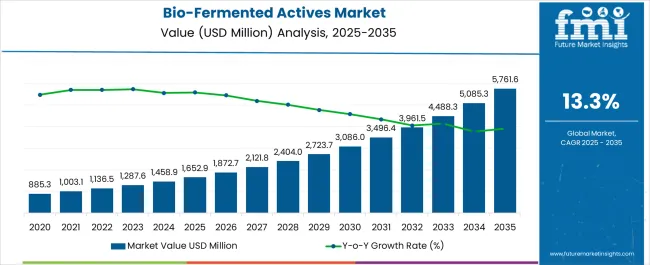

The global bio-fermented actives market is projected to grow from USD 1,652.9 million in 2025 to approximately USD 5,752.6 million by 2035, recording an absolute increase of USD 4,101.2 million over the forecast period. This translates into a total growth of 248.3%, with the market forecast to expand at a compound annual growth rate (CAGR) of 13.3% between 2025 and 2035. The overall market size is expected to grow by nearly 3.5X during the same period, supported by the rising adoption of biotechnology in skincare formulation and increasing demand for sustainable, naturally-derived beauty solutions.

Between 2025 and 2030, the Bio-Fermented Actives market is projected to expand from USD 1,652.9 million to USD 3,083.6 million, resulting in a value increase of USD 1,432.2 million, which represents 34.9% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of biotechnology in beauty and skincare, increasing consumer demand for clean-label solutions, and growing awareness about the benefits of fermented skincare ingredients. Service providers are expanding their fermentation capabilities to address the growing complexity of sustainable beauty requirements.

From 2030 to 2035, the market is forecast to grow from USD 3,083.6 million to USD 5,752.6 million, adding another USD 2,669.0 million, which constitutes 65.1% of the overall ten-year expansion. This period is expected to be characterized by advancement of fermentation technologies for skincare applications, integration of probiotic-derived formulations, and development of sophisticated biotechnology platforms across different product categories. The growing adoption of K-beauty trends and clean-label personalization will drive demand for more advanced bio-fermented formulation capabilities.

Between 2020 and 2025, the Bio-Fermented Actives market experienced rapid expansion, driven by technological breakthroughs in fermentation processes and increasing consumer awareness of sustainable beauty solutions. The market developed as consumers became increasingly interested in naturally-derived, science-backed ingredients and beauty brands recognized the potential of bio-fermented actives to differentiate their offerings and enhance product efficacy.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1,652.9 million |

| Projected Value (2035F) | USD 5,752.6 million |

| CAGR (2025 to 2035) | 13.3% |

Market expansion is being supported by the rapid advancement of biotechnology and increasing consumer demand for sustainable skincare solutions that deliver enhanced bioavailability and potency through fermentation processes. Modern consumers seek products that are naturally-derived yet scientifically-proven, moving away from synthetic alternatives toward bio-compatible formulations that work in harmony with skin's natural microbiome.

The growing sophistication of fermentation technologies, including precision fermentation, microbial cultivation, and biotechnology integration, is enabling more effective ingredient delivery and driving demand for bio-fermented formulation platforms. Beauty brands are increasingly investing in fermentation capabilities to offer differentiated products that provide superior skin benefits while meeting clean-label and sustainability requirements.

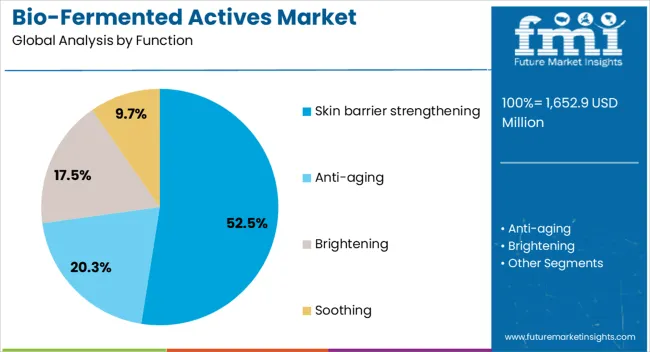

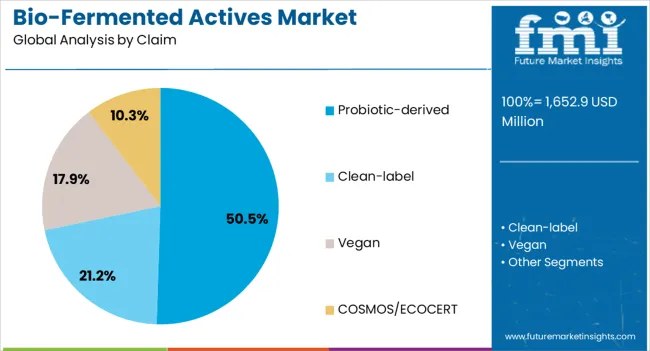

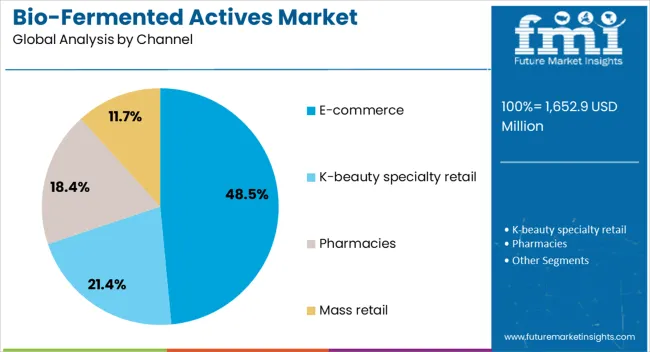

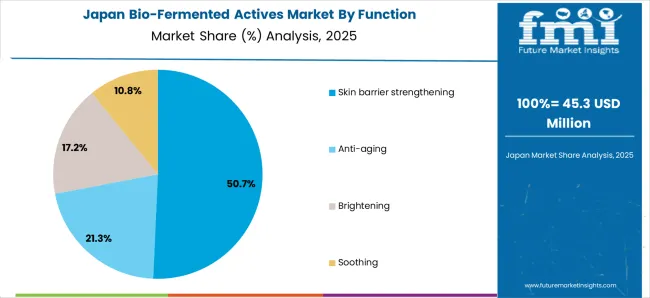

The market is segmented by source, function, product type, claim, and channel. By source, the market is divided into yeast-fermented extracts, lactobacillus-fermented peptides, rice/soy fermentation, and fruit/plant ferments. Based on function, the market is categorized into skin barrier strengthening, anti-aging, brightening, and soothing. In terms of product type, the market is segmented into serums, essences, creams, and masks. By claim, the market is classified into probiotic-derived, clean-label, vegan, and COSMOS/ECOCERT certified. By channel, the market is divided into e-commerce, K-beauty specialty retail, pharmacies, and mass retail. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Yeast-fermented extracts are projected to account for the largest share of the bio-fermented actives market in 2025, with values ranging from USD 1,652.9 million to USD 5,761.6 million by 2035, establishing their position as the leading source category in the global marketplace. This dominant market position is fundamentally supported by the superior bioavailability and enhanced penetration properties of yeast-derived compounds, combined with their proven efficacy in skincare applications.

The preference for yeast-fermented extracts stems from their ability to provide multiple skin benefits including improved hydration, enhanced barrier function, and accelerated cellular renewal. Yeast fermentation processes break down complex molecules into smaller, more bioactive compounds that can be easily absorbed by the skin, resulting in more effective product formulations compared to non-fermented alternatives.

The market leadership of yeast-fermented extracts is further reinforced by extensive research supporting their anti-aging and skin-strengthening properties, as well as their compatibility with various product formulations. The segment benefits from established production methods and growing consumer recognition of yeast-derived ingredients as premium, science-backed skincare solutions.

Skin barrier strengthening function is expected to represent 52.5% of bio-fermented actives demand in 2025, valued at USD 866.7 million, establishing its dominance in the global market landscape. This commanding market position reflects the growing awareness of skin barrier health importance and the proven effectiveness of fermented ingredients in strengthening the skin's natural protective functions.

The skin barrier strengthening segment benefits from the unique properties of bio-fermented actives that can enhance ceramide production, improve lipid barrier integrity, and support the skin microbiome balance. Modern bio-fermented formulations feature specialized peptides, amino acids, and postbiotic compounds that work synergistically to restore and maintain optimal barrier function.

The segment's growth is further supported by increasing incidence of sensitive skin conditions, growing awareness of environmental damage to skin barrier, and the effectiveness of fermented ingredients in providing gentle yet powerful barrier support. Bio-fermented actives enable the creation of products that strengthen skin resilience while providing long-term protective benefits.

Serums represent the leading product type for bio-fermented actives delivery, capitalizing on the concentrated nature of fermented ingredients and consumer preference for targeted skincare treatments. The lightweight, fast-absorbing format of serums provides optimal delivery for bio-fermented compounds, enabling maximum bioavailability and skin penetration.

The competitive advantage of serums lies in their ability to deliver high concentrations of active fermented ingredients without heavy textures, making them ideal for layering in multi-step skincare routines. This format aligns perfectly with K-beauty and Asian skincare trends that emphasize essence-like products with potent active ingredients.

Serums offer consumers precision targeting of specific skin concerns while maximizing the benefits of expensive fermented actives through concentrated formulations. The format supports premium positioning and enables brands to showcase the sophisticated nature of their bio-fermentation technology.

Probiotic-derived claims are projected to contribute 50.5% of the bio-fermented actives market in 2025, valued at USD 833.3 million, representing the preferred positioning for fermented skincare solutions. This claim category aligns perfectly with consumer interest in microbiome-friendly skincare and the scientific understanding of skin health as connected to beneficial microorganisms.

The competitive advantage of probiotic-derived positioning lies in its ability to communicate both the natural origin and scientific sophistication of fermented ingredients. This claim supports premium pricing while building consumer trust through association with proven health benefits of probiotics in other categories.

Probiotic-derived claims offer brands differentiation in the crowded skincare market while educating consumers about the benefits of fermentation processes. The positioning creates strong consumer appeal among health-conscious buyers who understand the connection between microbiome health and skin appearance.

E-commerce channels are projected to contribute 48.5% of the bio-fermented actives market in 2025, valued at USD 800.1 million, representing the preferred distribution method for fermented skincare products. This channel dominance reflects the educational nature of bio-fermented products and the need for detailed product information that online platforms can provide effectively.

The competitive advantage of e-commerce distribution lies in its ability to reach educated consumers who research ingredients and understand the benefits of fermented actives. Online channels enable brands to provide comprehensive education about fermentation processes, ingredient benefits, and usage instructions that are essential for bio-fermented product success.

E-commerce platforms offer consumers access to specialized K-beauty and niche brands that lead innovation in bio-fermented actives, while providing detailed reviews and ingredient analysis that support informed purchasing decisions. The channel supports direct-to-consumer relationships that are crucial for premium fermented skincare brands.

The Bio-Fermented Actives market is advancing rapidly due to technological innovation in fermentation processes and increasing consumer demand for sustainable, naturally-derived beauty solutions. However, the market faces challenges including high production costs for fermentation facilities, need for specialized storage and handling requirements, and varying regulatory acceptance of novel fermented ingredients across different regions. Standardization of fermentation processes and efficacy testing continue to influence market development patterns.

The growing deployment of sophisticated fermentation technologies including precision fermentation, controlled environment cultivation, and multi-strain fermentation systems is enabling more consistent and potent ingredient production. These technologies provide enhanced bioactivity and stability that improves product efficacy and enables continuous quality optimization based on fermentation parameters.

Modern beauty trends are incorporating traditional Asian fermentation wisdom with contemporary biotechnology to create innovative skincare solutions. Integration of time-honored fermentation practices with modern science provides deeper understanding of ingredient synergies and enables development of culturally-inspired yet scientifically-advanced formulations.

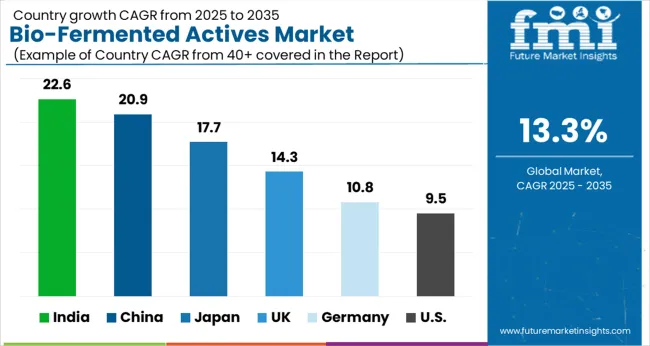

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 22.6% |

| China | 20.9% |

| Japan | 17.7% |

| UK | 14.3% |

| Germany | 10.8% |

| USA | 9.5% |

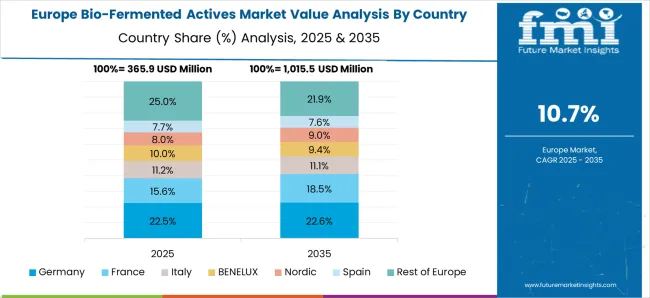

The bio-fermented actives market is growing rapidly across key regions, with India leading at a 22.6% CAGR through 2035, driven by rising interest in Ayurvedic fermentation traditions combined with modern biotechnology. China follows at 20.9%, supported by strong manufacturing capabilities and consumer acceptance of fermented skincare solutions. Japan grows at 17.7%, emphasizing traditional fermentation expertise and premium product development. The UK records 14.3% growth with focus on clean-label beauty trends. Germany shows 10.8% growth driven by biotechnology innovation and quality standards. The USA demonstrates steady 9.5% growth with established market adoption and diverse consumer segments.

Revenue from bio-fermented actives in India is projected to exhibit the highest growth rate with a CAGR of 22.6% through 2035, driven by the country's rich tradition of fermentation in wellness and beauty applications, combined with increasing modern biotechnology adoption. The convergence of traditional Ayurvedic fermentation practices with contemporary skincare science creates unique opportunities for indigenous innovation and culturally-relevant product development.

Revenue from bio-fermented actives in China is expanding at a CAGR of 20.9%, supported by advanced biotechnology infrastructure, significant investment in fermentation research, and strong consumer adoption of innovative skincare solutions. The country's leadership in biotechnology manufacturing and established beauty industry create favorable conditions for large-scale bio-fermented actives production and consumption.

Revenue from bio-fermented actives in Japan is growing at a CAGR of 17.7%, driven by the country's centuries-old fermentation expertise, advanced biotechnology capabilities, and sophisticated consumer preferences for high-quality skincare ingredients. Japanese companies lead global innovation in fermentation applications for beauty, combining traditional sake and koji fermentation knowledge with cutting-edge biotechnology.

Demand for bio-fermented actives in the UK is projected to grow at a CAGR of 14.3%, supported by strong consumer interest in clean-label beauty solutions, established biotechnology sector, and growing awareness of fermentation benefits for skincare. British consumers demonstrate high interest in naturally-derived yet scientifically-validated ingredients that align with clean beauty trends.

Demand for bio-fermented actives in Germany is expanding at a CAGR of 10.8%, driven by the country's strength in biotechnology research, rigorous quality standards, and consumer preference for scientifically-validated ingredients. German companies excel in developing fermentation processes that meet strict regulatory requirements while delivering consistent, high-quality actives for skincare applications.

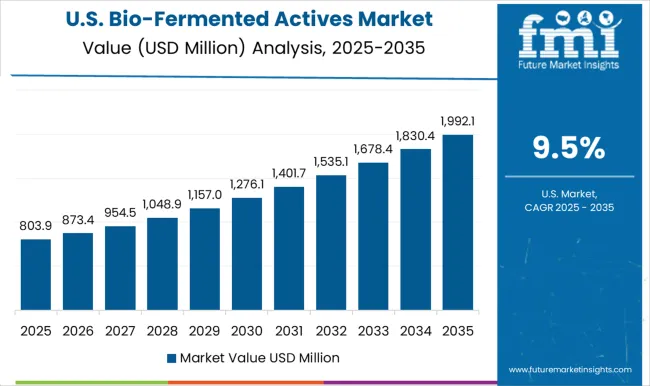

Demand for bio-fermented actives in the USA is growing at a CAGR of 9.5%, characterized by diverse consumer segments, established beauty industry infrastructure, and steady adoption of fermentation-based skincare solutions. The American market demonstrates growing interest in naturally-derived actives while maintaining focus on proven efficacy and convenient application.

The bio-fermented actives market is characterized by competition among K-beauty leaders, established personal care companies, and specialized biotechnology ingredient suppliers. Companies are investing in proprietary fermentation processes, unique ingredient development, sustainable production methods, and comprehensive product portfolios to deliver effective, naturally-derived, and scientifically-validated fermented actives for skincare applications.

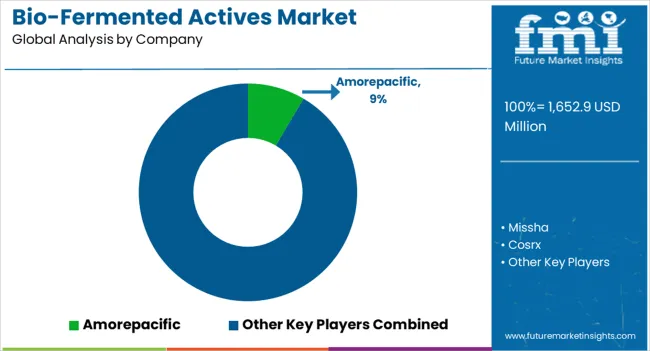

Amorepacific leads the market with an 8.5% global value share in 2025, focusing on traditional Korean fermentation expertise combined with modern biotechnology capabilities. The company's leadership position is built on decades of fermentation research and development of proprietary fermented ingredients that combine cultural heritage with scientific innovation.

Other key players maintain competitive positions through specialized expertise: Missha emphasizes accessible fermented skincare with proven ingredients; Cosrx focuses on targeted treatments using fermented actives; Sulwhasoo positions premium fermented formulations rooted in traditional Asian medicine; L'Oréal leverages global research capabilities for fermentation innovation; Dr. Jart+ combines dermatological expertise with fermented ingredients; SK-II builds on signature fermentation technology; The Face Shop offers accessible K-beauty fermentation; Neogen emphasizes innovative fermented treatments; and Innisfree focuses on natural fermentation aligned with clean beauty trends.

The Asia Pacific region leads global bio-fermented actives consumption, driven by traditional fermentation knowledge, established K-beauty trends, and sophisticated consumer understanding of fermented ingredients. Countries like South Korea and Japan leverage centuries of fermentation expertise to create innovative skincare solutions that combine cultural wisdom with modern science.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,652.9 million |

| Source | Yeast-fermented extracts, Lactobacillus-fermented peptides, Rice/soy fermentation, Fruit/plant ferments |

| Function | Skin barrier strengthening, Anti-aging, Brightening, Soothing |

| Product Type | Serums, Essences, Creams, Masks |

| Claim | Probiotic-derived, Clean-label, Vegan, COSMOS/ECOCERT |

| Channel | E-commerce, K-beauty specialty retail, Pharmacies, Mass retail |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Amorepacific, Missha, Cosrx, Sulwhasoo, L'Oréal, Dr. Jart+, SK-II, The Face Shop, Neogen, and Innisfree |

The global bio-fermented actives market is estimated to be valued at USD 1,652.9 million in 2025.

The market size for the bio-fermented actives market is projected to reach USD 5,761.6 million by 2035.

The bio-fermented actives market is expected to grow at a 13.3% CAGR between 2025 and 2035.

The key product types in bio-fermented actives market are skin barrier strengthening, anti-aging, brightening and soothing.

In terms of claim, probiotic-derived segment to command 50.5% share in the bio-fermented actives market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-Fermented Skincare Actives Market Size and Share Forecast Outlook 2025 to 2035

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Sea Buckthorn Actives Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Turmeric-Infused Actives Market Size and Share Forecast Outlook 2025 to 2035

Pomegranate Peel Actives Market Size and Share Forecast Outlook 2025 to 2035

Beta-Glucan-Based Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biorhythmic Skincare Actives Market Size and Share Forecast Outlook 2025 to 2035

Antiperspirants / Deo-Actives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA