The global areca nut market is projected to reach USD 1,008 million by 2025 and USD 2,075 million by 2035, based on a consistent CAGR of 7.9% during the forecast period. This translates to an absolute dollar opportunity of over USD 1.2 billion across the forecast horizon.

| Attribute | Values |

|---|---|

| Estimated Industry Size (2025E) | USD 1,008 million |

| Projected Industry Value (2035F) | USD 2,075 million |

| CAGR (2025 to 2035) | 7.9% |

In volume terms, markets in India, Bangladesh, Myanmar, and Indonesia are contributing to more than 70% of global consumption, while demand from the Middle East and North African (MENA)and European ethnic segmentsis rising steadily. India remains the dominant producer and consumer, accounting for over 45% of total production and domestic consumption, with Karnataka, Kerala, and Assam as key cultivation zones.

The industry accounts for varying levels of share across its parent markets. Within the food & beverage industry, it accounts for 0.5% of global value due to its niche application in traditional and regional products. In the agricultural commodities market, theycontribute around 1.2%, driven by their economic significance in South and Southeast Asia.

Its presence in the convenience and functional food market is limited, at less than 0.3%, as its use is highly localized. However, in the traditional medicine and herbal products market, it captures nearly 2.5% due to its frequent use in Ayurveda and traditional Chinese medicine. In the natural stimulants market, its share is higher, at 4.1%, owing to its psychoactive properties and habitual consumption.

Areca nut, widely known for its traditional use in betel quid chewing, is witnessing a broader application portfolio that includes medicinal and therapeutic use cases, particularly in Ayurveda and traditional Asian medicine. The demand surge can be traced to rising consumer awareness about herbal and natural products and their perceived health benefits.

As health-conscious consumers in Southeast Asia and parts of South Asia continue to favor natural stimulants over synthetic alternatives, this finding has increased relevance. Despite regulatory scrutiny in some countries due to health concerns associated with excessive consumption, demand continues to persist across rural and urban markets, driven by cultural embedding and habitual consumption patterns. The economic significance of product cultivation is also prompting regional governments to invest in farming practices and market infrastructure.

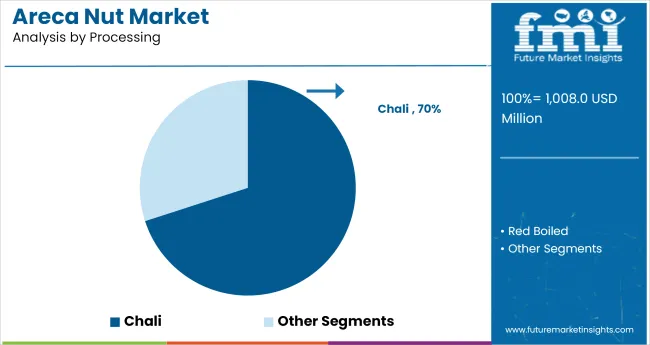

Chali areca nuts lead the market with a 70% share due to their longer shelf life, cost-effectiveness, and strong demand in India and Bangladesh. The Indian variety dominates with a 75% share, driven by superior quality, cultural relevance, and robust domestic production supported by organized cooperatives like The CAMPCO Ltd.

The Chali areca nut segment dominates the market by processing type, accounting for an estimated 70% share of global demand as of 2025. This dominance is attributed to its widespread consumption, especially in India and Bangladesh, where dried whole nuts are preferred for chewing and traditional uses.

The Indian areca nut variety holds the leading position in the global market, commanding 75% of the total market share by variety in 2025. This dominance is primarily due to India's position as the largest producer and consumer of areca nut globally, with key cultivation hubs in Karnataka, Kerala, and Assam.

The areca nut market is expanding due to strong cultural demand, growing herbal stimulant use, and rising exports, especially from South Asia. India leads with organized farming and stable yields, while regulatory pressures are driving a shift toward certified, low-alkaloid varieties.

Dynamics Driving Areca Nut Market Expansion

The global areca nut market is witnessing strong demand-side momentum, primarily fueled by traditional and habitual consumption patterns across South and Southeast Asia. Chewing applications continue to dominate, supported by deep-rooted cultural practices in India, Bangladesh, and Myanmar.

Rising demand for herbal and plant-based stimulants has introduced new consumer segments, particularly in urban and diaspora communities. The medicinal and ayurvedic uses of the product further add to its appeal, especially in natural health product markets. Export demand is also on the rise, particularly from the Gulf and East African regions.

Regulatory Factors Shaping Market Structure

On the supply side, India remains the largest producer, benefiting from organized cooperative systems and government support for farming. Stability in production volumes is further ensured by efficient post-harvest management practices and expanding cultivation acreage in states like Karnataka and Assam.

However, the market is increasingly shaped by regulatory scrutiny, especially due to health-related concerns tied to overconsumption. In response, producers are investing in premium-grade, low-alkaloid varieties and quality certifications to meet global compliance standards and retain market access.

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 4.6% |

| United Kingdom | 5.2% |

| France | 5.7% |

| Japan | 4.9% |

| India | 8.8% |

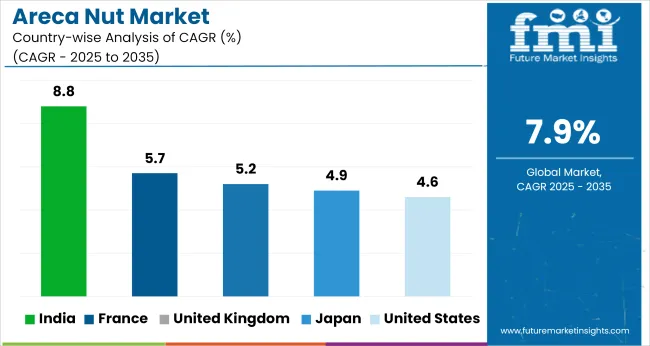

The industry is expected to grow at varied rates across key global economies, shaped by cultural, regulatory, and demographic factors. India leads with the highest CAGR of 8.8%, driven by its status as the world’s largest consumer and producer, with widespread cultural use, strong cooperative networks like CAMPCO, and integration into traditional medicine such as Ayurveda.

France (5.7%), the United Kingdom (5.2%), Japan (4.9%), and the United States (4.6%) represent moderate-growth markets, primarily driven by South and Southeast Asian diaspora consumption. These developed markets, all part of the OECD and G7 groups, reflect niche demand trends influenced by ethnic habits and growing interest in natural stimulants, though moderated by regulatory oversight and health labeling requirements.

India, being part of BRICS, G20, and SCO, continues to dominate through its cultural affinity and institutional support, while developed countries maintain steady demand through specialty retail and compliant imports.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The USA areca nut market is estimated to grow at a CAGR of 4.6% during the forecast period. Areca nut consumption is gaining traction primarily within immigrant communities from South and Southeast Asia, where the product holds cultural significance. The increasing availability of international and ethnic products in specialty grocery stores and e-commerce platforms has enhanced accessibility to areca nut products.

Consumers within the Indian, Bangladeshi, Burmese, and Nepalese diaspora often continue the practice of chewing areca nut as a traditional stimulant, driving steady growth. While the USA regulatory environment poses strict labeling and health warnings, demand remains resilient in pockets of ethnic populations.

Small-scale importers and distributors cater to this niche, ensuring consistent supply through direct sourcing from India and Myanmar. Awareness of cultural practices and relaxation in some regional regulations regarding traditional imports has made the USA a stable yet regulated market.

The UK areca nut market is projected to expand at a CAGR of 5.2% through 2035. The presence of large Indian, Pakistani, Bangladeshi, and Sri Lankan communities continues to drive demand for areca nut products. The chewing of betel quid remains a socially embedded habit among first-generation migrants and older adults, which baseline demand. While awareness about potential health risks has slowed uptake among younger populations, niche cultural use ensures a consistent buyer base.

The UK market is also benefiting from ethnic grocery chains and online stores that import high-quality products, mainly from India. The government mandates health warning labels, but products with compliant packaging and certified sourcing are permitted in the market. As demand stabilizes within these ethnic segments, some small enterprises are also exploring premium, herbal-blended formulations that appeal to the evolving preference for natural stimulants.

The France areca nut market is forecast to grow at a CAGR of 5.7% during the forecast period, and rising areca nut imports are linked to demand from Southeast Asian and Indian communities residing in centers like Paris, Marseille, and Lyon. Though traditionally not a French staple, the product is consumed by specific diaspora groups for its psychoactive and cultural value.

Local specialty stores and ethnic supermarkets are expanding their offerings to include processed forms like Chali and pan masala blends. France's consumer shifts toward plant-based and herbal alternatives have indirectly supported interest in ethnic botanicals, despite regulatory limitations.

While new consumption is not mainstream, the stability of demand among migrants is a small but reliable market. The industry is gradually exploring health-compliant formulations with proper labeling to navigate France's tight food safety frameworks and leverage demand through regulated trade.

The Japanese areca nut market is expected to grow at a CAGR of 4.9% from 2025 to 2035 Japan represents a niche but gradually evolving market for areca nut, with demand coming from Southeast Asian workers and small cultural enclaves. The consumption is still limited and remains within specific regions where ethnic stores cater to foreign labor populations.

Japan's strict import laws and quality control regulations restrict the entry of processed food items unless well-documented and compliant with the Food Sanitation Act. However, demand is steadily growing through formalized ethnic trade networks, and some companies are exploring value-added derivatives in traditional medicine and oral health supplements.

While general Japanese consumers do not consume widely, awareness is increasing due to its inclusion in some imported herbal products marketed for digestion and alertness. The market is small in size but promising in specialized retail formats and health-compliant derivatives.

The Indian areca nut market is projected to grow at a CAGR of 8.8% between 2025 and 2035. India remains the world's largest consumer and producer of areca nut, with deeply embedded cultural and economic connections to the product. Consumption spans all age groups and income levels, especially in the form of chewing products such as betel quid and pan masala.

The domestic market is driven by high-volume retail, institutional demand, and widespread small-scale consumption across populations. Government support through cooperatives like The CAMPCO Ltd. and regional subsidies ensures a strong supply chain infrastructure and farmer participation.

In India, it is also used in traditional medicine, particularly Ayurveda, adding a complementary layer of demand. The sector is evolving with better drying, processing, and packaging technologies to meet rising safety and quality standards. The growing preference for natural stimulants and the cultural continuity of chewing habits ensure India’s dominance in both consumption and cultivation.

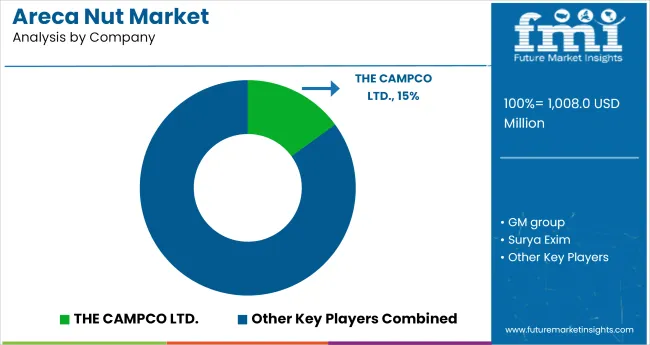

In the areca nut industry, key players are leveraging regional sourcing strength, cultural familiarity, and trade linkages to expand their footprints across domestic and export channels. Companies such as GM Group, Surya Exim, and K. TRADING are tapping into wholesale and bulk distribution networks across South Asia and the Gulf.

Firms like Biotan Pharma and Marlene Traders Co., Ltd. are positioning themselves in value-added applications, including nutraceuticals and herbal blends. THE CAMPCO LTD., a cooperative-based giant, dominates with traceable sourcing and farmer partnerships.

Exporters such as Viet D.E.L.T.A Industrial Co. Ltd and SWASTIKA INTERNATIONAL are building scale in ASEAN and Middle Eastern markets. Shri Ganesh Prasad Traders and SRI VINAYAKA BETELNUT TRADERS are reinforcing their presence through hybrid procurement and regional retail partnerships to cater to growing ethnic demand.

Recent Areca Nut Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1,008 million |

| Projected Market Size (2035) | USD 2,075 million |

| CAGR (2025 to 2035) | 7.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in metric tons |

| Processing Analyzed (Segment 1) | Chali and Red Boiled. |

| Varieties Analyzed (Segment 2) | Indian (South Kanaka, Thirthahali, Rotha, Mettupalayam, Kahikuchi, Mohitnaga) and non-Indian (Mangala, Sumangala, Sree Mangala, Others). |

| Regions Covered | North America, Europe, Asia Pacific, Middle East & Africa, Latin America |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | GM Group, Surya Exim, K. TRADING, Biotan Pharma, Shri Ganesh Prasad Traders, Marlene Traders Co., Ltd., Viet D.E.L.T.A Industrial Co., Ltd, SWASTIKA INTERNATIONAL, THE CAMPCO LTD., SRI VINAYAKA BETELNUT TRADERS. |

| Additional Attributes | Dollar sales, share, volume trends, top consuming regions, buyer behavior, export-import flows, regulatory updates, pricing dynamics, competitive positioning, and future demand forecasts. |

The industry is segmented into chali and red boiled.

The industry is segmented into Indian (South Kanaka, Thirthahali, Rotha, Mettupalayam, Kahikuchi, Mohitnaga) and non-Indian (Mangala, Sumangala, SreeMangala, Others).

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The global areca nut market is estimated to be valued at USD 1,008.0 million in 2025.

The market size for the areca nut market is projected to reach USD 2,087.0 million by 2035.

The areca nut market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in areca nut market are chali and red boiled.

In terms of varieties, indian (south kanaka, thirthahali, rotha, mettupalayam, kahikuchi, mohitnaga) segment to command 62.7% share in the areca nut market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Areca Bowl Market

Nutritive Sweetener Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Nutritional Bars Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Nutricosmetic Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nut Processing Machine Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Nutragenomics Market Size and Share Forecast Outlook 2025 to 2035

Nuts Market Size, Growth, and Forecast for 2025 to 2035

Nutricosmetics Market Analysis - Growth, Trends & Forecast 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Rigid Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Nutraceutical Ingredients Market Analysis by Product, Form, Application and Region through 2035

Nutritional Yeast Market Size, Growth, and Forecast for 2025 to 2035

Nutritional Labelling Market Trends and Forecast 2025 to 2035

Nutrient Dense Food Products Market Analysis by Application, Ingredients, Sales Channel and Region Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA