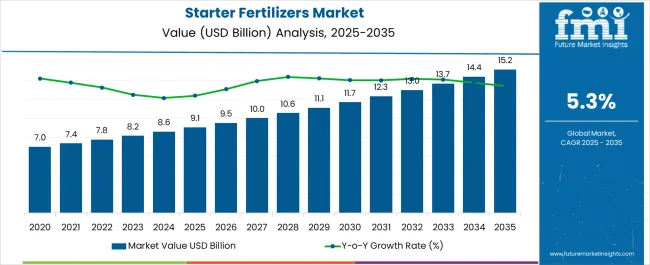

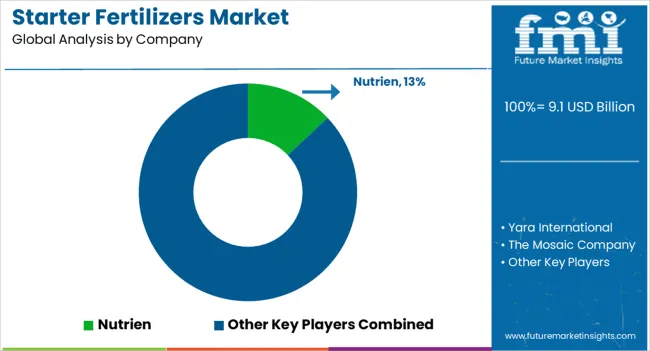

The starter fertilizers market, valued at USD 9.1 billion in 2025 and projected to reach USD 15.2 billion by 2035, is expanding at a CAGR of 5.3%. From 2020 to 2024, the market advanced from USD 7.0 billion to USD 8.6 billion, supported by rising adoption of precision agriculture practices and increasing emphasis on early-stage nutrient delivery to enhance crop establishment. Annual increments such as USD 7.4 billion in 2021, USD 7.8 billion in 2022, USD 8.2 billion in 2023, and USD 8.6 billion in 2024 reflect consistent expansion, driven by heightened demand for cereals, grains, and high-value crops.

From 2025 to 2030, the market progresses from USD 9.1 billion to USD 11.7 billion, accounting for nearly 42% of the overall projected growth. This phase is shaped by the rising use of customized fertilizer blends, micronutrient integration, and advanced application technologies designed to maximize nutrient use efficiency and reduce wastage. Between 2031 and 2035, the market grows further from USD 12.3 billion to USD 15.2 billion, contributing around 35% of the total increase. This later stage reflects the influence of government-backed initiatives supporting crop productivity, ongoing investments in R&D for controlled-release formulations, and increased adoption across emerging markets. The starter fertilizers market demonstrates consistent, long-term growth through 2035, driven by agricultural modernization, food security concerns, and technological improvements in fertilizer application.

| Metric | Value |

|---|---|

| Starter Fertilizers Market Estimated Value in (2025 E) | USD 9.1 billion |

| Starter Fertilizers Market Forecast Value in (2035 F) | USD 15.2 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The starter fertilizers market occupies a vital segment within the global agricultural inputs industry, supporting early-stage crop establishment and uniform seedling growth. Within the overall fertilizer market, starter fertilizers contribute approximately 7–9%, as bulk nitrogen, phosphate, and potash fertilizers dominate volumes. In the specialty fertilizers category, starter fertilizers hold a stronger share of nearly 15–17%, supported by precision farming practices and targeted nutrient application. Within row crop cultivation, including maize, wheat, and soybean, their contribution stands at 10–12%, given their critical role in improving root development and nutrient uptake during germination. In the horticulture and vegetable seed segment, starter fertilizers represent about 6–7%, primarily due to controlled nutrient release and quick solubility benefits. Within the precision agriculture and seed treatment ecosystem, starter fertilizers capture around 8–9%, given their compatibility with modern application equipment and site-specific farming practices.

Growth in this space is being fueled by increasing emphasis on maximizing yield potential from the earliest growth stages, adoption of micronutrient-enriched formulations, and strong demand across emerging agricultural markets where food security is a priority. Manufacturers are differentiating by offering balanced NPK formulations with trace elements, improving solubility, and ensuring compatibility with new seed varieties. Strategic focus on innovation, distribution partnerships, and farmer training programs has made starter fertilizers a critical enabler for yield optimization, positioning them as a steadily expanding component of the global fertilizer landscape.

Increasing global demand for high-quality food production, coupled with shrinking arable land, has intensified the adoption of starter fertilizers in modern farming practices. Advancements in precision agriculture are influencing the market, enabling accurate nutrient placement and optimized application rates that reduce waste and improve cost efficiency.

Sustainable farming initiatives and government programs encouraging balanced fertilizer use are further promoting market growth. Technological innovations in formulation and nutrient blending have allowed manufacturers to develop products that address specific soil deficiencies and crop requirements.

The shift toward climate-resilient agriculture and the demand for higher productivity in shorter crop cycles are driving adoption across diverse geographies. With continued investment in R&D, expansion of distribution networks, and greater farmer awareness about early nutrition benefits, the market is expected to maintain its upward trajectory.

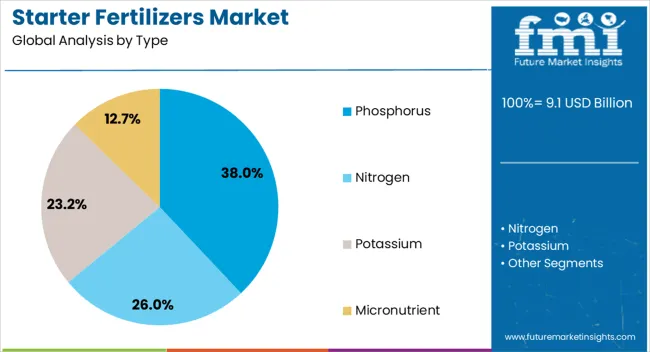

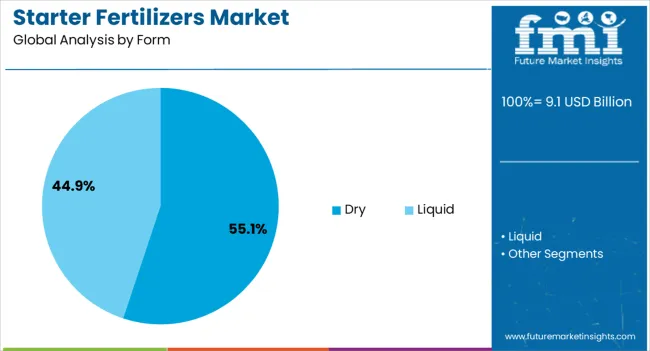

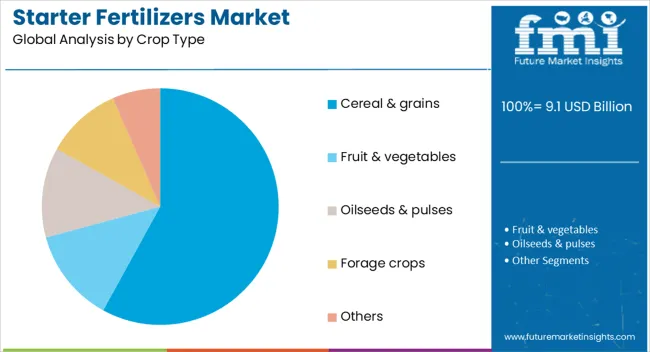

The starter fertilizers market is segmented by type, form, crop type, and geographic regions. By type, starter fertilizers market is divided into phosphorus, nitrogen, potassium, and micronutrient. In terms of form, starter fertilizers market is classified into dry and liquid. Based on crop type, starter fertilizers market is segmented into cereal & grains, fruit & vegetables, oilseeds & pulses, forage crops, and others. Regionally, the starter fertilizers industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The phosphorus type segment is projected to account for 38% of the starter fertilizers market revenue share in 2025, establishing it as the leading type. Growth in this segment has been driven by phosphorus’s critical role in promoting root growth, seedling vigor, and early plant establishment. Its essential contribution to energy transfer and photosynthesis has made it a preferred nutrient in starter formulations for various crops. The ability of phosphorus-based starter fertilizers to enhance nutrient uptake efficiency, especially in cold or compacted soils, has reinforced its adoption in both large-scale and smallholder farming systems. Increased awareness of balanced nutrient management and the integration of phosphorus in precision application techniques have supported consistent demand. Furthermore, the global push for sustainable agriculture has encouraged the use of phosphorus-based fertilizers in controlled amounts to maximize benefits while minimizing environmental impact Continuous improvements in product solubility and availability have also contributed to the strong position of this segment in the overall market.

The dry form segment is expected to hold 55.10% of the Starter Fertilizers market revenue share in 2025, making it the dominant form. This preference is attributed to the cost-effectiveness, ease of storage, and longer shelf life offered by dry formulations compared to liquid alternatives. Dry starter fertilizers are valued for their suitability in diverse application methods, including broadcasting, banding, and in-furrow placement, which provides flexibility for farmers across different farming systems.

Their stable composition allows for consistent nutrient release, supporting uniform crop emergence and growth. Widespread availability through established agricultural supply channels and the lower transportation costs associated with dry products have further boosted adoption. Additionally, dry forms can be blended with other granular fertilizers, enabling tailored nutrient programs that address specific crop and soil requirements. The combination of operational efficiency, economic benefits, and adaptability across crops has reinforced the leading position of this segment in the market.

The cereal and grains crop type segment is anticipated to command 58% of the Starter Fertilizers market revenue share in 2025, making it the most significant crop category. This dominance has been influenced by the large-scale cultivation of cereals and grains globally, driven by their role as staple foods and feedstock in multiple regions.

Starter fertilizers are widely applied to these crops to ensure rapid early growth, strong root systems, and improved nutrient use efficiency, all of which contribute to higher yields and better quality harvests. The segment’s growth has been supported by increasing global food demand, population growth, and the rising need for export-quality grain production. Enhanced farming techniques, including precision planting and targeted fertilizer application, have increased the effectiveness of starter fertilizers in cereal and grain production. Government initiatives promoting productivity in staple crops and the use of advanced nutrient management practices have further reinforced the position of this segment in the market.

Starter fertilizers are growing in relevance due to their role in early crop nutrition, precision farming integration, row crop and horticulture demand, and regulatory-driven adoption. These dynamics strengthen their position in modern agriculture.

Starter fertilizers are gaining wider importance due to their direct influence on early root development and seedling vigor. Farmers are increasingly adopting balanced formulations that provide nitrogen, phosphorus, and micronutrients in the initial growth stage to ensure uniform germination and improved stand establishment. Their application is proving beneficial in reducing early crop stress and enhancing nutrient availability during critical development phases. This has made them particularly relevant in high-value crops such as corn, soybean, and vegetables, where early nutrition directly impacts yield. Growing awareness among farmers about early-season nutrition benefits is propelling starter fertilizer adoption across developed and developing agricultural markets.

Precision agriculture is creating opportunities for targeted use of starter fertilizers, as they fit seamlessly into site-specific nutrient management strategies. Farmers are able to deliver nutrients directly to seeds or root zones through banding or in-furrow application, minimizing wastage and improving uptake efficiency. These methods ensure that the crop receives precise amounts of nutrition during sensitive growth stages, which improves yield consistency. Integration with modern equipment such as planters has increased convenience in application. The compatibility of starter fertilizers with emerging digital tools is encouraging larger farms to incorporate them as part of broader nutrient optimization practices, supporting growth in advanced farming regions.

Row crops, including maize, wheat, and soybean, remain the largest consumers of starter fertilizers, driven by their strong requirement for early root strengthening. At the same time, horticulture crops such as fruits, vegetables, and ornamentals are also fueling demand due to the need for uniform growth and higher productivity. Both row crop and specialty crop growers are widely accepting enhanced nutrient formulations combining phosphorus with zinc and other micronutrients. The versatility of starter fertilizers to deliver consistent results across diverse crop types ensures their relevance. As demand for food security rises, both commercial growers and smallholder farmers are showing greater interest in integrating starter fertilizers.

Regulatory standards and shifting market conditions are significantly influencing the trajectory of starter fertilizers. Governments in key agricultural economies are encouraging the use of efficient fertilizer types to minimize nutrient losses and improve farm productivity. This has supported wider distribution of starter fertilizer blends through cooperatives and agribusiness networks. On the commercial side, seed companies are collaborating with fertilizer manufacturers to develop crop-specific packages that combine seeds and starter nutrients. These partnerships are helping farmers adopt standardized solutions with proven benefits. The market is also witnessing growth through educational programs, extension services, and targeted subsidies that drive awareness and accessibility.

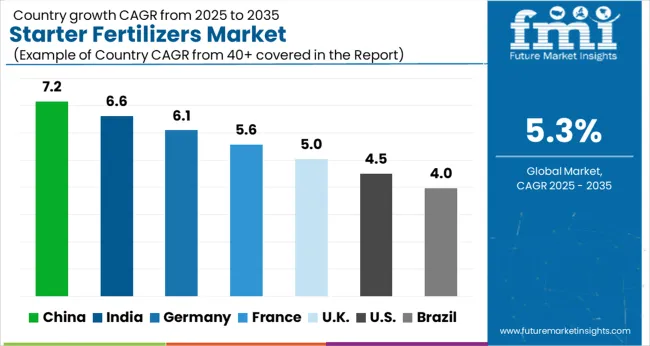

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

The starter fertilizers market is projected to expand globally at a CAGR of 5.3% from 2025 to 2035, supported by rising adoption of early-stage nutrient management practices, precision farming, and crop-specific fertilizer blends. China leads with a CAGR of 7.2%, driven by government-backed initiatives for crop productivity and rapid expansion of maize and wheat cultivation. India follows at 6.6%, supported by large-scale farming, growing food demand, and emphasis on nutrient efficiency in cereals and pulses. France grows at 5.6%, propelled by cereal and vegetable farming where starter fertilizers ensure consistent yields. The United Kingdom records 5.0%, influenced by horticulture expansion and adoption in high-value crops, while the United States posts 4.5%, where efficiency-focused practices in corn and soybean farming sustain steady growth. This trajectory underscores Asia’s dominance in growth momentum, while Europe focuses on yield optimization through nutrient-specific formulations, and North America maintains moderate expansion aligned with advanced farming practices.

The CAGR for the Chinese starter fertilizers market stood at 6.0% during 2020–2024 and increased to 7.2% between 2025 and 2035, reflecting steady improvement in early-stage crop nutrition practices. The earlier period saw moderate growth supported by maize and rice cultivation, but adoption was restrained by farmer reliance on bulk fertilizers. The stronger performance in the following decade is driven by government programs emphasizing nutrient efficiency, precision application, and enhanced seed-fertilizer integration. Rising demand for micronutrient-enriched blends tailored to cereals and vegetables has pushed adoption higher. China’s focus on food security and expanding agricultural modernization projects makes it the global leader in starter fertilizer demand.

India recorded a CAGR of 5.2% between 2020 and 2024, which then rose to 6.6% for the 2025–2035 period, marking stronger growth momentum. The earlier stage was limited by lower awareness among smallholder farmers and fragmented distribution networks. The sharp rise in the next few years expanding crop diversification, higher adoption in pulses and cereals, and government-backed programs for balanced fertilization. Starter fertilizers are increasingly used to improve yield consistency and enhance root development in early stages of crops. With large-scale agriculture and growing food demand, India is becoming a critical hub for starter fertilizer consumption, supported by agritech-driven distribution models.

The French starter fertilizers market posted a CAGR of 4.4% from 2020 to 2024 and advanced to 5.6% during 2025–2035, highlighting a gradual upward shift. Early growth was supported by steady use in cereals and oilseeds, but adoption was restricted by higher costs compared to conventional fertilizers. The following decade reflects stronger adoption due to increasing importance of nutrient efficiency, soil management programs, and demand for premium crop output in both cereals and vegetables. Regulatory incentives and partnerships between seed and fertilizer companies have improved access to balanced blends, ensuring broader adoption across both large farms and smaller agricultural holdings.

The CAGR for the UK starter fertilizers market was 4.1% during 2020–2024 and improved to 5.0% between 2025 and 2035, reflecting steady recovery. Initial growth was slower due to limited use outside high-value crops and reliance on conventional fertilizers. The next phase showed stronger expansion as horticulture, cereals, and vegetable farming required early-stage nutrition to ensure yield consistency. Wider use of precision farming methods and regulatory focus on nutrient efficiency supported the trend. Collaborations between input suppliers and cooperatives helped expand distribution and awareness among farmers. This steady progress positions the UK as an evolving but smaller contributor within Europe.

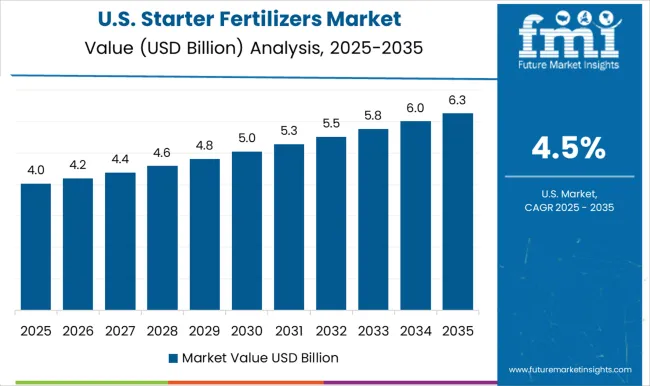

The USA starter fertilizers market registered a CAGR of 3.8% during 2020–2024 and advanced to 4.5% in 2025–2035, showing moderate but consistent growth. Earlier expansion was slower due to widespread reliance on bulk fertilizers and cost considerations. The next decade reflects gradual adoption in corn and soybean farming, where early-stage nutrient supply improves yields. Seed companies are working closely with fertilizer producers to offer integrated crop packages, supporting steady growth. While expansion remains slower than in Asia or Europe, the USA market maintains strong relevance due to its large-scale crop production and emphasis on efficiency-driven farming practices.

The starter fertilizers market is shaped by a mix of global fertilizer giants and regional players that emphasize crop-specific nutrient solutions and distribution scale. Nutrien maintains a leading position with its vast portfolio of nitrogen, phosphate, and potash-based formulations, backed by strong agronomic advisory services and retail distribution in North America and beyond. Yara International differentiates itself through advanced nutrient programs, providing balanced starter blends enriched with micronutrients and promoting precision farming practices to optimize early crop growth. The Mosaic Company leverages its large phosphate and potash production base to deliver tailored starter fertilizer solutions, particularly in cereals and row crops where early root establishment is critical.

CF Industries strengthens its role by focusing on nitrogen-based starter fertilizers and partnerships that integrate efficient nutrient use into seed planting practices. IFFCO and Coromandel, alongside other regional leaders, play a vital role in expanding accessibility across emerging agricultural markets, especially in Asia, through localized blends and farmer-focused outreach programs. Competitive strategies revolve around improving solubility, micronutrient integration, and compatibility with modern planting equipment, while also expanding farmer training and education programs. Long-term growth is being defined by product differentiation, stronger distribution partnerships, and innovation in crop-specific formulations that address both yield maximization and cost-efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 9.1 Billion |

| Type | Phosphorus, Nitrogen, Potassium, and Micronutrient |

| Form | Dry and Liquid |

| Crop Type | Cereal & grains, Fruit & vegetables, Oilseeds & pulses, Forage crops, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Nutrien, Yara International, The Mosaic Company, CF Industries, and IFFCO / Coromandel / Others |

| Additional Attributes | Dollar sales, share by crop type, application method, and region, competitive positioning, adoption trends in precision farming, regulatory impacts, farmer buying behavior, and distribution channel performance. |

The global starter fertilizers market is estimated to be valued at USD 9.1 billion in 2025.

The market size for the starter fertilizers market is projected to reach USD 15.2 billion by 2035.

The starter fertilizers market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in starter fertilizers market are phosphorus, monoammonium phosphate, diammonium phosphate, ammonium phosphate, nitrogen, ammonium nitrate, ammonium sulfate, potassium, potassium chloride, potassium magnesium sulfate, potassium sulfate, micronutrient, sulfur, zinc, boron and others.

In terms of form, dry segment to command 55.1% share in the starter fertilizers market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Starter Cultures Market Analysis by Microorganism Type, Type, Form, Growth Temperature, Application, Composition, and Region Through 2035

Starter Feed Market Analysis by Type, Ingredient, Livestock, Form, and Region Through 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Engine Starter Fluid Market Growth - Demand, Trends & Forecast 2025 to 2035

Vehicle Starter Motor Market

Organic Starter-Grower Chicken Feed Market

Automotive Starter And Alternator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Starter Motor Market Size and Share Forecast Outlook 2025 to 2035

Motor Soft Starters Market Trend Analysis Based on Voltage, End-Use, and Region 2025 to 2035

Vehicle Jump Starter Market Size and Share Forecast Outlook 2025 to 2035

Enclosed Motor Starter Market Growth – Trends & Forecast 2024-2034

Two Wheeler Electric Starter Magnet Market

Automotive Integrated Starter Generator Units Market Size and Share Forecast Outlook 2025 to 2035

Residential Automatic Motor Starter Market Size and Share Forecast Outlook 2025 to 2035

Biofertilizers Market Size and Share Forecast Outlook 2025 to 2035

NPK Fertilizers Market Analysis - Size, Share, and Forecast 2025 to 2035

Nano Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Specialty Fertilizers Market Size and Share Forecast Outlook 2025 to 2035

Microalgae in Fertilizers Market Analysis - Size, Share, and Forecast 2025 to 2035

Water Soluble Fertilizers Market Trends 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA