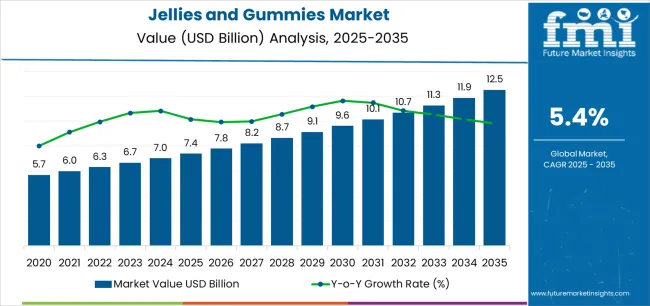

The global jellies and gummies market is valued at USD 7.4 billion in 2025. It is slated to reach USD 12.5 billion by 2035, recording an absolute increase of USD 5.1 billion over the forecast period. This translates into a total growth of 69.0%, with the market forecast to expand at a CAGR of 5.4% between 2025 and 2035. The market size is expected to grow by nearly 1.69X during the same period, supported by increasing demand for functional and fortified confectionery products, growing adoption of jellies and gummies as convenient nutritional supplement delivery formats, and rising emphasis on innovative flavors and natural ingredients across diverse children, youth, and adult consumer applications.

Between 2025 and 2030, the jellies and gummies market is projected to expand from USD 7.4 billion to USD 9.6 billion, resulting in a value increase of USD 2.2 billion, which represents 43.1% of the total forecast growth for the decade. This phase of development will be shaped by increasing consumer preference for functional confectionery and fortified snacking options, rising adoption of gummy-format vitamins and dietary supplements, and growing demand for natural ingredients and clean-label formulations across confectionery and nutraceutical sectors. Confectionery manufacturers and supplement producers are expanding their jellies and gummies capabilities to address the growing demand for enjoyable and convenient product formats that ensure consumer compliance and taste satisfaction while supporting nutritional goals.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 7.4 billion |

| Forecast Value in (2035F) | USD 12.5 billion |

| Forecast CAGR (2025 to 2035) | 5.4% |

From 2030 to 2035, the market is forecast to grow from USD 9.6 billion to USD 12.5 billion, adding another USD 2.9 billion, which constitutes 56.9% of the ten-year expansion. This period is expected to be characterized by the expansion of personalized nutrition and customized gummy supplement formulations, the development of plant-based and vegan gummy alternatives using innovative gelatin substitutes, and the growth of specialized applications for CBD-infused products, beauty supplements, and immune support formulations. The growing adoption of e-commerce distribution channels and direct-to-consumer business models will drive demand for jellies and gummies with enhanced convenience and personalized nutritional profiles.

Between 2020 and 2025, the jellies and gummies market experienced steady growth, driven by increasing consumer demand for convenient supplement formats and growing recognition of gummy products as enjoyable alternatives to traditional pills and capsules across diverse age groups and nutritional applications. The market developed as supplement manufacturers and confectionery brands recognized the potential for gummy technology to improve consumer compliance, enhance taste experience, and support functional nutrition objectives while meeting stringent quality and safety requirements. Technological advancement in gelatin alternatives and fortification techniques began emphasizing the critical importance of maintaining texture consistency and active ingredient stability in challenging storage environments.

Market expansion is being supported by the increasing global demand for functional and fortified confectionery products driven by health consciousness and wellness trends, alongside the corresponding need for convenient supplement delivery formats that can enhance consumer compliance, enable enjoyable consumption experiences, and maintain nutritional efficacy across various vitamin and mineral supplementation, children's nutrition, adult wellness, and beauty supplement applications. Modern consumers and health-conscious individuals are increasingly focused on selecting gummy products that can deliver nutritional benefits, provide taste satisfaction, and offer convenient consumption in on-the-go lifestyles.

The growing emphasis on preventive healthcare and self-care is driving demand for functional gummies that can support immune health, enable beauty-from-within approaches, and ensure comprehensive wellness support. Consumers' preference for supplement formats that combine efficacy with enjoyable consumption and lifestyle compatibility is creating opportunities for innovative gummy implementations. The rising influence of social media marketing and influencer endorsements is also contributing to increased adoption of jellies and gummies that can provide functional benefits without compromising taste appeal or consumption convenience.

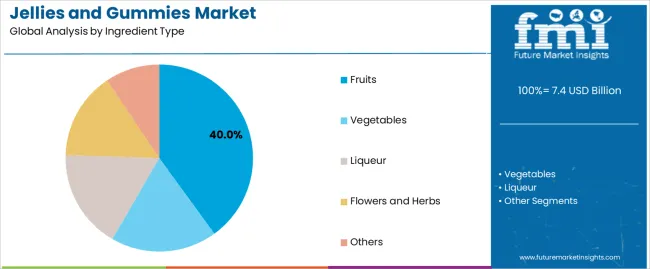

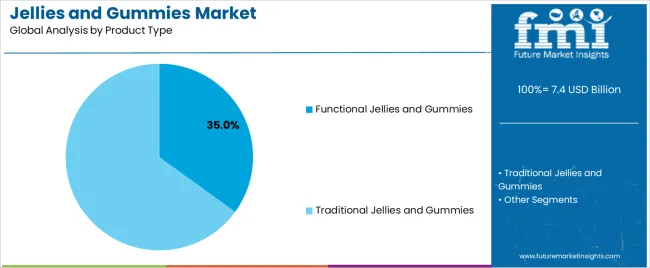

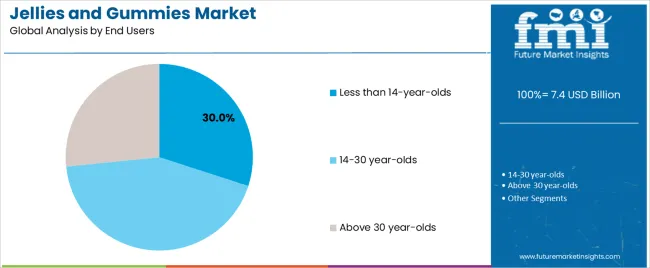

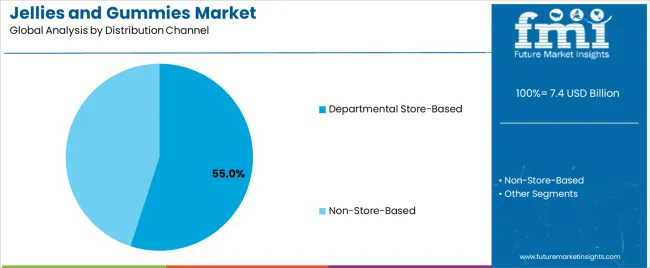

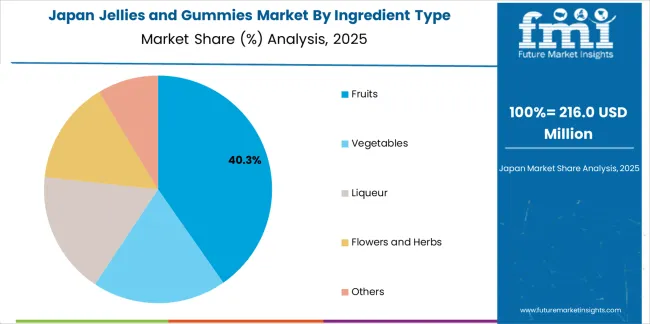

The market is segmented by ingredient type, product type, end users, distribution channel, and region. By ingredient type, the market is divided into fruits, vegetables, liqueur, flowers and herbs, and others. Based on product type, the market is categorized into functional jellies and gummies and traditional jellies and gummies. By end users, the market includes less than 14-year-olds, 14-30 year-olds, and above 30 year-olds. Based on distribution channel, the market is categorized into departmental store-based and non-store-based channels. Regionally, the market is divided into East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, and Eastern Europe.

The fruits segment is projected to maintain its leading position in the jellies and gummies market in 2025, with a 40% share, reaffirming its role as the preferred ingredient category for flavor delivery and natural appeal applications. Confectionery manufacturers and supplement producers increasingly utilize fruit-based ingredients for their superior taste profiles, excellent consumer acceptance, and proven effectiveness in providing natural flavor and color while maintaining product appeal. Fruit ingredient technology's proven effectiveness and application versatility directly address the industry requirements for natural taste delivery and clean-label positioning across diverse consumer age groups and product categories.

This ingredient segment forms the foundation of modern gummy products, as it represents the flavoring approach with the greatest contribution to consumer preference and established performance record across multiple confectionery applications and supplement formats. Food industry investments in natural ingredient technologies continue to strengthen adoption among manufacturers and brand owners. With consumer preferences demanding natural ingredients and recognizable flavors, fruit-based formulations align with both taste objectives and clean-label requirements, making them the central component of comprehensive product development strategies.

The functional jellies and gummies segment is experiencing robust growth in the market, with a 35% share in 2025, driven by increasing consumer demand for nutritional supplements in enjoyable formats and growing recognition of gummies as effective delivery systems for vitamins, minerals, and bioactive compounds. Health-conscious consumers prefer functional gummies due to superior taste compared to traditional supplements, enhanced compliance through enjoyable consumption, and the ability to combine nutritional benefits with confectionery appeal. Positioned as innovative wellness solutions for modern lifestyles, functional gummies offer both health advantages and consumption convenience.

The segment is supported by continuous innovation in fortification technologies and the growing availability of specialized functional formulations that enable targeted health benefits with enhanced bioavailability and product stability. Supplement manufacturers are investing in comprehensive research and development programs to support increasingly sophisticated functional gummy portfolios addressing immune support, beauty enhancement, digestive health, and cognitive function. As preventive healthcare awareness increases and self-care trends intensify, the functional jellies and gummies segment will continue to gain market share while supporting personalized nutrition and wellness optimization strategies.

The jellies and gummies market serves diverse age demographics, with each segment contributing significantly to demand. The less than 14-year-olds segment represents 30% of the market opportunity, driven by parental preference for enjoyable vitamin formats that ensure children's nutritional compliance and support healthy development. Parents prefer gummy vitamins due to ease of administration, reduced struggle during supplement routines, and the ability to ensure consistent nutrient intake for growing children.

The 14-30 year-olds segment shows strong growth potential, supported by increasing health consciousness among young adults and growing adoption of beauty and wellness supplements in convenient formats. This demographic prefers functional gummies for on-the-go consumption, social media-driven product discovery, and alignment with active lifestyles. The above 30 year-olds segment demonstrates steady demand, driven by preventive healthcare focus and growing interest in age-appropriate nutritional supplementation including joint health, heart health, and cognitive support formulations delivered through enjoyable gummy formats.

The departmental store-based distribution channel maintains a significant presence in the jellies and gummies market, with a 55% share, providing essential consumer access through supermarkets, pharmacies, and specialty health stores. Physical retail channels offer product discovery opportunities, immediate availability, and the ability to examine product packaging and ingredient information before purchase. Retailers prefer carrying jellies and gummies assortments due to high turnover rates, strong consumer demand, and the ability to support impulse purchases through strategic merchandising.

The non-store-based channel shows rapid growth, driven by e-commerce expansion and direct-to-consumer subscription models. Online platforms provide enhanced product variety, convenient home delivery, personalized recommendations, and access to specialty and international brands not available in local stores. This channel particularly appeals to functional gummy consumers seeking specific formulations, subscription-based auto-replenishment, and competitive pricing through direct brand relationships.

The jellies and gummies market is advancing steadily due to increasing demand for functional supplements in enjoyable formats driven by consumer preference for taste and convenience, growing adoption of preventive healthcare approaches that require accessible nutritional solutions providing enhanced compliance and consistent consumption benefits across diverse children's vitamins, adult supplements, beauty products, and wellness support applications. The market faces challenges, including concerns about sugar content and dental health implications, competition from traditional supplement formats and emerging delivery systems, and regulatory complexity related to health claims and supplement classification. Innovation in sugar-free formulations and plant-based alternatives continues to influence product development and market expansion patterns.

The growing adoption of gummy vitamins is driving demand for specialized formulations that address specific health needs including immune support, digestive wellness, beauty enhancement, and cognitive function while maintaining taste appeal and consumption enjoyment. Health-conscious consumers require functional gummy products that deliver nutritional benefits across multiple parameters while supporting lifestyle compatibility and supplement routine adherence. Manufacturers are increasingly recognizing the competitive advantages of functional gummy development for market differentiation and consumer engagement, creating opportunities for innovative formulations specifically designed for targeted health outcomes and demographic preferences.

Modern jellies and gummies manufacturers are incorporating plant-based gelatin alternatives and vegan-friendly formulations to address dietary preferences, support ethical consumption values, and expand addressable market segments through inclusive product development. Leading companies are developing pectin-based gummy technologies with comparable texture characteristics, implementing agar and carrageenan alternatives for vegan formulations, and advancing manufacturing processes that ensure product quality without animal-derived ingredients. These innovations improve market accessibility while enabling new consumer opportunities, including vegan supplement lines, clean-label confectionery products, and religiously compliant formulations. Advanced plant-based integration also allows brands to support comprehensive sustainability objectives and ethical positioning beyond traditional product attributes.

The expansion of personalized nutrition trends is driving demand for customized gummy supplements with tailored formulations based on individual health profiles, genetic testing results, and specific wellness goals. These personalized applications require flexible manufacturing capabilities with optimized production systems that enable small-batch customization and rapid formulation adjustment, creating premium market segments with differentiated value propositions. Manufacturers are investing in digital platforms and direct-to-consumer capabilities to serve emerging personalized nutrition applications while supporting innovation in targeted supplementation, condition-specific formulations, and individualized wellness programs.

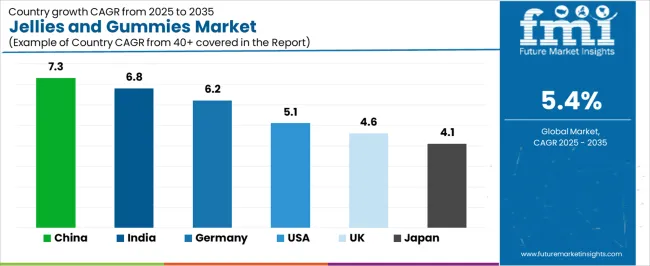

| Country | CAGR (2025-2035) |

|---|---|

| China | 7.3% |

| India | 6.8% |

| Germany | 6.2% |

| USA | 5.1% |

| UK | 4.6% |

| Japan | 4.1% |

The jellies and gummies market is experiencing solid growth globally, with China leading at a 7.3% CAGR through 2035, driven by expanding middle-class consumer base with increasing health consciousness, growing functional supplement market, and rising adoption of vitamin gummies among children and adults. India follows at 6.8%, supported by rapidly growing health awareness, expanding modern retail infrastructure, and increasing disposable income enabling premium confectionery and supplement purchases. Germany demonstrates 6.2% growth, supported by strong health and wellness culture, premium supplement market presence, and comprehensive functional confectionery development. The United States records 5.1%, focusing on functional gummy innovation, beauty supplement trends, and established vitamin gummy market penetration. The United Kingdom exhibits 4.6% growth, emphasizing wellness product adoption and functional confectionery expansion. Japan shows 4.1% growth, emphasizing quality-focused supplement products and innovative confectionery formats across consumer segments.

The report covers an in-depth analysis of 40+ countries, with top-performing countries highlighted below.

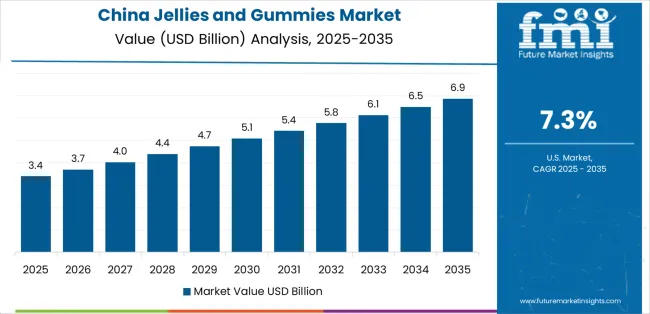

Revenue from jellies and gummies in China is projected to exhibit exceptional growth with a CAGR of 7.3% through 2035, driven by expanding middle-class consumer base and rapidly growing health and wellness awareness supported by government health promotion initiatives and retail modernization programs. The country's massive consumer market expansion and increasing investment in functional food and supplement categories are creating substantial demand for jellies and gummies solutions. Major confectionery manufacturers and international supplement brands are establishing comprehensive production and distribution capabilities to serve both domestic markets and regional export opportunities.

Demand for jellies and gummies in India is expanding at a CAGR of 6.8%, supported by the country's rapidly growing health awareness, expanding organized retail infrastructure, and increasing consumer willingness to invest in preventive healthcare and nutritional supplementation. The country's comprehensive retail modernization and rising middle-class aspirations are driving sophisticated jellies and gummies capabilities throughout urban markets. Leading confectionery companies and international supplement brands are establishing extensive distribution facilities to address growing domestic demand.

Revenue from jellies and gummies in Germany is growing at a CAGR of 6.2%, driven by the country's strong health and wellness culture, premium supplement market presence, and sophisticated consumer base demanding high-quality functional products. Germany's quality consciousness and preventive healthcare emphasis are driving advanced jellies and gummies capabilities throughout supplement sectors. Leading pharmaceutical companies and confectionery manufacturers are establishing comprehensive innovation programs for functional gummy technologies.

Demand for jellies and gummies in the United States is expected to expand at a CAGR of 5.1%, supported by the country's leadership in functional supplement innovation, expanding beauty-from-within trends, and established vitamin gummy market with diverse product offerings. The nation's sophisticated supplement industry and innovation culture are driving demand for advanced jellies and gummies solutions. Supplement manufacturers and confectionery brands are investing in functional gummy development and marketing initiatives to serve evolving consumer preferences.

Revenue from jellies and gummies in the United Kingdom is anticipated to grow at a CAGR of 4.6%, supported by the country's growing wellness culture, increasing functional supplement adoption, and expanding retail presence of vitamin gummies across pharmacy and grocery channels. The UK's developed retail infrastructure and health-conscious consumers are driving demand for jellies and gummies products. Supplement brands and confectionery manufacturers are investing in market development initiatives to address consumer demand.

Demand for jellies and gummies in Japan is forecasted to expand at a CAGR of 4.1%, driven by the country's emphasis on product quality, innovative supplement formats, and sophisticated consumer preferences for functional confectionery and wellness products. Japan's quality consciousness and innovation appreciation are supporting investment in premium jellies and gummies technologies. Leading pharmaceutical companies and confectionery manufacturers are establishing high-quality product capabilities for discerning consumers.

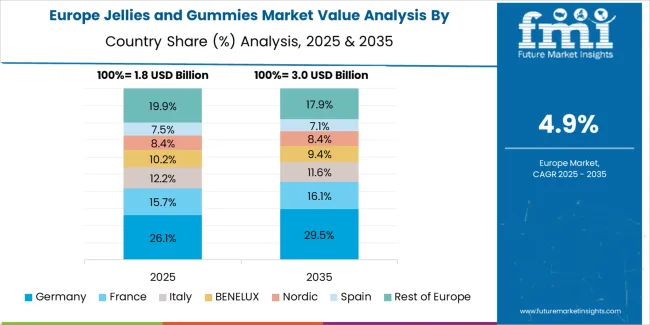

The jellies and gummies market in Europe is projected to grow from USD 1.9 billion in 2025 to USD 3.2 billion by 2035, registering a CAGR of 5.3% over the forecast period. Germany is expected to maintain leadership with a 26.5% market share in 2025, moderating to 26.2% by 2035, supported by health and wellness culture leadership, premium supplement market presence, and strong functional confectionery development.

The United Kingdom follows with 17.8% in 2025, projected at 17.6% by 2035, driven by wellness product adoption, functional supplement growth, and expanding vitamin gummy market penetration. France holds 15.2% in 2025, reaching 15.4% by 2035 on the back of confectionery tradition and growing functional food interest. Italy commands 12.9% in 2025, rising slightly to 13.1% by 2035, while Spain accounts for 10.6% in 2025, reaching 10.8% by 2035 aided by confectionery consumption culture and growing supplement awareness. The Netherlands maintains 6.3% in 2025, up to 6.4% by 2035 due to health-conscious consumer base and pharmacy channel strength. The Rest of Europe region, including Nordics, Central & Eastern Europe, and other markets, is anticipated to hold 10.7% in 2025 and 10.5% by 2035, reflecting steady growth in functional supplement adoption, confectionery innovation, and wellness product expansion.

The jellies and gummies market is characterized by competition among established confectionery manufacturers, specialized gummy vitamin producers, and diversified consumer health companies. Companies are investing in functional formulation development, plant-based technology innovation, product portfolio expansion, and taste optimization to deliver high-quality, effective, and enjoyable jellies and gummies solutions. Innovation in sugar-free technologies, vegan gelatin alternatives, and targeted functional formulations is central to strengthening market position and competitive advantage.

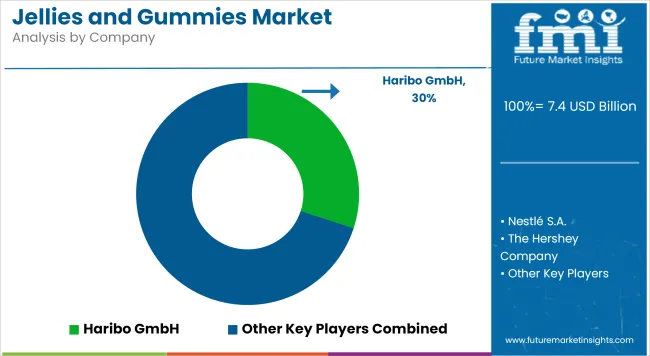

HARIBO GmbH & Co. KG leads the market with a 21.0% share, offering comprehensive jellies and gummies products with a focus on traditional confectionery excellence, innovative flavors, and diverse product formats across global markets. The company has announced investments in production capacity expansion and sustainable sourcing initiatives to meet growing demand while maintaining product quality standards. Jelly Belly Candy Company provides innovative gourmet jelly bean and gummy products with emphasis on flavor innovation and premium positioning.

Mars Inc. delivers established confectionery brands with gummy product portfolios serving diverse consumer preferences and retail channels. Mondelēz Global LLC offers comprehensive snacking solutions including gummy confectionery products across multiple brand platforms. Perfetti Van Melle Group B.V. provides diverse candy and gummy offerings with global distribution capabilities and innovation focus. Additional market participants include specialized vitamin gummy manufacturers, regional confectionery producers, and emerging functional supplement brands serving specific consumer segments and distribution channels across diverse geographic markets.

Jellies and gummies represent a dynamic confectionery and functional supplement segment within global food and wellness industries, projected to grow from USD 7.4 billion in 2025 to USD 12.5 billion by 2035 at a 5.4% CAGR. These gel-based products—primarily fruit-flavored and functional configurations for multiple applications—serve as enjoyable consumption formats in traditional confectionery, vitamin and mineral supplementation, beauty wellness, and functional nutrition applications where taste appeal, consumption convenience, and nutritional delivery are essential. Market expansion is driven by increasing functional supplement adoption, growing consumer preference for enjoyable supplement formats, expanding children's vitamin market, and rising demand for plant-based and clean-label formulations across diverse age demographics and wellness segments.

How Food and Supplement Regulators Could Strengthen Product Standards and Consumer Safety?

How Industry Associations Could Advance Standards and Market Development?

How Jellies and Gummies Manufacturers Could Drive Innovation and Market Leadership?

How Consumers and Healthcare Professionals Could Optimize Product Selection and Usage?

How Research Institutions Could Enable Technology Advancement?

How Investors and Financial Enablers Could Support Market Growth and Innovation?

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 7.4 billion |

| Ingredient Type | Fruits, Vegetables, Liqueur, Flowers and Herbs, Others |

| Product Type | Functional Jellies and Gummies, Traditional Jellies and Gummies |

| End Users | Less than 14-year-olds, 14-30 year-olds, Above 30 year-olds |

| Distribution Channel | Departmental Store-Based, Non-Store-Based |

| Regions Covered | East Asia, Europe, North America, South Asia, Latin America, Middle East & Africa, Eastern Europe |

| Countries Covered | China, India, Germany, United States, United Kingdom, Japan, and 40+ countries |

| Key Companies Profiled | HARIBO GmbH & Co. KG, Jelly Belly Candy Company, Mars Inc., Mondelēz Global LLC, Perfetti Van Melle Group B.V. |

| Additional Attributes | Dollar sales by ingredient type, product type, end users, and distribution channel category, regional demand trends, competitive landscape, technological advancements in functional formulations, plant-based innovation, sugar-free technologies, and nutritional delivery optimization |

The global jellies and gummies market is estimated to be valued at USD 7.4 billion in 2025.

The market size for the jellies and gummies market is projected to reach USD 12.5 billion by 2035.

The jellies and gummies market is expected to grow at a 5.4% CAGR between 2025 and 2035.

The key product types in jellies and gummies market are fruits, vegetables, liqueur, flowers and herbs and others.

In terms of product type, functional jellies and gummies segment to command 35.0% share in the jellies and gummies market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Fruit Jams, Jellies, and Preserves Market Analysis by Type, Distribution Channel, and Region Through 2035

Android Automotive OS (AAOS) Market Size and Share Forecast Outlook 2025 to 2035

Anderson Cascade Impactor Market Size and Share Forecast Outlook 2025 to 2035

Andersen-Tawil Syndrome Treatment Market Trends - Growth & Future Prospects 2025 to 2035

Andro Supplements Market

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Sandwich Panel System Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Land Survey Equipment Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Band File Sander Belts Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Sand Abrasion Tester Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Landscape Lighting Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA