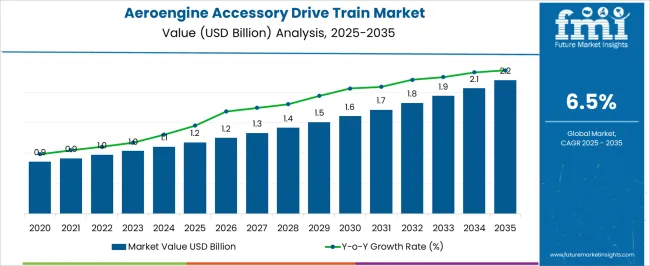

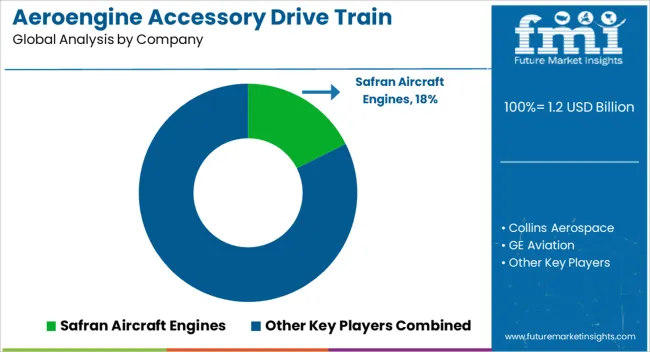

The aeroengine accessory drive train market is anticipated to grow from USD 1.2 billion in 2025 to USD 2.2 billion by 2035, reflecting a CAGR of 6.5%. This growth trajectory is supported by rising demand for fuel-efficient engines, advanced power transmission systems, and increased production of commercial and military aircraft. The growth contribution index highlights the relative influence of volume expansion versus price dynamics on overall market gains, showing how technological upgrades and higher adoption rates drive revenue generation.

From 2025 to 2027, the market climbs from USD 1.2 billion to USD 1.4 billion, marking early adoption of lightweight, high-performance drive trains in next-generation aeroengines. Growth in this phase is largely driven by leading OEMs such as Safran, Honeywell, and Rolls-Royce implementing advanced accessory systems to enhance efficiency, reliability, and compliance with stricter emission regulations.

Between 2028 and 2031, revenues rise from USD 1.5 billion to USD 1.8 billion, with incremental gains reflecting improvements in modular design, automated monitoring, and integration with engine control systems. Contribution from price growth is moderate, while volume expansion plays a larger role as fleet modernization and new aircraft programs accelerate deployment. From 2032 to 2035, the market further strengthens, reaching USD 2.2 billion.

| Metric | Value |

|---|---|

| Aeroengine Accessory Drive Train Market Estimated Value in (2025 E) | USD 1.2 billion |

| Aeroengine Accessory Drive Train Market Forecast Value in (2035 F) | USD 2.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The aeroengine accessory drive train market is strongly shaped by five interconnected parent markets, each contributing significantly to demand and technological development. The commercial aircraft engine market holds the largest share at 35%, as passenger aircraft require accessory drive trains to power essential auxiliary systems such as hydraulics, fuel pumps, and electrical systems, ensuring engine efficiency and flight safety.

The defense and military aircraft engine market contributes 25%, with fighter jets, transport, and reconnaissance aircraft demanding high-performance drive trains to maintain mission-critical engine operations under extreme conditions. The helicopter and rotorcraft engine market accounts for 15%, driven by civil and military rotorcraft that rely on accessory drives for hydraulic, pneumatic, and electrical power distribution. The aerospace component and engine systems market holds a 15% share, supplying gearboxes, shafts, and accessory components essential for reliable drive train functionality.

The MRO market represents 10%, supporting regular maintenance, inspections, and replacements of accessory drive components to ensure regulatory compliance and operational reliability. Commercial aviation, defense, and rotorcraft segments account for 75% of total demand, highlighting that aircraft engine applications remain the primary growth drivers, while component suppliers and MRO services enable continuous adoption and innovation globally.

The aeroengine accessory drive train market is gaining momentum, driven by the rising global aircraft fleet, increasing demand for fuel-efficient engines, and advancements in gearbox architecture. OEMs are focused on reducing weight and enhancing the power transmission efficiency of drive systems, aligning with broader aviation sustainability goals.

Furthermore, the resurgence of commercial air travel and ongoing investments in new-generation turbofan engines are reinforcing demand for optimized accessory drive trains. Regulatory pressures to improve engine performance and reduce emissions are prompting innovation in gear technology and thermal management systems.

With increased emphasis on lifecycle durability and reduced maintenance downtime, the market is expected to see sustained innovation across commercial and military applications.

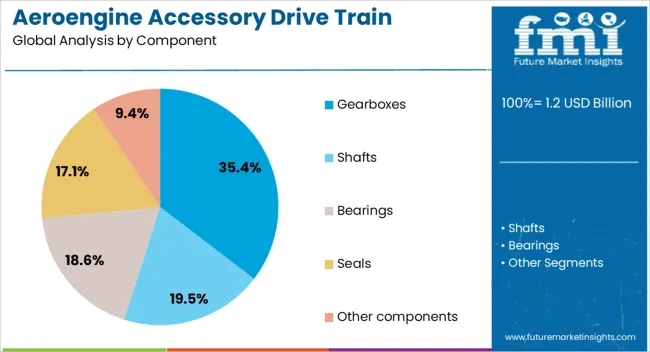

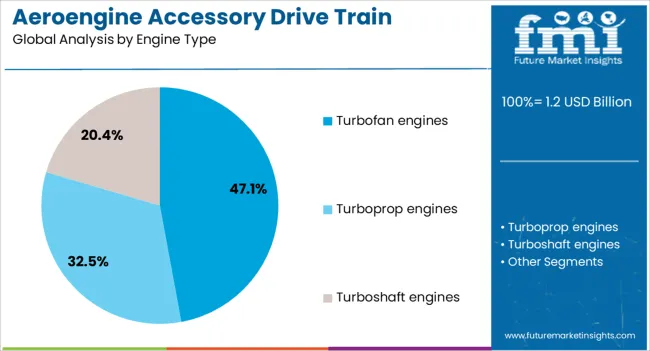

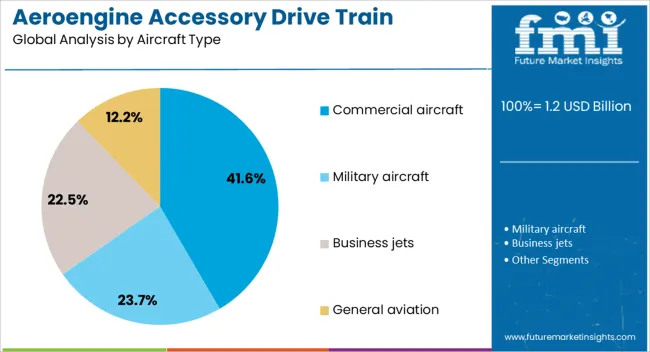

The aeroengine accessory drive train market is segmented by component, engine type, aircraft type, end-use, distribution channel, and geographic regions. By component, aeroengine accessory drive train market is divided into Gearboxes, Shafts, Bearings, Seals, and Other components. In terms of engine type, aeroengine accessory drive train market is classified into Turbofan engines, Turboprop engines, and Turboshaft engines. Based on aircraft type, aeroengine accessory drive train market is segmented into Commercial aircraft, Military aircraft, Business jets, and General aviation. By end-use, aeroengine accessory drive train market is segmented into Original Equipment Manufacturers (OEMs) and Aftermarket.

By distribution channel, aeroengine accessory drive train market is segmented into Direct Sales and Indirect Sales. Regionally, the aeroengine accessory drive train industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Gearboxes are projected to command 35.40% of the market share in 2025, emerging as the leading component in the aeroengine accessory drive train landscape. Their dominance stems from their crucial role in torque conversion and power distribution to vital engine accessories such as fuel pumps, generators, and lubrication systems.

Recent advancements in high-speed gearing materials, thermal coatings, and vibration-damping technologies have improved gearbox efficiency, reliability, and lifespan. With the shift toward more-electric aircraft architectures, the need for high-power-density gearboxes is growing significantly.

As modern engines aim for compactness and higher performance, gearboxes are positioned as essential components in both turbofan and hybrid propulsion platforms.

Turbofan engines are anticipated to hold 47.10% of the market share in 2025, making them the dominant engine type for accessory drive trains. This is largely due to their widespread use in commercial aviation and their compatibility with high-thrust, fuel-efficient performance.

The increased integration of advanced accessory systems such as electrical generators, hydraulic pumps, and air starters within turbofan engines intensifies the need for robust and lightweight drive train solutions. Innovations in high-bypass turbofan engines, aimed at reducing emissions and noise levels, further elevate demand for specialized gearboxes and drive shafts.

As global airlines modernize their fleets with new-generation aircraft powered by turbofan engines, accessory drive train manufacturers are scaling R&D to align with evolving design requirements.

Commercial aircraft are expected to represent 41.60% of the total market share in 2025, maintaining their position as the top end-user segment. Strong aircraft order backlogs, expansion of low-cost carriers, and the global push for airline fleet modernization drive this.

Accessory drive train components in commercial aircraft are critical for powering multiple onboard systems and ensuring engine performance consistency across long-haul operations. The increasing adoption of more-electric aircraft platforms is creating additional load demands on accessory drive systems, necessitating higher efficiency and thermal tolerance.

With airline operators prioritizing fuel economy and operational reliability, investment in advanced accessory drive technologies is expected to remain a central focus in commercial aviation.

The aeroengine accessory drive train market is growing as aircraft manufacturers and MRO providers prioritize engine efficiency, reliability, and reduced maintenance downtime. Demand is driven by the need for high-performance accessory systems that transfer power from engines to fuel pumps, generators, hydraulic systems, and environmental controls across commercial, business, and military aircraft. Challenges include high manufacturing costs, complex integration, and strict aerospace certification requirements. Opportunities exist in lightweight materials, modular designs, and digitally monitored drive systems. Trends highlight advanced gear technologies, reduced vibration systems, and predictive maintenance capabilities.

Aeroengine accessory drive trains are critical for transferring mechanical power from the engine to onboard systems such as generators, pumps, and environmental controls. Demand is rising as aircraft operators seek higher efficiency, reduced weight, and improved system reliability. Growth in commercial aviation, business jets, and military fleets has accelerated the need for drive trains that can handle higher power loads while maintaining operational safety. Integration with modern turbofan and turboprop engines requires precision engineering, vibration control, and durability under extreme temperatures. With increasing emphasis on engine performance, reliability, and lower lifecycle costs, accessory drive trains are being positioned as vital components in maintaining overall aircraft operational readiness and compliance with stringent aviation standards.

Constraints in the market include high material and manufacturing costs, precision engineering requirements, and complex system integration. Aerospace-grade alloys, advanced composites, and high-precision gears demand careful sourcing and quality control. Certification under FAA, EASA, and other aviation authorities adds regulatory complexity, increasing lead times and testing costs. Maintenance requirements, repair, and overhaul schedules affect operational budgets for airlines and MRO providers. Supply chain limitations, proprietary designs, and limited supplier options can impact scalability. Buyers increasingly favor manufacturers providing certified, high-performance drive trains, along with technical support, predictive maintenance solutions, and timely delivery to minimize operational risk and meet stringent aircraft safety regulations.

Opportunities exist in the development of lightweight, modular accessory drive trains that reduce engine weight and improve fuel efficiency. Integration of digital monitoring systems allows real-time health tracking, predictive maintenance, and early fault detection, minimizing downtime. Modular designs enable faster replacement and easier adaptation to multiple engine types. Growth in regional aviation, defense modernization, and business jet fleets is driving demand for high-performance, customizable drive trains. Partnerships between OEMs, component manufacturers, and digital solution providers enable innovation in gear materials, lubrication systems, and vibration damping technologies. Suppliers offering turnkey solutions with advanced diagnostics and lifecycle support are well positioned to capture both OEM and aftermarket demand.

The market is trending toward advanced gear materials, reduced friction systems, and optimized power transmission for higher efficiency. Predictive maintenance and digital monitoring technologies are becoming standard to detect wear, reduce unplanned downtime, and extend service life. Integration with modern aeroengines requires compact, vibration-resistant, and thermally stable designs. Collaboration between OEMs, defense agencies, and aftermarket service providers is accelerating technological innovation and operational reliability. Lightweight and modular accessory drive trains are increasingly preferred to reduce aircraft weight, improve fuel efficiency, and lower lifecycle costs. Suppliers combining high-quality manufacturing, certification support, and digital system integration are best positioned to meet evolving market requirements globally.

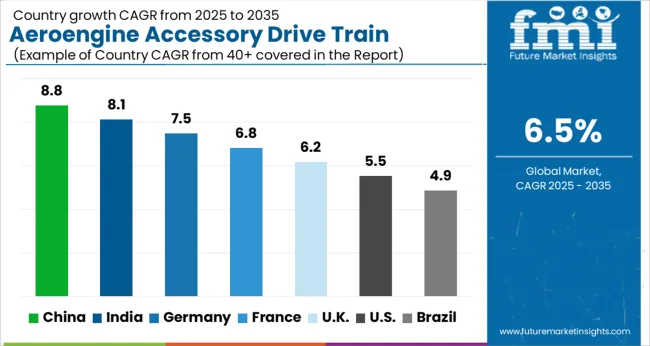

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

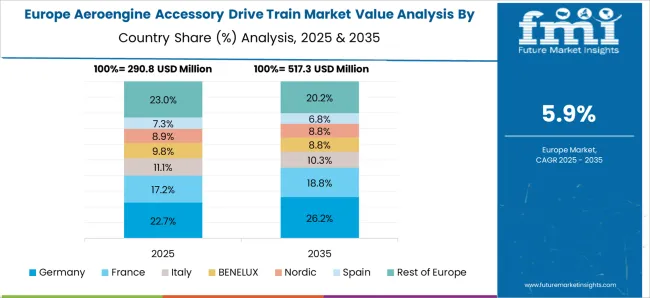

The global aeroengine accessory drive train market is projected to grow at a CAGR of 6.5% from 2025 to 2035, with China leading at 8.8% and India at 8.1%. Growth is fueled by modernization in civil aviation, defense aircraft programs, and engine upgrades for fuel efficiency, reliability, and advanced auxiliary power integration. Germany, the UK, and the USA focus on precision engineering, modular components, and predictive maintenance. BRICS countries drive expansion through rising domestic aircraft production and infrastructure investments, while OECD nations emphasize regulatory compliance, R&D, and high-performance applications in commercial and military fleets. The analysis spans over 40+ countries, with the leading markets shown below.

The aeroengine accessory drive train market in China is projected to grow at a CAGR of 8.8% from 2025 to 2035, supported by rapid expansion of both civil and military aviation sectors. Airlines and aircraft manufacturers are focusing on fuel-efficient engines with advanced accessory drive systems for auxiliary power, lubrication, and control mechanisms. Domestic OEMs are collaborating with international technology providers to integrate high-performance gearboxes, shafts, and couplings for commercial and defense aircraft. Maintenance, repair, and overhaul (MRO) facilities are scaling up to handle increasing fleet sizes, particularly for narrow-body and regional aircraft. Investments in engine testing and simulation labs ensure reliability and adherence to safety standards.

The aerogenic accessory drive train market in India is expected to grow at a CAGR of 8.1%, driven by expansion in civil aviation and defense aircraft programs. Air India, private carriers, and regional operators are upgrading fleets with engines incorporating advanced accessory drive trains for improved efficiency and reduced maintenance cycles. Indigenous engine programs and public-private partnerships are enabling local manufacturing of gearboxes, couplings, and drive shafts. MRO service providers are adopting predictive maintenance and digital monitoring solutions to enhance reliability and minimize downtime. Defense applications, including fighter jets and transport aircraft, further support market expansion. Collaborative projects with global aerospace companies facilitate technology transfer, precision manufacturing, and compliance with international quality standards.

The aeroengine accessory drive train market in Germany is projected to grow at a CAGR of 7.5%, fueled by advanced civil and defense aerospace programs. The country’s aircraft manufacturers focus on integrating high-performance accessory drives for fuel systems, hydraulics, and control applications in commercial, regional, and military engines. R&D centers are innovating lightweight gear systems, high-efficiency couplings, and modular drive solutions to meet EU standards. MRO service providers are upgrading capabilities for predictive maintenance, engine retrofits, and performance monitoring. German aerospace clusters prioritize precision engineering, quality certification, and adherence to EASA regulations. Collaborative research with universities and aerospace suppliers enhances innovation in drive systems for next-generation aircraft.

The UK market is expected to grow at a CAGR of 6.2%, supported by civil and defense aviation modernization programs. Airlines, engine manufacturers, and defense agencies prioritize accessory drive trains that optimize fuel efficiency, reduce vibration, and improve operational reliability. Aerospace OEMs are investing in lightweight gearboxes, couplings, and integrated shaft systems for both commercial and military engines. MRO providers focus on condition-based maintenance, digital diagnostics, and rapid component replacement to minimize downtime. Collaboration with European and USA aerospace firms enables access to advanced engineering solutions and certification standards. Growth in regional aircraft production, air traffic expansion, and defense fleet upgrades drive market demand, while technological innovation in high-performance accessories drives the UK’s position in global aerospace supply chains.

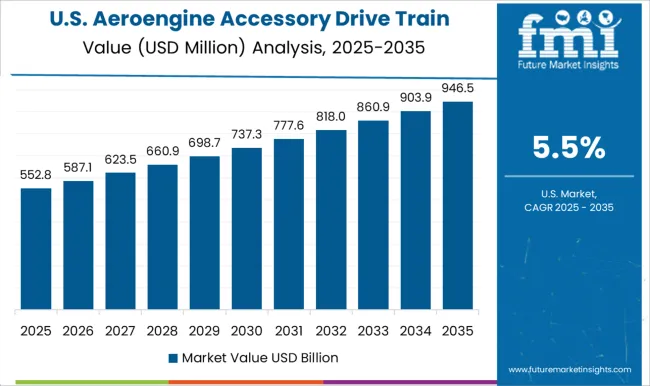

The USA market is projected to grow at a CAGR of 5.5%, fueled by civil, military, and defense aviation programs. Major airlines and aircraft manufacturers are adopting advanced accessory drive trains for fuel pumps, hydraulic systems, and electrical generators to improve efficiency and reduce operational costs. Defense applications, including fighter aircraft and transport jets, drive demand for high-reliability, precision-engineered systems. Domestic OEMs and MRO service providers are investing in modular, lightweight, and durable drive components, while leveraging digital monitoring for predictive maintenance. Strategic partnerships and technology licensing agreements with global aerospace leaders ensure compliance with FAA and military standards. Rising aircraft production, fleet upgrades, and exports strengthen market growth, while continuous R&D in accessory drives supports next-generation engine programs.

Competition in the aeroengine accessory drive train market is defined by precision engineering, reliability under high stress, and integration with advanced engine platforms. Safran Aircraft Engines and GE Aviation lead through full-spectrum drive systems designed for commercial and military engines, emphasizing vibration resistance, lightweight materials, and long operational life. Collins Aerospace, Honeywell Aerospace, and Pratt & Whitney compete by offering modular accessory gearboxes, starter-generators, and fuel and oil pump drives optimized for reduced maintenance and high thermal tolerance. GKN Aerospace, Liebherr-Aerospace, and Moog Inc. differentiate through high-performance mechanical components, precision actuation systems, and integrated monitoring solutions for turbine and auxiliary power applications.

Mid-tier and specialized suppliers, including Park Ohio Holding Corporation, Parker Hannifin Corporation, Triumph Group, UTC Aerospace Systems, Woodward, Inc., and Rolls-Royce plc, provide tailored solutions for specific engine families, regional airlines, and defense applications. Strategies emphasize standardization of components, lifecycle service agreements, and integration with predictive maintenance platforms. Lightweight alloys, additive manufacturing, and high-temperature composites are marketed to enhance efficiency, reduce fuel burn, and extend overhaul intervals. Partnerships with OEMs and engine integrators are used to streamline certification processes and accelerate adoption in new engine platforms.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Component | Gearboxes, Shafts, Bearings, Seals, and Other components |

| Engine Type | Turbofan engines, Turboprop engines, and Turboshaft engines |

| Aircraft Type | Commercial aircraft, Military aircraft, Business jets, and General aviation |

| End-Use | Original Equipment Manufacturers (OEMs) and Aftermarket |

| Distribution Channel | Direct Sales and Indirect Sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Safran Aircraft Engines, Collins Aerospace, GE Aviation, GKN Aerospace, Honeywell Aerospace, Liebherr-Aerospace, Moog Inc., Park Ohio Holding Corporation, Parker Hannifin Corporation, Pratt & Whitney, Rolls-Royce plc, RTX Corporation, Triumph Group, UTC Aerospace Systems, and Woodward, Inc. |

| Additional Attributes | Dollar sales by product type include illuminated versus non-illuminated, single-pole versus double-pole, and sealed versus unsealed configurations, segmented further by application across automotive, marine, industrial machinery, aerospace, residential, and commercial uses. Dollar sales by end use reflect OEM adoption in vehicles, aftermarket distribution, household installations, and industrial equipment manufacturing. Demand dynamics are driven by replacement cycles in marine and industrial sectors, design preferences in residential wiring, and increasing electrification of vehicles and appliances. Regional trends show North America leading with automotive and residential demand, Europe advancing through industrial and aerospace applications, and Asia Pacific scaling rapidly with consumer electronics, manufacturing equipment, and growing automotive production. |

The global aeroengine accessory drive train market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the aeroengine accessory drive train market is projected to reach USD 2.2 billion by 2035.

The aeroengine accessory drive train market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in aeroengine accessory drive train market are gearboxes, shafts, bearings, seals and other components.

In terms of engine type, turbofan engines segment to command 47.1% share in the aeroengine accessory drive train market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lab Accessory Market Analysis – Size, Share & Forecast 2024-2034

Pharmacy Accessory Bagging System (PABS) Market

Car Seat and Accessory Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Japan Mobile Phone Accessory Market Analysis - Size, Share & Trends 2025 to 2035

Korea Mobile Phone Accessory Market Analysis - Size, Share & Trends 2025 to 2035

Hunting Equipment and Accessory Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Medium Voltage Cable and Accessory Market Size and Share Forecast Outlook 2025 to 2035

Western Europe Mobile Phone Accessory Market Analysis – Size, Share & Trends 2025 to 2035

Train Antenna Market Size and Share Forecast Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Train Dispatching Market Size and Share Forecast Outlook 2025 to 2035

Train Loaders Market Size and Share Forecast Outlook 2025 to 2035

Train Contactor Market - Growth & Demand 2025 to 2035

Training Shoes Market Analysis - Size, Trends & Forecast 2025 to 2035

Train Seat Market Growth – Trends & Forecast 2025 to 2035

Train Battery Market Growth - Trends & Forecast 2024 to 2034

Train Auxiliary Rectifier Market

Train Transformer Market

Train Ceiling Modules Market

Train Bogie Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA