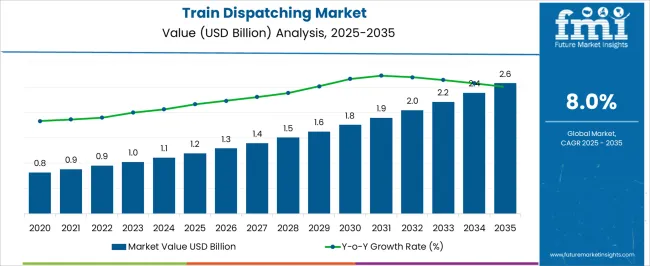

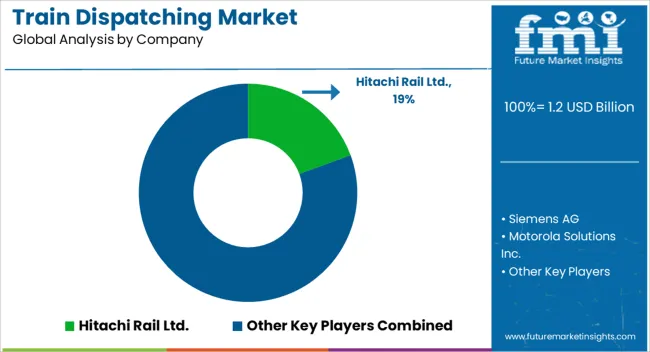

The Train Dispatching Market is estimated to be valued at USD 1.2 billion in 2025 and is projected to reach USD 2.6 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

While the expansion rate is healthy, it also signals a progressive shift towards market saturation beyond 2035 as technology adoption matures. Early growth is expected to be driven by digital control systems, real-time traffic management, and automation in high-speed rail networks. However, by the end of the forecast horizon, penetration in developed regions will be near full adoption, leading to slower incremental gains. Maturity signs are already visible in North America and Western Europe where dispatch modernization projects have reached advanced stages. Here, replacement demand will dominate rather than new installations. In contrast, emerging economies in Asia-Pacific, the Middle East, and parts of Latin America still present whitespace, delaying overall saturation. Vendors will be compelled to differentiate through AI-powered dispatch platforms, cybersecurity integration, and service-based models to maintain revenue streams when volume growth flattens.

| Metric | Value |

|---|---|

| Train Dispatching Market Estimated Value in (2025 E) | USD 1.2 billion |

| Train Dispatching Market Forecast Value in (2035 F) | USD 2.6 billion |

| Forecast CAGR (2025 to 2035) | 8.0% |

The train dispatching market is advancing steadily, driven by the need for efficient management of increasingly complex rail networks. Industry developments highlight growing investments in digital solutions designed to optimize train scheduling, improve safety, and reduce delays. The rise of smart city projects and urban transit expansions has accelerated the demand for advanced dispatching systems.

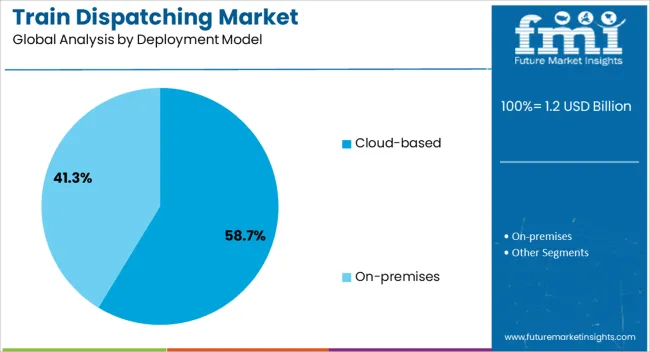

Technological innovations in storage and processing capabilities have enabled real-time decision-making and data sharing among rail operators. Additionally, the shift toward cloud-based platforms has enhanced scalability and remote accessibility, allowing rail authorities to manage dispatching operations more effectively.

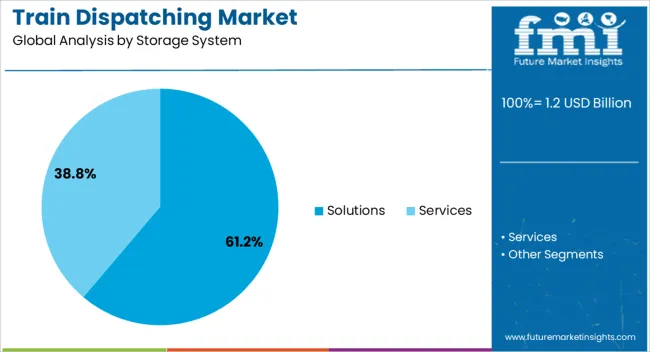

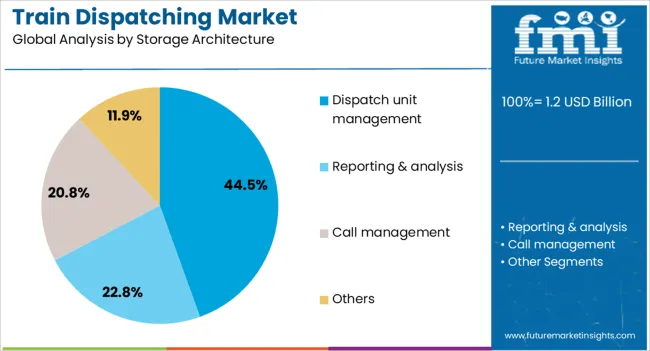

Future market growth is expected to be supported by the increasing integration of AI and automation technologies in train control systems. Segmental growth is expected to be led by Solutions in storage systems, Dispatch Unit Management within storage architectures, and Cloud-Based deployment models.

The train dispatching market is segmented by storage system, storage architecture, deployment model, railroad, and geographic regions. By storage system, the train dispatching market is divided into Solutions and Services. In terms of storage architecture, the train dispatching market is classified into Dispatch unit management, Reporting & analysis, Call management, and Others. Based on the deployment model, the train dispatching market is segmented into Cloud-based and On-premises.

The railroad train dispatching market is segmented into Dedicated freight railroads, Dedicated passenger railroads, Mixed railroads, and Regional & shortlines. Regionally, the train dispatching industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Solutions segment is projected to contribute 61.2% of the train dispatching market revenue in 2025, establishing itself as the leading storage system category. This segment has expanded due to the increasing adoption of integrated dispatching software and platforms that combine data collection, processing, and communication functions.

Operators have preferred solutions that provide comprehensive control over train movements and enable real-time updates to schedules and operations. The flexibility of software solutions to adapt to various rail network sizes and configurations has supported widespread adoption.

Additionally, the capacity to incorporate predictive analytics and performance monitoring has enhanced operational efficiency. The growth of this segment reflects the industry’s focus on holistic management tools that streamline dispatching processes and reduce human error.

The Dispatch Unit Management segment is expected to hold 44.5% of the market revenue in 2025, making it the primary storage architecture choice. This segment has gained prominence due to its ability to efficiently organize and control the flow of information between dispatchers and train operators.

It ensures seamless communication, rapid data processing, and accurate allocation of train movements across networks. The architecture supports centralized control while allowing localized adjustments to accommodate operational disruptions.

Investments in dispatch unit management systems have been driven by the need to improve train punctuality and safety standards. As rail networks grow more complex, this segment is expected to remain essential in managing train operations effectively.

The Cloud-Based deployment model is projected to capture 58.7% of the train dispatching market revenue in 2025, maintaining its position as the leading deployment approach. This growth is attributed to the scalability, flexibility, and cost efficiency offered by cloud platforms.

Rail operators have increasingly embraced cloud-based solutions to enable remote access, seamless software updates, and enhanced data security. Cloud deployment facilitates real-time data sharing among multiple stakeholders, improving coordination and decision-making.

Furthermore, the model supports integration with other smart transportation systems and IoT devices, promoting holistic transport management. With growing digital transformation initiatives across the transport sector, cloud-based dispatching is expected to dominate market adoption.

The train dispatching market is driven by network efficiency needs, infrastructure expansion, safety compliance, and integration with digital rail ecosystems. These dynamics ensure dispatching remains a foundation of global railway operations.

Train dispatching has become central to improving railway network efficiency as congestion and traffic density continue to rise across passenger and freight corridors. Operators are investing in advanced dispatching systems that can manage multiple routes in real time while minimizing delays. This growing focus on network optimization has increased reliance on centralized control centers, predictive algorithms, and integration of digital tools that can streamline train paths. Efficiency gains are also vital for reducing operating costs, enhancing fuel use, and improving on-time performance. The competitive advantage for operators lies in adopting dispatching platforms capable of handling complex network interactions while delivering faster, safer, and more reliable train movements.

The rapid build-out of rail infrastructure in Asia, Africa, and parts of Latin America has created fresh opportunities for train dispatching systems. New lines, particularly in freight-heavy regions, require sophisticated scheduling platforms to manage operations across long distances. These markets are prioritizing investments in dispatching technologies as they expand both passenger and freight corridors to meet rising mobility demands. For international suppliers, this creates an opportunity to provide scalable and adaptable solutions designed for new infrastructure while maintaining compatibility with older systems. The expansion of electrified and high-capacity railways in these economies makes train dispatching solutions an essential enabler of long-term infrastructure success.

Safety considerations and regulatory compliance are critical forces driving the adoption of modern train dispatching systems. Rail accidents linked to human error or poor coordination have pushed authorities and operators to implement stricter rules for real-time monitoring, communication, and dispatch oversight. Modern platforms support compliance by providing continuous tracking, automated alerts, and secure data transmission, helping operators meet regional safety standards. Compliance with government mandates on interoperability between national and regional rail systems has also increased adoption. By mitigating risks and ensuring adherence to international safety norms, train dispatching platforms strengthen confidence among regulators, operators, and passengers alike, reinforcing their long-term importance.

The role of train dispatching is expanding beyond scheduling to become part of broader digital ecosystems that include signaling, ticketing, and asset monitoring. Integration enables dispatching systems to exchange data seamlessly with predictive maintenance platforms, customer information services, and traffic management solutions. This holistic approach allows operators to better coordinate assets, improve service planning, and enhance passenger experiences. Global suppliers are competing to develop interoperable solutions that support cloud-based operations and real-time analytics across diverse rail environments. The strategic value of dispatching now lies in its ability to function as the command hub of railway operations, linking multiple systems to deliver operational excellence.

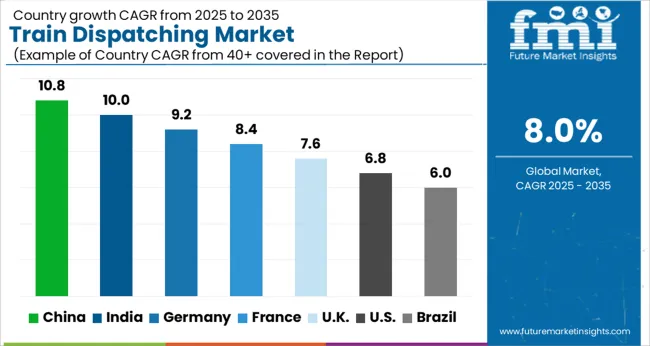

The train dispatching market is projected to expand globally at a CAGR of 8.0% from 2025 to 2035, supported by growing rail infrastructure, demand for efficient scheduling, and integration of real-time monitoring. China leads with a CAGR of 10.8%, driven by extensive high-speed rail projects, urban metro expansions, and large-scale investments in centralized dispatching platforms. India follows at 10.0%, fueled by rapid passenger rail expansion, freight corridor development, and adoption of digital control centers to improve efficiency.

France posts 8.4%, supported by investments in metro networks, intercity rail, and compliance with EU traffic management mandates. The United Kingdom grows at 7.6%, shaped by ongoing electrification projects, digital rail initiatives, and regional service coordination. The United States records 6.8%, reflecting steady growth in freight dispatching technologies and incremental adoption in passenger rail due to its mature infrastructure base. These growth rates highlight Asia-Pacific as the leading hub for expansion, while Europe remains focused on modernization and North America pursues efficiency gains in freight and passenger scheduling.

China is projected to register a CAGR of 10.8% for 2025-2035, higher than the estimated 9.1% recorded between 2020-2024, positioning it well above the global 8.0% baseline. This acceleration reflects China’s ongoing expansion of high-speed rail corridors, large-scale metro projects, and a strong pipeline of intercity networks. Dispatching systems are being upgraded with real-time platforms to handle the complexity of heavy passenger volumes and high-frequency services. State-backed infrastructure funding and regional investments in digitalized railway operations further reinforce adoption. In my opinion, China’s ability to merge scale with centralized planning makes it the most influential market in shaping global train dispatching trends.

India is expected to achieve a CAGR of 10.0% for 2025-2035, compared with about 8.4% during 2020-2024, maintaining its position above the global 8.0% path. The faster pace is supported by major freight corridor developments, expansion of electrified lines, and modernization of passenger services. Dedicated dispatching centers are being implemented to manage growing traffic complexity and improve punctuality in long-distance routes. Regional projects under government-backed railway modernization plans have added momentum. In my view, India’s scale in both freight and passenger segments combined with technology adoption ensures robust growth, making it a strong contender in the Asia-Pacific dispatching market.

France is projected to post a CAGR of 8.4% for 2025-2035, compared with nearly 7.0% in 2020-2024, keeping it slightly above the global 8.0% trajectory. This growth comes from high-speed rail upgrades, metro network expansion, and compliance with European Train Control System (ETCS) standards. France has also integrated dispatching into intercity and regional lines, ensuring better coordination across networks. Funding directed toward rail modernization and sustainability-driven mobility targets has accelerated investment in centralized dispatch centers. In my perspective, France’s policy-driven approach and advanced rail networks give it consistent demand for high-quality dispatching solutions across multiple operational layers.

The United Kingdom is forecast to achieve a CAGR of 7.6% for 2025-2035, up from an estimated 6.3% during 2020-2024, bringing it closer to the global 8.0% benchmark. The earlier lower pace reflected delays in infrastructure approvals, fragmented service operators, and limited early adoption of digital platforms. The rise is tied to investments in electrification, devolution of regional rail services, and modernization projects such as HS2. Integration of dispatching with digital rail systems and compliance-focused operations has added momentum. In my view, the UK’s ability to consolidate fragmented operators under unified systems is the primary driver of its higher growth outlook.

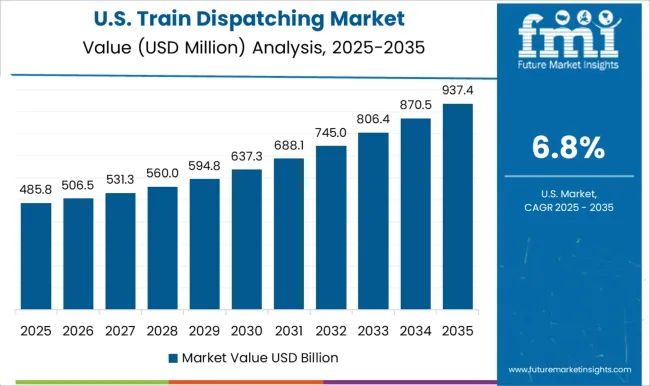

The United States is forecast to post a CAGR of 6.8% for 2025-2035, compared with about 5.7% during 2020-2024, placing it below the global 8.0% benchmark but showing steady acceleration. Growth in the earlier phase was tempered by a mature passenger system and slower digital upgrades. The later improvement reflects increased investment in freight dispatching technologies, upgrades to Amtrak services, and government funding for rail modernization. Freight remains the dominant driver, where dispatching ensures efficiency in heavy-haul scheduling and congestion reduction. In my opinion, the USA market’s emphasis on freight rail creates a distinct growth profile, with technology adoption focused on cost efficiency and reliability.

The train dispatching market features a competitive mix of rail technology providers, signaling system leaders, and integrated communication companies serving passenger and freight operators. Key participants include Hitachi Rail Ltd., Siemens AG, Alstom SA, and Wabtec Corporation, each leveraging strong project pipelines, signaling expertise, and integration capabilities to secure contracts across major rail networks.

Thales Group, Toshiba, and Mitsubishi Heavy Industries Ltd. maintain strong regional and global positions through their advanced control systems, partnerships with governments, and investment in automation for safe and efficient dispatching. Motorola Solutions Inc. and Hexagon AB bring communication, data analytics, and software-driven platforms, enhancing operational visibility and control for dispatchers. Tracsis PLC plays a specialized role in software optimization and analytics, supporting railway operators with scheduling, performance monitoring, and predictive capabilities.

This mid-tier positioning allows them to capture niche opportunities in operational efficiency. The competitive environment is influenced by safety mandates, digitalization of transport systems, and government-backed railway modernization programs. Companies differentiate based on reliability, integration flexibility, and long-term service contracts.

Strategic priorities include expanding smart dispatch platforms, strengthening regional collaborations, and offering customized solutions for freight and passenger segments. Global and regional players focus on scaling digital platforms, predictive maintenance, and collaborative models with rail operators to maintain their competitive edge.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.2 Billion |

| Storage System | Solutions and Services |

| Storage Architecture | Dispatch unit management, Reporting & analysis, Call management, and Others |

| Deployment Model | Cloud-based and On-premises |

| Railroad | Dedicated freight railroads, Dedicated passenger railroads, Mixed railroads, and Regional & shortlines |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Hitachi Rail Ltd., Siemens AG, Motorola Solutions Inc., Alstom SA, Wabtec Corporation, Thales Group, Hexagon AB, Tracsis PLC, Mitsubishi Heavy Industries Ltd., and Toshiba |

| Additional Attributes | Dollar sales, share, regional adoption trends, competitive positioning, regulatory compliance, digital integration levels, technology adoption rate, infrastructure investment, and future growth projections for better planning. |

The global train dispatching market is estimated to be valued at USD 1.2 billion in 2025.

The market size for the train dispatching market is projected to reach USD 2.6 billion by 2035.

The train dispatching market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in train dispatching market are solutions and services.

In terms of storage architecture, dispatch unit management segment to command 44.5% share in the train dispatching market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Train Loaders Market Size and Share Forecast Outlook 2025 to 2035

Train Contactor Market - Growth & Demand 2025 to 2035

Training Shoes Market Analysis - Size, Trends & Forecast 2025 to 2035

Train Seat Market Growth – Trends & Forecast 2025 to 2035

Train Battery Market Growth - Trends & Forecast 2024 to 2034

Train Transformer Market

Train Auxiliary Rectifier Market

Train Ceiling Modules Market

Train Bogie Market

Dog Training Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Gait Trainer Market Growth - Trends, Demand & Forecast 2025 to 2035

Air Entrainment Meters for Mortar Market Size and Share Forecast Outlook 2025 to 2035

Sales Training and Onboarding Software Market Size and Share Forecast Outlook 2025 to 2035

Potty Training and Step Stools Market Size and Share Forecast Outlook 2025 to 2035

Cross Training Shoes Market Size and Share Forecast Outlook 2025 to 2035

Multistrain Probiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Hybrid Train Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Weight Training Market Analysis - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA