The phosphate salts market is estimated to be valued at USD 60.3 billion in 2025 and is projected to reach USD 114.3 billion by 2035, registering a compound annual growth rate (CAGR) of 6.6% over the forecast period.

During this period, demand was primarily driven by targeted applications in agriculture, food processing, and industrial use. Early adopters, including specialized producers and regional distributors, helped establish initial market credibility. Growth in these years was steady, supported by incremental adoption and cautious expansion, as stakeholders evaluated supply chains, pricing, and market readiness. This foundational stage set the stage for broader acceptance and scaling in the coming years.

From 2025 to 2030, the market enters a scaling phase, climbing from USD 60.3 billion to approximately 83.1 billion. Wider adoption occurs as manufacturers and distributors expand their reach, and demand increases across multiple sectors. By 2030, with the market surpassing USD 83.1 billion, adoption becomes mainstream, signaling the start of consolidation. Between 2030 and 2035, the market grows steadily to USD 114.3 billion, with leading players solidifying market share, optimizing distribution networks, and stabilizing growth in a mature and predictable segment of the global phosphate salts market.

| Metric | Value |

|---|---|

| Phosphate Salts Market Estimated Value in (2025 E) | USD 60.3 billion |

| Phosphate Salts Market Forecast Value in (2035 F) | USD 114.3 billion |

| Forecast CAGR (2025 to 2035) | 6.6% |

The market is experiencing steady momentum, primarily fueled by its critical role across industries including agriculture, food processing, and pharmaceuticals. Rising global demand for nutrient-rich fertilizers, coupled with the increasing need for food preservation and pH stabilization, has positioned phosphate salts as a strategic commodity. Industry-led innovations and investments in high-purity formulations have been driving adoption, especially in food and medical-grade applications.

Regulatory trends supporting clean-label and fortified food products have further influenced market growth, as phosphate salts are being utilized as stabilizers, emulsifiers, and acidity regulators. From a production standpoint, major players are expanding processing capacities and optimizing mining outputs to meet diverse industrial specifications.

Furthermore, global supply chain resilience and regional government support in developing economies have encouraged domestic production and reduced import dependencies As applications continue to diversify and environmental guidelines shape sourcing practices, the phosphate salts market is poised for incremental yet sustained expansion in both volume and value terms.

The phosphate salts market is segmented by grade, product, end use, and geographic regions. By grade, the market is divided into food grade, technical grade, and pharmaceutical grade. In terms of product, the market is classified into sodium phosphates, aluminium phosphates, ammonium phosphates, potassium phosphates, sodium polyphosphates, pyrophosphate, calcium phosphates, and others. Based on end use, the market is segmented into fertilizer, dairy, bakery products, meat & seafood processing, beverages, metal & mining industry, water treatment, textiles, paints & coatings, animal feed, detergents, pharmaceuticals, and others. Regionally, the phosphate salts industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The food grade segment is expected to account for 41.7% of the market revenue share in 2025, making it the leading grade segment. This position has been driven by increasing use of phosphate salts in processed foods, dairy products, and beverages as stabilizers, emulsifiers, and pH control agents. Regulatory approval across major food safety authorities has ensured broad acceptance of food grade phosphate salts in global markets.

Their functional versatility in extending shelf life and maintaining texture consistency has made them indispensable in packaged and convenience foods. Rising consumer demand for fortified foods has further supported the segment’s prominence, as phosphate salts are used in mineral enrichment.

Adoption has also been influenced by manufacturers’ shift toward clean-label additives that offer functionality with minimal synthetic input This combination of regulatory alignment, performance benefits, and evolving dietary preferences has reinforced the food grade segment’s dominant share within the phosphate salts market.

The sodium phosphates segment is projected to contribute 26.3% of the market revenue share in 2025, positioning it as the leading product category. Its dominance has been supported by widespread usage across food, pharmaceutical, and water treatment applications due to its solubility, buffering capacity, and stability. In food applications, sodium phosphates have been preferred for their role in emulsification, moisture retention, and acidity regulation.

In the pharmaceutical sector, they are utilized as laxatives and electrolyte-replenishing agents, ensuring continued demand from healthcare providers. Industrial utility in detergents and boiler water conditioning has also contributed to consistent consumption.

The ease of formulation and compatibility with other ingredients have allowed sodium phosphates to maintain a stable presence across diversified end uses Additionally, manufacturers have focused on improving production efficiency and regulatory compliance, which has further strengthened this segment’s market share in 2025.

The fertilizer end use segment is anticipated to account for 18.9% of the market revenue share in 2025, establishing it as a significant contributor to the overall market. Growth in this segment has been supported by the increasing need for phosphate-rich fertilizers to enhance soil fertility and crop productivity. As global agricultural practices evolve toward intensive cultivation and sustainable yield improvement, the application of phosphate-based nutrients has gained traction.

Government-led agricultural subsidy programs and policies promoting balanced fertilization have further encouraged the use of phosphate salts in farming. Their role in supporting root development and improving plant metabolic functions has made them essential in both conventional and precision farming systems.

Technological advancements in granulation and slow-release formulations have improved application efficiency, reducing nutrient runoff and environmental impact These factors have collectively reinforced the fertilizer segment’s growing share within the phosphate salts market, reflecting its integral role in global food security initiatives.

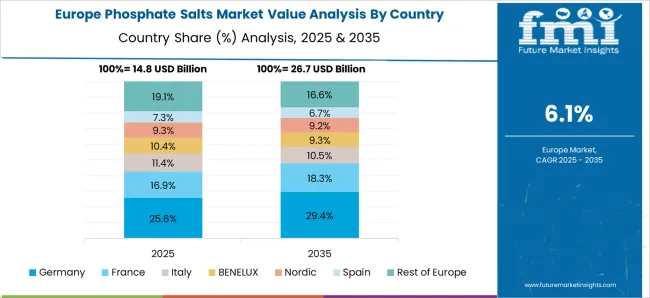

The phosphate salts market is experiencing steady growth, driven by demand from fertilizers, food additives, animal feed, and industrial applications. Phosphate salts are valued for their nutrient content, buffering capabilities, and functional properties in manufacturing processes. North America and Europe lead due to established agricultural and food industries, while Asia-Pacific shows strong growth potential driven by expanding agriculture and industrialization. Market growth is supported by innovations in high-purity formulations, environmentally friendly production, and multifunctional applications. Companies are focusing on product differentiation through quality, solubility, and regulatory compliance to capture share in diverse sectors.

Ensuring consistent quality of phosphate salts is a critical challenge. Variations in mineral sources, extraction methods, and chemical purity can affect solubility, nutrient content, and functional performance. Lack of standardized processing protocols may lead to batch-to-batch inconsistencies, impacting applications in food, feed, and fertilizers. Manufacturers targeting high-performance sectors require traceable supply chains, validated assay results, and adherence to regulatory standards such as food-grade or feed-grade certifications. Until harmonized quality benchmarks and testing procedures are widely adopted, variability in raw materials constrains market growth and product reliability.

Technological developments are improving the performance and application versatility of phosphate salts. Innovations in water-soluble formulations, micronutrient enrichment, and controlled-release fertilizers enhance agricultural productivity. In food and feed applications, high-purity salts with tailored solubility and buffering properties improve safety and functionality. Advanced processing methods reduce impurities and environmental impact, supporting sustainable practices. Companies leveraging R&D and partnerships with research institutions are able to deliver enhanced formulations that meet industry-specific standards. These innovations drive adoption across agriculture, food, and industrial segments while enabling premium product differentiation.

Phosphate salts are subject to regulatory oversight due to environmental, health, and safety concerns. Fertilizer applications must comply with nutrient management guidelines and restrictions on phosphorus runoff to prevent ecological damage. Food and feed grades require adherence to safety standards such as FDA, EFSA, or FAMI-QS certifications. Environmental and chemical regulations may impact production processes, discharge treatment, and labeling requirements. Suppliers aligning products with regulatory standards gain market credibility and access to global markets. Until uniform international regulations emerge, navigating diverse regional compliance frameworks remains a challenge for market participants.

The phosphate salts market is moderately competitive, featuring large multinational producers and regional players. Raw material sourcing is dependent on phosphate rock availability, mining operations, and geopolitical factors, creating potential supply volatility. Seasonal demand fluctuations, logistics constraints, and processing lead times further impact market stability. Companies investing in vertical integration, diversified mining sources, and efficient production technologies secure supply reliability and cost advantages. Competitive differentiation is increasingly achieved through product purity, solubility, and sustainability credentials. Until raw material supply and production scalability improve, competition and supply chain challenges will continue to influence market positioning and adoption.

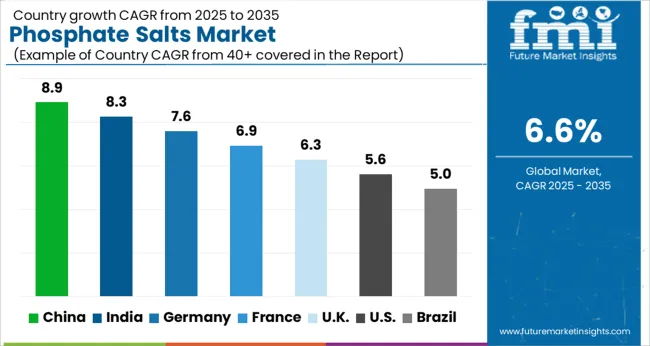

The global Phosphate Salts Market is projected to grow at a CAGR of 6.6% through 2035, supported by increasing demand across fertilizers, food additives, and industrial applications. Among BRICS nations, China has been recorded with 8.9% growth, driven by large-scale production and widespread agricultural use, while India has been observed at 8.3%, supported by growing fertilizer demand and industrial applications. In the OECD region, Germany has been measured at 7.6%, where production for food processing and industrial use has been steadily maintained. The United Kingdom has been noted at 6.3%, reflecting consistent adoption in agriculture and manufacturing, while the USA has been recorded at 5.6%, with steady utilization in fertilizers and food-grade applications being consistently increased. This report includes insights on 40+ countries; five markets are shown here for reference.

The phosphate salts market in China is growing at a CAGR of 8.9%, driven by expanding agricultural activities and industrial applications. Phosphate salts are extensively used as fertilizers to enhance crop yield, and China’s large-scale farming and government agricultural support programs are accelerating market adoption. Industrial applications in food additives, detergents, and water treatment also contribute to market growth. Manufacturers are investing in advanced production techniques to improve purity, solubility, and efficiency of phosphate salts to meet industrial and agricultural standards. Rising awareness about sustainable farming and regulatory standards regarding fertilizer use are influencing the market positively. With strong domestic production capacity and a growing number of industrial applications, the phosphate salts market in China is expected to maintain steady growth over the forecast period, catering to both domestic consumption and export demand.

The phosphate salts market in India is expanding at a CAGR of 8.3%, supported by the country’s growing agricultural sector and industrial utilization. India is a major consumer of phosphate salts for fertilizer production, improving crop yields and soil health. Industrial applications include food processing, detergents, and water treatment, further boosting market demand. Government initiatives promoting sustainable agriculture and increased production efficiency are strengthening the adoption of phosphate salts. Manufacturers are investing in R&D to develop high-quality, soluble, and efficient phosphate salts for diverse applications. With rising population and food demand, the market is expected to grow steadily. The growing awareness of eco-friendly practices and regulatory compliance in industrial and agricultural sectors also drives the market in India, providing opportunities for both domestic manufacturers and international suppliers.

The phosphate salts market in Germany is growing at a CAGR of 7.6%, influenced by strict environmental regulations and a strong focus on sustainable agriculture. Germany’s agricultural industry utilizes phosphate salts as essential fertilizers, while industrial sectors use them in food additives, detergents, and water treatment applications. The market is further supported by research initiatives aimed at producing high-purity, environmentally compliant phosphate salts. Growing consumer demand for eco-friendly agricultural and food products is pushing manufacturers to adopt phosphate salts with improved solubility and efficiency. Industrial applications continue to expand in line with Germany’s technological advancements and regulatory frameworks. Overall, the market demonstrates stable growth, driven by the combination of sustainable agriculture practices, industrial demand, and innovation in phosphate salt production and processing.

The phosphate salts market in the United Kingdom is expanding at a CAGR of 6.3%, fueled by increasing adoption in agriculture and industrial sectors. The UK agriculture sector uses phosphate salts to enhance soil fertility and crop yield, while industrial applications include food additives, detergents, and water treatment. Government policies and initiatives encouraging sustainable agricultural practices further support market growth. Manufacturers are investing in production improvements to deliver high-quality phosphate salts that comply with environmental and industrial standards. Rising demand for eco-friendly products and sustainable farming practices is driving both production and adoption. With steady industrial and agricultural demand, the phosphate salts market in the UK is expected to experience consistent growth in the coming years.

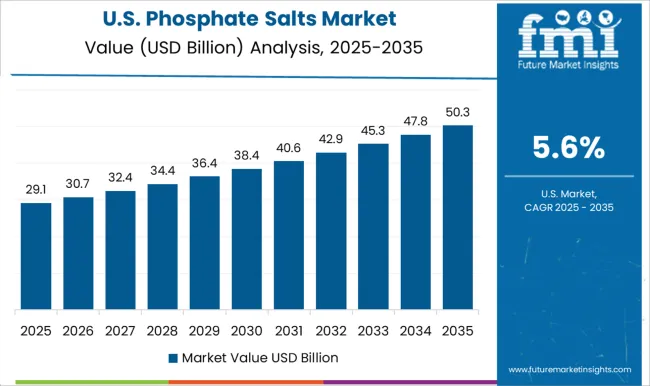

The phosphate salts market in the United States is growing at a CAGR of 5.6%, supported by agricultural and industrial demand. Phosphate salts are widely used as fertilizers to enhance crop productivity and in industrial applications such as food processing, detergents, and water treatment. The market is influenced by regulatory standards ensuring environmental safety and product quality. Manufacturers are focusing on improving the solubility and effectiveness of phosphate salts to meet industrial and agricultural requirements. The growing interest in sustainable farming and eco-friendly products drives adoption across both B2B and B2C sectors. With continuous demand from agriculture and industry, coupled with technological improvements in production, the phosphate salts market in the US is projected to expand steadily over the forecast period.

The phosphate salts market serves industries such as agriculture, food and beverages, pharmaceuticals, and water treatment. Key players focus on high-purity products, sustainable sourcing, and global distribution capabilities. ICL Group is a major supplier of phosphate salts for agriculture, food, and industrial applications. Chengdu Talent Chemical and Hubei Xingfa Chemicals provide phosphate salts for fertilizers and specialty chemicals. Haifa Group specializes in high-quality phosphate-based fertilizers and feed additives. Innophos focuses on food-grade and industrial phosphate salts, while Kanha Life Science supplies pharmaceutical and nutraceutical applications.

Sulux Phosphates and Wengfu Group produce phosphate salts for industrial, agricultural, and chemical uses. TKI Hrastnik d.d. offers specialty phosphate salts for technical and chemical applications. These suppliers continue to drive market growth through innovation, high-quality production, and adherence to global standards for safety and sustainability..

| Item | Value |

|---|---|

| Quantitative Units | USD 60.3 Billion |

| Grade | Food grade, Technical grade, and Pharmaceutical grade |

| Product | Sodium phosphates, Aluminium phosphates, Ammonium phosphates, Potassium phosphates, Sodium polyphosphates, Pyrophosphate, Calcium phosphates, and Others |

| End Use | Fertilizer, Dairy, Bakery products, Meat & seafood processing, Beverages, Metal & mining industry, Water treatment, Textiles, Paints & coatings, Animal feed, Detergents, Pharmaceuticals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | ICL Group, Chengdu Talent Chemical, Haifa Group, Hubei Xingfa Chemicals, Innophos, Kanha Life Science, Sulux Phosphates, TKI Hrastnik d.d., and Wengfu Group |

| Additional Attributes | Dollar sales by type including mono-, di-, and tri-sodium phosphate, application across food additives, fertilizers, and industrial uses, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand in agriculture, processed foods, and water treatment, alongside increasing focus on nutritional fortification and industrial efficiency. |

The global phosphate salts market is estimated to be valued at USD 60.3 billion in 2025.

The market size for the phosphate salts market is projected to reach USD 114.3 billion by 2035.

The phosphate salts market is expected to grow at a 6.6% CAGR between 2025 and 2035.

The key product types in phosphate salts market are food grade, technical grade and pharmaceutical grade.

In terms of product, sodium phosphates segment to command 26.3% share in the phosphate salts market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Phosphated Ester Market Size and Share Forecast Outlook 2025 to 2035

Phosphate Fertilizer Market Size, Growth, and Forecast 2025 to 2035

Phosphate Conversion Coatings Market 2025 to 2035

Phosphate Market Growth - Trends & Forecast 2024 to 2034

Phosphate Esters Market

Phosphated Distarch Phosphate Market

Diphosphates Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Polyphosphate Market Food-Grade, Feed Grade, Cosmetic Grade and Other Grades through 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Hyperphosphatemia Market Size and Share Forecast Outlook 2025 to 2035

Feed Phosphate Market Analysis by Product, Livestock, and Region through 2035

Organophosphate Insecticides Market Size and Share Forecast Outlook 2025 to 2035

Organophosphate Pesticides Market

Sodium Phosphate Market Growth & Demand Forecast 2025 to 2035

Ferric Phosphate Market

Calcium Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Distarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ammonium Phosphate Market Trends & Analysis 2019-2029

Industrial Phosphates Market Size and Share Forecast Outlook 2025 to 2035

Monostarch Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA