-saving practices. Manufacturers are also focusing on compact designs that can fit into tighter indoor or outdoor spaces, making retrofits more feasible. Together, these improvements are removing installation barriers and improving perceived value. As more users look for convenience, reliability, and adaptability, these product enhancements represent a significant opportunity for further market expansion.

One of the most persistent limitations facing the air source heat pump market is the relatively high initial investment required for equipment and installation. While operating costs are generally lower than conventional systems, the upfront expense discourages price-sensitive buyers, especially in regions without strong financial support programs. Even where rebates or tax incentives exist, the long-term stability of those programs is uncertain, and policy changes can disrupt purchasing decisions. Sudden reductions or delays in incentive offerings may cause market slowdowns, as consumers adopt a wait-and-see approach. Additionally, the cost advantage of heat pumps is sometimes undermined by regional electricity prices, which may not always favor electric heating. Installation costs can also vary widely depending on location, contractor availability, and building type. These economic variables make it difficult for potential buyers to calculate a clear return on investment, limiting broad appeal. Market expansion depends heavily on consistent cost reduction and stable support mechanisms.

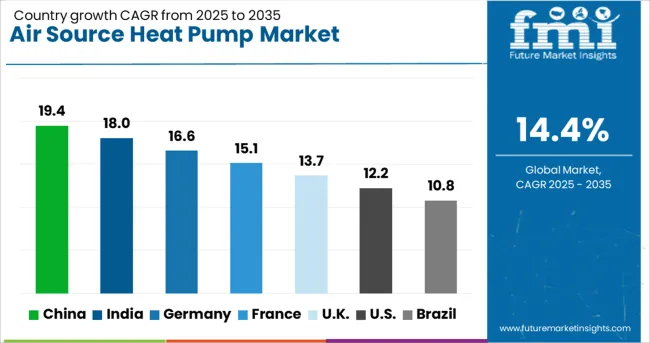

| Country | CAGR |

|---|---|

| China | 19.4% |

| India | 18.0% |

| Germany | 16.6% |

| France | 15.1% |

| UK | 13.7% |

| USA | 12.2% |

| Brazil | 10.8% |

The global air source heat pump market is expanding at a CAGR of 14.4%, driven by the transition to low-carbon heating solutions, rising energy efficiency standards, and supportive government policies. China leads with 19.4% growth, fueled by large-scale residential installations and national decarbonization goals. India follows at 18.0%, supported by urban development, rising awareness of sustainable HVAC systems, and energy-saving initiatives. Germany records 16.6% growth, reflecting strong regulatory incentives and widespread adoption in retrofitting older buildings. The United Kingdom grows at 13.7%, driven by commitments to net-zero targets and growing uptake in residential and commercial sectors. The United States, at 12.2%, remains a significant market, shaped by state-level incentives, innovation in dual-source systems, and demand for electrified heating. Market trends are influenced by installation flexibility, seasonal efficiency, and integration with smart home energy systems. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is leading the air source heat pump market with a strong 19.4% CAGR, driven by aggressive carbon neutrality goals and increasing adoption of energy-efficient technologies. Government incentives and building codes are accelerating residential and commercial installations, especially in colder northern provinces. Domestic manufacturers are scaling production of variable-speed and cold-climate units tailored to local weather conditions. Integration with solar systems and smart home platforms is becoming more common. The real estate sector is actively incorporating heat pumps in green building projects. Exports are also rising, with Chinese brands supplying affordable units to markets across Asia and Europe. Advanced inverter technologies and eco-friendly refrigerants are contributing to long-term market sustainability.

India is experiencing an 18.0% CAGR in the air source heat pump market, supported by rising electricity costs, growing awareness of green energy, and industrial heating needs. As urban areas expand and construction intensifies, heat pumps are gaining popularity as an alternative to conventional water heaters and boilers. Demand is rising from hotels, hospitals, and commercial complexes aiming to lower operating expenses and carbon footprints. Indian manufacturers are partnering with global firms to develop units suitable for local temperature conditions. Government programs promoting sustainable building practices are indirectly supporting adoption. The growing renewable energy sector is encouraging hybrid systems that integrate solar and heat pump technologies. Online marketplaces and B2B suppliers are expanding availability across metros and tier-2 cities.

Germany is registering a 16.6% CAGR in the air source heat pump market, driven by strict emissions targets and high energy efficiency standards. The government offers strong financial incentives and rebate programs for heat pump installations, especially in retrofitting older buildings. Homeowners and developers are favoring heat pumps over fossil-fuel systems to comply with updated heating regulations. German manufacturers are leading in the development of silent, high-performance systems with advanced defrosting and weather adaptation features. Integration with smart thermostats and district heating systems is increasing. Demand is strong in both residential and light commercial sectors. Public awareness campaigns and policy alignment with EU decarbonization goals are maintaining upward momentum.

The United Kingdom is observing a 13.7% CAGR in the air source heat pump market, driven by national net-zero goals and clean energy incentives. Government grant programs such as the Boiler Upgrade Scheme are encouraging homeowners to replace gas boilers with heat pumps. Residential installations are increasing in both new builds and retrofits, supported by rising public awareness of climate impact. British companies are developing quiet, space-saving units suited for urban housing. Energy price volatility is making efficient heat pump systems more appealing. There is also growing interest in hybrid setups that combine heat pumps with backup electric or gas heating. Installers are offering bundled packages that include design, installation, and service contracts, improving consumer confidence and ease of adoption.

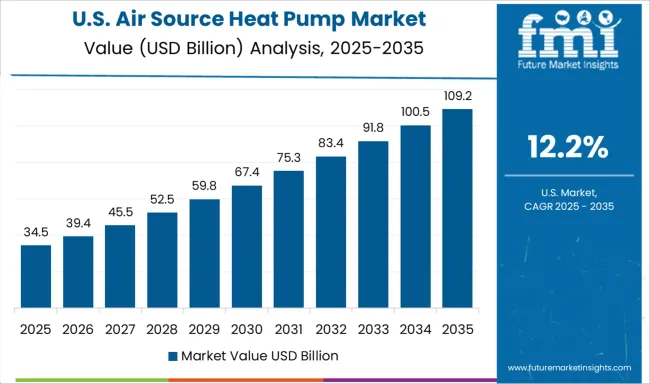

The United States is experiencing a 12.2% CAGR in the air source heat pump market, driven by electrification trends, building code updates, and tax incentives. As states push for decarbonization and improved building performance, residential and light commercial sectors are rapidly adopting heat pump technology. Federal rebate programs under the Inflation Reduction Act are making installations more affordable. Demand is rising for cold-climate models in northern regions and dual-mode systems that provide both heating and cooling. Leading manufacturers are introducing smart, connected systems with Wi-Fi control and performance analytics. Builders are integrating heat pumps in energy-efficient home designs. Utilities are also offering time-of-use rate plans that pair well with heat pump scheduling features.

The air source heat pump (ASHP) market is seeing steady global growth, largely driven by the increasing preference for efficient, all-electric heating and cooling solutions in residential, commercial, and light industrial buildings. ASHPs operate by transferring heat between indoor and outdoor air, making them an attractive alternative to traditional gas or electric heating systems. The rising demand for energy-efficient HVAC systems and a shift in residential construction trends are key factors pushing market expansion. The competitive landscape features major international players such as DAIKIN INDUSTRIES Ltd, Mitsubishi Electric Corporation, Carrier, Panasonic Corporation, and LG Electronics, which dominate with broad product lines, robust distribution networks, and strong brand trust.

These companies focus on developing compact, high-performance units that function efficiently even in colder climates. Bosch Thermotechnology, Fujitsu General, and NIBE Industrier AB are also prominent for their strong positions in Europe and advanced heat pump technology tailored to regional requirements. Mid-sized and emerging players like Gree Electric Appliances, Inc., SPRSUN, Colmac Industries, and Swegon Group AB are expanding their reach by targeting specific customer segments or markets with tailored solutions. Companies such as Rheem, Stiebel Eltron, and Glen Dimplex Group are focusing on hybrid or retrofit-friendly models to tap into the replacement and renovation sectors. As new building regulations and retrofit incentives take hold across key markets, competition will increasingly center on pricing, product adaptability, and system efficiency across varying climates.

As mentioned in Daikin’s March 2025 press release, the company launched its Altherma 4 series and CO₂-based VRV system at ISH 25. These low-GWP innovations support EU decarbonization targets. Daikin projects 250% market growth by 2030, driven by policies like Fit for 55 and EPBD.

| Item | Value |

|---|---|

| Quantitative Units | USD 62.4 Billion |

| Product | Air to Water and Air to Air |

| Application | Residential, Single Family, Multi Family, Commercial, Education, Healthcare, Retail, Logistics & Transportation, Offices, Hospitality, and Others |

| Residential Product | Room Heat Pump and Domestic Hot Water Heat Pump |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | DAIKIN INDUSTRIES Ltd, Bosch Thermotechnology Ltd, Carrier, Colmac Industries, Fujitsu General, Glen Dimplex Group, Gree Electric Appliances, Inc., Guangzhou SPRSUN New Energy Technology Development Co., Ltd., Lennox International Inc., LG Electronics, Mitsubishi Electric Corporation, NIBE Industrier AB, Panasonic Corporation, Rheem Manufacturing Company, SAMSUNG, Stiebel Eltron GmbH & Co. KG, and Swegon Group AB |

| Additional Attributes | Dollar sales vary by system type and application, with air-to-water residential systems dominating, while commercial and retrofit deployments grow fastest. Europe leads in market value and regulatory momentum, and Asia‑Pacific shows highest growth, while North America focuses on cold‑climate models and policy incentives. Pricing fluctuates with refrigerant, equipment, and installation costs. Growth accelerates via smart controls, hybrid systems, inverter tech, and favorable subsidies under climate-driven regulations. |

The global air source heat pump market is estimated to be valued at USD 62.4 billion in 2025.

The market size for the air source heat pump market is projected to reach USD 239.7 billion by 2035.

The air source heat pump market is expected to grow at a 14.4% CAGR between 2025 and 2035.

The key product types in air source heat pump market are air to water and air to air.

In terms of application, residential segment to command 56.0% share in the air source heat pump market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand for R290 Air Source Heat Pump in USA Size and Share Forecast Outlook 2025 to 2035

Ultra-low Temperature Air Source Heat Pump Units Market Size and Share Forecast Outlook 2025 to 2035

Air to Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Water Source Heat Pump Market Growth - Trends & Forecast 2025 to 2035

Seawater Source Heat Pump System Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Laundry Dryer Rotary Compressors Market Size and Share Forecast Outlook 2025 to 2035

Air Preheater Market

Airlift Pump Market Report - Demand, Growth & Industry Outlook 2025 to 2035

Airless Pumps Market Analysis - Size, Demand & Forecast 2025 to 2035

Competitive Overview of Airless Pumps Market Share

Aircraft Pumps Market Size and Share Forecast Outlook 2025 to 2035

Air Cooled Heat Exchanger Market Size and Share Forecast Outlook 2025 to 2035

Air Sampling Pump Market Size and Share Forecast Outlook 2025 to 2035

Cabin Air Heater Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA