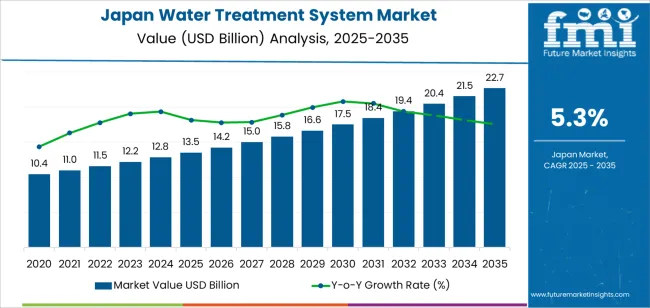

Japan’s water treatment system demand is valued at USD 13.5 billion in 2025 and is expected to reach USD 22.7 billion by 2035, reflecting a CAGR of 5.3%. Demand is supported by aging municipal infrastructure, rising wastewater treatment requirements, and the need to address contaminants such as nitrates, industrial residues, and emerging micro-pollutants. Urban density, industrial activity, and strict national water quality standards continue to reinforce investments across both municipal and commercial facilities. Upgrades focusing on system reliability, energy efficiency, and automated monitoring remain central to long-term planning.

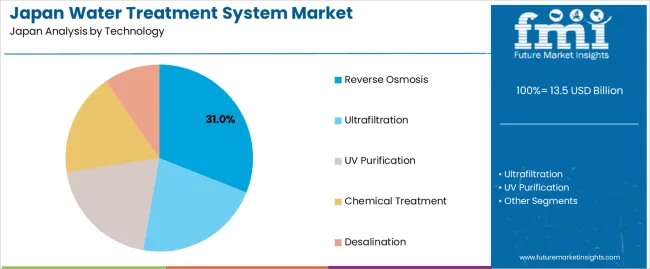

Reverse osmosis is the leading segment, used extensively in industrial water preparation, brackish water desalination, and high-purity treatment for electronics and pharmaceutical facilities. RO systems offer high dissolved solids removal and predictable performance when integrated into multi-stage processes. Advancements in membrane chemistry, anti-fouling design, and energy recovery components are improving operational efficiency and extending maintenance intervals.

The strongest demand is concentrated in Kyushu and Okinawa, Kanto, and Kinki, where urban development, industrial clusters, and municipal treatment capacity drive continued investment. Key suppliers active in Japan include Veolia Water Technologies, Veolia Water Technologies & Solutions, Xylem Inc., Pentair plc. Their activities focus on membrane-based systems, digital process control, and high-capacity treatment solutions suited to diverse regional needs.

The 10-year growth comparison shows a balanced expansion shaped by infrastructure renewal, industrial compliance requirements, and long-term municipal investment. Between 2025 and 2030, growth will be stronger as utilities address aging treatment facilities and incorporate membrane filtration, advanced oxidation, and nutrient-removal technologies. Industrial users in electronics, chemicals, and food processing will add further demand through upgrades to meet high-purity and wastewater-discharge standards.

From 2030 to 2035, the growth curve shifts toward steadier expansion as large municipal and industrial projects reach completion. Procurement will increasingly reflect replacement cycles and system optimization, with facilities integrating automated controls, leak-detection tools, and predictive monitoring. Although the pace moderates relative to the early period, sustained investment in resilience, earthquake-prepared water networks, and contaminant-treatment upgrades will support consistent gains. The decade-long comparison shows a transition from early infrastructure-led acceleration to a mature phase anchored in lifecycle management, regulatory continuity, and stable operational needs across Japan’s municipal and industrial water-treatment systems.

| Metric | Value |

|---|---|

| Japan Water Treatment System Sales Value (2025) | USD 13.5 billion |

| Japan Water Treatment System Forecast Value (2035) | USD 22.7 billion |

| Japan Water Treatment System Forecast CAGR (2025-2035) | 5.3% |

Demand for water treatment systems in Japan is rising as municipalities, industries and businesses face increasing pressure to upgrade ageing infrastructure, enhance water quality and meet environmental regulations. A sizable portion of Japan’s water supply network and sewerage systems were installed decades ago and require modernisation to maintain reliability and safety. Technological migration toward membrane filtration, advanced disinfection and decentralised modular treatment systems contributes to increased procurement of new equipment.

Industrial sectors, including electronics, automotive and chemicals, demand high-purity water and stringent effluent control, which drives investment in specialised water treatment units. Consumer and commercial interest in safe drinking water, reuse and recycling also elevate system deployment in smaller municipal districts and private utilities. Growth is constrained by high capital expenditure for large-scale upgrades, shrinking population in many regions that reduces consumption growth, and fragmented utility ownership that slows implementation of unified solutions. Some rural areas may delay system replacement due to limited budgets or prioritise maintenance over full upgrade.

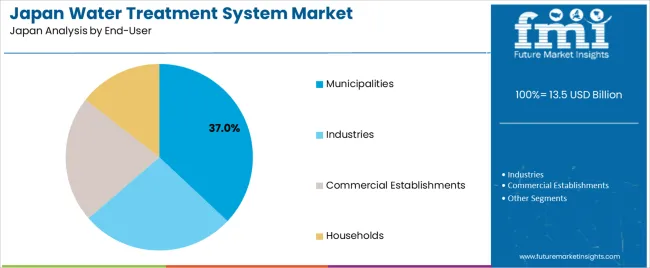

Demand for water treatment systems in Japan is shaped by regulatory requirements, water-quality concerns, and the need for high-reliability purification across municipal, industrial, commercial, and residential settings. Industry distribution across technology, application, and end-user groups reflects performance expectations, infrastructure maturity, and Japan’s focus on efficient, precision-based water-treatment processes.

Reverse osmosis holds an estimated 31.0% share of demand in Japan. Its broad use stems from its ability to remove dissolved solids, contaminants, and microorganisms across municipal, industrial, and residential systems. RO technology is widely adopted in areas where strict water-quality compliance and stable output are essential. Ultrafiltration accounts for 24.0%, supporting pre-treatment operations, pathogen removal, and industrial water conditioning. UV purification represents 18.0%, used primarily for chemical-free disinfection in commercial and residential settings. Chemical treatment holds 17.0%, supporting scaling control, microbial management, and industrial processing. Desalination represents 10.0%, serving select coastal installations and industrial operations with specialized water-supply constraints.

Key drivers and attributes:

Municipal water treatment holds an estimated 35.0% share of Japanese demand. Public water utilities rely on membrane technologies, disinfection systems, and chemical-treatment frameworks to comply with national standards and ensure consistent supply. Industrial process water represents 30.0%, supported by electronics, chemicals, food processing, and precision manufacturing that require highly controlled water specifications. Residential water purification holds 23.0%, including point-of-use filters, RO units, and UV systems driven by household quality concerns. Wastewater treatment accounts for 12.0%, involving municipal effluent management, industrial discharge treatment, and resource-recovery systems.

Key drivers and attributes:

Municipalities represent an estimated 37.0% share of water-treatment demand in Japan. Their operations rely on high-capacity purification, advanced filtration, and disinfection systems to deliver safe water across densely populated regions. Industries account for 34.0%, driven by high-specification requirements in semiconductor manufacturing, chemicals, and food processing. Commercial establishments represent 17.0%, including hospitality, healthcare, and retail facilities requiring localized purification for safe consumption and system protection. Households account for 12.0%, reflecting use of domestic RO units, activated-carbon filters, and UV systems for drinking and cooking applications.

Key drivers and attributes:

Infrastructure renewal needs, stricter water quality regulations, and increased industrial wastewater treatment demand are driving growth.

In Japan, demand for water treatment systems is increasing as aging municipal water and sewer infrastructure requires replacement or upgrade for reliability and seismic resilience. Stricter discharge standards and concerns about emerging contaminants such as PFAS and nitrates are causing municipalities and industries to invest in advanced treatment technologies. Industrial sectors such as semiconductors, chemicals, and pharmaceuticals require ultra-clean water and high purity effluent treatment, which elevates demand for advanced systems like reverse osmosis, membrane filtration and chemical dosing units. Growth in water reuse and zero-liquid discharge initiatives supports additional deployment of tertiary and compact modular treatment systems.

High project cost, limited new construction opportunities, and demographics-related demand decline restrain expansion.

Large scale water-treatment projects involve substantial capital outlays for engineering, construction and operation which may limit implementation especially in rural or declining-population regions. Japan's mature infrastructure and slowing population growth reduce incremental demand for new water supply systems in some domestic regions. Some treatment solutions face long validation and permitting processes and hospitals, factories or municipal sites may postpone system upgrades when existing systems remain operable. These factors moderate investment pace despite strong underlying drivers.

Shift toward digital monitoring & remote operation, growth in industrial water-reuse systems, and adoption of compact modular treatment units are shaping future trends.

Manufacturers are offering water treatment systems with integrated sensors, IoT connectivity and remote performance monitoring to enable predictive maintenance and optimise energy consumption. Industrial users are increasingly deploying water-reuse and recycling systems to reduce freshwater intake and wastewater discharge which drives demand for compact treatment modules, especially in process industries. Modular and plug-and-play water-treatment units designed for smaller sites or scattered facilities are gaining traction in Japan’s industry.

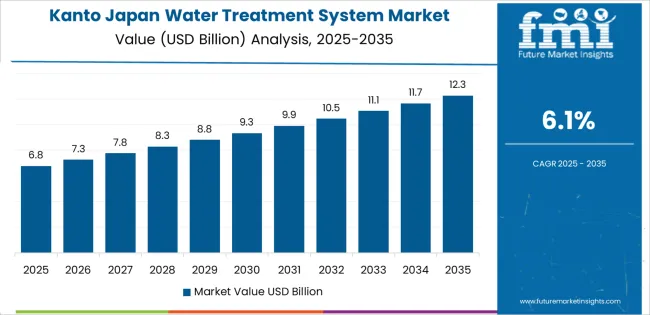

Japan’s demand for water treatment systems is increasing through 2035 as households, municipal utilities, and industrial facilities adopt improved filtration, disinfection, and pretreatment technologies. Growth is shaped by aging distribution networks, regional groundwater conditions, and expanding use of point-of-entry and point-of-use systems across residential buildings. Industrial users deploy pretreatment systems to support process stability, while commercial facilities rely on treatment equipment to maintain water quality for daily operations. Regional variations reflect differences in infrastructure age, population concentration, tourism activity, and industrial density. Kyushu & Okinawa leads with a 6.7% CAGR, followed by Kanto (6.1%), Kinki (5.4%), Chubu (4.7%), Tohoku (4.2%), and the Rest of Japan (3.9%)

| Region | CAGR (2025-2035) |

|---|---|

| Kyushu & Okinawa | 6.7 |

| Kanto | 6.1 |

| Kinki | 5.4 |

| Chubu | 4.7 |

| Tohoku | 4.2 |

| Rest of Japan | 3.9 |

Kyushu & Okinawa grows at 6.7% CAGR, supported by strong residential adoption, ongoing upgrades in municipal water networks, and increased reliance on treatment technologies to manage varying water-quality conditions across island and coastal environments. Prefectures such as Fukuoka, Kumamoto, and Kagoshima continue to expand point-of-entry and point-of-use treatment installations due to concerns related to mineral content, turbidity variation, and localized water-supply disruption during peak seasons. Municipal utilities upgrade filtration, disinfection, and monitoring systems to maintain compliance with national water-quality standards. Tourist-oriented facilities in Okinawa adopt purification systems to ensure consistent potable-water safety, while commercial buildings integrate treatment units to protect plumbing and reduce equipment wear. Stable consumption across households and businesses maintains regional system demand.

Kanto grows at 6.1% CAGR, driven by dense urban populations, aging water-distribution infrastructure, and increasing consumer reliance on point-of-use filtration solutions. Tokyo, Kanagawa, Chiba, and Saitama show widespread adoption of compact filtration devices addressing chlorine levels, residual contaminants, and taste-quality concerns. Commercial buildings and institutional facilities use treatment systems to protect equipment and maintain consistency in potable-water output. Municipal operators perform phased upgrades of membrane units, monitoring tools, and disinfection technologies to accommodate high daily demand. High-rise residential complexes integrate building-level purification systems to manage large consumption volumes. E-commerce channels support steady sales of household filters and cartridges, reinforcing recurring demand.

Kinki grows at 5.4% CAGR, supported by stable demand across Osaka, Kyoto, and Hyogo. Residential users maintain consistent adoption of point-of-entry and point-of-use purification units addressing residual chlorine, sediment variation, and mineral buildup. Commercial buildings rely on treatment systems for equipment protection and potable-water consistency. Municipal utilities undertake gradual modernization, including upgrades to filtration beds, chemical-dosing mechanisms, and monitoring infrastructure. Food-processing and beverage manufacturers adopt pretreatment units to ensure ingredient-quality reliability. Smaller communities near mountainous regions use treatment solutions to manage seasonal water-quality shifts. Although the region’s infrastructure is relatively modern, regular system replacement cycles and growth in compact home systems maintain demand.

Chubu grows at 4.7% CAGR, supported by moderate residential adoption and strong industrial activity across Aichi, Shizuoka, and Nagano. Manufacturing sites use pretreatment systems to control mineral content and reduce scaling within production equipment. Households adopt compact purification units to address sediment levels and taste-related concerns. Municipal utilities conduct limited but consistent upgrades to treatment lines, including filtration renewal and improved monitoring. Regions with tourism activity, especially mountain and coastal areas, rely on treatment systems for hotels, restaurants, and seasonal facilities. Growth is moderate due to balanced infrastructure quality and stable residential patterns, but recurring replacement cycles maintain steady equipment demand.

Tohoku grows at 4.2% CAGR, supported by regional residential use, moderate industrial activity, and ongoing upgrades in municipal water systems. Prefectures such as Miyagi, Iwate, and Fukushima install purification units to address mineral content, legacy contaminants, and taste-quality variation in groundwater-dependent communities. Municipal operators replace aging components in treatment plants, focusing on filtration consistency and disinfection reliability. Industrial facilities adopt pretreatment solutions for process-water stability, particularly in food production and equipment manufacturing. Cooler climates support steady household usage of filtration systems across the year. Growth remains modest due to lower population density but consistent across core user groups.

The Rest of Japan grows at 3.9% CAGR, supported by scattered residential adoption, small municipal systems, and localized industrial use. Households in rural prefectures rely on compact purification devices to manage mineral buildup, turbidity, and seasonal variation in well-water quality. Municipal utilities in smaller towns perform incremental upgrades to improve reliability in distribution networks. Industrial sites with modest process-water needs install pretreatment units to reduce scaling and maintain equipment durability. Retail availability of basic filtration units maintains recurring purchases across family users. Growth remains moderate due to smaller populations and limited commercial infrastructure, yet consistent replacement of filters and purification modules supports stable long-term demand.

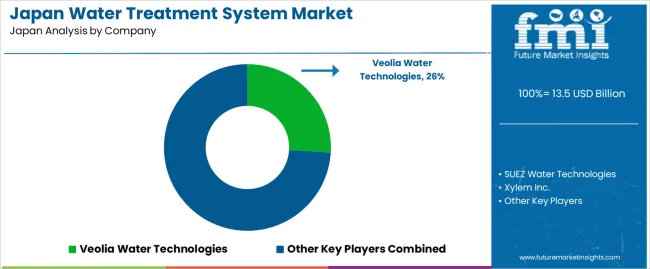

Demand for water treatment systems in Japan is shaped by established engineering firms supplying solutions for municipal utilities, industrial facilities, and commercial installations. Veolia Water Technologies holds the leading position with an estimated 26.0% share, supported by broad coverage across membrane treatment, sludge handling, biological processing, and advanced oxidation. Its position is reinforced by long-term public-sector contracts and consistent compliance with Japanese water-quality standards.

Veolia Water Technologies & Solutions and Xylem Inc. follow as key participants, offering filtration, UV disinfection, and monitoring systems suited to municipal drinking-water plants, industrial effluent streams, and decentralized treatment units. Their strengths include documented operational stability, strong field-service networks, and integration with digital oversight tools used by Japanese utilities. Pentair plc maintains a stable role through compact treatment solutions designed for residential and commercial use, emphasizing efficient filtration, disinfection, and point-of-entry control.

Competition across this segment centers on treatment efficiency, reliability under variable water conditions, lifecycle cost, and alignment with regulatory requirements. Demand is sustained by aging utility infrastructure, increased industrial water-quality needs, and broader adoption of membrane filtration, advanced oxidation processes, and automated monitoring across Japan’s municipal and industrial operations.

| Items | Values |

|---|---|

| Quantitative Units | USD billion |

| Technology | Reverse Osmosis, Ultrafiltration, UV Purification, Chemical Treatment, Desalination |

| Application | Municipal Water Treatment, Industrial Process Water, Residential Water Purification, Wastewater Treatment |

| End-User | Municipalities, Industries, Commercial Establishments, Households |

| Regions Covered | Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, Rest of Japan |

| Key Companies Profiled | Veolia Water Technologies, Veolia Water Technologies & Solutions, Xylem Inc., Pentair plc |

| Additional Attributes | Dollar sales by technology, application, and end-user categories; regional adoption trends across Kyushu & Okinawa, Kanto, Kinki, Chubu, Tohoku, and Rest of Japan; competitive landscape of water treatment solution providers; advancements in membrane filtration, UV disinfection, chemical dosing, and desalination systems; integration with Japan’s municipal water networks, industrial recycling systems, and household purification technologies. |

The global demand for water treatment system in japan is estimated to be valued at USD 13.5 billion in 2025.

The market size for the demand for water treatment system in japan is projected to reach USD 22.7 billion by 2035.

The demand for water treatment system in japan is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in demand for water treatment system in japan are reverse osmosis, ultrafiltration, uv purification, chemical treatment and desalination.

In terms of application, municipal water treatment segment to command 35.0% share in the demand for water treatment system in japan in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Demand Signal Repository Solutions Market Size and Share Forecast Outlook 2025 to 2035

Demand Side Management Market Size and Share Forecast Outlook 2025 to 2035

Demand Response Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

North America Shipping Supplies Market Trends – Innovations & Growth 2024-2034

Demand of Kozani Saffron in Greece Analysis - Size, Share & Forecast 2025 to 2035

Demand of No-acid Whey Strained Dairy Processing Concepts in European Union Size and Share Forecast Outlook 2025 to 2035

Demand for Bronte Pistachio in Italy Analysis - Size, Share & Forecast 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Gaming Monitor in Japan Size and Share Forecast Outlook 2025 to 2035

Glycine Soja (Soybean) Seed Extract Market Size and Share Forecast Outlook 2025 to 2035

Demand and Trend Analysis of Yeast in Japan - Size, Share, and Forecast Outlook 2025 to 2035

Demand of Pistachio-based desserts & ingredients in France Analysis - Size, Share & Forecast 2025 to 2035

Western Europe Men’s Skincare Market Analysis – Forecast 2023-2033

Demand and Trends Analysis of Stevia in Japan Size and Share Forecast Outlook 2025 to 2035

Japan Women’s Intimate Care Market Trends – Growth & Forecast 2024-2034

Demand and Trend Analysis of Fabric Stain Remover in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Korea Size and Share Forecast Outlook 2025 to 2035

Demand and Sales Analysis of Paper Cup in Western Europe Size and Share Forecast Outlook 2025 to 2035

Demand of MFGM-enriched Powders & RTDs in European Union Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA