The global Water Source Heat Pump will witness tremendous growth driven by the increasing demand for energy-efficient and environmentally friendly heating, air conditioning solutions.

With water the source of energy exchange, water source heat pumps are quite popular in commercial, industrial, and residential applications. Growing concern over emissions and rising commitment to green building standards are driving the market's expansion. Technological innovations in variable refrigerant flow integration and advanced control systems have even made water source heat pumps more efficient, more versatile than ever.

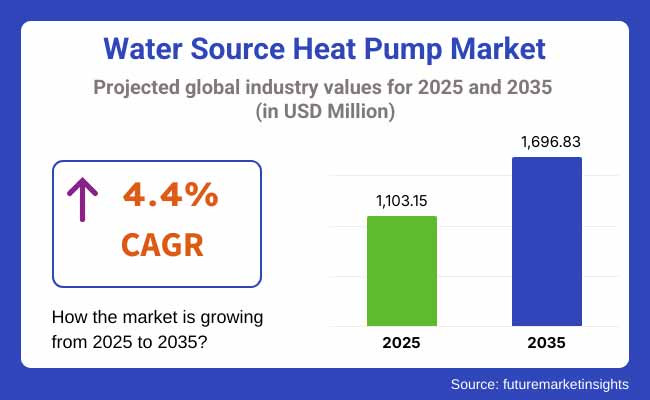

The water source heat pumps market is projected to exceed USD 1,696.83 Million by 2035, growing at a CAGR of 4.4% during the forecast period.

North America is the leading market for water source heat pump technology, energized by the two largest markets of the United States and Canada. The area enjoys stringent energy efficiency legislation and incentive policies that promote the adoption of new energy technologies.

Ongoing remodelling projects in commercial buildings, as well as government moves to reduce greenhouse gas emissions, are both significant growth drivers. However, another major factor for North America is sustainable development and the popularization of green certifications such as LEED this will help increase product demand. Cutting-edge developments further improve the area's technical research capabilities in smart control and advanced refrigerants.

Europe is a key market for water source heat pump, aided by strong government initiatives for net-zero emissions. Territories such as Germany, Britain, France and Holland are attaching importance to renewable energy integration as well as energy-efficient building solutions.

European Union policies, such as its Energy Performance of Buildings Directive (EPBD), have sped up the adoption of eco-compatible HVAC systems. The green building wave and the upgrading of aging infrastructure, too, serve to increase market demand. On the other hand, higher awareness of climate change and low-carbon targets are both driving forces behind the sustainable heating and cooling as a service industry.

Asia-Pacific engages in urbanization policy, construction-oriented infrastructure expansion, energy conservation, and so on, which explains why this region is anticipated to be the fastest-growing market for water source heat pumps. Places like China, Japan, South Korea, and Australia gain market share by government incentive programs, which promote renewable energy and energy policies that are simply too strict. Setting up commercial complexes, hospitals, schools or other places for everyday use further adds to market growth.

Challenges

High Installation Costs and Infrastructure Requirements

For the Water Source Heat Pump (WSHP) Market, the top difficulty is the huge initial installation cost and the need for professional infrastructure support. Such infrastructure includes access to water sources and drilling. Retrofitting existing buildings with WSHP systems can be complex and expensive, and is a deterrent to potential customers in both the residential and commercial sectors.

Regulatory and Environmental Concerns

On the water extraction, thermal discharge, and system, efficiency improvements are hindered as environmental regulations become stricter and more demanding. Adhering to these regulations as they change can slow project approvals and inflate the operational costs of WSHP manufacturers and installers.

Opportunities

Growing Focus on Energy Efficiency and Sustainability

As energy-efficient, environmentally friendly heating cooling solutions are gaining in popularity, there are opportunities for the WSHP Market. WSHP promotion is becoming both a government and organizational responsibility. Through giving incentives to customers and providing funds rebates and green building certifications (LEED, etc.), WSHP is beginning to achieve greater market recognition.

Expansion in Urban and Commercial Infrastructure Projects

As the rise in urbanization continues and sustainable building methods develop momentum, with large commercial complexes, hospitals, universities, schools of higher learning, and government department premises being constructed in all new forms, the need for WSHP systems is becoming increasingly urgent. Technological advancements such as hybrid WSHP systems and integration with renewable energy sources are also bringing new opportunities to the market.

By 2025 to 203,5 meanwhile, smart WSHP systems with IoT capabilities and AI-driven energy management are expected to drive forward the market. The growing adoption of district heating and cooling networks and integration with geothermal energy will further drive the market.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with water-use and energy-efficiency regulations |

| Market Demand | Growth driven by energy-efficiency awareness |

| Industry Adoption | Adoption in new commercial and residential buildings |

| Supply Chain and Sourcing | Dependence on traditional manufacturing and local supply chains |

| Market Competition | Dominance of established HVAC manufacturers |

| Market Growth Drivers | Emphasis on reducing carbon footprint and achieving energy savings |

| Sustainability and Energy Efficiency | Use of energy-efficient compressors and environmentally friendly refrigerants |

| Integration of Digital Innovations | Limited use of remote monitoring and control systems |

| Advancements in System Design | Standard WSHP configurations |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Implementation of stricter emissions standards and enhanced water usage regulations |

| Market Demand | Surge in demand from smart cities, green buildings, and renewable-integrated projects |

| Industry Adoption | Broad integration into retrofitting projects and large-scale infrastructure developments |

| Supply Chain and Sourcing | Expansion into smart component sourcing and eco-friendly materials |

| Market Competition | Increased competition from specialized green technology firms and smart HVAC solution providers |

| Market Growth Drivers | Government incentives, smart grid integration, and advanced heat pump technologies |

| Sustainability and Energy Efficiency | Expansion of zero-carbon and hybrid systems with advanced thermal energy storage solutions |

| Integration of Digital Innovations | Adoption of IoT-enabled WSHPs, AI-based optimization, and predictive maintenance technologies |

| Advancements in System Design | Customizable modular WSHP systems with smart energy management and enhanced connectivity |

As more and more people in the United States adopt energy-efficient air conditioning systems, the Water Source Heat Pump (WSHP) market shows steady growth. Driven by sustainable building science and accompanied by government policies and tax breaks favouring economies of scale production, WSHPs are being installed in both residential and low-rise commercial buildings. In addition, there is an upward commitment around the world to put existing structures in shape, which will feed more needs for WSHPs in these markets.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 4.2% |

In the United Kingdom, the WSHP market, as part of the country's overall increase in heat production, reflects its commitment to carbon neutrality and looking for renewable rather than fossil energy sources. Housing policy with public utilities' provision helps drive up market demand, together with the government's rewards for heat pump installations. Now greater awareness of ecological heating sources supports further development.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

The WSHP market in the European Union is helped by strict environmental regulations and energy-saving building targets across Europe. Major industries such as multi-family housing, hotels and commercial property are adopting WSHP technology to comply with the EU Green Deal-not to mention tight national energy efficiency goals.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

South Korea's WSHP market is expanding moderately. Modernizing its heating and cooling infrastructure on a wide scale is changing the profile of urban life all along these five main train lines within half-hour walks from viable in-city homes, one built in the 1960s on modern foundations etc. At the same time, budding 'smart cities' intensify encouragement for efficient HVAC systems, including WSHPs, in both public development jobs and private industry segments.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The water-to-air heat pump has a dominant market share in water source heat pumps, because of its wide adaptability in many parts of the country and with different building types. Heating is supplied throughout homes and light commercial buildings by systems that pump heat from a water source into the air in ducts outside the building. They are very suitable for residential and light commercial heating and cooling applications.

Because they can be easily installed into conventional ductwork systems, as well as saving 50% on initial cost this has made them the basic choice of new construction and retrofit applications in recent years. Water-to-air heat pumps also offer higher efficiency and lower greenhouse gases than traditional heating and cooling systems.

With the global priority of saving energy, demand for these systems is growing in the city regions where there are access to water bodies or underground water sources is feasible. In addition, financial incentives can be found in many places now that promote the adoption of this type of HVAC technology.

The dominant position held by the closed loop water source heat pumps in the heating and cooling market is due to its excellent performance (high-efficiency) combined with more modest environmental impacts. Water or an antifreeze solution is pumped continually around a sealed loop or loops buried in the ground, submersed in water. Potable supply systems expand on this basic idea.

Consequently, new water sources. Right now, this type of system forms a particularly fast-growing part of the market in areas where environmental laws are strict: it does not overload local water supply resources, and there is no disturbance to biological ecosystems. By making full use of the constant temperature of groundwater or surface water, this system offers warm and cool performance throughout the whole year.

What's more, since they use sealed circulating Liquid heaters instead of simple absorption refrigeration equipment, they require little maintenance and therefore their use costs are lower. The attention to prominence of sustainable building and environmental rating systems such as LEED is driving the push for closed-loop water source heat pumps in both commercial and residential markets.

Instead of trying to meet the requirements for energy efficiency through expensive day-after-day correcting measures, more developers and occupants are joining in to select closed-loop technologies. They want their buildings' use of energy and water to be compatible with ecology for the long term.

The water source heat pump market is gaining traction due to increasing demand for energy-efficient heating and cooling solutions. These systems are widely used in residential, commercial, and industrial applications to leverage stable water temperatures for efficient heat exchange.

The market benefits from growing sustainability trends and governmental regulations encouraging green building technologies. Innovations in variable refrigerant flow systems and advanced heat pump designs are further accelerating market growth.

Market Share Analysis by Key Players & Manufacturers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Daikin Industries Ltd. | 20-25% |

| Carrier Global Corporation | 15-20% |

| Trane Technologies plc | 12-17% |

| Bosch Thermotechnology | 8-12% |

| Mitsubishi Electric Corporation | 5-10% |

| Other Manufacturers | 25-35% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Daikin Industries Ltd. | Advanced water source heat pumps with high energy efficiency and smart control systems for commercial use. |

| Carrier Global Corporation | Sustainable HVAC solutions, including modular water source heat pumps for multi-zone applications. |

| Trane Technologies plc | Energy-efficient water source heat pump systems with enhanced indoor air quality and low environmental impact. |

| Bosch Thermotechnology | Compact and flexible heat pump systems suitable for both small and large building applications. |

| Mitsubishi Electric Corporation | Innovative water source heat pump solutions with inverter technology and low noise operations. |

Key Market Insights

Daikin Industries Ltd. (20-25%)

Daikin leads the market by offering high-performance water source heat pumps with advanced energy-saving features and intelligent controls.

Carrier Global Corporation (15-20%)

Carrier delivers scalable water source heat pump solutions ideal for diverse commercial environments, promoting energy efficiency and environmental responsibility.

Trane Technologies plc (12-17%)

Trane specializes in sustainable HVAC systems, including highly adaptable water source heat pumps for reducing operational costs and emissions.

Bosch Thermotechnology (8-12%)

Bosch offers versatile water source heat pump solutions focused on compact designs and superior system reliability.

Mitsubishi Electric Corporation (5-10%)

Mitsubishi emphasizes innovation through inverter-driven water source heat pumps that deliver quiet and efficient climate control.

Other Key Players (25-35% Combined)

Numerous regional and niche manufacturers are enhancing the market with custom-built water source heat pumps, contributing to increased adoption in green buildings and retrofitting projects worldwide.

The overall market size for water source heat pump market was USD 1,103.15 Million in 2025.

The water source heat pump market is expected to reach USD 1,696.83 Million in 2035.

The water source heat pump market will be driven by increasing energy efficiency regulations, growing demand for sustainable HVAC solutions, and rising adoption in residential and commercial sectors, particularly favouring closed loop and water-to-water systems for eco-friendly heating and cooling.

The top 5 countries which drives the development of water source heat pump market are USA, European Union, Japan, South Korea and UK.

Closed Loop Technology demand supplier to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Application, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Application, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 30: Western Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 38: Eastern Europe Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 40: Eastern Europe Market Volume (Units) Forecast by Application, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Application, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 54: East Asia Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 56: East Asia Market Volume (Units) Forecast by Application, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Technology, 2018 to 2033

Table 62: Middle East and Africa Market Volume (Units) Forecast by Technology, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 64: Middle East and Africa Market Volume (Units) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Technology, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 14: Global Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 18: Global Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Technology, 2023 to 2033

Figure 23: Global Market Attractiveness by Application, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 38: North America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 42: North America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Technology, 2023 to 2033

Figure 47: North America Market Attractiveness by Application, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Technology, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 62: Latin America Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 66: Latin America Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Technology, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 86: Western Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 90: Western Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Technology, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Technology, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 110: Eastern Europe Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 114: Eastern Europe Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Technology, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Technology, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Technology, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Technology, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 158: East Asia Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 162: East Asia Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Technology, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Technology, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Technology, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Technology, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Technology, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Technology, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Application, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Technology, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seawater Source Heat Pump System Market Size and Share Forecast Outlook 2025 to 2035

Air Source Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Commercial Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Residential Air to Water Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Demand for R290 Air Source Heat Pump in USA Size and Share Forecast Outlook 2025 to 2035

Ultra-low Temperature Air Source Heat Pump Units Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Heat Pump Laundry Dryer Rotary Compressors Market Size and Share Forecast Outlook 2025 to 2035

Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Dewatering Pump Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Dewatering Pump Manufacturers

Gas Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Sea Water Pumps Market Growth - Trends & Forecast 2025 to 2035

Water Underfloor Heating Thermostat Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Solar Water Pumps Market Size and Share Forecast Outlook 2025 to 2035

Rotary Heat Pump Compressors Market Size and Share Forecast Outlook 2025 to 2035

Ducted Heat Pump Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA