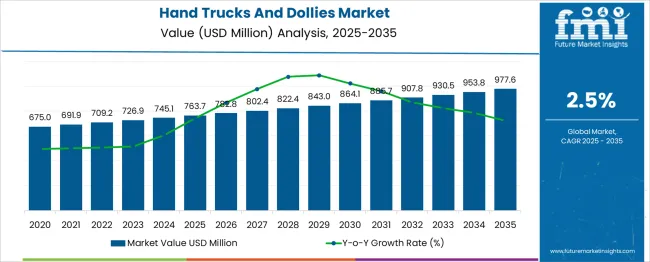

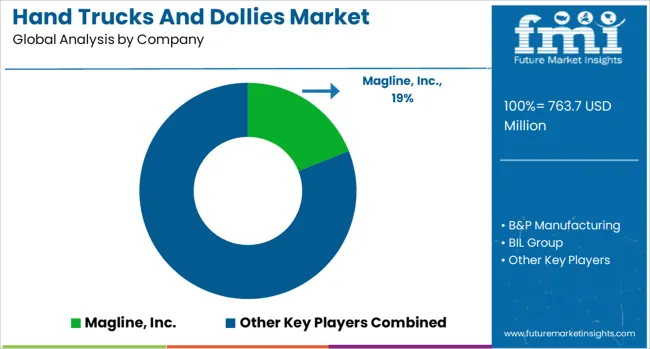

The Hand Trucks And Dollies Market is estimated to be valued at USD 763.7 million in 2025 and is projected to reach USD 977.6 million by 2035, registering a compound annual growth rate (CAGR) of 2.5% over the forecast period.

Over this period, the market experiences steady expansion but faces notable dynamics regarding market share distribution. While the overall market size increases by approximately 28%, individual players must navigate shifts driven by evolving supply chain requirements and changing industrial demands. Market share erosion is evident among traditional manufacturers who rely heavily on legacy designs and lack innovation in ergonomics or materials. These companies face growing competition from newer entrants offering lightweight, durable, and customizable solutions that better align with modern logistics needs. The rising preference for automation and integrated handling solutions in warehouses is reshaping demand patterns, further impacting conventional hand truck and dolly suppliers. Conversely, firms investing in R&D and diversifying product portfolios are gaining market share. Emphasis on enhanced durability, user-friendly features, and compliance with safety standards enables these players to capitalize on emerging opportunities. Growth in e-commerce, warehousing, and last-mile delivery sectors fuels demand for versatile handling equipment, benefiting innovators. Overall, the market sees a gradual redistribution of share, with technologically agile and customer-focused companies strengthening their foothold amid evolving industry requirements.

| Metric | Value |

|---|---|

| Hand Trucks And Dollies Market Estimated Value in (2025 E) | USD 763.7 million |

| Hand Trucks And Dollies Market Forecast Value in (2035 F) | USD 977.6 million |

| Forecast CAGR (2025 to 2035) | 2.5% |

A breakpoint analysis reveals critical phases in market growth and dynamics between 2025 and 2035. The market value rises steadily from USD 763.7 million in 2025 to USD 977.6 million in 2035, but distinct shifts in growth momentum occur at specific intervals. The first breakpoint appears around 2028, when the market crosses USD 782 million. This phase marks the initial adoption of newer, ergonomically designed models and increased investment in lightweight materials. Here, growth accelerates modestly, reflecting early-stage acceptance of product innovation by key industrial sectors.

A second notable breakpoint emerges near 2032, as the market surpasses USD 907 million. This period coincides with broader integration of advanced handling solutions in warehousing and logistics operations, particularly driven by automation trends. At this stage, the demand for specialized, durable hand trucks and dollies expands more rapidly, highlighting a shift in buyer preferences towards high-performance, safety-compliant equipment. After 2032, growth maintains a steady pace but at a slightly reduced rate, reflecting a maturing market where incremental improvements and competitive pricing become crucial. These breakpoints indicate strategic windows for manufacturers to intensify innovation, expand product lines, or reinforce distribution channels to maximize market share gains before saturation effects emerge.

The hand trucks and dollies market is witnessing steady expansion due to rising demand for manual material handling solutions across warehousing, retail, and logistics sectors. Increased focus on workplace ergonomics and injury prevention has driven the adoption of wheeled transport equipment that minimizes lifting effort.

Growth in e-commerce and last-mile delivery services has expanded small-scale logistics infrastructure, boosting demand for cost-effective and maneuverable load-moving tools. Manufacturers are introducing lightweight aluminum and foldable designs tailored to urban and tight-space applications.

The market is also seeing innovation in multi-position and convertible hand trucks, offering greater utility for diverse load shapes and sizes. As businesses look to streamline internal transport and reduce downtime, hand trucks and dollies continue to be a preferred solution due to their affordability, durability, and minimal maintenance needs.

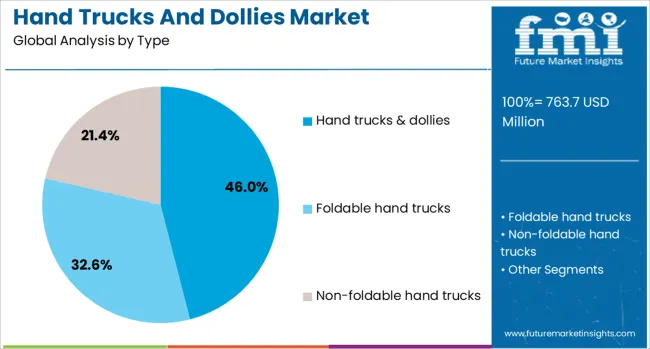

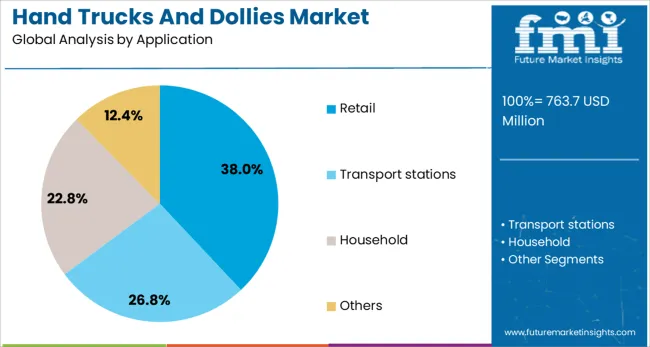

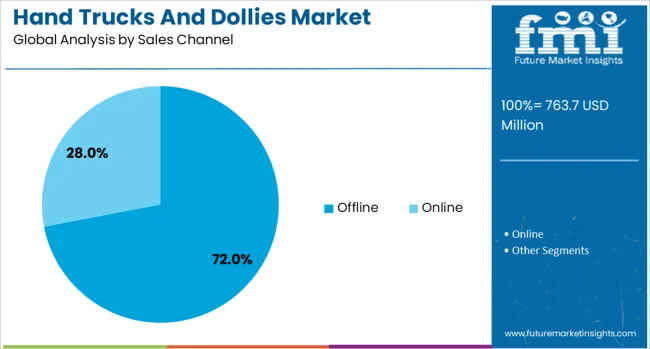

The hand trucks and dollies market is segmented by type, application, and sales channel and geographic regions. By type of the hand trucks and dollies market is divided into Hand trucks & dollies, Foldable hand trucks, and Non-foldable hand trucks. In terms of application of the hand trucks and dollies market is classified into Retail, Transport stations, Household, and Others. Based on sales channel of the hand trucks and dollies market is segmented into Offline and Online. Regionally, the hand trucks and dollies industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hand trucks & dollies segment is anticipated to dominate the market with a 46.0% share by 2025. This leadership is driven by the segment’s versatility in transporting a wide variety of loads in warehouses, retail environments, and distribution centers.

Their ability to carry both bulky and heavy items while reducing strain on workers makes them essential for short-distance goods movement. Hand trucks, particularly convertible variants, are favored for their dual upright and flatbed functionality, while dollies provide stable, four-wheel support for heavier loads.

This segment continues to benefit from enhancements in materials, such as aluminum and composite builds, which offer strength without adding excess weight.

The retail sector is projected to account for 38.0% of the market revenue in 2025, making it the leading application segment for hand trucks and dollies. Retailers rely heavily on manual transport equipment for stocking shelves, unloading deliveries, and in-store product movement.

The need for efficient backroom logistics and reduced labor fatigue has fueled investments in compact, easy-to-store units. With quick product turnover and high SKU volume, especially in grocery and general merchandise stores, the demand for versatile and durable handling tools remains high.

Additionally, the trend of in-store pickup and inventory decentralization in omnichannel retail formats is further increasing deployment across retail chains.

Offline sales channels are expected to dominate with a 72.0% market share in 2025, led by demand from industrial distributors, hardware stores, and B2B procurement centers. Buyers in the hand trucks and dollies market often prioritize tactile product evaluation and after-sales service, which favors offline transactions.

Heavy-duty product categories and bulk purchases are commonly routed through physical channels where custom orders, demos, and onsite delivery coordination are standard.

While online sales are growing, offline stores remain dominant due to their ability to address commercial buyer preferences for warranty assurance, replacement parts access, and immediate product availability.

The hand trucks and dollies market is expanding steadily due to increased logistics activities, warehouse automation, and demand for efficient material handling solutions. These tools provide cost-effective ways to transport heavy goods across manufacturing, retail, and shipping sectors. Rising adoption in small and medium enterprises further propels market growth. Innovations such as ergonomic designs and lightweight materials improve usability. As businesses seek to optimize supply chain efficiency and worker safety, hand trucks and dollies remain vital equipment in material transport and workplace productivity.

The rising volume of goods movement across manufacturing, distribution centers, and retail outlets is fueling demand for hand trucks and dollies. These tools enable faster, safer handling of bulky and heavy items, improving operational efficiency in warehouses, shipping docks, and retail environments. The increase in e-commerce and global trade further intensifies logistics throughput, requiring reliable equipment for last-mile transport and inventory management. Additionally, small and medium businesses benefit from affordable and versatile material handling tools to support diverse load types. Ergonomic and foldable designs add to the appeal, allowing easier storage and reducing operator fatigue. The steady expansion of warehouses and fulfillment centers worldwide reinforces the need for durable and flexible hand trucks and dollies. As companies prioritize cost-effective workflow solutions, these products become essential for maintaining high productivity and reducing workplace injuries.

While hand trucks and dollies are fundamental manual tools, growing automation in warehouses and factories presents a challenge to market growth. Automated guided vehicles (AGVs), conveyor systems, and robotic handlers increasingly perform tasks traditionally done by manual equipment. These automated solutions offer consistent speed and reduced human error, appealing to large-scale operations focused on productivity gains. As investments in warehouse robotics and smart logistics increase, manual material handling tools may face reduced demand in highly automated environments. Additionally, automation reduces dependence on labor-intensive processes, impacting the frequency and volume of hand truck usage. However, automated systems require significant capital and infrastructure changes, limiting immediate displacement potential. Hand trucks and dollies will likely continue to serve smaller operations, temporary tasks, and specific applications where flexibility and cost-efficiency remain priorities.

Emerging economies present significant growth potential for hand trucks and dollies as industrialization, urbanization, and retail expansion accelerate. Increasing construction activities, warehousing projects, and informal logistics in these regions boost demand for manual handling tools. Local manufacturers and suppliers are developing cost-effective, customizable products tailored to regional load requirements and working conditions. Lightweight materials, adjustable handles, and multi-wheel configurations cater to varied user needs. Moreover, demand for eco-friendly and durable products is rising, encouraging innovations in sustainable material use. Partnerships with distributors and rental services also extend market reach. By addressing specific challenges like uneven terrain and climate conditions, manufacturers can differentiate offerings and gain customer loyalty. Expanding after-sales service and repair networks further enhance product appeal. Targeting underpenetrated regions with versatile and adaptable hand trucks and dollies offers significant opportunities for market players seeking to broaden their footprint.

Strict safety regulations governing workplace equipment use place constraints on the hand trucks and dollies market. Compliance with load capacity, structural integrity, and ergonomic standards requires continuous product improvement and testing. Failure to meet these standards can result in legal penalties and reputational damage, discouraging substandard product availability. Additionally, ensuring consistent material quality, such as corrosion-resistant metals and durable wheels, adds to production costs. In regions with stringent occupational health and safety rules, improper use or poorly maintained equipment is heavily regulated, limiting market growth for low-cost or counterfeit alternatives. Consumer awareness around operator safety and injury prevention also pressures manufacturers to invest in better design and safety features, which can raise prices. These regulatory and quality-related challenges slow market expansion in cost-sensitive segments and complicate entry for new manufacturers lacking compliance expertise.

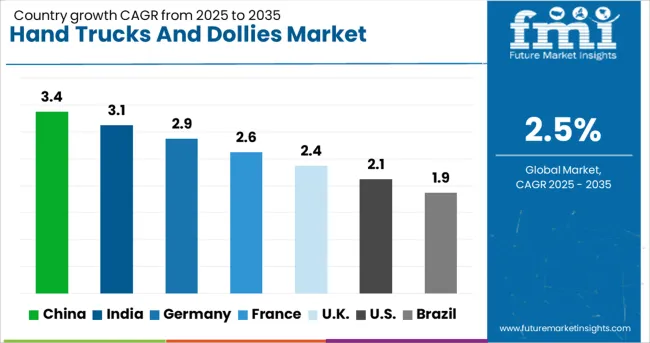

| Country | CAGR |

|---|---|

| China | 3.4% |

| India | 3.1% |

| Germany | 2.9% |

| France | 2.6% |

| UK | 2.4% |

| USA | 2.1% |

| Brazil | 1.9% |

The global hand trucks and dollies market is growing steadily at a CAGR of 2.5%, driven by rising industrial activities and logistics optimization. China leads the market with a 3.4% growth rate, supported by its vast manufacturing base and expanding e-commerce sector. India follows closely at 3.1%, fueled by increased demand from small and medium enterprises upgrading their material handling equipment. Germany reports 2.9% growth, reflecting the emphasis on high-quality and ergonomic designs for industrial use. The United Kingdom shows moderate growth at 2.4%, focusing on specialized applications in warehousing and retail. The United States, as a mature market, grows at 2.1%, driven by regulatory standards and advanced equipment features. Market trends are shaped by durability, safety regulations, and automation integration. This report includes insights on 40+ countries; the top countries are shown here for reference.

The hand trucks and dollies market in China is advancing with a CAGR of 3.4%, propelled by increasing demand in logistics, warehousing, and retail sectors. Expanding e-commerce and supply chain activities have created a need for efficient material handling equipment. Manufacturers are focusing on producing durable and lightweight models to enhance worker productivity and safety. Additionally, urban development projects and new industrial parks contribute to steady market growth. The demand for ergonomic designs and customized solutions is growing among small and medium enterprises. Domestic companies are also expanding their distribution networks to reach tier-2 and tier-3 cities, supporting market penetration.

In India, the hand trucks and dollies market is growing at a CAGR of 3.1%, driven by rising industrial and retail sectors. The growing warehousing and logistics industries require efficient handling tools to improve operational speed and reduce manual labor injuries. Domestic manufacturers are enhancing product features such as load capacity and foldability to meet varied user needs. Government initiatives promoting industrial parks and cold chain logistics further support market expansion. Increased adoption of mechanized equipment in urban and semi-urban areas boosts sales, while growing awareness about workplace safety encourages the use of quality-hand trucks and dollies.

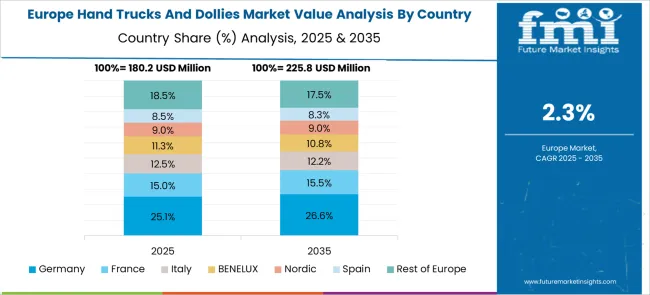

Hand trucks and dollies market in Germany is expanding steadily at a CAGR of 2.9%, supported by the strong manufacturing and logistics sectors. The demand for robust and reliable material handling equipment is driven by automotive, chemical, and retail industries. Manufacturers emphasize high-quality materials and safety certifications to comply with stringent European standards. Growing focus on worker ergonomics leads to innovations in handle design and load distribution. The expanding e-commerce industry also contributes to increasing usage in warehouses and distribution centers. Local companies prioritize sustainable production methods, aligning with environmental policies.

The United Kingdom hand trucks and dollies market is growing at a CAGR of 2.4%, driven by demand in logistics, retail, and construction sectors. Increasing automation in warehouses is complemented by durable hand trucks used for last-mile transport and short-distance handling. Companies seek equipment that offers easy maneuverability in confined spaces. Construction activities also support demand for heavy-duty dollies that handle bulky materials safely. Local manufacturers focus on compact, foldable products to cater to small businesses and urban logistics. Environmental regulations encourage manufacturers to adopt recyclable materials and reduce waste.

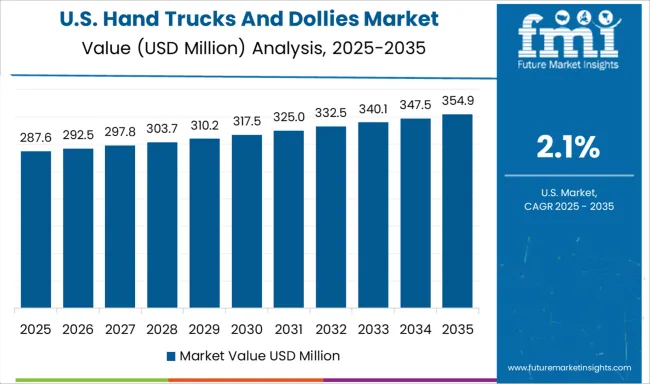

The United States market for hand trucks and dollies is expanding with a CAGR of 2.1%, primarily driven by growth in retail, manufacturing, and warehouse automation. Demand for versatile and heavy-capacity hand trucks is increasing to enhance workplace efficiency and safety. Industrial players focus on features such as pneumatic wheels and adjustable handles to suit diverse environments. Rising awareness of ergonomic equipment benefits boosts adoption in warehouses and distribution centers. Additionally, the growing presence of fulfillment centers supporting e-commerce has elevated the use of dollies for material transport. Safety compliance remains a priority, with manufacturers adhering to occupational health guidelines.

The hand trucks and dollies market caters to industries ranging from logistics and warehousing to retail and home use, where efficient manual material handling is crucial. Major suppliers such as Magline, Inc., B&P Manufacturing, and BIL Group have established themselves through durable, ergonomic designs and a broad product portfolio. These companies emphasize robust construction and versatility, addressing a wide array of weight capacities and terrain types to meet diverse customer needs. Brands like Cosco Home & Office Products, Harper Trucks, Inc., and Little Giant Products, Inc. focus on specialized dollies and hand trucks designed for convenience and maneuverability in tighter spaces, appealing to both commercial users and consumers. Their products often feature lightweight frames and foldable designs for easy storage and transport.

These suppliers have developed strong distribution networks across hardware stores and online platforms, making their products accessible to a wide audience. Companies such as Mighty Lift, Milwaukee Hand Trucks, and Wesco Industrial Products provide heavy-duty and industrial-grade solutions tailored for manufacturing and construction sectors. Suppliers from Asia like Qingdao Huatian Hand Truck Co., Ltd. offer competitive pricing with reliable quality, expanding market reach globally. Across the market, innovation focuses on improving load capacity, enhancing safety features, and increasing user comfort to help operators handle heavy materials with greater ease and efficiency.

Magliner introduced the Neo Powered Stair Climber in 2025, featuring a lithium-ion battery and ergonomic handle. It ascends stairs at 35 steps per minute, reducing physical strain and enhancing safety. It is ideal for transporting heavy items like kegs and cylinders.

| Item | Value |

|---|---|

| Quantitative Units | USD 763.7 Million |

| Type | Hand trucks & dollies, Foldable hand trucks, and Non-foldable hand trucks |

| Application | Retail, Transport stations, Household, and Others |

| Sales Channel | Offline and Online |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Magline, Inc., B&P Manufacturing, BIL Group, Cosco Home & Office Products, Harper Trucks, Inc., Little Giant Products, Inc., Mighty Lift, Milwaukee Hand Trucks, Qingdao Huatian Hand Truck Co., Ltd., and Wesco Industrial Products |

| Additional Attributes | Dollar sales vary by product type and end-use sector, with hand trucks dominating, while dollies grow fastest. Asia-Pacific leads in volume, while North America and Europe drive value. Pricing fluctuates with material and manufacturing costs. Growth accelerates via ergonomic designs, lightweight materials, and e-commerce-driven logistics needs under warehouse automation trends. |

The global hand trucks and dollies market is estimated to be valued at USD 763.7 million in 2025.

The market size for the hand trucks and dollies market is projected to reach USD 977.6 million by 2035.

The hand trucks and dollies market is expected to grow at a 2.5% CAGR between 2025 and 2035.

The key product types in hand trucks and dollies market are hand trucks & dollies, foldable hand trucks and non-foldable hand trucks.

In terms of application, retail segment to command 38.0% share in the hand trucks and dollies market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Handheld Electrostatic Meter Market Size and Share Forecast Outlook 2025 to 2035

Hand Towel Automatic Folding Machine Market Size and Share Forecast Outlook 2025 to 2035

Handheld Ultrasound Scanner Market Size and Share Forecast Outlook 2025 to 2035

Handheld Tagging Gun Market Forecast and Outlook 2025 to 2035

Handheld Imaging Systems Market Size and Share Forecast Outlook 2025 to 2035

Hand Tools Market Size and Share Forecast Outlook 2025 to 2035

Handloom Product Market Size and Share Forecast Outlook 2025 to 2035

Handheld XRF Analyzers Market Size and Share Forecast Outlook 2025 to 2035

Handheld Police Radar Guns Market Size and Share Forecast Outlook 2025 to 2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Handheld Robotic Navigation Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Handheld Mesh Nebulizer Market Size and Share Forecast Outlook 2025 to 2035

Hand & Arm Protection (PPE) Market Size and Share Forecast Outlook 2025 to 2035

Handwheels Market Size and Share Forecast Outlook 2025 to 2035

Handheld Chemical and Metal Detector Market Size and Share Forecast Outlook 2025 to 2035

Hands-Free Safety Tools Market Size and Share Forecast Outlook 2025 to 2035

Hand-held Breast Cancer Detection Market Analysis Size and Share Forecast Outlook 2025 to 2035

Handheld Dental X-Ray Systems Market Analysis - Size, Share, and Forecast 2025 to 2035

Hand Dryer Market Size and Share Forecast Outlook 2025 to 2035

Hand Blender Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA