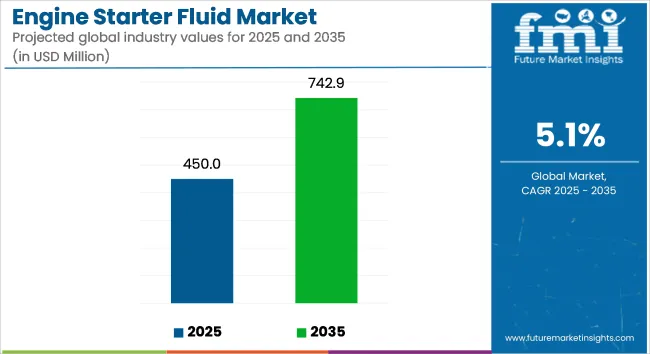

The global engine starter fluid market was valued at USD 362.8 million in 2020 and reached USD 450 million by 2025. A CAGR of 5.1% has been projected for the period between 2025 and 2035, with the market expected to reach USD 742.9 million by 2035. Growth has been supported by routine use in cold-weather operations, heightened equipment complexity, and expanded aftermarket service intervals across multiple sectors.

Product advancements have been introduced by key manufacturers. In late 2024, Jump Start Starting Fluid with Lubricity was launched by CRC Industries. Designed for both gasoline and diesel engines, the formulation included an upper-cylinder lubricant intended to minimize wear during sub-zero starts. Compliance with UL 7103 standards and VOC limitations was confirmed by CRC in its official product documentation.

In early 2024, Lucas Oil updated its Sure Start Premium line. A 50% ether blend was combined with added lubricity to improve ignition in unresponsive engines. According to a company release, the product was “designed to deliver cold-start reliability with added engine protection for high-cycle usage environments.”

The STABIL brand, under Gold Eagle Co., retained its presence with a 2024 release supporting both carbureted and fuel-injected systems. Compatibility with small engines used in landscaping and seasonal power equipment has supported demand from professional and residential segments.

Starter fluid usage has expanded with growing adoption of turbocharged, direct-injection, and hybrid ICE platforms. Maintenance teams in municipal fleets and logistics operators have incorporated starter fluid into winterization protocols to reduce crank time and improve uptime. Field data from 2025 indicated strong seasonal demand across construction, agriculture, and emergency service equipment.

Retail distribution has broadened. Leading SKUs have been listed across Amazon, AutoZone, O’Reilly Auto Parts, and OEM portals. Multi-format packaging options have catered to both DIY users and professional service centers. Private-label expansion has been observed, particularly for cost-sensitive fleet applications.

Regulatory compliance with EU aerosol directives, CARB VOC standards, and North American flammability classifications has been confirmed by industry participants. Formulations have been adjusted without compromising cold-start efficacy.

Despite rising electrification, ICE and hybrid use cases are projected to sustain product demand through 2035. Emphasis is expected to remain on sub-zero performance, reduced engine wear, and cross-platform compatibility.Key Segments

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 450 million |

| Industry Value (2035F) | USD 742.9 million |

| CAGR (2025 to 2035) | 5.1% |

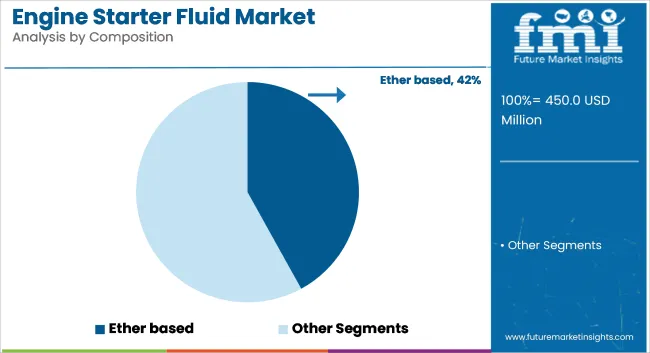

Ether-based starting fluid formulations accounted for 42% of the global market share in 2025 and are projected to grow at a CAGR of 5.3% through 2035. These formulations remained the most preferred due to their high volatility and reliable ignition properties under low-temperature conditions.

In 2025, ether-based starting fluids were extensively used in diesel engines, particularly across heavy-duty commercial vehicles, agricultural machinery, and off-road equipment operating in cold or high-altitude regions. Their compatibility with a wide range of engine types and consistent ignition behavior supported ongoing demand across both OEM-specified and aftermarket applications.

Manufacturers continued to refine aerosol delivery systems and safety standards, aligning with evolving regional regulations for flammability and storage. Adoption remained strong in North America, Northern Europe, and Central Asia, where prolonged winter conditions necessitated enhanced starting assistance.

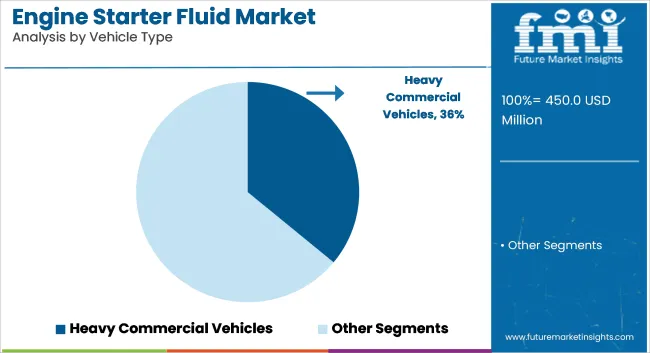

Heavy commercial vehicles accounted for 36% of global starting fluid consumption by vehicle type in 2025 and are forecast to grow at a CAGR of 5.2% through 2035. This segment represented consistent demand due to the high prevalence of large diesel engines that require starting assistance in sub-zero or high-load scenarios. In 2025, fleet operators and equipment owners relied on starting fluids for long-haul trucks, mining dumpers, and construction haulers exposed to cold-start risks.

Regular usage was observed in logistics corridors across Canada, Russia, and Northern China, where ambient conditions often fell below safe cranking thresholds. Maintenance teams used starting fluid as part of scheduled servicing routines to ensure rapid restarts and reduce wear on starter motors. Suppliers offered bulk-pack and single-use aerosol variants tailored to engine size and ignition system compatibility, further supporting adoption in the heavy-duty vehicle category.

Rising expansion of agricultural and construction market

One of the largest users of diesel powered heavy machinery like tractors, harvesters, earthmovers are agricultural and construction industries. The reliance on the diesel engines from these industries in extreme weather conditions, dusty environments and non-usage of engines for a long period of time drives the market for engine starter fluid market.

The growing trend of mechanization to increase productivity and to meet the demand of expanding population and infrastructure development in agriculture and construction industry also drives the engine starter fluid market.

To enhance the efficiency of equipment’s and reduce manual labor governments and private sectors are heavily investing in mechanized agriculture which is increases the demand for engine starter fluid. In the construction industry many machines operate in difficult weather conditions or are sometimes stored as idle machines during off season, starter fluid plays a vital role in order to enhance or start the idle machines in case of engine troubleshoots or any other issues.

Increasing dependency on mechanized agriculture and construction activities highlights the importance of engine starter fluid. This expansion ensures the high growth potential in the market which are driven by rising expansion of agriculture and construction market.

Increase in adoption of engine starter fluid due to its effective cost

In various industries and scenario’s, from individual vehicles to large scale industry machinery engine starter fluid is widely recognized as a cost effective solution. They are a simple, affordable, easy to use and highly effective alternative solution to high cost repairs or high time consuming professional services provided, particularly in remote locations. These are designed to work instantly, reduce downtime and operational delays in various industries. Starter fluid eliminates the need for long troubleshooting or waiting for professional assistance.

To maintain schedules and minimize service interruptions, reliable and quick engine starting is essential which is offered by the engine starter fluid. Its affordable pricing allows consumer to us it for personal vehicles or personal use as well.

It also opens up growth potential for budget conscious consumer or budget focused industries which ensures a sustained or increasing demand. By providing an affordable and quick solution to starting problems, engine starter fluids address a fundamental need across individual, commercial, and industrial applications. This cost-effectiveness is a key reason for their sustained popularity and market growth.

Seasonal demand for the engine starter fluid

North America and North Europe are the regions whose temperatures often drops below freezing. Due to these low temperatures lack of fuel vaporization takes place creating significant challenge for the engine. The fuel becomes less volatile which requires an external solution to provide an ignitable compound or chemical.

Diesel engines whose operation depends on compression engines becomes inefficient at lower temperatures. Engine starter address this issue by offering highly flammable and ignitable chemical or component providing necessary combustion in cold weather or regions.

This seasonal demand creates a huge market opportunity for the engine starter fluid market where the sales peak and creates a reliable revenue for the manufacturers in this industry. Addressing cold weather performance and diesel fuel gelling ensures that engine starter fluid remains an indispensable product in regions experiencing harsh winters.

Advancements in technology slows down the growth of engine starter fluid market

The dependency on the traditional starter fluids is reducing due to the advancement in technologies like fuel injection system, electronic injection systems and cold start features.

Fuel injection systems automatically adjusts the air-fuel intake mixture for optimum combustion which ensures smooth engine starts, in different climatically conditions reducing the dependency on engine starter fluid. Coil-on plug ignition provides powerful and precise sparks for ignition which eliminates the starting issues of old engines or unused engines. As vehicles with advanced technologies become more prevalent, particularly in developed regions, the demand for engine starter fluids is declining.

Another challenge for the engine starter fluid is the transition or switch towards electric vehicles. They completely operate on electric motors and battery which does not require any product or solution or starter motors for ignition. This rising adoption of EV vehicles globally is shrinking the market for engine starter fluids.

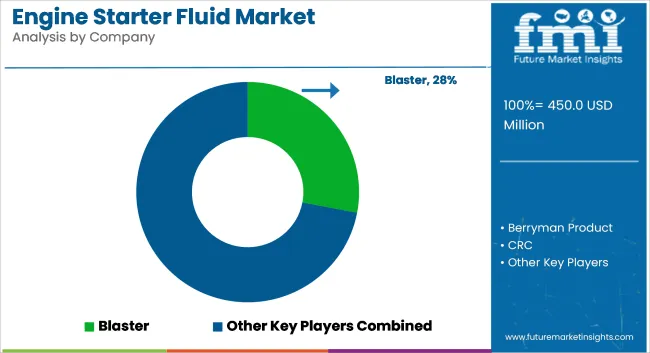

The global engine starter fluid market is moderately fragmented, with a mix of established multinational corporations and regional players competing for market share. Larger companies dominate the market with their extensive product portfolios, advanced manufacturing capabilities, and strong global distribution networks. However, regional and niche players contribute significantly by catering to local markets with cost-effective solutions.

Tier 1 companies include industry leaders with annual revenues exceeding USD 18 Million. These companies are currently capturing a significant share of 20% to 25%. These frontrunners are characterized by high production capacity and a wide product portfolio.

They are distinguished by extensive expertise in manufacturing and a broad geographical reach, underpinned by a robust consumer base. The firms provide a wide range of products and utilize the latest technology to meet regulatory standards. Prominent companies within this tier I players include Valvoline Inc., STA-BIL, Blaster.

Tier 2 companies encompass most of the small-scale enterprises operating within the regional sphere and catering to specialized needs with revenues between USD 10-18 Million. These businesses are notably focused on meeting local demand and are hence categorized within the Tier 2 segment.

They are small-scale participants with limited geographical presence. In this context, Tier 2 is acknowledged as an informal sector, indicating a segment distinguished by a lack of extensive organization and formal structure in comparison to the structured one. Tier II Players such as the CRC, Gumout, Penray, Johnsens and others have been considered in this tier where they are projected to account for 45-50% of the overall market.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche having revenue below USD 10 Million. These companies are notably oriented towards fulfilling local demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. The manufacturers such as Tier III Players Berryman products, Pyroil chemicals and others are expected to hold 30-35% of the share.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.1% |

| Germany | 4.2% |

| Canada | 4.4% |

| India | 4.1% |

| China | 4.9% |

Dependency on diesel-powered vehicles and machinery across various industries like transport, agriculture and industrial operations is a key driver for engine starter fluid market in Germany. Use of diesel engines with country’s extreme cold weather conditions combines as a major driver for the market of engine starter fluid. With a huge share of vehicles running on the diesel engines, Germany has one of the largest automotive markets in Europe particularly in commercial vehicles like trucks, buses, and delivery vans.

Regions like Bavaria, Baden-Württemberg, and parts of eastern Germany, experiences harsh winters which frequently causes engine starting issues. Starter fluids ensure that vehicles and machinery remain operational despite freezing conditions.

Robust agriculture sector of Germany uses heavy diesel machineries like tractors and irrigation systems. Construction and logistics industry in Germany also relies on the heavy machinery and fleet which requires engine starter fluid for good efficiency and consistent performance in different environmental conditions.

Even after the county’s transition or switch towards electric vehicles is rising, the country still has a large base of older vehicles and engines which drives the market for engine starter fluids in Germany. Engine starter fluid is a vital product in Germany due to its dependency on diesel-powered vehicles and machinery across its automotive, agricultural, and industrial sectors.

The agricultural sector in the USA heavily depends on equipment’s like tractors, harvesters and irrigation pumps to meet the demands for large scale production farming. Especially in challenging weather conditions of USA This reliance on mechanization creates a steady and growing demand for engine starter fluids to ensure operational efficiency.

Majority of agriculture equipment of USA relies on diesel engine powers due to the need for high torque and reliability in heavy duty operations. In states like, states like Iowa, Illinois, and Nebraska engine often starts facing starting issues during winter conditions where engine starter fluid acts as an effective solution.

Due to the increasing demands in mechanization, there is an increase use in advanced equipment’s, including small, family run farms which drives the market for engine started fluid in the USA Reliable engine performance is essential to avoid delays that could result in significant crop losses especially during spring planting and fall harvesting seasons. Beyond agriculture, rural areas also depend on starter fluids for other diesel-powered machinery, such as generators and small engines used in landscaping and forestry, further boosting demand.

The section provides comprehensive assessments and insights that highlight current opportunities and emerging trends for companies in developed and developing countries. It analyzes advancements in manufacturing and identifies the latest trends poised to drive new applications in the.

A few key players in the Engine starter fluids are actively enhancing capabilities and resources to cater to the growing demand for the compound across diverse applications. Leading companies also leverage partnership and joint venture strategies to co-develop innovative products and bolster resource base.

Significant players are further introducing new products to address the increasing need for cutting-edge solutions in various end-use sectors. Geographic expansion is another important strategy that is being embraced by reputed companies. Start-ups are likely to emerge in the sector through 2035, thereby making it more competitive.

Key companies are investing in continuous research for producing new products and increasing their production capacity to meet end-user demand. They are also showing an inclination toward adopting strategies, including acquisitions, partnerships, mergers, and facility expansions to strengthen their footprint.

Industrial Developments

The overall market size for solar air conditioners was USD 428.6 million in 2024.

The engine starter fluid market is expected to reach USD 742.9 million in 2035.

Increased adoption of mechanization and seasonal demand will drive the engine starter fluid during the forecast period.

The top 5 countries which drives the development of engine starter fluid are USA, Germany, Canada, India and China.

Diesel Engines type is expected to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Engine Piston Ring Set Market Size and Share Forecast Outlook 2025 to 2035

Engine Cylinder Liners Market Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Industry Analysis in North America Size and Share Forecast Outlook 2025 to 2035

Engine Fogging Oil Market Size and Share Forecast Outlook 2025 to 2035

Engine Valve Market Size and Share Forecast Outlook 2025 to 2035

Engineering Service Outsourcing Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Engineering Analytics Market Growth & Demand 2025 to 2035

Engineering Plastic Market Analysis - Size, Share & Forecast 2025 to 2035

Engineered Cell Therapy - Market Trends & Forecast 2025 to 2035

Engine Tuner Market - Growth & Demand 2025 to 2035

Engine Flush Market Growth – Trends & Forecast 2025-2035

Engineered Wood Market

Engine Actuators Market

Engine Mounting Brackets Market

Geoengineering Market Analysis – Size, Demand & Forecast 2025 to 2035

Aeroengine Accessory Drive Train Market Size and Share Forecast Outlook 2025 to 2035

Gas Engines Market Size and Share Forecast Outlook 2025 to 2035

Aero Engine Coatings Market Growth - Trends & Forecast 2025 to 2035

Civil Engineering Market Size and Share Forecast Outlook 2025 to 2035

Tissue Engineered Skin Substitute Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA