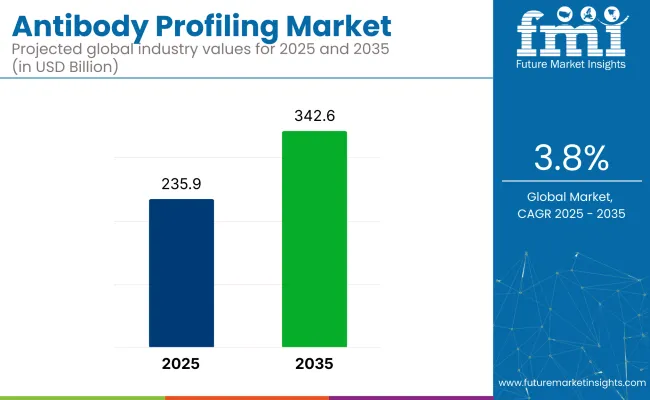

The global antibody profiling market is projected to rise from USD 235.9 billion in 2025 to USD 342.6 billion by 2035, expanding at a CAGR of 3.8%. The increased demand for precision diagnostics and immunotherapy validation is fueling steady investment in this segment.

| Metric | Value |

|---|---|

| Estimated Market Size (2025) | USD 235.9 billion |

| Projected Market Size (2035) | USD 342.6 billion |

| CAGR (2025 to 2035) | 3.8% |

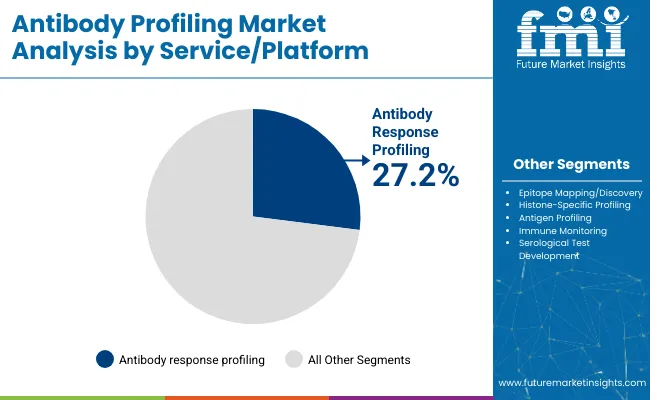

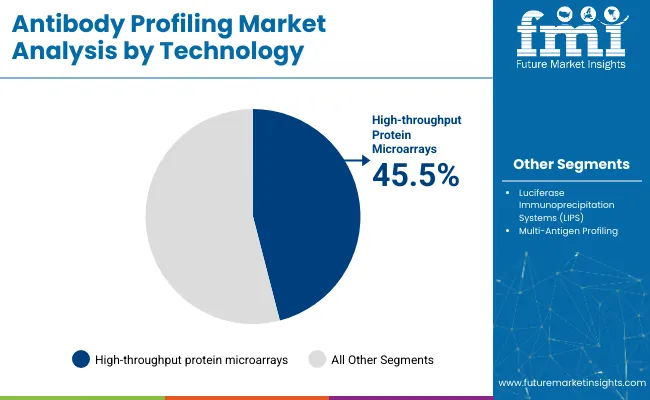

In terms of technology, high-throughput protein microarrays are expected to lead with a 45.5% industry share in 2025, owing to their ability to screen thousands of proteins in parallel. The antibody response profiling service type will contribute significantly, holding 27.2% of the industry, due to its broad use in infectious disease tracking, oncology, and autoimmune disorder research.

A significant advancement in the field comes from a study published in Cell Reports Methods, which introduced PolyMap-a high-throughput platform combining ribosome display with microfluidics for comprehensive antibody library specificity profiling.

PolyMap enables rapid mapping of antibody-protein interactions, dramatically accelerating early-stage screening and therapeutic antibody selection. This breakthrough represents a major technological leap, reinforcing the growing industry demand for sophisticated profiling tools that enhance antibody development pipelines and improve clinical research outcomes.

The industry, as a subset of the global research antibodies industry, makes up a notable portion of targeted protein-analysis tools. Within the proteomics market, immunoprofiling accounts for approximately 5%, leveraging immunoassays in biomarker discovery.

In the broader immunoassay/immunodiagnostics market, it contributes around 8%, thanks to ELISA and related techniques. Within the diagnostics market, it holds roughly 8-10%. In the biopharmaceutical & drug discovery market-often exceeding USD 200 B-immunoprofiling represents under 1%, used primarily in therapeutic development and biomarker validation. Lastly, as part of the expansive life science research tools market, its share is ~1%, essential but specialized among a wide range of lab instruments.

As drug developers aim to de-risk clinical trials and shorten development timelines, technologies are being adopted at scale. Coupled with advancements in AI, single-cell analysis, and bioinformatics integration, the industry is expected to benefit from expanding applications across vaccine research, personalized immunotherapy, and biomarker discovery.

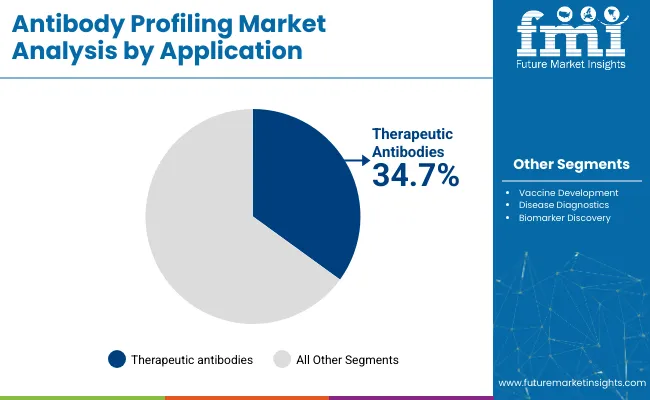

Antibody response profiling, high-throughput protein microarrays, and therapeutic antibodies are projected to dominate the industry in 2025 due to rising precision diagnostics, advanced proteomics, and targeted immunotherapy development.

Antibody response profiling is expected to dominate the service/platform type segment with a 27.2% share in 2025.Demand is expected to grow as the platform enables detailed evaluation of humoral immune responses against specific antigens across infectious diseases, autoimmune conditions, and cancer.

High-throughput protein microarrays are projected to lead the technology segment with a 45.5% industry share in 2025.Demand is rising as these arrays allow simultaneous screening of thousands of protein-antibody interactions on a single chip, making them ideal for large-scale applications.

Therapeutic antibodies are expected to lead the application segment with a 34.7% share in 2025.Immunoprofilingplays a vital role in developing monoclonal antibodies, bispecific antibodies, and antibody-drug conjugates by identifying off-target effects, immunogenicity, and binding affinity.

Antibody profiling advances disease diagnosis and accelerates biotherapeutic discovery. Dual-mode profiling enhances diagnostic precision, while high-throughput and AI-assisted workflows optimize antibody drug pipeline development in oncology and infectious diseases.

Enhancing Disease Diagnostics through Dual-Mode Profiling Approaches

Immunoprofiling is being leveraged to improve accuracy in disease diagnostics. Dual-mode assays combining serological and cellular response markers support comprehensive disease detection. In oncology, paired detection of autoantibodies and immune cell markers is enhancing early tumor identification. Vaccine research relies on profiling antibody repertoires to assess humoral immunity across a range of pathogens, including SARS-CoV-2. Advanced platforms offer expansive antigen coverage, enabling more precise immune profiling and monitoring.

Accelerated Biotherapeutic Discovery Using High-Throughput Antibody Profiling

High-throughput immunoprofiling is fueling rapid biotherapeutic development. Single-cell sequencing and nanowell screening enable identification of antigen-specific B cells and therapeutic antibody candidates. Microfluidic technologies and multiplex assays allow rapid affinity and epitope specificity assessment, expediting drug discovery. For instance, microfluidic nanowell platforms have isolated high-affinity antibodies targeting viral antigens such as influenza. AI-driven repertoire analysis further enhances candidate selection processes by predicting functional antibody properties.

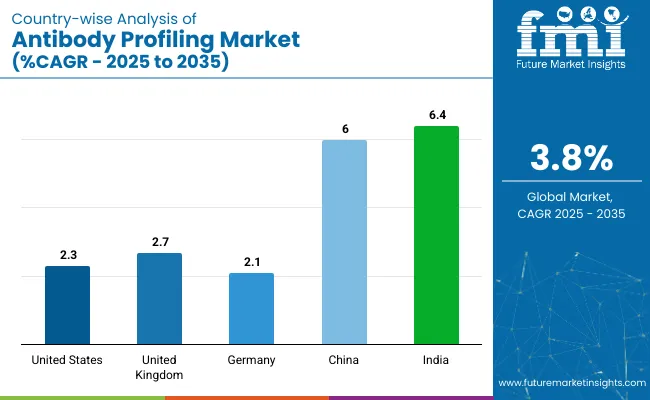

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 2.3% |

| United Kingdom | 2.7% |

| Germany | 2.1% |

| China | 6% |

| India | 6.4% |

In the global context, the OECD countries, including the United States and Germany, exhibit steady growth in the industry. The United States, with a projected CAGR of 2.3%, shows stable growth, driven by established demand for advanced diagnostic and therapeutic profiling services.

The country's mature healthcare infrastructure and strong biotechnology sector continue to support incremental growth. Germany, at a CAGR of 2.1%, also reflects steady demand, bolstered by its well-established healthcare system and ongoing interest in cutting-edge biotechnology research.

In contrast, the BRICS group, particularly India, is experiencing faster growth, with a projected CAGR of 6.4%. India’s rapid economic development, coupled with increasing disposable incomes and investments in healthcare, is fueling a growing demand for antibody profiling technologies.

The expanding middle class, along with a burgeoning focus on biopharmaceutical advancements, positions India as one of the fastest-growing industries in the sector. Similarly, China is advancing its industry with a projected CAGR of 6%, driven by robust investments in healthcare infrastructure and biotechnological research.

While the OECD countries represent mature industries with steady demand, India’s and China’s growth trajectories underscore the shift toward emerging economies as key drivers of future industry expansion.

The OECD countries continue to contribute to steady demand in the industry, with the USA leading in terms of established infrastructure. India and China in the BRICS group offer the highest growth potential due to their evolving healthcare sectors and increasing investments in biotechnology. Both developed and emerging industries will play crucial roles in shaping the future of the global industry.

The industry in the United States is projected to grow at a CAGR of 2.3% between 2025 and 2035.

The industry in United Kingdom is expanding at a CAGR of 2.7% during the forecast timeframe from 2025 to 2035.

The industry in Germany grows at a CAGR of 2.1% over the 2025 to 2035 period.

China is anticipated to witness robust growth in its industry, registering a CAGR of 6% from 2025 to 2035.

The industry in India is forecast to grow at the fastest rate, with a projected CAGR of 6.4% from 2025 to 2035.

The industry features a dynamic and evolving competitive landscape, categorized into dominant, key, and emerging players. Dominant players such as SomaLogic and Infinity Bio lead with high-throughput platforms and proprietary proteomic technologies enabling large-scale immune profiling.

Key players including Rapid Novor, CellFree Sciences, and CDI Labs offer specialized antibody sequencing, epitope mapping, and expression analysis services tailored for clinical and biopharma applications. Emerging players like AZoLifeSciences and Biocopare focus on targeted innovations and cost-effective profiling kits, catering to academic labs and niche research sectors, driving broader adoption and personalized immunological insights across global healthcare and diagnostics industries.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 235.9 billion |

| Projected Industry Size (2035) | USD 342.6 billion |

| CAGR (2025 to 2035) | 3.8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and number of profiling tests conducted for volume |

| Service/Platform Types Analyzed (Segment 1) | Antibody Response Profiling, Epitope Mapping/Discovery, Histone-Specific Profiling, Antigen Profiling, Immune Monitoring, Serological Test Development |

| Technologies Analyzed (Segment 2) | High-Throughput Protein Microarrays, Luciferase Immunoprecipitation Systems (LIPS), Multi-Antigen Profiling |

| Applications Analyzed (Segment 3) | Therapeutic Antibodies, Vaccine Development, Disease Diagnostics, Biomarker Discovery |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Saudi Arabia, UAE, South Africa |

| Key Players influencing the Industry | Infinity Bio, Rapid Novor , CellFree Sciences Co., Ltd., SomaLogic, AZoLifeSciences, CDI Labs, Biocopare |

| Additional Attributes | Dollar sales, profiling demand across therapeutic R&D and diagnostics, technology adoption in epitope mapping, personalized vaccine design using multiplex platforms, academic vs commercial profiling trends |

By service/platform type, the industry is segmented into Antibody Response Profiling, Epitope Mapping/Discovery, Histone-Specific Profiling, Antigen Profiling, Immune Monitoring, and Serological Test Development.

By technology, the industry includes High-Throughput Protein Microarrays, Luciferase Immunoprecipitation Systems (LIPS), and Multi-Antigen Profiling.

By application, the industry is segmented into Therapeutic Antibodies, Vaccine Development, Disease Diagnostics, and Biomarker Discovery.

By region, the industry is categorized into North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa.

The industry is projected to be valued at USD 235.9 billion in 2025.

The industry is expected to reach USD 342.6 billion by 2035.

The industry is anticipated to grow at a CAGR of 3.8% during the forecast period.

High-throughput protein microarrays dominate the industry with a 45.5% share in 2025.

SomaLogic leads the industry with a 12% market share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antibody Market Size and Share Forecast Outlook 2025 to 2035

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Antibody Therapy Market Insights - Growth, Demand & Forecast 2025 to 2035

Antibody Purification Service Market - Growth, Demand & Forecast 2025 to 2035

Antibody-mediated Rejection Prevention Market Overview - Growth & Forecast 2025 to 2035

Global Antibody Discovery Market Insights – Size, Trends & Forecast 2024-2034

Antibody Isotyping Kits Market

Antibody Pair Kits Market

Pet Antibody Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Bispecific Antibody Market

Antinuclear Antibody Test Market

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Anti-Neurofilament L Antibody Market Trends - Growth & Forecast 2024 to 2034

Industry Share & Competitive Positioning in Tumor Profiling

Thermal Profiling System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Multiplex Protein Profiling Market Size and Share Forecast Outlook 2025 to 2035

Tissue-Based Genomic Profiling Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA