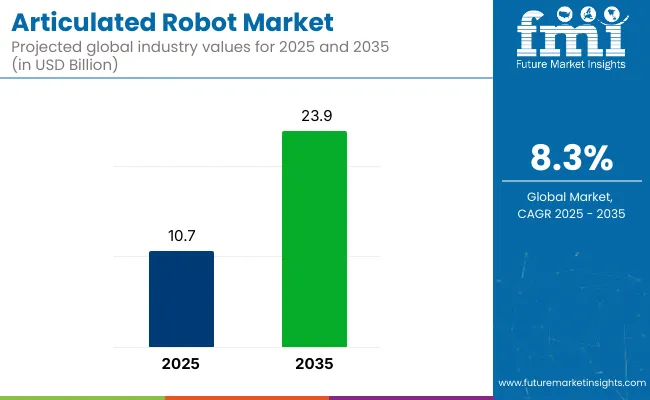

The global articulated robot market is anticipated to witness significant growth from 2025 to 2035, with projections indicating an increase in market value from USD 10.7 billion in 2025 to USD 23.9 billion by 2035. This represents a robust CAGR of 8.3%.

| Metric | Value |

|---|---|

| Estimated Size (2025) | USD 10.7 billion |

| Projected Value (2035) | USD 23.9 billion |

| CAGR (2025-2035) | 8.3% |

Factors driving this expansion include advancements in artificial intelligence (AI), the growing need for automation in industries like automotive and electronics, and the rapid adoption of collaborative robots that are more versatile and can work alongside humans.

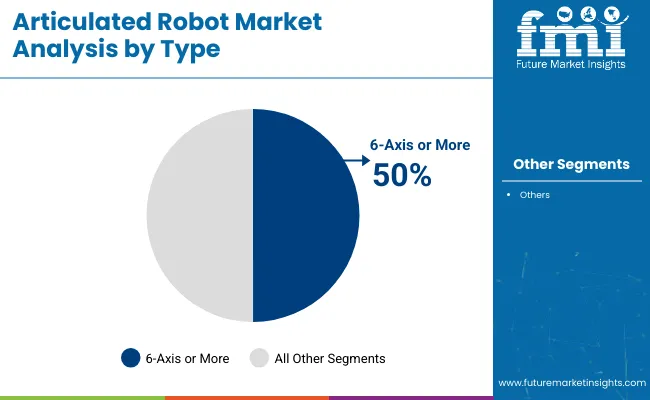

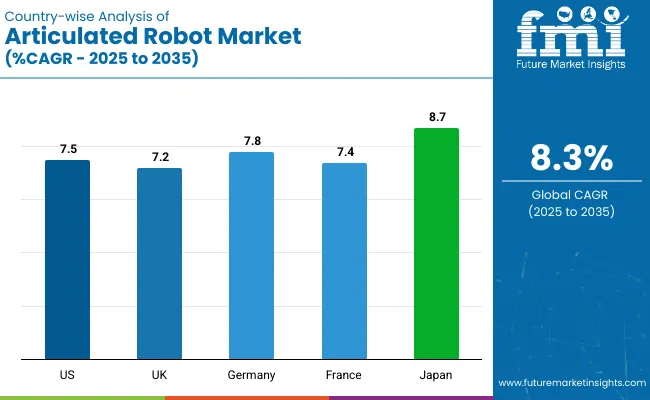

Asia-Pacific is expected to remain the largest contributor to market growth, with Japan rapidly growing at a significant CAGR of 8.7%. Meanwhile, Germany and the USA closely follow this growth with respective CAGRs of 7.8% and 7.5%. 6-axis or more by type segment accounts for a prominent market share of 50%, while the automotive sector by end-use industry holds 40% market share in 2025.

The market holds a significant share within several parent markets, driven by its widespread use in manufacturing and automation. In the industrial automationmarket, articulated robots contribute approximately 10-12% of the total market value, given their essential role in automating manufacturing processes.

Within the broader robotics market, articulated robots account for around 15-20%, as they are among the most widely adopted types of industrial robots. In the collaborative robots market, their share is smaller, roughly 5-8%, due to the growing prominence of collaborative robotic solutions. Their percentage within other parent markets like AI and machine vision is also substantial, but more difficult to quantify directly.

Looking forward, the articulated robot market is poised to see further innovations, particularly in AI, machine learning, and cloud robotics. Industry 4.0 is reshaping production lines, while next-gen robots with lower energy consumption and improved environmental impact will be integral in transforming industrial operations.

The integration of digital twin simulations and AI-driven predictive maintenance will ensure robots are more adaptable and cost-effective, offering significant value to industries looking to optimize their production processes. Additionally, advancements in collaborative robots (cobots) will enhance human-robot interaction, further expanding automation into more diverse and flexible applications.

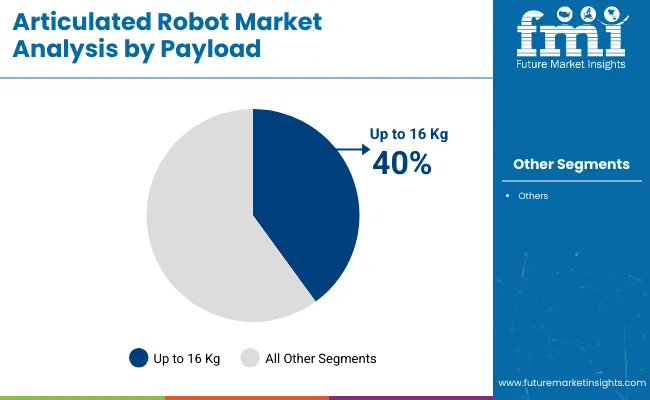

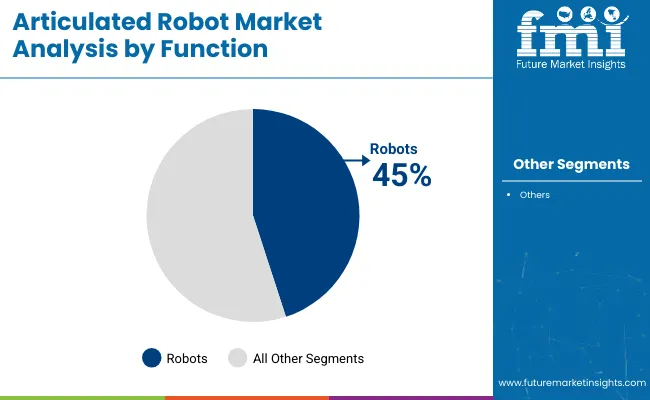

The articulated robot market is segmented into payload, function, type, component, end-use industry and region. By payload, it is segmented into categories of up to 16 kg, 16 to 60 kg, 60 to 225 kg, and more than 225 kg. By function, it includes handling, welding, dispensing, assembling, and other processes (inspection, painting, quality control).

By type, it is segmented into 4-axis or less, 5-axis, and 6-axis or more. By component, it includes the controller, arm, end effector, drive, sensor and others (communication modules, power supply). By end-use industry, it includes automotive, electrical and electronics, chemicals, rubber and plastics, metal and machinery, food and beverages, precision engineering and optics, pharmaceuticals and cosmetics & others (aerospace, logistics, healthcare). By region, it covers North America, Latin America, Europe, Asia Pacific, and MEA.

The up to 16 Kg payload segment leads the articulated robot market due to its adoption in small-scale manufacturing environments such as electronics and medical device assembly. The up to 16 Kg segment holds approximately 40% of the total market share, dominating light manufacturing and assembly sectors.

Handling robots dominate the articulated robot market, accounting for a significant portion of the market share due to their wide usage in material handling, packaging, and sorting. The handling segment holds around 45% of the total market share, driven by the manufacturing and logistics sectors.

The 6-Axis or more type holds approximately 50% of the market share, primarily due to its suitability for high-precision applications.

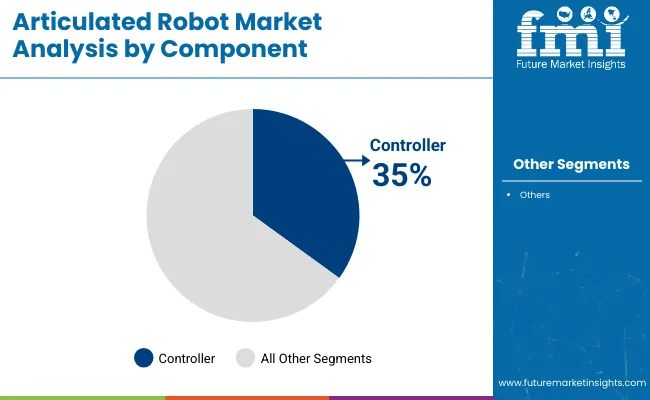

The controller component holds around 35% of the market share in 2025, driven by advancements in AI and IoT integration. This growth is propelled by increasing demand for intelligent, autonomous robotic systems in various industries.

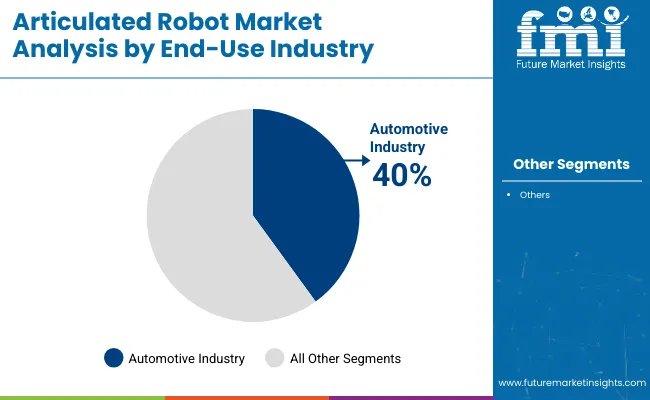

The automotive industry remains the largest adopter of articulated robots, accounting for nearly 40% of the market share. In this sector, robots are extensively used for tasks such as welding, painting, assembly, and material handling.

Recent Trends in the Articulated Robot Market

Challenges the Articulated Robot Market is Facing

The growth rates in the articulated robot market for these countries show strong, yet varied, trends. The United States is projected to grow at a 7.5% CAGR from 2025 to 2035, driven by advancements in automation and smart manufacturing. The United Kingdom follows closely with a 7.2% CAGR, supported by digital transformation and sustainability initiatives in automotive and aerospace.

Germany leads with the highest growth rate of 7.8% CAGR, driven by its strong industrial automation and precision manufacturing sectors. France is expected to grow at 7.4% CAGR, fueled by the increasing adoption of robots in aerospace and automotive. Japan shows the strongest growth at 8.7% CAGR, led by its focus on robotics and AI integration.

The report covers an in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below

The USA articulated robot market is projected to grow at a CAGR of 7.5% from 2025 to 2035. The country’s advanced manufacturing landscape, especially in industries like automotive, aerospace, and electronics, continues to drive demand for articulated robots.

The UK articulated robot revenueis expected to grow at a CAGR of 7.2% from 2025 to 2035. The country’s manufacturing sector, especially in automotive and aerospace, continues to drive demand for advanced robotic solutions.

Germany is forecast to grow at a CAGR of 7.8% from 2025 to 2035 in the articulated robot market. The country remains a global leader in industrial automation, driven by its strong manufacturing and automotive sectors.

The articulated robot demandin France is expected to grow at a CAGR of 7.4% from 2025 to 2035. The country’s focus on renewable energy, combined with the growing adoption of automation in its aerospace and automotive industries, is driving demand for articulated robots.

Japan’s articulated robot revenueis projected to grow at a CAGR of 8.7% from 2025 to 2035. As a global leader in robotics, Japan is advancing automation in high-precision industries, including automotive, electronics, and semiconductor manufacturing.

The articulated robot market is moderately consolidated, with several global leaders accounting for a significant share of revenues. Tier-one companies like ABB Ltd., Fanuc Corporation, KUKA Aktiengesellschaft, Mitsubishi Electric Corporation, and Denso Wave Incorporated are competing based on automation, intelligent software integration, and advanced robotics technologies. These companies focus on enhancing production line speed, reliability, and traceability using AI, RFID, and IoT-enabled systems.

Company strategies increasingly revolve around cost-effective automation, real-time defect detection, and sustainability, with firms investing in collaborative robots, recyclable materials, and energy-efficient solutions to meet environmental regulations.

Recent Articulated Robot Industry News

In June 2025, Fanuc unveiled ROBOGUIDE v10, an enhanced version of its offline robot simulation software, offering improved performance features and a better user experience.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 10.7 billion |

| Projected Market Size (2035) | USD 23.9 billion |

| CAGR (2025 to 2035) | 8.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020-2024 |

| Projections Period | 2025-2035 |

| Market Analysis Parameters | Revenue in USD billions / Volume in Units |

| By Payload | Upto 16 Kg, 16 to 60 Kg, 60 to 225 Kg, More than 225 Kg |

| By Function | Handling, Welding, Dispensing, Assembling, Others (Inspection, Painting, Quality Control) |

| By Type | 4-Axis or Less, 5-Axis, 6-Axis or More |

| By Component | Controller, Arm, End Effector, Drive, Sensor, Others (Communication Modules, Power Supply) |

| By End-Use Industry | Automotive, Electrical and Electronics, Chemicals, Rubber and Plastics, Metal and Machinery, Food and Beverages, Precision Engineering and Optics, Pharmaceuticals and Cosmetics, Others (Aerospace, Logistics, Healthcare) |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, MEA |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | ABB Ltd., Aurotek Corporation, Denso Wave Incorporated, Fanuc Corporation, Kawasaki Heavy Industries Ltd., Kuka Aktiengesellschaft ( Midea Group), Mitsubishi Electric Corporation, Nachi -Fujikoshi Corp., Nimak GmbH, Seiko Epson Corporation, Yaskawa Electric Corporation |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The market size is valued at USD 10.7 billion in 2025.

The market is forecasted to reach USD 23.9 billion by 2035, reflecting a CAGR of 8.3%.

The up to 16 Kg payload segment is expected to lead with a 40% market share in 2025.

Handling robots are expected to capture 45% of the market share in 2025.

Japan is anticipated to be the fastest-growing region with a CAGR of 8.7% from 2025 to 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Robot Controller, Integrator and Software Market Size and Share Forecast Outlook 2025 to 2035

Robotic Warfare Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lawn Mower Market Size and Share Forecast Outlook 2025 to 2035

Robotics Welding Market Size and Share Forecast Outlook 2025 to 2035

Robotic Rehab Tools Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Robotics-Assisted Telesurgery Market Size and Share Forecast Outlook 2025 to 2035

Robotic Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Robot Assisted Surgical Microscope Market Size and Share Forecast Outlook 2025 to 2035

Robotic Assisted Endovascular Systems Market Size and Share Forecast Outlook 2025 to 2035

Robotic Lung Biopsy Market Size and Share Forecast Outlook 2025 to 2035

Robotics as a Service (RaaS) Market Size and Share Forecast Outlook 2025 to 2035

Robotic X-ray Scanner Market Size and Share Forecast Outlook 2025 to 2035

Robotic Catheterization Systems Market Growth – Innovations, Trends & Forecast 2025-2035

Robot Sensor Market Size and Share Forecast Outlook 2025 to 2035

Robotaxi Market Size and Share Forecast Outlook 2025 to 2035

Robotic Aseptic Syringe Filler Capper Market Size and Share Forecast Outlook 2025 to 2035

Robot Market Size and Share Forecast Outlook 2025 to 2035

Robotic Vision Market Size and Share Forecast Outlook 2025 to 2035

Robotics Actuators Market Size and Share Forecast Outlook 2025 to 2035

Robotic Biopsy Devices Market Insights - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA