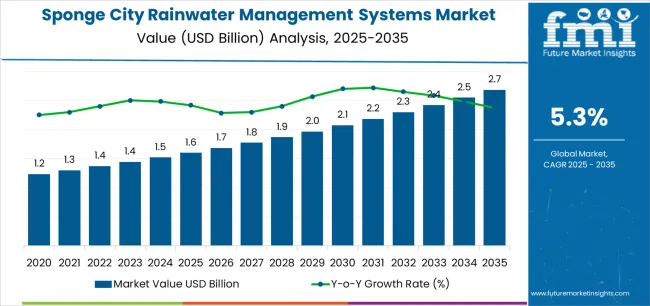

The global sponge city rainwater management systems market is projected to grow from USD 1.6 billion in 2025 to approximately USD 2.7 billion by 2035, recording an absolute increase of USD 1.1 billion over the forecast period. This translates into a total growth of 67.7%, with the market forecast to expand at a CAGR of 5.3% between 2025 and 2035.

The overall market size is expected to grow by nearly 1.7X during the same period, supported by increasing urban flooding challenges driving adoption of integrated water management infrastructure, growing government investment in climate adaptation programs across metropolitan regions, and rising emphasis on sustainable urban development requiring advanced stormwater retention systems for environmental compliance.

Urban planners and municipal authorities across developed and emerging economies are implementing comprehensive water management frameworks that prioritize natural infiltration processes over conventional drainage systems.

Climate change impacts, including intensified precipitation events and prolonged flooding periods, are accelerating infrastructure investments in permeable collection technologies and modular storage solutions. Metropolitan regions experiencing rapid urbanization face mounting pressure to retrofit existing drainage networks with sustainable systems that reduce surface runoff while supporting groundwater recharge objectives. Regulatory frameworks mandating low-impact development standards are creating sustained demand for engineered rainwater management modules that integrate with urban landscapes. Major infrastructure development projects, including smart city initiatives and transit-oriented developments, are incorporating sponge city principles as foundational design requirements, driving adoption of standardized collection modules and load-bearing systems that support vehicular traffic loads while maintaining hydraulic performance specifications.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 1.6 billion |

| Market Forecast Value (2035) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

| CLIMATE ADAPTATION REQUIREMENTS | INFRASTRUCTURE MODERNIZATION | REGULATORY FRAMEWORKS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

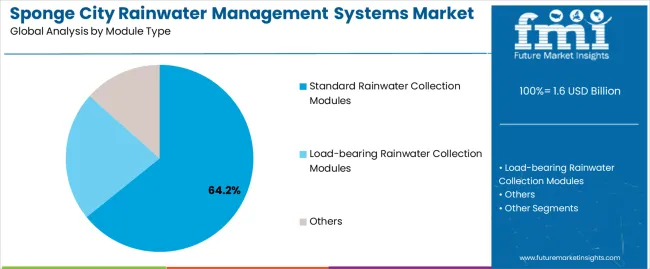

| By Module Type | Standard Rainwater Collection Modules, Load-bearing Rainwater Collection Modules, Others |

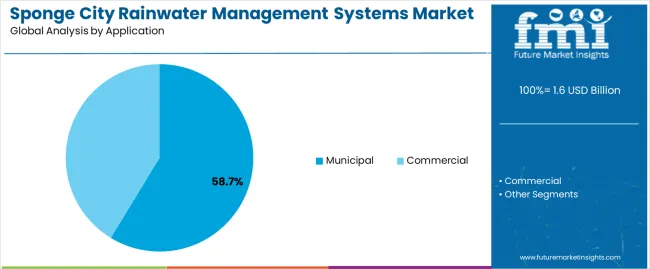

| By Application | Municipal, Commercial |

| By Region | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Segment | 2025 to 2035 Outlook |

|---|---|

| Standard Rainwater Collection Modules |

|

| Load-bearing Rainwater Collection Modules |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Municipal |

|

| Commercial |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

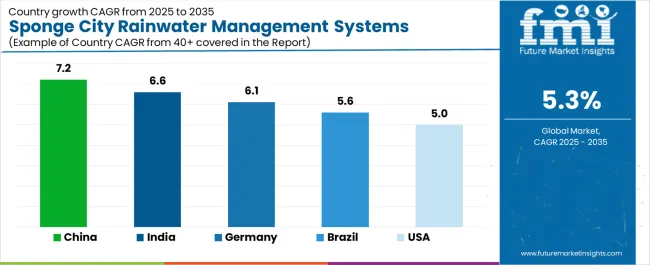

| Country | CAGR (2025 to 2035) |

|---|---|

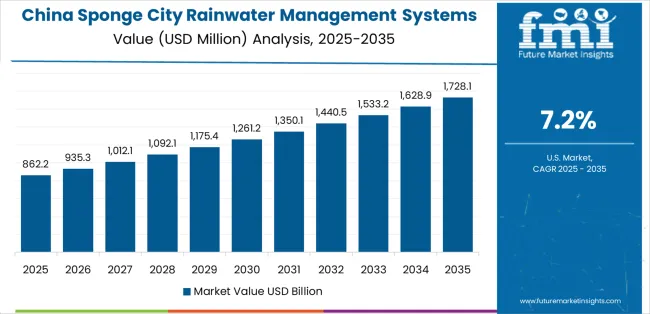

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| Brazil | 5.6% |

| United States | 5.0% |

Revenue from sponge city rainwater management systems in China is expected to expand at a CAGR of 7.2% from 2025 to 2035, driven by comprehensive national programs targeting 80% of urban areas for integrated water management implementation by 2030. The government's Sponge City Initiative, launched in 2015, has expanded to cover over 700 cities, creating sustained demand for modular collection systems across municipal infrastructure projects and commercial developments. State-owned enterprises and municipal water authorities are establishing regional manufacturing capabilities to support large-scale deployment requirements while meeting domestic content preferences. Major metropolitan regions including Beijing, Shanghai, Shenzhen, and Chengdu are implementing comprehensive retrofits of existing drainage infrastructure, creating opportunities for both standard and load-bearing module suppliers.

Demand for sponge city rainwater management systems in India is projected to grow at a CAGR of 6.6% from 2025 to 2035, supported by critical water scarcity challenges affecting major cities and government initiatives promoting rainwater harvesting across urban areas. The National Water Mission and Smart Cities Mission are driving infrastructure investments in integrated water management systems, with particular emphasis on groundwater recharge capabilities. State governments in Tamil Nadu, Karnataka, and Rajasthan have implemented mandatory rainwater harvesting regulations for commercial and residential buildings, creating sustained demand for modular collection infrastructure. Private developers and infrastructure contractors are establishing local manufacturing operations to serve growing project pipelines while navigating complex regulatory requirements across different states.

Demand for sponge city rainwater management systems in Germany is anticipated to increase at a CAGR of 6.1% from 2025 to 2035, supported by stringent environmental regulations and comprehensive water management frameworks requiring on-site stormwater retention for new developments. German municipalities have established detailed technical specifications for rainwater management systems, creating a preference for high-quality engineered solutions that demonstrate long-term performance reliability. The country's decentralized water management approach places responsibility on property owners to manage stormwater on-site, driving consistent demand across residential, commercial, and municipal projects. Major infrastructure investments in climate adaptation programs are supporting retrofits of existing urban areas with permeable systems that reduce combined sewer overflow events.

Demand for sponge city rainwater management systems in Brazil is expected to grow at a CAGR of 5.6% from 2025 to 2035, driven by infrastructure investments addressing chronic urban flooding challenges in major metropolitan regions and expanding adoption of sustainable urban development practices. Cities including São Paulo, Rio de Janeiro, and Belo Horizonte are implementing comprehensive stormwater management strategies that incorporate permeable collection systems in public infrastructure projects. Federal programs supporting municipal infrastructure modernization are providing financing mechanisms for climate adaptation investments, including integrated water management systems. Private sector developers are incorporating rainwater management features in commercial and residential projects to meet environmental licensing requirements and differentiate premium developments.

Demand for sponge city rainwater management systems in the United States is forecasted to increase at a CAGR of 5.0% from 2025 to 2035, driven by federal and state stormwater regulations requiring on-site management of runoff from new developments and infrastructure retrofits. The Environmental Protection Agency's Municipal Separate Storm Sewer System permit program establishes performance requirements for urban stormwater management, creating consistent demand for engineered collection systems across regulated areas. State-level initiatives, including California's sustainable groundwater management regulations and Northeastern states' combined sewer overflow reduction programs, are driving infrastructure investments in integrated water management systems. Private developers are incorporating rainwater management features to meet LEED certification requirements and local green building ordinances.

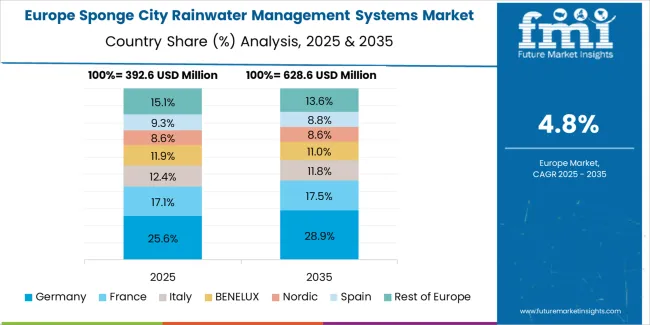

The sponge city rainwater management systems market in Europe is projected to grow from USD 398.5 million in 2025 to USD 712.4 million by 2035, registering a CAGR of 6.0% over the forecast period. Germany is expected to maintain its leadership position with a 29.3% market share in 2025, expanding to 30.1% by 2035, supported by comprehensive water management regulations and advanced technical standards for stormwater infrastructure.

Netherlands follows with a 19.7% share in 2025, projected to reach 20.4% by 2035, driven by extensive experience with integrated water management and ongoing climate adaptation programs in low-lying urban areas. The United Kingdom holds a 16.8% share in 2025, expected to reach 17.1% by 2035, supported by sustainable drainage system regulations and municipal flood risk management investments. France commands a 15.2% share in 2025, while Sweden accounts for 9.4% driven by Nordic sustainability standards. The Rest of Europe region is anticipated to maintain an 9.6% share through 2035, with emerging adoption in Eastern European cities implementing EU-aligned environmental standards and climate adaptation frameworks requiring integrated stormwater management infrastructure.

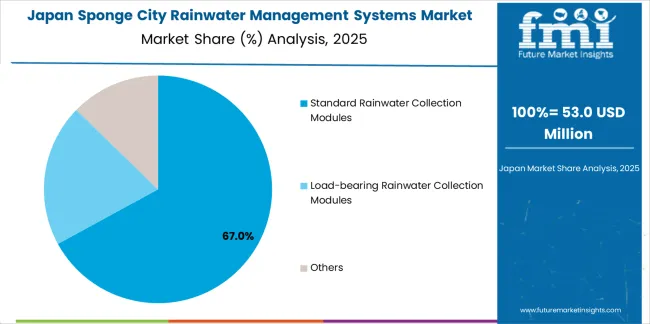

Japanese sponge city rainwater management operations reflect the country's rigorous technical standards and comprehensive disaster preparedness frameworks. Major municipalities including Tokyo, Osaka, and Yokohama maintain sophisticated stormwater management requirements developed through decades of typhoon and flood response experience. Government agencies enforce detailed specifications for rainwater collection systems, requiring extensive performance testing and certification processes that typically span 18-24 months before products gain approval for municipal infrastructure projects.

The Japanese market demonstrates unique application preferences, with significant demand for compact modular systems designed for high-density urban environments where underground space utilization requires efficient storage configurations. Municipal authorities specify precise infiltration rates, structural load capacities, and seismic performance requirements that exceed international standards, creating barriers for foreign suppliers without established local testing relationships and technical support infrastructure.

Regulatory oversight through the Ministry of Land, Infrastructure, Transport and Tourism emphasizes comprehensive disaster resilience and long-term performance validation. The procurement system favors suppliers with documented installation histories spanning multiple decades, creating advantages for established domestic manufacturers and joint ventures with Japanese engineering firms. Quality assurance protocols require batch testing and on-site inspection that necessitate local technical support capabilities.

Supply chain management prioritizes relationship-based partnerships rather than transactional procurement. Japanese municipalities typically maintain long-term supplier relationships, with contract renewals emphasizing performance consistency over competitive bidding. This stability supports specialized manufacturing investments tailored to Japanese specifications, including custom module dimensions compatible with local construction practices and traffic load requirements specific to Japanese vehicle weight distributions.

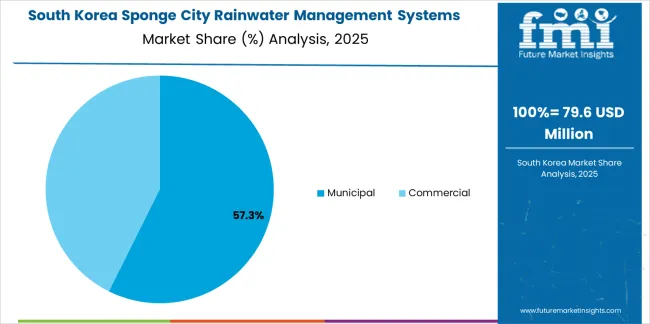

South Korean sponge city rainwater management operations reflect the country's rapid urbanization management and comprehensive smart city development programs. Major metropolitan governments including Seoul, Busan, and Incheon are implementing integrated water management strategies that incorporate rainwater collection systems throughout public infrastructure modernization projects and private development requirements. Government initiatives including the Water Circulation City Program establish performance benchmarks for stormwater retention, creating consistent demand for engineered modular systems across municipal and commercial applications.

The Korean market demonstrates particular strength in integrating rainwater management with urban redevelopment projects, with authorities requiring comprehensive stormwater solutions for high-rise residential complexes and commercial developments. This creates demand for load-bearing modules capable of supporting parking structures while maintaining hydraulic performance specifications. Technical requirements emphasize durability under freeze-thaw cycling and compatibility with district-scale water management networks that coordinate multiple building systems.

Regulatory frameworks administered by the Ministry of Environment establish stringent water quality standards and retention capacity requirements that influence system design specifications. Municipalities enforce non-point source pollution control measures requiring treatment of urban runoff before infiltration or discharge, driving adoption of integrated systems combining collection and filtration capabilities. The regulatory environment particularly favors suppliers demonstrating compliance with Korean Construction Standards and maintaining local technical support infrastructure.

Supply chain efficiency benefits from concentrated manufacturing capabilities and established relationships between major construction firms and material suppliers. Korean contractors typically prefer domestically manufactured systems due to warranty support considerations and compatibility with local installation practices. However, premium projects increasingly specify European-manufactured modules for applications requiring exceptional structural performance or specialized hydraulic characteristics, creating opportunities for international suppliers with established distribution partnerships and technical certification in Korean standards.

Market concentration reflects regional manufacturing advantages and technical certification requirements rather than global brand dominance. Leading suppliers maintain geographic strongholds where local engineering standards, contractor relationships, and regulatory familiarity create competitive barriers. European manufacturers leverage technical sophistication and comprehensive product documentation to command premium pricing in developed markets, while regional players in Asia Pacific compete through cost advantages and customization capabilities for local project requirements. Distribution strategies vary by market maturity, with established regions favoring direct relationships between manufacturers and large contractors, while emerging markets rely on distributor networks serving fragmented contractor bases.

Technical differentiation centers on structural performance, installation efficiency, and hydraulic modeling capabilities rather than proprietary technologies with patent protection. Load-bearing module suppliers compete on certified traffic ratings and connection system designs that simplify field installation while maintaining structural integrity. Standard module manufacturers emphasize cost competitiveness and availability through distributor networks serving residential and light commercial applications. Integration with monitoring technologies represents emerging differentiation as municipalities seek data-driven infrastructure management capabilities.

Market entry barriers include capital requirements for manufacturing facilities, engineering certification processes spanning multiple years, and contractor relationship development essential for project specification. Established suppliers maintain advantages through documented project histories, technical support infrastructure, and financial capacity to support bid bonds and performance guarantees required for large municipal contracts. Consolidation pressures increase as municipalities standardize specifications around fewer certified suppliers, driving smaller manufacturers toward niche applications or regional market focus. Vertical integration remains limited, with most suppliers maintaining pure manufacturing and technical support roles rather than construction capabilities. Strategic priorities include expanding certified product portfolios across traffic-rating categories, establishing regional manufacturing to serve growing markets while managing logistics costs, and developing digital monitoring capabilities that support municipal asset management requirements.

| Items | Values |

|---|---|

| Quantitative Units | USD 1.6 billion |

| Module Type | Standard Rainwater Collection Modules, Load-bearing Rainwater Collection Modules, Others |

| Application | Municipal, Commercial |

| Distribution Channel | Not Applicable |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, Middle East & Africa |

| Country Covered | China, India, Germany, Brazil, United States, and other 40+ countries |

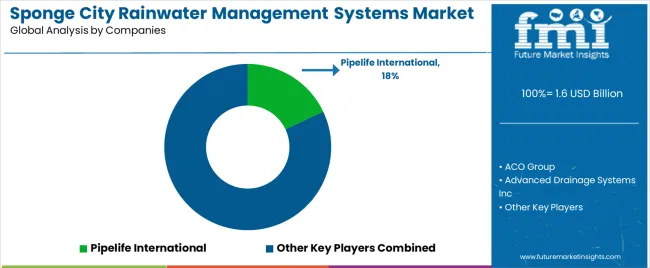

| Key Companies Profiled | Pipelife International, ACO Group, Advanced Drainage Systems Inc, Doctor Rain, ParkUSA, Oldcastle Infrastructure, StormTank, Xerxes, GRAF, FRÄNKISCH, Jiangsu Hippo Plastics, REHAU, Jiangsu Bluewater, Beijing Tidelion, Cirtex Industries Ltd, Jensen Precast, Baozhen |

| Additional Attributes | Dollar sales by module type/application, regional demand (NA, EU, APAC), competitive landscape, municipal vs commercial adoption, climate adaptation integration, and sustainable urban development innovations driving water management enhancement, environmental compliance, and infrastructure efficiency |

The global sponge city rainwater management systems market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the sponge city rainwater management systems market is projected to reach USD 2.7 billion by 2035.

The sponge city rainwater management systems market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in sponge city rainwater management systems market are standard rainwater collection modules, load-bearing rainwater collection modules and others.

In terms of application, municipal segment to command 58.7% share in the sponge city rainwater management systems market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sponge and Scouring Pad Market Growth – Size, Demand & Forecast 2024-2034

Sponge Applicator Market

Drain Sponges Market

Nonwoven Sponges Market Size and Share Forecast Outlook 2025 to 2035

Laparotomy Sponge Market Analysis – Size, Share & Forecast 2024-2034

Silicone Makeup Sponge Market Size and Share Forecast Outlook 2025 to 2035

Intercity Bus Travel Market Size and Share Forecast Outlook 2025 to 2035

Smart City Platforms Market Size and Share Forecast Outlook 2025 to 2035

Spasticity Treatment Market Size and Share Forecast Outlook 2025 to 2035

Smart City Kiosk Deployment Market – Digital Urbanization 2034

Electricity Transmission Infrastructure Market Size and Share Forecast Outlook 2025 to 2035

Cytotoxicity Assays Market Size and Share Forecast Outlook 2025 to 2035

Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Large Capacity Stationary Fuel Cell Market Size and Share Forecast Outlook 2025 to 2035

Food Authenticity Testing Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hospital Capacity Management Solutions Market Insights - Growth & Forecast 2024 to 2034

PEM Small Capacity Electrolyzer Market Size and Share Forecast Outlook 2025 to 2035

Radiation Toxicity Treatment Market Size and Share Forecast Outlook 2025 to 2035

Histamine Toxicity Market

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA