The Bio-Fermented Skincare Actives Market is anticipated to reach USD 1,351.2 million in 2025 and expand to USD 4,921.3 million by 2035. Over the decade, this growth translates to an incremental rise of USD 3,570.1 million, equivalent to an overall expansion of nearly 3.6 times the base year. The implied compound annual growth rate (CAGR) is 13.8%, reflecting sustained acceleration in consumer preference for naturally derived, clinically supported skincare solutions.

Quick Stats for Bio-Fermented Skincare Actives Market

Bio-Fermented Skincare Actives Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value In (2025e) | USD 1,351.2 Million |

| Market Forecast Value In (2035f) | USD 4,921.3 Million |

| Forecast CAGR (2025 To 2035) | 13.80% |

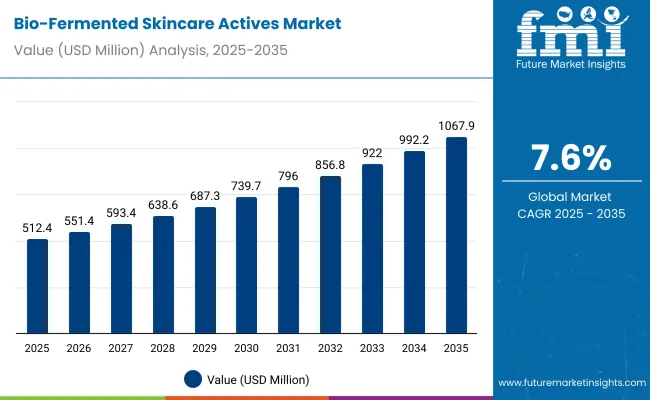

During the first half of the assessment period (2025-2030), the market is expected to scale from USD 1,351.2 million to USD 2,578.7 million, generating USD 1,227.5 million in additional value. This period is projected to contribute around 34% of the total decade’s growth, supported by strong adoption across Asia-Pacific, particularly China and India, where consumer awareness and demand for skin-barrier-friendly formulations are rapidly expanding. Anti-aging and wrinkle repair functions are likely to dominate during this phase, holding nearly 38% of the functional share, while serums are forecast to maintain leadership in product formats with over 40% contribution to revenues.

The second half (2030-2035) is forecast to accelerate further, with market value rising from USD 2,578.7 million to USD 4,921.3 million. This increase of USD 2,342.6 million accounts for nearly two-thirds of the decade’s expansion, indicating stronger compounding effects in the later years. The premium and luxury segment is anticipated to outpace mass-market growth, supported by higher consumer spending power and demand for evidence-based performance claims. By 2035, online distribution and clinically validated bio-fermented ingredients are projected to set the competitive benchmark for market leadership.

From 2020 to 2024, the market was accelerated by consumer awareness of fermented actives as natural yet potent alternatives to synthetic compounds. During this phase, product launches by leaders such as Amorepacific and Shiseido dominated revenues, with Asia-Pacific brands influencing global skincare trends. Competitive positioning relied heavily on anti-aging efficacy, hydration claims, and differentiation through clinical validation.

In 2025, the market is projected to surpass USD 1,350 Million, while by 2035 it is forecasted to cross USD 4,900 Million, indicating a shift toward premiumization, biotechnology-driven formulations, and microbiome-friendly claims. The competitive advantage is expected to move beyond single-ingredient innovation toward ecosystem strength, sustainability, and subscription-based personalized skincare models.

The growth of the Bio-Fermented Skincare Actives Market is being driven by multiple converging factors that align with evolving consumer expectations and industry advancements. Increasing demand for natural, science-backed formulations is being witnessed as consumers shift toward safer and more sustainable skincare solutions. Bio-fermentation is being adopted as a preferred production method since it enhances ingredient efficacy, ensures high purity, and reduces reliance on synthetic chemicals. Rising awareness regarding skin barrier health and anti-aging benefits is fueling greater adoption of fermented actives such as peptides and hyaluronic acid, which are perceived to deliver superior hydration, wrinkle repair, and sensitivity reduction.

Premiumization trends are being accelerated by consumers seeking products with clinically validated claims, resulting in higher willingness to pay for bio-fermented formulations. Rapid growth in e-commerce and direct-to-consumer channels is expanding accessibility, while advanced research in biotechnology is enabling cost-efficient production at scale. With Asia-Pacific markets, particularly China and India, showing double-digit growth trajectories, the market is projected to sustain strong expansion throughout the forecast period.

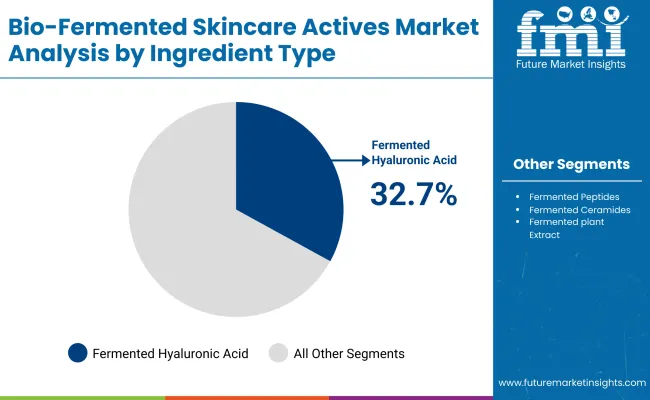

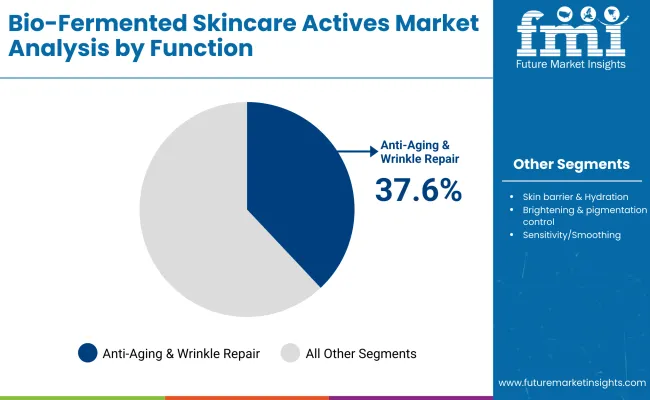

The Bio-Fermented Skincare Actives Market has been segmented across ingredient type, function, and product format to evaluate the structural growth drivers shaping this industry. Ingredient-based segmentation highlights the significance of fermented hyaluronic acid and other bio-fermented actives, each contributing uniquely to skin hydration, repair, and rejuvenation. Functional segmentation emphasizes applications such as anti-aging and wrinkle repair, which dominate consumer demand due to rising focus on visible results and clinically validated benefits.

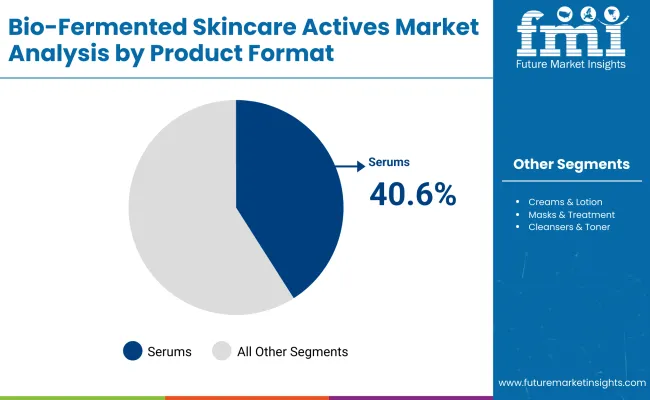

Product format segmentation reflects consumer preferences, with serums and other formulations catering to varying routines and spending capacities. By analyzing these segments, clear opportunities are revealed for companies to invest in premium actives, innovate across multifunctional solutions, and align offerings with evolving skincare expectations across both mass and luxury markets.

| Ingredient Type | Market Value Share, 2025 |

|---|---|

| Fermented hyaluronic acid | 32.7% |

| Others | 67.3% |

The ingredient type segmentation is expected to be led by fermented hyaluronic acid, holding 32.7% of the market share in 2025, equivalent to USD 441.44 million. Its dominance is being driven by strong consumer demand for hydration, barrier support, and skin elasticity benefits. Other bio-fermented actives, including peptides, ceramides, and plant extracts, are collectively anticipated to contribute the majority share, reflecting their multifunctional performance in soothing, brightening, and rejuvenation. Innovation in bioprocessing methods is projected to improve purity, bioavailability, and formulation stability, ensuring wider adoption in both premium and mass-market ranges. With proven compatibility across diverse skincare products, fermented hyaluronic acid is expected to remain the leading active ingredient throughout the forecast horizon.

| Function | Market Value Share, 2025 |

|---|---|

| Anti-aging & wrinkle repair | 37.6% |

| Others | 62.4% |

The function segment is projected to be dominated by anti-aging and wrinkle repair, representing 37.6% of market share in 2025, valued at USD 508.32 million. This leadership is being reinforced by rising consumer focus on longevity, youth-preserving skincare, and clinically proven efficacy of fermented actives. Growing adoption of bio-fermented peptides and hyaluronic acid is enhancing demand for formulations that visibly reduce fine lines and improve skin texture. The broader functional category, including brightening, pigmentation control, and soothing, is also contributing significantly to the market by addressing holistic skin health needs. With aging populations, higher disposable incomes, and a shift toward evidence-backed beauty solutions, the anti-aging and wrinkle repair category is expected to retain a strong trajectory through 2035.

| Product Format | Market Value Share, 2025 |

|---|---|

| Serums | 40.6% |

| Others | 59.4% |

The product format segment is anticipated to be dominated by serums, with a 40.6% share in 2025, valued at USD 548.45 million. Serums are increasingly preferred for their concentrated formulations, high penetration capacity, and ease of incorporation into personalized skincare routines. This segment’s strength is being amplified by the rising trend of targeted treatments that offer visible outcomes within shorter timeframes. Other formats, including creams, masks, and lotions, are collectively commanding a larger share but are more fragmented across routine steps. As consumer behavior shifts toward minimalist regimens with maximum efficacy, serums are expected to remain the format of choice, driving premiumization and repeat purchases within both online and offline retail channels.

Growing complexity in formulation science and evolving consumer expectations are reshaping the Bio-Fermented Skincare Actives Market. Despite structural opportunities, challenges related to production scale, cost optimization, and regulatory compliance remain decisive in shaping future strategies.

Scientific Validation and Clinical Integration

The market is being propelled by deeper integration of bio-fermented actives into clinical dermatology and aesthetic practice. Fermentation processes are increasingly being optimized for molecular stability, enabling actives to achieve greater penetration and longer-lasting efficacy. Clinical trials are being positioned as a marketing differentiator, where robust data packages are projected to strengthen credibility in both premium and mass-market skincare. This scientific validation is expected to build consumer trust, sustain premium pricing, and widen adoption across age groups and skin conditions.

Supply Chain Vulnerability in Fermentation Inputs

The reliance on controlled microbial strains, nutrient-rich substrates, and highly specialized fermentation environments is creating vulnerabilities in supply stability. Disruptions in sourcing biomaterials, combined with rising energy and bioprocessing costs, are likely to pressure margins, particularly for smaller innovators. While scale economies are expected to mitigate some risks, volatility in raw material costs and stringent global regulations on biotech processes are projected to restrict consistent supply. This restraint highlights the need for vertical integration, strategic partnerships with biotech suppliers, and regional diversification to ensure reliability in an increasingly competitive and globalized market landscape.

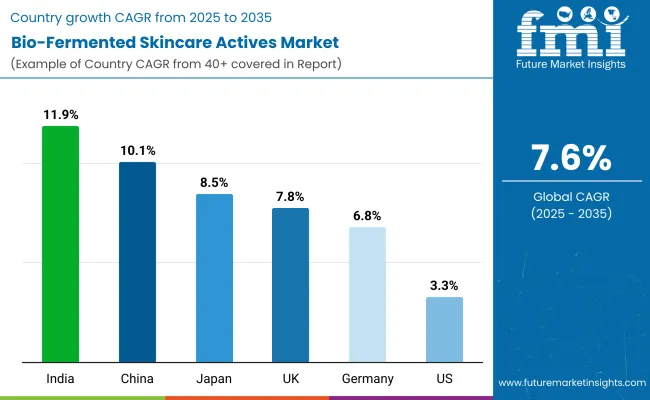

| Countries | CAGR |

|---|---|

| China | 17.3% |

| USA | 7.2% |

| India | 19.4% |

| UK | 11.2% |

| Germany | 8.4% |

| Japan | 14.0% |

The Bio-Fermented Skincare Actives Market demonstrates significant variation in growth trajectories across countries, shaped by consumer awareness, regulatory landscapes, and technological integration in skincare innovation. Asia is expected to remain the primary growth engine, with India and China positioned as the fastest-expanding markets. India is projected to record the highest CAGR of 19.4% between 2025 and 2035, supported by the rapid penetration of premium skincare brands, evolving middle-class spending, and strong alignment with wellness-driven consumption. China is anticipated to follow closely with a CAGR of 17.3%, where state-backed biotechnology investment and consumer preference for fermented, natural-derived formulations are expected to reinforce large-scale adoption.

Japan is forecasted to advance at a CAGR of 14.0%, sustained by deep-rooted skincare culture and brand-led innovations around anti-aging and barrier-repair solutions. Europe maintains steady expansion, led by the UK at 11.2% and Germany at 8.4%. These markets are expected to benefit from stringent product safety standards, transparency demands, and consumer prioritization of clinically validated formulations. In North America, the USA is projected to post a moderate CAGR of 7.2%, reflecting maturity in existing product lines but ongoing adoption of bio-fermented actives within premium and clean-label skincare ranges. This divergence underlines a future where Asia’s demand momentum redefines global competitive strategies.

| Year | USA Bio-Fermented Skincare Actives Market (USD Million) |

|---|---|

| 2025 | 304.02 |

| 2026 | 341.92 |

| 2027 | 384.54 |

| 2028 | 432.48 |

| 2029 | 486.39 |

| 2030 | 547.02 |

| 2031 | 615.21 |

| 2032 | 691.91 |

| 2033 | 778.16 |

| 2034 | 875.16 |

| 2035 | 984.26 |

The Bio-Fermented Skincare Actives Market in the United States is projected to grow at a CAGR of 7.2%, rising from USD 304.02 million in 2025 to USD 984.26 million by 2035. This trajectory represents more than a threefold increase over the decade, with the market expected to cross USD 547.02 million by 2030 before reaching USD 875.16 million in 2034.

Growth in the USA is being driven by premiumization, where bio-fermented actives are positioned as science-backed, naturally derived solutions that deliver visible skincare outcomes. Strong consumer preference for safe, effective, and clinically validated ingredients is expected to strengthen adoption across both premium and mass-market categories. Strategic investment by leading skincare companies in innovation pipelines, combined with expanding online retail and direct-to-consumer models, is set to enhance product accessibility and consumer engagement.

The Bio-Fermented Skincare Actives Market in the UK is projected to expand at a CAGR of 11.2% between 2025 and 2035, supported by strong demand for premium and evidence-backed formulations. The market is expected to benefit from consumers’ preference for transparency, clinical validation, and sustainability in skincare. The integration of fermented peptides and ceramides into luxury skincare lines is anticipated to play a significant role in sustaining premium adoption. Regulatory alignment with EU safety frameworks is expected to ensure high compliance and drive confidence among both consumers and retailers. With rising adoption of digital channels, direct-to-consumer platforms are likely to accelerate penetration.

The Bio-Fermented Skincare Actives Market in India is forecasted to grow at the fastest CAGR of 19.4% through 2035, driven by increasing middle-class spending power, rising wellness consciousness, and preference for safe, natural yet high-performing skincare. Rapid urbanization and digital access are expanding awareness, while younger demographics are becoming key adopters of science-backed beauty solutions. Domestic and international brands are expected to invest in product localization, affordability, and targeted marketing to capture diverse consumer needs. The premium segment is likely to expand strongly, but mass-market acceptance of bio-fermented actives is also projected to accelerate with rising affordability.

The Bio-Fermented Skincare Actives Market in China is expected to expand at a CAGR of 17.3% over 2025-2035, supported by state-backed biotech investments and strong consumer demand for advanced skincare. Fermented ingredients are being positioned as premium, natural-derived solutions with higher efficacy, aligning with rising consumer awareness around skin-barrier repair and anti-aging. Leading local and global brands are accelerating R&D collaborations to strengthen clinical validation and differentiation. The rapid expansion of e-commerce platforms and beauty-tech integration is expected to play a pivotal role in distribution. With tightening regulatory frameworks ensuring safety and transparency, consumer trust is anticipated to strengthen further, boosting overall growth.

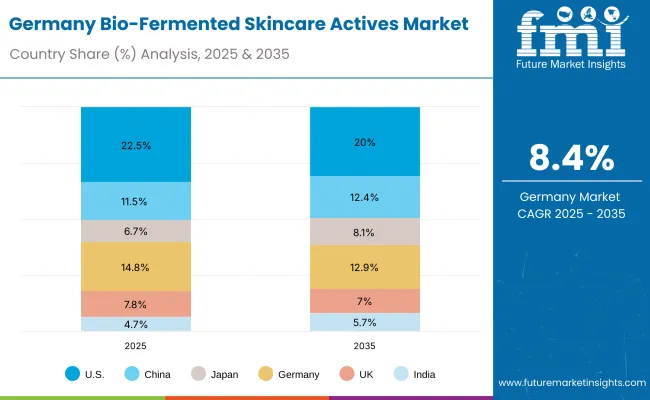

| Countries | 2025 |

|---|---|

| USA | 22.5% |

| China | 11.5% |

| Japan | 6.7% |

| Germany | 14.8% |

| UK | 7.8% |

| India | 4.7% |

| Countries | 2035 |

|---|---|

| USA | 20.0% |

| China | 12.4% |

| Japan | 8.1% |

| Germany | 12.9% |

| UK | 7.0% |

| India | 5.7% |

The Bio-Fermented Skincare Actives Market in Germany is projected to grow at a CAGR of 8.4% during 2025-2035, supported by strong demand for sustainable, clean-label, and dermatologically validated formulations. Consumers in Germany are prioritizing functional skincare solutions with clear scientific substantiation, creating opportunities for bio-fermented actives in hydration, sensitivity relief, and anti-aging. Brands are expected to focus on sustainable sourcing, eco-friendly packaging, and regulatory alignment with EU guidelines to maintain trust. The pharmacy and specialist retail channels are anticipated to remain central for consumer education and conversion. Premiumization will progress steadily, but broad-based adoption in mass-market lines is expected as affordability improves.

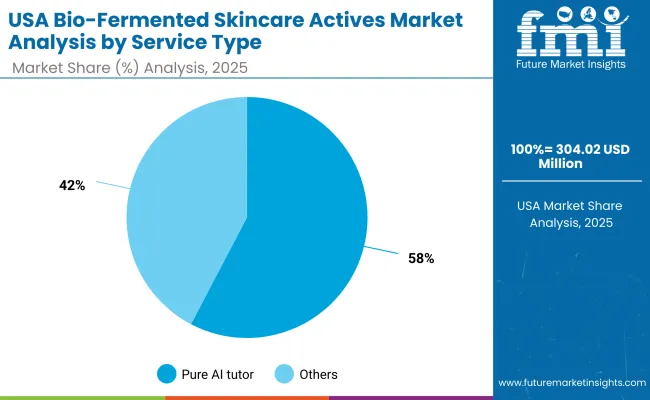

| Segment | Market Value Share, 2025 |

|---|---|

| Pure AI tutor | 57.7% |

| Others | 42.3% |

The USA bio-fermented skincare actives market is projected at USD 304.02 million in 2025, with pure AI tutor solutions contributing USD 175.42 million (57.7%), while other service formats account for USD 128.60 million (42.3%). The segment dominance of pure AI tutor solutions is expected to reflect a growing shift toward hyper-personalized, algorithm-driven skincare recommendations. This transition is being fueled by the increasing demand for precision formulations and real-time consumer engagement through virtual platforms.

The rise of pure AI tutors is anticipated to create a self-learning feedback loop where consumer skin profiles, microbiome data, and seasonal variations are continuously analyzed to deliver optimal product suggestions. This capability is forecast to strengthen consumer trust and reduce trial-and-error product purchases, leading to higher adoption rates among premium and mass-market buyers.

The segment is also expected to benefit from integrations with tele-dermatology platforms, e-commerce portals, and connected skincare devices, enabling a seamless purchase-to-application experience. Regulatory approvals for AI-driven diagnostic tools are likely to accelerate mainstream deployment. The presence of major beauty conglomerates and tech-driven startups in the USA is projected to amplify R&D spending, pushing innovation beyond simple recommendation engines toward fully automated skin-health monitoring ecosystems.

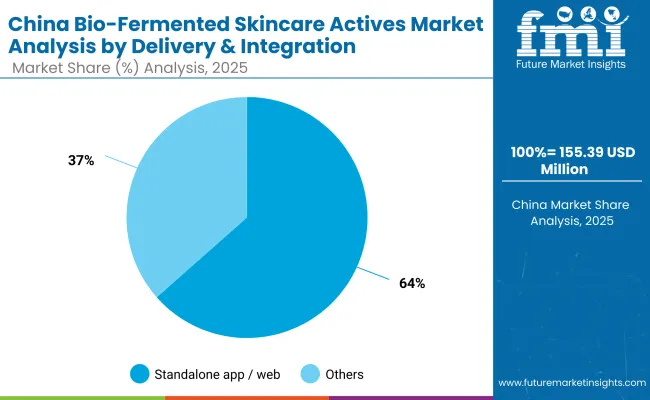

| Segment | Market Value Share, 2025 |

|---|---|

| Standalone app / web | 63.5% |

| Others | 36.5% |

The China bio-fermented skincare actives market is projected at USD 155.39 million in 2025, with standalone app/web-based delivery commanding USD 98.67 million (63.5%), while other integration modes contribute USD 56.72 million (36.5%). The dominance of digital-first platforms is anticipated to highlight China’s position as a global frontrunner in tech-enabled skincare personalization.

Standalone app and web interfaces are expected to be favored as they provide seamless consumer experiences, integrating skin diagnostics, product recommendations, and purchase pathways within a single ecosystem. The market is likely to benefit from the widespread adoption of super-app ecosystems and mini-programs within major Chinese e-commerce and social platforms, which are expected to drive higher user engagement and conversion rates.

The growth trajectory is forecast to be reinforced by government encouragement of biotech innovation and the rapid penetration of AI-driven health and wellness applications. Cross-industry partnerships between beauty brands, tech startups, and dermatology networks are projected to accelerate market maturity, enabling a higher degree of personalization and real-time consumer support.

Standalone app/web platforms are also anticipated to leverage big data analytics and predictive modeling, which will allow hyper-targeted product suggestions based on individual skin profiles, regional climate conditions, and evolving consumer preferences. This level of personalization is expected to elevate brand loyalty and premium product uptake, further expanding market revenues.

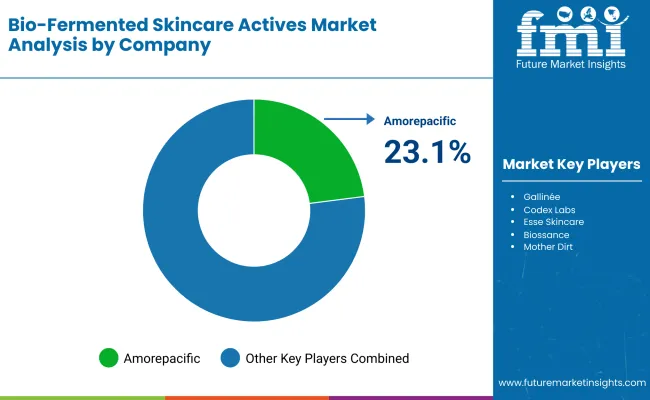

The market is characterized as moderately fragmented, with global leaders, mid-sized innovators, and niche specialists competing across efficacy, proof, and digital engagement. Leadership is held by beauty conglomerates such as Amorepacific, L’Oréal, Shiseido, Estée Lauder, and Procter & Gamble (SK-II), whose portfolios are being reinforced by fermentation science, clinical validation, and omnichannel scale. Strategies are expected to emphasize microbiome-safe actives, longitudinal efficacy datasets, and end-to-end consumer journeys that integrate diagnostics, tailoring, and replenishment.

Established mid-sized players, including LG Household & Health Care, Beiersdorf, Unilever, Tonymoly, and emerging science-led brands such as Codex Labs, are anticipated to expand relevance through agile R&D, faster claim substantiation, and premiumization in serums and barrier-health systems. Adoption is projected to accelerate via DTC ecosystems, retailer co-development, and dermatologist partnerships that lower evidence barriers and raise repeat purchase rates.

Specialists are expected to win on narrow problem statements pigmentation control, sensitivity relief, and post-procedure recovery where customization, clean-label storytelling, and region-specific compliance offer leverage over scale. Competitive differentiation is forecast to shift away from single-ingredient claims toward integrated platforms that blend bio-fermented actives, AI-guided regimen design, and subscription services, with supply security and sustainability credentials used as tie-breakers in enterprise procurement.

Key Developments in Bio-Fermented Skincare Actives Market

| Item | Value |

|---|---|

| Market size (2025) | USD 1,351.2 Million |

| Market size (2035) | USD 4,921.3 Million |

| Absolute growth (2025-2035) | USD 3,570.1 Million |

| CAGR (2025-2035) | 13.80% |

| Ingredient type | Fermented hyaluronic acid - USD 441.44 Million (32.7%); Others - USD 909.76 Million (67.3%) |

| Function | Anti-aging & wrinkle repair - USD 508.32 Million (37.6%); Others - USD 842.88 Million (62.4%) |

| Product format | Serums - USD 548.45 Million (40.6%); Others - USD 802.75 Million (59.4%) |

| Distribution channels | Online (DTC, marketplaces); Offline (specialty beauty, department stores, pharmacies) |

| End consumer | Mass market - USD 548.45 Million (40.6%); Premium & luxury - USD 802.75 Million (59.4%) |

| Regions covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries covered (with CAGR) | USA - 7.2%; China - 17.3%; Japan - 14.0%; India - 19.4%; UK - 11.2%; Germany - 8.4% |

| Key country shares of global value | 2025 → 2035: USA - 22.5% (USD 304.02 Million) → 20.0% (USD 984.26 Million); China - 11.5% (USD 155.39 Million) → 12.4%; Japan - 6.7% (USD 90.53 Million) → 8.1%; Germany - 14.8% → 12.9%; UK - 7.8% → 7.0%; India - 4.7% → 5.7% |

| Key companies profiled | Amorepacific; Shiseido; L’Oréal; Estée Lauder Companies; Procter & Gamble (SK-II); LG Household & Health Care; Beiersdorf; Unilever; Codex Labs; Tonymoly |

| Competitive snapshot (2025) | Amorepacific - 9.2%; Others - 90.8% |

| Additional attributes | Premiumization and clinical validation are projected to sustain pricing; Asia (China and India) is expected to drive accelerated growth; e-commerce and derm-retail expansion will deepen penetration; fermentation QbD processes and secure supply chains are becoming priorities; microbiome-friendly and evidence-backed positioning will define innovation |

The global Bio-Fermented Skincare Actives Market is estimated to be valued at USD 1,351.2 million in 2025, supported by rising adoption of fermented hyaluronic acid, peptides, and ceramides across premium skincare.

The market size for the Bio-Fermented Skincare Actives Market is projected to reach USD 4,921.3 million by 2035, highlighting sustained global expansion driven by innovation and clinical validation.

The Bio-Fermented Skincare Actives Market is expected to grow at a CAGR of 13.8% between 2025 and 2035, representing an absolute growth of USD 3,570.1 million over the decade.

The key product formats in the Bio-Fermented Skincare Actives Market are serums, creams and lotions, masks and treatments, and cleansers and toners, with serums leading at 40.6% share in 2025.

In terms of function, the anti-aging and wrinkle repair segment is expected to dominate with a 37.6% share in 2025, reflecting strong consumer demand for longevity-driven and clinically supported skincare solutions.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Bio-Fermented Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Ceramide Skincare Market Insights – Trends & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA