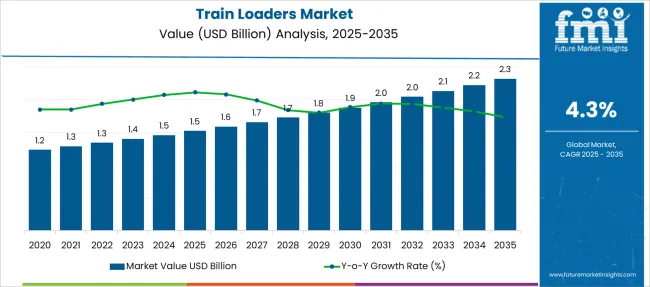

The Train Loaders Market is estimated to be valued at USD 1.5 billion in 2025 and is projected to reach USD 2.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Train Loaders Market Estimated Value in (2025E) | USD 1.5 billion |

| Train Loaders Market Forecast Value in (2035F) | USD 2.3 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The Train Loaders market is experiencing stable growth supported by the increasing demand for bulk material handling solutions across mining, construction, and agricultural industries. As the need for higher efficiency in material transportation intensifies, operators are investing in advanced loading systems that ensure safety, accuracy, and speed.

Government infrastructure development programs and the rising volumes of mineral and grain exports have further driven adoption of train loading systems in both developed and emerging economies. Technological advancements in automation and remote operation are reshaping the market, allowing for streamlined logistics, lower labor dependency, and enhanced operational uptime.

Additionally, the growing emphasis on workplace safety and environmental compliance has encouraged the replacement of manual or semi-automated systems with more sophisticated loaders. With industries increasingly focused on cost optimization and throughput efficiency, the adoption of high-performance train loaders is anticipated to rise steadily, creating new opportunities for both manufacturers and technology integrators in the years ahead..

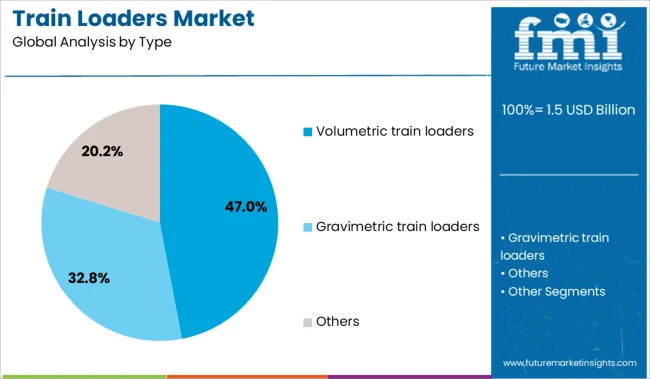

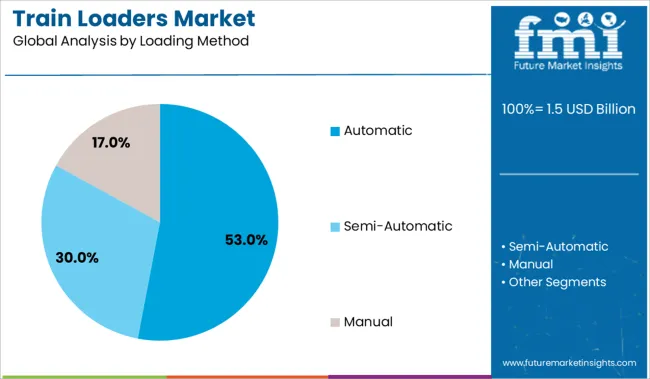

The market is segmented by Type, Loading Method, Capacity, Application, and End-Use Industry and region. By Type, the market is divided into Volumetric train loaders, Gravimetric train loaders, and Others. In terms of Loading Method, the market is classified into Automatic, Semi-Automatic, and Manual.

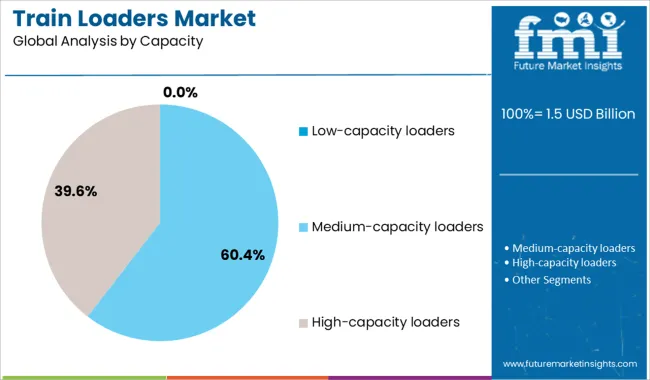

Based on Capacity, the market is segmented into Low-capacity loaders, Medium-capacity loaders, and High-capacity loaders. By Application, the market is divided into Open wagon, Hopper wagon, Tanker wagon, and Others. By End-Use Industry, the market is segmented into Mining, Agriculture, Construction, Oil & gas, Energy & power, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The volumetric train loaders segment is projected to account for 47% of the Train Loaders market revenue share in 2025, making it the dominant type category. This leadership has been attributed to the high accuracy and consistent material distribution that volumetric systems offer across train wagons.

Their ability to measure and load predetermined volumes of material with minimal deviation ensures reliable operation and reduced material spillage. These loaders have been favored in industries where material density and flow characteristics vary significantly, allowing operators to maintain optimal load balance and avoid overloading.

The precision achieved through volumetric measurement contributes to both safety and cost savings, making it a strategic choice for high-throughput terminals. As industries continue to automate bulk material handling processes, demand for volumetric train loaders is expected to remain strong, especially where regulatory compliance and payload consistency are critical operational factors..

The automatic segment is expected to lead the Train Loaders market in 2025, holding a 53% revenue share by virtue of its operational efficiency and reduced reliance on manual labor. Automatic train loaders have gained traction due to their ability to perform consistent loading cycles with minimal human intervention, thereby minimizing safety risks and operational downtime.

These systems have been increasingly integrated with centralized control and monitoring platforms, allowing remote supervision and process optimization. Industries have shown preference for automatic loaders as they support rapid cycle times, enhanced material tracking, and minimal error margins, which are essential for high-volume transportation logistics.

The automation trend aligns with broader digital transformation goals across mining and logistics sectors, encouraging investment in intelligent loading solutions. With growing emphasis on throughput optimization and workplace safety, the automatic loading method is anticipated to retain its leadership across multiple industrial settings..

The low capacity loaders segment holds strategic importance in the Train Loaders market, particularly for operations involving short-distance haulage or smaller-scale production sites. Although no specific share has been provided for 2025, this segment has seen stable adoption in regions where infrastructure constraints or limited railcar availability require compact yet efficient solutions. These loaders have been utilized effectively in smaller plants and processing units where capital expenditure is constrained, and loading volumes are moderate.

Their simpler mechanical structure and lower power requirements contribute to lower installation and maintenance costs. While growth in this segment may not match that of high-capacity systems, demand remains steady in markets prioritizing operational flexibility and entry-level automation.

Manufacturers have also introduced enhancements such as basic automation modules and remote diagnostics in this category, allowing for incremental performance improvements. As small and mid-scale facilities seek modernization within budgetary limits, low capacity loaders are expected to maintain relevance in specific industrial applications..

The need for efficient handling of bulk commodities has been identified as a primary driver of train loaders adoption. In 2023, mining and agriculture firms turned to volumetric and gravimetric loaders to accelerate coal, grain, and ore transfers.

By 2024, infrastructure expansions in the Asia Pacific will have led to heightened deployment of automatic loading systems to meet rising export volumes. Through 2025, elevated rail freight activity was noted, with carload counts and intermodal volumes experiencing growth-marking automated loader systems as central to supply chain efficiency. These shifts have positioned train loaders as essential assets in modern logistics operations

Increased adoption of automation in material handling was evidenced in 2023 when manual loading processes were largely replaced by train loader systems equipped with volumetric controls and remote operation interfaces. By 2024, loader integration with rail yard management software was being pursued to enable synchronized train arrivals and departure scheduling. In 2025, pilot implementations of automated loader systems featuring self-calibrating sensors and predictive maintenance diagnostics have been recorded, aimed at minimizing idle time and equipment downtimes. These developments have demonstrated that loader technologies can shift from standalone bulk-transfer assets to central pillars of connected logistics ecosystems. Providers offering adaptive, software-driven loading platforms are thus well-positioned for market leadership.

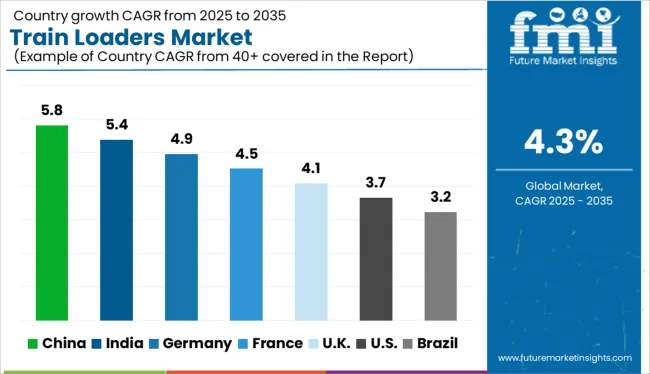

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

The train loaders market is projected to expand at a global CAGR of 4% from 2025 to 2035. China leads among the 40 countries analyzed with a 5.8% CAGR, followed by India at 5.4% and Germany at 4.9%. France records modest growth at 4.5%, while the United Kingdom shows the slowest momentum at 4.1%. Demand in China and India is fueled by large-scale bulk material transport in mining and cement, along with automation upgrades in rail logistics. Germany benefits from retrofits in industrial rail yards and automation standards. France sees controlled expansion through agro-bulk handling. The UK remains stable, with demand focused on maintenance upgrades and selective automation.

China is projected to lead the train loaders market with a 5.8% CAGR, fueled by national railway electrification plans and industrial freight corridor modernization. High-capacity loading systems are being installed across bulk cargo terminals, especially for coal, cement, and grain. Regional OEMs offer integrated control features for real-time load tracking, while automation improves cycle time across multi-wagon setups. Investments in West and Northeast China rail freight zones push loader demand forward.

The train loaders market in India is forecast to grow at a 5.4% CAGR, supported by rapid industrialization and growing reliance on freight corridors for bulk commodities. Indian Railways and Coal India have increased automated train loading infrastructure in key coal belts. Local equipment providers are delivering modular systems tailored to legacy siding configurations. Public-private partnerships help standardize loader operations across Eastern and Central India.

Germany is forecast to expand its train loaders market at a 4.9% CAGR, driven by smart retrofitting projects and environmental compliance upgrades. Port-based industries and logistics terminals in Hamburg and North Rhine-Westphalia are integrating enclosed and low-emission loader systems. German manufacturers are also exporting modular systems across Europe. Sustainability targets favor precision loading, noise reduction, and digital monitoring.

France is projected to grow at a 4.5% CAGR in the train loaders segment, supported by adoption in agricultural co-ops, chemical suppliers, and export-oriented grain corridors. Municipal infrastructure agencies are co-financing loader upgrades in southern France’s rail-linked silos. Interest in enclosed, high-throughput systems for fertilizers and grains is rising. However, bureaucratic delays and fragmented procurement frameworks keep growth conservative.

The United Kingdom is expected to expand its train loaders market at a 4.1% CAGR, shaped by selective adoption in waste handling, aggregates, and construction rail corridors. London and Midlands-based operators are replacing outdated loading systems with partially automated solutions equipped with load sensors and safety shut-offs. Loader growth remains constrained by capital-intensive deployment and infrastructure limitations at older rail yards.

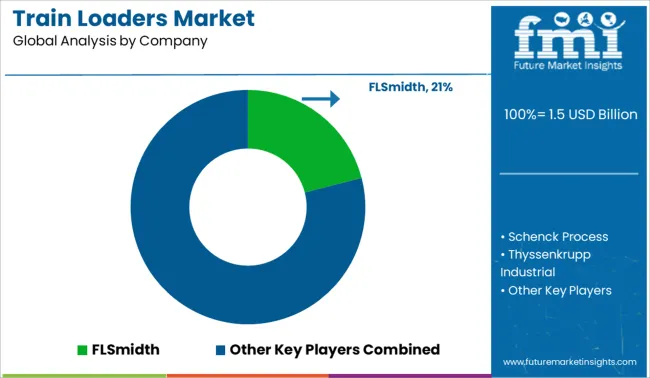

The train loaders market is moderately consolidated, led by FLSmidth with a significant market share. The company holds a dominant position through its advanced bulk handling technologies, high-throughput loading systems, and integrated infrastructure support for mining and material export terminals. Dominant player status is held exclusively by FLSmidth. Key players include Schenck Process, Thyssenkrupp Industrial, Metso Outotec, and Sandvik AB - each offering engineered train loading systems optimized for throughput, dust control, and operational safety across coal, ore, and aggregate handling applications. Emerging player Telestack Ltd focuses on mobile and modular railcar loading solutions, serving customers requiring flexible, rapid-deployment loading infrastructure. Increased mineral exports, infrastructure modernization, and the need for efficient, automated rail loading operations drive market demand.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.5 Billion |

| Type | Volumetric train loaders, Gravimetric train loaders, and Others |

| Loading Method | Automatic, Semi-Automatic, and Manual |

| Capacity | Low-capacity loaders, Medium-capacity loaders, and High-capacity loaders |

| Application | Open wagon, Hopper wagon, Tanker wagon, and Others |

| End-Use Industry | Mining, Agriculture, Construction, Oil & gas, Energy & power, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | FLSmidth, Schenck Process, Thyssenkrupp Industrial, Metso Outotec, Telestack Ltd, and Sandvik AB |

| Additional Attributes | Dollar sales by loader type (rotary, manual, automatic), Dollar sales by railcar compatibility (hopper, gondola, tank, boxcar), Trends in smart controls and automated weighing integration, Use of dust‑suppression and spill‑containment features, Growth in bulk commodity (coal, grain, cement) and logistics applications, Regional deployment patterns across North America, Europe, and Asia‑Pacific. |

The global train loaders market is estimated to be valued at USD 1.5 billion in 2025.

The market size for the train loaders market is projected to reach USD 2.3 billion by 2035.

The train loaders market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in train loaders market are volumetric train loaders, gravimetric train loaders and others.

In terms of loading method, automatic segment to command 53.0% share in the train loaders market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Train Antenna Market Size and Share Forecast Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Train Dispatching Market Size and Share Forecast Outlook 2025 to 2035

Train Contactor Market - Growth & Demand 2025 to 2035

Training Shoes Market Analysis - Size, Trends & Forecast 2025 to 2035

Train Seat Market Growth – Trends & Forecast 2025 to 2035

Train Battery Market Growth - Trends & Forecast 2024 to 2034

Train Transformer Market

Train Auxiliary Rectifier Market

Train Ceiling Modules Market

Train Bogie Market

Strain Clamp Market Size and Share Forecast Outlook 2025 to 2035

Dog Training Equipment Market Size and Share Forecast Outlook 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Gait Trainer Market Growth - Trends, Demand & Forecast 2025 to 2035

Air Entrainment Meters for Mortar Market Size and Share Forecast Outlook 2025 to 2035

Sales Training and Onboarding Software Market Size and Share Forecast Outlook 2025 to 2035

Potty Training and Step Stools Market Size and Share Forecast Outlook 2025 to 2035

Cross Training Shoes Market Size and Share Forecast Outlook 2025 to 2035

Multistrain Probiotics Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA