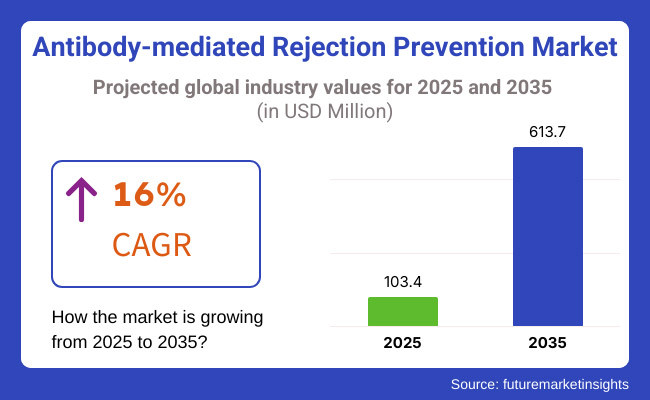

The antibody-mediated rejection (AMR) prevention market is set for significant growth between 2025 and 2035, driven by advancements in transplant immunology, increasing organ transplant procedures, and rising prevalence of antibody-mediated rejection in transplant patients. The market is expected to reach USD 103.4 million in 2025 and expand to USD 613.7 million by 2035, reflecting a compound annual growth rate (CAGR) of 16% over the forecast period.

The growing use of immunosuppressive therapies, emerging biologics, and precision medicine strategies continue to tack on gains in market growth paired with an increasing public awareness. Due to advances in monoclonal antibody therapies, complement inhibitors and plasma exchange techniques, AMR prevention is now becoming an important part of transplant medicine. Outcomes are expected to improve further with increasing studies on desensitization strategies, newer diagnostic biomarkers, and post-transplant monitoring capabilities.

Rising government initiatives, such as support for organ donation and transplant success rates, along with increasing budge towards biopharmaceutical research on innovative immunomodulatory treatments, are some other major factors expected to boost the growth of the market. Moreover, partnerships among pharmaceutical firms, transplant centers, and research organizations are optimizing treatment effectiveness and availability.

But obstacles such as expensive treatments, shortage of matching organs and litigation add hurdles that need to be tackled through strategic interventions. As a result, more and more companies are investing in biosimilar products, next-gen immunosuppressants, and AI-based transplant monitoring solutions to improve treatment outcomes and reduce costs.

Due to its advanced organ transplantation research, robust pharmaceutical infrastructure, and the high prevalence of end-stage organ failure, North America dominates the antibody-mediated rejection (AMR) prevention market. The USA & Canada dominate the market for transplant diagnostics with OEMs investing in monoclonal antibodies, immunosuppressant’s, and personalized transplant medicine being the key factors stimulating growth in the region.

The rising demand for AMR prevention therapies in kidney, heart, and lung transplants is also reflected in recent FDA approvals, ongoing advancements in desensitization protocols, and government funding for transplant innovation." But high cost of treatment, scarcity of organ donors and rigid regulatory procedures hamper the growth of this market. An increase in collaborative efforts among biotech companies, transplant centers and research institutions will further speed advances in the future, researchers expect.

Europe represents a prominent market for AMR prevention, as key markets including Germany, France, and the United Kingdom all have established healthcare policies that enable the implementation of transplantation programs and help drive the growth of immunotherapy research and development in the region. The region’s emphasis on personalized medicine and targeted immunosuppression also increases the need for AMR prevention therapies.

Market growth is driven by the rising prevalence of organ transplants and increased investments in novel biologics and innovative diagnostic techniques. Adoption rates however are hampered due to stringent regulatory frameworks, high cost of biologic therapies and hurdles to reimbursement. European companies are focusing on next-generation AMR prevention therapies, which include complement inhibitors and antibody-targeted therapies to maximize transplant success rates and patient outcomes.

Asia-Pacific is eclipsing other regions in terms of growth in the AMR prevention market, driven by higher healthcare spending and leading a rise in the incidence of chronic kidney disease and organ transplant programs in China, Japan, South Korea, and India. However, factors such as government schemes related to improving the accessibility to transplant procedures, increase in immunosuppressive drug development, and increase in clinical trials drive the market.

The sector has a solid pharmaceutical manufacturing base, which allows cost-effective production of AMR-palliation therapies. Market penetration is hindered by factors such as limited organ donation rates, inconsistent regulatory factors, and disparity in access to healthcare. Future market growth is expected to be driven by initiatives to improve transplant regulations, academic research collaborations, and affordable immunotherapy.

Challenges

Complexity of Immune System Modulation and Therapy Costs

Challenges in the AMR prevention market include the elaboration in immune system modulation and the above-average cost of therapy. Treating AMR in transplant patients is complex; it requires expensive, highly specialized therapies such as monoclonal antibodies and immune-modulating drugs that need to be monitored continuously. Moreover, inter-patient variability in immune responses prevents straightforward standardization of treatments, resulting in disparate outcomes with conventional therapies. Overcoming these hurdles, however, will require significant investments in personalized medicine, advanced biomarker identification, and affordable biologic manufacturing.

Opportunities

Advancements in Precision Immunotherapy and Biomarker Development

The increasing awareness regarding transplant immunology coupled with the mechanism of antibody-mediated rejection will serve as a key opportunity for growth. Specific immunotherapeutic are now targeted, which enhance transplant success and long-term graft function, such as inhibitors of complement and strategies targeting B-cell depletion. Moreover, progress in biomarker-based diagnostics is facilitating the early diagnosis of rejection risks, allowing for timely and personalized interventions. The AMR prevention market will continue to grow with ongoing investment into AI-based drug discovery and real-time immune monitoring technologies.

During 2020 to 2024, the AMR prevention market experienced growth due to the growing number of transplantation procedures and enhanced biologics for immune suppression. Nonetheless, limitations remained with access to niche therapies, prohibitive costs and the requirement for long-term immune suppression. Novel biologics and new diagnostics to detect rejection at earlier time points were developed by researchers and pharmaceutical developers alike.

In 2025 to 2035, gene-editing techniques like CRISPR alongside AI-driven immune profiling and precise immunotherapy will revolutionize AMR prevention. Machine learning has great potential to develop personalized therapeutic approaches and improve post-transplant outcomes while minimizing lifetime immunosuppression. Moreover, partnerships between biopharma companies and healthcare systems will leverage innovation in immune tolerance medications and make timely and effective AMR prevention available in many practice settings.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Strict regulations on biologic therapies |

| Technological Advancements | Development of monoclonal antibodies and complement inhibitors |

| Industry Adoption | Limited to major transplant centers |

| Supply Chain and Sourcing | Dependence on a few biotech firms |

| Market Competition | Dominance of a few pharmaceutical companies |

| Market Growth Drivers | Increasing organ transplant procedures |

| Sustainability and Energy Efficiency | High costs of biologic production |

| Integration of Smart Monitoring | Emerging use of real-time immune monitoring |

| Advancements in Drug Delivery | Traditional intravenous and subcutaneous administration |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined approvals for precision immunotherapies |

| Technological Advancements | AI-driven drug discovery and gene-based immune modulation |

| Industry Adoption | Widespread use across global transplant programs |

| Supply Chain and Sourcing | Expansion of biosimilar and localized manufacturing capabilities |

| Market Competition | Growth of niche biotech firms specializing in AMR prevention |

| Market Growth Drivers | Advancements in personalized medicine and immune tolerance therapies |

| Sustainability and Energy Efficiency | Cost-effective and eco-friendly biopharmaceutical manufacturing |

| Integration of Smart Monitoring | AI-based predictive analytics for transplant rejection risk assessment |

| Advancements in Drug Delivery | Development of long-acting and oral immunomodulatory treatments |

The United States dominates the AMR prevention market owing to its well-established healthcare system, increased research budget and an increasing number of transplant procedures. The rising prevalence of antibody-mediated rejection within solid organ transplantation (SOT) especially these of kidney, heart and lung transplants, has led to an increased need for novel immunosuppressive directed therapies as well as monoclonal antibodies.

Furthermore, the numerous major pharmaceutical companies and biotechnology firms operating in the space and engaged in creating innovative AMR treatment solutions are boosting the growth of the market. In addition, the FDA's more rapid approvals of innovative biologics and targeted therapies are speeding up adoption rates.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 15.8% |

In the UK, AMR prevention volume is maintained due to the growing rates of organ transplantation along with developments in personalized medicine. It is up to the National Health Service (NHS) to provide access to the cutting-edge AMR prevention therapies such as plasmapheresis, intravenous immunoglobulin (IVIG), and complement inhibitors.

Academic research institutions, biotech enterprises, and healthcare providers work closely together, spurring new drug discoveries and novel therapies. The expansion of the market is also driven by government-backed clinical trials and investments in regenerative medicine.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 15.3% |

The EU accounts for a considerable share of global AMR prevention market, with leading medical research and development centers in Germany, France, and Italy. The European Medicines Agency (EMA) smooths license approvals for new classes of immunosuppressant’s and biologics with rapid marketing authorization, which increases the rate at which drugs enter the European market.

The market is expanding due to the increasing awareness among the transplant patients about the antibody-mediated rejection, and the rising investment in the transplant diagnostics and therapeutic solutions. Moreover, research programs investigating long-term graft survival outcomes and personalized transplantation are accelerating the introduction of new AMR prevention strategies.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 15.4% |

Japan is currently experiencing strong growth in the AMR prevention market, owing to the country's growing number of solid organ transplant patients and increasing healthcare expenditure. AMR prevention initiatives in the country are led by a well-established pharmaceutical industry with top companies investing in monoclonal antibody-based therapies and precision medicine approaches.

Demand will continue to be reinforced by Japan's focus on technological solutions in transplant immunology and diagnostic science. Support from Japan's Pharmaceuticals and Medical Devices Agency (PMDA) is facilitating the fast-tracked introduction of new AMR therapeutics into the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 15.6% |

Fast-growing South Korea supported by increasing biotechnology investments and organ transplantation programs is another market for AMR prevention. The pharmaceutical industry in the country is getting bigger, especially through biosimilar and targeted immunotherapy solutions.

The development of more complex therapies in the area of transplant immunology has also supported growth in the market, complemented by government-backed initiatives encouraging the development of new therapies for AMR. Next, South Korea has been getting better with its proficiency in cell therapy and regenerative medicine which is paving its way towards AMR prevention next-generation solutions.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 15.7% |

Monoclonal antibodies have the largest share of antibody-mediated rejection (amr) prevention market, as they provide high specificity, potent immunosuppressive action, and long-term efficacy in rejection cases therapeutic monoclonal antibodies (mAbs) have revolutionized the area of transplant medicine, as these agents specifically target pro-rejection immune pathways.

Thus avoiding non-specific immunosuppression along with its sequelae and associated toxicities. These biologics target the detrimental action of the B cell and complement pathways responsible for a critical mechanism of acute rejection (i.e., antibody-mediated rejection).

The growth in global organ transplant procedures has led to a major demand for efficacious AMR preventive measures, positioning monoclonal antibodies at the forefront of AMR therapeutic intervention. Because allograft survival rates have improved with improved immunosuppressive management, transplant specialists now include mAbs into the standard protocols for maintaining long-term graft function. Increased adoption of novel monoclonal antibodies having higher specificity and longer half-lives are also accelerating the growth of this segment.

Monoclonal antibodies including rituximab, eculizumab and daratumumab appear to be promising in the prevention of rejection and therefore have been successfully used in kidney and heart transplantation. These therapies are B cell depleting and complement blocking, which greatly reduces the incidence of chronic AMR, the most significant challenge to transplant medicine.

The expectation is that next-generation monoclonal antibodies in clinical trials would help refine treatment as well; i.e., they could modulate an increasingly specific target pathway of the immune system and minimize adverse events.

The number of regulatory approvals for new monoclonal antibodies is rapidly increasing, with pharmaceutical companies highly involved in research and development efforts to enhance these biologics. The ability of monoclonal antibodies to drive personalized medicine and biomarker-driven treatment strategies has accelerated their adoption, making them the treatment of choice for transplant rejection prevention.

Monoclonal antibody therapies have shown benefits against COVID-19, yet their high cost is a barrier to broad access, especially in low- and middle-income countries. However, the gap will soon be filled with the entrance of biosimilar and the creation of government-funded reimbursement programs.

Biotechnology is on the rise, leading to surgeries and new understandings of immunology behind transplant rejection, and as describes, monoclonal antibodies stand to grow in the Antibody-Mediated Rejection Prevention Market, continuing to act as corner stone for transplant immunosuppression strategies.

Segment wise, the Hospitals segment is leading the antibody-mediated rejection prevention market globally, attributed to the availability of advanced transplant centers, high-end immunosuppressive treatment, and multidisciplinary teams specialized in transplant medicine. As primary hospitals performing organ transplantation procedures, AMR prevention strategies in renal, hepatic, cardiac, and lung allograft recipients are required under one roof where the latest facilities are provided for organ transplants.

Monoclonal antibodies, plasmapheresis, and other immunomodulatory therapies also need to be administered to patients in the hospital due to the specialized monitoring required of these therapies. Therefore, the ability to perform real-time immunological tests, therapeutic drug monitoring, and biopsy evaluation make hospitals the most appropriate environment for the prevention and management of AMR. Moreover, the application of precision medicine in the hospital environment has led to tailored immunosuppressive plans that enhance patient prognosis and decrease rejection episodes.

IDC reports that Hospital-associated infections (device-related) and high mortality rates leading to larger populations of patients necessitating early transplantation in cases of end-stage organ failure, are common problems with significant morbidity and mortality associated with end-stage organ failure contributing to the demand for organ transplant centre and significant morbidity all around.

The capacity of hospitals to implement advanced AMR prevention strategies like the complement inhibitors and B-cell depleting agents which will guarantee the best possible post-transplant outcome has been fortified with both public funding and private investments in transplant infrastructure.

By translating pioneering research coming out of leading transplant centers in North America and Europe into a clinical application, this work tackles AMR prevention with the use of AI-driven diagnostic tools and predictive analytics to optimise the efficacy of immunosuppressive therapy. As AMR trends continue to transform approachability to transplant hospitals into treatment costs, these engage with data evolution have placed hospitals to be able to dominate AMR prevention market, create innovation in the domain and improve in-patient, transplant prognosis.

While they enjoy a dominant position in the market, hospitals serve as the care continuum, but they are mired in high treatment costs, low availability of organs and complexities of managing multi-drug immunosuppressive regimens.

However, as transplant programs expand, awareness of antibody-mediated rejection grows, and novel therapeutic strategies come into play, hospitals will carry their leadership in the Antibody-Mediated Rejection Prevention Market, guaranteeing the continued evolution of transplant immunology and precision patient care.

The Antibody-mediated Rejection Prevention Market is expected to grow at a significant compound annual growth rate (CAGR) during the forecast period driven by factors such as increasing organ transplantation procedures, rising awareness about graft rejection and advancements in immunosuppressive therapies.

A potential new service for AMR prevention aging and a shortened lifespan for clinicians and organ transplant patients, this service can benefit the demand for targeted antibody therapies as well as the investment in biopharmaceutical companies developing monoclonal antibodies, complement inhibitors, and novel immunosuppressive agents.

Market players are increasingly emphasizing research and development (R&D), clinical trials, and regulatory approvals, to improve the efficacy of treatment and support long-term outcomes for transplants.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Roche Holding AG | 22-27% |

| Novartis AG | 18-22% |

| Bristol-Myers Squibb | 12-16% |

| Sanofi | 10-14% |

| Hansa Biopharma | 6-10% |

| Other Biopharmaceutical Companies (Combined) | 25-30% |

| Company Name | Key Offerings/Activities |

|---|---|

| Roche Holding AG | Spearheads development of targeted monoclonal antibody therapies for AMR, with a focus on complement inhibition and immune modulation. |

| Novartis AG | The company provides immunosuppressive drugs and biologics for the prevention of organ transplant rejection. |

| Bristol-Myers Squibb | Immune-modulation in kidney transplantation management of biologic therapies for desensitization approaches in novel biologics: towards the inhibition of donor specific antibodies (DSA). |

| Sanofi | Advanced immunotherapies for transplant patients, monoclonal antibodies, and fusion proteins. |

| Hansa Biopharma | Immunosuppressive therapy to improve transplantation in sensitized recipients. |

Key Company Insights

Roche Holding AG (22-27%)

Roche, a leader in the Antibody-mediated Rejection Prevention Market with its innovative monoclonal antibody therapies and complement inhibitors, addresses the critical challenge of AMR in kidney and heart transplant patients.

Novartis AG (18-22%)

Novartis has pioneered immunosuppressive therapies and our innovative biologics help prevent antibody-mediated organ rejection following transplantation.

Bristol-Myers Squibb (12-16%)

Strategies like those developed by Bristol-Myers Squibb (modulation of immune responses, hence BMS's immune modulating therapies, such as those that help reduce donor-specific antibodies, or the risk of rejection).

Sanofi (10-14%)

Monoclonal Antibodies: Immune pathway monoclonal antibodies to treat rejection, filgrastim.

Hansa Biopharma (6-10%)

Hansa Biopharma focuses on desensitization therapies that allow highly sensitized patients to undergo organ transplants with less risk of rejection.

Other Key Players (25-30% Combined)

Several emerging biotechnology and pharmaceutical companies are contributing to the development of advanced AMR therapies. Notable players include:

The overall market size for the antibody-mediated rejection prevention market was USD 103.4 million in 2025.

The antibody-mediated rejection prevention market is expected to reach USD 613.7 million in 2035.

The antibody-mediated rejection prevention market is expected to grow at a CAGR of 16% during the forecast period.

The demand for the antibody-mediated rejection prevention market will be driven by advancements in transplant medicine, increasing organ transplant procedures, growing research in immunosuppressive therapies, rising awareness about transplant rejection management, and improved healthcare infrastructure.

The top five countries driving the development of the antibody-mediated rejection prevention market are the USA, Germany, France, Japan, and the UK.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 10: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Europe Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 12: Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 13: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Asia Pacific Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 15: Asia Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 16: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: MEA Market Value (US$ Million) Forecast by Treatment, 2018 to 2033

Table 18: MEA Market Value (US$ Million) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 13: Global Market Attractiveness by Treatment, 2023 to 2033

Figure 14: Global Market Attractiveness by End User, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 28: North America Market Attractiveness by Treatment, 2023 to 2033

Figure 29: North America Market Attractiveness by End User, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Treatment, 2023 to 2033

Figure 44: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Europe Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 47: Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 48: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Europe Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 53: Europe Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 54: Europe Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 56: Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 57: Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 58: Europe Market Attractiveness by Treatment, 2023 to 2033

Figure 59: Europe Market Attractiveness by End User, 2023 to 2033

Figure 60: Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Asia Pacific Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 62: Asia Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 63: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Asia Pacific Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 68: Asia Pacific Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 69: Asia Pacific Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 70: Asia Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 71: Asia Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 72: Asia Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 73: Asia Pacific Market Attractiveness by Treatment, 2023 to 2033

Figure 74: Asia Pacific Market Attractiveness by End User, 2023 to 2033

Figure 75: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 76: MEA Market Value (US$ Million) by Treatment, 2023 to 2033

Figure 77: MEA Market Value (US$ Million) by End User, 2023 to 2033

Figure 78: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: MEA Market Value (US$ Million) Analysis by Treatment, 2018 to 2033

Figure 83: MEA Market Value Share (%) and BPS Analysis by Treatment, 2023 to 2033

Figure 84: MEA Market Y-o-Y Growth (%) Projections by Treatment, 2023 to 2033

Figure 85: MEA Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 86: MEA Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: MEA Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: MEA Market Attractiveness by Treatment, 2023 to 2033

Figure 89: MEA Market Attractiveness by End User, 2023 to 2033

Figure 90: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Embolic Prevention Systems Market

Hair Loss Prevention Products Market Size and Share Forecast Outlook 2025 to 2035

Infection Prevention Market is segmented by Product type and End User from 2025 to 2035

Bio-Fouling Prevention Coatings Market

Stretch Mark Prevention Creams Market Size and Share Forecast Outlook 2025 to 2035

Preterm Birth Prevention and Management Market Analysis - Size, Share, and Forecast 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Fraud Detection and Prevention Market Size and Share Forecast Outlook 2025 to 2035

Ischemic Cerebral Stroke Prevention Therapeutics Market

Next-Generation Intrusion Prevention System (NGIPS) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA