The antibody market is expanding steadily due to growing demand for targeted therapies, rising prevalence of chronic and infectious diseases, and rapid advancements in biopharmaceutical research. The current scenario is defined by strong investment in biologics development and a growing pipeline of antibody-based treatments aimed at improving efficacy and safety profiles.

Market growth is being supported by technological innovations in monoclonal antibody production, recombinant DNA technology, and antibody–drug conjugate platforms that enhance therapeutic outcomes. Increasing healthcare expenditure, favorable regulatory frameworks, and strategic collaborations between pharmaceutical and biotechnology companies are also contributing to market expansion.

The future outlook is marked by continued integration of precision medicine, expansion of biosimilar portfolios, and greater penetration of antibody therapeutics across emerging economies Growth rationale is anchored in the increasing clinical success rates of antibody therapies, their expanding indications across multiple disease types, and the scalability of biomanufacturing technologies, collectively supporting strong and sustained market growth over the coming years.

| Metric | Value |

|---|---|

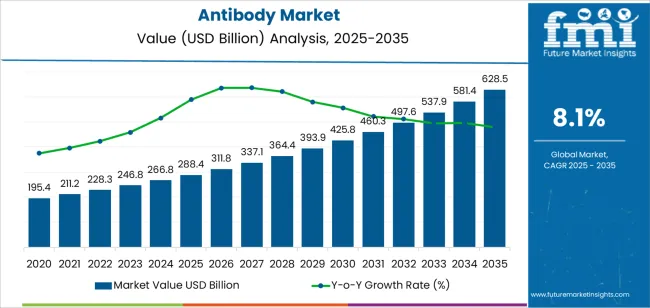

| Antibody Market Estimated Value in (2025 E) | USD 288.4 billion |

| Antibody Market Forecast Value in (2035 F) | USD 628.5 billion |

| Forecast CAGR (2025 to 2035) | 8.1% |

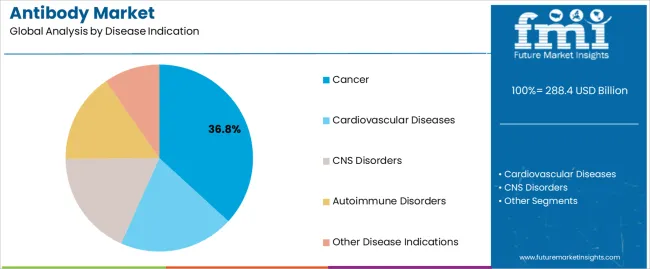

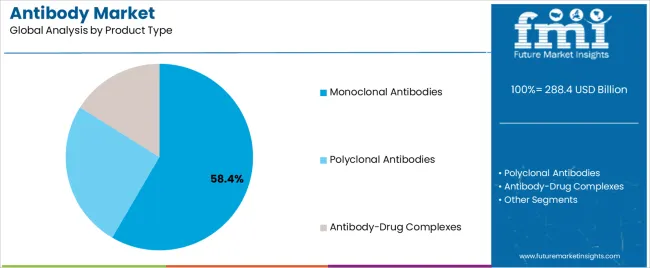

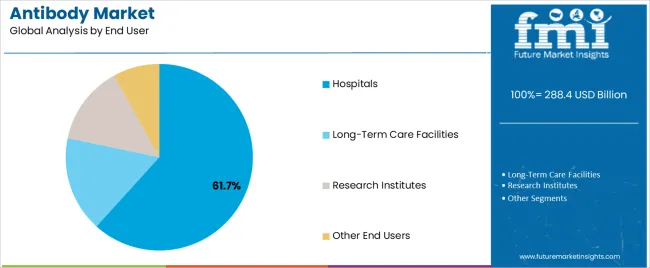

The market is segmented by Disease Indication, Product Type, and End User and region. By Disease Indication, the market is divided into Cancer, Cardiovascular Diseases, CNS Disorders, Autoimmune Disorders, and Other Disease Indications. In terms of Product Type, the market is classified into Monoclonal Antibodies, Polyclonal Antibodies, and Antibody-Drug Complexes. Based on End User, the market is segmented into Hospitals, Long-Term Care Facilities, Research Institutes, and Other End Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The cancer segment, accounting for 36.80% of the disease indication category, has emerged as the leading contributor to market revenue. Growth has been driven by the high prevalence of cancer globally and the growing acceptance of antibody-based targeted therapies as a standard treatment option.

The ability of antibodies to selectively bind and neutralize cancer cells while minimizing off-target effects has significantly increased their clinical adoption. Strong research funding, rapid approval of novel oncology antibodies, and improvements in biomarker-guided therapy selection have reinforced market leadership.

Rising demand for personalized treatment regimens and favorable reimbursement policies for advanced cancer therapies are expected to sustain the dominance of this segment Continuous innovation in immunotherapy and the development of bispecific and conjugated antibodies are anticipated to further strengthen its position in the global antibody market.

The monoclonal antibodies segment, representing 58.40% of the product type category, has maintained its leadership position due to broad therapeutic applications and high clinical efficacy. Its growth has been supported by increasing R&D investment, technological advancements in antibody engineering, and expanding indications across oncology, autoimmune, and infectious diseases.

Monoclonal antibodies are being increasingly integrated into first-line treatment regimens owing to their targeted action and reduced adverse effects. The introduction of humanized and fully human antibodies has enhanced safety profiles, boosting market confidence.

Manufacturing scalability and cost optimization achieved through advanced bioprocessing techniques have further strengthened commercial viability As biosimilar monoclonal antibodies gain regulatory approvals, market accessibility is expected to expand, supporting consistent revenue growth and reinforcing this segment’s dominant share in the antibody market.

The hospitals segment, holding 61.70% of the end user category, continues to dominate the antibody market due to its critical role in patient care, treatment administration, and clinical diagnostics. Hospitals serve as the primary distribution and usage centers for antibody-based therapeutics, particularly in oncology and immunology.

The presence of advanced healthcare infrastructure, skilled medical professionals, and comprehensive diagnostic facilities has facilitated high adoption rates within hospital settings. Strategic partnerships between hospitals and pharmaceutical manufacturers have enabled efficient supply chain management and rapid access to new antibody therapies.

Increasing hospitalization rates for chronic diseases and the rise in inpatient biologic treatments have further strengthened this segment’s position Continuous improvement in hospital-based infusion centers and integration of digital healthcare systems are expected to sustain dominance and drive future growth within the antibody market.

The global antibody market was valued at USD 195.4 billion in 2020. The market overview of antibody drugs progressed at an annual rate of 12.5% between 2020 and 2025. The overall market value was about USD 288.4 billion by 2025.

| Attributes | Details |

|---|---|

| Antibody Market Value (2020) | USD 195.4 billion |

| Market Revenue (2025) | USD 288.4 billion |

| Market Historical Growth Rate (CAGR 2020 to 2025) | 12.5% CAGR |

Research and Development Activities Impact Antibodies Sales Outlook

A surge in research and development activities among pharmaceutical market leaders to develop economical and effective antibodies is driving growth opportunities for diagnostic specialty antibody suppliers.

In February 2024, Abingdon Health collaborated with Abcam to explore opportunities for their service and portfolio expansion which includes Abcam's reagent portfolio and Abingdon Health's rapid test contract development and manufacturing services.

Rising cases of multiple sclerosis and Parkinson's disease among the older population is a key factor fueling the demand for antibodies. There is an urgency to develop personalized and cheap medicines, advanced therapeutics, advanced genetic engineering technology, and novel and effective treatments in middle-income countries.

In 2024, Berkeley Lights, a digital cell biology company, joined hands with Genovac, an antibody discovery company, to readily access the right antibodies in the shortest amount of time with the help of modern technology.

Increasing Production of Bio-similar Antibodies is Driving Demand

Biosimilar antibodies are experiencing heavy demand as they are inexpensive in comparison with human monoclonal antibodies, and they have very few side effects. In 2024, Johnson and Johnson reported USD 266.8 Billion achieved through the sales of Remicade. According to Pfizer, Inflectra, the biosimilar competitor of Remicade, generated USD 659 million in 2024.

USA Food and Drug Administration (FDA) approved a biosimilar of Remicade called Avsola in December 2020 and is now eligible for producing biologics products all over the world. Increasing demand for biosimilar antibodies in the treatment of rheumatoid arthritis, along with a high patient acceptance rate, is anticipated to boost the market growth for antibodies.

One of the leaders in prescription medicines, Pfizer, received EU approval for biosimilar antibody therapeutics Amsparity for Crohn’s disease, psoriasis, and psoriatic arthritis in February 2024. Elevated new drug approval rates and products in clinical trials in pharmaceutical companies are anticipated to further drive the market in the upcoming years.

The table below mentions the countries that are expected to witness higher growth opportunities in this market.

| Regional Market Comparison | CAGR (2025 to 2035) |

|---|---|

| United States | 9.6% |

| Germany | 9.4% |

| United Kingdom | 10.1% |

| India | 9.5% |

| China | 6.5% |

The United States therapeutic antibodies market is poised to advance at a rate of 10.1% per year till 2035.

Consumption of antibody products in the United Kingdom is projected to rise at a rate of 10.1% during the forecast years.

The antibodies industry in China is projected to thrive at a CAGR of 5.8% through the projected years.

Sales of antibodies in Germany are anticipated to increase at a rate of 9.4% from 2025 to 2035.

Demand for antibodies in India is expected to rise at a rate of 9.5% per year between 2025 and 2035.

Based on product type, the monoclonal antibodies market segment is estimated to account for 95% of the market share in 2025.

| Attributes | Details |

|---|---|

| Top Product Type or Segment | Monoclonal Antibodies |

| Total Market Share in 2025 | 95% |

Based on disease indication, the use of antibodies for treating cancer is expected to account for 57% of the total sales in 2025.

| Attributes | Details |

|---|---|

| Top Disease Indication Type or Segment | Cancer |

| Total Market Share in 2025 | 57% |

Leading market players are working towards developing new antibodies to remain competitive in the present market. They are also researching to create long-acting antibody drugs to reduce healthcare costs and attract chronic patients.

In order to gain a competitive edge in the antibody testing market, key players are developing oral and noninvasive treatments using antibodies to treat chronic ailments. Strategic mergers and acquisitions for portfolio expansion are in the cards as well.

Future market players should concentrate on acquiring additional money through financing rounds to broaden their research and company scope. New businesses are looking into how to leverage cutting-edge technologies to streamline the creation of therapeutic antibodies, including nanobodies and monoclonal antibodies.

Recent Developments in the Global Antibody Market

On June 11, 2024, Novartis published its new Phase II data of an investigational oral treatment iptacopan, developed for treating paroxysmal nocturnal hemoglobinuria (PNH). The study indicated that during 12 weeks of iptacopan monotherapy treatment, no unexpected safety issues were reported which led to rapid and durable transfusion-free improvement of hemoglobin levels in the majority of patients.

In August 2024, Johnson & Johnson entered into a final agreement to acquire Momenta Pharmaceuticals Inc. for around USD 6.5 Billion. Momenta Pharmaceuticals Inc. is a market leader in developing novel therapies for immune-mediated diseases.

The acquisition may allow the Janssen Pharmaceutical Companies of Johnson & Johnson to expand its product portfolio in immune-mediated diseases while driving growth opportunities through expansion into autoantibody-driven disease.

Leading pharmaceutical company Sanofi announced in March 2025 that it will collaborate with IGM Biosciences to research, produce, and market six novel immunoglobulin M antibody agonists. Sanofi has agreed to approximately USD 6 billion in possible milestone payments through this agreement.

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 266.83 billion |

| Projected Market Size (2035) | USD 581.42 billion |

| Anticipated Growth Rate (2025 to 2035) | 8.1% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million or billion for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; Middle East & Africa (MEA); East Asia; South Asia and Oceania |

| Key Countries Covered | United States, Canada, Brazil, Mexico, Germany, Spain, Italy, France, United Kingdom, Russia, China, India, Australia & New Zealand, GCC Countries, and South Africa |

| Key Segments Covered | By Product Type, By Disease Indication, By End Use Verticals, and By Region |

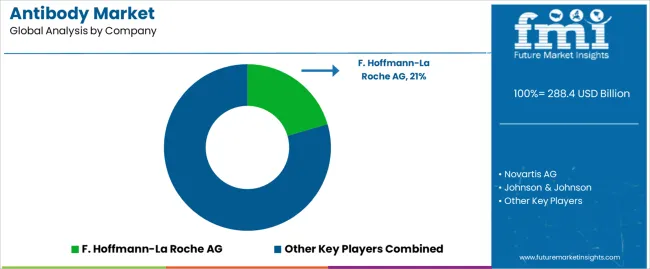

| Key Companies Profiled | Novartis AG; F. Hoffmann-La Roche AG; Johnson & Johnson; Takeda Pharmaceutical Company Limited; Amgen Inc. |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, DROT Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global antibody market is estimated to be valued at USD 288.4 billion in 2025.

The market size for the antibody market is projected to reach USD 628.5 billion by 2035.

The antibody market is expected to grow at a 8.1% CAGR between 2025 and 2035.

The key product types in antibody market are cancer, cardiovascular diseases, cns disorders, autoimmune disorders and other disease indications.

In terms of product type, monoclonal antibodies segment to command 58.4% share in the antibody market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Antibody Therapy Market Insights - Growth, Demand & Forecast 2025 to 2035

Antibody Profiling Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Antibody Purification Service Market - Growth, Demand & Forecast 2025 to 2035

Antibody-mediated Rejection Prevention Market Overview - Growth & Forecast 2025 to 2035

Global Antibody Discovery Market Insights – Size, Trends & Forecast 2024-2034

Antibody Isotyping Kits Market

Antibody Pair Kits Market

Pet Antibody Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Bispecific Antibody Market

Antinuclear Antibody Test Market

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Anti-Neurofilament L Antibody Market Trends - Growth & Forecast 2024 to 2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA