The global train seat market is poised for steady growth as governments and private operators continue to invest in expanding rail networks, upgrading rolling stock, and improving passenger comfort. Train seats play a critical role in ensuring a comfortable and safe travel experience, making them a key component of both passenger and high-speed trains.

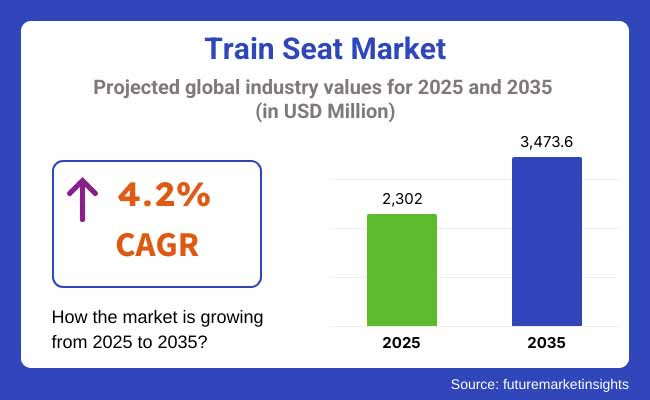

With rising urbanization, the growth of long-distance travel, and increased focus on ergonomic and lightweight designs, demand for advanced train seating solutions is on the rise. Additionally, the market is witnessing ongoing innovation in materials, design customization, and durability, ensuring the train seat market maintains consistent growth through 2035. In 2025, the global train seat market was estimated at approximately USD 2,302.0 Million. By 2035, it is projected to grow to around USD 3,473.6 Million, reflecting a compound annual growth rate (CAGR) of 4.2%.

Train seats remain a significant segment of annual revenue in North America, supported by sustained investments in commuter types of rail projects, intercity trains as well as high-speed rail development. The well-being, protection, and assistance of passengers is of utmost importance to the United States and Canada; this contributes to growing demand for these fine seating solutions. The market is also being driven by programs to modernize ageing rolling stock with more ergonomic and lighter seats.

Europe is another key market, with well-developed rail networks, strong government support for rail infrastructure, and high intercity and high-speed train travel demand. Increasing adoption of advanced seating solutions focusing on comfort, durability, and compliance to safety regulations across countries like Germany, France, and United Kingdom are some factors driving the market. The region’s continued drive toward energy-efficient and environmentally friendly train designs is driving demand for lightweight and sustainable seat materials as well.

Europe is another important market, given its extensive rail networks, strong government support for rail infrastructure and relatively high intercity and high-speed train travel demand. Growth in adoption of advanced seating solutions focusing on comfort, durability and compliance to safety regulations across countries like Germany, France, and United Kingdom are some factors driving the market. Demand for lightweight and sustainable seat materials is also being propelled by the region’s ongoing push toward energy-saving and eco-friendly train designs.

Challenges

High Manufacturing Costs, Durability Requirements, and Regulatory Compliance

The train seat market has emerged as leading players in this field of great innovation, advancing growth and development, while the continued innovative designs are quite conducive to novel styles as well as function, yet are not without significant costs-manufacturing costs that can be quite high due to advanced materials, ergonomic designs, fire-resistant materials, and durability.

Because train seats are used for long periods of time, must be used by passengers of a myriad of weight and size classes, and are cleaned exceptionally often reinforced materials and anti-vandalism feature increase the cost of production. Durability requirements pose another major challenge to be conquered, as wear and tear, moisture exposure and environmental stress factors drastically decrease the lifespan of seats leading to rising maintenance and replacement costs.

Furthermore, stringent regulatory compliance (e.g., EN 45545 (fire safety for railway vehicles), ADA (disability accessibility), UIC) means that materials must be flame-retardant, non-toxic and environmentally safe, which complicates the material selection and design innovation.

Opportunities

rowth in High-Speed Rail, Smart Seat Innovations, and Sustainable Materials

However, even amidst these challenges, the train seat market holds significant growth potential owing to the growing expansion of high-speed rail projects, AI-powered smart seating innovations, and the adoption of sustainable materials. Growing adoption of urban metro systems, bullet trains, and upscale rail services is fueling demand for lightweight, ergonomic, customizable seating solutions.

Moreover, AI-driven smart seating technologies, such as climate and comfort-controlled seats, real-time occupancy monitoring, and adaptable comfort settings, are improving passenger comfort and operational efficiency. The transition towards recyclable, biodegradable and low carbon footprint seat materials is also driving sustainable manufacturing and circular economy practices in the railway seating segment.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Compliance with fire safety (EN 45545), ADA accessibility, and UIC railway seating standards. |

| Consumer Trends | Demand for comfortable, ergonomic, and easy-to-maintain train seats. |

| Industry Adoption | High use of PU foam, synthetic leather, and durable plastic composites. |

| Supply Chain and Sourcing | Dependence on synthetic upholstery materials, metal frames, and polymer-based seat cushions. |

| Market Competition | Dominated by rail seating manufacturers, transportation interior designers, and OEM train builders. |

| Market Growth Drivers | Growth fueled by urban rail expansion, high-speed train adoption, and increasing passenger expectations. |

| Sustainability and Environmental Impact | Moderate adoption of recyclable upholstery and eco-friendly foam alternatives. |

| Integration of Smart Technologies | Early adoption of adjustable seats, USB charging ports, and antimicrobial seat coatings. |

| Advancements in Train Interior Design | Development of lightweight, modular train seating for improved passenger space utilization. |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter carbon-neutral material mandates, AI-based passenger safety monitoring, and sustainable seat manufacturing laws. |

| Consumer Trends | Growth in smart seats with AI-powered climate control, adaptive cushioning, and personalized passenger comfort settings. |

| Industry Adoption | Expansion into biodegradable seat materials, nanotechnology-infused stain-resistant coatings, and AI-driven predictive maintenance. |

| Supply Chain and Sourcing | Shift toward bio-based upholstery, lightweight alloy frames, and 3D-printed seat structures for cost efficiency. |

| Market Competition | Entry of AI-powered seat technology firms, sustainable rail interior startups, and modular seating system innovators. |

| Market Growth Drivers | Accelerated by AI-driven real-time seat availability tracking, modular seating designs, and recyclable rail interior materials. |

| Sustainability and Environmental Impact | Large-scale shift toward carbon-neutral train seat production, upcycled railway interiors, and AI-optimized sustainable seating solutions. |

| Integration of Smart Technologies | Expansion into AI-driven adaptive seating, real-time seat occupancy monitoring, and blockchain-based sustainable seat sourcing. |

| Advancements in Train Interior Design | Evolution toward self-sanitizing seat surfaces, smart vibration-absorbing seat cushions, and AI-customized ergonomic designs. |

The train seat market is growing steadily in the USA, primarily owing to rising investments in railway infrastructure and modernization of passenger trains coupled with increasing demand for ergonomic and comfortable seating solutions. The railway additions of high-speed rail projects and metro networks only adds to the demand in the market. Significantly, this, as well as innovations in lightweight, fireproof and modular train seat designs, is supporting industry growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.3% |

The train seat market in the United Kingdom is growing due to the upgradation of rail networks, increasing emphasis on passenger comfort, and government investments in high-speed and urban transit systems. Recent trends witnessed are the increased focus on sustainable and recyclable materials used for the seat, and the need for smart seating, which means seating with built-in technology.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.1% |

Train seat market is segregated into; coach, business, first class, and economy class. This trend is driven by increasing adoption of lightweight composite materials and smart seats integrated into trains such as internet of things (IoT) connectivity. The stringent EU regulations for fire prevention and ergonomic design of public transport seats further enhance innovation in the industry.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.2% |

Japan train seat market is moderate in nature and is augmented by constant blue-chip investments in High-Speed rail (Shinkansen), Metro, and high-speed rail & Seating Technology. There is a rising need for lightweight, space-efficient and vibration-absorbing seats. Moreover, innovative seating materials being developed for antimicrobial and self-cleaning properties are expected to drive future market trends.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.1% |

The South Korea train seat market is rising with urban transit projects, high-speed rail network expansions, and the growing demand for smart and passenger-friendly solutions. Growing adoption of temperature-regulated and reclining seats in premium rail classes is driving the demand in the industry. Also, investments on rail updates backed by the government are helping a market expansion.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.3% |

Rail seat market is witnessing lucrative growth owing to the railway operators are mainly concentrating towards improved passenger comfort along with ergonomic design and lightweight material to ensure enhanced rail travel experience as well as fuel efficiency.

As investments expand into high-speed rail networks, urban metro systems and luxury train services, manufacturers are working on tailored, modular and high-durability seating solutions that account for customer expectations as well as industry safety requirements. Market is segmented into Train Type (Regional/Intercity, High-Speed, Metro, Light Rail) & Product (Non-Recliner, Luxury/Premium, Recliner, Subway Seats, Sleeper/Couchette, Others).

High-Speed train segment captures the largest market share, in which governments and railway operators globally are invested in Bullet Trains, High-Speed Rail Corridors, and Electrified Train Networks.

The Metro segment also has seen substantial demand, especially in urban transit systems with needs for high-capacity, sturdy, vandal-proof interior solutions. Metro seats favor compact designs, anti-graffiti coatings, and lightweight aluminum or composite materials to maximize passenger flow and reduce maintenance costs.

Rising urbanization, increasing investments towards smart city transport, and extensive metro network extensions throughout Asia and Europe has driven the need for efficient, space-optimizing, and fire-retardant metro seating solutions.

Passengers are seeking greater comfort, adjustability, and ergonomic support for long-distance travel, thus Recliner segment is expected to dominate in the Train Seat Market. In order to improve passenger comfort and convenience, recliner seats are employed in high-speed trains, regional/intercity trains, and luxury rail services with adjustable headrests, footrests, and reclining mechanism.

Reliable developments such as USB charging ports, customizable seat adjustments, and foldable tray tables used in high-tech recliner seats have raised traveler demands, compelling manufacturers to focus on premium rail segments for passenger comfort.

Demand for the Sleeper/Couchette segment is also on the rise, especially on overnight train services and long-distance rail routes. Sleeper and couchette seats convert to beds, have seat partitions for privacy, and memory-foam cushions, making them perfect for overnight passengers want to be comfortable while saving on space.

As sustainable train travel becomes more popular, overnight train routes across Europe are experiencing a resurgence, and modular sleeper compartments receive a facelift, manufacturers are investing in space-efficient sleeper seating solutions that are fit for five-star luxury.

Growing demand for high-speed rail, metro, and long-distance transportation seating that are comfortable, durable, and lightweight is driving the train seat market. Railway infrastructure investments, urbanization, exposure to AI-powered ergonomic design, and sustainable materials are pushing the market growth. Given the importance of maintaining safety, durability and comfort throughout their lifespans, companies are exploring customized seat designs, fire-resistant materials, and AI-assisted passenger comfort optimization.

Market Share Analysis by Key Players & Train Seat Manufacturers

| Company Name | Estimated Market Share (%) |

|---|---|

| Grammer AG | 18-22% |

| Franz Kiel GmbH | 12-16% |

| Compin-Fainsa | 10-14% |

| Saira Seats (Lantal Textiles AG) | 8-12% |

| Freedman Seating Company | 5-9% |

| Other Train Seat Manufacturers (combined) | 30-40% |

| Company Name | Key Offerings/Activities |

|---|---|

| Grammer AG | Develops AI-optimized ergonomic train seating, fire-resistant materials, and lightweight composite seats for high-speed trains. |

| Franz Kiel GmbH | Specializes in metro and intercity train seats, AI-assisted seat comfort analysis, and modular seat designs. |

| Compin-Fainsa | Provides customized train seating solutions, AI-driven passenger comfort studies, and high-durability fabric options. |

| Saira Seats (Lantal Textiles AG) | Focuses on luxury and business-class train seats, AI-powered seat durability testing, and sustainable upholstery materials. |

| Freedman Seating Company | Offers public transport seating, AI-enhanced safety compliance, and cost-efficient train seating solutions. |

Key Market Insights

Grammer AG (18-22%)

Grammer leads the train seat market, offering AI-powered ergonomic designs, lightweight composite seats, and high-comfort rail seating solutions.

Franz Kiel GmbH (12-16%)

Franz Kiel specializes in high-performance metro and intercity train seats, ensuring AI-assisted passenger comfort enhancement and modular train seat innovations.

Compin-Fainsa (10-14%)

Compin-Fainsa provides customized and ergonomic train seating solutions, optimizing AI-powered durability testing and sustainable material integration.

Saira Seats (Lantal Textiles AG) (8-12%)

Saira Seats focuses on luxury and premium-class train seating, integrating AI-enhanced comfort studies and advanced fire-resistant seat materials.

Freedman Seating Company (5-9%)

Freedman develops public transport train seats, ensuring AI-assisted cost-efficient manufacturing and compliance with rail safety regulations.

Other Key Players (30-40% Combined)

Several railway seating manufacturers, interior design firms, and sustainable material providers contribute to next-generation train seating innovations, AI-powered passenger comfort optimization, and eco-friendly seat development. These include:

The overall market size for the train seat market was USD 2,302.0 Million in 2025.

The train seat market is expected to reach USD 3,473.6 Million in 2035.

Growth is driven by the expansion of railway networks, increasing investment in high-speed trains, rising demand for ergonomic and comfortable seating solutions, and advancements in lightweight and durable seat materials.

The top 5 countries driving the development of the train seat market are the USA, China, Germany, Japan, and India.

High-Speed Trains and Recliner Seats are expected to command a significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Train, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Train, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Product, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Train, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Train, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Train, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Train, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by Product, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Train, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Train, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Train, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Train, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by Product, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Train, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Train, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by Product, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Train, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Train, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by Product, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Train, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Train, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by Product, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Train, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Train, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Train, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Train, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Train, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 16: Global Market Attractiveness by Train, 2023 to 2033

Figure 17: Global Market Attractiveness by Product, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Train, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Train, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Train, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Train, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Train, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 34: North America Market Attractiveness by Train, 2023 to 2033

Figure 35: North America Market Attractiveness by Product, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Train, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Train, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Train, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Train, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Train, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Train, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Train, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Train, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Train, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Train, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Train, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Train, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Train, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Train, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Train, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Train, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Train, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Train, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Train, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Train, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Train, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Train, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Train, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Train, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Train, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Train, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Train, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Train, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Train, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Train, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Train, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Train, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Train, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Train, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Train, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by Product, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Train, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Seatbelt Polyester Yarn Market Size and Share Forecast Outlook 2025 to 2035

Train Antenna Market Size and Share Forecast Outlook 2025 to 2035

Seat Control Module (SCM) Market Forecast and Outlook 2025 to 2035

Train Control and Management Systems Market Size and Share Forecast Outlook 2025 to 2035

Train Dispatching Market Size and Share Forecast Outlook 2025 to 2035

Seating And Positioning Belts Market Size and Share Forecast Outlook 2025 to 2035

Train Loaders Market Size and Share Forecast Outlook 2025 to 2035

Train Contactor Market - Growth & Demand 2025 to 2035

Training Shoes Market Analysis - Size, Trends & Forecast 2025 to 2035

Train Battery Market Growth - Trends & Forecast 2024 to 2034

Train Transformer Market

Train Auxiliary Rectifier Market

Train Ceiling Modules Market

Train Bogie Market

Strain Type Pressure Sensors Market Size and Share Forecast Outlook 2025 to 2035

Strain Clamp Market Size and Share Forecast Outlook 2025 to 2035

Dog Training Equipment Market Size and Share Forecast Outlook 2025 to 2035

Car Seat and Accessory Market Analysis - Size, Growth, & Forecast Outlook 2025 to 2035

Belt Trainers Market Size and Share Forecast Outlook 2025 to 2035

Golf Training Aids Market Analysis by Growth, Trends and Forecast from 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA