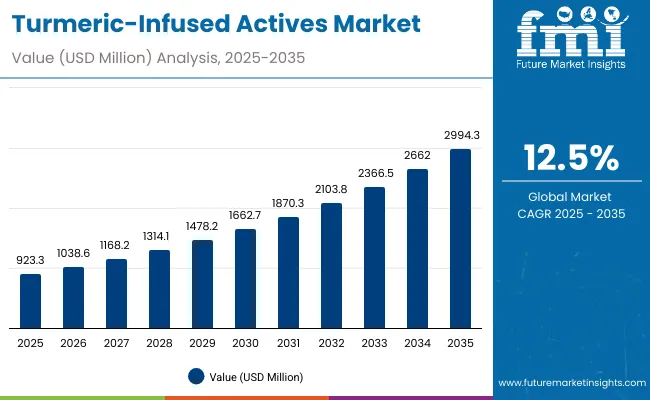

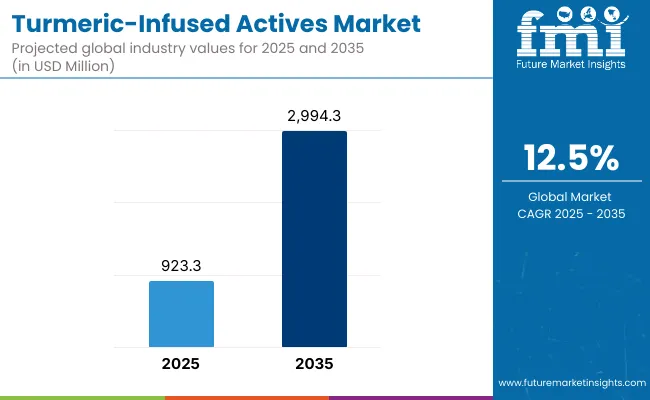

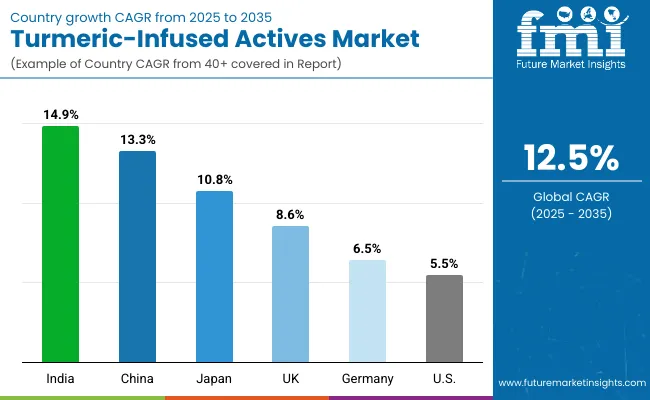

The Global Turmeric-Infused Actives Market is expected to record a valuation of USD 923.3 million in 2025 and USD 2,994.3 million in 2035, with an increase of USD 2,071.0 million, which equals a growth of 224% over the decade. The overall expansion represents a CAGR of 12.5% and a 3X increase in market size.

Global Turmeric-Infused Actives Market Key Takeaways

| Metric | Value |

|---|---|

| Global Turmeric-Infused Actives Market Estimated Value in (2025E) | USD 923.3 million |

| Global Turmeric-Infused Actives Market Forecast Value in (2035F) | USD 2,994.3 million |

| Forecast CAGR (2025 to 2035) | 12.5% |

During the first five-year period from 2025 to 2030, the market increases from USD 923.3 million to USD 1,662.7 million, adding USD 739.4 million, which accounts for 36% of the total decade growth. This initial phase highlights the gradual mainstreaming of turmeric actives within global beauty portfolios. Ayurvedic-inspired brands, such as Forest Essentials and Kama Ayurveda, are gaining traction in international markets, while mass-market players like Unilever and L’Oréal continue to introduce turmeric-based SKUs to capture demand for natural products.

The popularity of creams & lotions, alongside brightening serums, underlines a consumer trend toward routine-based, affordable formats. In this phase, brightening & glow functions dominate, addressing consumer concerns around dullness, uneven skin tone, and pigmentation, particularly in Western markets where glow-oriented beauty is central.

The second half from 2030 to 2035 contributes USD 1,331.6 million, equal to 64% of total growth, as the market jumps from USD 1,662.7 million to USD 2,994.3 million. Growth momentum accelerates in this period as turmeric actives move beyond traditional Ayurvedic positioning and become embedded in premium clean-label formulations, personalized skincare regimens, and digitally-enabled product delivery systems such as AI-personalized serums.

Oils, serums, and high-performance dermal patches see stronger adoption, together capturing above 30% of the product share by 2035. Alongside this, the rise of vegan and organic claims pushes brands to invest heavily in certified supply chains, ensuring transparency and authenticity. The global surge in e-commerce further enhances accessibility, enabling turmeric actives to become part of global beauty and wellness subscription models.

From 2020 to 2024, the Global Turmeric-Infused Actives Market grew from USD 580 million to USD 880 million, driven primarily by herbal and Ayurveda-centric adoption. During this period, the competitive landscape was dominated by Indian-origin Ayurvedic brands controlling nearly 40% of revenue, with leaders such as Forest Essentials, Kama Ayurveda, Vicco, and Dabur setting the tone for authentic turmeric skincare. Their strength lay in heritage-based storytelling, authenticity, and deep consumer trust, which enabled them to hold a competitive advantage despite limited international distribution.

Global players such as L’Oréal, Unilever, and Innisfree diversified their portfolios with turmeric actives as part of broader natural beauty product launches, particularly targeting consumers in Western markets with turmeric serums and glow masks. This phase was characterized by reliance on offline sales in pharmacies and Ayurvedic stores, with e-commerce emerging but not yet dominant.

Competitive differentiation during this period came from authenticity, purity, and natural positioning rather than advanced technology or personalization. Service-based wellness integrations, such as turmeric spa treatments and professional Ayurvedic facials, remained small, contributing less than 10% of total market value.

Demand for turmeric-infused actives will expand to USD 923.3 million in 2025, and the revenue mix will shift significantly by 2035. E-commerce and specialty Ayurvedic stores will account for more than 45% of total sales, reflecting the rise of online-first brands and consumer preference for curated herbal beauty platforms.

Traditional Ayurvedic leaders face increasing competition from clean-label, organic, and vegan-focused startups that emphasize sustainability and ethical sourcing. Large FMCG companies are also pivoting to hybrid models, integrating Ayurvedic wisdom with dermocosmetic claims (anti-aging, microbiome balance, or SPF protection) to retain younger and globalized consumers. The competitive advantage is moving away from Ayurvedic positioning alone toward a combination of ecosystem strength, recurring premium subscriptions, retail dominance, and sustainability certifications.

The growth of the global turmeric-infused actives market can be attributed to several interlinked factors. Advances in natural skincare science have validated the efficacy of turmeric, particularly its active compound curcumin, which provides strong anti-inflammatory, antibacterial, and antioxidant benefits. This has made turmeric an ideal choice for addressing consumer concerns around acne, hyperpigmentation, premature aging, and skin dullness.

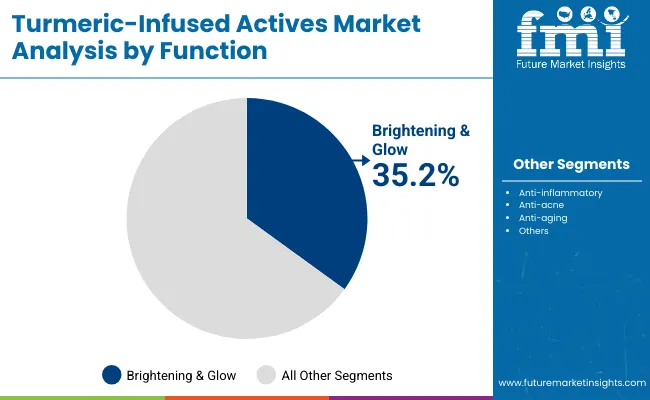

Turmeric-infused brightening & glow solutions are seeing rapid adoption globally, with 35.2% market share in 2025, because they meet the cross-market demand for radiance-enhancing products. Western markets emphasize glow and anti-aging, while Asian markets prioritize complexion balance, both of which align perfectly with turmeric’s properties. The rise of Ayurvedic-inspired and clean-label claims has further bolstered the perception of turmeric as a safe, trusted, and premium ingredient, differentiating it from synthetic actives.

Expansion of distribution channels, particularly e-commerce platforms, has been critical in market growth. Online retail enables niche Ayurvedic and clean-label startups to scale internationally, while pharmacies act as credibility-driven channels that reinforce the therapeutic and natural wellness aspects of turmeric-infused actives. This dual distribution strategy combines trust with accessibility, making turmeric actives relevant across consumer groups.

Segment growth is expected to be led by brightening & glow in function, creams & lotions in product categories, and Ayurvedic-inspired claims because they combine tradition, efficacy, and everyday usability. By 2035, these drivers will establish turmeric-infused actives not only as a niche within natural beauty but as a mainstream global skincare category.

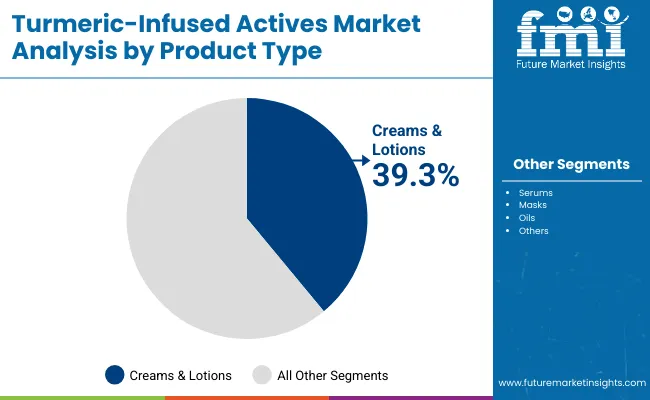

The market is segmented by function, product type, channel, claim, and region. Functional categories include brightening & glow, anti-inflammatory, anti-acne, and anti-aging, highlighting the key skin benefits consumers are seeking. Product type classification spans serums, creams & lotions, masks, and oils, covering both everyday formats and premium niches.

Channels include pharmacies, e-commerce, specialty Ayurvedic stores, and mass retail. By claim, segments are Ayurvedic-inspired, clean-label, organic, and vegan. Regionally, the scope spans North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Function Segment | Market Value Share, 2025 |

|---|---|

| Brightening & glow | 35.2% |

| Others | 64.8% |

The brightening & glow segment is projected to contribute 35.2% of the Global Turmeric-Infused Actives Market revenue in 2025, maintaining its lead as the dominant functional category. This segment has grown due to rising global demand for skin luminosity, addressing issues like hyperpigmentation, pollution damage, and lifestyle-induced dullness. Turmeric’s natural capacity to inhibit melanin overproduction, coupled with its anti-inflammatory effects, positions it as an ideal solution for radiance-enhancing products.

Brands are increasingly blending turmeric with vitamin C and botanical antioxidants to enhance visible brightening results, particularly in serums and lotions. The appeal of holistic skin glow aligns strongly with both Eastern beauty ideals and Western wellness-driven beauty trends. This dual cultural resonance ensures that brightening & glow will retain its dominance over the forecast period.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams & lotions | 39.3% |

| Others | 60.7% |

The creams & lotions segment is forecasted to hold 39.3% of the market share in 2025, underscoring its role as the most widely adopted format. Creams and lotions benefit from being accessible, affordable, and part of everyday routines across global consumers. Unlike serums and oils that may be perceived as niche or premium, creams & lotions fit into daily skincare practices universally, from India and China to the USA and Europe.

The segment’s growth is also supported by innovation in multifunctional products, such as turmeric-based creams offering SPF protection, hydration, or microbiome balance. As global consumers continue to seek hybrid products that combine cosmetic and therapeutic value, creams & lotions are expected to remain the backbone of turmeric-infused actives, appealing to both mass-market buyers and premium clean-beauty consumers.

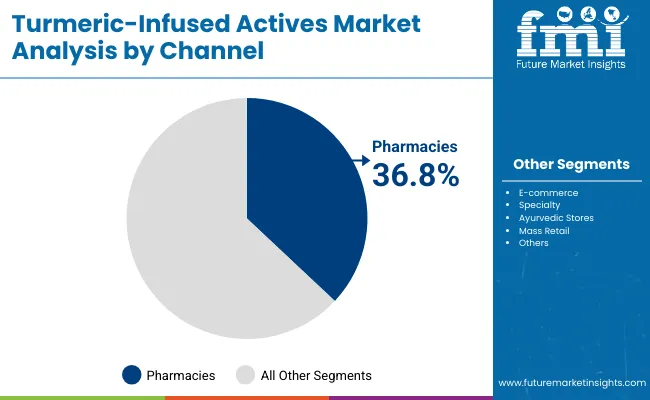

| Channel Segment | Market Value Share, 2025 |

|---|---|

| Pharmacies | 36.8% |

| Others | 63.2% |

The pharmacies segment is projected to account for 36.8% of the Global Turmeric-Infused Actives Market revenue in 2025, reflecting its role as a credibility-driven channel. Pharmacies serve as trusted distribution outlets, reinforcing turmeric-infused actives as not only cosmetic enhancers but also functional and wellness-oriented solutions. This is particularly relevant in Western markets, where consumers perceive pharmacy channels as a mark of safety, clinical validation, and higher product integrity.

The pharmacy channel also benefits from partnerships with Ayurvedic and natural brands expanding into dermocosmetics. For example, Ayurvedic creams positioned alongside pharmacy-exclusive dermocosmetics increase their legitimacy and accessibility. While e-commerce is rapidly growing and will likely surpass pharmacies by 2030, pharmacies are expected to retain their relevance by focusing on consumer education, consultation-based selling, and hybrid wellness-beauty product portfolios.

Rising Consumer Preference for Ayurvedic-Inspired and Natural Beauty

A major driver of the global turmeric-infused actives market is the increasing demand for Ayurvedic-inspired formulations and natural skincare solutions. Modern consumers, particularly in regions like South Asia & Pacific, East Asia, and North America, are shifting away from chemical-heavy products due to growing awareness of their long-term side effects. Turmeric, rooted in centuries-old Ayurveda and traditional medicine, has become a trusted symbol of authenticity, purity, and holistic wellness.

The brightening & glow function, which already accounts for 35.2% of the market share in 2025, directly reflects this driver. Consumers are not only attracted to turmeric for its natural glow-enhancing benefits but also for its multifunctional efficacy including anti-inflammatory, antibacterial, and antioxidant properties.

As global beauty standards increasingly embrace holistic wellness and “inside-out beauty,” turmeric-infused actives offer both therapeutic credibility and cosmetic appeal. This trend is reinforced by premium Ayurvedic brands like Forest Essentials and Kama Ayurveda, which have successfully exported the Ayurveda story to global consumers, influencing mainstream adoption.

E-commerce Expansion and Global Accessibility of Turmeric-Based Products

The rapid expansion of e-commerce and online beauty platforms is another strong growth driver. By 2025, pharmacies will account for 36.8% of sales, but online-first brands and Ayurvedic-focused specialty stores are fast gaining traction. E-commerce offers global consumers direct access to turmeric-infused products from India, Korea, and other emerging herbal hubs, while enabling smaller brands to scale internationally without the need for heavy offline infrastructure.

This has led to the rise of subscription models, personalized AI-based skincare solutions, and D2C (direct-to-consumer) strategies. For example, brands like Herbivore Botanicals and Innisfree are blending turmeric into clean-label and vegan product portfolios, using digital marketing to target niche audiences that care about sustainability and ingredient transparency.

The accessibility created by e-commerce ensures that turmeric actives are no longer confined to Ayurvedic stores in India or Asia but are available to consumers worldwide. Over the next decade, this accessibility will not only drive absolute growth but also increase consumer experimentation with premium turmeric-based serums, oils, and dermal patches.

Formulation Challenges with Stability and Efficacy of Turmeric Extracts

One of the major restraints of the turmeric-infused actives market lies in the formulation challenges around curcumin stability, solubility, and bioavailability. Curcumin, the primary bioactive in turmeric, is highly sensitive to light, heat, and oxidation. This creates difficulties in ensuring product stability, long shelf life, and consistent efficacy in topical formulations. Many mass-market products struggle to maintain performance levels, which can undermine consumer trust if results fall short of expectations.

To address this, brands are investing in advanced formulation technologies such as nanoencapsulation, liposomal delivery, and synergistic blending with stabilizers. However, these innovations increase production costs, making it harder for smaller Ayurvedic and organic players to compete with multinational giants. Unless formulation challenges are consistently addressed across the supply chain, consumer adoption in highly competitive Western markets could face resistance.

Regulatory Barriers and Inconsistent Global Standards for Herbal Cosmetics

Another significant restraint is the fragmented regulatory landscape governing herbal and Ayurvedic-inspired beauty products. While turmeric enjoys wide recognition in India and parts of Asia as a safe and traditional ingredient, regulatory frameworks in Europe, the USA, and Middle East impose stricter controls on claims, labelling, and clinical validation. For example, terms like “Ayurvedic” or “natural anti-inflammatory” cannot always be used freely in Western markets without scientific substantiation, limiting marketing flexibility for brands.

This fragmentation complicates international expansion for Ayurvedic brands. Companies must adapt product labels, formulations, and claims to comply with region-specific standards, increasing operational costs and slowing time-to-market. Additionally, certifications such as organic, vegan, and cruelty-free are becoming mandatory in consumer perception, but gaining these certifications adds layers of complexity for small-to-mid Ayurvedic brands seeking global distribution.

Convergence of Ayurveda with Clean-Label and Premium Beauty

A defining trend in the global turmeric-infused actives market is the fusion of traditional Ayurveda with modern clean-label beauty positioning. Consumers in both developed and emerging markets are seeking products that deliver authenticity without compromising on safety, traceability, or luxury appeal. Turmeric’s Ayurvedic heritage provides credibility, while claims like organic, vegan, and cruelty-free enhance its positioning in the global clean-beauty movement.

Premium players like Forest Essentials are exporting Ayurveda-backed luxury, while multinationals like L’Oréal and Unilever are integrating turmeric into mainstream product lines. This convergence is fueling the rise of hybrid turmeric formulations such as brightening serums enriched with curcumin nanoparticles, turmeric-oil masks blended with essential oils, and multifunctional lotions that combine turmeric with SPF and anti-aging peptides. By 2035, turmeric-infused actives will not only be perceived as heritage-based but also as a premium, science-backed choice within the clean-beauty ecosystem.

Growth of Personalized and E-Commerce-Enabled Skincare Models

Another key trend is the rise of personalization in turmeric-based skincare, powered by e-commerce and digital platforms. AI-driven skin analysis tools, subscription-based models, and online-first D2C brands are enabling customized product delivery. For example, consumers can now purchase turmeric-based formulations tailored to their skin tone, type, or lifestyle needs, moving beyond one-size-fits-all creams & lotions.

E-commerce has not only democratized access but also made turmeric actives highly discoverable in global beauty markets. Brands are using social media storytelling to emphasize turmeric’s cultural and wellness heritage, creating powerful brand narratives that resonate with Gen Z and millennial consumers. This trend aligns with data showing that China and India are among the fastest-growing markets (CAGR of 13.3% and 14.9% respectively), where younger consumers are increasingly engaging with online beauty ecosystems.

| Country | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 13.3% |

| USA | 5.5% |

| India | 14.9% |

| UK | 8.6% |

| Germany | 6.5% |

| Japan | 10.8% |

Between 2025 and 2035, the growth dynamics of the Global Turmeric-Infused Actives Market vary widely across key countries, reflecting differences in consumer awareness, cultural affinity, and retail maturity. India leads with a projected CAGR of 14.9%, supported by its strong Ayurvedic heritage, abundant turmeric supply, and increasing export of herbal cosmetics to international markets.

The Indian government’s active promotion of Ayurveda and natural wellness products further accelerates this trajectory. China follows with a CAGR of 13.3%, where demand is driven by the growing popularity of herbal and functional skincare, rising middle-class consumption, and the influence of K-beauty-inspired turmeric-infused creams and masks. Meanwhile, Japan, with a CAGR of 10.8%, demonstrates strong adoption of turmeric actives in anti-aging and brightening formulations, benefiting from consumers’ preference for science-backed natural solutions.

By contrast, Western markets show slower yet steady growth. The USA records a CAGR of 5.5%, where turmeric-infused actives are positioned more as clean-label and wellness-centric products rather than traditional Ayurveda-based offerings. Demand here is primarily concentrated in e-commerce and pharmacy channels, with brightening serums and creams gaining moderate traction.

Germany is projected at 6.5% CAGR, reflecting the country’s cautious yet rising adoption of organic and herbal skincare, while the UK grows at 8.6%, driven by clean beauty trends, multicultural consumer bases, and premium Ayurvedic product launches. Overall, the divergence between high-growth Asian markets and steady Western markets underscores the role of cultural resonance, affordability, and retail infrastructure in shaping the decade’s turmeric-infused actives demand.

| Year | USA Turmeric-Infused Actives Market (USD Million) |

|---|---|

| 2025 | 197.6 |

| 2026 | 219.6 |

| 2027 | 244.2 |

| 2028 | 271.4 |

| 2029 | 301.7 |

| 2030 | 335.4 |

| 2031 | 372.9 |

| 2032 | 414.5 |

| 2033 | 460.8 |

| 2034 | 512.3 |

| 2035 | 569.5 |

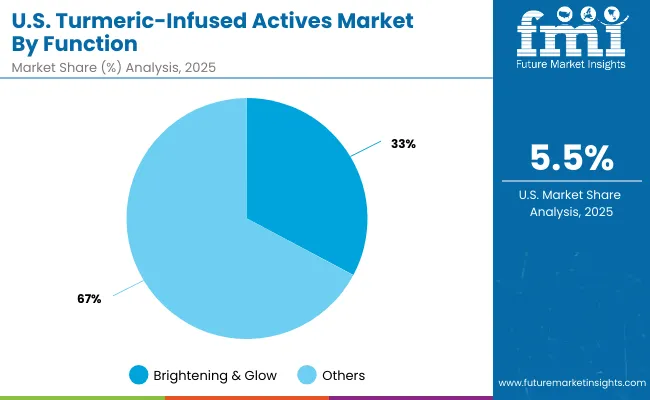

The Turmeric-Infused Actives Market in the United States is projected to grow at a CAGR of 5.5%, led by increased consumer interest in clean-label, Ayurvedic-inspired, and multifunctional skincare. Brightening & glow formulations account for 32.8% of functional share in 2025, reflecting demand for radiance-enhancing creams and serums. Pharmacies remain a strong channel due to their credibility, but e-commerce is rapidly gaining share as USA consumers experiment with turmeric-based serums, oils, and face masks promoted through wellness-driven digital campaigns. Innovation is shaped by hybrid beauty, where turmeric is blended with peptides, vitamin C, or ceramides to combine tradition with modern science.

The Turmeric-Infused Actives Market in the United Kingdom is expected to grow at a CAGR of 8.6%, supported by a strong clean beauty movement and growing multicultural demand for Ayurvedic-inspired skincare. Premium and mid-tier beauty retailers are expanding turmeric-infused creams, lotions, and oils, often positioned as natural radiance solutions. Multicultural communities with South Asian heritage fuel grassroots demand, while mainstream adoption is driven by clean-label, vegan, and organic positioning. The UK market is also seeing increasing collaborations between Ayurvedic brands and pharmacies, boosting accessibility and consumer trust.

India is witnessing the fastest growth globally, with the Turmeric-Infused Actives Market forecast to expand at a CAGR of 14.9% through 2035. Deep cultural familiarity with turmeric ensures widespread acceptance across both rural and urban segments, while the export potential of Ayurvedic skincare is expanding rapidly. Domestic players such as Vicco, Dabur, Himalaya Wellness, and Kama Ayurveda dominate distribution in pharmacies, Ayurvedic stores, and mass retail. Rising disposable incomes in tier-2 and tier-3 cities are unlocking new demand, while international recognition of Ayurveda drives premiumization.

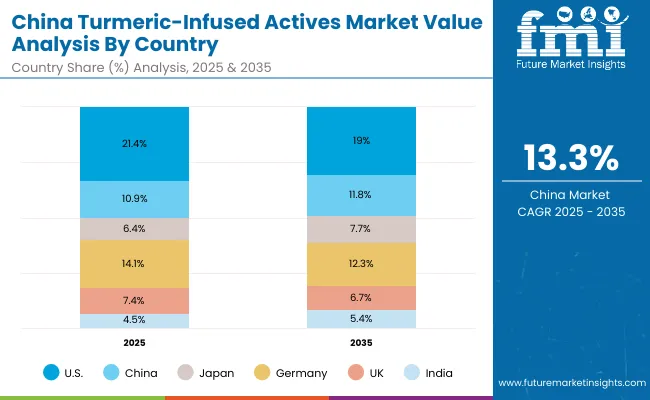

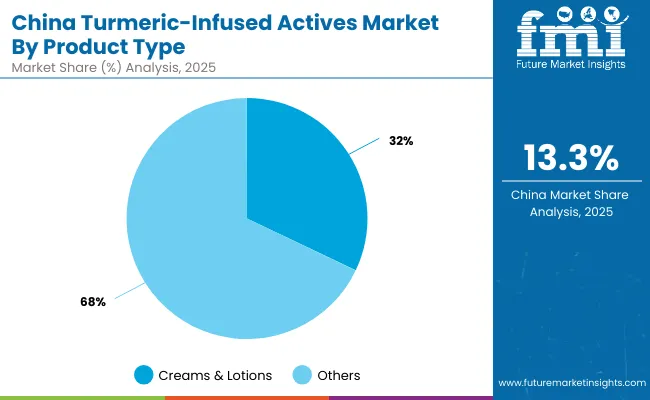

The Turmeric-Infused Actives Market in China is expected to grow at a CAGR of 13.3%, among the highest globally. This momentum is fueled by the country’s strong appetite for brightening creams, herbal formulations, and clean-label imports. By 2025, creams & lotions already represent 32.1% of market share, supported by K-beauty and J-beauty influences that emphasize glow and anti-aging. E-commerce dominates distribution, with turmeric-infused products widely marketed through social platforms and live-streaming channels. Affordable yet effective herbal formulations from domestic companies, combined with premium Ayurvedic imports, are expanding both entry-level and luxury segments.

| Country | 2025 Share (%) |

|---|---|

| USA | 21.4% |

| China | 10.9% |

| Japan | 6.4% |

| Germany | 14.1% |

| UK | 7.4% |

| India | 4.5% |

| Country | 2035 Share (%) |

|---|---|

| USA | 19.0% |

| China | 11.8% |

| Japan | 7.7% |

| Germany | 12.3% |

| UK | 6.7% |

| India | 5.4% |

| Function Segment | Market Value Share, 2025 |

|---|---|

| Brightening & glow | 32.8% |

| Others | 67.2% |

The Turmeric-Infused Actives Market in the United States is valued at USD 197.56 million in 2025, with brightening & glow leading at 32.8%. The dominance of this segment is a direct outcome of USA consumer preferences for radiance-enhancing skincare, particularly in creams and serums. Brightening products are strongly positioned within the clean beauty and dermocosmetic space, where turmeric is blended with vitamin C, niacinamide, or ceramides for visible glow results.

Pharmacies and e-commerce channels are the primary growth enablers, with pharmacies providing credibility while online-first Ayurvedic-inspired brands drive niche adoption. The rise of vegan, organic, and clean-label claims resonates with USA consumers who value ingredient transparency. This positions turmeric actives as a crossover category, straddling wellness, beauty, and therapeutic skincare. Other functional areas such as anti-inflammatory and anti-acne are gaining relevance, especially as turmeric-infused oils and masks penetrate younger demographics.

| Product Type Segment | Market Value Share, 2025 |

|---|---|

| Creams & lotions | 32.1% |

| Others | 67.9% |

The Turmeric-Infused Actives Market in China is valued at USD 100.97 million in 2025, with creams & lotions leading at 32.1%. The dominance of this product category reflects Chinese consumers’ preference for daily-use formulations that deliver both brightening and anti-aging benefits. K-beauty and J-beauty influences have strongly shaped the Chinese skincare ecosystem, with turmeric actives increasingly appearing in creams, masks, and serums promoted as natural radiance enhancers.

E-commerce platforms and social commerce (including livestreaming channels) are the central growth drivers, enabling both premium Ayurvedic imports and affordable domestic launches to reach a wide audience. Younger consumers are particularly drawn to turmeric actives due to their clean-label and herbal positioning, aligning with the broader shift toward functional, safe, and natural ingredients. While oils and serums are emerging as aspirational products, creams & lotions remain the mass-market backbone of turmeric adoption.

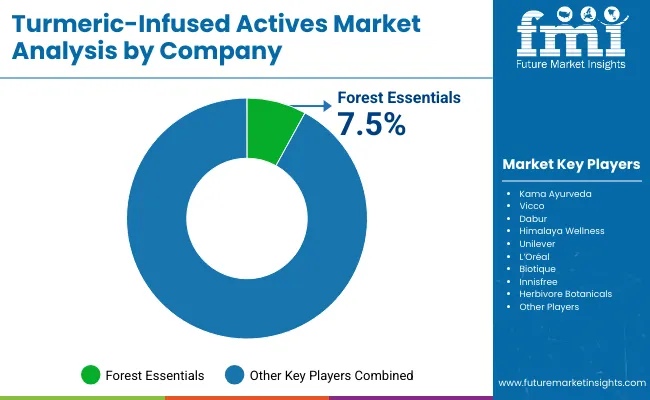

| Company | Global Value Share 2025 |

|---|---|

| Forest Essentials | 7.5% |

| Others | 92.5% |

The Global Turmeric-Infused Actives Market is highly fragmented, with Ayurvedic heritage brands, multinational FMCG leaders, and clean-beauty startups all competing across diverse segments. Forest Essentials, with a global value share of 7.5% in 2025, leads due to its strong Ayurvedic identity, premium positioning, and export-driven growth. Its luxury Ayurveda branding has made turmeric-based creams, serums, and oils a central offering in both domestic and international markets.

Indian-origin players such as Kama Ayurveda, Dabur, Himalaya Wellness, Biotique, and Vicco dominate the Ayurvedic and herbal segment, leveraging cultural trust and extensive pharmacy distribution. Their strength lies in affordability, mass appeal, and multi-channel presence across both traditional and modern retail outlets.

Global giants like Unilever and L’Oréal use turmeric-infused actives to diversify product portfolios, particularly in brightening creams, masks, and serums. They target clean-label beauty consumers while ensuring large-scale distribution through supermarkets, e-commerce platforms, and pharmacies. Meanwhile, K-beauty and Western clean-beauty innovators such as Innisfree and Herbivore Botanicals appeal to niche segments by blending turmeric with premium claims like vegan, organic, and cruelty-free.

Competitive differentiation is no longer about turmeric inclusion alone but about ecosystem strength fbrands that integrate ingredient transparency, premium positioning, sustainable sourcing, and digital-first distribution are gaining share. With consumer trust in Ayurvedic and herbal products increasing globally, competition is intensifying between traditional heritage players and multinational innovators that combine Ayurveda with modern dermocosmetic science.

Key Developments in Global Turmeric-Infused Actives Market

| Item | Value |

|---|---|

| Quantitative Units | USD 923.3 million |

| Function | Brightening & glow, Anti-inflammatory, Anti-acne, and Anti-aging |

| Product Type | Serums, Creams/lotions, Masks, and Oils |

| Channel | E-commerce, Mass retail, Pharmacies, and Specialty Ayurvedic stores |

| Claim | Ayurvedic -inspired, Clean-label, Organic, and Vegan |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Forest Essentials, Kama Ayurveda, Vicco , Dabur, Himalaya Wellness, Unilever, L’Oréal, Biotique , Innisfree, Herbivore Botanicals |

| Additional Attributes | Dollar sales by function and product type, adoption trends in brightening and anti-inflammatory skincare, rising demand for vegan and Ayurvedic -inspired claims, segment-specific growth in creams & lotions and serums, e-commerce and pharmacy channel expansion, integration of clean-label and eco-friendly packaging, regional trends influenced by Ayurveda and K-beauty, and innovations in organic and sustainable formulations. |

The Global Turmeric-Infused Actives Market is estimated to be valued at USD 923.3 million in 2025.

The market size for the Global Turmeric-Infused Actives Market is projected to reach USD 2,994.3 million by 2035.

The Global Turmeric-Infused Actives Market is expected to grow at a 12.5% CAGR between 2025 and 2035.

The key product types in the Global Turmeric-Infused Actives Market are serums, creams/lotions, masks, and oils.

In terms of function, the brightening & glow segment is expected to command the largest share at 35.2% in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Botanical Bioactives Market Size and Share Forecast Outlook 2025 to 2035

Bio-Fermented Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Sea Buckthorn Actives Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Cellular Renewal Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pomegranate Peel Actives Market Size and Share Forecast Outlook 2025 to 2035

Beta-Glucan-Based Actives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Biorhythmic Skincare Actives Market Size and Share Forecast Outlook 2025 to 2035

Antiperspirants / Deo-Actives Market Size and Share Forecast Outlook 2025 to 2035

Bio-Fermented Skincare Actives Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA