The global antibody therapy systems market is estimated to be valued at USD 144,734.5 million in 2025 and is projected to reach USD 301,088.9 million by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 144,734.5 million |

| Industry Value (2035F) | USD 301,088.9 million |

| CAGR (2025 to 2035) | 7.6% |

The Antibody Therapy Market is entering a new growth phase in 2025, driven by clinical advances in monoclonal antibodies (mAbs), bispecific antibodies, and antibody-drug conjugates (ADCs). High clinical efficacy, combined with expanding indications across oncology, autoimmune disorders, infectious diseases, and rare genetic conditions, is accelerating adoption. Increasing regulatory flexibility, such as accelerated approvals and orphan designations by the FDA and EMA, is streamlining the path for antibody-based therapies targeting previously untreatable or drug-resistant conditions.

Additionally, the expanding use of biomarker-guided treatment protocols is enhancing precision in therapeutic targeting, improving patient outcomes and reducing systemic toxicity. Pharmaceutical companies are actively investing in modular antibody platforms, allowing faster engineering of targeted therapies with better safety and stability profiles. The rise of next-generation production systems-such as single-use bioreactors and AI-optimized protein engineering-is lowering costs and shortening development timelines.

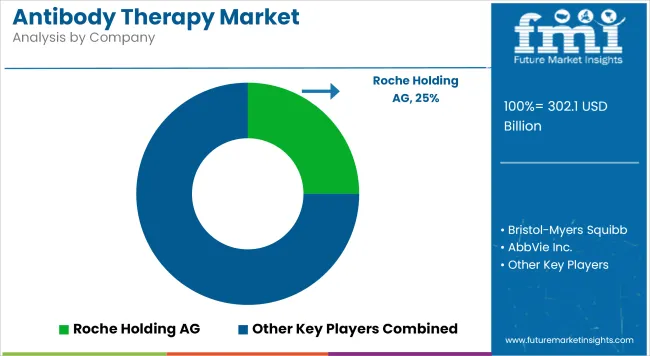

Key players influencing the antibody therapy market include Roche, Regeneron, AstraZeneca, AbbVie, Sanofi, Invenra Inc., and Eli Lilly. These companies are actively expanding their antibody portfolios by investing in bispecific constructs, ADCs, and novel immune checkpoint inhibitors. In May 2025, Invenra Inc., launched T-Body™ trispecific antibody platform, a next-generation technology designed to reliably direct correct chain pairing and afford high expression and assembly efficiency in a variety of antibody constructs, including complex trispecific constructs.

In 2025, Roland Green, Ph.D., CEO and Chairman of Invenra, stated: “Trispecific antibodies represent a major leap forward in therapeutic design, and our T-Body platform offers a unique approach to unlock their potential.”

This launch marks a significant milestone in non-oncologic antibody expansion. Meanwhile, Roche and Regeneron are co-developing oncology-focused bispecific antibodies with broader tumor-agnostic indications, and Eli Lilly has accelerated trials of ADCs in triple-negative breast cancer. These developments underscore the market's evolution from first-generation mAbs toward complex, multifunctional antibody platforms designed for high-specificity and high-impact therapeutic modulation.

In 2025, monoclonal antibodies hold significant market share of 78.3% in the year 2025. Monoclonal antibodies account for the majority share of the antibody therapy market, primarily due to their extensive clinical utility, high therapeutic efficacy, and strong regulatory backing across a wide range of disease areas. These biologics are highly specific in targeting antigens, which minimizes off-target effects and enhances safety and tolerability compared to traditional therapies.

Their effectiveness in treating complex conditions such as cancers, autoimmune disorders, and infectious diseases has led to widespread adoption in both hospital and outpatient settings. Regulatory agencies have continued to grant approvals for novel monoclonal antibodies, reinforcing their role as a cornerstone in modern therapeutic strategies.

Furthermore, the presence of a robust development pipeline, including next-generation monoclonal antibodies such as bispecific and Fc-engineered variants, is expanding their clinical relevance. Strong intellectual property protection and favourable reimbursement frameworks further support their commercial success. The ongoing shift toward personalized medicine and biomarker-driven therapies continues to strengthen their market leadership.

Hospitals account for the largest share of the antibody therapy market end users, contributing around 62.6% of total sales in 2025. This dominance is primarily driven by the complexity of antibody-based treatments, which often require intravenous administration, close monitoring, and multidisciplinary care teams. Monoclonal antibodies used in oncology, autoimmune diseases, and infectious disease management are frequently administered in hospital-based infusion centers due to the need for controlled environments and supportive care.

Additionally, hospitals are typically the first point of treatment for patients requiring biologics, especially during acute or advanced disease stages. Their access to advanced diagnostic tools and specialized healthcare professionals ensures proper patient selection, dosing, and adverse event management. Moreover, institutional procurement channels and inclusion in hospital formularies further support high-volume use of antibody therapies in these settings. As newer indications and advanced formulations emerge, hospitals will continue to be central to the delivery of antibody-based treatments.

North America leads the global antibody therapy market due to its strong biologics R&D ecosystem, access to capital, and comprehensive payer frameworks supporting high-cost therapies. The USA dominates in terms of FDA approvals, with over 85% of recent antibody therapies granted expedited review or orphan status. Companies headquartered in the USA benefit from proximity to world-class academic research centers and CROs specializing in biologics development.

The CMS’s increased flexibility in coverage for rare disease and oncology therapies is fuelling wider adoption of newer antibody formats. Additionally, mRNA and cell line engineering partnerships between pharma and AI-focused biotech startups are amplifying innovation in next-gen antibody discovery pipelines. Canada is also advancing in this space through government-supported translational research programs focused on immune-mediated disorders.

Europe is emerging as a strategic hub for antibody therapeutics, supported by EMA’s adaptive pathways and multi-nation trials under the EU Clinical Trials Regulation. Germany, Switzerland, and the UK are leading biologics innovation, with national health services funding real-world evidence (RWE) programs for post-market antibody performance tracking. The EU’s pandemic response fund has been partially redirected toward reinforcing biologic production capabilities, including modular antibody manufacturing hubs.

Meanwhile, France and the Netherlands are piloting hospital-based antibody delivery initiatives to reduce patient travel burden. Cross-border regulatory alignment and shared manufacturing infrastructure are also enabling smaller biopharma’s to scale production. As biosimilar adoption matures, Western Europe’s focus is shifting to advanced antibody formats and regional self-sufficiency in therapeutic protein production, establishing a robust base for long-term market expansion.

High Development Costs and Regulatory Complexities

There are vital challenges in the antibody therapy field such as the high cost of research and development and stringent regulatory requirements. The time-consuming and expensive process of creating, testing and approving antibody-based treatments requires putting in a large amount of money and time.

Additionally, differing legal requirements imposed by jurisdictions that range from municipalities to countries impede the growth of markets. To effectively meet these growing issues, businesses need to develop new bio manufacturing methods in partnership with some key groups.

Rising Demand for Targeted and Personalized Therapies

Rising prevalence of chronic diseases (cancer, autoimmune disorders, and infectious diseases) will be major factor driving the antibody therapy market growth. Emerging companies are investing heavily in research and development of antibody therapies. Biotechnology and genetic engineering:

Owing to the advances of biopharmaceutical and genetic engineering, the methods for developing antibody production have taken the forefront and we are now achievable to develop antibody as the most specific and personalized therapy on the market. Other important aspects likely to be fostered during the forecast period include integration of artificial intelligence and machine learning for drug discovery, increasing investments in monoclonal and bispecific antibodies and their target market.

North America accounts for the largest share of the global antibody therapy market due to strong healthcare infrastructure, high spending in research & development and presence of major biopharmaceutical companies in the region. Ever-increasing prevalence of chronic diseases, including cancer and auto immune diseases, has the growth of monoclonal antibodies and targeted therapies.

The Food and Drug Administration (FDA) plays a critical role in expanding markets, which often results in approvals of drugs at a faster pace and more innovation coming into the marketplace. In addition, collaboration between biotech and large pharmaceutical companies solidifies the development pipeline. As consumer education improves and more biosimilar enter into use, the USA antibody therapy market should continue to demonstrate strong growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 13.2% |

As for the United Kingdom, factors such as, government-supported healthcare systems, research colleges, and mounting inclination towards precision medicine, drive the antibody therapy market in the region. Patients can expect to see more biologics and monoclonal antibody treatments in the NHS in the UK.

Existing biotech clusters in Cambridge and London position the nation well to capitalize on new advances in next-generation antibody therapies. The movement toward personalized medicine and favourable regulatory policies of the Medicines and Healthcare Products Regulatory Agency (MHRA) are promoting the steady growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 12.7% |

A lucrative market for antibody therapy, EU offers a developed biopharma industry as well as increased public funds to assess immunotherapy-led trials in hospitals. Now it is countries such as Germany, France and Italy that have lead the clinical testing and drug commercialization.

It has had particular success in paving the way for novel biologic products to be approved allowing patients access to lifesaving antibody drugs as quickly as possible through this approach. In addition, the rising acceptance of biosimilar and emphasis on targeted therapies in oncology and auto-immune diseases are expected to propel the market growth in EU region.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 12.8% |

The Japanese antibody therapy market is benefiting from the rapid development of biopharmaceutical research and strong governmental supports in regenerative medicine. It has sparked significant growth in the use of monoclonal antibodies for cancer treatment, particularly in gastric and lung cancers.

Leading drug makers Takeda and Astellas have bet big on antibody-drug conjugates (ADCs) and new immunotherapies. Due to the aging population and increasing burden of chronic diseases, Japan is expected to provide favourable demand for antibody-based therapies over the coming ten years, as per the report.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.0% |

The advanced bio manufacturing capabilities and increasing government investments, South Korea is rising as a competitive player in the antibody therapy market. Under the innovative biopharmaceutical development policy, the country is also emerging among the global leaders in biosimilar, with the likes of Celltrion and Samsung Biologics earning first places in shipments.

In addition, strategic partnerships among universities, research institutes and biotech companies are advancing the discovery of new antibody therapeutics. With its population increasingly elderly and growing rates of chronic conditions, South Korea is set for stable growth in antibody therapy.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.1% |

The antibody therapy market is expected to increase as an honest increase within the Demand of targeted therapies and with the rise within the antibody therapy market. The rising adoption of monoclonal antibodies (mAbs) for the treatment of cancer, autoimmune disorders, and infectious diseases is significantly driving the market growth.

The focus of biopharmaceutical companies on R&D can potentially improve the therapeutic efficacy, minimize treatment side effects, and optimize patient outcomes. The market is primarily driven by strategic collaborations, regulatory approvals, and investments in next-generation antibody technologies.

The overall market size for the antibody therapy market was USD 144,734.5 million in 2025.

The antibody therapy market is expected to reach USD 301,088.9 million in 2035.

The antibody therapy market is expected to grow at a CAGR of 7.6% during the forecast period.

The demand for the antibody therapy market will be driven by advancements in biologic drug development, increasing prevalence of chronic diseases, rising investment in personalized medicine, expanding applications in oncology and autoimmune disorders, and growing government support for biopharmaceutical research.

The top five countries driving the development of the antibody therapy market are the USA, China, Germany, Japan, and the UK.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Antibody Profiling Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Antibody Purification Service Market - Growth, Demand & Forecast 2025 to 2035

Antibody-mediated Rejection Prevention Market Overview - Growth & Forecast 2025 to 2035

Global Antibody Discovery Market Insights – Size, Trends & Forecast 2024-2034

Global Antibody Market Report – Size, Demand & Forecast 2024-2034

Antibody Isotyping Kits Market

Antibody Pair Kits Market

Pet Antibody Testing Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Protein/Antibody Engineering Market Size and Share Forecast Outlook 2025 to 2035

Bispecific Antibody Market

Antinuclear Antibody Test Market

Human Combinatorial Antibody Libraries (HuCAL) Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Anti-Neurofilament L Antibody Market Trends - Growth & Forecast 2024 to 2034

IV Therapy and Vein Access Devices Market Insights – Trends & Forecast 2024-2034

Mesotherapy Market Size and Share Forecast Outlook 2025 to 2035

Cryotherapy Market Growth - Demand, Trends & Emerging Applications 2025 to 2035

Radiotherapy Positioning Devices Market Size and Share Forecast Outlook 2025 to 2035

Cell Therapy Systems Market Size and Share Forecast Outlook 2025 to 2035

Chemotherapy-Induced Nausea And Vomiting Therapeutics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA