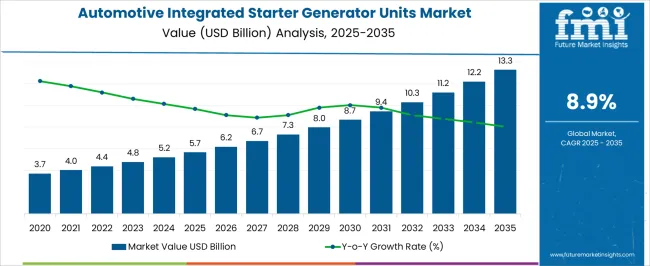

The Automotive Integrated Starter Generator Units Market is estimated to be valued at USD 5.7 billion in 2025 and is projected to reach USD 13.3 billion by 2035, registering a compound annual growth rate (CAGR) of 8.9% over the forecast period.

This strong trajectory reflects the rapid electrification of vehicle powertrains, where ISG units play a central role in mild hybrid systems by combining starter, generator, and motor functions into a single compact unit. From 2025 to 2030, growth will be propelled by regulatory pressure for reduced fuel consumption and emissions, leading automakers to adopt 48V mild hybrid architectures across mid-segment passenger vehicles.

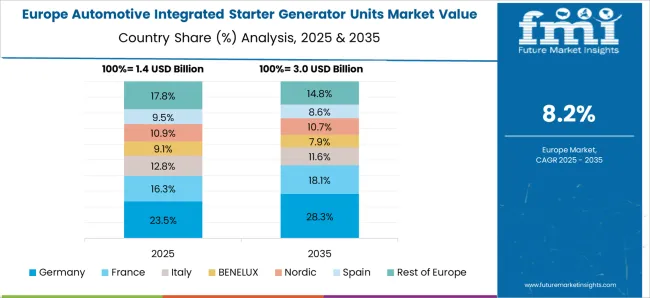

Between 2030 and 2035, adoption is expected to intensify further as hybrid penetration expands beyond passenger cars into light commercial vehicles, raising the market’s value above USD 13 billion. The incremental opportunity of USD 7.6 billion across the forecast period highlights ISG’s importance as a cost-effective transition technology bridging internal combustion and full electrification. Competitive intensity will deepen as suppliers invest in higher-efficiency motors, power electronics integration, and scalable platforms for different vehicle classes. With Europe and Asia-Pacific leading adoption through regulatory frameworks and OEM strategies, ISG units are positioned as a pivotal enabler of hybridization in the global automotive landscape.

| Metric | Value |

|---|---|

| Automotive Integrated Starter Generator Units Market Estimated Value in (2025 E) | USD 5.7 billion |

| Automotive Integrated Starter Generator Units Market Forecast Value in (2035 F) | USD 13.3 billion |

| Forecast CAGR (2025 to 2035) | 8.9% |

The automotive integrated starter generator (ISG) units market is gaining momentum as automotive OEMs increasingly prioritize fuel efficiency, emission reduction, and electrification of conventional powertrains. Mild hybrid systems leveraging ISG units are being adopted as a transitional solution to full electric drivetrains, offering immediate regulatory compliance and lower total cost of ownership.

Advances in 48V architectures, improved battery management systems, and energy recovery technologies have made ISG solutions more viable across volume-driven vehicle categories. The integration of ISG units enables enhanced start-stop functionality, torque assist, and regenerative braking, contributing to improved vehicle performance and lower emissions.

With rising pressure from global fuel economy standards and the push for lightweight, modular engine designs, ISG technology is expected to play a critical role in supporting automakers through the electrification transition over the next decade.

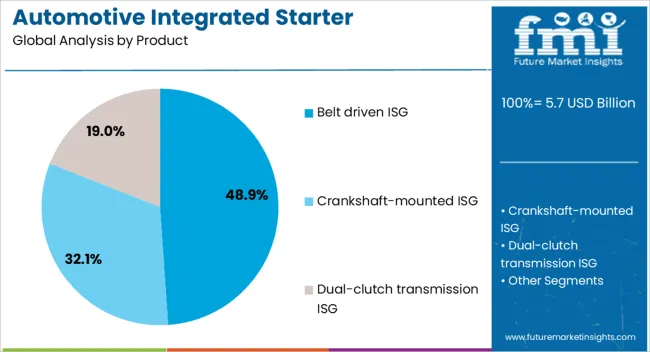

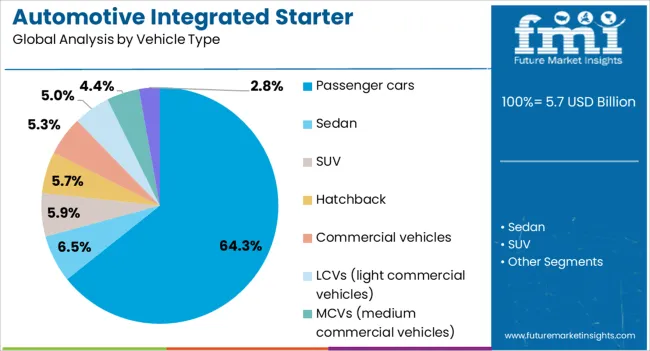

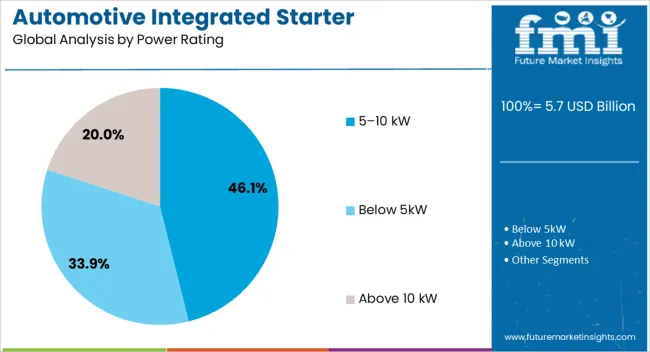

The automotive integrated starter generator units market is segmented by product, vehicle type, power rating, propulsion, sales channel, and geographic regions. By product, the automotive integrated starter generator units market is divided into belt-driven ISG, Crankshaft-mounted ISG, and Dual-clutch transmission ISG. In terms of vehicle type, the automotive integrated starter generator units market is classified into Passenger cars, sedans, SUVs, hatchbacks, Commercial vehicles, LCVs (light commercial vehicles), MCVs (medium commercial vehicles), and HCVs (heavy commercial vehicles). Based on the power rating, the automotive integrated starter generator units market is segmented into 5–10 kW, below 5kW, and above 10 kW. By propulsion, the automotive integrated starter generator units market is segmented into Mild hybrid-electric vehicles and Internal combustion engine vehicles.

By sales channel, the automotive integrated starter generator units market is segmented into OEM and Aftermarket. Regionally, the automotive integrated starter generator units industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Belt driven ISG systems are projected to hold 48.90% of the total market revenue in 2025, establishing them as the leading product type. Their popularity stems from the relatively simple integration process with existing internal combustion engines, requiring minimal structural redesign.

Cost efficiency, ease of installation, and lower development timelines make belt-driven configurations attractive for OEMs looking to deploy mild hybrid solutions across high-volume models. These systems enable quick adoption of start-stop and torque assist features without requiring extensive electrical or cooling upgrades.

As regulatory pressure grows and OEMs seek scalable hybridization pathways, belt-driven ISG units are being favored for their compatibility with current manufacturing platforms and ability to deliver measurable efficiency gains with limited investment.

Passenger cars are expected to contribute 64.30% of the overall market revenue in 2025, making them the dominant vehicle type segment. This leadership is being driven by the need for affordable hybrid solutions in the mass market, where ISG units offer incremental fuel savings and reduced emissions without the cost burden of full electrification.

Rising consumer awareness of eco-friendly mobility, along with stricter emissions norms in urban centers, has accelerated ISG deployment in compact and mid-size passenger vehicles. Automakers are using ISG systems to meet fleet-wide CO₂ targets, especially in Europe and Asia, while maintaining internal combustion-based vehicle lines.

As more models are introduced with 48V mild hybrid systems, passenger cars are expected to remain the primary segment for ISG integration due to volume scalability and consumer demand.

The 5–10 kW segment is forecast to hold 46.10% of the market revenue by 2025, making it the top-rated power category in the automotive ISG units market. This range offers an optimal balance between power output, efficiency, and integration flexibility for entry-level and mid-tier mild hybrid applications.

It supports key ISG functions such as start-stop, coasting, and low-end torque assist without demanding excessive battery or thermal management upgrades. The increasing adoption of 48V powertrains in passenger cars and light commercial vehicles has aligned with the capabilities of ISG units in this power bracket.

As OEMs prioritize modular and scalable hybrid systems, the 5–10 kW range is emerging as the most practical solution for broad-based deployment across multiple vehicle platforms.

ISG adoption is accelerating in hybridization strategies due to regulatory, performance, and efficiency demands.Evolving designs and competitive strategies are reinforcing market penetration potential.

Adoption of automotive integrated starter generator (ISG) units is accelerating as mild hybrid vehicle production grows across global markets. Automakers are focusing on 48V architectures that enhance fuel economy, improve drivability, and reduce CO₂ output without full electrification costs. ISG technology delivers start-stop capability, regenerative braking, and torque assistance in a compact form factor, appealing to both passenger and light commercial segments. Strategic partnerships between OEMs and component suppliers are targeting higher efficiency systems with compact packaging to suit multiple vehicle classes. Stronger demand is emerging in Asia-Pacific and Europe, where regulations and incentives are promoting hybrid integration in mainstream vehicle models.

Stringent CO₂ and fuel economy standards in the EU, China, and North America are reinforcing the need for cost-effective electrification strategies. ISG units provide a bridge technology that allows compliance without extensive engine redesign. Their integration supports energy recovery and improved power delivery, enabling automakers to meet targets across a wider range of vehicles. Light commercial fleets are increasingly adopting ISG systems to optimize operational efficiency while reducing fuel use. Legislative pressures, combined with public policy incentives, are expected to elevate ISG penetration rates, making them a critical part of OEM compliance and competitive positioning strategies in the coming decade.

Manufacturers are refining ISG designs to deliver higher torque density, better efficiency, and greater adaptability. Newer units incorporate liquid cooling, optimized rotor-stator geometries, and enhanced electronics to maximize regenerative braking output. Improvements in energy conversion efficiency are enabling integration with more complex drivetrain architectures, including parallel hybrid systems. Enhanced thermal management capabilities allow ISGs to operate consistently under high-load conditions, extending durability and reducing performance drop-off. These engineering upgrades are expected to widen ISG adoption from premium vehicles into high-volume mainstream models, creating scale advantages that further drive cost competitiveness in the market.

The competitive environment for ISG manufacturing is shaped by global tier-1 suppliers and OEM collaborations. Supply chain resilience has become a strategic priority amid semiconductor shortages and raw material price fluctuations. Companies are investing in regionalized manufacturing hubs to secure faster delivery and reduce import dependency. Mergers, joint ventures, and technology licensing agreements are expanding product portfolios and strengthening geographic coverage. Competitive success will hinge on balancing production efficiency with continuous performance upgrades, ensuring ISG systems remain relevant as vehicle platforms evolve toward greater electrification and energy recovery capabilities.

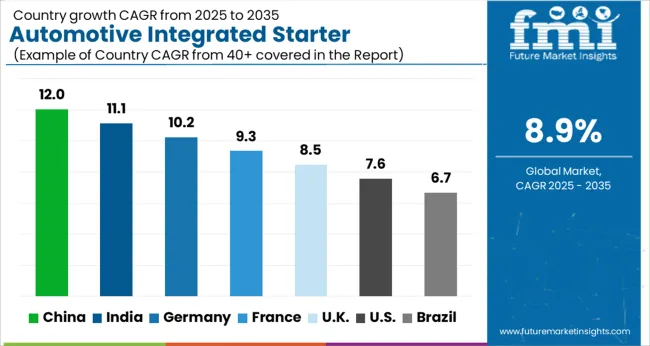

The automotive ISG units market is projected to expand globally at a CAGR of 8.9% from 2025 to 2035, propelled by the rising demand for mild hybrid systems, regulatory shifts toward fuel efficiency, and greater OEM integration of start-stop and regenerative braking systems. China leads with a CAGR of 12.0%, supported by strong EV-hybrid adoption policies, extensive local manufacturing, and high-volume passenger vehicle sales. India follows at 11.1%, driven by rapid fleet electrification, component localization, and cost-competitive hybrid technology adoption. France posts 9.3%, shaped by government incentives, urban clean mobility policies, and integration into compact hybrid cars. The United Kingdom shows 8.5%, with momentum coming from hybrid penetration in both passenger and light commercial vehicles. The United States reports 7.6%, reflecting a gradual transition from ICE to hybrid systems with increasing adoption in pickup trucks and SUVs. The report covers more than 40 countries, with these leading markets setting technological benchmarks, shaping hybrid vehicle architecture adoption, and influencing supplier strategies in the global ISG ecosystem.

The CAGR of the China automotive ISG units market averaged 9.8% during 2020–2024 and is expected to accelerate to 12.0% in 2025–2035, reflecting stronger adoption of hybrid systems. Early growth was shaped by gradual integration of ISG technology into compact and mid-sized passenger cars to meet local emission standards. Between 2025 and 2035, the pace rises as the government enforces stricter fuel economy targets and OEMs increase production of 48V mild hybrids. Local suppliers and joint ventures benefit from economies of scale, making ISG systems more cost-effective for mass deployment. The surge is also supported by consumer preference shifts toward fuel-efficient vehicles amid rising fuel costs.

India’s automotive ISG units market recorded a CAGR of 9.0% between 2020 and 2024 and is projected to climb to 11.1% in 2025–2035. The earlier phase saw a steady build-up driven by mild hybrid adoption in urban commuter vehicles and regulatory moves toward Bharat Stage VI norms. In the coming decade, the higher rate is fueled by rapid hybridization in both entry-level and premium segments, alongside growing consumer awareness of fuel savings. Localization of ISG manufacturing reduces costs, while government-led incentives for hybrid components create a favorable environment for suppliers. Fleet operators in public and shared mobility sectors increasingly adopt ISG-powered vehicles to cut operational fuel expenses.

The CAGR for France’s automotive ISG units market stood at 8.1% during 2020–2024 and is set to rise to 9.3% over 2025–2035. Early expansion came from integrating ISG technology into compact hybrids, driven by EU emissions mandates and urban low-emission zones. From 2025 onward, higher adoption will be propelled by increased government subsidies for hybrid powertrains and OEM strategies to embed ISG systems into all small and mid-size vehicle platforms. French automakers emphasize blending ISG with regenerative braking for better fuel economy, which aligns with consumer interest in long-term cost savings. The aftermarket segment also expands as older vehicles undergo hybrid retrofitting to comply with stricter emission rules.

The CAGR for the UK automotive ISG units market averaged 7.4% from 2020 to 2024 and is projected to advance to 8.5% between 2025 and 2035, indicating an upward shift in adoption. The earlier period saw measured growth as ISG systems were integrated mainly into premium segment hybrids to meet CO₂ targets. The acceleration in the next decade is attributed to a broader rollout of 48V mild hybrids across mid-range and utility vehicles, coupled with supportive government policies promoting low-emission transport. Consumer demand for better fuel economy amid volatile fuel prices also drives uptake. OEM investment in localized ISG assembly further boosts supply chain efficiency and adoption rates.

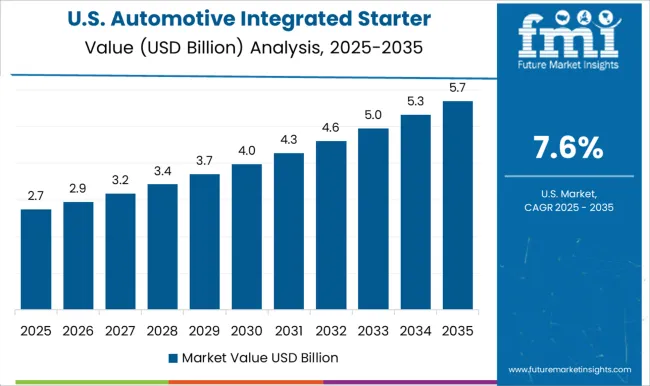

The CAGR of the USA automotive ISG units market was around 6.9% during 2020–2024 and is forecast to increase to 7.6% in 2025–2035, indicating a measured yet steady rise in adoption. The initial period was defined by selective integration in premium and performance vehicle segments, largely driven by corporate average fuel economy (CAFE) regulations. Moving into 2025–2035, the rate climbs as ISG-equipped mild hybrids penetrate mid-range SUVs, light trucks, and fleet vehicles. Federal incentives for hybrid powertrain adoption, combined with OEM investments in 48V architectures, improve market accessibility for consumers. Growth is also reinforced by aftermarket interest in ISG retrofitting for fuel efficiency upgrades in commercial fleets.

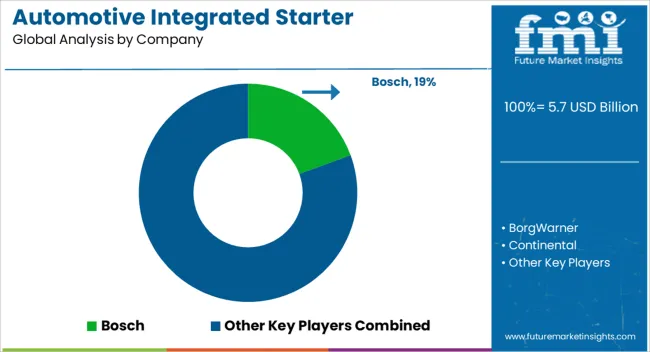

The competitive landscape of the automotive integrated starter generator (ISG) market is defined by a concentrated group of global powertrain and electrification leaders, each leveraging specialized engineering capabilities, regional production strategies, and strong OEM collaborations to strengthen market presence. Bosch remains a central force, channeling over $2 billion into North American expansion through capital investment and targeted acquisitions, while deepening its focus on hybrid and software-defined vehicle platforms to accelerate ISG integration. BorgWarner advances its position through high-value contracts, including a recent dual inverter supply agreement with a leading Chinese OEM, enhancing its mild hybrid ISG offerings and supporting its broader electrification roadmap. Continental, Valeo, and Denso maintain competitive traction by optimizing torque density, refining scalable architectures, and aligning product pipelines with CO₂ compliance standards. Mitsubishi Electric, Hitachi Astemo, Magna International, SEG Automotive, and ZF Friedrichshafen remain pivotal in supplying core ISG components such as electric machines, control units, and power electronics, integrating these into modular systems for diverse OEM platforms.

Key strategies across these players include portfolio diversification via mergers, acquisitions, and joint ventures; investment in localized manufacturing to meet regional OEM requirements; performance optimization without sacrificing modularity; and synchronization with OEM electrification strategies for regulatory and cost efficiency. This competitive synergy positions ISG technology as a critical bridge between conventional internal combustion and full electric powertrains, enabling broad market adoption in both mature and emerging regions.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.7 Billion |

| Product | Belt driven ISG, Crankshaft-mounted ISG, and Dual-clutch transmission ISG |

| Vehicle Type | Passenger cars, Sedan, SUV, Hatchback, Commercial vehicles, LCVs (light commercial vehicles), MCVs (medium commercial vehicles), and HCVs (heavy commercial vehicles) |

| Power Rating | 5–10 kW, Below 5kW, and Above 10 kW |

| Propulsion | Mild hybrid-electric vehicles and Internal combustion engine vehicles |

| Sales Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Bosch, BorgWarner, Continental, Valeo, Denso, Mitsubishi Electric, Hitachi Astemo, Magna International, SEG Automotive, and ZF Friedrichshafen |

| Additional Attributes | Dollar sales, share, competitive positioning, regional demand patterns, regulatory influences, OEM partnerships, technology shifts, pricing trends, and supply chain risks. |

The global automotive integrated starter generator units market is estimated to be valued at USD 5.7 billion in 2025.

The market size for the automotive integrated starter generator units market is projected to reach USD 13.3 billion by 2035.

The automotive integrated starter generator units market is expected to grow at a 8.9% CAGR between 2025 and 2035.

The key product types in automotive integrated starter generator units market are belt driven isg, crankshaft-mounted isg and dual-clutch transmission isg.

In terms of vehicle type, passenger cars segment to command 64.3% share in the automotive integrated starter generator units market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Manufacturing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Pressure Sensor Market Size and Share Forecast Outlook 2025 to 2035

Automotive Vacuum Brake Booster Market Size and Share Forecast Outlook 2025 to 2035

Automotive Smart Antenna Market Size and Share Forecast Outlook 2025 to 2035

Automotive Actuator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Exhaust Manifold Market Size and Share Forecast Outlook 2025 to 2035

Automotive Roof Rails Market Size and Share Forecast Outlook 2025 to 2035

Automotive Resonator Market Size and Share Forecast Outlook 2025 to 2035

Automotive Counter Shaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wheel Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Water Separation Systems Market Size and Share Forecast Outlook 2025 to 2035

Automotive Refinish Coating Market Size and Share Forecast Outlook 2025 to 2035

Automotive Emission Test Equipment Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tire Market Size and Share Forecast Outlook 2025 to 2035

Automotive Glass Market Size and Share Forecast Outlook 2025 to 2035

Automotive Wire & Cable Material Market Size and Share Forecast Outlook 2025 to 2035

Automotive Camshaft Market Size and Share Forecast Outlook 2025 to 2035

Automotive DC-DC Converter Market Size and Share Forecast Outlook 2025 to 2035

Automotive Key Blank Market Size and Share Forecast Outlook 2025 to 2035

Automotive Tensioner Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA