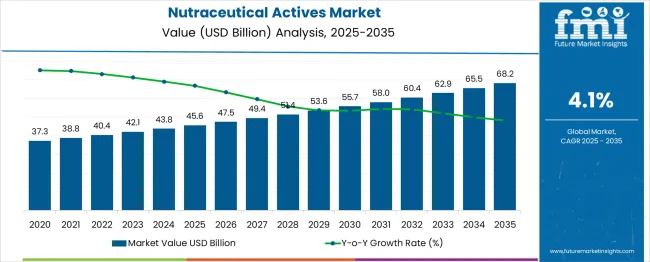

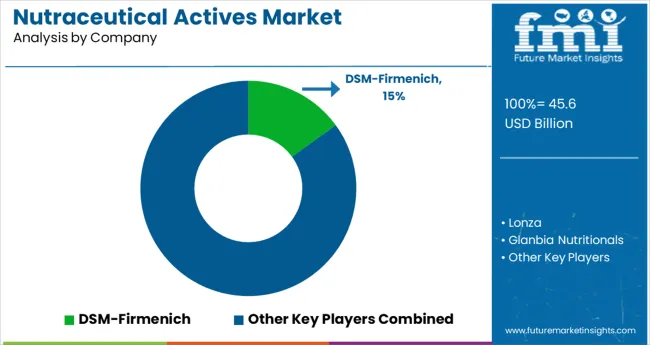

The nutraceutical actives market, starting at USD 45.6 billion in 2025, grows at a steady CAGR of 4.1%, reaching USD 68.2 billion by 2035. Annual gains rise incrementally from USD 1.87 billion in 2026 to nearly USD 2.65 billion in 2035.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 45.6 billion |

| Industry Value (2035F) | USD 68.2 billion |

| CAGR (2025 to 2035) | 4.1% |

This consistent increase signals stable demand for active compounds like polyphenols, amino acids, and omega-3s, driven by functional health concerns. Between 2027 to 2030, the largest YoY jumps coincide with rising demand for personalized nutrition, sports recovery, and cognitive health. North America and Europe remain high-value industries while Asia leads volume growth.

The nutraceutical actives market commands a significant footprint across its parent industries. It contributes approximately 35-40% of the overall nutraceuticals market, being the functional core of fortified foods, supplements, and health beverages.

Within the functional ingredients market, its share stands at 30-35%, led by botanicals, amino acids, and probiotics. In the dietary supplements market, nutraceutical actives represent about 25-28%, powering most capsule and powder formulations.

Within the broader health and wellness ingredients segment, their contribution is estimated at 20-25%, as they drive innovation in preventive nutrition. In the bioactive compounds market, nutraceutical actives comprise nearly 45-50% due to their central role in delivering physiological benefits.

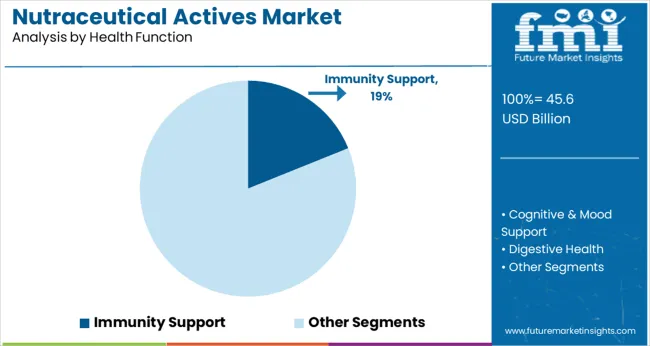

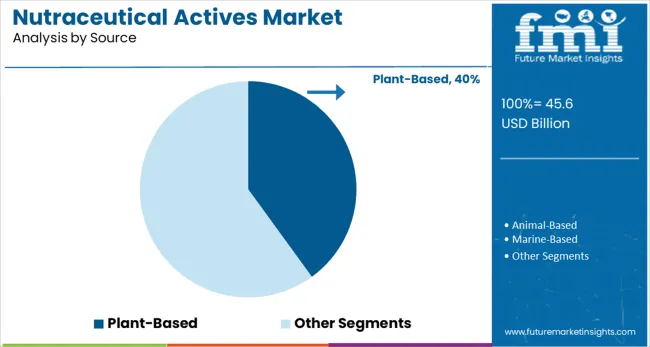

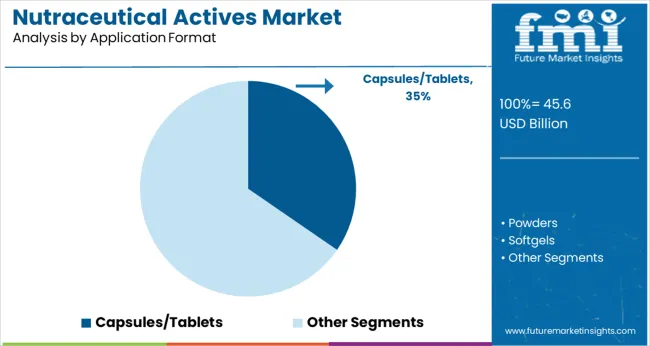

The industryis led by botanical extracts, holding a 21.3% share, driven by their wide use in various health supplements. Immunity support is the leading health function at 19%, while plant-based sources account for 40%. Capsules/tablets are the dominant application format at 35%, showing their convenience and widespread use.

Botanical extracts lead the active type segment with a 21.3% share. Their popularity can be attributed to their numerous health benefits, including immunity-boosting and antioxidant properties. As the preference for plant-based and natural ingredients rises, botanical extracts have become essential in nutraceutical products.

They are widely used in dietary supplements and functional foods, offering an eco-friendly and consumer-trusted alternative to synthetic options. The trend towards plant-based products and their role in preventive health strategies ensures that botanical extracts will continue to hold a significant share in the nutraceuticals industry.

Immunity support holds an 19% share within the health function segment. As awareness about the importance of immunity rises, especially in light of recent global health events, nutraceutical products aimed at boosting immunity are in high demand. Active ingredients such as vitamin C, zinc, and herbal extracts like echinacea and elderberry are widely incorporated into supplements.

This segment is set for steady growth as consumers continue to seek preventive health measures to protect against illnesses. Immunity support remains a key selling point for nutraceutical brands, contributing to a strong industry presence.

Plant-based sources capture a significant 40% share in the source type category. As the shift towards vegan and vegetarian diets continues, plant-based nutraceuticals are gaining substantial traction. These products are perceived as healthier and more environmentally friendly, further driving their demand.

The plant-based sources align with consumer trends focused on clean-label and organic ingredients. This segment’s growth is reinforced by its appeal to a wide demographic, including those who are increasingly adopting plant-based lifestyles, thus ensuring plant-based sources maintain dominance.

Capsules and tablets are the dominant format, holding a 35% share in the application format segment. Their convenience, ease of consumption, and precise dosage control make them the go-to option for nutraceutical products. This format is particularly popular for multivitamins, minerals, and herbal supplements.

Capsules and tablets also offer a longer shelf life and are easy to store, making them ideal for global distribution. The widespread acceptance of this format ensures its continued dominance, as it provides a reliable method of delivering active ingredients to consumers.

The industry is growing as consumers seek health-boosting ingredients like botanicals, probiotics, and vitamins. The regulatory challenges and varying quality standards across regions hinder industry expansion. Companies focusing on compliance, quality control, and ingredient efficacy are well-positioned to capitalize on the growing demand for natural health solutions.

Growing Demand for Health Boosting Ingredients

The demand for nutraceutical actives is surging, with consumers seeking products that offer health benefits beyond basic nutrition. Active ingredients such as botanical extracts, probiotics, and vitamins are gaining prominence due to their proven efficacy in supporting immunity, cognitive health, and overall wellness. The growing preference for preventive health measures and natural alternatives is expanding opportunities for nutraceutical ingredient manufacturers.

Regulatory Challenges and Ingredient Quality Assurance

Despite growing consumer interest, the nutraceutical actives industry faces significant barriers related to inconsistent regulations across regions. Companies must navigate complex regulatory environments, which can lead to delays in product launches and increased compliance costs. ensuring the efficacy and safety of nutraceutical ingredients remains a challenge, with varying standards for ingredient sourcing and processing.

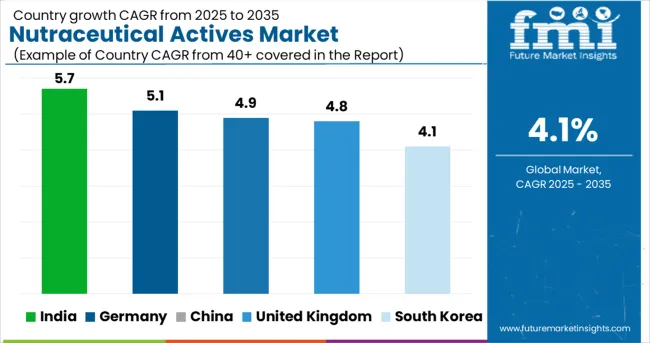

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 5.7% |

| Germany | 5.1% |

| China | 4.9% |

| United Kingdom | 4.8% |

| South Korea | 4.1% |

The nutraceutical actives market is forecast to grow at a 4.1% CAGR from 2025 to 2035, driven by clinical ingredient adoption, bioavailability innovation, and therapeutic diversification. India, part of BRICS, leads with 5.7%, supported by strong extraction capacity for curcumin, ashwagandha, and fenugreek actives.

Germany, a key OECD economy, follows at 5.1%, propelled by EFSA-compliant compounds in metabolic and immune health formats. China, also within BRICS, posts 4.9% as TCM-derived actives become embedded in modern health portfolios.

The United Kingdom, part of the OECD, records 4.8%, with growth driven by gut-health and adaptogenic SKUs. South Korea, another OECD member, grows at 4.1%, in line with the global average, anchored in nutricosmetic peptide applications.

The report includes analysis of over 40 countries, with five profiled below for reference.

Sales for nutraceutical actives in India are expanding at a CAGR of 5.7% from 2025 to 2035. This growth is primarily driven by the increasing adoption of functional foods and supplements. Between 2020 to 2024, demand surged in metropolitan areas, particularly for plant-based extracts and immunity-boosting ingredients.

local manufacturers are intensifying R&D efforts, with advancements in the availability of bioactive compounds and encapsulation technologies. The sector is expected to benefit from broader distribution through online platforms, providing easier access to a wider consumer base.

Demand for nutraceutical actives in Germany is growing at a CAGR of 5.1% from 2025 to 2035. Growth is being bolstered by a shift toward preventive health solutions and the increasing popularity of clean-label products. Between 2020 to 2024, demand was concentrated in both natural food colors and immune-supporting supplements.

Regulatory adjustments in the European Union also provided a favorable environment for the development of high-quality active ingredients. A surge in the popularity of functional beverages further enhanced market opportunities.

The nutraceutical actives market in China is forecast to grow at a CAGR of 4.9% from 2025 to 2035. Growth is expected to be propelled by increasing consumer awareness around health and wellness, along with greater integration of natural products into daily diets.

From 2020 to 2024, the demand was led by products like collagen, vitamins, and antioxidants, which were commonly found in dietary supplements. Furthermore, investments in product innovation and enhanced local distribution networks have positioned China as a key growth market for nutraceuticals.

The nutraceutical actives market in the United Kingdom is projected to expand at a CAGR of 4.8% from 2025 to 2035. This expansion is primarily driven by consumer demand for personalized nutrition and clean-label products. Between 2020 to 2024, sales of immune-enhancing products and functional ingredients saw a marked increase.

demand for high-quality botanical extracts and adaptogens has been rising steadily, especially in the wellness and fitness sectors. With a growing preference for plant-based supplements, the UK market is set for continued growth.

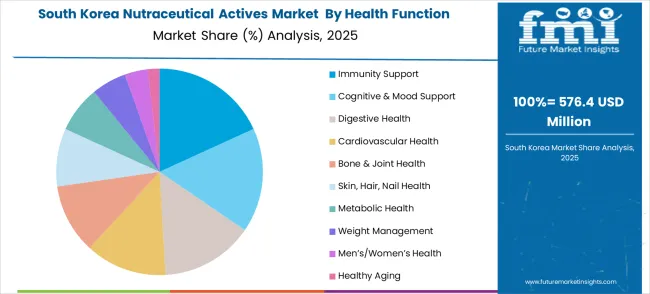

Sales for nutraceutical actives in South Korea areexpected to rise at a CAGR of 4.1% from 2025 to 2035. Consumer interest in functional foods and supplements that support gut health and skin care is driving industry expansion.

Between 2020 to 2024, the demand for probiotics and herbal supplements saw consistent growth, particularly among younger populations. Korean manufacturers are focusing on creating unique formulations to cater to domestic and international markets, ensuring a steady growth trajectory for the industry.

The nutraceutical actives market is highly competitive, driven by major players like DSM-Firmenich, Lonza, Glanbia Nutritionals, ADM, and BASF. DSM-Firmenich leads with its extensive portfolio of vitamins and minerals, enhancing functional ingredient offerings through strategic partnerships and innovations.

Lonza stands out for its plant-based ingredients and personalized nutrition solutions, with a strong focus on scientific efficacy. Glanbia Nutritionals specializes in bioactives, particularly in immunity support and gut health.

ADM offers a wide range of botanicals and functional ingredients, meeting rising consumer demand for health-enhancing products. BASF's focus on bioactive ingredients and scientifically-backed solutions positions it as a key player in the market.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 45.57 billion |

| Projected Industry Size (2035) | USD 68.24 billion |

| CAGR (2025 to 2035) | 4.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and thousand metric tons for volume |

| Active Types Analyzed (Segment 1) | Vitamins (A, B1-B12, C, D2/D3, E, K1/K2), Minerals (Calcium, Magnesium, Iron, Zinc, Selenium, Iodine, Chromium, Manganese, Copper), Amino Acids (L-glutamine, L-carnitine, L-theanine, BCAAs), Fatty Acids (Omega-3, 6, 9), Antioxidants (CoQ10, Astaxanthin, Resveratrol, Polyphenols, Lycopene, Lutein, Zeaxanthin), Probiotics & Prebiotics (Lactobacillus spp., Bifidobacterium spp., Inulin, FOS, GOS, XOS), Botanical Extracts (Curcumin, Green Tea, Ashwagandha, Ginseng, Ginkgo Biloba, Rhodiola, Elderberry), Enzymes (Bromelain, Papain, Amylase, Protease, Lipase, Lactase, Cellulase), Fibers (Psyllium Husk, Beta-glucan, Pectin, Inulin, Guar Gum, Cellulose), Specialty Actives (Collagen Peptides, Hyaluronic Acid, Glucosamine, Chondroitin, NAC, ALA), Hormonal Support Actives (Melatonin, DHEA, Phytoestrogens) |

| Health Functions Analyzed (Segment 2) | Immunity Support, Cognitive & Mood Support, Digestive Health, Cardiovascular Health, Bone & Joint Health, Skin/Hair/Nail Health, Metabolic Health, Weight Management, Men’s /Women’s Health, Healthy Aging. |

| Sources Analyzed (Segment 3) | Plant-Based, Animal-Based, Marine-Based, Microbial (fermentation-derived), Synthetic |

| Application Formats Analyzed (Segment 4) | Capsules/Tablets, Powders, Softgels, Gummies, Liquids & Shots, Functional Foods/Beverages, Sachets & Stick Packs |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | DSM-Firmenich, Lonza, Glanbia Nutritionals, ADM, BASF |

| Additional Attributes | Dollar sales, share by active type and health function, demand shift toward cognitive and immunity blends, rise in gummies and stick-pack formats, clean-label and fermentation-derived innovations, application diversification into functional foods |

The segment is categorized into Vitamins (A, B, C, D, E, K), Minerals (Calcium, Magnesium, Iron, Zinc, Selenium), Amino Acids (L-glutamine, L-carnitine, BCAAs), Fatty Acids (Omega-3, Omega-6, Omega-9), Antioxidants (Coenzyme Q10, Astaxanthin, Resveratrol), Probiotics & Prebiotics (Lactobacillus, Bifidobacterium), Botanical Extracts (Curcumin, Green Tea Extract), Enzymes (Bromelain, Amylase, Lipase), Fibers (Psyllium Husk, Beta-glucan), Specialty Actives (Collagen peptides, Hyaluronic acid), and Hormonal Support Actives (Melatonin, DHEA).

This includes Immunity Support, Cognitive & Mood Support, Digestive Health, Cardiovascular Health, Bone & Joint Health, Skin, Hair & Nail Health, Metabolic Health, Weight Management, Men’s/Women’s Health, Healthy Aging.

The industry is segmented into Plant-Based, Animal-Based, Marine-Based, Microbial (fermentation-derived), and Synthetic sources.

This includes Capsules/Tablets, Powders, Softgels, Gummies, Liquids & Shots, Functional Foods/Beverages, and Sachets & Stick Packs.

Regional analysis covers North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The industry is projected to reach USD 45.57 billion in 2025.

The industry is expected to grow at a CAGR of 4.1% from 2025 to 2035.

Botanical extracts are expected to capture 21.30% in 2025.

The Asia Pacific region, particularly India and China, is projected to register significant growth.

The industry is projected to reach USD 68.24 billion by 2035.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutraceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Gummies Market Analysis - Size, Share, and Forecast 2025 to 2035

Nutraceutical Rigid Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Nutraceutical Ingredients Market Analysis by Product, Form, Application and Region through 2035

Key Companies & Market Share in Nutraceutical Packaging Sector

Nutraceutical Flexible Packaging Market

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Bio-Fermented Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sea Buckthorn Actives Market Size and Share Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Turmeric-Infused Actives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA