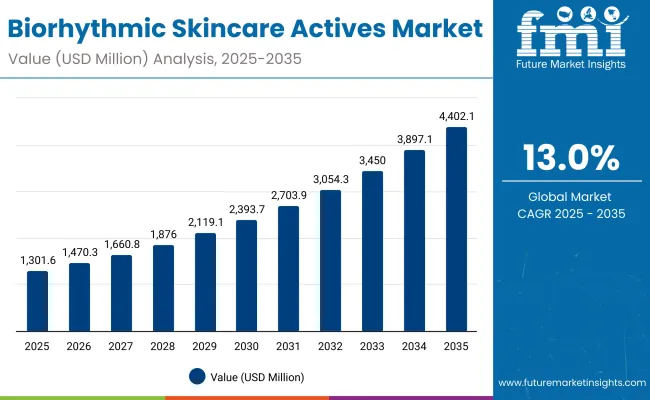

A market valuation of USD 1,301.60 Million has been estimated for 2025 in biorhythmic skincare actives, with expansion projected to reach USD 4,402.10 Million by 2035. The rise of USD 3,100.50 Million over the decade reflects a 238% increase in size, equal to a CAGR of 13.00%. This trajectory is set to be underpinned by circadian rhythm alignment technologies, clinically validated claims, and consumer prioritization of recovery-led formulations that align with natural biorhythms.

Biorhythmic Skincare Actives Market Key Takeaways

| Metric | Value |

|---|---|

| Biorhythmic Skincare Actives Market Estimated Value in (2025E) | USD 1,301.60 Million |

| Biorhythmic Skincare Actives Market Forecast Value in (2035F) | USD 4,402.10 Million |

| Forecast CAGR (2025 to 2035) | 13.00% |

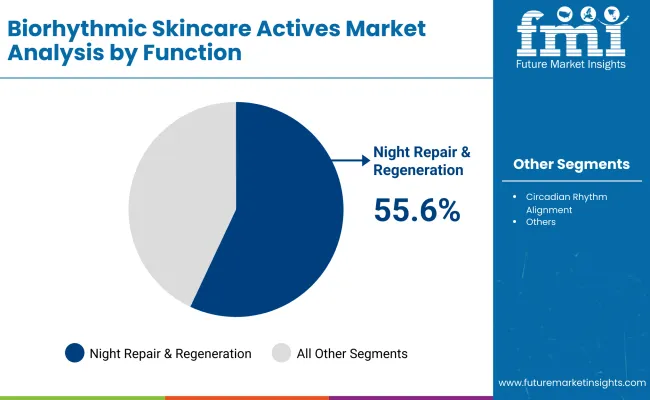

Between 2025 and 2030, the market is projected to expand from USD 1,301.60 Mn to USD 2,393.70 Mn, adding USD 1,092.10 Mn in just five years. This contribution accounts for more than one-third of the overall decade growth. Uptake is expected to be driven by increasing awareness of skin’s circadian cycles, demand for clinical-grade protocols, and the emergence of advanced chrono-peptide actives. Night repair & regeneration is anticipated to remain the dominant function throughout this period, representing 55.60% of the global value in 2025, equal to USD 722.20 Mn.

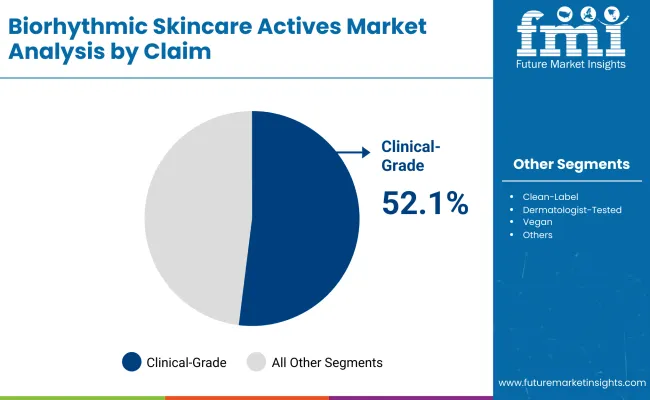

The second half of the decade from 2030 to 2035 is forecast to deliver accelerated momentum as the market rises from USD 2,393.70 Mn to USD 4,402.10 Mn, contributing USD 2,008.40 Mn—about 65% of total growth. This phase is expected to be powered by advanced time-stamped efficacy trials, integration of AI-driven regimen timing, and expanded participation of emerging markets such as China and India. Clinical-grade claims are projected to retain leadership with a 52.10% share in 2025, reflecting consumer reliance on dermatologist-tested validation and professional trust signals.

From 2020 to 2024, the foundation of circadian skincare was established through targeted R&D and early consumer adoption, which set the stage for exponential growth from 2025 onward. By 2025, demand for evidence-based formulations is expected to reach USD 1,301.60 Mn, with clinically validated actives gaining early trust.

Over the decade, value is projected to rise to USD 4,402.10 Mn, as expansion in Asia-Pacific, especially China and India, accelerates adoption and drives category depth. The competitive landscape is anticipated to shift toward clinical-grade claims, plant circadian extracts, and melatonin-pathway boosters, with premium players defending share through transparent assay protocols and dermatologist partnerships.

Competitive advantage is expected to evolve away from traditional branding strength toward science-backed innovation, timing-specific actives, and ecosystem integration across retail, clinics, and digital platforms. Recurring value streams are likely to emerge from subscription-based regimens and AI-driven adherence solutions, establishing new growth layers.

Growth in the Biorhythmic Skincare Actives Market is being driven by rising consumer preference for formulations synchronized with circadian rhythms and backed by clinical validation. Night repair and regeneration actives are expected to dominate as measurable overnight results are prioritized. Scientific advances in chrono-peptides, melatonin boosters, and plant circadian extracts are being translated into differentiated claims that resonate strongly with evidence-seeking consumers. Expansion in Asia-Pacific, particularly China and India, is projected to accelerate adoption as younger demographics embrace clinical-grade and dermatologist-tested products. Premium positioning is being reinforced by transparent efficacy trials and AI-guided regimen personalization, which are anticipated to boost consumer trust and long-term engagement. Growth momentum is also supported by increasing availability of premium channels, including e-commerce platforms and dermatology clinics, which ensure broad access. Over the decade, innovation pipelines, clinical claim substantiation, and alignment with wellness-focused lifestyles are expected to remain central growth catalysts across global markets.

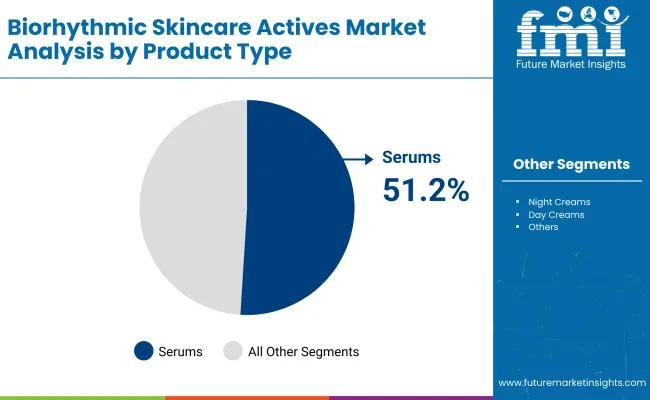

The Biorhythmic Skincare Actives Market has been segmented on the basis of Function, Claim, and Product Type, highlighting the core areas that shape adoption and consumer preference. These segments reflect how circadian alignment, clinical validation, and delivery formats are being positioned to address evolving skincare needs. Function-based segmentation emphasizes the importance of nighttime recovery and regeneration as a dominant consumer priority. Claim-based segmentation underscores the value of clinical validation and dermatologist endorsement in building consumer trust. Product type segmentation showcases how concentrated formats such as serums are leading the way due to precision dosing and compatibility with time-specific regimens. Together, these segments define the current structure of demand and highlight where growth momentum is expected to accelerate over the next decade.

| Segment | Market Value Share, 2025 |

|---|---|

| Night repair & regeneration | 55.6% |

| Others | 44.4% |

Night repair & regeneration is projected to dominate the function segment with a 55.60% share in 2025, equal to USD 722.20 Million. Growth is expected to be reinforced by consumer demand for measurable overnight recovery, barrier repair, and radiance improvements. The preference for nighttime routines is being supported by the biological synchronization of circadian repair processes, which ensures more effective outcomes when active ingredients are aligned with skin cycles. As consumers increasingly seek science-backed evidence, this function is anticipated to attract stronger adoption in both developed and emerging markets. Over the decade, innovation pipelines in melatonin boosters and peptide complexes are expected to strengthen this segment’s leadership within the global market.

| Segment | Market Value Share, 2025 |

|---|---|

| Clinical-grade | 52.1% |

| Others | 47.9% |

Clinical-grade formulations are anticipated to lead the claim segment in 2025 with a 52.10% share, valued at USD 682.80 Million. Demand is being driven by consumer reliance on dermatologist-tested validation, clinical trial evidence, and transparent efficacy reporting. This positioning is reinforced by the growing requirement from regulatory authorities and retail gatekeepers for scientific substantiation, which has increased trust in clinically proven skincare. The segment’s growth is projected to be supported by professional tie-ins, clinical endorsements, and strong uptake in both e-commerce and dermatology clinics. As new assay technologies emerge and circadian efficacy trials are standardized, the clinical-grade claim is expected to consolidate its role as the most trusted and premium positioning in the market.

| Segment | Market Value Share, 2025 |

|---|---|

| Serums | 51.2% |

| Others | 48.8% |

Serums are projected to lead the product type segment with a 51.20% share in 2025, valued at USD 669.70 Million. Their dominance is expected to be supported by precision dosing, lightweight textures, and superior absorption that align well with circadian skincare protocols. Consumer preference for concentrated formulations is being reinforced by the ability of serums to deliver higher efficacy in smaller amounts, improving compliance and measurable outcomes. Innovation in chrono-peptide delivery systems and plant extract infusions is likely to elevate the appeal of this format over the decade. With refillable packaging trends and AI-personalized regimens advancing, serums are forecast to retain leadership by providing flexibility, targeted benefits, and premium user experience in the global market.

Increasing complexity of circadian efficacy validation and the premiumization of clinical-grade skincare are shaping adoption, while demand is also being influenced by digital adherence tools and wellness-driven personalization, creating new opportunities alongside challenges for global market participants.

Integration of AI in Circadian Personalization

Market expansion is being supported by the integration of artificial intelligence in regimen synchronization, where algorithmic platforms recommend ingredient timing and product layering based on skin rhythm mapping. This shift is enabling consumers to link visible results with digital adherence insights. The resulting trust is being strengthened by transparent evidence reporting and clinical dashboards that reinforce brand credibility. In the next decade, ecosystem partnerships with wearables and sleep trackers are expected to amplify adoption by connecting skincare usage directly to biological feedback. Such data-backed personalization is projected to sustain premium pricing and secure long-term consumer loyalty, positioning AI-driven circadian synchronization as a transformative growth lever.

Limited Standardization of Chronobiology Testing Protocols

Growth is expected to face constraints due to the absence of standardized chronobiology testing frameworks, which creates inconsistency in substantiation claims. Divergent assay methodologies are undermining comparability across product lines, slowing regulatory approvals and diluting consumer confidence. Without harmonized evaluation metrics, replication of circadian alignment outcomes remains challenging, making it harder for brands to defend premium positioning. Over the forecast period, the establishment of recognized global testing standards will be critical to resolve these gaps. Until then, market scaling may be slowed by uncertainty in claim validation and by reluctance from institutional buyers, such as dermatology clinics and premium retail platforms, to expand offerings without consistent scientific proof.

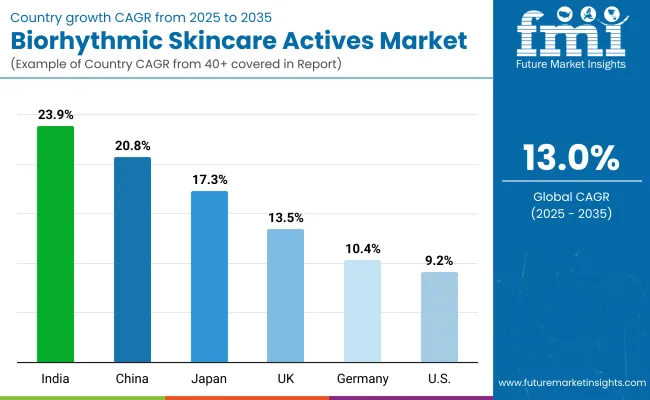

| Country | CAGR |

|---|---|

| China | 20.8% |

| USA | 9.2% |

| India | 23.9% |

| UK | 13.5% |

| Germany | 10.4% |

| Japan | 17.3% |

Adoption of biorhythmic skincare actives is showing distinct differences across countries, shaped by consumer awareness, scientific validation, and evolving wellness preferences. Asia is positioned as the fastest-growing hub, with India projected to expand at 23.90% CAGR and China at 20.80% CAGR from 2025 to 2035. India’s momentum is expected to be reinforced by rising middle-class spending, digital-first beauty engagement, and the strong appeal of clinical-grade products in urban centers. China’s trajectory is anticipated to be powered by rapid uptake of circadian-aligned innovations and alignment with premium beauty channels that emphasize scientific credibility.

Japan is forecast to achieve a 17.30% CAGR, driven by mature consumers favoring low-irritancy, evidence-backed night repair formulations that complement local skincare traditions. In Europe, the UK and Germany are expected to expand at 13.50% and 10.40% CAGR respectively, supported by strong clinical positioning, dermatologist partnerships, and regulatory alignment for substantiated claims. These markets are projected to remain innovation leaders in active development pipelines.

The U.S., by contrast, is projected to post a steadier 9.20% CAGR, reflecting a mature premium beauty landscape. Growth is anticipated to rely on dermatologist-endorsed clinical-grade launches, subscription-based regimens, and data-driven personalization strategies that reinforce consumer trust in circadian skincare.

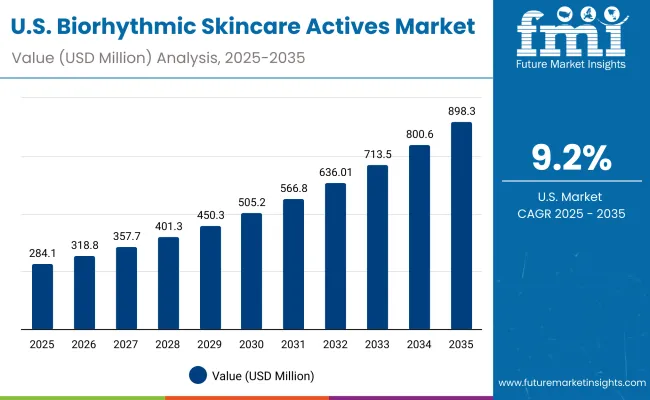

| Year | USA Biorhythmic Skincare Actives Market (USD Million) |

|---|---|

| 2025 | 284.16 |

| 2026 | 318.82 |

| 2027 | 357.71 |

| 2028 | 401.35 |

| 2029 | 450.31 |

| 2030 | 505.23 |

| 2031 | 566.86 |

| 2032 | 636.01 |

| 2033 | 713.59 |

| 2034 | 800.63 |

| 2035 | 898.30 |

The Biorhythmic Skincare Actives Market in the United States is projected to advance at a CAGR of 9.20% from 2025 to 2035, rising from USD 284.16 Million in 2025 to USD 898.30 Million by the end of the forecast period. Growth is anticipated to be sustained by consumer adoption of clinical-grade products and strong demand for dermatologist-tested formulations. Clinical validation is expected to remain central in driving premium positioning, while subscription-based regimens and AI-guided personalization tools are likely to enhance consumer loyalty. Distribution through dermatology clinics and premium retail channels is projected to expand further, reinforcing accessibility for evidence-seeking consumers.

The Biorhythmic Skincare Actives Market in the UK is forecast to grow at a CAGR of 13.50% from 2025 to 2035. This growth trajectory is expected to be supported by the rising adoption of clinically validated formulations and heightened consumer interest in dermatologist-endorsed products. Premium beauty retail channels are projected to expand their share as consumers increasingly seek evidence-based skincare solutions. Regulatory alignment around claim substantiation is likely to reinforce the competitive edge of clinical-grade actives. Over the decade, innovation in chrono-peptides and plant-based circadian extracts is expected to resonate strongly with consumers who demand science-led wellness offerings.

The Biorhythmic Skincare Actives Market in India is projected to grow at a CAGR of 23.90% during 2025-2035, making it the fastest-growing key market globally. This rapid expansion is anticipated to be driven by rising middle-class spending, digital-first beauty engagement, and the popularity of dermatologist-tested formulations among younger consumers. E-commerce platforms are expected to act as major enablers of category penetration, with localized education campaigns driving awareness. Urban centers are likely to anchor premium adoption, while tier-two cities emerge as new growth nodes for circadian skincare. Innovation in affordable clinical-grade actives is projected to widen accessibility and sustain momentum.

The Biorhythmic Skincare Actives Market in China is forecast to grow at a CAGR of 20.80% from 2025 to 2035. Expansion is anticipated to be powered by consumer receptivity to circadian science, strong demand for clinical-grade claims, and integration with premium beauty retail ecosystems. Digital platforms are expected to amplify adoption through AI-driven regimen personalization and adherence support tools. Regulatory frameworks emphasizing transparency and efficacy are projected to favor market leaders that invest in clinical trials and disclose assay methodologies. China is also likely to witness strong brand competition, with global and domestic players leveraging localized consumer insights.

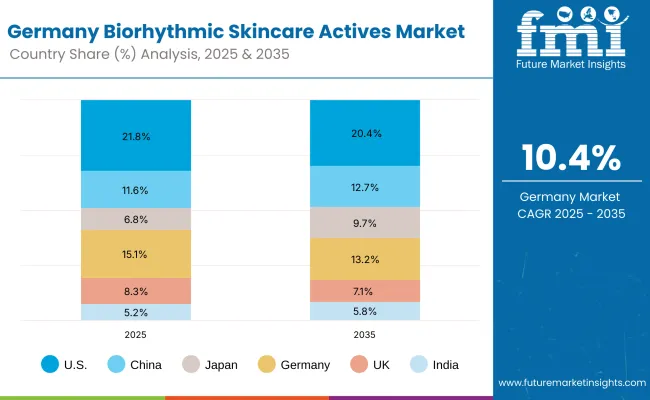

| Country | 2025 |

|---|---|

| USA | 21.8% |

| China | 11.6% |

| Japan | 6.8% |

| Germany | 15.1% |

| UK | 8.3% |

| India | 5.2% |

| Country | 2035 |

|---|---|

| USA | 20.4% |

| China | 12.7% |

| Japan | 9.7% |

| Germany | 13.2% |

| UK | 7.1% |

| India | 5.8% |

The Biorhythmic Skincare Actives Market in Germany is expected to grow at a CAGR of 10.40% during 2025-2035. Growth is projected to be supported by consumer reliance on dermatologist-tested products, regulatory scrutiny over claims, and demand for sustainable, science-led skincare. Strong presence of premium retail chains and clinic-based distribution is anticipated to reinforce accessibility for evidence-seeking consumers. Innovation pipelines focused on enzyme regulators and plant circadian extracts are likely to align with Germany’s preference for natural yet clinically validated actives. Partnerships between dermatology clinics and premium brands are expected to strengthen credibility and foster repeat adoption.

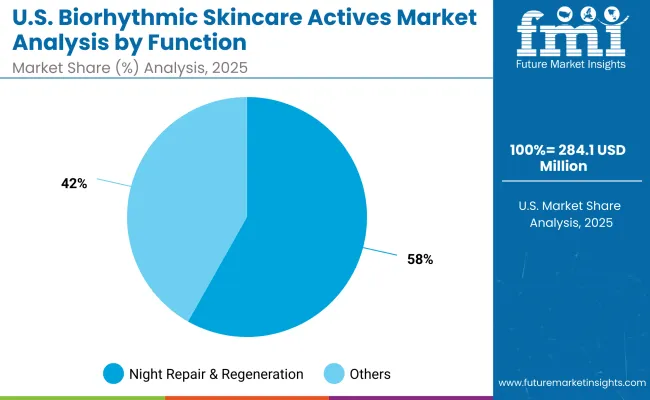

| Segment | Market Value Share, 2025 |

|---|---|

| Night repair & regeneration | 58.2% |

| Others | 41.8% |

The Biorhythmic Skincare Actives Market in the United States is projected at USD 284.16 Million in 2025. Night repair & regeneration contributes 58.20% with USD 165.30 Million, while other functions account for 41.80% with USD 118.91 Million. This dominance of night repair reflects consumer alignment with biological recovery cycles, where evening skincare routines are increasingly prioritized for visible outcomes. The preference for clinically validated repair actives is expected to accelerate as dermatologist-endorsed formulations become central to premium positioning. Unlike general-purpose actives, circadian repair products are being supported by transparent trials and AI-driven personalization that enhance regimen adherence. Over the decade, heightened emphasis on barrier strength, hydration, and overnight recovery biomarkers is projected to secure the leadership of this segment. By contrast, other functional categories are expected to remain supplementary, addressing broad wellness preferences without eclipsing the appeal of repair-focused innovation.

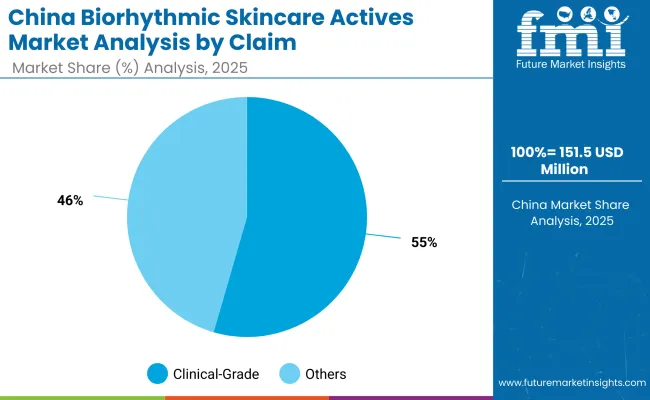

| Segment | Market Value Share, 2025 |

|---|---|

| Clinical-grade | 54.5% |

| Others | 45.5% |

The Biorhythmic Skincare Actives Market in China is projected at USD 151.58 Million in 2025. Clinical-grade claims contribute 54.50% with USD 82.60 Million, while other claims account for 45.50% with USD 68.95 Million. This leadership of clinical-grade products reflects the growing trust in dermatologist-tested validation and transparent efficacy reporting, which are increasingly demanded by Chinese consumers. The rapid uptake is being supported by digital-first beauty platforms that emphasize clinical substantiation and regimen education. Over the decade, integration of AI-driven regimen personalization and evidence-based communication is expected to further strengthen the clinical-grade segment. Meanwhile, non-clinical categories are anticipated to serve wellness-oriented consumers, but without displacing the dominance of scientifically anchored positioning. Regulatory focus on substantiated claims is projected to favor brands that invest in transparent trial disclosures and validated circadian efficacy protocols.

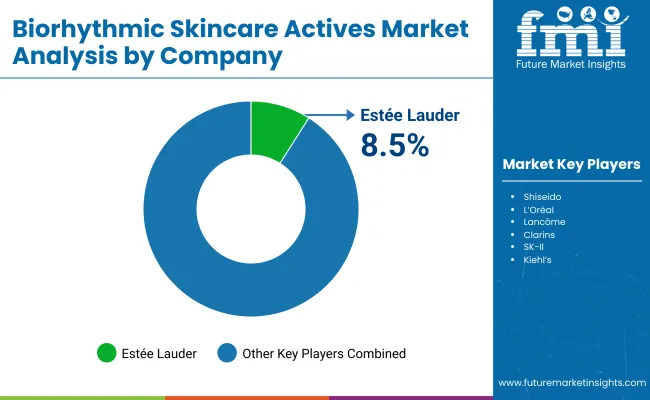

| Company | Global Value Share 2025 |

|---|---|

| Estée Lauder | 8.5% |

| Others | 91.5% |

The Biorhythmic Skincare Actives Market is moderately fragmented, with multinational leaders, regional premium players, and niche specialists competing across diverse skincare categories. Global beauty leaders such as Estée Lauder, L’Oréal, Shiseido, Lancôme, Clarins, SK-II, Kiehl’s, Amorepacific, Murad, and Clinique are projected to dominate market influence. Among these, Estée Lauder is estimated to hold the largest global value share in 2025 at 8.50%, while the remainder of the market is distributed among other players at 91.50%. Competitive intensity is expected to focus on clinical validation, circadian efficacy substantiation, and dermatologist partnerships, which are central to building long-term consumer trust.Regional innovators such as Amorepacific and SK-II are anticipated to strengthen their positions in Asia-Pacific through culturally aligned night repair formulations. Premium clinical-grade brands are expected to expand their footprint in the U.S. and Europe by leveraging dermatologist endorsements and transparent trial disclosures. Differentiation is projected to shift from traditional branding power toward data-backed personalization, AI-driven regimen optimization, and refillable sustainable formats. Over the forecast period, strategic partnerships with clinics, digital-first platforms, and wellness ecosystems are likely to become defining features of competitive positioning.

Key Developments in Biorhythmic Skincare Actives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,301.60 Million (2025) → USD 4,402.10 Million (2035) |

| Function | Night repair & regeneration, Circadian rhythm alignment, Anti-aging & firming, Others |

| Active Type | Chronopeptides, Plant circadian extracts, Melatonin boosters, Enzyme regulators |

| Claim | Clinical-grade, Clean-label, Dermatologist-tested, Vegan, Others |

| Product Type | Serums, Night creams, Day creams, Masks, Others |

| Channel | E-commerce, Premium beauty retail, Pharmacies, Spas/Dermatology clinics |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Germany, United Kingdom, China, Japan, India |

| Key Companies Profiled | Estée Lauder, Shiseido, L’Oréal, Lancôme, Clarins, SK-II, Kiehl’s, Amorepacific, Murad, Clinique |

| Additional Attributes | Dollar sales by function, claim, and product type; accelerated adoption in Asia-Pacific (China CAGR 20.80%, India CAGR 23.90%); night repair & regeneration dominating at 55.60% in 2025; clinical-grade claims at 52.10%; strong reliance on dermatologist partnerships; innovations in chrono-peptides, melatonin boosters, and plant-based circadian extracts; rising digital-first adoption via e-commerce and AI-guided regimen personalization. |

The global Biorhythmic Skincare Actives Market is estimated to be valued at USD 1,301.60 Million in 2025.

The market size for the Biorhythmic Skincare Actives Market is projected to reach USD 4,402.10 Million by 2035.

The Biorhythmic Skincare Actives Market is expected to grow at a CAGR of 13.00% between 2025 and 2035.

The key product types in the Biorhythmic Skincare Actives Market are serums, night creams, day creams, masks, and others.

In terms of function, the night repair & regeneration segment is expected to command 55.60% share in the Biorhythmic Skincare Actives Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA