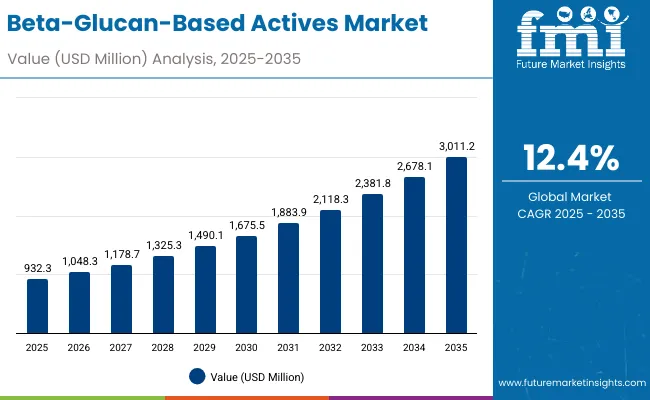

The Beta-Glucan-Based Actives Market is expected to record a valuation of USD 932.3 million in 2025 and USD 3,011.2 million in 2035, with an increase of USD 2,078.9 million, which equals a growth of 193% over the decade. The overall expansion represents a CAGR of 12.4% and a 2X increase in market size.

Beta-Glucan-Based Actives Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 932.3 million |

| Market Forecast Value in (2035F) | USD 3,011.2 million |

| Forecast CAGR (2025 to 2035) | 12.4% |

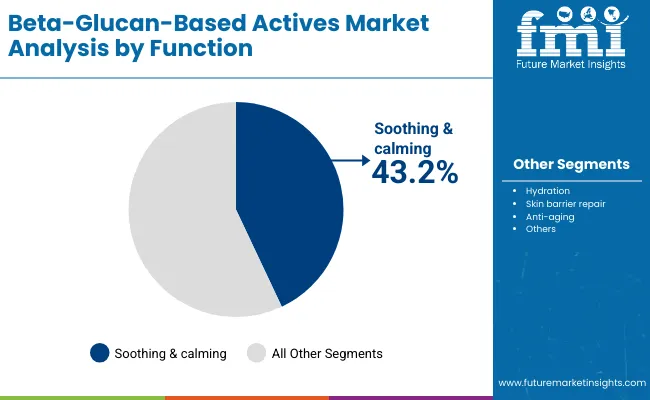

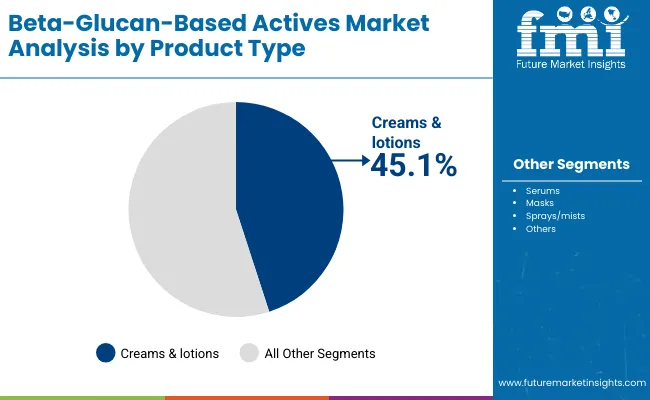

During the first five-year period from 2025 to 2030, the market increases from USD 932.3 million to USD 1,675.5 million, adding USD 743.2 million, which accounts for 36% of the total decade growth. This phase records steady adoption in skincare formulations emphasizing soothing & calming properties (43.2% share in 2025) and creams & lotions (45.1% share in 2025), driven by rising consumer demand for hydration and skin barrier repair in personal care.

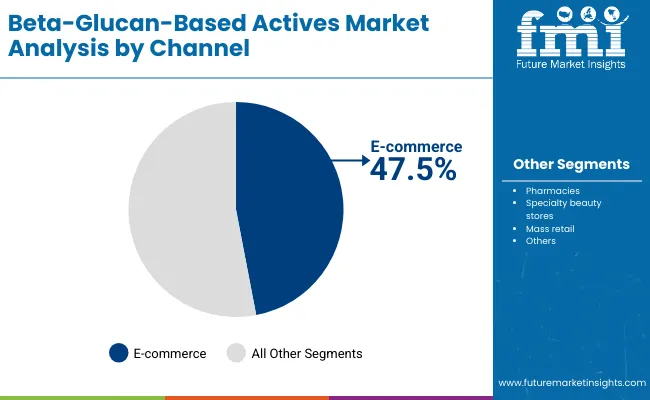

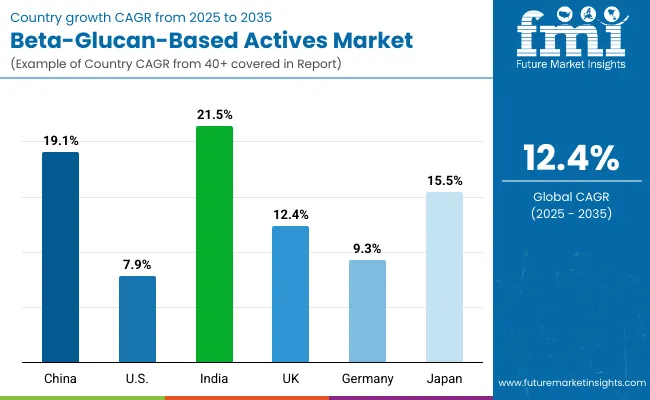

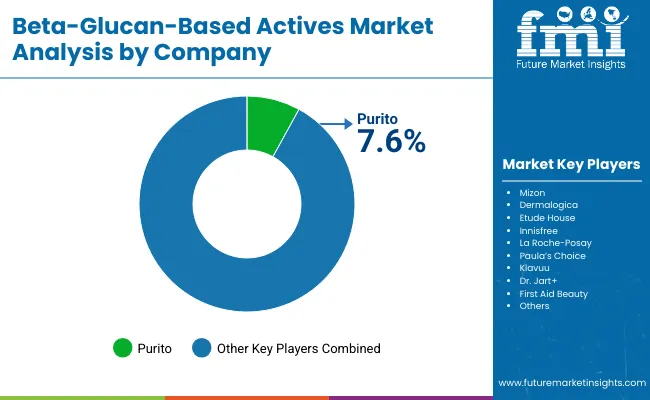

The second half from 2030 to 2035 contributes USD 1,335.7 million, equal to 64% of total growth, as the market jumps from USD 1,675.5 million to USD 3,011.2 million. This acceleration is powered by widespread deployment of e-commerce channels (47.5% share in 2025), strong growth in China (19.1% CAGR) and India (21.5% CAGR), and expanding uptake of multifunctional actives for anti-aging and sensitive-skin-safe claims. Regional dynamics shift as Asia consolidates leadership, while competitive positioning highlights Purito with 7.6% global share in 2025, leaving space for new entrants to scale.

From 2020 to 2024, the Beta-Glucan-Based Actives Market steadily expanded on the back of rising consumer awareness of natural polysaccharides, skin sensitivity, and hydration-focused formulations. Growth was largely driven by K-beauty and dermo-cosmetic brands introducing beta-glucan-enriched creams, serums, and masks, with strong adoption in East Asia and Europe. During this phase, competitive differentiation was shaped by claims such as clean-label, vegan formulations, and sensitive-skin-safe positioning, while larger cosmetic houses leveraged scale and distribution networks to dominate availability across offline retail channels.

Demand for Beta-Glucan-Based Actives is projected to reach USD 932.3 million in 2025, with the revenue mix shifting towards e-commerce channels (47.5% share in 2025) and broader integration across creams & lotions (45.1% share). Over the next decade, Asia-Pacific markets (China CAGR 19.1%, India CAGR 21.5%, Japan CAGR 15.5%) will drive disproportionate growth, outpacing mature markets such as the USA (7.9% CAGR) and Germany (9.3% CAGR). Competitive intensity will increase, as leading players such as Purito (7.6% global share in 2025) seek to strengthen brand equity while global beauty majors and niche clean-label startups scale their portfolios.

The competitive edge is shifting from simple ingredient incorporation to ecosystem strength, combining natural sourcing, clinical efficacy claims, channel partnerships, and digital-first consumer engagement. This dynamic will define the next growth phase of the Beta-Glucan-Based Actives Market through 2035.

The growing prevalence of skin sensitivity, driven by pollution, lifestyle factors, and aggressive cosmetic routines, is accelerating demand for beta-glucan-based actives. With their proven soothing, calming, and skin-barrier repair properties, beta-glucans are being integrated into creams, serums, and masks. Brands are positioning these actives as natural, safe, and effective solutions, making them increasingly attractive to health-conscious consumers prioritizing preventive skincare.

E-commerce platforms are transforming accessibility and awareness of beta-glucan-based skincare. Rising online sales, influencer-driven marketing, and direct-to-consumer brand strategies are enabling niche and global players to capture a wider base of beauty consumers. This shift is particularly strong in Asia, where digital platforms dominate purchasing behavior. The channel expansion is ensuring faster product adoption and wider global penetration, driving sustained market growth.

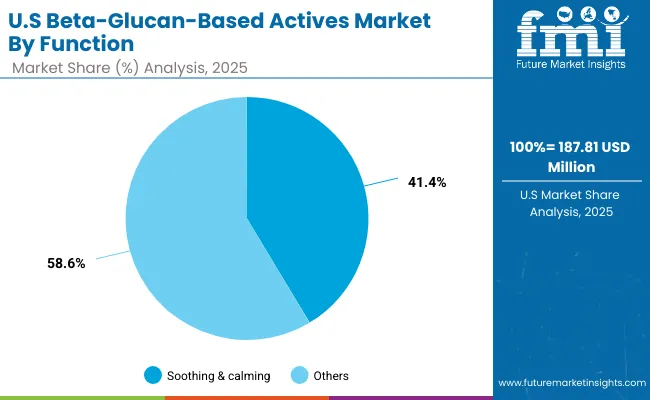

The Beta-Glucan-Based Actives Market is segmented by function, product type, channel, claim, and geography. By function, the market includes soothing & calming, hydration, skin barrier repair, and anti-aging, with soothing & calming leading at 43.2% share in 2025. By product type, creams & lotions dominate with 45.1% share, while serums and masks appeal to premium users. By channel, e-commerce holds 47.5% in 2025, reflecting the digital shift in skincare sales. Claims include clean-label, vegan, natural polysaccharide, and sensitive-skin safe, with the latter driving consumer trust. Geographically, China (19.1% CAGR), India (21.5% CAGR), and Japan (15.5% CAGR) lead growth, while the USA, UK, and Germany provide steady expansion, consolidating the global footprint of beta-glucan-based actives.

| Function | Value Share% 2025 |

|---|---|

| Soothing & calming | 43.2% |

| Others | 56.8% |

The soothing & calming segment is projected to contribute 43.2% of the Beta-Glucan-Based Actives Market revenue in 2025, maintaining its lead as the dominant functional category. This is driven by rising consumer preference for actives that address skin irritation, inflammation, and sensitivity key concerns in both daily skincare and premium dermo-cosmetic products. Soothing formulations are increasingly positioned as essential in product lines that emphasize safety, tolerance, and long-term skin health.

The segment’s growth is also supported by the expansion of multifunctional products that combine calming effects with hydration and barrier repair benefits. As demand for sensitive-skin-safe and natural polysaccharide-based claims grows, brands are prioritizing beta-glucan inclusion in creams, serums, and masks. The soothing & calming function is expected to retain its leadership, serving as the backbone of beta-glucan-based actives adoption across global skincare portfolios.

| Product Type | Value Share% 2025 |

|---|---|

| Creams & lotions | 45.1% |

| Others | 54.9% |

The creams & lotions segment is forecasted to hold 45.1% of the market share in 2025, led by its widespread application in daily skincare routines. These formulations are favored for their ease of use, consumer familiarity, and ability to effectively deliver hydration, soothing, and barrier-repair benefits. Their broad acceptance across mass-market and premium categories makes them the most accessible format for incorporating beta-glucan-based actives.

Their versatility and compatibility with multiple claims such as sensitive-skin safe, vegan, and clean-label have facilitated strong adoption across both e-commerce and offline channels. The segment’s growth is further bolstered by innovation in textures and formulations that enhance absorption and skin feel. As consumers increasingly seek functional skincare products for preventive and restorative purposes, creams & lotions are expected to continue their dominance in the beta-glucan-based actives market.

| Channel | Value Share% 2025 |

|---|---|

| E-commerce | 47.5% |

| Others | 52.5% |

The e-commerce segment is projected to account for 47.5% of the Beta-Glucan-Based Actives Market revenue in 2025, establishing it as the leading distribution channel. Online platforms are increasingly preferred for their convenience, product variety, and ability to support niche and emerging beauty brands. The growing influence of digital marketing, social commerce, and beauty influencers is accelerating consumer adoption of beta-glucan-based skincare products through e-commerce.

Its suitability for both premium and mass-market product launches, combined with seamless global reach, has made e-commerce the fastest-growing sales avenue across beauty and personal care. Developments in logistics, subscription models, and personalized recommendations have further improved the shopping experience, boosting conversion rates. Given its balance of accessibility, convenience, and growth potential, e-commerce is expected to maintain its leading role in the Beta-Glucan-Based Actives Market.

Rising Demand for Natural and Sensitive-Skin-Safe Actives

The increasing prevalence of skin irritation, sensitivity, and pollution-driven conditions is fueling demand for natural polysaccharides like beta-glucans. Consumers are shifting away from harsh synthetics and embracing plant- and yeast-derived actives positioned as clean-label and safe for long-term use. The soothing and calming properties of beta-glucans, alongside their proven role in strengthening the skin barrier, make them central to formulations for creams, serums, and masks. This rising trust in natural and sensitive-skin-safe solutions is a powerful driver for sustained market adoption and expansion globally.

Growth of E-Commerce and Direct-to-Consumer Beauty

E-commerce platforms and direct-to-consumer channels are redefining access and awareness of beta-glucan-based skincare products. With nearly half of the market revenue in 2025 driven by online channels, the segment benefits from rapid product launches, targeted digital campaigns, and influencer-driven brand promotions. Convenience, coupled with tailored subscription models and trial-size offerings, has enhanced adoption among younger demographics. Asia-Pacific, led by China and India, is experiencing a surge in online beauty sales, making e-commerce a primary growth engine. This digital shift ensures broader penetration, faster adoption, and higher engagement for beta-glucan actives.

Limited Consumer Awareness Outside Premium Markets

Despite strong efficacy, consumer awareness of beta-glucan-based actives remains limited beyond premium skincare segments and urbanized markets. Many consumers are more familiar with hyaluronic acid, retinol, or ceramides, which overshadow beta-glucans in product marketing. This lack of widespread knowledge hampers adoption in price-sensitive regions, where consumers prioritize established actives with strong visibility. Additionally, limited education on beta-glucan’s multifunctional benefits reduces brand differentiation opportunities. Without targeted awareness campaigns and broader dermatological endorsements, market penetration outside advanced and K-beauty-led geographies could remain constrained, slowing uptake in emerging global regions over the next decade.

Multifunctionality Driving Next-Generation Formulations

A strong trend shaping the Beta-Glucan-Based Actives Market is the growing focus on multifunctionality in skincare. Beta-glucans are increasingly positioned not only for soothing and calming but also for hydration, barrier repair, and anti-aging benefits. Brands are responding by formulating hybrids such as calming-hydrating creams, barrier-strengthening serums, and anti-aging masks infused with beta-glucans. This multifunctional appeal aligns with consumer demand for fewer, high-performance products, particularly among urban and younger demographics. The trend is reinforced by claims such as clean-label, vegan, and sensitive-skin safe, making beta-glucans a cornerstone of future multifunctional skincare portfolios.

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.1% |

| USA | 7.9% |

| India | 21.5% |

| UK | 12.4% |

| Germany | 9.3% |

| Japan | 15.5% |

The global Beta-Glucan-Based Actives Market shows significant regional variation in adoption speed, influenced by consumer awareness, beauty culture, and distribution strength.

Asia-Pacific emerges as the fastest-growing region, led by India at 21.5% CAGR and China at 19.1% CAGR. India’s rapid trajectory reflects growing demand for affordable yet functional skincare, rising middle-class spending, and heightened acceptance of sensitive-skin-safe and natural polysaccharide claims. China, supported by its dominant e-commerce platforms and K-beauty inspired product launches, is scaling adoption through both premium and mass-market skincare, making it a pivotal hub for global growth. Japan also demonstrates strong growth at 15.5% CAGR, supported by consumer preference for clinically backed formulations.

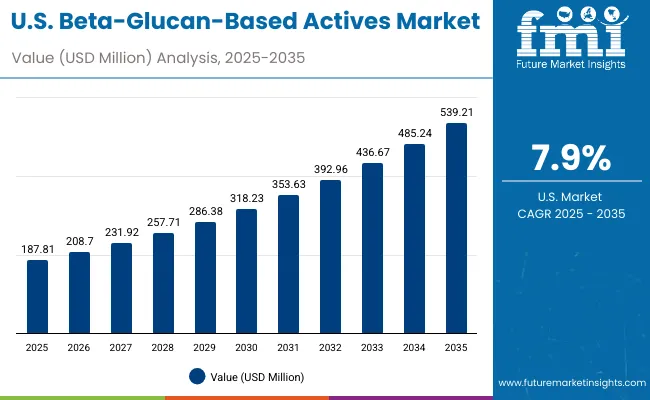

Europe maintains a steady growth profile, with the UK at 12.4% CAGR and Germany at 9.3% CAGR, driven by rising demand for clean-label and vegan-certified products, coupled with dermatological endorsements. The region’s established beauty and personal care ecosystem ensures consistent penetration, particularly across premium skincare categories. North America, led by the USA at 7.9% CAGR, shows moderate expansion compared to Asia and Europe. Growth here is supported by dermo-cosmetic brands and pharmacies, though consumer awareness of beta-glucan remains relatively lower than for actives such as hyaluronic acid or retinol. However, e-commerce adoption and clean-label preferences continue to drive steady gains in the USA market.

| Year | USA Beta-Glucan-Based Actives Market (USD Million) |

|---|---|

| 2025 | 187.81 |

| 2026 | 208.70 |

| 2027 | 231.92 |

| 2028 | 257.71 |

| 2029 | 286.38 |

| 2030 | 318.23 |

| 2031 | 353.63 |

| 2032 | 392.96 |

| 2033 | 436.67 |

| 2034 | 485.24 |

| 2035 | 539.21 |

The Beta-Glucan-Based Actives Market in the United States is projected to grow at a CAGR of 7.9%, reaching USD 539.21 million by 2035. Growth is supported by rising demand for soothing & calming formulations, which account for 41.4% of functional share in 2025 (USD 77.69 million). Increasing consumer awareness of sensitive-skin-safe and clean-label claims, coupled with dermatology-led product recommendations, is boosting adoption. While e-commerce is expanding rapidly, pharmacies and specialty beauty stores remain strong retail anchors, reflecting USA consumer reliance on established distribution networks.

The Beta-Glucan-Based Actives Market in the United Kingdom is expected to grow at a CAGR of 12.4% from 2025 to 2035, supported by increasing consumer preference for natural, vegan, and sensitive-skin-safe formulations. British skincare consumers are demonstrating strong demand for multifunctional actives that combine hydration, anti-aging, and barrier repair benefits. Premium beauty brands are introducing beta-glucan-based creams and serums through pharmacies, department stores, and specialty outlets, while e-commerce channels are expanding reach across younger demographics. Growth is further accelerated by the UK’s strong clean beauty movement, regulatory focus on product safety, and a rising shift to dermatologist-recommended skincare lines.

India is witnessing the fastest growth in the Beta-Glucan-Based Actives Market, forecast to expand at a CAGR of 21.5% through 2035. Rising disposable incomes, growing urbanization, and increased awareness of skincare benefits are fueling demand for hydration, barrier repair, and soothing actives. The market is seeing rapid penetration in tier-2 and tier-3 cities, where affordability and clean-label positioning are driving acceptance. E-commerce platforms are accelerating reach, supported by strong demand for vegan, natural polysaccharide, and sensitive-skin-safe formulations. Premium and mid-market beauty brands are investing in beta-glucan-based creams, serums, and masks, aligning with India’s youthful and expanding consumer base.

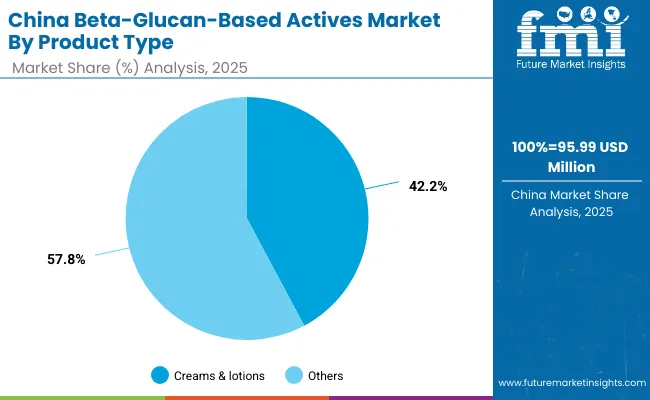

The Beta-Glucan-Based Actives Market in China is expected to grow at a CAGR of 19.1% from 2025 to 2035, the highest among leading economies. This momentum is driven by a booming e-commerce ecosystem, K-beauty and J-beauty influence, and rising consumer preference for hydration, soothing, and anti-aging formulations. In 2025, creams & lotions account for 42.2% of the market (USD 40.56 million), while serums and masks fall within the others category at 57.8% (USD 55.44 million). Younger demographics and middle-class consumers are embracing sensitive-skin-safe and vegan claims, amplifying demand for beta-glucan-infused skincare.

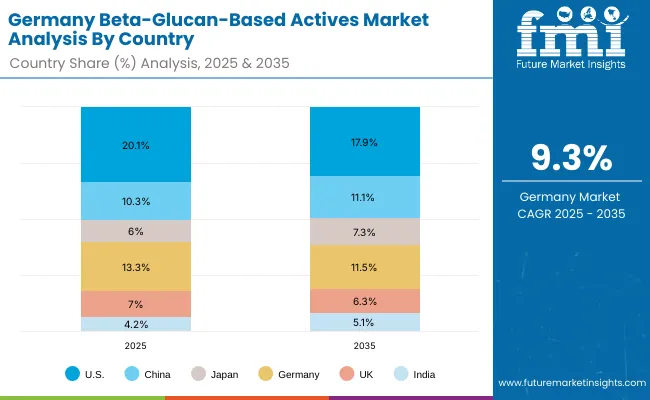

| Countries | 2025 Share (%) |

|---|---|

| USA | 20.1% |

| China | 10.3% |

| Japan | 6.0% |

| Germany | 13.3% |

| UK | 7.0% |

| India | 4.2% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 17.9% |

| China | 11.1% |

| Japan | 7.3% |

| Germany | 11.5% |

| UK | 6.3% |

| India | 5.1% |

The Beta-Glucan-Based Actives Market in Germany is projected to grow at a CAGR of 9.3% from 2025 to 2035, reaching a stable yet slightly declining global share from 13.3% in 2025 to 11.5% by 2035. Growth is underpinned by Germany’s strong dermo-cosmetic culture, premium beauty retail networks, and consumer demand for clean-label actives. Beta-glucans are gaining traction in creams and serums, particularly those marketed for hydration, soothing, and anti-aging benefits. While adoption is slower than Asia-Pacific, German consumers place high value on scientific validation and dermatologist endorsement, which boosts credibility for beta-glucan formulations.

| USA By Function | Value Share% 2025 |

|---|---|

| Soothing & calming | 41.4% |

| Others | 58.6% |

The Beta-Glucan-Based Actives Market in the USA is projected to grow from USD 187.81 million in 2025 to USD 539.21 million by 2035, at a CAGR of 7.9%. Functional segmentation shows soothing & calming leading with 41.4% share in 2025 (USD 77.69 million), highlighting consumer preference for products addressing irritation and sensitive skin. Other functions, including hydration, barrier repair, and anti-aging, collectively account for 58.6% share, driven by multifunctional skincare demand. Growth is supported by strong dermo-cosmetic positioning, pharmacy-based retail channels, and increasing clean-label and sensitive-skin-safe claims. E-commerce expansion continues to complement established offline channels, shaping long-term adoption.

| China By Product Type | Value Share% 2025 |

|---|---|

| Creams & lotions | 42.2% |

| Others | 57.8% |

The Beta-Glucan-Based Actives Market in China presents strong expansion opportunities, growing at a CAGR of 19.1% from 2025 to 2035, one of the highest globally. In 2025, creams & lotions dominate with 42.2% share (USD 40.56 million), while other formats including serums, masks, and sprays hold 57.8% (USD 55.44 million). The rapid rise of e-commerce platforms and strong digital engagement with beauty consumers create favorable conditions for local and international brands to scale distribution.

Opportunities lie in targeting younger demographics, who demand multifunctional products combining hydration, soothing, and anti-aging. Growing preference for clean-label, vegan, and sensitive-skin-safe claims amplifies the role of beta-glucans as a differentiating ingredient. Additionally, the K-beauty and J-beauty influence continues to shape China’s market, making it an entry point for global beauty innovation. With domestic brands offering competitive price points and global players pushing premium positioning, China is set to remain a pivotal hub for future beta-glucan adoption.

The Beta-Glucan-Based Actives Market is moderately fragmented, with global beauty brands, regional K-beauty innovators, and niche natural skincare specialists competing across multiple segments. In 2025, Purito holds 7.6% of the global value share, while the remainder is distributed among diverse players including Mizon, Dermalogica, Etude House, Innisfree, La Roche-Posay, Paula’s Choice, Klavuu, Dr. Jart+, and First Aid Beauty. The competitive intensity is shaped by brand equity, claim positioning (clean-label, vegan, sensitive-skin-safe), and distribution strength across e-commerce and offline channels.

Leading players are leveraging beta-glucan’s multifunctional profile soothing, hydrating, and barrier-repairing to differentiate portfolios, especially within creams, serums, and masks. K-beauty brands are capitalizing on affordability and trend-driven marketing, while European dermo-cosmetic leaders emphasize clinical validation and dermatologist endorsements. Premium positioning in the USA and Europe contrasts with value-driven strategies in Asia, where mass-market adoption is accelerating.

Competitive differentiation is shifting from single-function formulations toward ecosystem strategies that integrate scientific validation, sustainability credentials, and digital-first consumer engagement. This dynamic creates opportunities for both established global brands and niche entrants to strengthen their presence in the expanding beta-glucan-based actives landscape.

Key Developments in Beta-Glucan-Based Actives Market

| Item | Value |

|---|---|

| Quantitativ e Units | USD 932.3 Million |

| Function | Soothing & calming, Hydration, Skin barrier repair, Anti-aging |

| Product Type | Creams & lotions, Serums, Masks, Sprays/mists |

| Channel | E-commerce, Pharmacies, Specialty beauty stores, Mass retail |

| Claim | Clean-label, Vegan, Natural polysaccharide, Sensitive-skin safe |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Mizon, Purito, Dermalogica, Etude House, Innisfree, La Roche- Posay, Paula’s Choice, Klavuu, Dr. Jart +, First Aid Beauty |

| Additional Attributes | Dollar sales by function and product type, adoption trends in soothing & calming and hydration formulations, rising demand for creams & lotions and multifunctional serums, sector-specific growth in dermo -cosmetics, premium beauty, and mass retail skincare, channel revenue segmentation highlighting e-commerce expansion, integration with clean-label, vegan, and sensitive-skin-safe claims, regional trends influenced by Asia-Pacific’s rapid adoption and Europe’s regulatory-driven growth, and innovations in natural polysaccharide formulations supporting barrier repair, hydration efficiency, and anti-aging performance. |

The global Beta-Glucan-Based Actives Market is estimated to be valued at USD 932.3 million in 2025.

The market size for the Beta-Glucan-Based Actives Market is projected to reach USD 3,011.2 million by 2035.

The Beta-Glucan-Based Actives Market is expected to grow at a 12.4% CAGR between 2025 and 2035.

The key product types in the Beta-Glucan-Based Actives Market are creams & lotions, serums, masks, and sprays/mists.

In terms of product type, the creams & lotions segment is projected to command 45.1% share in 2025, making it the leading category in the Beta-Glucan-Based Actives Market.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Bio-Fermented Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sea Buckthorn Actives Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Turmeric-Infused Actives Market Size and Share Forecast Outlook 2025 to 2035

Pomegranate Peel Actives Market Size and Share Forecast Outlook 2025 to 2035

Biorhythmic Skincare Actives Market Size and Share Forecast Outlook 2025 to 2035

Antiperspirants / Deo-Actives Market Size and Share Forecast Outlook 2025 to 2035

Bio-Fermented Skincare Actives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA