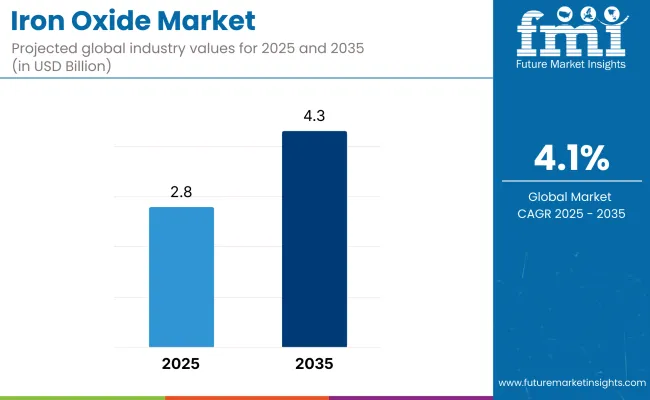

The iron oxide market is expected to experience consistent growth, with a market size of USD 2.8 billion in 2025 set to be around USD 4.3 billion by 2035, demonstrating a CAGR of approximately 4.1%. This growth will be driven by demand from construction, coatings, plastic, and cosmetics sectors.

The industry is used extensively as a pigment, valued for its UV stability, toxicity-free character, and durability. It finds applications from paints, coatings, and tiles to plastics and cosmetics and is therefore a critical material in industrial and consumer goods requiring prolonged color and protection.

Construction is a primary force behind industry growth. The pigments find wide application in concrete, bricks, and paving stones to provide long-lasting, visually attractive finishes. With global infrastructure and urban development growing rapidly, especially in the developing economies, colored building materials are in increasing demand.

Environmental sustainability is also considered. The pigments are normally made from recyclable materials and are non-poisonous, hence a top choice among sustainable production and green building initiatives. This is along with international movement toward ecologically friendly material acquisition.

However, the sector is facing challenges such as volatility of raw material prices and stringent environmental laws in pigment production and mining. The factors have the capacity to impact the cost of production and supply continuity, especially for synthetic options derived from industrial processes.

The Asia Pacific region is responsible for the majority of world consumption with booming construction activity, industrial production, and growing consumer goods manufacturing. India and China continue to be the top countries in demand, while North America and Europe feel the growing popularity of sustainable, high-performance pigments for specialty applications.

Trends of tailored pigment shades, micron-sized particle sizes, and multi-function composites are gathering pace. There is investment by manufacturers in R&D to drive cleaner, greener production and value-added goods with improved dispersion and performance for industries.

In summary, the industry is transforming with the rise of sustainable infrastructure, design aesthetics, and product innovation. With industries looking for durable, green, and low-cost pigments, iron oxide continues to be a foundation material in international manufacturing and construction.

| Market Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 2.8 billion |

| Industry Value (2035F) | USD 4.3 billion |

| CAGR (2025 to 2035) | 4.1% |

The industry is growing steadily due to the growing demand from different industries like building, paints and coating, plastics, and ceramics. The pigments are appreciable for their good color stability, resistance to UV, and non-toxicity, due to which they can be applied to many different applications.

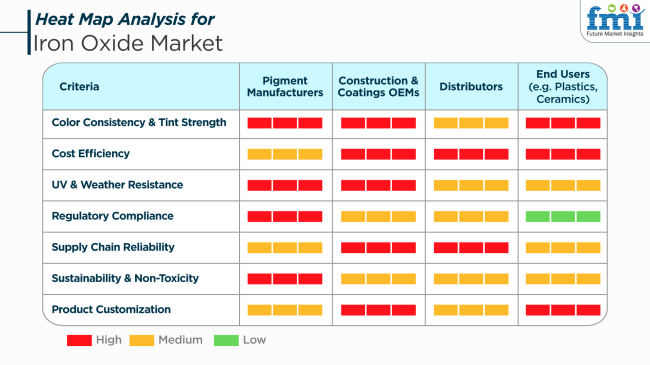

Distributors focus on cost-effectiveness and secure supply chains to satisfy the needs of their varied customer base. They need pigments that are easily accessible and competitively priced to ensure their industry share.End Users, like producers in the ceramics and plastics industries, seek pigments that are easy to incorporate into their processes. They appreciate choice in customizing solutions to meet certain color needs and performance attributes for their products.

Generally, the industry is dominated by a collaborative approach by stakeholders to create and use pigments that are compliant with performance needs, environmentally friendly, and responsive to changing consumer needs.

Theindustry underwent steady growth from 2020 to 2024, spurred mainly by a high demand within the construction industry and the coatings industry. The pigments were in great demand due to their exceptional color stability, UV resistance, and non-toxicity in concrete, tiles, and paint.

For example, in the building industry, pigments were often used for paving stones and pre-fabricated panels to ensure color uniformity and weather resistance. Nevertheless, factors such as stricter environmental regulations on the production of synthetic pigments and supply chain disintermediation impacted manufacturing, especially in Asia-Pacific countries.

Between 2025 and 2035, the industry is set to pay greater attention to high-tech advancements and sustainability. New technologies such as lithium-ion battery nano iron oxide and bio-based pigments are also being in demand.

There is a greater investment being made by companies into cleaner, lower-emitting manufacturing technology in order to help them achieve the climate objectives of the world.Increasing demand for green energy and electric vehicles also fuels demand as a battery material and catalysts. Urbanization in emerging economies will also support long-term growth, particularly for industrial and infrastructural uses.

Comparative Market Shift Analysis 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Very strong demand in construction, coatings, and infrastructural uses. | Specific focus on technology development in electric vehicles and renewable energy, nano-iron oxide, and sustainability. |

| Greater use of pigments in concrete, tile, and paint. | Emergence of nano-iron oxide and bio-based technologies. |

| Greater use in battery systems and catalytic processes. | Environmental policies impacting production of man-made pigments. |

| Tighter emission controls encouraging cleaner, low-emission production techniques. | Strong Asia-Pacific production and demand, with supply chain bottlenecks. |

| Urbanization in emerging economies driving industrial and infrastructure demand. | Construction, coatings, and paints industrie s driving demand. |

| Electric cars, energy storage (batteries), and renewable energy industrie s as principal drivers of growth. | Early transition to environmentally friendly production in pigment production. |

The industry is sensitive to changes in raw material prices. Volatility in the prices of key inputs, including iron ore and energy, can have a substantial impact on production costs. Unanticipated price spikes can undermine profit margins, making it difficult for manufacturers to sustain competitive pricing levels.

Environmental controls are a major threat to the industry. Compliance with diverse regional requirements involves ongoing monitoring and adjustment. Incompliance can lead to legal action and brand reputational harm, influencing industry position and customer confidence.

Supply chain disruptions, including transport delays or geopolitics, can stall the delivery of raw materials and finished products within schedules. Interruptions in such may lead to halting of productions and lost demand to customers and damage sales, and customer base relationships over a longer term.

Competition and technology overwhelm the industry. Companies are compelled to invest in research and development for innovations to increase and sustain product offerings from time to time. Otherwise, they risk becoming obsolete and losing industry share to nimbler players.

Reliance on principal industries like construction, paints, and coatings means that a slump in these industries can directly influence the demand. Having a diversified customer base across many industries can avoid this risk.

In summary, the industry faces risks from raw material price volatility, regulatory challenges, supply chain disruptions, technological changes, and sector-specific economic downturns. Proactive strategies addressing these factors are essential for sustaining growth and competitiveness in this dynamic industry.

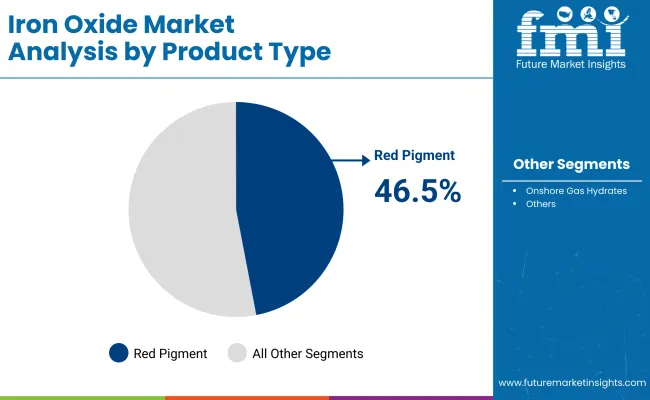

The entire pigment industry in 2025 is projected to be held by the red pigment segment, the significant contributor to which it is estimated to occupy 46.5% of the entire industry share. The yellow pigment segment comes next with a 20.1% industry share.

In addition, considerable demand growth will be witnessed by red pigments, derived mainly from the industries of construction, coatings, plastics, and ceramics. Known for high color strength, UV stability, and chemical and atmospheric weather resistance, red pigments are extremely popular in applications, including concrete blocks, pavers, roofing tiles, and paints for exteriors.

Major players like LANXESS AG and Cathay Industries, along with Venator Materials Plc, are supplying high-purity synthetic red iron oxides to meet the aesthetic and durability requirements in infrastructure and decorative building projects. Increased adoption of the build material trend toward sustainable, lasting constructions in developed and developing economies continues to push the demand for these colors.

The yellow pigment part also occupies a good share because it is used in coating industrial, plastics, rubber, and finish paints. They yield deep, bright colors and some opacity, all of which provide an essential component in color-matching systems for both architectural and industrial coatings.

It also applies to agricultural equipment, warning signs, and consumer goods for appeal, where the performance to fade is critical. Diversified yellow shades are met using high precipitation and blending methodologies at companies such as Hunan Sanhuan Pigment Co., Ltd. and Yipin Pigments.

These product segments will continue to gain traction due to the increased emphasis on aesthetic finishes, environmental compatibility, and cost-effective solutions for coloration, especially in construction and coatings. Iron oxide is thus likely to remain used for future growth across infrastructure, consumer goods, and industrial applications.

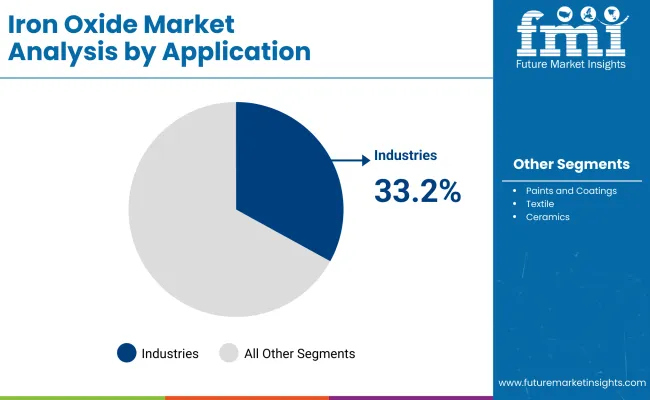

Pigments in 2025 are expected to be propelled by two prime application segments: construction will lead the industry with a 33.2% industry share, and application in paints & coatings, which account for 24.5% of the overall demand.

The construction segment is likely to capture the lion's share at 33.2%, which is fueled by the groundwork development that has mushroomed substantially in emerging economies. The same finds extensive use in coloring concrete, pavers, roof tiles, and flooring due to their long-lasting coloration under UV, weather-stable, and resistance qualities.

The pigments improve the aesthetic quality of buildings' durability in massive-scale infrastructure and housing projects. Some of the major manufacturers are LANXESS, Cathay Industries, and Venator; the companies manufacture high-performance pigments specially tailored for use in concrete applications to ensure a homogenous color distribution and high tinting strength. It has further propelled growth in the segment of pre-colored concrete blocks as well as sustainable construction materials.

In paints and coatings, it should make up about 24.5%, entering the industry in 2025. The pigments have become preferable in this industry because of their opacity, retention of color, and corrosion resistance. They are, therefore, useful in allowing them to be used in either decorative or protective coatings.

For instance, in architectural paints, automotive primers, industrial coatings, and marine finishes, where performance during the long term is essential, iron oxides by Hunan Sanhuan Pigment and Yipin Pigments provide a rich palette of high-durability coatings designed to resist environmental stress and mechanical wear. Such industries focus on eco-friendliness; Europe and North America currently prefer low-VOC, heavy-metal-free pigments whose iron oxide pigment properties would perfectly suit and thus further add to the cause.

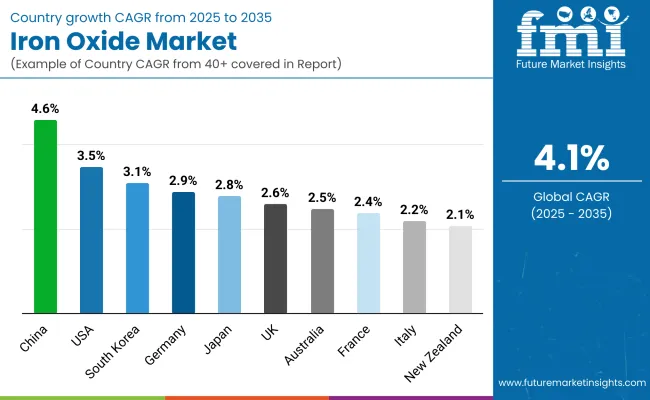

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 3.5% |

| UK | 2.6% |

| France | 2.4% |

| Germany | 2.9% |

| Italy | 2.2% |

| South Korea | 3.1% |

| Japan | 2.8% |

| China | 4.6% |

| Australia | 2.5% |

| New Zealand | 2.1% |

The USAindustry will grow at 3.5% CAGR from 2025 to 2035. Expansion is driven by demand in construction, coating, and plastic applications. Iron oxide pigments are widely used for coloring pavers, concrete, and coatings in accordance with infrastructure renewal and green building construction. Technology integration for paint manufacturing also propels volume growth.

Key industry players like Venator Materials PLC and Lanxess Corporation are focusing on product consistency, environmental regulation, and process improvement. Increasing pressure on natural appearance in building design also underpins demand for synthetic and natural forms. Local production bases and rigorous quality control give growth added strength.

The UK industry is anticipated to register a growth rate of 2.6% CAGR between 2025 and 2035. Decorative coatings and construction segments propel the demand. Renovation activities, as well as the restoration of aging buildings, are boosting the persistent usage of pigments in architectural paints and concrete goods.

Industry leaders such as BASF and Cathay Industries are investing in niche pigment blends to meet color-matching specifications. The use of green pigments is driving demand for pigments with low toxicity grades. Industrial coatings and refinish automotive coatings are also secondary yet stable segments that are driving industry growth.

The French industry is projected to expand at 2.4% CAGR from 2025 to 2035. Industry expansion is driven by growing demand for corrosion-resistant pigments and coatings used in coating applications and construction materials. Industry expansion is also driven by regulatory drives for the adoption of eco-friendly materials in infrastructure development.

High-quality producers are directing attention to natural pigment sources and water-based systems of dispersion. Product development programs adhere to European specifications for low-VOC products. Domestic consumption of ceramics and industrial paints is enhancing the stable demand for them from regional manufacturing complexes.

The industry in Germany is estimated to increase at a rate of 2.9% between 2025 and 2035. The construction industry in Germany is still the main area of application of pigments. Demand is supported by the application of highly colored concrete in new city-center developments and its wider use in tiles and paving blocks.

Key players like Lanxess AG are implementing sophisticated manufacturing technologies and augmenting their portfolios of synthetic pigments. Demand from the plastics processing industry, as well as machinery coatings, is also generating a solid platform for consumption. Focusing on precision-engineered color shades further augments the differentiation of products in the industry.

The Italian industry is expected to gain a CAGR of 2.2% in 2025 to 2035. Middle-of-the-pack growth in tile-manufacturing and construction industries propels the industry trends. The pigments are valued for their hardness and cost-efficiency for exterior finishes as well as for concrete buildings.

Key producers are concentrating on enhancing pigment dispersibility and compatibility with different binder systems. Italy's focus on the restoration of historic buildings to keep up with the demand for specific color schemes based on pigments is another growth area for specialty-grade pigments. It is used in ceramics and terrazzo and offers further growth opportunities for specialty-grade pigments.

The South Korean industry is predicted to expand at a 3.1% CAGR over the period between 2025 and 2035. Industry expansion is stimulated by growth in construction materials, pigment plastics, and high-technology coatings. The increasing government spending on infrastructure and development and beautification programs sparks increased product use.

Producers such as Yipin Pigments and domestic suppliers are launching technologically superior grades for application in a range of industrial uses. Iron oxide's UV stability and toxicity are perfectly matched for the domestic demand for green products. Wider use in electronic casing and packaging also fuels diversified trends.

The Japanese industry is anticipated to develop at a 2.8% CAGR between 2025 and 2035. The demand for these products in industrial paint, automotive coating, and special ceramics is fueling the industry. Industry growth in terms of development is spearheaded by requirements of particle size stable pigments as well as the quality of the dispersion.

Well-established players such as Toda Kogyo Corp. and Sakai Chemical Industry Co., Ltd. are bent on developing pigment properties to suit high-performance applications. Increasing demand for heat resistance and UV stability in architectural exterior applications is the space for continued absorption. Domestic innovation in specialty colorants drives product function across downstream industries.

China is forecast to drive global growth in the industry at a CAGR of 4.6% between 2025 and 2035. Sustained demand from the construction, paint, plastic, and coatings sectors drives industry growth. Urbanization and state-sponsored infrastructure development drive bulk pigment demand.

Large domestic producers like Deqing Tongchem Co., Ltd. and Yuxing Pigment Co., Ltd. are boosting domestic production to meet domestic and export demands. Large-scale manufacturing coupled with innovation in synthetic pigment quality has ensured competitive pricing as well as leadership in world supply. Stable demand for long-lasting pigment solutions is made possible through progressive urbanization towards sustainability.

The industry in Australia is anticipated to record a CAGR of 2.5% from 2025 to 2035. Construction, landscaping, and protective coatings are the growth segments. Growing usage in precast concrete products and pavers is driving volume demand.

Firms like Venator and domestic producers are trying to coordinate pigment products with climate-resilient building trends. Green sensitivities are convincing the use of non-toxic and natural-source pigments. Civil engineering and infrastructure development offer consistent encouragement for synthetic uptake.

New Zealand's industry will grow at a CAGR of 2.1% during the period 2025 to 2035. Consistent demand in residential building construction, colored concrete products, and exterior finishes is propelling growth. Environmental focus on materials is having an impact on purchasing behavior.

Producers are focusing on high-strength pigment systems that are appropriate for outdoor weathering and underwater use. Decorative concrete industries continue to be major consumers of pigments, especially in urban development and municipal landscaping construction. Import-driven availability is marked by consistent demand for stable and permanent colorants.

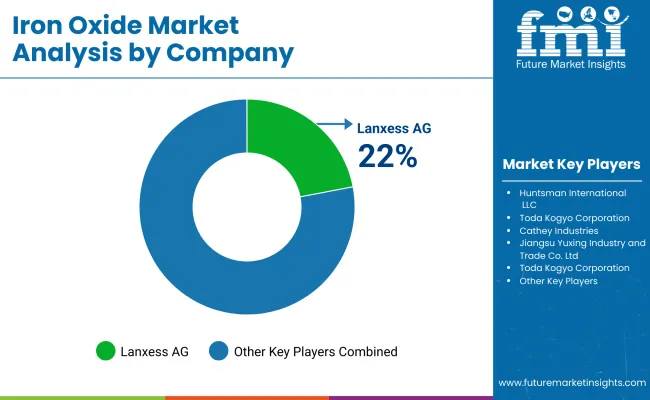

The competitive landscape of the industryis dominated by international supply chains of chemicals, pigment manufacturers, and suppliers of several specialty oxides. The leaders, such as Lanxess AG, Huntsman International LLC, Toda Kogyo Corporation, Cathey Industries, and Jiangsu Yuxing Industry and Trade Co. Ltd., have unsurpassed industry standing capabilities through pigment processing modifications, high-quality iron oxides and built global distribution networks.

They work particularly on color formulation customization, environment-friendly processes, and product durability to enhance competitive advantages. Mediocre companies, such as Alabama Pigments Company and Golccha Pigments Pvt. Ltd., concentrate on regional industry development, the costs of production, and supply chain alliances. They distill their manufacturing through custom pigment blends for construction, coatings, and plastics, with strict quality and regulatory conformance.

Upcoming companies like Tata Pigments Company, Yaroslavsky Pigment Company, and Hunan Three-Ring Pigments Co. Ltd. are making their entry, with strongholds on localized manufacturing, competitive pricing, and pigment solutions of sustainability. Their business revolves around the growing demand for pigments in paints, coatings, ceramics and industrial applications while developing their export capabilities.

The competitive landscape is constantly evolving due to technological advancements in iron oxide processing, as well as mergers and acquisitions, and an increasing demand for environmentally friendly pigments. Lanxess and Huntsman International LLC are leading the way in innovation by offering high-purity synthetic iron oxides and color-stable formulations. These products are recognized for their high purity, which helps both companies strengthen their positions in the international market.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Lanxess AG | 22-26% |

| Huntsman International LLC | 16-20% |

| Toda Kogyo Corporation | 12-16% |

| Cathey Industries | 8-12% |

| Jiangsu Yuxing Industry and Trade Co. Ltd. | 6-10% |

| Others (combined) | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Lanxess AG | Produces high-purity synthetic iron oxide pigments for coatings, construction, and plastics applications. |

| Huntsman International LLC | Specializes in premium-grade pigments with enhanced durability and UV resistance. |

| Toda Kogyo Corporation | Focuses on customized pigment formulations for industrial coatings and specialty applications. |

| Cathey Industries | Supplies cost-effective oxides for construction and ceramic industries. |

| Jiangsu Yuxing Industry and Trade Co. Ltd. | Develops high-performance pigment solutions with advanced processing technologies. |

Key Company Insights

Lanxess AG (22-26%)

The industry leader in synthetic iron oxide pigments, focusing on color consistency, sustainability, and innovation in coatings and plastics applications.

Huntsman International LLC (16-20%)

Extending a premium range of pigments that stress high-performance, weather-resistant, eco-friendly solutions.

Toda Kogyo Corporation (12-16%)

Intensifying its specialty pigment division, developing custom oxide formulations directed at industrial coatings and precision applications.

Cathey Industries (8-12%)

To enhance its ability to produce low-cost suitable for regional construction and ceramic industries.

Jiangsu Yuxing Industry and Trade Co. Ltd. (6-10%)

Involved in getting high performance in processing and advanced pigment dispersion technology.

Other Key Players

By product type, the industry is segmented into various product types including red, yellow, black, brown, orange, green, and other blends.

By application, the industry finds use in a wide range of industries, including construction, paints and coatings, plastics, chemicals, paper and pulp manufacturing, textile, ceramics, leather, and other sectors such as fertilizers, cosmetics, and rubber.

By region, the industry is analyzed across North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is estimated to be worth USD 2.8 billion in 2025.

Sales are projected to grow significantly, reaching USD 4.3 billion by 2035.

China is expected to experience a CAGR of 4.6%.

Red pigment is leading the industry, primarily used in the production of paints, coatings, and construction materials due to its stability and versatility.

Prominent companies include Lanxess AG, Huntsman International LLC, Toda Kogyo Corporation, Cathey Industries, Jiangsu Yuxing Industry and Trade Co. Ltd., Alabama Pigments Company, LLC, Golccha Pigments Pvt. Ltd., Shenghua Group Deqing Huayuan Pigment Co. Ltd., Tata Pigments Company, Yaroslavsky Pigment Company, and Hunan Three-Ring Pigments Co. Ltd.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Kilo Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Kilo Tons) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Kilo Tons) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Kilo Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Kilo Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Kilo Tons) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Kilo Tons) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Kilo Tons) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Iron and Steel Casting Market Size and Share Forecast Outlook 2025 to 2035

Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Ironing Table Market Size and Share Forecast Outlook 2025 to 2035

Iron Powder Market - Trends & Forecast 2025 to 2035

Iron Ore Pellets Market Growth - Trends & Forecast 2025 to 2035

Environment Health and Safety Market Size and Share Forecast Outlook 2025 to 2035

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environment Testing, Inspection and Certification Market Report – Demand, Growth & Industry Outlook 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

Total Iron-Binding Capacity Reagents Market

Lithium Iron Phosphate Market Size and Share Forecast Outlook 2025 to 2035

Lithium Iron Phosphate (LIP) Battery Market Size and Share Forecast Outlook 2025 to 2035

Reduced Iron Powder Market Analysis by Product, Application and Distribution Channel Through 2035

Curling Irons Market Analysis – Growth, Sales & Demand 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA