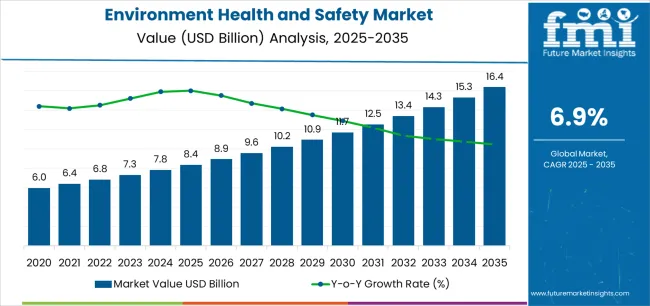

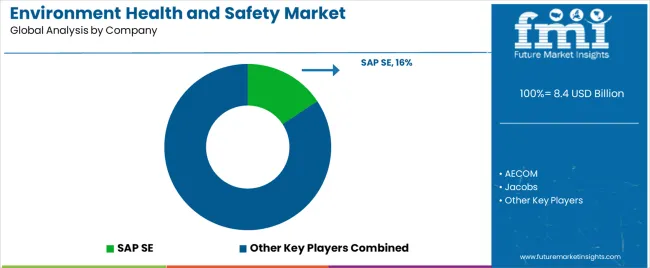

The Environment Health and Safety Market is estimated to be valued at USD 8.4 billion in 2025 and is projected to reach USD 16.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.9% over the forecast period.

The environment health and safety (EHS) market is experiencing sustained expansion, driven by increasing regulatory compliance requirements, corporate sustainability initiatives, and the growing emphasis on workforce safety. Organizations are adopting advanced EHS management systems to streamline incident reporting, risk assessment, and compliance tracking across global operations. Digital transformation and the integration of analytics-driven tools have enhanced operational transparency and decision-making efficiency.

The market is also influenced by stricter environmental standards and the adoption of ESG frameworks, compelling companies to implement technology-based EHS solutions. Demand is rising across industries such as oil & gas, chemicals, manufacturing, and construction, where safety and regulatory accountability remain critical.

With cloud-based deployment models becoming standard, scalability and real-time monitoring capabilities are improving accessibility for enterprises of all sizes. Over the forecast period, the EHS market is expected to witness strong momentum as sustainability-linked governance and automation continue to define industrial best practices.

| Metric | Value |

|---|---|

| Environment Health and Safety Market Estimated Value in (2025 E) | USD 8.4 billion |

| Environment Health and Safety Market Forecast Value in (2035 F) | USD 16.4 billion |

| Forecast CAGR (2025 to 2035) | 6.9% |

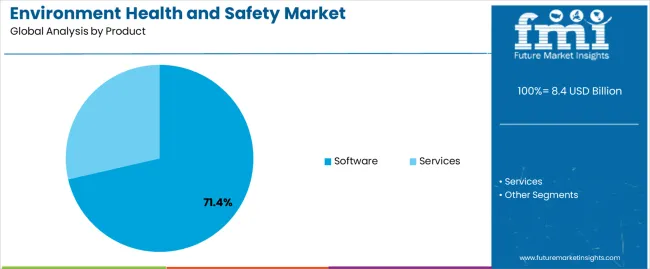

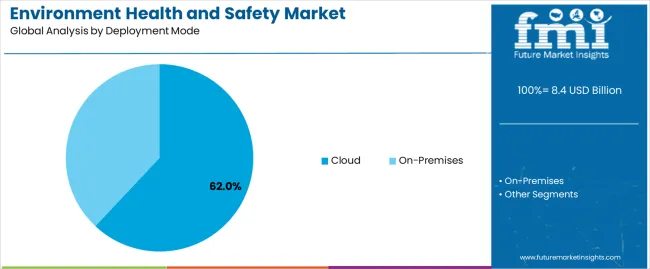

The market is segmented by Product, Deployment Mode, and End Use and region. By Product, the market is divided into Software and Services. In terms of Deployment Mode, the market is classified into Cloud and On-Premises.

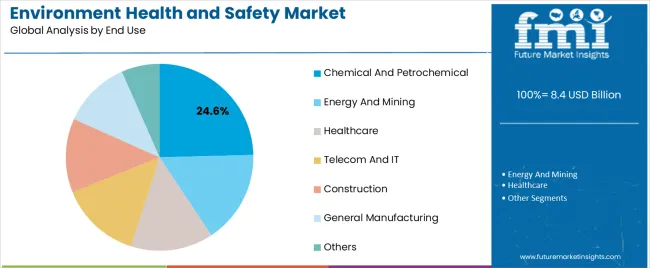

Based on End Use, the market is segmented into Chemical And Petrochemical, Energy And Mining, Healthcare, Telecom And IT, Construction, General Manufacturing, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

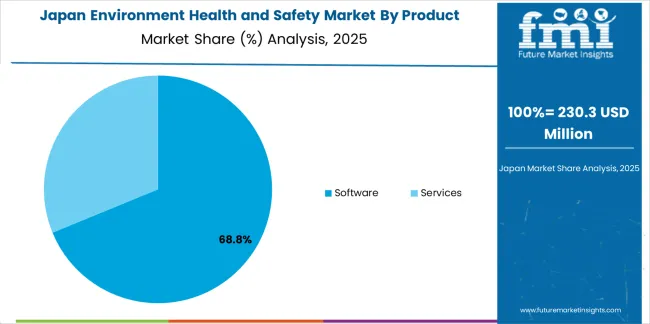

The software segment dominates the product category, accounting for approximately 71.4% share of the environment health and safety market. This segment’s leadership is attributed to the increasing reliance on digital platforms for managing environmental compliance, safety reporting, and audit workflows.

EHS software provides centralized visibility and automated risk mitigation tools, enhancing efficiency and reducing human error. The growing shift toward integrated, cloud-based management systems has further expanded its application across multiple industries.

Vendors are introducing AI-powered modules for predictive analytics and performance benchmarking, improving proactive safety management. With the need for consistent regulatory reporting and corporate accountability, the software segment continues to displace traditional manual processes, positioning it as a vital component of modern enterprise sustainability strategies.

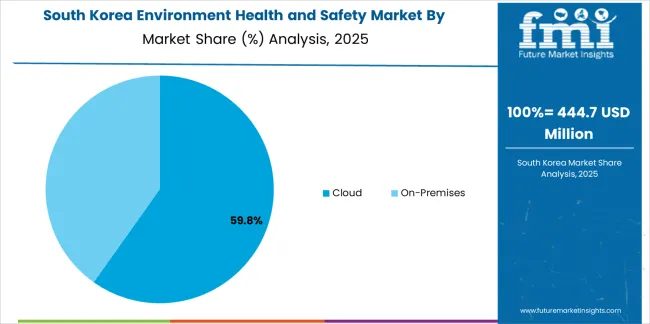

The cloud segment holds approximately 62% share within the deployment mode category, reflecting its growing adoption for scalability, data accessibility, and cost efficiency. Cloud-based EHS solutions enable real-time monitoring and centralized data management across distributed operations, reducing IT overhead for organizations.

This segment’s growth is reinforced by the demand for remote compliance management, particularly among global enterprises managing multiple sites. Enhanced cybersecurity measures and regulatory data protection frameworks have improved trust in cloud platforms.

The segment benefits from ease of integration with existing enterprise systems such as ERP and HR management software. With digital transformation accelerating across industries, the cloud deployment model is expected to remain dominant due to its flexibility and low maintenance requirements.

The chemical and petrochemical segment leads the end-use category with approximately 24.6% share. This leadership stems from the industry’s complex regulatory landscape and high safety risk environment.

Companies in this sector depend on EHS systems for incident prevention, emissions monitoring, and hazardous materials management. Increasing environmental scrutiny and global sustainability targets have amplified adoption rates, while digital tools are being leveraged to ensure real-time safety tracking and compliance verification.

The segment’s prominence is also driven by the need to standardize safety procedures across global production sites. With continuous investments in digital safety transformation and stricter environmental norms, the chemical and petrochemical segment is expected to sustain its leadership position in the coming years.

The table below offers a comparative outlook of three markets, including the main market. The other two markets are environment testing, inspection, and certification market and testing, inspection and certification market. These markets focus on inspection services to ensure product quality and different claims by the product brand.

Out of these markets, environment health and safety market is projected to register a higher growth rate of 7.3% CAGR through 2035. As more companies operating in different domains are setting their sustainability goals, demand for environmental health and safety management systems is expected to rise.

Environment Health and Safety Market:

| Attributes | Environment Health and Safety Market |

|---|---|

| CAGR (2025 to 2035) | 7.3% |

| Growth Factor | Increasing prioritization of sustainability among companies |

| Opportunity | Rising government initiatives to ascertain workforce safety by mandating environmental standards and regulations |

| Key Trends | Growing demand for cloud-based environment health and safety solutions |

Environment Testing, Inspection, and Certification Market:

| Attributes | Environment Testing, Inspection, and Certification Market |

|---|---|

| CAGR (2025 to 2035) | 6.5% |

| Growth Factor | Increasing consumer awareness about product quality owing to the deterioration of resources like soil and water continues |

| Opportunity | Accelerating efforts by private and public organizations to promote environment protection |

| Key Trends | Surging demand for soil inspection |

Testing, Inspection, and Certification Market:

| Attributes | Testing, Inspection, and Certification Market |

|---|---|

| CAGR (2025 to 2035) | 5.30% |

| Growth Factor | Growing demand for services that include vigorous testing and certification procedures to ascertain the integrity of nanoparticles, nanomaterials, and nano-devices |

| Opportunity | Increasing emphasis on sustainability is projected to create heightened demand for biodegradability testing |

| Key Trends | Growing demand to ensure quality control of additive manufacturing. |

The United States and China are the top consumers of environment health and safety services or software. These countries are expected to register moderate sales prospects throughout the forecast period. Meanwhile, the market is set to exhibit a promising future in countries like the United Kingdom and Japan.

South Korea is projected to emerge as a lucrative market for environment health and safety (EHS). Proactive investors and manufacturers are anticipated to set their foot in the country to increase their revenue.

| Countries | Forecasted CAGR (2025 to 2035) |

|---|---|

| The United States | 7.60% |

| The United Kingdom | 8.30% |

| China | 7.90% |

| Japan | 8.30% |

| South Korea | 9.10% |

The environment health and safety industry in the United States is anticipated to account for a value of USD 16.4 billion by 2035. The market is projected to reach a 7.6% CAGR through 2035. Factors propelling the growth are:

The market value of environment health and safety in the United Kingdom is estimated to reach USD 641.3 million by 2035. Through the forecast period, the demand is projected to increase at a CAGR of 8.3%. Factors increasing the market growth are:

The environment health and safety market in China is forecast to gather USD 2.6 billion by 2035. From 2025 to 2035, the market is anticipated to increase at a CAGR of 7.9%. The top leading market growth factors are:

Revenue generation by the environment health and safety industry in Japan is anticipated to reach USD 1.7 billion by 2035. Over the forecast period, the market is projected to extend at a pace of 8.3% CAGR.

Key players in the EHS market in South Korea are predicted to generate a revenue of USD 1.0 billion by 2035. The market is likely to register a CAGR of 9.1% through 2035. The following factors are contributing to market development:

| Attributes | Details |

|---|---|

| Top Product | Software |

| Market Growth Rate from 2025 to 2035 | 7.1% |

The software segment is projected to increase at a CAGR of 7.1% over the forecast period. Factors that are driving the market growth are:

| Attributes | Details |

|---|---|

| Top Deployment Mode | Cloud |

| Market Growth Rate from 2025 to 2035 | 6.8% |

The cloud segment is anticipated to register a CAGR of 6.8% through 2035. Growing demand for cloud services is hinged on the following factors:

Key players are aiming to lead the way by offering robust solutions that are effective in different sectors to position themselves as a premier environment health and safety provider. Industry participants are further focusing on developing strategic partnerships with other companies in this space.

Market players are further making significant investments to maintain their technological prowess and develop new products. Additionally, industry participants are assembling a large and impressive team of environment health and safety and management experts with wide knowledge, experience, and skills as demand for a single-source service provider is increasing among organizations.

Manufacturers are increasing their market penetration and challenging themselves to meet shifts in technological demands from different applications like telecom and IT, chemicals and petrochemicals, healthcare, manufacturing, energy, and mining by using different market strategies. These include mergers, geographic expansions, new product developments, acquisitions, and joint ventures.

Recent Development in the Environment Health and Safety Market

The global environment health and safety market is estimated to be valued at USD 8.4 billion in 2025.

The market size for the environment health and safety market is projected to reach USD 16.4 billion by 2035.

The environment health and safety market is expected to grow at a 6.9% CAGR between 2025 and 2035.

The key product types in environment health and safety market are software, services, _analytics, _project deployment and implementation, _business consulting and advisory, _audit, assessment, and regulatory compliance, _certification and _others.

In terms of deployment mode, cloud segment to command 62.0% share in the environment health and safety market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Environmental Radiation Monitor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Chambers Market Size and Share Forecast Outlook 2025 to 2035

Environmental Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Environmental Sensor Market Size and Share Forecast Outlook 2025 to 2035

Environmental Test Equipment Market Growth - Trends & Forecast 2025 to 2035

Environmental Remediation Technology Market - Size, Share & Forecast 2025 to 2035

Environmental Catalysts Market Trends & Growth 2025 to 2035

Environmental Monitoring Market Report – Trends & Forecast 2024-2034

Environment Testing, Inspection and Certification Market Report – Demand, Growth & Industry Outlook 2025 to 2035

AI In Environmental Sustainability Market Size and Share Forecast Outlook 2025 to 2035

Controlled Environment Agriculture (CEA) Market Size and Share Forecast Outlook 2025 to 2035

Server Operating Environments Market

Healthcare Flooring Market Size and Share Forecast Outlook 2025 to 2035

Healthcare AI Computer Vision Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Master Data Management Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Contact Center Solution Market Size and Share Forecast Outlook 2025 to 2035

Healthy Snacks Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Semiconductor Market Size and Share Forecast Outlook 2025 to 2035

Healthcare Cold Chain Logistics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA