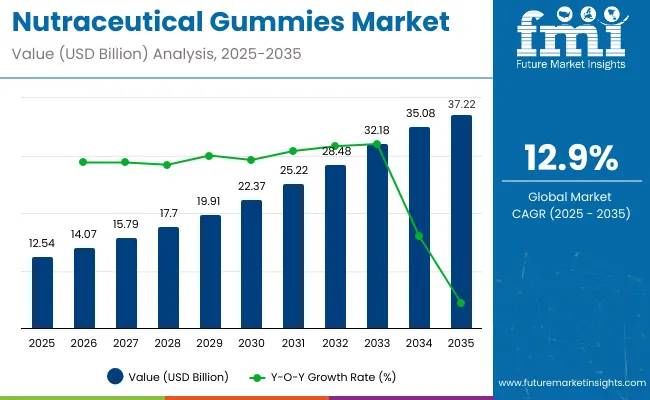

The global nutraceutical gummies market is poised for dynamic growth, with its valuation expected to increase from approximately USD 12.54 billion in 2025 to nearly USD 37.22 billion by 2035. This growth corresponds to a robust CAGR of 12.9% over the forecast period. The market’s expansion is driven by the increasing consumer inclination towards health and wellness, coupled with a rising preference for convenient, flavorful, and easy-to-consume dietary supplements.

Nutraceutical gummies represent a popular alternative to traditional supplement forms such as tablets, capsules, and powders. Their chewable nature, combined with the incorporation of functional ingredients like vitamins, minerals, botanicals, probiotics, and omega-3 fatty acids, appeals to a wide demographic including adults and children. The palatability and convenience offered by gummies support better compliance with daily supplement intake, particularly among pediatric and geriatric consumers who may face difficulties with conventional formats.

The growing focus on preventive healthcare and holistic wellness significantly contributes to the demand for nutraceutical gummies. Consumers are increasingly seeking supplements that not only address nutritional deficiencies but also support immune health, cognitive function, digestive wellness, and beauty from within. This shift aligns with broader trends emphasizing natural and functional nutrition, fueling product innovation and market diversification.

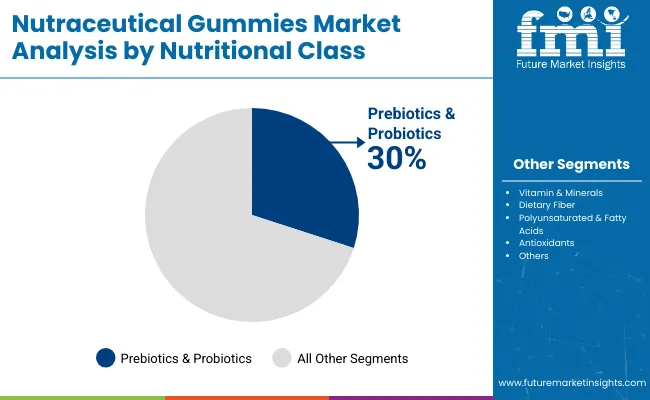

Market segmentation includes various gummy formulations targeting specific health benefits, such as immune boosters, multivitamins, omega fatty acids, and probiotics. Immune support gummies hold a significant share due to heightened health awareness and demand for products that help mitigate infection risks. Probiotic gummies are also gaining traction, driven by increasing consumer interest in gut health and digestive balance.

In May 2024, Goli Nutrition launched its Matcha Mind Cognitive Gummies, formulated with matcha powder and Cognizin® to support focus and attention. The product was introduced nationwide at retailers including Target, CVS, and Kroger, as well as online platforms such as Amazon and Goli.com. Within 24 hours of launch, it ranked among the top 20 products in its category on Amazon.

Sustainability and clean-label considerations influence product development strategies within the market. Manufacturers are adopting natural flavors, colors, and organic ingredients while minimizing artificial additives to meet consumer expectations for transparency and healthfulness. Packaging innovations that enhance product freshness and reduce environmental impact are also becoming important.

Despite the positive growth trajectory, challenges such as regulatory complexities, ingredient sourcing, and quality control need to be managed carefully. Ensuring safety and efficacy through rigorous testing and compliance with varying regional standards remains critical for market players.

Per capita spending on nutraceutical gummies is increasing globally as consumers shift toward convenient, palatable, and functional health supplements. These gummies deliver vitamins, minerals, herbal extracts, and other bioactives in an easy-to-consume format, appealing to both adults and children. Rising health awareness, preventive healthcare trends, and demand for clean-label, sugar-free, and vegan options are key factors driving up individual spending in this segment.

Developed Countries:

In regions such as the United States, Canada, Germany, the United Kingdom, and Australia, per capita spending on nutraceutical gummies is relatively high. Consumers are willing to pay premium prices for gummies that offer benefits such as immunity support, sleep aid, beauty enhancement, and gut health. Leading brands include Olly, Nature’s Bounty, SmartyPants, and Vitafusion. E-commerce platforms, health food stores, and pharmacies play a major role in product accessibility and category growth.

Emerging Markets:

Countries including India, Brazil, Indonesia, South Africa, and Mexico are experiencing a steady rise in per capita spending on nutraceutical gummies. Increasing middle-class incomes, urbanization, and greater awareness of nutritional deficiencies are driving adoption. Local and international brands like Power Gummies, Goli, and Wellbeing Nutrition are expanding their presence through digital marketing, influencer partnerships, and availability on online retail platforms. The youth and millennial population is a key consumer base fueling this growth.

Nutraceutical gummies, positioned between food and pharmaceuticals, are regulated to ensure product safety, quality, and truthful marketing. Government authorities around the world set standards related to ingredients, health claims, labeling, and manufacturing practices to protect consumers and prevent misleading information.

Ingredient and Safety Regulations:

Nutraceutical gummies must comply with national regulations governing the use of vitamins, minerals, herbal extracts, and other bioactive compounds. In the United States, the Food and Drug Administration (FDA) regulates these products under the Dietary Supplement Health and Education Act (DSHEA). In the European Union, the European Food Safety Authority (EFSA) oversees safety assessments of ingredients.

Labeling and Health Claims:

Labeling regulations govern how nutraceutical gummies are marketed. Claims about health benefits, such as “supports immunity” or “promotes sleep,” must be supported by scientific evidence and fall within allowable guidelines. The FDA, EFSA, and national agencies in Canada, India (FSSAI), and Australia (TGA) enforce rules against unapproved disease-treatment claims. Products must also include disclaimers, ingredient lists, nutritional facts, and usage instructions.

Prebiotics and probiotics gummies are widely sold because they offer a convenient, tasty, and easy-to-consume alternative to traditional supplements. These gummies support digestive health, boost immunity, and promote overall gut balance, which appeals to a broad consumer base seeking natural wellness solutions. Unlike capsules or powders, gummies are more enjoyable to take, making them especially popular among children and adults who dislike swallowing pills.

Their appealing flavors and attractive packaging also enhance consumer interest. As awareness of gut health and the importance of microbiome balance grows, demand for functional and accessible formats like gummies continues to rise in the health supplement market.

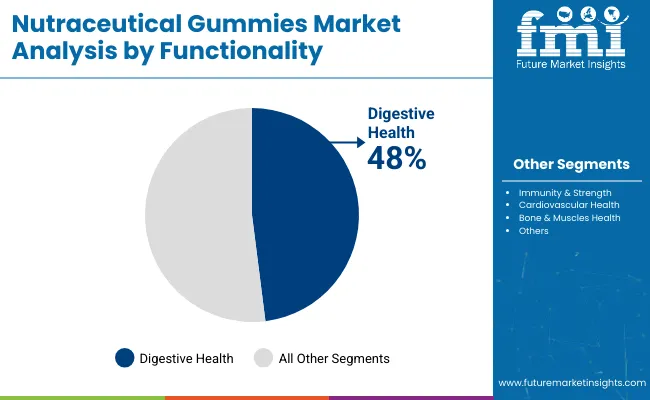

Nutraceutical gummies are widely sold for digestive health because they combine effectiveness with convenience and taste, making them more appealing than traditional pills or powders. These gummies often contain ingredients like fiber, prebiotics, probiotics, and digestive enzymes that support gut function and overall digestive balance.

Their chewable form makes them easier to consume, especially for children and adults who have difficulty swallowing capsules. The growing awareness of gut health’s impact on immunity and well-being has increased demand for user-friendly supplements. Additionally, their attractive flavors and on-the-go portability contribute to their popularity in the health and wellness market.

North America leads the market due to high supplement consumption, preventive health awareness, and innovative products. The USA is by far the leader, with wide adoption of gummies for sleep, stress, and immunity, with brands incorporating apple cider vinegar, melatonin, ashwagandha, and collagen. They have a good online retail ecosystem and influencer marketing which aids in building the brand.

Europe is a mature but growing market, with particularly strong traction in Germany, the UK, France and Italy. The EFSA framework has enabled regulatory alignment, generating consumer confidence in functional supplements such as multivitamin and immune support gummies.

The Asia-Pacific region is anticipated to grow at the highest rate, particularly in developing countries like China, India, Japan, South Korea, and Australia. Healthcare awareness is rising across the region, as is consumer demand for on-the-go nutrition and crossover into functional food & beverage. Regional players are working with traditional components (such as ginseng, turmeric, green tea) in gummies that appeal to regional taste.

Reactor Sugar Content Concerns and Stability of Active Ingredients

Formulating nutraceuticals as gummies is complex, especially in achieving the stability and bioavailability of certain active ingredients (vitamins, minerals, adaptogens, probiotics, etc.) in gummy form. Furthermore, the presence of sugar or sugar substitutes has provided reasons for concern to diabetic or weight-wary consumers, and heat sensitivity and moisture retention present challenges to shelf-life and packaging. And, regulatory confusion about labeling (supplement vs. food) and ingredient efficacy claims means consumer trust and product marketing might be hampered.

Growing Demand for Convenient, Tasty, and Functional Wellness Products

Against that backdrop, demand is booming as consumers - especially millennials, Gen Z and aging populations - increasingly seek tasty, convenient and fun formats for their daily health and wellness routines. Gummies are increasingly popular for delivering multivitamins, sleep aids (melatonin), immunity boosters (vitamin C, zinc), stress relief (ashwagandha, magnesium) and gut health (fiber, probiotics). The growing popularity of vegan, sugar-free, and clean-label gummies and advancing bioactive delivery systems and 3D-printed personalized nutrition are broadening the market across demographics and health categories.

Between 2020 and 2024, the market exploded as pandemic-era wellness consciousness surged and gummies focused on immunity began to take hold. Limitations in production scalability, quality control, and differentiation, however, led to brand saturation and consumer skepticism in some product categories.

By 2025 to 2035 the market is predicted to turn into a personalized, targeted and sustainable wellness platform with AI powered nutrition planning, functional gummy stacks (multiple health benefits combined in one), customized formulas based on age, genetics and lifestyle data. Also, biodegradable packaging, alternatives to sugar and the traceability of ingredients will inform brand loyalty.

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Oversight by FDA (DSHEA), EFSA, and local supplement authorities |

| Technology Innovations | Use of pectin, gelatin, and standard flavoring systems |

| Market Adoption | Popular among children, young adults, and general wellness users |

| Sustainability Trends | Limited use of sustainable packaging or biodegradable materials |

| Market Competition | Led by Olly, Nature’s Bounty, SmartyPants, Goli, Vitafusion, Nordic Naturals |

| Consumer Trends | Demand for multivitamin, immunity, and beauty-from-within gummies |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Stricter standards for dosage accuracy, clean-label claims, and bioavailability validation |

| Technology Innovations | Growth in encapsulation tech, heat-stable actives, and 3D-printed custom gummies |

| Market Adoption | Expansion into elderly care, sports nutrition, nootropics, and hormonal wellness |

| Sustainability Trends | Large-scale adoption of plastic-free wrappers, refillable formats, and vegan/organic inputs |

| Market Competition | Entry of AI-personalized nutrition brands, pharma-crossover supplements, and low-GI gummy startups |

| Consumer Trends | Rise of customized wellness stacks, sugar-free botanical blends, and gut-brain axis support gummies |

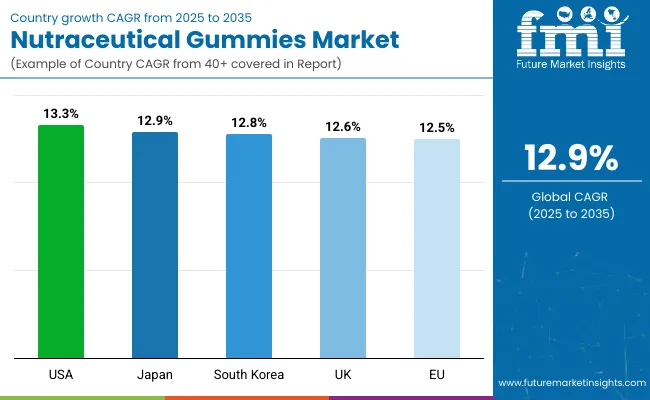

The United States nutraceutical gummies industry is burgeoning owing to shifting consumer demand towards convenient, delicious and functional health supplements. Touted adoption (by adults and children alike) is being driven (largely) by strong demand for gummy formulations of vitamins, minerals, probiotics and sleep-support formulations.

Market momentum is being supported by the presence of existing large nutraceutical and wellness brands, planned expansion of direct-to-consumer (DTC) channels, and increasing awareness around preventive health. Continuous innovation in sugar-free, vegan, and organic gummy formats is also driving growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 13.3% |

The UK nutraceutical gummies market is growing to an increasing desire for wellness, immunity, and stress management. But gummies have become a popular alternative to pills and powders - particularly among millennials and Gen Z.

Gummies containing multivitamins, collagen and CBD are in demand on both retail and online formats. The transition to clean-label, plant-based, and allergen-free formulations is also fueling innovation and consumer loyalty.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.6% |

The rising health consciousness, increasing popularity of functional food, and market acceptance of the consumption of gummies as an approved delivery format of dietary supplements, are the major factors which have fuelled the growth of European Union (EU) Nutraceutical Gummies market.

Germany, France and Italy are major markets, and the consumption of immune-boosting and sleep-enhancing gummies is on the rise. Aiming for sustainable and natural ingredients, EU is stimulating brands to create gummies with organic actives and biodegradable packaging.

| Region | CAGR (2025 to 2035) |

|---|---|

| EU | 12.5% |

Japan nutraceutical gummies market is registering stable growth due to high demand for compact and easy-to-consume functional products. The gummies format is particularly gaining traction in the anti-aging, digestive health, and energy-boosting segments among older adults and working professionals.

Japanese manufacturers focus on flavor, portion control and scientifically supported ingredients. The popularity of collagen, vitamin C, gummies based on enzymes; and dual-texture and functional candy-like formats persis.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 12.9% |

South Korea nutraceutical gummies market is witnessing an exponential growth due to increasing consumer interest in personalized nutrition, K-beauty wellness and immunity support. The adoption of gummies as a trendy, more flavorful supplement format tends to skew to young adults and female consumers.

Gum products for probiotics, biotin, and detox-support are especially booming, with demand bolstered by social media influencers and online health platforms. Local players are innovating functional blends and eye-catching packages to snag the youth segment.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 12.8% |

The nutraceutical gummies market is rapidly growing due to increasing consumer demand for convenient, tasty, and effective dietary supplements. Market research enabled by machines Chews offer a more palatable alternative to the usual capsules and tablets, particularly among children, older adults, and health-oriented adults. The direction of the market reflects trends in immunity boosting, beauty-from-within, sleep and stress support, vegan formats, sugar-free formulations - as well as innovation in functional ingredient delivery and clean-label compliance.

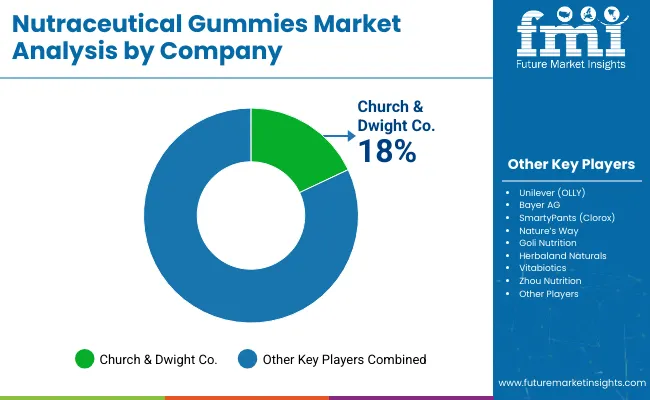

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Church & Dwight Co., Inc. (Vitafusion) | 18-22% |

| Unilever (OLLY Nutrition) | 14-18% |

| Bayer AG (One A Day, Flintstones) | 12-16% |

| SmartyPants Vitamins (The Clorox Company) | 10-14% |

| Nature’s Way Products, LLC | 8-12% |

| Others | 26-32% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Church & Dwight Co., Inc. | Markets Vitafusion and L’il Critters gummies for adult multivitamins, hair & skin, prenatal, and immune health. |

| Unilever (OLLY Nutrition) | Offers trendy, flavorful gummies focused on mood, sleep, beauty, and women’s health, appealing to younger demographics. |

| Bayer AG | Provides legacy multivitamin gummy lines under One A Day and Flintstones, trusted by families and pediatricians. |

| SmartyPants Vitamins | Produces non-GMO, allergen-free, and sugar-reduced gummies, featuring omega-3s, fiber, and probiotics. |

| Nature’s Way Products, LLC | Offers Botanical and herb-based nutraceutical gummies, including elderberry, ashwagandha, and apple cider vinegar formulas. |

Church & Dwight Co., Inc. (18-22%)

With Vitafusion and L’il Critters, the company leads in both adult and children’s segments, offering high-dose, flavor-forward, and shelf-stable gummies for everyday wellness.

Unilever (OLLY Nutrition) (14-18%)

OLLY is a millennial-focused brand known for its vibrant packaging, influencer marketing, and mood-support, sleep, and women’s health focused gummies.

Bayer AG (12-16%)

Bayer’s gummy supplements are backed by clinical credibility, appealing to family buyers, with formulations that support daily multivitamin needs.

SmartyPants Vitamins (10-14%)

This brand emphasizes transparency, purity, and functional nutrition, offering gummies with combined benefits (e.g., vitamins + omega-3 + fiber).

Nature’s Way Products (8-12%)

Nature’s Way leads in botanical nutraceutical gummies, responding to demand for herbal, clean-label, and immunity-boosting solutions.

Other Key Players (26-32% Combined)

Emerging and specialty brands are contributing to market growth through novel ingredients, targeted formulations, and premium wellness positioning, including:

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 12.54 billion |

| Projected Market Size (2035) | USD 37.22 billion |

| CAGR (2025 to 2035) | 12.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Nutritional Classes Analyzed (Segment 1) | Vitamin & Minerals, Dietary Fiber, Prebiotics & Probiotics, Polyunsaturated & Fatty Acids, Antioxidants |

| Functionalities Covered (Segment 2) | Digestive Health, Immunity & Strength, Cardiovascular Health, Bone & Muscles Health |

| Age Groups Analyzed (Segment 3) | Paediatric, Geriatric, Adult |

| Distribution Channels Assessed (Segment 4) | Hospital Pharmacies, Retail Pharmacies, Drugstores, Supermarkets, Online Stores |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; Middle East & Africa |

| Countries Covered | United States, United Kingdom, Germany, France, Italy, China, India, Japan, South Korea, Australia |

| Key Players Influencing the Market | Church & Dwight Co. (Vitafusion), Unilever (OLLY), Bayer AG, SmartyPants (Clorox), Nature’s Way, Goli Nutrition, Herbaland Naturals, Vitabiotics, Zhou Nutrition |

| Additional Attributes | Dollar sales by nutritional class (vitamins, fiber, probiotics), regional demand by age segment, e-commerce sales growth, personalized stack-based formats, plant-based and gelatin-free innovation, regulatory and clinical trial evolution |

| Customization and Pricing | Customization and Pricing Available on Request |

The overall market size for nutraceutical gummies market was USD 12.54 billion in 2025.

The nutraceutical gummies market is expected to reach USD 37.22 billion in 2035.

Growing consumer preference for convenient and tasty supplement formats, rising awareness of preventive healthcare, and increasing demand for functional ingredients will drive market growth.

The top 5 countries which drives the development of nutraceutical gummies market are USA, European Union, Japan, South Korea and UK

Vitamin C gummies expected to grow to command significant share over the assessment period.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Nutritional Class, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nutritional Class, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Functionality, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 7: Global Market Value (US$ million) Forecast by Age, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Age, 2018 to 2033

Table 9: Global Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ million) Forecast by Nutritional Class, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Nutritional Class, 2018 to 2033

Table 15: North America Market Value (US$ million) Forecast by Functionality, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 17: North America Market Value (US$ million) Forecast by Age, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Age, 2018 to 2033

Table 19: North America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ million) Forecast by Nutritional Class, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Nutritional Class, 2018 to 2033

Table 25: Latin America Market Value (US$ million) Forecast by Functionality, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 27: Latin America Market Value (US$ million) Forecast by Age, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Age, 2018 to 2033

Table 29: Latin America Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 31: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ million) Forecast by Nutritional Class, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Nutritional Class, 2018 to 2033

Table 35: Europe Market Value (US$ million) Forecast by Functionality, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 37: Europe Market Value (US$ million) Forecast by Age, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Age, 2018 to 2033

Table 39: Europe Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 41: East Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 42: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: East Asia Market Value (US$ million) Forecast by Nutritional Class, 2018 to 2033

Table 44: East Asia Market Volume (MT) Forecast by Nutritional Class, 2018 to 2033

Table 45: East Asia Market Value (US$ million) Forecast by Functionality, 2018 to 2033

Table 46: East Asia Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 47: East Asia Market Value (US$ million) Forecast by Age, 2018 to 2033

Table 48: East Asia Market Volume (MT) Forecast by Age, 2018 to 2033

Table 49: East Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 51: South Asia Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 52: South Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: South Asia Market Value (US$ million) Forecast by Nutritional Class, 2018 to 2033

Table 54: South Asia Market Volume (MT) Forecast by Nutritional Class, 2018 to 2033

Table 55: South Asia Market Value (US$ million) Forecast by Functionality, 2018 to 2033

Table 56: South Asia Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 57: South Asia Market Value (US$ million) Forecast by Age, 2018 to 2033

Table 58: South Asia Market Volume (MT) Forecast by Age, 2018 to 2033

Table 59: South Asia Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 60: South Asia Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 61: Oceania Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 62: Oceania Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: Oceania Market Value (US$ million) Forecast by Nutritional Class, 2018 to 2033

Table 64: Oceania Market Volume (MT) Forecast by Nutritional Class, 2018 to 2033

Table 65: Oceania Market Value (US$ million) Forecast by Functionality, 2018 to 2033

Table 66: Oceania Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 67: Oceania Market Value (US$ million) Forecast by Age, 2018 to 2033

Table 68: Oceania Market Volume (MT) Forecast by Age, 2018 to 2033

Table 69: Oceania Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 70: Oceania Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ million) Forecast by Nutritional Class, 2018 to 2033

Table 74: Middle East and Africa Market Volume (MT) Forecast by Nutritional Class, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ million) Forecast by Functionality, 2018 to 2033

Table 76: Middle East and Africa Market Volume (MT) Forecast by Functionality, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ million) Forecast by Age, 2018 to 2033

Table 78: Middle East and Africa Market Volume (MT) Forecast by Age, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ million) Forecast by Distribution Channel, 2018 to 2033

Table 80: Middle East and Africa Market Volume (MT) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Nutritional Class, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Functionality, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Age, 2023 to 2033

Figure 4: Global Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 5: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ million) Analysis by Nutritional Class, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Nutritional Class, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Nutritional Class, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nutritional Class, 2023 to 2033

Figure 14: Global Market Value (US$ million) Analysis by Functionality, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 18: Global Market Value (US$ million) Analysis by Age, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Age, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Age, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Age, 2023 to 2033

Figure 22: Global Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Nutritional Class, 2023 to 2033

Figure 27: Global Market Attractiveness by Functionality, 2023 to 2033

Figure 28: Global Market Attractiveness by Age, 2023 to 2033

Figure 29: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ million) by Nutritional Class, 2023 to 2033

Figure 32: North America Market Value (US$ million) by Functionality, 2023 to 2033

Figure 33: North America Market Value (US$ million) by Age, 2023 to 2033

Figure 34: North America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 35: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ million) Analysis by Nutritional Class, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Nutritional Class, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Nutritional Class, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nutritional Class, 2023 to 2033

Figure 44: North America Market Value (US$ million) Analysis by Functionality, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 48: North America Market Value (US$ million) Analysis by Age, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Age, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Age, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Age, 2023 to 2033

Figure 52: North America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Nutritional Class, 2023 to 2033

Figure 57: North America Market Attractiveness by Functionality, 2023 to 2033

Figure 58: North America Market Attractiveness by Age, 2023 to 2033

Figure 59: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ million) by Nutritional Class, 2023 to 2033

Figure 62: Latin America Market Value (US$ million) by Functionality, 2023 to 2033

Figure 63: Latin America Market Value (US$ million) by Age, 2023 to 2033

Figure 64: Latin America Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ million) Analysis by Nutritional Class, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Nutritional Class, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nutritional Class, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nutritional Class, 2023 to 2033

Figure 74: Latin America Market Value (US$ million) Analysis by Functionality, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 78: Latin America Market Value (US$ million) Analysis by Age, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Age, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Age, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Age, 2023 to 2033

Figure 82: Latin America Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Nutritional Class, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Functionality, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Age, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ million) by Nutritional Class, 2023 to 2033

Figure 92: Europe Market Value (US$ million) by Functionality, 2023 to 2033

Figure 93: Europe Market Value (US$ million) by Age, 2023 to 2033

Figure 94: Europe Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ million) Analysis by Nutritional Class, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Nutritional Class, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Nutritional Class, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Nutritional Class, 2023 to 2033

Figure 104: Europe Market Value (US$ million) Analysis by Functionality, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 108: Europe Market Value (US$ million) Analysis by Age, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Age, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Age, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Age, 2023 to 2033

Figure 112: Europe Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Nutritional Class, 2023 to 2033

Figure 117: Europe Market Attractiveness by Functionality, 2023 to 2033

Figure 118: Europe Market Attractiveness by Age, 2023 to 2033

Figure 119: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: East Asia Market Value (US$ million) by Nutritional Class, 2023 to 2033

Figure 122: East Asia Market Value (US$ million) by Functionality, 2023 to 2033

Figure 123: East Asia Market Value (US$ million) by Age, 2023 to 2033

Figure 124: East Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 125: East Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 126: East Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 127: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: East Asia Market Value (US$ million) Analysis by Nutritional Class, 2018 to 2033

Figure 131: East Asia Market Volume (MT) Analysis by Nutritional Class, 2018 to 2033

Figure 132: East Asia Market Value Share (%) and BPS Analysis by Nutritional Class, 2023 to 2033

Figure 133: East Asia Market Y-o-Y Growth (%) Projections by Nutritional Class, 2023 to 2033

Figure 134: East Asia Market Value (US$ million) Analysis by Functionality, 2018 to 2033

Figure 135: East Asia Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 136: East Asia Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 137: East Asia Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 138: East Asia Market Value (US$ million) Analysis by Age, 2018 to 2033

Figure 139: East Asia Market Volume (MT) Analysis by Age, 2018 to 2033

Figure 140: East Asia Market Value Share (%) and BPS Analysis by Age, 2023 to 2033

Figure 141: East Asia Market Y-o-Y Growth (%) Projections by Age, 2023 to 2033

Figure 142: East Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 143: East Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 144: East Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 145: East Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 146: East Asia Market Attractiveness by Nutritional Class, 2023 to 2033

Figure 147: East Asia Market Attractiveness by Functionality, 2023 to 2033

Figure 148: East Asia Market Attractiveness by Age, 2023 to 2033

Figure 149: East Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 150: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia Market Value (US$ million) by Nutritional Class, 2023 to 2033

Figure 152: South Asia Market Value (US$ million) by Functionality, 2023 to 2033

Figure 153: South Asia Market Value (US$ million) by Age, 2023 to 2033

Figure 154: South Asia Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 155: South Asia Market Value (US$ million) by Country, 2023 to 2033

Figure 156: South Asia Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 157: South Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: South Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia Market Value (US$ million) Analysis by Nutritional Class, 2018 to 2033

Figure 161: South Asia Market Volume (MT) Analysis by Nutritional Class, 2018 to 2033

Figure 162: South Asia Market Value Share (%) and BPS Analysis by Nutritional Class, 2023 to 2033

Figure 163: South Asia Market Y-o-Y Growth (%) Projections by Nutritional Class, 2023 to 2033

Figure 164: South Asia Market Value (US$ million) Analysis by Functionality, 2018 to 2033

Figure 165: South Asia Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 166: South Asia Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 167: South Asia Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 168: South Asia Market Value (US$ million) Analysis by Age, 2018 to 2033

Figure 169: South Asia Market Volume (MT) Analysis by Age, 2018 to 2033

Figure 170: South Asia Market Value Share (%) and BPS Analysis by Age, 2023 to 2033

Figure 171: South Asia Market Y-o-Y Growth (%) Projections by Age, 2023 to 2033

Figure 172: South Asia Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 173: South Asia Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 174: South Asia Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 175: South Asia Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 176: South Asia Market Attractiveness by Nutritional Class, 2023 to 2033

Figure 177: South Asia Market Attractiveness by Functionality, 2023 to 2033

Figure 178: South Asia Market Attractiveness by Age, 2023 to 2033

Figure 179: South Asia Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 180: South Asia Market Attractiveness by Country, 2023 to 2033

Figure 181: Oceania Market Value (US$ million) by Nutritional Class, 2023 to 2033

Figure 182: Oceania Market Value (US$ million) by Functionality, 2023 to 2033

Figure 183: Oceania Market Value (US$ million) by Age, 2023 to 2033

Figure 184: Oceania Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 185: Oceania Market Value (US$ million) by Country, 2023 to 2033

Figure 186: Oceania Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 187: Oceania Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 188: Oceania Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: Oceania Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: Oceania Market Value (US$ million) Analysis by Nutritional Class, 2018 to 2033

Figure 191: Oceania Market Volume (MT) Analysis by Nutritional Class, 2018 to 2033

Figure 192: Oceania Market Value Share (%) and BPS Analysis by Nutritional Class, 2023 to 2033

Figure 193: Oceania Market Y-o-Y Growth (%) Projections by Nutritional Class, 2023 to 2033

Figure 194: Oceania Market Value (US$ million) Analysis by Functionality, 2018 to 2033

Figure 195: Oceania Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 196: Oceania Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 197: Oceania Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 198: Oceania Market Value (US$ million) Analysis by Age, 2018 to 2033

Figure 199: Oceania Market Volume (MT) Analysis by Age, 2018 to 2033

Figure 200: Oceania Market Value Share (%) and BPS Analysis by Age, 2023 to 2033

Figure 201: Oceania Market Y-o-Y Growth (%) Projections by Age, 2023 to 2033

Figure 202: Oceania Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 203: Oceania Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 204: Oceania Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 205: Oceania Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 206: Oceania Market Attractiveness by Nutritional Class, 2023 to 2033

Figure 207: Oceania Market Attractiveness by Functionality, 2023 to 2033

Figure 208: Oceania Market Attractiveness by Age, 2023 to 2033

Figure 209: Oceania Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 210: Oceania Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ million) by Nutritional Class, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ million) by Functionality, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ million) by Age, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ million) by Distribution Channel, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ million) Analysis by Nutritional Class, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (MT) Analysis by Nutritional Class, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Nutritional Class, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Nutritional Class, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ million) Analysis by Functionality, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (MT) Analysis by Functionality, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Functionality, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Functionality, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ million) Analysis by Age, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (MT) Analysis by Age, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Age, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Age, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ million) Analysis by Distribution Channel, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (MT) Analysis by Distribution Channel, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Nutritional Class, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Functionality, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Age, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Nutraceutical Packaging Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical CDMO Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Contract Manufacturing Services Market Size and Share Forecast Outlook 2025 to 2035

Nutraceutical Excipients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Actives Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceutical Rigid Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Nutraceuticals Market Size, Growth, and Forecast for 2025 to 2035

Nutraceutical Ingredients Market Analysis by Product, Form, Application and Region through 2035

Key Companies & Market Share in Nutraceutical Packaging Sector

Nutraceutical Flexible Packaging Market

Halal Nutraceuticals and Vaccines Market Growth - Trends & Forecast 2025 to 2035

Marine Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

Herbal Nutraceuticals Market Size and Share Forecast Outlook 2025 to 2035

Asia Pacific Nutraceutical Market Size and Share Forecast Outlook 2025 to 2035

MENA Nutraceuticals Market Trends – Dietary Supplements & Functional Foods

CBD Gummies Market Analysis - Size, Share and Forecast Outlook 2025 to 2035

CoQ10 Gummies Market Analysis by Source, Distribution Channels, and Key Regions Through 2035

Biotin Gummies Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Citrus Gummies Market Analysis - Flavor Trends & Growth 2025 to 2035

Ectoin Gummies Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA