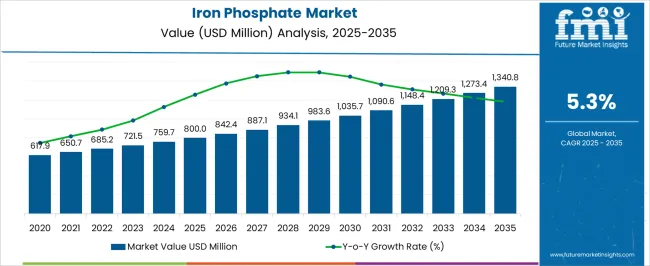

The Iron Phosphate Market is estimated to be valued at USD 800.0 million in 2025 and is projected to reach USD 1340.8 million by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. Between 2025 and 2030, the market exhibits steady year-on-year (YoY) growth, with values rising from USD 800 million in 2025 to approximately USD 842.4 million in 2026, marking a 5.3% increase. This trend continues through 2027 with USD 887.1 million and 2028 with USD 934.1 million, showing consistent annual increments close to the CAGR.

By 2029, the market will reach USD 983.6 million, and in 2030, it will cross the USD 1 billion mark, reaching around USD 1,035.7 million. Post-2030, the iron phosphate market maintains its momentum, with YoY growth rates steadily hovering near the 5% mark. The market expands to USD 1,090.6 million in 2031 and reaches USD 1,148.4 million in 2032. By 2033, it further increases to USD 1,209.3 million, followed by USD 1,273.4 million in 2034. The market is expected to reach USD 1,340.8 million by 2035. The consistent YoY growth underscores the ongoing demand for iron phosphate in various applications, driving incremental market expansion annually at a reliable pace.

| Metric | Value |

|---|---|

| Iron Phosphate Market Estimated Value in (2025E) | USD 800.0 million |

| Iron Phosphate Market Forecast Value in (2035F) | USD 1340.8 million |

| Forecast CAGR (2025 to 2035) | 5.3% |

The iron phosphate market is witnessing a steady uptick in demand, driven by applications across lithium iron phosphate (LFP) batteries, agriculture, and food fortification. Shifting preferences toward phosphate-based cathode materials for energy storage are reshaping the market landscape, particularly in the electric vehicle and grid storage sectors.

Government-led decarbonization strategies, increased deployment of renewables, and incentives for localized battery manufacturing are accelerating the uptake of iron phosphate compounds. In parallel, regulatory push for micronutrient enrichment in food and fertilizer formulations is sustaining demand in agrochemical and nutritional segments.

Manufacturers are also responding to rising purity requirements and performance optimization through advancements in granulation, surface modification, and controlled pH synthesis processes. As battery chemistries evolve and nutritional security initiatives expand, iron phosphate is expected to remain integral to both energy transition and food security ecosystems.

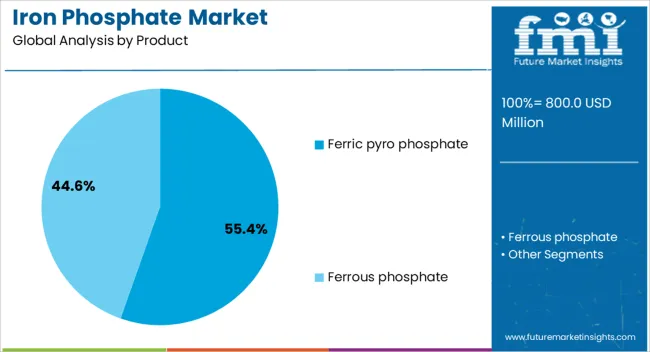

The iron phosphate market is segmented by product, and geographic regions. By product of the iron phosphate market is divided into Ferric pyro phosphate and Ferrous phosphate. Regionally, the iron phosphate industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ferric pyro phosphate is projected to lead the market with a 55.40% revenue share in 2025, positioning it as the most dominant product category in the iron phosphate landscape. Its stronghold is being driven by growing adoption in food and pharmaceutical applications, owing to its bioavailability, stability, and non-reactive nature.

Regulatory approval for ferric pyro phosphate as a safe iron supplement has expanded its use in nutrient fortification of cereals, infant foods, and dietary supplements. The compound’s favorable sensory profile minimized metallic taste and low reactivity has made it suitable for diverse formulations without compromising product integrity.

In addition, its role in precision fertilizers is being reinforced by the need for sustained-release nutrient systems in modern agriculture. Ease of handling, compatibility with various excipients, and extended shelf stability further contribute to its widespread commercial acceptance across high-volume end-user segments.

The iron phosphate market is expanding as industries increasingly use this compound for corrosion protection, surface treatment, and as a key ingredient in battery manufacturing. Its multifunctional applications across automotive, construction, electronics, and chemical sectors drive demand. Environmental regulations encouraging eco-friendly coatings and sustainable manufacturing boost its adoption as a safer alternative to traditional phosphates. While challenges like raw material availability and cost fluctuations exist, innovations in production processes and growing demand from emerging markets provide significant growth opportunities.

Iron phosphate is widely employed as a corrosion-resistant coating in metal treatment processes. Its ability to form a stable, protective layer enhances metal durability and paint adhesion, especially in automotive and industrial machinery. This functionality reduces maintenance costs and extends asset life, appealing to manufacturers focused on product longevity. Increasing emphasis on vehicle lightweighting and durability further supports iron phosphate usage in automotive coatings. Regulations limiting hazardous chemicals in surface treatments drive a shift toward iron phosphate-based alternatives, expanding its market penetration in protective coatings and pre-treatment applications globally.

Iron phosphate is a critical component in lithium iron phosphate (LiFePO4) batteries, favored for their safety, thermal stability, and long life cycle. As electric vehicles and renewable energy storage gain momentum, demand for these batteries surges, positively impacting iron phosphate consumption. Research focuses on enhancing battery performance and reducing production costs by refining iron phosphate synthesis methods. Growing investments in energy storage infrastructure and the shift toward sustainable power solutions contribute to steady growth. This expanding battery application opens new markets and drives technological advancements within the iron phosphate industry.

The iron phosphate market faces risks related to fluctuations in raw material availability, particularly phosphate rock and iron ore. Mining and geopolitical factors can disrupt supply, causing price volatility and impacting production costs. Additionally, the environmental impact of phosphate mining and stringent regulations may restrict access to certain deposits. These challenges require manufacturers to optimize sourcing strategies and invest in recycling and alternative raw materials. Ensuring a stable, sustainable supply chain is critical for meeting growing demand, especially in high-growth sectors like automotive coatings and battery materials.

Emerging economies are witnessing increased industrialization and automotive production, boosting demand for iron phosphate in corrosion protection and battery applications. Governments’ focus on environmental protection and sustainable manufacturing practices encourages adoption of iron phosphate as a non-toxic alternative in surface treatments. Expansion of electric vehicle infrastructure and renewable energy projects further stimulate market growth. Local production facilities and strategic partnerships in these regions help overcome supply chain challenges and customize products to regional standards. These trends position the iron phosphate market for robust growth over the coming years.

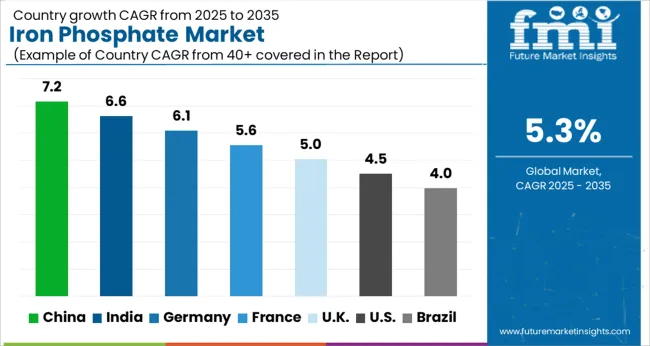

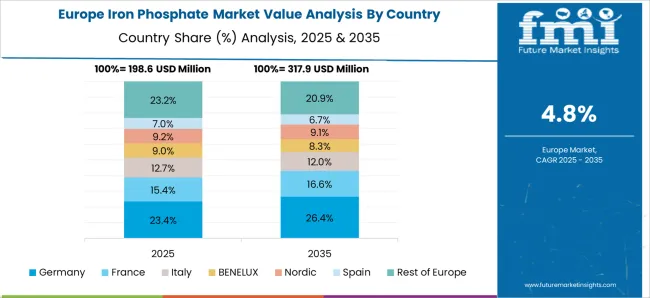

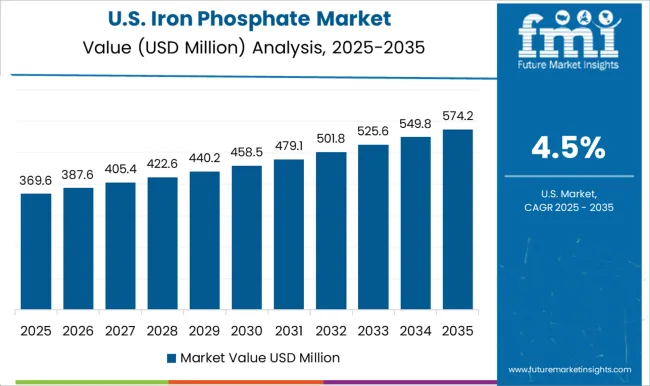

The global iron phosphate market is expanding at a 5.3% CAGR, driven by its growing use in coatings, batteries, and corrosion-resistant applications. Among BRICS nations, China leads with 7.2% growth, supported by large-scale industrial production and research investments. India follows at 6.6%, fueled by rising demand in automotive and electronics sectors. In the OECD region, Germany records 6.1% growth, reflecting strong regulatory frameworks and innovation in sustainable materials. The United Kingdom grows at 5.0%, driven by increasing use in protective coatings and energy storage. The United States, a mature market, shows 4.5% growth, shaped by stringent environmental standards and technological advancements. These countries collectively influence market trends through improvements in production processes, regulatory compliance, and product development. This report includes insights on 40+ countries; the top countries are shown here for reference.

China iron phosphate market is growing at a 7.2% CAGR, driven by rising demand in the battery, agriculture, and coating industries. The expanding electric vehicle sector significantly boosts the need for iron phosphate in lithium iron phosphate batteries. Compared to Western markets, China leads in production capacity and consumption, benefiting from strong government support for clean energy and advanced manufacturing. Additionally, agricultural use as a fertilizer additive promotes soil health and crop yields, enhancing market expansion. Domestic chemical manufacturers focus on innovation to improve product quality and reduce costs. Environmental regulations also encourage the use of iron phosphate as an eco-friendly alternative in coatings and pigments. China's rapid industrialization and green energy focus position it at the forefront of the iron phosphate market globally.

India iron phosphate market is advancing at a 6.6% CAGR, supported by rising battery manufacturing and agricultural activities. The growing electric vehicle market and renewable energy projects increase demand for lithium iron phosphate batteries. Compared to China, India’s market is smaller but expanding rapidly due to government incentives promoting green energy and sustainable farming practices. Agricultural use of iron phosphate helps improve soil fertility and pest resistance, gaining popularity among farmers. Local chemical manufacturers are investing in production capacity and product development. Coating and pigment industries also adopt iron phosphate as a non-toxic, corrosion-resistant additive. India's market growth reflects a balance between industrial expansion and environmental awareness in chemical applications.

Germany iron phosphate market is progressing at a 6.1% CAGR, driven by high demand in automotive batteries, agriculture, and industrial coatings. Germany’s strong focus on environmental sustainability encourages use of iron phosphate as a green alternative in coatings and pigments. The electric vehicle industry propels lithium iron phosphate battery production, supporting market expansion. Compared to Asian markets, Germany emphasizes product quality and regulatory compliance in chemical manufacturing. Agricultural applications benefit from advancements in bio-based fertilizers using iron phosphate. Collaboration between manufacturers and research institutes accelerates innovation. Germany’s commitment to reducing hazardous chemicals aligns with growing iron phosphate adoption for safer and more sustainable industrial uses.

United Kingdom iron phosphate market is growing at a 5.0% CAGR, supported by demand in battery manufacturing, agriculture, and coatings. The UK market focuses on sustainable chemical products to meet environmental regulations and consumer preferences. Lithium iron phosphate batteries gain traction in renewable energy storage and electric vehicle sectors, driving growth. Agricultural adoption of iron phosphate-based fertilizers promotes eco-friendly farming practices. Compared to Germany, the UK market is smaller but steadily expanding due to government support for green technologies. Coating industries increasingly use iron phosphate for corrosion resistance and pigment applications. The UK market balances industrial demand with environmental sustainability priorities to ensure steady growth.

United States iron phosphate market is advancing at a 4.5% CAGR, driven by battery production, agriculture, and industrial coatings. The expanding electric vehicle market fuels demand for lithium iron phosphate batteries. Compared to Asian and European markets, the USA market growth is moderate due to established alternatives and regultory considerations. Agricultural use of iron phosphate for soil conditioning and pest control contributes to steady demand. Coating and pigment manufacturers increasingly adopt iron phosphate as a safer, environmentally friendly additive. Research and development focus on improving product efficiency and sustainability. The USA market reflects gradual adoption of iron phosphate aligned with energy transition and green manufacturing trends.

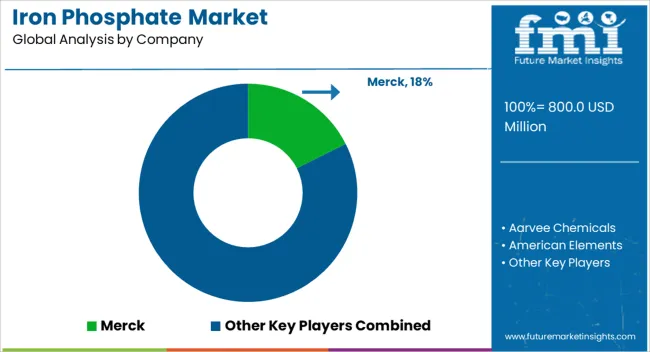

The iron phosphate market is shaped by suppliers focusing on high-purity, consistent-quality compounds for use in pharmaceuticals, coatings, agriculture, and specialty chemicals. Merck is a prominent leader, known for its stringent quality standards and diversified product portfolio serving pharmaceutical and industrial applications worldwide. Aarvee Chemicals and American Elements are key players that emphasize tailored chemical formulations and reliable supply chains to meet varied industry demands. Charkit Chemical Corporation and Crest Industrial Chemicals focus on specialty chemical distribution, providing customized iron phosphate grades to niche markets such as corrosion inhibitors and pigments. Hefei Asialon Chemical Co., Ltd. and Zhengzhou Ruipu Biological Engineering Co., Ltd. cater predominantly to the Asian market, offering cost-effective solutions with an emphasis on agricultural and industrial uses. Imperial Chem Incorporation, Jost Chemical Co., and Spectrum Laboratory Products round out the competitive landscape by supplying specialty iron phosphate compounds and intermediates for research, manufacturing, and product development. The market competition encourages continuous innovation in production processes and product quality enhancement, driven by rising demand for eco-friendly and efficient iron phosphate variants across multiple sectors.

A key player in the battery industry, Livent produces high-quality lithium iron phosphate and is focusing on expanding its capacity to meet the growing demand for EV batteries.

Solvay manufactures iron phosphate-based chemicals and has been involved in the development of eco-friendly coatings and agricultural products.

| Item | Value |

|---|---|

| Quantitative Units | USD 800.0 Million |

| Product | Ferric pyro phosphate and Ferrous phosphate |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Merck, Aarvee Chemicals, American Elements, Charkit Chemical Corporation, Crest Industrial Chemicals, Hefei Asialon Chemical Co., Ltd., Imperial Chem Incorporation, Jost Chemical Co., Spectrum Laboratory Products, and Zhengzhou Ruipu Biological Engineering Co., Ltd. |

| Additional Attributes | Dollar sales in the Iron Phosphate Market vary by application (batteries, coatings, ceramics, water treatment), product type (monohydrate, dihydrate), end-use industry (automotive, electronics, construction), and region (North America, Europe, Asia-Pacific). Growth is driven by demand for eco-friendly materials, battery technology advancements, and industrial applications. |

The global iron phosphate market is estimated to be valued at USD 800.0 million in 2025.

The market size for the iron phosphate market is projected to reach USD 1,340.8 million by 2035.

The iron phosphate market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in iron phosphate market are ferric pyro phosphate, _end-use, _pharma, _animal feed, _fertilizers, _paint & coating, _steel manufacturing, ferrous phosphate and _end-use.

In terms of , segment to command 0.0% share in the iron phosphate market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lithium Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Automotive Portable Lithium Iron Phosphate Battery Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Counterweight Market Size and Share Forecast Outlook 2025 to 2035

Phosphated Ester Market Size and Share Forecast Outlook 2025 to 2035

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Phosphate Salts Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Phosphate Fertilizer Market Size, Growth, and Forecast 2025 to 2035

Iron Oxide Market Report - Growth, Demand & Forecast 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Phosphate Market Growth - Trends & Forecast 2024 to 2034

Phosphate Esters Market

Phosphated Distarch Phosphate Market

Diphosphates Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Environmentally Friendly RPET Webbing Market Size and Share Forecast Outlook 2025 to 2035

Environment Health and Safety Market Size and Share Forecast Outlook 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA