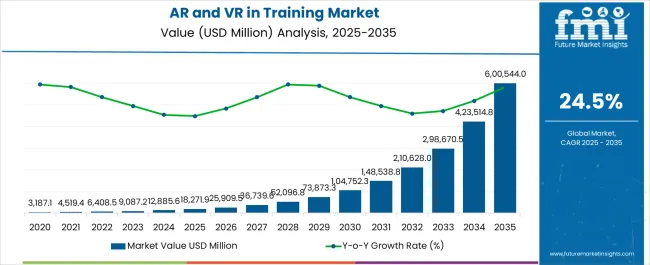

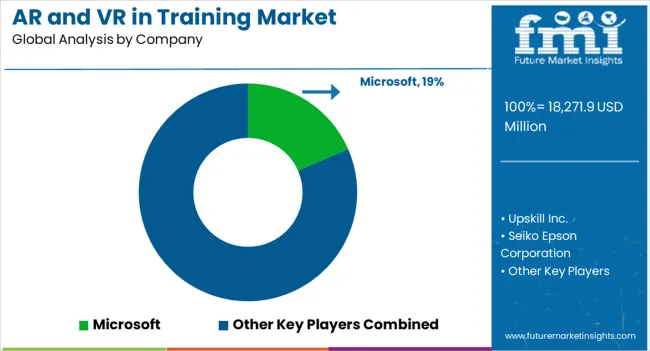

The AR and VR in Training Market is estimated to be valued at USD 18271.9 million in 2025 and is projected to reach USD 600544.0 million by 2035, registering a compound annual growth rate (CAGR) of 24.5% over the forecast period.

| Metric | Value |

|---|---|

| AR and VR in Training Market Estimated Value in (2025 E) | USD 18271.9 million |

| AR and VR in Training Market Forecast Value in (2035 F) | USD 600544.0 million |

| Forecast CAGR (2025 to 2035) | 24.5% |

The AR and VR in training market is witnessing accelerated growth, driven by the need for immersive learning solutions that enhance knowledge retention and skill development across industries. Organizations are adopting AR and VR technologies to simulate real-world scenarios, reduce training risks, and lower costs associated with physical resources. Current market momentum is supported by advancements in hardware, software, and cloud-based delivery platforms, enabling scalable training programs.

Healthcare, defense, and industrial sectors are leading adopters, where the ability to replicate complex environments provides a measurable return on training investment. The market outlook remains strong as enterprises prioritize digital transformation and workforce upskilling.

Growing affordability of devices and increasing integration with artificial intelligence and analytics further enhance market potential. With expanding application scope and consistent corporate investment, AR and VR in training is expected to remain a high-growth segment of the digital learning ecosystem.

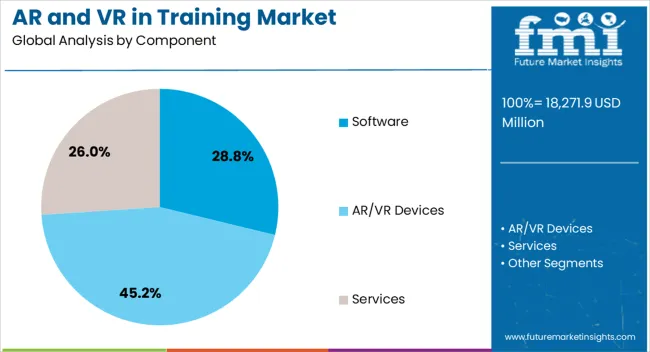

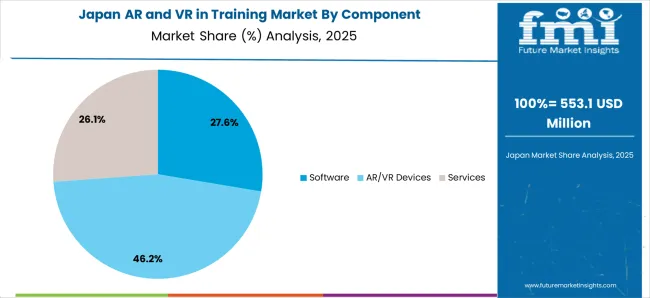

The software segment accounts for approximately 28.8% share of the component category in the AR and VR in training market. This segment’s leadership is supported by the rising demand for content development platforms, learning management integration, and customizable training solutions.

Software enables scalability and flexibility, allowing organizations to tailor immersive training programs to specific skill requirements. Continuous advancements in simulation engines, cloud-based delivery, and real-time analytics have enhanced training effectiveness and user engagement.

The segment benefits from recurring revenue models such as subscriptions and licensing, supporting long-term growth. With ongoing innovation and increasing adoption across diverse industries, the software segment is expected to maintain its significant market share.

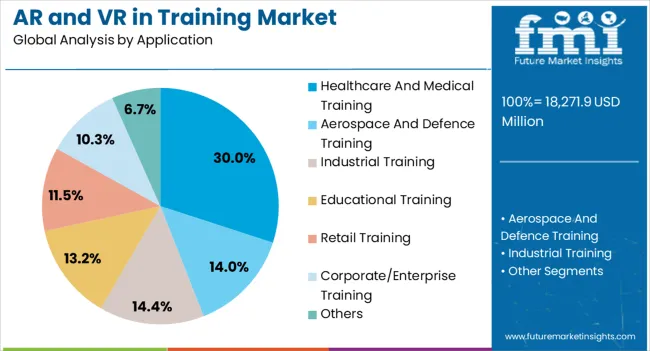

The healthcare and medical training segment holds approximately 30% share of the application category, reflecting the growing reliance on AR and VR technologies for simulating clinical procedures and patient interactions. The ability to create risk-free, immersive environments for medical training enhances both skill acquisition and patient safety.

Adoption is being reinforced by the global shortage of trained healthcare professionals and the need for scalable, cost-effective training solutions. Advanced VR simulators and AR-assisted visualization tools are being integrated into curricula for medical students and professional development programs.

With the continuous evolution of healthcare delivery models and emphasis on practical skill enhancement, the segment is projected to retain its leading position in the foreseeable future.

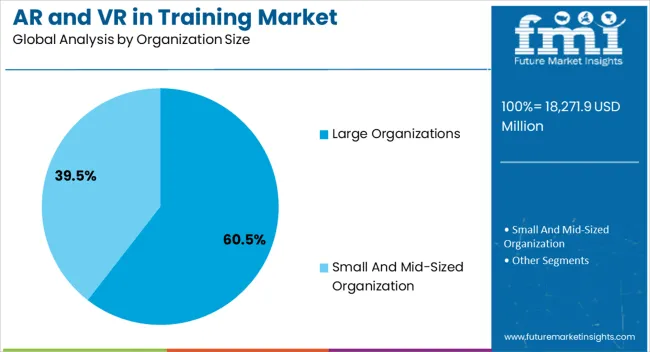

The large organizations segment dominates the organization size category with approximately 60.5% share of the AR and VR in training market. This segment’s leadership stems from higher budgets, greater adoption of digital transformation initiatives, and large-scale workforce training requirements.

Large enterprises benefit from the ability to deploy immersive training solutions across multiple geographies, ensuring consistency and efficiency in skill development. The segment also leverages AR and VR for compliance training, safety drills, and leadership development programs.

With strong focus on employee productivity and performance optimization, large organizations continue to invest heavily in immersive technologies. As AR and VR solutions become more sophisticated and cost-effective, large organizations are expected to sustain their dominant share in the market.

From 2020 to 2025, the AR and VR in training market experienced a CAGR of 40.1%, reaching a market size of USD 9,087.2 Billion in 2025. AR and VR in training witnessed robust growth during the historic period as this period saw an increase in the use of the advances in technology, research, and practice. This improved the AR and VR functionalities that have enabled learners to connect with experts in virtual or augmented spaces, creating more collaborative experiences and allowing the AR and VR in training market to expand along with it.

The aerospace and military sectors were among the first to use AR and VR for training purposes. Pilot training and maintenance duties were conducted using simulations, showcasing the immersive capabilities of these technologies.

The healthcare sector started utilizing AR and VR for medical simulations and training. For example, surgeons could hone their abilities and lower the danger involved in actual surgeries by practicing intricate procedures in virtual surroundings.

The AR and VR in training market is estimated to showcase a high demand for substantial growth and innovation. AR and VR are expected to transform the training landscape across several industries as technology advances. AR and VR technologies' immersive and interactive nature provides unique opportunities for realistic simulations and hands-on learning experiences.

Looking ahead, the global AR and VR in training market is expected to rise at a CAGR of 41.8% from 2025 to 2035. The market size is expected to reach USD 2,98,682.1 Billion during the forecast period.

The table presents the expected CAGR for AR and VR in training market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2025 to 2035, the field is predicted to surge at a CAGR of 40.2%, followed by a slightly higher growth rate of 40.3% in the second half (H2) of the same decade. Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to increase slightly to 41.6% in the first half and remain relatively moderate at 41.7% in the second half.

| Particular | Value CAGR |

|---|---|

| H1 | 40.2% (2025 to 2035) |

| H2 | 40.3% (2025 to 2035) |

| H1 | 41.6% (2025 to 2035) |

| H2 | 41.7% (2025 to 2035) |

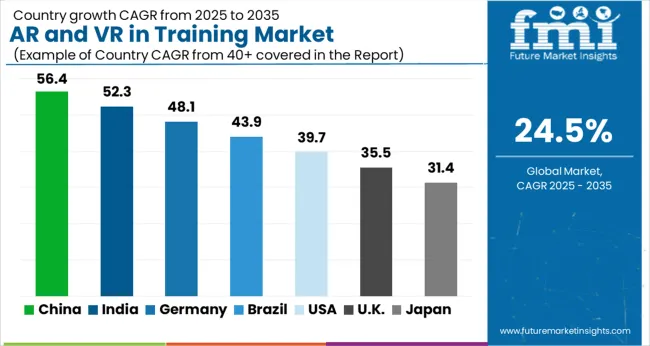

The below table shows the estimated growth rates of the top five countries. India, China, and Japan are set to record higher CAGRs of 48.2%, 45.6%, and 43.5%, respectively, through 2035.

By 2035, the AR and VR in training market in the United States is expected to surge at a CAGR of 38.4% In the United States, augmented reality (AR) and virtual reality (VR) are used to train employees, particularly in manufacturing, healthcare, and aviation. In a secure and regulated setting, employees can learn practical skills through simulations and virtual scenarios.

Several start-ups and businesses specializing in AR and VR development have emerged in the United States. These organizations are actively fostering the expansion of the AR and VR markets, especially in entertainment and gaming sector.

Japan has always been at the forefront of developing gaming hardware and software, and it is acknowledged as a global leader in AR and VR technologies. In Japan, the primary usage of AR and VR is for entertainment and gaming purposes.

The industry will expand due to Japan's deployment of fifth-generation (5G) wireless technology, robust government support, and a more comprehensive range of AR and VR applications. Japan’s AR and VR in training market is estimated to rise at a CAGR of 43.5% over the forecast period.

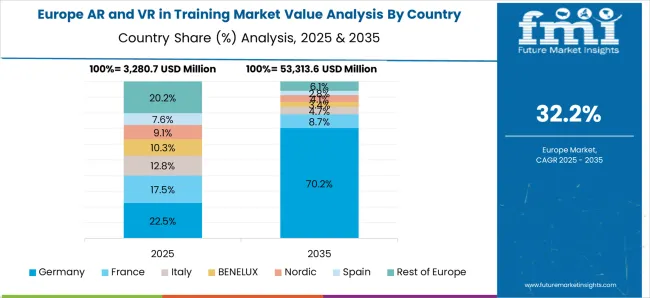

In Germany, AR and VR's strengths span all aspects of the industry, from creating, developing, and producing immersive content to software and hardware creation. AR and VR technologies are used across industries, such as smart cities, engineering, film and TV, gaming, and health tech in Germany. Germany is estimated surge at a CAGR of 40.7% in the AR and VR training market by 2035.

India-based companies have adopted advanced technologies, such as artificial intelligence (AI), big data, AR and VR, to improve efficiency and productivity in businesses. The technology is also in greater demand in the automotive, oil and gas, logistics, and healthcare sectors. There is potential for integrating technologies such as AI with AR and VR in mobile application development software.

Adopting 5G technology is strengthening the mobile network and increase data speed, accelerating the adoption of AR and VR. In India, smartphone penetration further improved AR/VR-based technology accessibility. Due to the points mentioned above, India is estimated to expand at a CAGR of 48.2%.

The promotion of AR and VR technologies has garnered the attention of the Chinese government. Several programs and policies have been introduced to encourage the development and uptake of these technologies across several industries, including education and training.

China is progressively using AR and VR in its training and education programs. Virtual classrooms, realistic training simulations, and interactive educational materials are being created to improve professional and student learning.

The below section shows the software segment dominating by component type. It is forecast to thrive at a 43.1% CAGR between 2025 and 2035. Based on organization size, the small and mid-sized organizations segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 43.6% during the forecast period.

New software development kits (SDKs) and APIs make it easier for developers to create AR and VR applications. Developing new AR and VR engines and middleware provides developers with powerful tools for creating realistic and immersive experiences in software.

The critical software trend is the development of new AR and VR multiplayer and social experiences. These experiences will enable users to connect and interact with each other in virtual worlds.

It will likely be a significant driver of AR and VR adoption in the forecast years. As software continues improving, AR and VR are expected to become more affordable, accessible, and user-friendly. This will lead to more people and firms adopting AR and VR.

| By Component Type | Value CAGR |

|---|---|

| AR/VR Devices | 41.4% |

| Software | 43.1% |

| Services | 39.8% |

AR and VR is influencing the development and advancement of the aerospace sector worldwide. Aerospace engineers have benefited from AR and VR in platform and system design, training for pilots and astronauts, engineering assistance, military exploration, and intelligence gathering.

Technology drivers such as virtual reality and augmented reality are in high demand. AR has gained traction in the defense industry due to its ability to superimpose computer-generated content, such as text, photographs, and videos. VR, on the other hand, makes it easier to teach and train other important aspects to flight crews and aerospace engineers.

| By Application | Value CAGR |

|---|---|

| Healthcare and Medical Training | 41.6% |

| Aerospace and Defense Training | 44.8% |

| Industrial Training | 40.2% |

| Educational Training | 43.2% |

| Retail Training | 38.7% |

| Corporate/Enterprise Training | 37.4% |

| Others | 35.8% |

Small and mid-sized organizations with a younger workforce will most likely utilize AR/VR in their upcoming and ongoing errands. Younger respondents generally demonstrated more interest in AR and VR technology. It has propelled them into becoming more technologically advanced and diverse.

There is a growing need for AR, VR, and mixed reality (MR), including other hybrid, immersive experiences. Industries increasingly recognize the importance of AR and VR technologies, which can provide organizations with opportunities for greater efficiency, accuracy, and productivity for their workforces. This allows small and mid-sized organizations to expand at a CAGR of 43.6% over the forecast period.

| Organization Size | Value CAGR |

|---|---|

| Small and Mid-sized Organizations | 43.6% |

| Large Organizations | 40.7% |

Key players are focusing on the improvement of the customer experience during payments. They also consider the different needs and requirements of the end-users and develop solutions tailored to their needs.

Product Innovation

Businesses in the AR and VR training industry put much effort into developing new features, functions, and integrations with cutting-edge technology like analytics and artificial intelligence. These businesses spend in research and development to deliver innovative solutions that meet the changing needs of their clientele.

Strategic Partnerships and Collaborations

To increase their customer base, integrate platforms, and broaden their market reach, AR and VR training businesses are creating strategic alliances with start-ups, technology suppliers, and industry experts. These collaborations promote growth and innovation by ensuring industry compliance and confidence.

Mergers and Acquisitions

Companies are strengthening their market position and obtaining a competitive advantage through mergers and acquisitions in the quickly changing business IT solutions sector.

Key Developments in the AR and VR in Training Market

| Attribute | Details |

|---|---|

| Estimated Market Size (2025) | USD 9,087.2 Billion |

| Projected Market Size (2035) | USD 2,98,682.1 Billion |

| Anticipated Growth Rate (2025 to 2035) | 41.8% |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Value (USD Billion) and Volume (KT) |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Market Segments Covered | Organization size, Component, Application, Region |

| Regions Covered | North America; Latin America; Europe; East Asia; South Asia Pacific; Middle East and Africa |

| Key Companies | Microsoft; Upskill Inc.; Seiko Epson Corporation; Eon reality; Atheer, Inc.; Sixense enterprise; VR vision Inc.; 8ninths, Inc.; Datamatics; Fusion VR |

| Key Countries Covered | Germany, France, United Kingdom, Italy, Spain, Russia, Rest of Europe, United States, Canada, Mexico, China, India, Japan, South Korea, Australia, Rest of Asia Pacific, Brazil, South Africa, GCC Countries, Kingdom of Saudi Arabia |

The global AR and VR in training market is estimated to be valued at USD 18,271.9 million in 2025.

The market size for the AR and VR in training market is projected to reach USD 600,544.0 million by 2035.

The AR and VR in training market is expected to grow at a 24.5% CAGR between 2025 and 2035.

The key product types in AR and VR in training market are software, ar/vr devices, _head-mounted displays, _smart glasses, _heads-up display (hud), _others, services, _ar/vr design and development, _ar/vr consulting, _integration and development and _support services.

In terms of application, healthcare and medical training segment to command 30.0% share in the AR and VR in training market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Arch Top Door Market Size and Share Forecast Outlook 2025 to 2035

Aromatherapy Market Size and Share Forecast Outlook 2025 to 2035

Arthroscopy Devices Market Size and Share Forecast Outlook 2025 to 2035

Aramid Honeycomb Core Material Market Size and Share Forecast Outlook 2025 to 2035

AR Coated Film Glass Market Size and Share Forecast Outlook 2025 to 2035

Artificial Tears Market Size and Share Forecast Outlook 2025 to 2035

Architectural Membranes Market Size and Share Forecast Outlook 2025 to 2035

Areca Nut Market Size and Share Forecast Outlook 2025 to 2035

Argan Oil Moisturizers Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Artificial Lift Systems Market Size and Share Forecast Outlook 2025 to 2035

AR Fitness Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Aromatic Ketone Polymers Market Size and Share Forecast Outlook 2025 to 2035

Architectural Flat Glass Market Size and Share Forecast Outlook 2025 to 2035

AR Tour Services Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Arthrogryposis Management Market Size and Share Forecast Outlook 2025 to 2035

Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Aronia Berries Market Size and Share Forecast Outlook 2025 to 2035

Arterial Cannula Market Size and Share Forecast Outlook 2025 to 2035

Artichokes Market Analysis- Size and Share Forecast Outlook 2025 to 2035

Arm Pouches Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA