The nutraceutical excipients market is estimated to be valued at USD 2.8 billion in 2025. It is projected to reach USD 5.2 billion by 2035, registering a compound annual growth rate (CAGR) of 6.4% over the forecast period.

The market is projected to add an absolute dollar opportunity of USD 2.4 billion over the forecast period. This reflects a 1.9 times growth at a compound annual growth rate of 6.4%. The market's evolution is expected to be shaped by rising health consciousness, demand for clean-label products, personalized nutrition trends, and growing preference for natural excipients, particularly where enhanced bioavailability and product stability are required.

By 2030, the market is likely to reach USD 3.8 billion, reflecting USD 1.0 billion in incremental value over the first half of the decade. The remaining USD 1.4 billion is expected to be realized during the second half, suggesting a moderately accelerated growth pattern. Product innovation in liquid excipients, natural sourcing, and sustainable manufacturing practices is gaining traction.

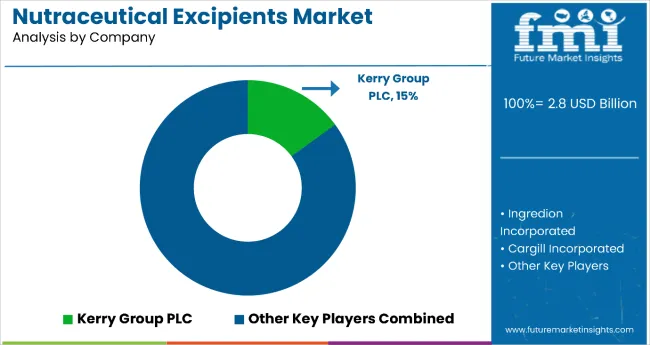

Companies such as Kerry Group PLC and Ingredion Incorporated are advancing their competitive positions through investment in biotechnology development, clean-label product innovation programs, and global distribution networks. Rising health awareness, expanding personalized nutrition applications, and improved bioavailability enhancement features are supporting expansion into dietary supplements, functional foods, and specialized nutraceutical applications. Market performance will remain anchored in product quality standards, regulatory compliance, and consumer safety optimization benchmarks.

The market holds a significant and rapidly growing position within its parent markets. Within the global excipients market, it accounts for 12% due to its specialized nutraceutical applications. In the dietary supplements ingredients segment, it commands a 25% share, supported by enhanced bioavailability technology and formulation stability benefits. It contributes nearly 18% to the functional food ingredients market and 14% to the pharmaceutical excipients crossover segment. In clean-label ingredients, nutraceutical excipients hold around 20% share, driven by natural sourcing requirements and organic certification trends. Across the personalized nutrition ingredients market, its share is close to 15%, owing to its position as a leading customization enabler requiring specialized formulation capabilities.

The market is undergoing a strategic transformation driven by rising demand for fillers & diluents, natural sourcing, and multi-functional excipient capabilities. Advanced technologies using enhanced solubility, improved bioavailability, and intelligent delivery systems have enhanced product efficacy, stability, and consumer acceptance, making nutraceutical excipients viable solutions for complex formulation challenges and personalized nutrition requirements. Manufacturers are introducing specialized features, including clean-label formulations, sustainable sourcing practices, and enhanced functionality tailored for different health applications and consumer preferences, expanding their role beyond basic formulation support to comprehensive nutritional delivery solutions. Strategic collaborations between excipient manufacturers and nutraceutical companies have accelerated innovation in bioavailability enhancement and market penetration.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 2.8 billion |

| Projected Value (2035F) | USD 5.2 billion |

| CAGR (2025 to 2035) | 6.4% |

The nutraceutical excipients market’s exceptional growth is driven by rising health consciousness, demand for personalized nutrition solutions, and rising awareness of clean-label products, making it an attractive ingredient category for manufacturers and formulators seeking innovative health solutions. The growing preference for natural ingredients, enhanced bioavailability, and sustainable sourcing appeals to consumers prioritizing health benefits, product transparency, and environmental responsibility.

A growing understanding of the benefits of functional ingredients, aging population demographics, and preventive healthcare trends is further propelling adoption, particularly in dietary supplements, functional foods, and personalized nutrition applications. Rising disposable income, expanding e-commerce platforms, and continuous product innovation are also enhancing market accessibility and consumer adoption.

As personalized nutrition and clean-label trends accelerate across global markets and health consciousness becomes increasingly important, the market outlook remains highly favorable. With consumers prioritizing natural ingredients, enhanced efficacy, and product transparency, nutraceutical excipients are well-positioned to expand across various dietary supplement, functional food, and specialized health applications.

The market is segmented by product, form, end use, and region. Byproduct, the market is categorized into binders, fillers & diluents, disintegrants, lubricants, coating agents, flavoring agents, coloring agents, and others. Based on form, the market is bifurcated into dry and liquid. In terms of end use, the market is divided into protein & amino acids, omega-3 fatty acids, vitamins, minerals, prebiotics & postbiotics, and other applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

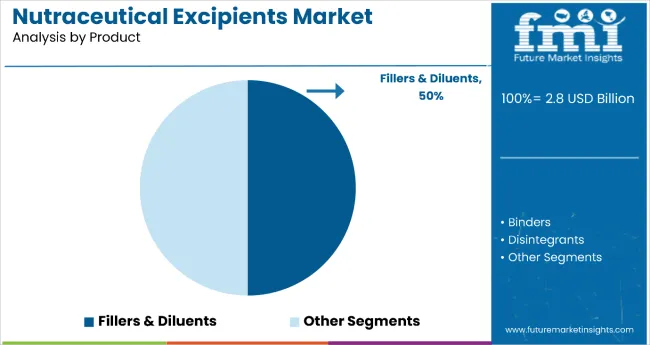

The fillers & diluents segment holds a dominant position with 50% of the market share in the product category, owing to their essential role in ensuring consistent dosages, improving flowability, and maintaining product stability throughout shelf life for diverse nutraceutical formulations. Fillers & diluents are widely used across dietary supplements and functional foods due to their bulking properties, uniform mixing capabilities, and cost-effectiveness, which significantly improve manufacturing efficiency and product quality.

They enable manufacturers to achieve consistent product quality while maintaining excellent stability and consumer acceptability in everyday supplement and functional food applications. As demand for standardized dosages, manufacturing efficiency, and product consistency grows, the fillers & diluents segment continues to gain preference in both traditional and innovative nutraceutical formulations.

Manufacturers are investing in advanced natural filler development, improved flowability characteristics, and sustainable sourcing to enhance functionality, expand application versatility, and improve manufacturing outcomes. The segment is poised to grow further as global consumer preferences favor consistent quality and manufacturers seek reliable formulation solutions.

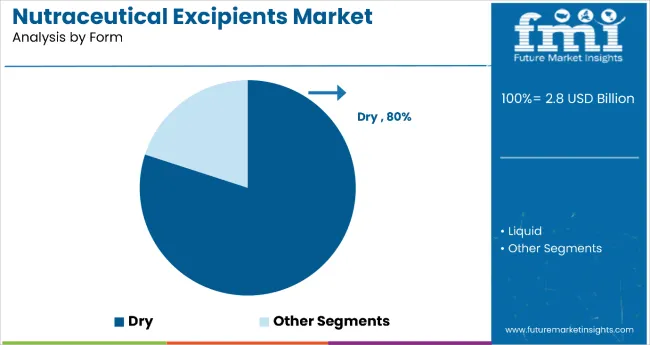

Dry form applications remain the core market segment with 80% of the market share in 2025, since they provide superior stability, convenient handling, and extended shelf life for various nutraceutical formulation requirements in supplement and functional food manufacturing. Their functional versatility supports multiple product formats, including tablets, capsules, powders, and sachets, making them essential components for standardized dosing and consumer convenience.

Dry excipients also ensure consistent performance, reduced manufacturing complexity, and improved storage stability compared to liquid alternatives, while offering cost-effective solutions suitable for large-scale production environments. This makes them indispensable in contemporary nutraceutical manufacturing and quality-focused production environments.

Ongoing demand for stable formulations and the convenience required for modern manufacturing processes are key trends driving the sustained relevance of dry form applications in this ingredient category.

In 2024, global nutraceutical excipients adoption grew by 12% year-on-year, with North America and Asia-Pacific taking significant market shares. Applications include dietary supplements, functional foods, personalized nutrition, and preventive healthcare solutions. Manufacturers are introducing specialized formulations and clean-label options that deliver superior bioavailability and consumer-centered health benefits. Natural formulations now support sustainable positioning. Evidence-based health benefits and safety studies support consumer confidence. Technology providers increasingly supply ready-to-use excipient systems with integrated functionality to reduce formulation complexity.

Clean-Label Innovation Accelerates Nutraceutical Excipients Market Demand

Nutraceutical manufacturers and formulators are choosing clean-label excipients to achieve superior consumer acceptance, enhance product transparency, and meet growing demands for natural, sustainable ingredient solutions. In performance tests, natural excipients deliver up to 85% better consumer acceptance compared to synthetic variants, with 30-40% higher bioavailability rates. Formulations equipped with clean-label excipients maintain optimal product performance throughout extended shelf life and diverse application conditions. In dietary supplement applications, integrated natural systems help reduce formulation complexity while maintaining safety standards by up to 70%. Sustainable sourcing applications are now being deployed for environmental compliance, increasing adoption in sectors demanding comprehensive transparency features.

Cost Pressures, Regulatory Complexity and Supply Chain Limit Growth

Market expansion is constrained by higher costs of natural excipients, complex regulatory requirements, and supply chain vulnerabilities for specialized ingredients. Natural excipient prices can range from 20% to 150% premium over synthetic alternatives, depending on sourcing and certification requirements, impacting formulation costs and leading to pricing pressures in competitive markets. Regulatory compliance complexity restricts product development timelines, extending approval processes by 40-60% for novel excipient applications. Supply chain dependencies on agricultural sources add complexity to procurement stability, especially for specialty natural ingredients. Limited standardization of natural excipients restricts scalable manufacturing adoption, particularly in large-scale production environments and quality-sensitive applications.

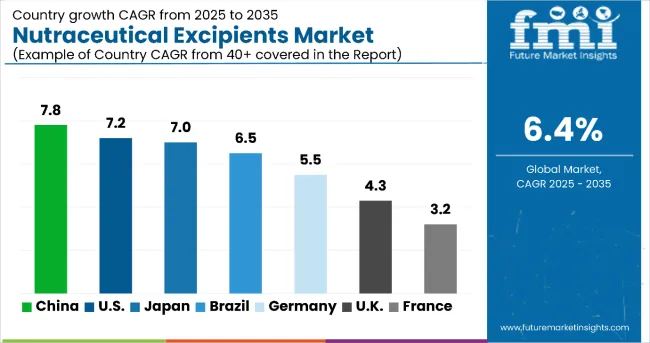

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 7.8% |

| USA | 7.2% |

| Japan | 7.0% |

| Brazil | 6.5% |

| Germany | 5.5% |

| UK | 4.3% |

| France | 3.2% |

In the nutraceutical excipients market, China leads with the highest projected CAGR of 7.8% from 2025 to 2035, driven by rapid health consciousness growth, expanding middle-class demographics, and strong dietary supplement adoption. USA follows with a CAGR of 7.2%, supported by advanced regulatory frameworks and established preventive healthcare trends. Japan shows robust growth at 7.0%, benefiting from aging population demographics and traditional health supplement culture. Brazil, Germany, the UK, and France demonstrate consistent growth at 6.5%, 5.5%, 4.3%, and 3.2% respectively, supported by established health awareness and regulatory stability. These growth patterns reflect regional differences in market maturity, consumer adoption, and healthcare infrastructure development.

The report covers an in-depth analysis of 40+ countries; seven top-performing OECD countries are highlighted below.

Revenue from nutraceutical excipients in China is projected to grow at a CAGR of 7.8% from 2025 to 2035, significantly exceeding the global average. Growth is fueled by rising health consciousness, aging population trends, and strong e-commerce penetration across major cities, including Beijing, Shanghai, and Shenzhen. Chinese consumers are increasingly adopting preventive healthcare solutions as lifestyle changes drive demand for dietary supplements and functional foods.

Key Statistics

The nutraceutical excipients market in the USA is anticipated to expand at a CAGR of 7.2% from 2025 to 2035, reflecting strong consumer adoption driven by preventive healthcare trends and regulatory framework stability. Growth is centered on clean-label excipient adoption and personalized nutrition solutions in California, Texas, and New York regions. Advanced formulations, including bioavailability enhancers, natural sourcing, and specialized delivery systems, are being deployed for health-conscious consumers and aging demographics seeking efficacy improvements.

Key Statistics

Sales of nutraceutical excipients in Japan are projected to flourish at a CAGR of 7.0% from 2025 to 2035, driven by the rapidly aging population and established health supplement culture. Growth has been concentrated in functional food applications and preventive healthcare segments in the Tokyo, Osaka, and Nagoya regions. Japanese consumers are increasingly turning to science-backed nutraceutical solutions that address age-related health concerns. Premium positioning and technological innovation are leading market deployment strategies.

Key Statistics

The demand for nutraceutical excipients in Brazil is expected to increase at a CAGR of 6.5% from 2025 to 2035, driven by expanding middle-class demographics and rising health awareness. Demand is driven by lifestyle disease prevention, natural ingredient preferences, and robust retail infrastructure in São Paulo, Rio de Janeiro, and Brasília markets. Evidence-based health benefits and affordable formulation solutions are increasingly adopted by health-conscious consumers seeking accessible wellness products.

Key Statistics

Revenue from nutraceutical excipients in Germany is projected to rise at a CAGR of 5.5% from 2025 to 2035, supported by quality engineering standards, regulatory compliance excellence, and established pharmaceutical expertise. Consumer adoption in Berlin, Munich, and Hamburg is experiencing expansion in clean-label solutions, organic certifications, and evidence-based formulations. German consumers are leveraging stringent quality standards to meet expectations for safe and effective nutraceutical products.

Key Statistics

The nutraceutical excipients market in the UK is expected to grow at a CAGR of 4.3% from 2025 to 2035, reflecting mature market dynamics with a focus on regulatory compliance and quality assurance. Growth is centered on clean-label adoption and sustainable sourcing practices in the London, Manchester, and Edinburgh regions. Advanced formulations, including plant-based excipients, organic certifications, and enhanced bioavailability features, are being deployed for environmentally conscious consumers and health-focused demographics.

Key Statistics

Sales of nutraceutical excipients in France are projected to advance at a CAGR of 3.2% from 2025 to 2035, driven by premium positioning and traditional healthcare integration. Growth has been concentrated in pharmaceutical crossover applications and luxury wellness segments in the Paris, Lyon, and Marseille regions. French consumers continue to prefer scientifically validated solutions with established safety profiles. Regulatory excellence and quality assurance are leading market positioning strategies.

Key Statistics

The Nutraceutical Excipients Market is expanding steadily as demand for functional foods, dietary supplements, and fortified beverages grows worldwide. Key industry leaders such as Ingredion Incorporated, Cargill Incorporated, and Kerry Group plc are driving innovation through clean-label, plant-based, and multifunctional excipient formulations designed to enhance stability, solubility, and bioavailability of active ingredients. These companies are investing heavily in R&D to develop excipients compatible with a wide range of delivery forms, including tablets, capsules, gummies, and functional powders.

Roquette Frères S.A., Ashland Global Holdings Inc., and BASF SE are focusing on sustainable and natural ingredient development, aligning with consumer demand for transparency and environmentally responsible sourcing. Meanwhile, SPI Pharma Inc., Innophos Inc., and JRS Pharma LP are strengthening their portfolios of binders, fillers, and disintegrants tailored for nutraceutical applications, ensuring improved performance in formulation and processing efficiency.

| Items | Value |

|---|---|

| Quantitative Units (2025) | USD 2.8 Billion |

| Product | Binders, Fillers & Diluents, Disintegrants, Lubricants, Coating Agents, Flavoring Agents, Coloring Agents, Others |

| Form | Dry, Liquid |

| End Use | Protein & Amino Acids, Omega 3 Fatty Acids, Vitamins, Minerals, Prebiotics & Postbiotics, Others |

| Regions Covered | North America, Europe, Asia Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, China, Japan, Germany, Brazil, United Kingdom, France, Australia, India and 40+ Countries |

| Key Companies Profiled |

Ingredion Incorporated, Cargill Incorporated, Kerry Group plc, Roquette Frères S.A., The Lubrizol Corporation, Ashland Global Holdings Inc., BASF SE, SPI Pharma Inc., Innophos Inc., JRS Pharma LP, Hilmar Ingredients Inc., Galenova Inc. |

| Additional Attributes | Dollar sales by product and form ; regional demand trends; competitive landscape; consumer preferences for natural versus synthetic alternatives; sustainable sourcing integration; innovations in processing and formulation; quality standardization for diverse nutraceutical applications |

The global nutraceutical excipients market is estimated to be valued at USD 2.8 billion in 2025.

The market size for nutraceutical excipients is projected to reach USD 5.2 billion by 2035.

The nutraceutical excipients market is expected to grow at a 6.4% CAGR between 2025 and 2035.

The fillers & diluents segment is projected to lead in the nutraceutical excipients market with 50% market share in 2025.

In terms of form, the dry segment is projected to command 80% share in the nutraceutical excipients market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutraceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Rigid Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Nutraceutical Ingredients Market Analysis by Product, Form, Application and Region through 2035

Key Companies & Market Share in Nutraceutical Packaging Sector

Nutraceutical Flexible Packaging Market

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Sugar-based Excipients Market Analysis by Product, Type, Functionality, Formulation, and Region Through 2035

Sustained Release Excipients Market Report – Trends & Industry Forecast 2018-2026

Biopharmaceutical Fermentation Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA