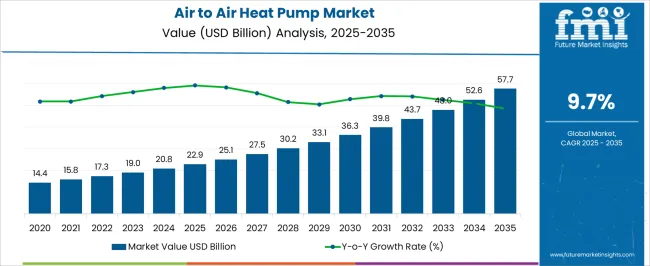

The air to air heat pump market is projected at USD 22.9 billion in 2025 and anticipated to reach USD 57.7 billion by 2035, advancing at a CAGR of 9.7%. A half-decade weighted growth assessment highlights that between 2025 and 2030, the market rises from USD 22.9 billion to USD 33.1 billion, posting a weighted expansion of nearly 44.5% in this interval. From 2030 to 2035, the trajectory extends further to USD 57.7 billion, reflecting a weighted surge of almost 74.4% compared with the base of 2030. This dual-stage examination shows that the second half-decade exerts greater influence on the overall CAGR, with acceleration supported by broader adoption across residential and commercial installations.

Market momentum is anticipated to strengthen as awareness of energy-efficient heating and cooling grows in both advanced economies and emerging geographies. Vendors are prioritizing inverter-based systems, refrigerant transition compliance, and hybrid integration with ventilation technologies, which are anticipated to define the competitive edge.

Expansion of retrofitting projects, government-backed incentives, and building efficiency regulations are pushing acceptance in mature regions, while new construction projects in Asia Pacific and Eastern Europe contribute to rising installation rates. The half-decade weighted growth underscores a market that is anticipated to double within ten years, supported by shifting consumer priorities, evolving energy efficiency standards, and a strategic tilt of suppliers toward high-efficiency models, localized production footprints, and partnerships with real estate developers. This makes the air to air heat pump industry not only one of the most attractive spaces in HVAC but also an area where technology adaptation and policy influence will remain key accelerators.

| Metric | Value |

|---|---|

| Air to Air Heat Pump Market Estimated Value in (2025 E) | USD 22.9 billion |

| Air to Air Heat Pump Market Forecast Value in (2035 F) | USD 57.7 billion |

| Forecast CAGR (2025 to 2035) | 9.7% |

The air to air heat pump market is shaped by several interconnected parent markets that determine its adoption, sales distribution, and long-term expansion. The residential construction sector accounts for nearly 38%, as homebuilders and retrofit projects consistently demand energy-efficient heating and cooling units to comply with building codes and consumer preferences. The commercial real estate segment contributes around 26 percent, with offices, retail centers, and hospitality properties turning toward these systems for reduced energy costs and enhanced indoor climate control. The utilities and energy management sector captures close to 14 %, supported by partnerships that encourage demand-side efficiency programs and integration with smart energy grids. The industrial facilities sector makes up about 12%, with warehouses, light manufacturing plants, and logistics hubs adopting air to air systems to balance temperature control with operational efficiency.

The remaining 10% comes from educational institutions, healthcare facilities, and niche applications where long-term operating savings and policy-driven efficiency requirements make these systems attractive. In my view, this layered distribution illustrates how the air to air heat pump space has grown beyond a residentially driven category into a multi-sector domain where construction, energy management, and commercial operations converge. Companies that concentrate on hybrid solutions, variable refrigerant flow integration, and region-specific performance optimization are expected to consolidate their positions across these parent markets, reinforcing their competitiveness and ensuring sustained growth over the next decade.

The Air to Air Heat Pump market is experiencing rapid growth due to increasing energy efficiency regulations and rising demand for sustainable heating and cooling solutions globally. The market’s expansion is supported by advancements in heat pump technology that enhance performance while reducing environmental impact.

Growing consumer awareness about energy conservation and government incentives aimed at reducing carbon footprints are further driving adoption. The integration of heat pumps into residential and commercial buildings as part of smart HVAC systems is shaping the future market landscape.

Increasing urbanization and the push for greener building solutions are creating substantial opportunities for market players to innovate and expand their offerings Overall, the transition towards eco-friendly climate control methods is anticipated to sustain robust growth in this market over the coming decade.

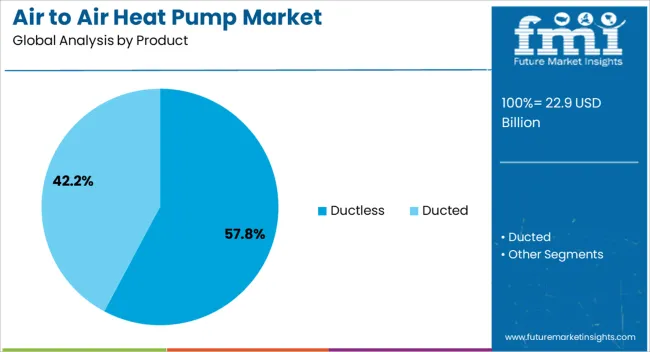

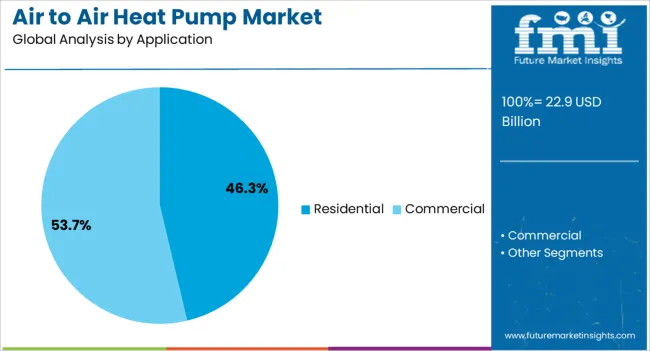

The air to air heat pump market is segmented by product, application, and geographic regions. By product, air to air heat pump market is divided into Ductless and Ducted. In terms of application, air to air heat pump market is classified into Residential and Commercial. Regionally, the air to air heat pump industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The ductless product segment is estimated to hold 57.8% of the Air to Air Heat Pump market revenue in 2025, establishing it as the leading product category. This prominence is attributed to its flexible installation options, which do not require ductwork and thus reduce upfront costs and complexity.

The ductless systems provide targeted heating and cooling, which improves energy efficiency and comfort, particularly in retrofit applications and spaces lacking existing duct infrastructure. Their ability to support zoned temperature control and compatibility with smart home automation platforms has also contributed to increased adoption.

The ease of maintenance and reduced space requirements make ductless heat pumps appealing to both residential and light commercial users, reinforcing this segment’s growth trajectory.

The residential application segment is projected to account for 46.3% of the total market revenue in 2025, marking it as the largest application area. This leadership is driven by the rising demand for efficient and sustainable heating and cooling solutions in single-family homes, apartments, and condominiums.

Growing environmental consciousness and stricter energy efficiency standards for residential buildings have encouraged homeowners to adopt air to air heat pumps as an alternative to conventional HVAC systems. Additionally, the versatility of these systems in providing both heating and cooling throughout the year meets the diverse climatic needs of residential consumers.

Increasing government incentives and rebates for residential heat pump installations have further accelerated market penetration in this segment, supporting continued growth.

Air to air heat pumps are expanding across residential, commercial, and industrial spaces. Government policies, compliance standards, and competitive innovation continue to shape the market’s long-term trajectory.

Residential construction and retrofit projects have become the leading demand source for air to air heat pumps, driven by growing interest in efficient heating and cooling alternatives. Homeowners are shifting toward systems that deliver energy savings, enhanced comfort, and compliance with regional energy codes. Government rebates, tax incentives, and energy efficiency regulations are further pushing installation rates across both new builds and existing properties. Market adoption has been strengthened by rising awareness of cost-effective climate control, which allows households to offset high upfront investment with long-term savings. The segment is anticipated to remain the single largest contributor to market expansion, with suppliers tailoring compact designs and noise reduction features to appeal to residential buyers.

The commercial and industrial sectors have played a critical role in broadening the air to air heat pump market base. Offices, educational institutions, warehouses, and production plants are seeking integrated climate systems that reduce operating costs and support consistent temperature management. Commercial property developers have been encouraged by regional building codes to install efficient HVAC solutions, while industries prefer these systems for their balance of efficiency and performance. Industrial adoption is largely concentrated in logistics hubs, light manufacturing units, and food processing facilities where precise temperature control is essential. The diversity of applications has reinforced demand beyond residential adoption, ensuring steady revenue growth from large-scale installations.

Public policy and regulatory frameworks are significant accelerators for air to air heat pump adoption. National energy efficiency goals and strict building performance standards have led to mandatory requirements in several countries, ensuring that property developers and facility managers incorporate efficient heating and cooling units. Incentives offered by governments, such as grants and subsidies, have lowered the financial barrier for both residential and commercial consumers. This regulatory influence has created a predictable demand environment where suppliers can scale production with greater confidence. The policy-driven adoption cycle is anticipated to remain a decisive factor, with regional compliance acting as a key differentiator in competitive strategies.

The competitive landscape of the air to air heat pump industry is being shaped by product innovation, distribution partnerships, and hybrid integration with other HVAC technologies. Leading manufacturers are focusing on variable refrigerant flow systems, inverter-based models, and refrigerants that comply with environmental safety requirements. Collaboration with real estate developers and utilities has improved market penetration, while strong aftersales service networks are being built to retain customers. Strategic moves, including mergers, acquisitions, and regional manufacturing expansions, are positioning companies to capitalize on growing demand across multiple sectors. In my opinion, brands that deliver cost-effective solutions with consistent performance will be best placed to capture long-term growth.

| Country | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| France | 10.2% |

| UK | 9.2% |

| USA | 8.2% |

| Brazil | 7.3% |

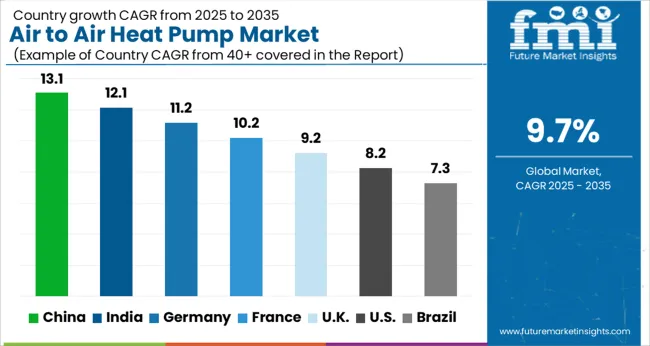

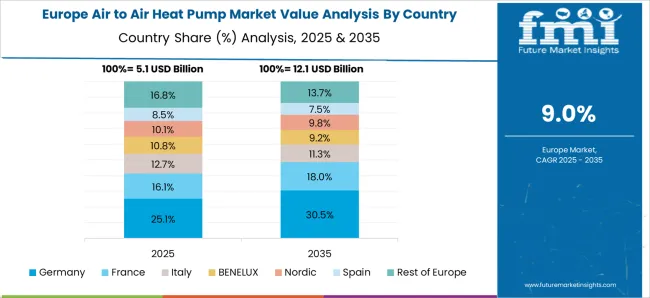

The global air to air heat pump market is anticipated to grow at a CAGR of 9.7% between 2025 and 2035. China leads growth at 13.1%, followed by India at 12.1%, Germany at 11.2%, France at 10.2%, the United Kingdom at 9.2%, and the United States at 8.2%. Expansion is being supported by rising investments in residential retrofits, energy-efficient commercial buildings, and climate-focused construction programs. China and India dominate due to large-scale housing developments, policy-driven adoption, and manufacturing scale. Germany benefits from structured energy regulations and advanced engineering practices, while France emphasizes building modernization and compliance with energy codes. The United Kingdom shows traction in retrofitting projects and public infrastructure upgrades, while the United States progresses at a measured pace as demand is concentrated in retrofits and region-specific energy programs. The analysis spans more than 40+ countries, with the leading markets detailed below.

The air to air heat pump market in China is projected to grow at a CAGR of 13.1% from 2025 to 2035, supported by large residential programs, accelerated retrofits in tier two and tier three cities, and active provincial incentives. Building energy codes have been enforced more strictly, guiding developers toward higher efficiency HVAC choices. Procurement by public housing agencies has been widened, creating steady tender volumes for mid-capacity units. Commercial offices and hospitality properties have shifted toward inverter-based systems and VRF configurations to manage peak loads and cut utility bills. Supply chains have been localized, and component ecosystems for compressors, controls, and heat exchangers have been strengthened. Based on current policy direction and developer behavior, China is expected to remain the anchor of global shipments through 2035, with exports supported by competitive manufacturing.

The air to air heat pump market in India is anticipated to rise at a CAGR of 12.1% during 2025 to 2035, led by state programs for efficient buildings, green code adoption by major urban bodies, and rising air conditioning penetration in tier two cities. Developers have shown preference for packaged solutions that combine filtration, dehumidification, and smart controls. Commercial complexes, tech parks, and hospitality assets have prioritized lifecycle cost over low upfront pricing, which favors high seasonal efficiency ratings. Training initiatives for installers have been expanded by OEMs and EPC partners, improving commissioning quality and warranty outcomes. With logistics parks and light manufacturing expanding along freight corridors, steady demand for mid to high tonnage systems is expected. India is positioned to be the fastest rising demand center in South Asia through the forecast horizon.

The air to air heat pump market in Germany is projected to advance at a CAGR of 11.2% between 2025 and 2035, supported by stringent building performance rules, federal incentives, and disciplined retrofit schedules. Heat pump readiness has been embedded in many renovation plans, giving preference to solutions that integrate with heat recovery ventilation and smart thermostats. Commercial properties have adopted metered energy service contracts, creating predictable payback for efficient HVAC. Noise norms and seasonal efficiency thresholds have guided product portfolios toward quieter outdoor units and advanced defrost logic. Distribution has remained professionalized through trained installers and certified dealers, which stabilizes service outcomes. Given the combination of policy certainty and engineering depth, Germany is expected to maintain a premium share in Europe with strong replacement cycles through 2035.

The air to air heat pump market in the UK is expected to increase at a CAGR of 9.2% from 2025 to 2035, propelled by grant schemes, EPC rating pressures on landlords, and active retrofit campaigns for aging housing stock. Housing associations and local councils have issued frameworks that specify high SCOP equipment, ensuring consistent volumes for compliant models. Light commercial sites such as retail, education, and small offices have pursued quick installation formats with Wi-Fi controls for occupancy scheduling. Grid flexibility programs have been encouraged, allowing time-of-use tariffs to support optimized operation. With installer capacity growing and distributor inventories normalized, a steady climb in annual installations is anticipated. The UK is likely to post consistent gains as retrofit intensity and landlord compliance remain in focus.

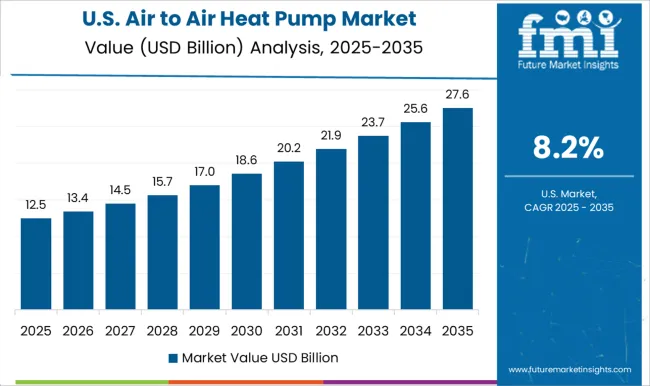

The air to air heat pump market in the USA is forecast to grow at a CAGR of 8.2% over 2025 to 2035, aided by federal tax credits, state rebates, and utility programs that reward high HSPF and SEER ratings. Regional adoption differences persist, with strong traction in the Southeast and Mid-Atlantic, and rising interest in the Northeast through cold-climate models. Multifamily retrofits and suburban single-family replacements have been prioritized, while small commercial sites adopt packaged rooftop units with variable capacity. Distribution through contractor networks and big-box channels has been balanced, improving product access. The market is expected to expand steadily as codes tighten and demand response incentives encourage efficient operation. With service quality and installer training improving, replacement demand should remain resilient through 2035.

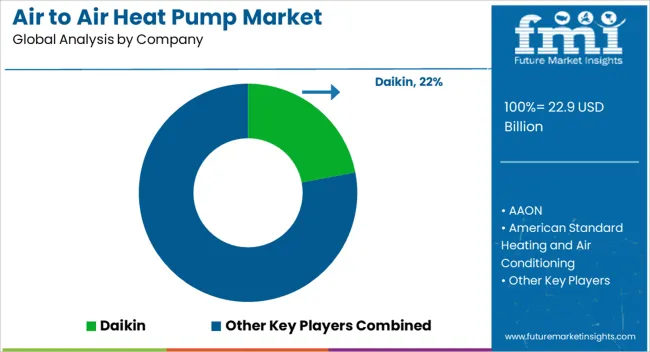

Competition in the air to air heat pump market is shaped by technological capability, energy efficiency performance, global distribution reach, and adaptation to regional building codes. Daikin leads with its broad product range, advanced inverter systems, and extensive service networks, making it a dominant name in both residential and commercial segments. Carrier, Trane, and Lennox maintain strong market shares in North America by leveraging established dealer channels and trusted service reliability. Fujitsu General, Panasonic, LG Electronics, and Samsung expand their footprint through compact designs, smart connectivity features, and aggressive marketing strategies across Asia and Europe. Bosch Thermotechnology and Stiebel Eltron focus on premium solutions in Europe, emphasizing precision engineering, reliability, and compliance with strict efficiency regulations. American Standard Heating and Air Conditioning, Bard HVAC, and Rheem remain key players in the USA, driven by deep contractor relationships and localized product portfolios tailored to climate-specific needs. GREE Comfort and MRCool strengthen their presence with competitively priced systems that target mass adoption, particularly in emerging economies. Napoleon brings niche strength in hybrid solutions combining heating and cooling versatility, while AAON focuses heavily on customized commercial systems for institutional and industrial spaces. In my view, competitive advantage in this market will favor brands that emphasize cost-effective installation, refrigerant transition readiness, and durable service models while scaling innovation in connectivity and hybrid energy integration. Players capable of balancing global reach with localized adaptation are expected to secure long-term market positioning.

| Item | Value |

|---|---|

| Quantitative Units | USD 22.9 Billion |

| Product | Ductless and Ducted |

| Application | Residential and Commercial |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Daikin, AAON, American Standard Heating and Air Conditioning, Bard HVAC, Bosch Thermotechnology, Carrier, Fujitsu General, GREE Comfort, LG Electronics, Lennox, MRCOOL, Napoleon, Panasonic, Rheem, Samsung, Stiebel Eltron, and Trane |

| Additional Attributes | Dollar sales, share, growth forecasts, competitor strategies, regulatory impact, consumer adoption trends, distribution channels, pricing dynamics, technology integration, and regional demand shifts. |

The global air to air heat pump market is estimated to be valued at USD 22.9 billion in 2025.

The market size for the air to air heat pump market is projected to reach USD 57.7 billion by 2035.

The air to air heat pump market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in air to air heat pump market are ductless and ducted.

In terms of application, residential segment to command 46.3% share in the air to air heat pump market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Commercial Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Air-to-Air Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Air Fryer Paper Liners Market Size and Share Forecast Outlook 2025 to 2035

Air Struts Market Size and Share Forecast Outlook 2025 to 2035

Airless Paint Spray System Market Size and Share Forecast Outlook 2025 to 2035

Air Caster Skids System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Molecular Contamination Control Services Market Forecast and Outlook 2025 to 2035

Airflow Balancer Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Environment Sensor Market Forecast and Outlook 2025 to 2035

Aircraft Flight Control System Market Size and Share Forecast Outlook 2025 to 2035

Airborne Radar Market Size and Share Forecast Outlook 2025 to 2035

Airport Ground Transportation Market Forecast and Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA