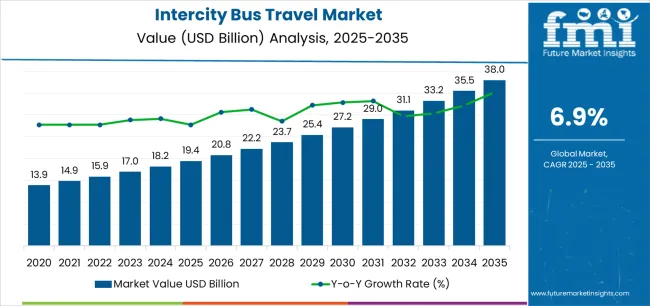

The Intercity Bus Travel Market is estimated to be valued at USD 19.4 billion in 2025 and is projected to reach USD 38.0 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The intercity bus travel market is witnessing consistent expansion driven by the rising demand for affordable, comfortable, and efficient transportation options. Increasing urban connectivity, growing domestic tourism, and improved highway infrastructure are supporting passenger mobility across regions. Operators are investing in modern fleets with enhanced comfort and safety features, while digitalization is transforming booking and payment systems.

The market outlook remains positive as economic growth and fuel-efficient vehicle technologies strengthen operational profitability. Environmental sustainability initiatives and government-led transportation development programs are also contributing to higher adoption rates.

Growth rationale is founded on the integration of technology-driven ticketing platforms, increased preference for convenient travel modes, and improved route optimization by operators As competition intensifies, service differentiation and strategic partnerships with tourism agencies are expected to enhance market penetration, driving steady revenue growth over the forecast period.

| Metric | Value |

|---|---|

| Intercity Bus Travel Market Estimated Value in (2025 E) | USD 19.4 billion |

| Intercity Bus Travel Market Forecast Value in (2035 F) | USD 38.0 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

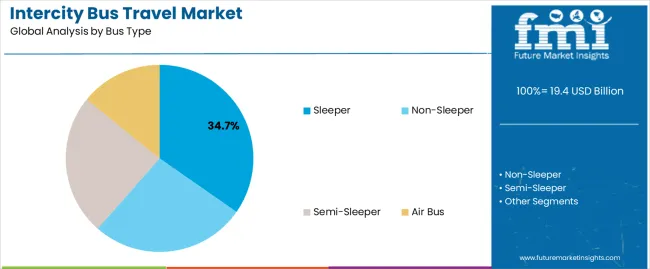

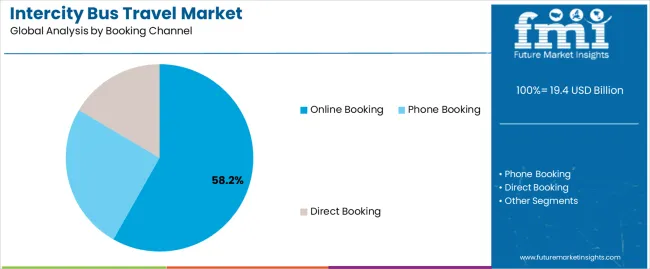

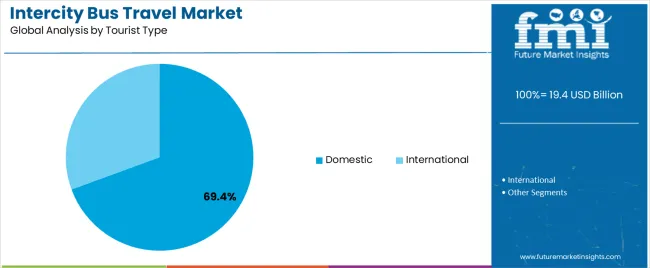

The market is segmented by Bus Type, Booking Channel, Tourist Type, Consumer Orientation, and Age Group and region. By Bus Type, the market is divided into Sleeper, Non-Sleeper, Semi-Sleeper, and Air Bus. In terms of Booking Channel, the market is classified into Online Booking, Phone Booking, and Direct Booking. Based on Tourist Type, the market is segmented into Domestic and International. By Consumer Orientation, the market is divided into Men and Women. By Age Group, the market is segmented into 26-35 Years, 15-25 Years, 36-45 Years, 46-55 Years, 56-65 Years, and 66-75 Years. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The sleeper bus segment, accounting for 34.70% of the bus type category, has emerged as the leading configuration due to its comfort, privacy, and suitability for long-distance overnight travel. Rising intercity connectivity and growing demand for convenient travel experiences have reinforced adoption.

Operators are upgrading fleets with ergonomically designed sleeper coaches, air suspension systems, and advanced amenities to attract premium travelers. Passenger preference for rest-oriented travel has supported segment stability, while cost-effective ticket pricing compared to rail and air alternatives has strengthened market competitiveness.

Continuous improvements in vehicle design and regulatory standards for passenger safety are further sustaining growth, ensuring that sleeper buses maintain a leading role in intercity travel offerings.

The online booking segment, holding 58.20% of the booking channel category, has maintained dominance as digital transformation reshapes the intercity transportation industry. Increased smartphone penetration, secure payment gateways, and transparent fare comparison platforms have accelerated the shift toward online reservations.

Operators and aggregators are leveraging mobile apps and real-time tracking systems to enhance user experience and operational efficiency. Dynamic pricing strategies and targeted digital promotions are further boosting customer engagement.

The convenience of cashless transactions and digital ticketing compliance has strengthened adoption among both frequent and occasional travelers Continued integration of AI-based personalization and loyalty programs is expected to solidify the leadership of online booking within the intercity bus travel ecosystem.

The domestic tourist segment, representing 69.40% of the tourist type category, has been driving the majority of demand due to growing inter-regional mobility and rising disposable incomes. Domestic tourism growth, supported by cultural, leisure, and business travel, has enhanced passenger traffic across both major and secondary routes.

Affordable ticket pricing, frequent service schedules, and improved travel comfort have reinforced the preference for intercity bus travel among local populations. Government initiatives promoting regional tourism and intercity connectivity have further strengthened this trend.

The segment’s sustained dominance is expected to continue as urbanization, digital booking accessibility, and flexible travel preferences contribute to increasing ridership within the domestic tourism segment.

From 2020 to 2025, the intercity bus travel market witnessed steady growth, with a historical CAGR of 5.1%. During this period, various factors contributed to this expansion, including increasing urbanization, rising disposable incomes, and advancements in bus technology enhancing the overall travel experience. Growing concerns about environmental sustainability prompted more individuals to choose bus travel over other modes of transportation, further bolstering market demand.

As we transition into the forecasted period from 2025 to 2035, the market is expected to experience an accelerated growth rate, with a projected CAGR of 7.3%. This forecasted surge can be attributed to several factors, including continued urbanization, improvements in bus technology making travel more efficient and comfortable, and an increasing emphasis on sustainable transportation options.

Evolving consumer preferences, innovative marketing strategies, and enhanced intermodal connectivity are anticipated to drive the intercity bus travel market to new heights in the coming decade.

| Historical CAGR 2020 to 2025 | 5.1% |

|---|---|

| Forecast CAGR 2025 to 2035 | 7.3% |

The provided table illustrates the top five countries in terms of revenue, with Canada holding a prominent position in the market. Canada leads the intercity bus travel market due to its vast geography and the need for reliable transportation in remote and rural areas.

Intercity buses connect these communities and foster economic development, social mobility, and tourism. Initiatives to enhance transportation networks further boost the market growth.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 7.9% |

| Canada | 9.7% |

| Italy | 5.5% |

| China | 3.8% |

| India | 8.1% |

Intercity bus travel is widely utilized in the United States due to its extensive network covering vast distances between cities and regions. The well-developed highway infrastructure and affordable bus fares make it a popular choice for domestic and international travelers.

Rising urban congestion and environmental concerns contribute to the preference for bus travel as a more sustainable and efficient mode of transportation. The convenience of direct routes, comfortable amenities, and competitive pricing further drive the popularity of intercity bus services in the United States.

The intercity bus travel market in Canada is essential for connecting remote and rural communities where other transportation options may be limited. The expansive geography, including vast wilderness areas and remote regions, necessitates reliable and accessible transportation services.

Intercity buses connect cities and towns, facilitating economic development, tourism, and social mobility. Initiatives to enhance intermodal transportation networks and address environmental sustainability contribute to the projected growth of the intercity bus travel market in Canada.

The intercity bus travel market is characterized by its significance in connecting historical and cultural destinations and serving domestic and international tourists. The rich cultural heritage, diverse landscapes, and numerous UNESCO World Heritage sites attract millions of visitors annually, creating demand for efficient transportation options between major cities and tourist destinations.

Intercity buses offer convenient and cost-effective travel solutions for tourists exploring iconic landmarks, picturesque towns, and scenic regions. Despite other transportation modes, such as trains, buses remain a popular choice for travelers seeking flexibility, affordability, and accessibility.

In China, the intercity bus travel market is utilized primarily for domestic travel, serving as an essential mode of transportation for urban and rural populations. The vast territory, rapid urbanization, and expanding middle class contribute to the demand for intercity bus services.

While high-speed rail and air travel are popular for long-distance journeys, intercity buses are crucial in connecting smaller cities, towns, and rural areas where rail and air infrastructure may be less developed. Government initiatives to improve transportation accessibility and reduce traffic congestion support the growth of the intercity bus travel market in China.

Intercity bus travel is extensively used in India due to its affordability, accessibility, and extensive route network covering diverse geographical regions. The large population, urbanization, and economic growth contribute to the demand for intercity bus services as a primary mode of transportation for short- and long-distance travel.

The diverse cultural heritage, religious sites, and tourist attractions further drive the utilization of intercity buses for leisure and pilgrimage travel. Government investments in road infrastructure development and initiatives to promote public transportation also support the growth of intercity bus travel market.

The below section shows the leading segment. Based on bus type, the AC buses are accounted to hold a market share of 31% in 2025. Based on the tourist type, the domestic segment is anticipated to hold a market share of 67% in 2025.

The widespread preference for AC buses stems from the driver of passenger comfort and convenience. Domestic tourists prioritize destinations within their own country due to ease of access, familiarity, and lower costs compared to international travel.

| Category | Market Share in 2025 |

|---|---|

| AC Buses | 31% |

| Domestic | 67% |

In 2025, the market share of AC buses stands at 31%, indicating a significant preference for air-conditioned comfort among travelers. AC buses offer enhanced comfort, especially during long-distance journeys, attracting passengers seeking a more pleasant travel experience. This trend reflects the increasing demand for amenities and convenience in intercity bus travel.

The domestic tourist segment is projected to dominate the market with a 67% share in 2025. This indicates a strong preference for domestic travel among travelers, driven by accessibility, familiarity with local destinations, and affordability.

The domestic segment dominance underscores the importance of catering to local tourism preferences and developing tailored services to meet domestic travelers' needs.

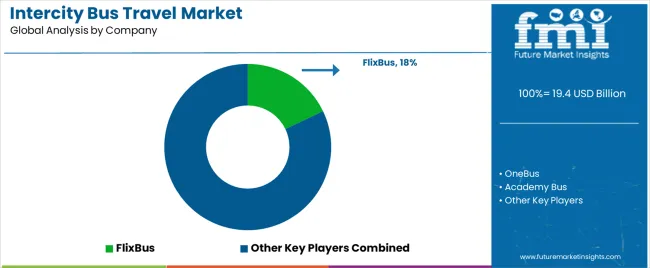

The competitive landscape of the intercity bus travel market features a mix of established players and emerging competitors vying for market share. Major bus operators, including both national and regional companies, compete based on factors such as route coverage, service quality, pricing, and customer experience.

Technological advancements and innovation play a significant role in shaping competitiveness, with companies investing in amenities such as Wi-Fi connectivity, on-board entertainment, and mobile ticketing to attract passengers. Partnerships, collaborations, and strategic alliances are also common strategies employed by bus operators to strengthen their market position and expand their reach in this competitive landscape.

Some of the key developments

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 18.1 billion |

| Projected Market Valuation in 2035 | USD 36.7 billion |

| Value-based CAGR 2025 to 2035 | 7.3% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD million |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Bus Type, Booking Channel, Tourist Type, Tour Type, Consumer Orientation, Age Group, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | OneBus; Academy Bus; Green Tortoise; Flixbus; Limoliner; Central Greyhound Lines; JR Group Japan; Miller Express; Keio Bus; BlaBlaBus; Rapid Penang |

The global intercity bus travel market is estimated to be valued at USD 19.4 billion in 2025.

The market size for the intercity bus travel market is projected to reach USD 38.0 billion by 2035.

The intercity bus travel market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in intercity bus travel market are sleeper, non-sleeper, semi-sleeper and air bus.

In terms of booking channel, online booking segment to command 58.2% share in the intercity bus travel market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Busbars Market Size and Share Forecast Outlook 2025 to 2035

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Business Analytics BPO Services Market Analysis – Size, Share & Forecast 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Bus Flooring Market Growth – Trends & Forecast 2025 to 2035

Bus Bellows Market Insights – Growth & Forecast 2025 to 2035

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

Competitive Overview of Business Analytics BPO Services Companies

Business Card Holder Market from 2024 to 2034

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Bus Chassis Market

Rubus Fructicosus (Blackberry) Seed Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA