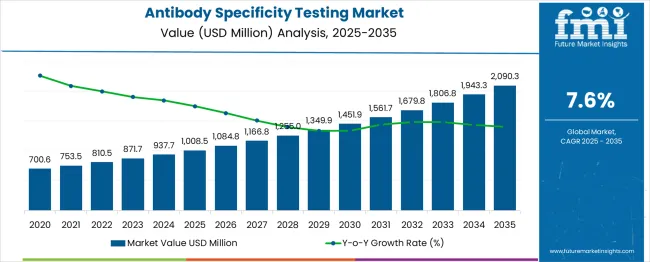

The antibody specificity testing market is valued at USD 1,008.5 million in 2025 and is expected to grow to USD 2,090.3 million by 2035, registering a CAGR of 8%. From 2021 to 2025, the market grows from USD 700.6 million to USD 1,008.5 million, with values increasing through USD 753.5 million, 810.5 million, and 871.7 million. This growth is driven by increasing research and development in healthcare, rising demand for personalized medicine, and advancements in diagnostic technologies. The need for highly specific antibody

Between 2026 and 2030, the market sees further expansion, advancing from USD 1,008.5 million to USD 1,451.9 million, with intermediate values of USD 1,084.8 million, 1,166.8 million, and 1,255.0 million. This phase is characterized by increased adoption in clinical diagnostics and the growing utilization of antibodies for therapeutic purposes. By 2035, the market continues to accelerate, reaching USD 2,090.3 million, driven by continuous product innovations, increased healthcare spending, and rising prevalence of autoimmune diseases. This results in a steady increase in market size, with incremental year-on-year growth figures reinforcing the demand for precise antibody testing solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 1,008.5 million |

| Forecast Value in (2035F) | USD 2,090.3 million |

| Forecast CAGR (2025 to 2035) | 8% |

The biotechnology market holds the largest share of the antibody specificity testing market, contributing about 25-30%. Biotechnology companies heavily rely on antibody specificity testing to develop novel monoclonal antibodies and biologics for therapeutic use. As research into biologics grows, especially in immunotherapy and biosimilars, the demand for accurate antibody testing is growing in tandem. The immunology market accounts for 20-25%, driven by the increasing need for testing in autoimmune disorders, vaccine development, and immune-oncology research. Specificity testing ensures that antibodies involved in immune response studies are targeting only the intended antigen.

The diagnostic market holds 18-22% of the share. Antibody specificity testing plays a vital role in ensuring that diagnostic antibodies provide accurate results by binding exclusively to their target, which is crucial for disease detection, especially in precision medicine. The pharmaceutical and biopharmaceutical market contributes about 15-18%, as testing is essential for ensuring the safety and efficacy of antibody-based therapies in clinical trials. Lastly, the R&D market represents 10-15%, with academic research institutions and contract research organizations using these tests to validate the reliability of antibodies in their studies.

Market expansion is being supported by the increasing awareness about the importance of antibody validation in scientific research and the corresponding demand for reliable testing solutions. Modern researchers are increasingly focused on ensuring reproducibility and accuracy in their experiments, particularly in areas such as drug discovery, biomarker identification, and diagnostic development. The proven efficacy of comprehensive antibody specificity testing in preventing false-positive results and ensuring experimental reliability makes it an essential component of quality research protocols.

The growing focus on regulatory compliance and standardization is driving demand for validated antibody testing products and services that meet international quality standards. Research institutions and pharmaceutical companies are increasingly investing in comprehensive antibody validation programs to support their research activities and regulatory submissions. The rising influence of scientific publishing requirements and funding agency guidelines emphasizing proper antibody validation is also contributing to increased adoption of specificity testing solutions across different research applications and therapeutic areas.

The market is segmented by product & services, technology, application, end use, and region. By product & services, the market is divided into products and antibody validation & specificity testing services. Based on technology, the market is categorized into immunoassay-based technologies, western blotting, immunochemistry, flow cytometry, and others. In terms of application, the market is segmented into research & development, drug discovery & development, proteomics & biomarker discovery, clinical diagnostics, and infectious diseases. By end use, the market is classified into pharmaceutical & biotechnology companies, academic & research institutes, diagnostic laboratories, and other end users. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

The products segment is projected to account for 63% of the antibody specificity testing market in 2025, reaffirming its position as the dominant category. This segment includes antibodies, control & standards, kits & reagents, and gene validation tools that are essential for conducting comprehensive antibody specificity testing. The strong market share reflects the fundamental need for reliable testing materials and reagents in research laboratories and pharmaceutical companies conducting antibody validation studies.

This segment forms the foundation of antibody specificity testing workflows, as it provides the essential components required for accurate and reproducible testing procedures. The continued dominance of products is supported by ongoing research activities, expanding pharmaceutical pipelines, and increasing focus on research quality and reproducibility. Scientific institutions and commercial laboratories require consistent supplies of high-quality testing products to maintain their antibody validation programs and support their research objectives.

Immunoassay-based technologies are projected to represent 53% of antibody specificity testing demand in 2025, underscoring their role as the preferred methodology for antibody validation. These technologies offer high sensitivity, specificity, and throughput capabilities that make them ideal for comprehensive antibody characterization and validation studies. The segment includes various immunoassay formats such as ELISA, multiplex assays, and automated immunoassay platforms that provide reliable and quantitative results.

The segment is supported by continuous technological advancements that enhance assay performance, reduce testing time, and improve data quality. The compatibility of immunoassay-based technologies with automated systems and high-throughput screening platforms makes them attractive for large-scale antibody validation programs. As research institutions and pharmaceutical companies prioritize efficiency and reliability in their antibody testing workflows, immunoassay-based technologies continue to dominate the market landscape.

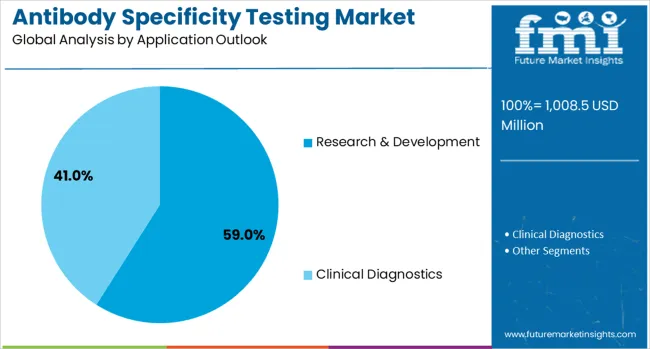

The research & development application is forecasted to contribute 59% of the antibody specificity testing market in 2025, reflecting the critical role of antibody validation in scientific research. This application encompasses basic research studies, applied research programs, and translational research activities that require accurate antibody characterization. The strong market share demonstrates the fundamental importance of antibody specificity testing in ensuring research quality and reproducibility across various scientific disciplines.

The segment benefits from increasing research funding, expanding biomedical research programs, and growing focus on research reproducibility and reliability. Academic institutions, research centers, and pharmaceutical companies are investing heavily in antibody validation programs to support their research activities and ensure the accuracy of their experimental results. The ongoing focus on precision medicine and personalized therapeutics further drives demand for comprehensive antibody specificity testing in research applications.

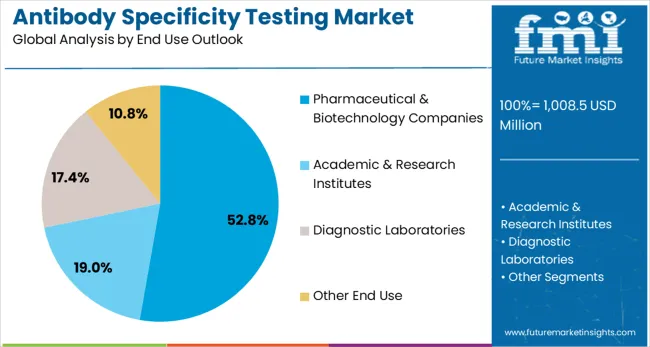

The pharmaceutical & biotechnology companies segment is projected to account for 53% of the antibody specificity testing market in 2025, highlighting the critical role of antibody validation in drug development and commercialization processes. These companies require comprehensive antibody testing solutions to support their research programs, drug discovery activities, and regulatory submissions. The segment's dominance reflects the substantial investments that pharmaceutical and biotechnology companies make in antibody validation to ensure the quality and reliability of their research data.

The segment is driven by increasing drug development activities, expanding biotechnology sector, and growing regulatory requirements for antibody validation in pharmaceutical research. Companies in this sector are particularly focused on ensuring the specificity and reliability of antibodies used in their research programs to minimize the risk of false results and support successful drug development outcomes. The continued growth of the biotechnology industry and increasing investments in biopharmaceutical research further strengthen this segment's market position.

The antibody specificity testing market is experiencing steady growth, driven by the rising focus on research reproducibility and the increasing need for dependable antibody validation solutions. The market faces challenges such as the high costs of thorough testing, the complexity of validation procedures, and the scarcity of validated antibodies for specific targets. Advancements in testing techniques and the integration of automation technologies are playing a key role in shaping product innovation and expanding the market.

The growing focus on research reproducibility is driving demand for reliable antibody validation solutions, crucial in drug discovery, diagnostics, and therapeutic development. Automation and high-throughput technologies are improving testing efficiency by processing multiple tests simultaneously, reducing human error and costs. Increased investment in biopharmaceutical research, particularly in monoclonal antibodies and biologics, is further boosting the need for robust antibody specificity testing. These drivers are shaping a rapidly expanding market, focused on improving accuracy, efficiency, and the development of new therapies.

Antibody specificity testing laboratories are increasingly adopting advanced analytics and data management systems to streamline data interpretation and optimize decision-making. These systems offer real-time data analysis, automated reporting, and seamless integration with existing laboratory information management systems (LIMS). By utilizing machine learning algorithms and predictive analytics, researchers can detect trends, anomalies, and correlations within large datasets, improving the accuracy of antibody validation. Such innovations not only enhance testing efficiency but also provide actionable insights, enabling researchers to make more informed, data-driven decisions and accelerate scientific progress.

| Country | CAGR (2025-2035) |

|---|---|

| China | 10.2% |

| India | 9.5% |

| Germany | 8.7% |

| France | 7.9% |

| UK | 7.2% |

| USA | 6.4% |

| Brazil | 5.7% |

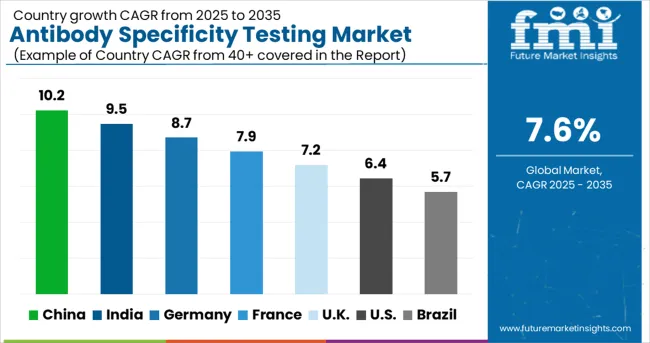

The antibody specificity testing market is experiencing robust growth globally, with China leading at a 10.2% CAGR through 2035, driven by increasing investments in biotechnology research, expanding pharmaceutical industry, and growing focus on research quality and reproducibility. India follows closely at 9.5%, supported by expanding life sciences sector, increasing research activities, and growing awareness about antibody validation importance. Germany shows steady growth at 8.7%, emphasizing advanced research infrastructure and pharmaceutical industry requirements. France records 7.9%, focusing on biotechnology innovation and academic research excellence. The UK shows 7.2% growth, prioritizing research quality standards and biotechnology sector development.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

China is set to experience significant growth in the antibody specificity testing market, with a CAGR of 10.2% from 2025 to 2035. This expansion is fueled by the country’s increasing focus on biotechnology advancements and growing healthcare investments. Research institutions and biopharmaceutical companies are increasingly relying on antibody testing to ensure precision in drug development and diagnostics. The integration of artificial intelligence and automation into testing platforms is enhancing the speed and accuracy of antibody validation processes. China's government is promoting biotechnology research, contributing to the accelerated demand for antibody specificity testing solutions. With a robust manufacturing base, local producers are strengthening their capabilities to provide cost-effective and high-quality testing tools for both domestic and international markets.

The antibody specificity testing market in India is experiencing a strong growth trajectory, with a CAGR of 9.5% over the next decade. The country’s growing healthcare needs, driven by an increase in chronic diseases and a rising demand for advanced diagnostic solutions, is propelling the market forward. India's expanding research base, particularly in the pharmaceutical and biotechnology sectors, is fueling the need for more precise antibody testing systems. International collaborations and the increasing number of clinical trials further highlight the demand for reliable antibody validation. Moreover, the adoption of automation and machine learning in antibody testing is becoming more widespread, helping to streamline processes and improve test accuracy.

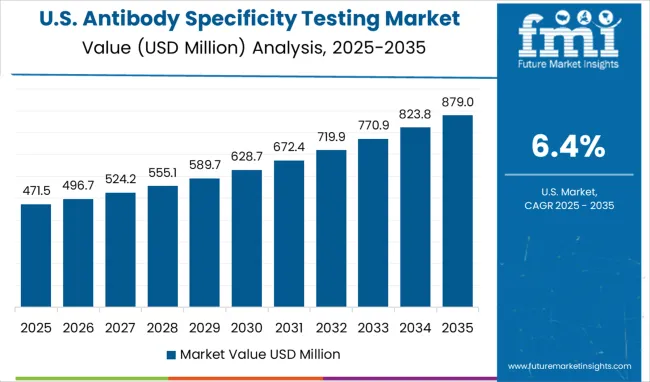

In the USA, the antibody specificity testing market is expected to grow at a CAGR of 6.4% over the next decade, propelled by advancements in biotechnology and personalized healthcare. The market is primarily driven by the growing demand for antibody testing in clinical trials, drug discovery, and disease diagnostics. Pharmaceutical companies and research institutions are focusing more on antibody validation to ensure the reliability and effectiveness of their products. The rise of automation and AI in antibody specificity testing is significantly improving testing processes, offering faster, more accurate results. The increasing number of academic and commercial collaborations in the biotechnology field is further expanding the market for antibody testing.

Demand for antibody specificity testing in Germany is forecasted to grow at a CAGR of 8.7% through 2035, driven by its well-established research infrastructure and a growing focus on personalized medicine. The market is benefiting from the country’s strong focus on healthcare and clinical research, with significant investments in biotechnology and pharmaceutical research. Germany’s leading pharmaceutical companies are increasingly integrating antibody specificity testing into their drug development pipelines, fueling demand. The country’s healthcare providers are prioritizing more accurate diagnostic methods, contributing to the expansion of antibody testing applications. The presence of state-of-the-art research facilities and universities ensures that the demand for precise and reproducible antibody validation remains high.

The UK is witnessing steady growth in the antibody specificity testing market, projected at a CAGR of 7.2%. The increasing integration of biotechnology in healthcare and rising investments in personalized medicine are major drivers for this market. The UK is home to numerous world-class research institutions and pharmaceutical companies, which are increasingly prioritizing high-precision antibody validation in drug development and diagnostic processes. With rising government funding in the life sciences and healthcare sectors, there is a growing demand for highly accurate, reproducible antibody testing methods. The adoption of digital technologies such as AI and data analytics is enhancing the precision of testing.

In France, the antibody specificity testing market is anticipated to expand at a CAGR of 7.9% over the forecast period. France’s strong focus on healthcare and biotechnological innovation is driving the market’s demand. The growing number of diagnostic laboratories, pharmaceutical companies, and academic institutions requiring high-quality antibody tests is contributing to this growth. The increasing focus on clinical trials and biotechnology research projects in the country is creating significant opportunities for antibody testing solutions. With healthcare regulations becoming more stringent, French healthcare providers are adopting advanced testing methodologies to meet the rising standards for clinical diagnostics.

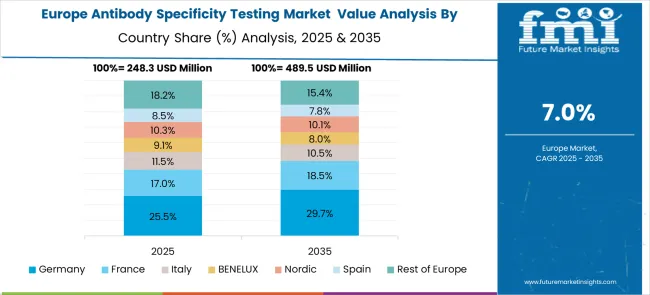

The antibody specificity testing market in Europe demonstrates strong development across major economies, with Germany showing a robust presence through its advanced research infrastructure and significant investments in biotechnology and pharmaceutical research, supported by leading institutions and companies leveraging scientific expertise to develop comprehensive antibody validation programs that ensure research quality and support drug development activities. France represents a significant market driven by its strong life sciences sector and government support for biomedical research, with companies and institutions pioneering innovative antibody testing approaches that combine French scientific excellence with advanced validation technologies for enhanced research reliability and pharmaceutical development.

The UK exhibits considerable growth through its world-class research universities and biotechnology sector, with institutions and companies leading the development of standardized antibody validation protocols and comprehensive testing solutions. Germany, France, and the UK collectively account for substantial market share in Europe, supported by their established pharmaceutical industries, advanced research capabilities, and strong regulatory frameworks. Other European countries including Italy, Spain, and Nordic regions show expanding interest in antibody specificity testing, particularly in academic research institutions and growing biotechnology sectors.

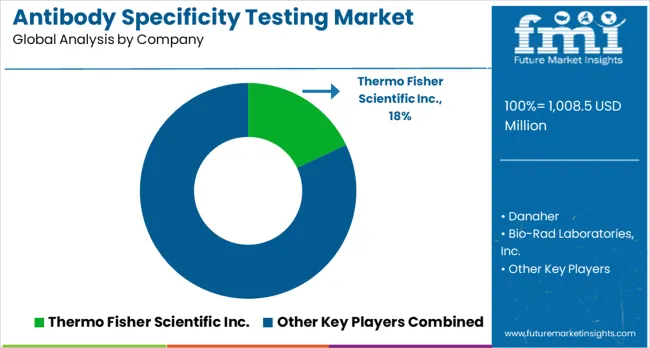

The competition in the antibody validation market is driven by advancements in testing methodologies, automation, and strategic partnerships aimed at providing reliable and efficient solutions. Thermo Fisher Scientific Inc. maintains a market leadership position with an 18% global value share, providing a comprehensive portfolio that integrates antibodies, reagents, and testing services for complete antibody validation workflows. The company's strategy focuses on delivering seamless solutions that enhance research reliability and ensure the highest quality assurance for customers. Danaher follows with advanced testing technologies and automated platforms, emphasizing high-throughput applications for large-scale antibody validation processes. Bio-Rad Laboratories Inc. competes by offering specialized testing solutions that highlight the importance of scientific accuracy, with strong technical support capabilities aimed at enhancing research reliability.

Merck KGaA brings its global reach into the competitive landscape, providing antibody testing solutions for various research applications. Their broad product range allows them to address a wide spectrum of customer needs. Cell Signaling Technology Inc. focuses on high-quality antibodies and validation services, positioning itself as an expert in scientific excellence and customer education. BD stands out by offering automated testing platforms and integrated solutions that increase laboratory efficiency. Companies such as Novus Biologicals, OriGene Technologies Inc., Creative Diagnostics, and GenScript differentiate themselves through specialized products targeting niche research areas. Their strategies focus on customizing solutions to meet specific application needs, driving customer satisfaction and repeat business.

Product brochures from these companies emphasize comprehensive portfolios. Thermo Fisher integrates full antibody testing workflows. Danaher and Bio-Rad present automated solutions and high-throughput technologies. Merck KGaA offers global antibody testing products across sectors. BD highlights laboratory efficiency with integrated platforms, and Cell Signaling Technology focuses on educational tools for better customer understanding. These offerings reflect a competitive landscape focused on quality, efficiency, and customer-centered solutions.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,008.5 million |

| Product & Services | Products, Antibody validation & specificity testing services |

| Technology | Immunoassay-based Technologies, Western Blotting, Immunochemistry, Flow Cytometry, Others |

| Application | Research & Development, Drug Discovery & Development, Proteomics & Biomarker Discovery, Clinical Diagnostics, Infectious Diseases |

| End Use | Pharmaceutical & Biotechnology Companies, Academic & Research Institutes, Diagnostic Laboratories, Other End Use |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Thermo Fisher Scientific Inc., Danaher, Bio-Rad Laboratories Inc., Merck KGaA, Cell Signaling Technology Inc., BD, Novus Biologicals, OriGene Technologies Inc., Creative Diagnostics, and GenScript |

| Additional Attributes | Dollar sales by product type and technology platform, regional demand trends, competitive landscape, customer preferences for automated versus manual testing solutions, integration with research workflow management systems, innovations in high-throughput validation, standardized protocols, and quality assurance practices |

The global antibody specificity testing market is estimated to be valued at USD 1,008.5 million in 2025.

The market size for the antibody specificity testing market is projected to reach USD 2,090.3 million by 2035.

The antibody specificity testing market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in antibody specificity testing market are products, _antibodies, _control & standards, _kits & reagents, _gene validation tools and antibody validation & specificity testing services.

In terms of technology outlook , immunoassay-based technologies segment to command 52.5% share in the antibody specificity testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antibody Market Size and Share Forecast Outlook 2025 to 2035

Antibody Therapy Market Insights - Growth, Demand & Forecast 2025 to 2035

Antibody Profiling Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Antibody Purification Service Market - Growth, Demand & Forecast 2025 to 2035

Antibody-mediated Rejection Prevention Market Overview - Growth & Forecast 2025 to 2035

Global Antibody Discovery Market Insights – Size, Trends & Forecast 2024-2034

Antibody Isotyping Kits Market

Antibody Pair Kits Market

Pet Antibody Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Bispecific Antibody Market

Antinuclear Antibody Test Market

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Anti-Neurofilament L Antibody Market Trends - Growth & Forecast 2024 to 2034

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA